Key Insights

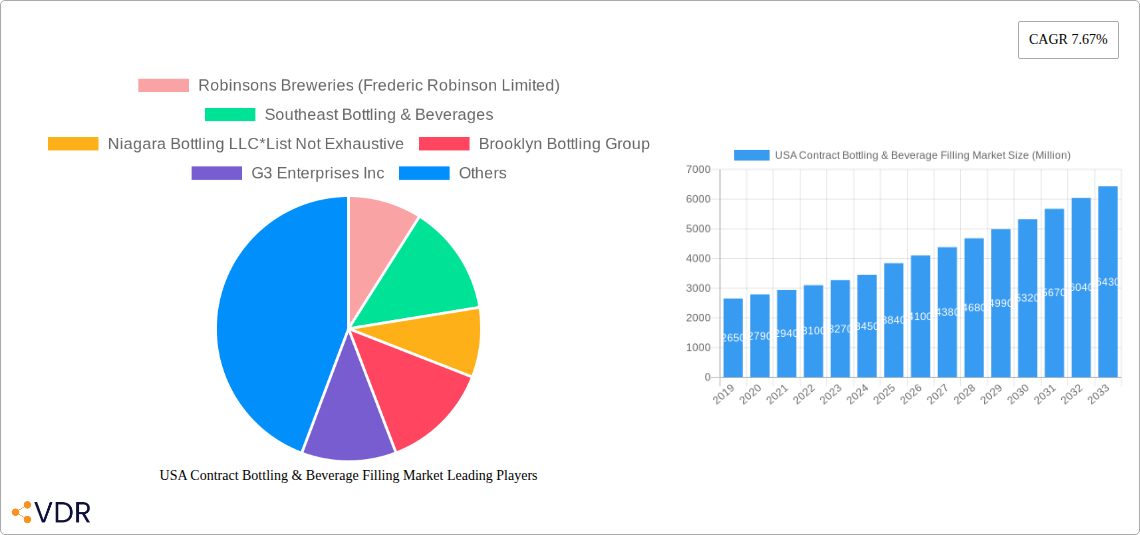

The USA Contract Bottling & Beverage Filling Market is poised for robust expansion, projected to reach an estimated \$3.84 billion by 2025. This growth is fueled by a consistent Compound Annual Growth Rate (CAGR) of 7.67%, indicating a dynamic and evolving industry. Key drivers for this surge include the increasing demand for convenience and a growing preference for diverse beverage options among consumers, especially in segments like bottled water and fruit-based beverages. Beverage manufacturers are increasingly relying on contract bottlers to manage production complexities, scale operations efficiently, and respond rapidly to market shifts, thereby reducing capital expenditure and optimizing supply chains. This outsourcing trend is particularly prominent for smaller brands and those looking to enter new markets without substantial upfront investment in bottling infrastructure. The market's expansion is further supported by advancements in packaging technology and a heightened focus on sustainability, with contract bottlers increasingly offering eco-friendly packaging solutions.

USA Contract Bottling & Beverage Filling Market Market Size (In Billion)

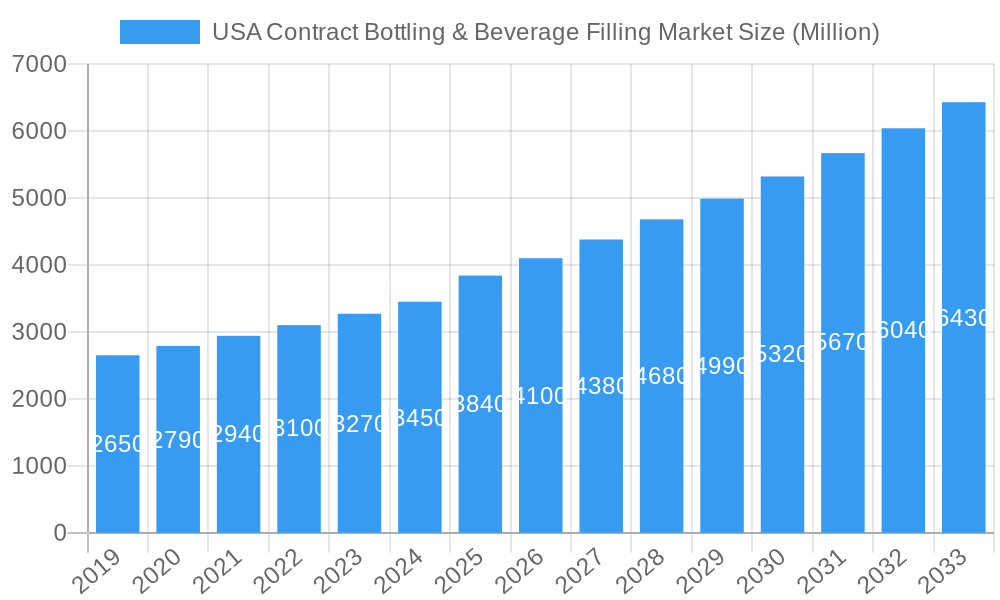

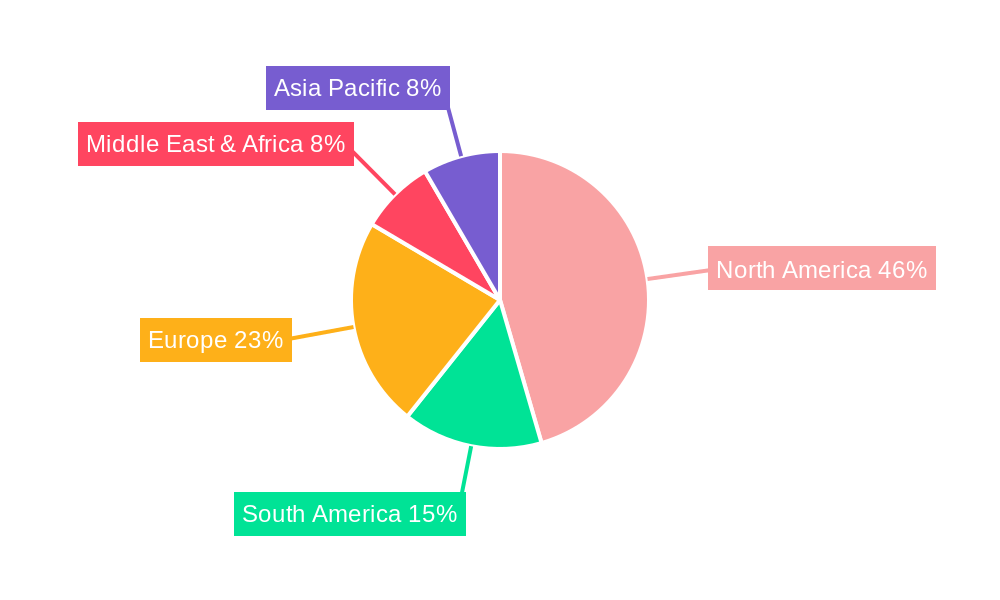

The competitive landscape features established players like Robinsons Breweries and Niagara Bottling LLC, alongside a host of specialized co-packers, all vying for market share. While the market is experiencing significant growth, certain restraints, such as stringent regulatory compliance and rising raw material costs, could pose challenges. However, the overall outlook remains highly positive, driven by the unwavering consumer demand for a wide array of beverages and the strategic advantages contract bottling offers to brands. The market segmentation reveals strong performance across various beverage types, with Beer, Carbonated Drinks, Fruit-based Beverages, and Bottled Water forming the core segments. The North American region, encompassing the United States, Canada, and Mexico, is expected to dominate, given its mature beverage industry and high consumer spending power. Projections for the forecast period (2025-2033) indicate continued strong performance, solidifying the USA contract bottling and beverage filling sector as a vital component of the broader beverage industry.

USA Contract Bottling & Beverage Filling Market Company Market Share

USA Contract Bottling & Beverage Filling Market: Comprehensive Industry Analysis and Forecast (2019-2033)

This in-depth report provides a meticulous examination of the USA contract bottling and beverage filling market, a critical sector supporting a diverse range of beverage producers. With a focus on key market dynamics, growth trends, regional dominance, product landscape, and strategic insights, this report is an indispensable resource for industry stakeholders. We delve into the intricate interplay of technological advancements, evolving consumer preferences, and regulatory landscapes that shape this dynamic industry. The analysis spans the historical period of 2019-2024, with the base year in 2025, and projects future growth through a comprehensive forecast period of 2025-2033, offering a granular understanding of market evolution and untapped potential. This report includes critical data on parent market and child market segments, providing a holistic view of the beverage filling ecosystem. All values are presented in Million units.

USA Contract Bottling & Beverage Filling Market Market Dynamics & Structure

The USA contract bottling and beverage filling market is characterized by a moderately concentrated structure, with a blend of large-scale service providers and specialized niche players. Technological innovation is a significant driver, with advancements in aseptic filling, high-speed canning, and sustainable packaging solutions constantly reshaping operational efficiencies. Regulatory frameworks, encompassing food safety standards (e.g., FDA regulations), environmental compliance, and labeling requirements, significantly influence market entry and operational strategies. Competitive product substitutes are limited within the core contract filling services, but the rise of in-house bottling capabilities for larger brands can be considered an indirect substitute. End-user demographics are expanding, driven by the growth of craft beverages, ready-to-drink (RTD) cocktails, functional beverages, and plant-based drinks. Mergers and acquisitions (M&A) are a notable trend, consolidating market share and expanding service portfolios. For instance, the acquisition of Lion Beverages by Encore Consumer Capital signifies a strategic move to enhance capabilities and reach. The market's growth is also influenced by barriers to innovation, such as high capital investment for advanced equipment and the need for specialized expertise in handling diverse beverage types.

- Market Concentration: Moderate, with a mix of large national players and regional specialists.

- Technological Innovation: Driven by automation, sustainability, and efficiency improvements in filling and packaging.

- Regulatory Influence: Stringent food safety and environmental regulations are paramount.

- End-User Diversification: Catering to a growing demand for craft, RTD, and specialty beverages.

- M&A Activity: Strategic consolidations to gain market share and broaden service offerings.

USA Contract Bottling & Beverage Filling Market Growth Trends & Insights

The USA contract bottling and beverage filling market has witnessed robust growth driven by a confluence of factors, including the burgeoning demand for convenience, the proliferation of new beverage categories, and the strategic outsourcing decisions by both established and emerging beverage brands. The market size has steadily expanded, reflecting increasing production volumes and a greater reliance on specialized co-packing services. Adoption rates of contract filling services are high, particularly among smaller and medium-sized enterprises (SMEs) that benefit from the capital cost savings and operational expertise provided by contract manufacturers. Technological disruptions, such as advancements in high-speed canning lines and advanced filling technologies for sensitive beverages, are continually enhancing efficiency and expanding the scope of services offered. Consumer behavior shifts are significantly impacting market trends, with a growing preference for health-conscious beverages, RTD options, and environmentally friendly packaging solutions. These trends necessitate contract fillers to adapt their capabilities and offer a wider range of specialized services. The market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) through the forecast period, fueled by ongoing innovation and increasing outsourcing of production. The penetration of contract filling services is expected to deepen across all beverage segments, as brands prioritize flexibility and scalability in their supply chains.

Dominant Regions, Countries, or Segments in USA Contract Bottling & Beverage Filling Market

Within the USA contract bottling and beverage filling market, the Bottled Water segment consistently emerges as a dominant force, propelled by escalating consumer demand for convenient and healthy hydration options across the nation. This segment's dominance is underpinned by several key drivers, including widespread public health awareness regarding water consumption, the convenience offered by single-serve and multi-gallon formats, and the continuous innovation in filtration and purification technologies that enhance product appeal. Economically, the affordability and broad appeal of bottled water contribute significantly to its high market share and consistent growth trajectory. Infrastructure plays a crucial role, with a well-established distribution network that facilitates wide availability.

Key Drivers for Bottled Water Dominance:

- Health and Wellness Trends: Growing consumer focus on hydration and the perception of bottled water as a pure, calorie-free beverage.

- Convenience: Availability in various sizes and packaging formats catering to on-the-go lifestyles.

- Economic Accessibility: Relatively lower price point compared to other beverage categories makes it a mass-market product.

- Technological Advancements: Improvements in filtration, purification, and packaging (e.g., lighter-weight plastics, sustainable options).

- Wide Distribution Networks: Extensive availability across retail channels, from convenience stores to supermarkets.

While Bottled Water leads, other segments such as Carbonated Drinks and Fruit-based Beverages also represent substantial portions of the market. The Beer segment, especially with the growth of craft breweries, shows significant potential for contract filling and packaging, as evidenced by G3 Enterprises' new aluminum can supply initiative. The Other Beverage Types (Sport Drinks) segment is also expanding, driven by the active lifestyle trends and the increasing variety of functional beverages. The dominance of Bottled Water is projected to continue, but the dynamism within the other segments, particularly RTDs and functional beverages, presents significant growth opportunities for contract fillers specializing in these areas. Market share within the bottled water segment is substantial, estimated to be over 40% of the total contract bottling market in the US.

USA Contract Bottling & Beverage Filling Market Product Landscape

The USA contract bottling and beverage filling market product landscape is characterized by a strong emphasis on diversity and specialization. Contract fillers cater to a wide array of beverage types, offering tailored solutions for everything from sparkling water and sodas to premium juices, energy drinks, and alcoholic RTDs. Key product innovations revolve around enhancing shelf-life, maintaining product integrity, and aligning with sustainability goals. This includes advanced aseptic filling technologies for sensitive products, high-speed canning for carbonated beverages, and specialized bottling lines for viscous or particulate-laden drinks. Performance metrics such as fill accuracy, line speed, and minimal product loss are crucial. Unique selling propositions often lie in specialized capabilities, such as organic beverage filling, cold-fill processing, or the ability to handle unusual packaging formats. Technological advancements continue to drive efficiency, reduce waste, and enable the production of innovative beverage formulations.

Key Drivers, Barriers & Challenges in USA Contract Bottling & Beverage Filling Market

Key Drivers:

- Growing Demand for Niche & Craft Beverages: The explosion of craft beers, RTDs, and functional drinks necessitates flexible and specialized bottling partners.

- Cost-Effectiveness & Scalability: Outsourcing production allows brands to avoid significant capital investment in bottling facilities and scale operations efficiently.

- Focus on Core Competencies: Brands can concentrate on product development, marketing, and sales by entrusting manufacturing to experts.

- Technological Advancements: Contract fillers invest in cutting-edge equipment to offer diverse packaging solutions and enhance efficiency.

- Supply Chain Resilience: Diversifying production through contract manufacturers can mitigate risks associated with single-source manufacturing.

Barriers & Challenges:

- Supply Chain Volatility: Disruptions in raw material sourcing (e.g., aluminum cans) and logistics can impact production schedules and costs.

- Regulatory Compliance: Navigating complex and evolving food safety and environmental regulations requires constant vigilance and investment.

- Quality Control & Brand Reputation: Maintaining consistent quality is paramount, as any lapse directly impacts the client's brand image.

- Intense Competition: The market features numerous players, leading to price pressures and the need for differentiation.

- Skilled Labor Shortages: Finding and retaining qualified personnel for specialized bottling and filling operations can be challenging.

- Minimum Order Quantities (MOQs): Smaller brands may struggle to meet the MOQs of larger contract fillers, limiting their options.

Emerging Opportunities in USA Contract Bottling & Beverage Filling Market

Emerging opportunities in the USA contract bottling and beverage filling market are largely shaped by evolving consumer preferences and technological advancements. The burgeoning market for functional beverages, including those fortified with vitamins, probiotics, and adaptogens, presents a significant avenue for contract fillers equipped to handle specialized formulations and ingredients. Similarly, the continued growth of Ready-to-Drink (RTD) cocktails and mocktails offers substantial potential, requiring expertise in canning and bottling diverse alcoholic and non-alcoholic mixtures. The increasing consumer focus on sustainability is driving demand for contract fillers that can offer eco-friendly packaging solutions, such as aluminum cans, biodegradable materials, and optimized packaging designs that minimize waste. Furthermore, the expansion of plant-based beverages, including oat milk, almond milk, and other dairy alternatives, creates demand for specialized filling processes to maintain product integrity and shelf-life. Untapped markets include hyper-local beverage producers and emerging international brands looking to enter the US market without significant upfront investment.

Growth Accelerators in the USA Contract Bottling & Beverage Filling Market Industry

Several key catalysts are propelling long-term growth in the USA contract bottling and beverage filling market. Technological breakthroughs in automation and robotics are significantly increasing line speeds, reducing labor costs, and improving overall efficiency, allowing contract fillers to offer more competitive pricing. Strategic partnerships between contract fillers and ingredient suppliers or packaging manufacturers are fostering innovation and enabling the development of novel beverage solutions. Market expansion strategies, such as contract fillers investing in new facilities or acquiring smaller players, are broadening their geographical reach and service capabilities, catering to a wider client base. The ongoing trend of brand consolidation and the rise of private label also benefit contract fillers, as larger entities seek to streamline their supply chains and smaller brands look for reliable manufacturing partners. The increasing demand for premium and specialized beverages further fuels growth, as contract fillers with the expertise and equipment to handle these complex products gain a competitive edge.

Key Players Shaping the USA Contract Bottling & Beverage Filling Market Market

- Robinsons Breweries (Frederic Robinson Limited)

- Southeast Bottling & Beverages

- Niagara Bottling LLC

- Brooklyn Bottling Group

- G3 Enterprises Inc

- CSD Co-Packers Inc

- Western Innovations Inc

Notable Milestones in USA Contract Bottling & Beverage Filling Market Sector

- April 2022 - G3 Enterprises introduces a new; dedicated aluminum can supply to craft brewers, RTD cocktail producers, and beverage companies. The recent aluminum can shortage has questioned this pastime, particularly for small beer companies, forced to pay more for aluminum cans if they can find them.

- January 2022 - Encore consumer capital, a private equity firm based in Pennsylvania, has acquired contract manufacturer Lion Beverages. Lion brews craft beer in Wilkes-Barre and provides brewing, blending, canning, bottling, and packaging services to customers, including large national beverage brands. Lion believes it has a fantastic opportunity to leverage Encore's capabilities and expertise as the company strives to reach its full potential.

- October 2021 - MSI Express, backed by HCI Equity Partners, headquartered in the United States, has acquired Power Packaging. MSI Express provides contract packaging and contract manufacturing services for well-known brands in the shelf-stable human and pet food space. Power also brings MSI Express into categories such as powdered beverages, soups, bases, beverage mixes, food service beverages, coffees, and teas. Power Packaging has four locations - two outside Chicago, one in Wisconson, and one in Texas. It serves various companies by adding capabilities such as aseptic beverage filling, stick packaging, and filling of jars and cans.

In-Depth USA Contract Bottling & Beverage Filling Market Market Outlook

The future outlook for the USA contract bottling and beverage filling market is exceptionally promising, driven by sustained demand for outsourced manufacturing solutions and the continuous evolution of the beverage industry. Growth accelerators such as advancements in sustainable packaging, the expansion of RTD and functional beverage categories, and the increasing adoption of automation and AI in production will continue to shape market trajectories. Strategic partnerships, coupled with investments in specialized capabilities like aseptic filling and cold-fill processing, will enable contract fillers to capture a larger share of the market. The market's resilience is further bolstered by its role in supporting a diverse range of beverage producers, from nascent startups to established corporations. Future growth will also be influenced by the ability of contract manufacturers to adapt to evolving consumer preferences for health, convenience, and environmental responsibility, ensuring their continued relevance and profitability in the years to come.

USA Contract Bottling & Beverage Filling Market Segmentation

-

1. Beverage Type

- 1.1. Beer

- 1.2. Carbonated Drinks and Fruit-based Beverages

- 1.3. Bottled Water

- 1.4. Other Beverage Types (Sport Drinks)

USA Contract Bottling & Beverage Filling Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Contract Bottling & Beverage Filling Market Regional Market Share

Geographic Coverage of USA Contract Bottling & Beverage Filling Market

USA Contract Bottling & Beverage Filling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. CapEx Benefits offered by contract bottlers for small-scale beverage manufacturers; Rise in demand from new-age drinks and craft beer segment; Gradual change in the business model of Contact packagers towards a consultative approach involving design & placement

- 3.3. Market Restrains

- 3.3.1. Strong Competition from the Paints Segment; Recent Changes in Macro-environment Expected to Impact Customer Spending

- 3.4. Market Trends

- 3.4.1. Beer is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Beverage Type

- 5.1.1. Beer

- 5.1.2. Carbonated Drinks and Fruit-based Beverages

- 5.1.3. Bottled Water

- 5.1.4. Other Beverage Types (Sport Drinks)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Beverage Type

- 6. North America USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Beverage Type

- 6.1.1. Beer

- 6.1.2. Carbonated Drinks and Fruit-based Beverages

- 6.1.3. Bottled Water

- 6.1.4. Other Beverage Types (Sport Drinks)

- 6.1. Market Analysis, Insights and Forecast - by Beverage Type

- 7. South America USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Beverage Type

- 7.1.1. Beer

- 7.1.2. Carbonated Drinks and Fruit-based Beverages

- 7.1.3. Bottled Water

- 7.1.4. Other Beverage Types (Sport Drinks)

- 7.1. Market Analysis, Insights and Forecast - by Beverage Type

- 8. Europe USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Beverage Type

- 8.1.1. Beer

- 8.1.2. Carbonated Drinks and Fruit-based Beverages

- 8.1.3. Bottled Water

- 8.1.4. Other Beverage Types (Sport Drinks)

- 8.1. Market Analysis, Insights and Forecast - by Beverage Type

- 9. Middle East & Africa USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Beverage Type

- 9.1.1. Beer

- 9.1.2. Carbonated Drinks and Fruit-based Beverages

- 9.1.3. Bottled Water

- 9.1.4. Other Beverage Types (Sport Drinks)

- 9.1. Market Analysis, Insights and Forecast - by Beverage Type

- 10. Asia Pacific USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Beverage Type

- 10.1.1. Beer

- 10.1.2. Carbonated Drinks and Fruit-based Beverages

- 10.1.3. Bottled Water

- 10.1.4. Other Beverage Types (Sport Drinks)

- 10.1. Market Analysis, Insights and Forecast - by Beverage Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Robinsons Breweries (Frederic Robinson Limited)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Southeast Bottling & Beverages

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Niagara Bottling LLC*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Brooklyn Bottling Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 G3 Enterprises Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CSD Co-Packers Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Western Innovations Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Robinsons Breweries (Frederic Robinson Limited)

List of Figures

- Figure 1: Global USA Contract Bottling & Beverage Filling Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 3: North America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 4: North America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 7: South America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 8: South America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 11: Europe USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 12: Europe USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 15: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 16: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 19: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 20: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 2: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 4: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 9: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 14: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 25: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 33: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Contract Bottling & Beverage Filling Market?

The projected CAGR is approximately 7.67%.

2. Which companies are prominent players in the USA Contract Bottling & Beverage Filling Market?

Key companies in the market include Robinsons Breweries (Frederic Robinson Limited), Southeast Bottling & Beverages, Niagara Bottling LLC*List Not Exhaustive, Brooklyn Bottling Group, G3 Enterprises Inc, CSD Co-Packers Inc, Western Innovations Inc.

3. What are the main segments of the USA Contract Bottling & Beverage Filling Market?

The market segments include Beverage Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.84 Million as of 2022.

5. What are some drivers contributing to market growth?

CapEx Benefits offered by contract bottlers for small-scale beverage manufacturers; Rise in demand from new-age drinks and craft beer segment; Gradual change in the business model of Contact packagers towards a consultative approach involving design & placement.

6. What are the notable trends driving market growth?

Beer is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Strong Competition from the Paints Segment; Recent Changes in Macro-environment Expected to Impact Customer Spending.

8. Can you provide examples of recent developments in the market?

April 2022 - G3 Enterprises introduces a new; dedicated aluminum can supply to craft brewers, RTD cocktail producers, and beverage companies. The recent aluminum can shortage has questioned this pastime, particularly for small beer companies, forced to pay more for aluminum cans if they can find them.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Contract Bottling & Beverage Filling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Contract Bottling & Beverage Filling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Contract Bottling & Beverage Filling Market?

To stay informed about further developments, trends, and reports in the USA Contract Bottling & Beverage Filling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence