Key Insights

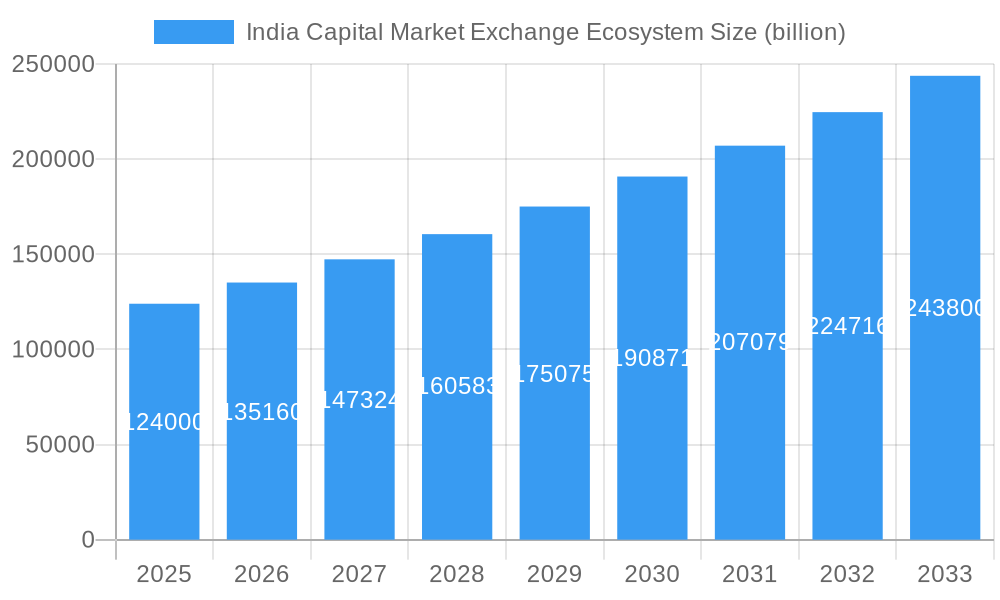

The India Capital Market Exchange Ecosystem is poised for significant expansion, projected to reach an estimated $124 billion by 2025. This robust growth trajectory is underpinned by a Compound Annual Growth Rate (CAGR) of 9%, indicating sustained momentum in the market. A confluence of factors is driving this expansion, including increasing investor participation, the digitization of financial services, and a growing appetite for diverse investment avenues. The primary drivers include the burgeoning equity market, fueled by both retail and institutional investors, and the expanding debt market, catering to corporate funding needs and government initiatives. Furthermore, the increasing emphasis on corporate governance and compliance monitoring, alongside structured corporate restructuring activities, contributes to a more mature and dynamic exchange ecosystem. The presence of a vibrant intermediary network, facilitating seamless transactions and advisory services, is also a critical enabler of this growth.

India Capital Market Exchange Ecosystem Market Size (In Billion)

The ecosystem is characterized by a sophisticated segmentation, encompassing both primary and secondary markets. Primary markets facilitate the issuance of new securities, while secondary markets provide liquidity and price discovery. Within secondary markets, the cash market for equities, alongside various derivatives markets including equity, commodity, currency, and interest rate derivatives, offers a comprehensive range of trading opportunities. This multifaceted structure is supported by robust market infrastructure institutions and a wide array of associated intermediaries. Looking ahead, the forecast period (2025-2033) suggests a continued upward trajectory, driven by evolving financial instruments, regulatory enhancements, and India's position as an attractive investment destination. The market is anticipated to benefit from increased financial inclusion and the ongoing development of capital market infrastructure, further solidifying its importance in the nation's economic landscape.

India Capital Market Exchange Ecosystem Company Market Share

Unlocking India's Financial Future: India Capital Market Exchange Ecosystem Report (2019-2033)

Gain an unparalleled understanding of India's dynamic capital market exchange ecosystem with this comprehensive report. Spanning from 2019 to 2033, this analysis delves into the intricate structure, growth trajectory, and future potential of India's financial markets, from its nascent primary markets to its robust secondary markets. Featuring critical insights into market dynamics, key players, and emerging opportunities, this report is an indispensable resource for investors, financial institutions, policymakers, and market participants seeking to navigate and capitalize on India's rapidly evolving financial landscape.

India Capital Market Exchange Ecosystem Market Dynamics & Structure

The India Capital Market Exchange Ecosystem is characterized by a complex interplay of regulatory frameworks, technological advancements, and evolving investor behavior. Market concentration is influenced by the presence of dominant Market Infrastructure Institutions and a growing number of specialized intermediaries. Technological innovation drivers are primarily focused on enhancing trading efficiency, data analytics, and regulatory compliance, with FinTech solutions playing an increasingly pivotal role. Robust regulatory frameworks, overseen by bodies like SEBI, are continuously adapting to foster market integrity and investor protection, while also encouraging innovation. Competitive product substitutes exist, particularly with the rise of alternative investment platforms and digital assets, though traditional equity and debt instruments remain foundational. End-user demographics are diversifying, with increased participation from retail investors and a growing institutional investor base seeking sophisticated investment vehicles. Mergers and acquisitions (M&A) trends indicate a consolidation among intermediaries and a strategic integration of technology providers to enhance service offerings and market reach.

- Market Concentration: Dominated by key exchange operators and a significant presence of regulated intermediaries, with a growing fragmentation in niche advisory and technology services.

- Technological Innovation: Focus on AI-driven analytics, blockchain for settlement, and advanced trading platforms to improve efficiency and transparency.

- Regulatory Frameworks: Continuous evolution to align with global best practices, focusing on investor protection, market integrity, and the facilitation of new financial products.

- Competitive Substitutes: Growing competition from P2P lending, alternative investment funds, and digital asset exchanges, though traditional markets retain significant dominance.

- End-User Demographics: Broadening investor base, including a significant influx of young, tech-savvy retail investors and an expanding presence of sophisticated institutional investors.

- M&A Trends: Strategic acquisitions of FinTech companies by established financial institutions and consolidation among broking and advisory firms to achieve scale and synergies. The total M&A deal volume in the Indian financial services sector has seen a steady increase, with over $xx billion in deals recorded between 2019-2024.

India Capital Market Exchange Ecosystem Growth Trends & Insights

The India Capital Market Exchange Ecosystem is poised for significant expansion, driven by a confluence of favorable economic policies, a burgeoning young population, and increasing financial literacy. The market size evolution has been remarkable, with a projected Compound Annual Growth Rate (CAGR) of xx% over the forecast period (2025-2033). Adoption rates for digital investment platforms and sophisticated financial products are accelerating, indicating a paradigm shift in how Indians engage with their capital markets. Technological disruptions, including the integration of Artificial Intelligence (AI) for algorithmic trading and predictive analytics, alongside the exploration of Distributed Ledger Technology (DLT) for enhanced settlement processes, are fundamentally reshaping market operations. Consumer behavior shifts are evident, with a pronounced move towards direct equity investments, a greater demand for personalized financial advice, and an increased appetite for diverse investment instruments beyond traditional equities and bonds. The penetration of formal financial services is expanding, bringing a larger segment of the population into the investment fold.

- Market Size Evolution: Expected to grow from an estimated $xxx billion in 2025 to $xxxx billion by 2033, reflecting robust economic growth and increasing investor confidence.

- Adoption Rates: Digital investment platform adoption is projected to reach xx% by 2030, a substantial increase from xx% in 2019.

- Technological Disruptions: AI-powered trading strategies and blockchain-based clearing and settlement are emerging as key differentiators, promising greater efficiency and security.

- Consumer Behavior Shifts: A discernible trend towards diversified portfolios, with increased interest in ETFs, mutual funds, and alternative assets, alongside a growing demand for ESG-compliant investments.

- Market Penetration: Financial inclusion initiatives and simplified investment processes are expected to increase overall market penetration by xx% by 2030.

Dominant Regions, Countries, or Segments in India Capital Market Exchange Ecosystem

Within the expansive India Capital Market Exchange Ecosystem, the Secondary Markets: Cash Market segment stands out as the dominant force driving market growth. This segment, encompassing the daily trading of publicly listed equities, forms the bedrock of investor activity and liquidity. Its dominance is further amplified by the underlying strength of the Primary Markets: Equity Market, which fuels the supply of new investable securities. The interconnectedness of these segments creates a self-reinforcing growth cycle. Key drivers of this dominance include India's robust economic growth, a rapidly expanding corporate sector, and a growing population of informed retail and institutional investors actively seeking wealth creation opportunities. The ease of access through digital platforms further bolsters the cash market's prominence.

- Dominant Segment: Secondary Markets: Cash Market, consistently exhibiting the highest trading volumes and market capitalization. In 2025, the estimated market size for the Cash Market is $xxx billion.

- Key Driver - Economic Policies: Pro-growth economic policies, including initiatives to attract foreign direct investment and promote domestic manufacturing, directly translate into increased equity issuance and trading activity.

- Key Driver - Investor Demographics: A significant and growing pool of retail investors, coupled with substantial inflows from domestic and foreign institutional investors, fuels demand in the cash market.

- Market Share & Growth Potential: The Cash Market accounts for an estimated xx% of the total capital market exchange volume. Its growth potential remains high, driven by ongoing economic expansion and a rising savings rate.

- Interconnectivity with Primary Markets: The health and vibrancy of the Primary Markets: Equity Market directly support the Secondary Markets: Cash Market by providing a continuous pipeline of quality listed companies and investment opportunities. The Equity Market alone is projected to see new issuances valued at over $xx billion annually during the forecast period.

- Supporting Segments: Market Infrastructure Institutions, such as exchanges and depositories, play a crucial role in facilitating the smooth functioning and growth of the dominant cash market segment.

India Capital Market Exchange Ecosystem Product Landscape

The India Capital Market Exchange Ecosystem is characterized by a dynamic and expanding product landscape, driven by innovation and evolving investor needs. From traditional equity and debt instruments to sophisticated derivatives and structured products, the market offers a diverse range of investment avenues. Product innovations are increasingly focused on leveraging technology for enhanced trading strategies, risk management, and investor accessibility. Performance metrics are continuously being refined, with a focus on transparency, efficiency, and cost-effectiveness. Unique selling propositions often lie in the integration of advanced analytics, bespoke financial solutions, and seamless digital onboarding processes. Technological advancements are enabling the development of new asset classes and trading mechanisms, catering to a wider spectrum of risk appetites and investment objectives.

Key Drivers, Barriers & Challenges in India Capital Market Exchange Ecosystem

Key Drivers:

- Technological Advancements: The adoption of AI, blockchain, and advanced data analytics is revolutionizing trading, risk management, and market accessibility.

- Economic Growth: India's robust economic expansion fuels corporate profitability, leading to increased listings and investment opportunities.

- Favorable Demographics: A young, aspirational population with increasing disposable incomes and a growing appetite for investment is a significant catalyst.

- Government Initiatives: Policies promoting financial inclusion, ease of doing business, and foreign investment are actively supporting market development.

- Increasing Financial Literacy: Greater awareness and understanding of investment principles are driving participation across all investor segments.

Barriers & Challenges:

- Regulatory Hurdles: While evolving, complex and sometimes slow-moving regulatory frameworks can pose challenges to rapid innovation and market entry.

- Cybersecurity Threats: The increasing reliance on digital platforms necessitates robust cybersecurity measures to protect investor data and market integrity.

- Market Volatility: Global and domestic economic uncertainties can lead to market volatility, impacting investor confidence and investment decisions.

- Infrastructure Gaps: While improving, certain regions may still face infrastructure limitations that could hinder broader market access.

- Competition: Intense competition among intermediaries and the emergence of new FinTech players require continuous adaptation and differentiation. The overall market faces a competitive pressure resulting in an estimated xx% margin squeeze on certain intermediary services.

Emerging Opportunities in India Capital Market Exchange Ecosystem

Emerging opportunities within the India Capital Market Exchange Ecosystem are abundant, driven by unmet financial needs and evolving market trends. The growing demand for sustainable and ESG (Environmental, Social, and Governance) investing presents a significant avenue for product development and fund creation. The vast untapped rural market, with increasing digital penetration, offers substantial potential for financial product adoption. Innovative applications of AI and machine learning in personalized financial advisory services and algorithmic trading are poised to disrupt traditional models. Furthermore, the increasing interest in alternative asset classes, such as real estate investment trusts (REITs) and infrastructure investment trusts (InvITs), signifies a diversification of investor preferences, creating new investment horizons. The integration of blockchain technology for streamlined settlement and tokenized assets could unlock unprecedented efficiencies and liquidity.

Growth Accelerators in the India Capital Market Exchange Ecosystem Industry

Several key catalysts are accelerating the growth of the India Capital Market Exchange Ecosystem. Technological breakthroughs, such as the widespread adoption of cloud computing for scalable infrastructure and the development of sophisticated AI-driven trading algorithms, are enhancing efficiency and opening new investment strategies. Strategic partnerships between established financial institutions and agile FinTech startups are fostering innovation and expanding service offerings to a broader customer base. Market expansion strategies, including efforts to onboard more retail investors through simplified processes and educational initiatives, are crucial growth drivers. The continuous liberalization of foreign investment norms and the government's focus on ease of doing business further contribute to attracting global capital and enhancing market liquidity.

Key Players Shaping the India Capital Market Exchange Ecosystem Market

- Taurus Corporate Advisory Services Limited

- Valuefy Solutions Private Limited

- Hedge Equities Ltd

- Sunflower Broking Pvt Ltd

- Nine Star Broking Pvt Ltd

- Research Icon

- Agroy Finance and Investment Ltd

- United Stock Exchange of India

- Basan Equity Broking Ltd

- Indira Securities P Ltd

Notable Milestones in India Capital Market Exchange Ecosystem Sector

- 2019: Launch of SEBI's enhanced framework for alternative investment funds (AIFs), broadening investment options.

- 2020: Significant surge in retail investor participation driven by increased digital access and market volatility.

- 2021: Introduction of new derivative contracts, expanding hedging and speculative opportunities.

- 2022: Increased focus on ESG investing with the launch of new sustainability-linked bonds and equity funds.

- 2023: Regulatory push for improved corporate governance and disclosure standards across listed entities.

- 2024 (Est.): Continued growth in FinTech adoption, with a rise in AI-powered investment advisory services.

In-Depth India Capital Market Exchange Ecosystem Market Outlook

The India Capital Market Exchange Ecosystem is set for an era of unprecedented growth and transformation. Accelerators such as ongoing digital transformation, a burgeoning investor base, and supportive government policies will continue to propel its expansion. Strategic opportunities lie in further developing specialized financial products, deepening market integration with global financial hubs, and leveraging technology to enhance financial inclusion. The market's outlook is overwhelmingly positive, driven by India's strong economic fundamentals and its position as a rapidly developing financial powerhouse. The estimated market value is expected to reach $xxxx billion by 2033, indicating substantial future potential.

India Capital Market Exchange Ecosystem Segmentation

-

1. Primary Markets

- 1.1. Equity Market

- 1.2. Debt Market

- 1.3. Corporate Governance and Compliance Monitoring

- 1.4. Corporate Restructuring

- 1.5. Intermediaries Associated

-

2. Secondary Markets

- 2.1. Cash Market

- 2.2. Equity Derivatives Markets

- 2.3. Commodity Derivatives Market

- 2.4. Currency Derivatives Market

- 2.5. Interest Rate Derivatives Market

- 2.6. Market Infrastructure Institutions

- 2.7. Intermediaries Associated

India Capital Market Exchange Ecosystem Segmentation By Geography

- 1. India

India Capital Market Exchange Ecosystem Regional Market Share

Geographic Coverage of India Capital Market Exchange Ecosystem

India Capital Market Exchange Ecosystem REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Equity Derivatives Occupied with Major Share in the Secondary Capital Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Markets

- 5.1.1. Equity Market

- 5.1.2. Debt Market

- 5.1.3. Corporate Governance and Compliance Monitoring

- 5.1.4. Corporate Restructuring

- 5.1.5. Intermediaries Associated

- 5.2. Market Analysis, Insights and Forecast - by Secondary Markets

- 5.2.1. Cash Market

- 5.2.2. Equity Derivatives Markets

- 5.2.3. Commodity Derivatives Market

- 5.2.4. Currency Derivatives Market

- 5.2.5. Interest Rate Derivatives Market

- 5.2.6. Market Infrastructure Institutions

- 5.2.7. Intermediaries Associated

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Primary Markets

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Taurus Corporate Advisory Services Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Valuefy Solutions Private Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hedge Equities Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sunflower Broking Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nine Star Broking Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Research Icon

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Agroy Finance and Investment Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Stock Exchange of India

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Basan Equity Broking Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Indira Securities P Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Taurus Corporate Advisory Services Limited

List of Figures

- Figure 1: India Capital Market Exchange Ecosystem Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Capital Market Exchange Ecosystem Share (%) by Company 2025

List of Tables

- Table 1: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Primary Markets 2020 & 2033

- Table 2: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Secondary Markets 2020 & 2033

- Table 3: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Primary Markets 2020 & 2033

- Table 5: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Secondary Markets 2020 & 2033

- Table 6: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Capital Market Exchange Ecosystem?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the India Capital Market Exchange Ecosystem?

Key companies in the market include Taurus Corporate Advisory Services Limited, Valuefy Solutions Private Limited, Hedge Equities Ltd, Sunflower Broking Pvt Ltd, Nine Star Broking Pvt Ltd, Research Icon, Agroy Finance and Investment Ltd, United Stock Exchange of India, Basan Equity Broking Ltd, Indira Securities P Ltd **List Not Exhaustive.

3. What are the main segments of the India Capital Market Exchange Ecosystem?

The market segments include Primary Markets, Secondary Markets.

4. Can you provide details about the market size?

The market size is estimated to be USD 124 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Equity Derivatives Occupied with Major Share in the Secondary Capital Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Capital Market Exchange Ecosystem," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Capital Market Exchange Ecosystem report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Capital Market Exchange Ecosystem?

To stay informed about further developments, trends, and reports in the India Capital Market Exchange Ecosystem, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence