Key Insights

The U.S. Medical Contract Packaging Market is projected to reach $31.9 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.42% from 2025 to 2033. This growth is propelled by escalating demand for outsourced pharmaceutical and medical device packaging, driven by increasing healthcare spending and an aging demographic. The rising incidence of chronic diseases further amplifies the need for secure and effective packaging for medications and medical supplies. Innovations in packaging materials and automated processes are enhancing efficiency, thus supporting market expansion. The market is segmented by service, product, and material types, with primary packaging, secondary and tertiary packaging, and plastic, paper & paperboard, and glass materials being key components. Leading companies are actively engaged in strategic collaborations and acquisitions to enhance their market position.

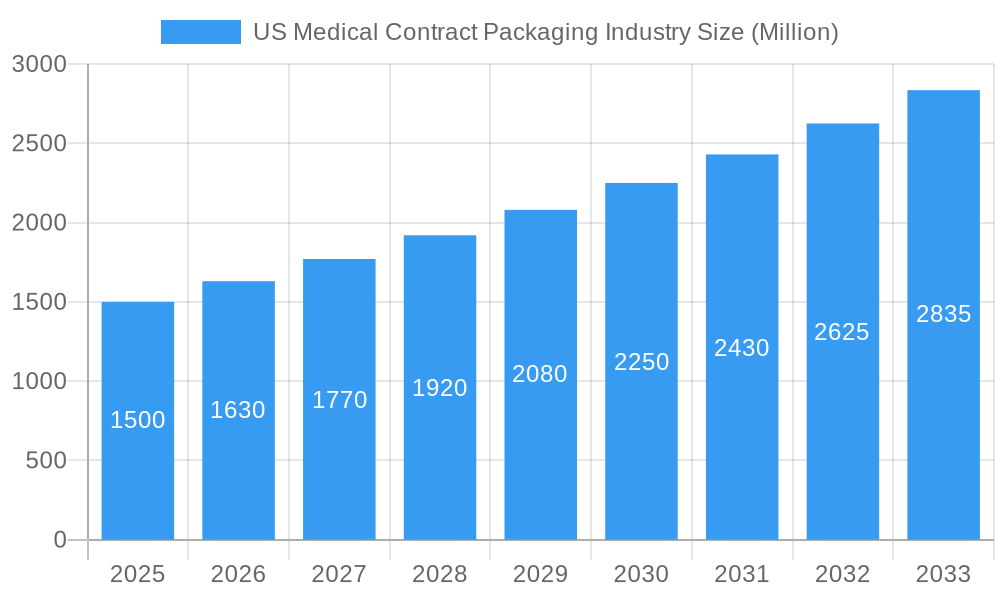

US Medical Contract Packaging Industry Market Size (In Billion)

Key market restraints include stringent regulatory compliance and quality control mandates within the healthcare sector, which necessitate substantial investment in technology and adherence. Volatility in raw material pricing also presents a challenge to profitability. Nevertheless, the long-term outlook for the U.S. Medical Contract Packaging Market is optimistic, buoyed by ongoing innovation, the demand for personalized medicine packaging, and the adoption of advanced packaging technologies focused on product integrity and patient safety, promising continued growth and diversification.

US Medical Contract Packaging Industry Company Market Share

US Medical Contract Packaging Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the US medical contract packaging industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report delivers a granular understanding of market dynamics, growth trends, and future opportunities within this rapidly evolving sector. The report focuses on key segments including Primary and Other Service Types, Secondary and Tertiary Product Types, and Plastic, Paper & Paperboard, and Glass Material Types. The market size is presented in million units.

US Medical Contract Packaging Industry Market Dynamics & Structure

The US medical contract packaging market is characterized by moderate concentration, with several large players and numerous smaller specialized firms. Technological innovation, particularly in automation and aseptic processing, is a major growth driver. Stringent regulatory frameworks, including FDA guidelines, significantly impact operations and investment decisions. Competitive pressures arise from both established players and emerging companies offering niche solutions. The end-user demographic is primarily pharmaceutical and biotechnology companies, with increasing demand from smaller biotech firms and personalized medicine providers. M&A activity has been relatively robust in recent years, driven by consolidation and expansion strategies.

- Market Concentration: Moderately concentrated, with a top 5 market share of xx%.

- Technological Innovation: Significant investment in automation, robotics, and aseptic technologies.

- Regulatory Framework: Stringent FDA regulations drive compliance costs and influence packaging choices.

- Competitive Substitutes: Limited direct substitutes, but pressure from alternative packaging solutions and in-house packaging capabilities.

- End-User Demographics: Pharmaceutical and biotechnology companies, including large multinational firms and smaller specialized players.

- M&A Trends: xx M&A deals completed between 2019-2024, primarily focused on consolidation and expansion into new therapeutic areas.

US Medical Contract Packaging Industry Growth Trends & Insights

The US medical contract packaging market has experienced robust growth from 2019 to 2024, fueled by a surge in pharmaceutical production, increasing demand for innovative drug delivery systems, and the prevalent outsourcing trend within the pharmaceutical industry. This upward trajectory is projected to continue throughout the forecast period (2025-2033), driven by several key factors. The rising prevalence of chronic diseases necessitates larger-scale packaging solutions, while advancements in biotechnology introduce new packaging requirements. The increasing demand for sterile and tamper-evident packaging, driven by heightened consumer awareness of product safety and authenticity, further fuels market expansion. Moreover, technological advancements, including the adoption of sophisticated materials and automation technologies, are significantly enhancing efficiency and enabling the production of complex packaging formats.

- Market Size (2024): xx Million Units

- CAGR (2019-2024): xx%

- Market Penetration (2024): xx%

- Projected Market Size (2033): xx Million Units

Dominant Regions, Countries, or Segments in US Medical Contract Packaging Industry

The Northeast and West Coast regions of the United States currently dominate the medical contract packaging market, owing to the high concentration of pharmaceutical and biotechnology companies in these areas. Within the service landscape, primary packaging services (including blister packs, bottles, and vials) comprise a significantly larger segment compared to secondary or tertiary packaging services. Plastic remains the leading material type, followed by paper and paperboard. However, secondary and tertiary packaging, encompassing cartons and shipping containers, represent a rapidly growing segment. The continued expansion in these dominant regions is underpinned by robust infrastructure, a readily available skilled workforce, and proximity to major pharmaceutical hubs. This strategic geographic advantage contributes significantly to operational efficiency and cost-effectiveness.

- Leading Region: Northeast and West Coast

- Dominant Service Type: Primary Packaging

- Leading Material Type: Plastic

- Key Growth Drivers: Strong pharmaceutical industry presence, robust infrastructure, and a skilled workforce.

US Medical Contract Packaging Industry Product Landscape

The US medical contract packaging industry offers a diverse range of products tailored to various pharmaceutical and biotech needs. Innovations focus on enhanced barrier properties, improved tamper evidence, and sustainable materials. Performance metrics such as sterility assurance, barrier integrity, and ease of use are critical factors influencing product selection. Unique selling propositions often involve specialized capabilities like aseptic filling, flexible packaging solutions, and customized labeling options. Technological advancements encompass automation, robotics, and advanced materials science.

Key Drivers, Barriers & Challenges in US Medical Contract Packaging Industry

Key Drivers: The escalating trend of pharmaceutical companies outsourcing their packaging needs, the growing demand for sterile packaging solutions to maintain product integrity, ongoing technological innovations in packaging materials and automation processes that enhance efficiency, and increasingly stringent regulatory compliance requirements are all significant drivers of market growth. The pursuit of enhanced efficiency and compliance is pushing market expansion.

Key Challenges: The substantial costs associated with stringent regulatory compliance, disruptions to the supply chain that impact the availability of raw materials, and the intense competition among contract packaging providers pose significant challenges to market players. These challenges can lead to increased operational costs and reduced profit margins for some companies. Supply chain disruptions in 2024 are estimated to have reduced market growth by approximately xx%.

Emerging Opportunities in US Medical Contract Packaging Industry

Emerging opportunities lie in personalized medicine packaging, the rise of biologics requiring specialized containment, growth in the cannabis and CBD markets, and an increasing demand for sustainable and eco-friendly packaging solutions. These segments present untapped market potential for contract packaging providers capable of offering innovative and customized solutions.

Growth Accelerators in the US Medical Contract Packaging Industry

Technological advancements, strategic partnerships between contract packaging firms and pharmaceutical companies, and market expansion into high-growth segments like personalized medicine and biologics are accelerating growth. Investment in automation and advanced technologies significantly enhances production efficiency, reduces costs, and enables the production of complex packaging formats.

Key Players Shaping the US Medical Contract Packaging Market

- Action Pak Inc

- Aphena Pharma Solutions

- MBK Tape Solutions

- Sonic Packaging Industries Inc

- AmeriPac Inc

- Elitefill Inc

- Thermo-Pak Co Inc

- Assemblies Unlimited Inc

- Deluxe Packaging

- Tru Body Wellness

- List Not Exhaustive

Notable Milestones in US Medical Contract Packaging Industry Sector

- January 2022: West Pharmaceutical Services and Corning Incorporated announced a substantial multimillion-dollar investment to expand Corning's Valor Glass technology for advanced injectable drug packaging. This collaboration has had a notable impact on the glass packaging segment, signifying a focus on innovation and enhanced drug delivery systems.

- February 2022: Moderna and Thermo Fisher Scientific formed a 15-year strategic collaboration for the manufacturing and packaging of Moderna's COVID-19 vaccine. This high-profile partnership vividly illustrates the massive scale of contract packaging required for large-scale vaccine rollouts and highlights the crucial role of contract packaging in public health initiatives.

In-Depth US Medical Contract Packaging Industry Market Outlook

The US medical contract packaging market is poised for continued growth over the forecast period, driven by technological advancements, strategic partnerships, and expansion into emerging therapeutic areas. The focus on sustainable packaging solutions and personalized medicine will present significant opportunities for innovative contract packaging providers to capture market share and drive long-term value creation. The market's future potential is substantial, presenting lucrative opportunities for strategic investment and expansion.

US Medical Contract Packaging Industry Segmentation

-

1. Service Type

-

1.1. Primary

- 1.1.1. Medical Pouches

- 1.1.2. Blister Packs

- 1.1.3. Cartridges and Syringes

- 1.1.4. Vials

- 1.1.5. Ampoules

- 1.1.6. Others Product Types

- 1.2. Secondary

- 1.3. Tertiary

-

1.1. Primary

-

2. Material Type

- 2.1. Plastic

- 2.2. Paper & Paperboard

- 2.3. Glass

US Medical Contract Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Medical Contract Packaging Industry Regional Market Share

Geographic Coverage of US Medical Contract Packaging Industry

US Medical Contract Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost-Effectiveness Of The Outsourcing; Access to the advanced technologies and expertise

- 3.3. Market Restrains

- 3.3.1. Monitoring issues and lack of standardization

- 3.4. Market Trends

- 3.4.1. Increasing Outsourcing Volumes by Major Pharmaceutical Companies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Medical Contract Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Primary

- 5.1.1.1. Medical Pouches

- 5.1.1.2. Blister Packs

- 5.1.1.3. Cartridges and Syringes

- 5.1.1.4. Vials

- 5.1.1.5. Ampoules

- 5.1.1.6. Others Product Types

- 5.1.2. Secondary

- 5.1.3. Tertiary

- 5.1.1. Primary

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Plastic

- 5.2.2. Paper & Paperboard

- 5.2.3. Glass

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America US Medical Contract Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Primary

- 6.1.1.1. Medical Pouches

- 6.1.1.2. Blister Packs

- 6.1.1.3. Cartridges and Syringes

- 6.1.1.4. Vials

- 6.1.1.5. Ampoules

- 6.1.1.6. Others Product Types

- 6.1.2. Secondary

- 6.1.3. Tertiary

- 6.1.1. Primary

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Plastic

- 6.2.2. Paper & Paperboard

- 6.2.3. Glass

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. South America US Medical Contract Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Primary

- 7.1.1.1. Medical Pouches

- 7.1.1.2. Blister Packs

- 7.1.1.3. Cartridges and Syringes

- 7.1.1.4. Vials

- 7.1.1.5. Ampoules

- 7.1.1.6. Others Product Types

- 7.1.2. Secondary

- 7.1.3. Tertiary

- 7.1.1. Primary

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Plastic

- 7.2.2. Paper & Paperboard

- 7.2.3. Glass

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Europe US Medical Contract Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Primary

- 8.1.1.1. Medical Pouches

- 8.1.1.2. Blister Packs

- 8.1.1.3. Cartridges and Syringes

- 8.1.1.4. Vials

- 8.1.1.5. Ampoules

- 8.1.1.6. Others Product Types

- 8.1.2. Secondary

- 8.1.3. Tertiary

- 8.1.1. Primary

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Plastic

- 8.2.2. Paper & Paperboard

- 8.2.3. Glass

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Middle East & Africa US Medical Contract Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Primary

- 9.1.1.1. Medical Pouches

- 9.1.1.2. Blister Packs

- 9.1.1.3. Cartridges and Syringes

- 9.1.1.4. Vials

- 9.1.1.5. Ampoules

- 9.1.1.6. Others Product Types

- 9.1.2. Secondary

- 9.1.3. Tertiary

- 9.1.1. Primary

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Plastic

- 9.2.2. Paper & Paperboard

- 9.2.3. Glass

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Asia Pacific US Medical Contract Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Primary

- 10.1.1.1. Medical Pouches

- 10.1.1.2. Blister Packs

- 10.1.1.3. Cartridges and Syringes

- 10.1.1.4. Vials

- 10.1.1.5. Ampoules

- 10.1.1.6. Others Product Types

- 10.1.2. Secondary

- 10.1.3. Tertiary

- 10.1.1. Primary

- 10.2. Market Analysis, Insights and Forecast - by Material Type

- 10.2.1. Plastic

- 10.2.2. Paper & Paperboard

- 10.2.3. Glass

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Action Pak Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aphena Pharma Solutions

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MBK Tape Solutions

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sonic Packaging Industries Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AmeriPac Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Elitefill Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Thermo-Pak Co Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Assemblies Unlimited Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Deluxe Packaging*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tru Body Wellness

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Action Pak Inc

List of Figures

- Figure 1: Global US Medical Contract Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Medical Contract Packaging Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 3: North America US Medical Contract Packaging Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America US Medical Contract Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 5: North America US Medical Contract Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America US Medical Contract Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America US Medical Contract Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Medical Contract Packaging Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 9: South America US Medical Contract Packaging Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: South America US Medical Contract Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 11: South America US Medical Contract Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: South America US Medical Contract Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: South America US Medical Contract Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Medical Contract Packaging Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 15: Europe US Medical Contract Packaging Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Europe US Medical Contract Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 17: Europe US Medical Contract Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 18: Europe US Medical Contract Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe US Medical Contract Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Medical Contract Packaging Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 21: Middle East & Africa US Medical Contract Packaging Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Middle East & Africa US Medical Contract Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 23: Middle East & Africa US Medical Contract Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 24: Middle East & Africa US Medical Contract Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Medical Contract Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Medical Contract Packaging Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 27: Asia Pacific US Medical Contract Packaging Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Asia Pacific US Medical Contract Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 29: Asia Pacific US Medical Contract Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 30: Asia Pacific US Medical Contract Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific US Medical Contract Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 3: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 5: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 11: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 12: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 17: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 18: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 29: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 30: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 38: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 39: Global US Medical Contract Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Medical Contract Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Medical Contract Packaging Industry?

The projected CAGR is approximately 7.42%.

2. Which companies are prominent players in the US Medical Contract Packaging Industry?

Key companies in the market include Action Pak Inc, Aphena Pharma Solutions, MBK Tape Solutions, Sonic Packaging Industries Inc, AmeriPac Inc, Elitefill Inc, Thermo-Pak Co Inc, Assemblies Unlimited Inc, Deluxe Packaging*List Not Exhaustive, Tru Body Wellness.

3. What are the main segments of the US Medical Contract Packaging Industry?

The market segments include Service Type, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Cost-Effectiveness Of The Outsourcing; Access to the advanced technologies and expertise.

6. What are the notable trends driving market growth?

Increasing Outsourcing Volumes by Major Pharmaceutical Companies.

7. Are there any restraints impacting market growth?

Monitoring issues and lack of standardization.

8. Can you provide examples of recent developments in the market?

January 2022 -West Pharmaceutical Service, Inc., a global player in innovative solutions for injectable drug administration, announced an exclusive supply and technology agreement with Corning Incorporated. The new collaboration includes a multimillion-dollar investment to expand Corning's Valor Glass technology to enable advanced injectable drug packaging and delivery systems for the pharmaceutical industry with the goal of advancing patient safety and expanding access to life-saving treatments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Medical Contract Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Medical Contract Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Medical Contract Packaging Industry?

To stay informed about further developments, trends, and reports in the US Medical Contract Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence