Key Insights

The United States hydrogen generation market is poised for substantial expansion, propelled by escalating cross-sector demand and supportive government clean energy initiatives. Projected to grow at a Compound Annual Growth Rate (CAGR) of 8.6%, the market is estimated to reach $204.86 billion by 2025. Key growth catalysts include widespread adoption of hydrogen fuel cells in transportation, increasing demand in refining and chemical processing, and a strong focus on decarbonizing heavy industries such as iron and steel production. Advancements in Steam Methane Reforming (SMR) and nascent green hydrogen production technologies are further accelerating market growth. Despite challenges like the cost of green hydrogen and infrastructure development needs, the long-term outlook remains exceptionally positive.

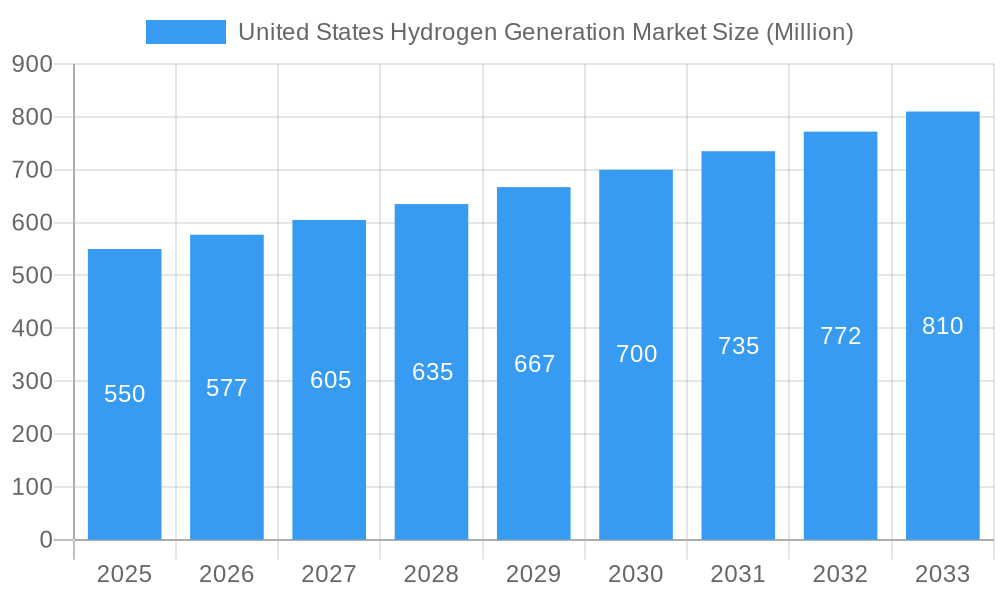

United States Hydrogen Generation Market Market Size (In Billion)

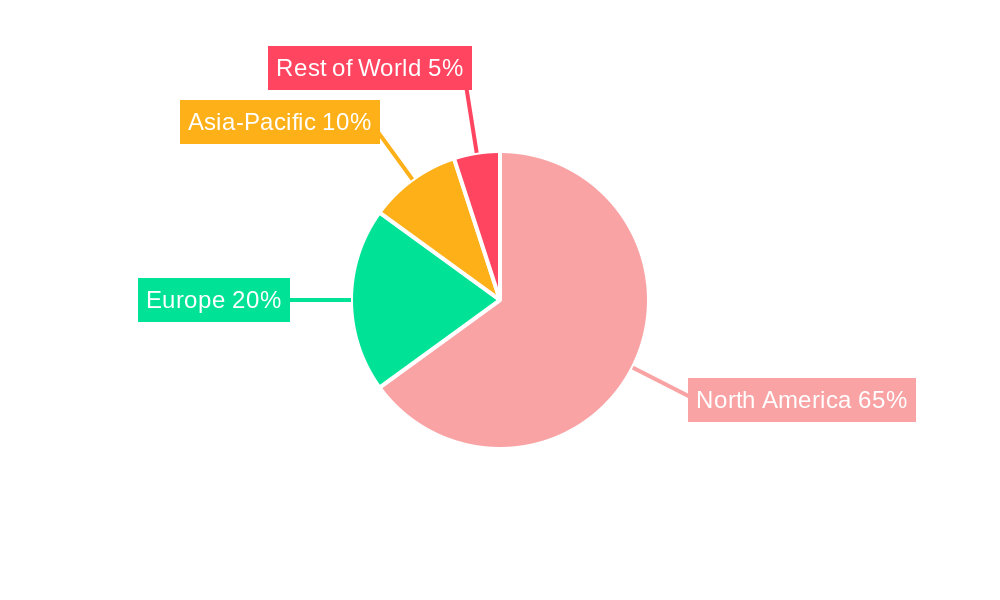

Market segmentation highlights a dynamic landscape. Steam Methane Reforming (SMR) currently leads in technology due to established infrastructure and cost-effectiveness, while green hydrogen, derived from renewable sources, is rapidly gaining traction driven by environmental imperatives and policy support. Oil refining and chemical processing are significant application segments, with iron and steel production exhibiting substantial growth potential for decarbonization efforts. Leading industry players, including Air Products and Chemicals, Linde Plc, and Air Liquide SA, are actively expanding production capacities and investing in innovative technologies, intensifying market competition. The North American region, particularly the United States, holds a dominant market share owing to its robust industrial base and favorable policy environment. The forecast period, 2025-2033, anticipates sustained expansion driven by renewable energy investments, stringent emission regulations, and a strategic shift toward a hydrogen-based economy.

United States Hydrogen Generation Market Company Market Share

United States Hydrogen Generation Market Analysis: Forecast 2025-2033

This comprehensive report provides an in-depth analysis of the U.S. hydrogen generation market, detailing market dynamics, growth trajectories, regional dominance, product segmentation, key drivers, barriers, emerging opportunities, growth accelerators, leading competitors, and significant milestones. The analysis covers the period from 2019 to 2033, with 2025 designated as the base and estimated year. The market is meticulously segmented by source (blue, green, grey hydrogen), technology (Steam Methane Reforming (SMR), coal gasification, others), and application (oil refining, chemical processing, iron & steel production, others), offering granular insights into this rapidly evolving sector. Market valuation is presented in billions.

United States Hydrogen Generation Market Dynamics & Structure

The US hydrogen generation market is characterized by a moderately concentrated landscape, with key players such as Air Products and Chemicals Inc, Linde Plc, and Air Liquide SA holding significant market share. Technological innovation, particularly in electrolysis technologies for green hydrogen production, is a primary growth driver. Stringent environmental regulations and government incentives are further accelerating market expansion. However, high capital costs associated with hydrogen production and infrastructure development pose a significant barrier. The market also faces competition from alternative energy sources. Mergers and acquisitions (M&A) activity is rising as major players consolidate their position and expand their capabilities. The market share of the top three players is estimated at xx% in 2025. M&A deals in the sector totalled xx in 2024.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Technological Innovation: Rapid advancements in electrolysis and fuel cell technologies.

- Regulatory Framework: Supportive policies and incentives driving green hydrogen adoption.

- Competitive Substitutes: Natural gas and other fossil fuels pose a significant competition.

- End-User Demographics: Oil refining, chemical processing, and steel industries represent key end-users.

- M&A Trends: Increasing consolidation through mergers and acquisitions to expand market share and capacity.

- Innovation Barriers: High capital expenditure requirements and technological complexities.

United States Hydrogen Generation Market Growth Trends & Insights

The US hydrogen generation market is experiencing robust growth, driven by increasing demand for clean energy and stringent environmental regulations. The market size is projected to reach xx million in 2025 and xx million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by the rising adoption of green hydrogen, technological advancements in electrolysis, and government support for hydrogen infrastructure development. The market penetration rate for green hydrogen is expected to increase significantly in the coming years. The historical period (2019-2024) showed a steady growth trajectory and the shift towards renewable energy is expected to accelerate the market further. Consumer behavior is also shifting with increasing demand for sustainable energy.

Dominant Regions, Countries, or Segments in United States Hydrogen Generation Market

The United States hydrogen generation market is characterized by a dynamic regional and segment landscape. California and Texas continue to be the frontrunners, fueled by robust policy frameworks, established infrastructure, and a high concentration of industrial consumers actively seeking decarbonization solutions. In terms of segments, green hydrogen is experiencing an accelerated growth trajectory, propelled by heightened environmental consciousness and substantial government incentives aimed at fostering a low-carbon economy. While Steam Methane Reforming (SMR) remains the predominant technology for grey hydrogen production due to its established cost-effectiveness, its market share is anticipated to gradually diminish as green hydrogen technologies mature and become more competitive.

- Leading Regions: California and Texas stand out as the primary hubs for hydrogen generation, exhibiting significant market size and impressive growth rates.

- Key Growth Segment: Green hydrogen is the fastest-growing segment, closely followed by blue hydrogen, reflecting a strong industry shift towards cleaner production methods.

- Primary Growth Drivers: A confluence of supportive government policies, escalating environmental awareness among businesses and consumers, and continuous technological advancements are collectively propelling market expansion.

- Evolving Market Share: While the grey hydrogen segment currently commands the largest market share, a discernible trend indicates a future shift towards green and blue hydrogen as production costs decrease and sustainability mandates intensify.

- Significant Growth Potential: All hydrogen generation segments offer substantial growth potential, with green and blue hydrogen poised for particularly rapid expansion in the coming years.

United States Hydrogen Generation Market Product Landscape

The product landscape within the US hydrogen generation market is diverse and innovative, encompassing a range of production technologies such as Steam Methane Reforming (SMR), electrolysis (including Alkaline, PEM, and SOEC), and biomass gasification. Product development efforts are intensely focused on enhancing energy efficiency, driving down production costs, and maximizing sustainability. Key performance indicators that define product competitiveness include hydrogen purity levels, scalability of production capacity, overall energy efficiency of the process, and the upfront capital expenditure required. Manufacturers are differentiating their offerings by emphasizing low-carbon emissions, superior cost-effectiveness, and the inherent scalability of their solutions. Recent breakthroughs in Proton Exchange Membrane (PEM) electrolyzers, for instance, are leading to improved efficiency and reduced operational expenditures, further bolstering the appeal of green hydrogen production.

Key Drivers, Barriers & Challenges in United States Hydrogen Generation Market

Key Drivers:

- Increasing demand for clean energy and reduction of carbon emissions.

- Government support through policies and incentives for hydrogen adoption.

- Technological advancements, specifically in electrolysis for green hydrogen production.

Challenges:

- High capital costs associated with hydrogen production and infrastructure development.

- Intermittency of renewable energy sources for green hydrogen production.

- Supply chain challenges in procuring essential components for electrolysis systems. The lack of adequate infrastructure and skilled workforce also pose difficulties.

- Regulatory hurdles and complexities in obtaining permits and approvals.

Emerging Opportunities in United States Hydrogen Generation Market

The United States hydrogen generation market presents a wealth of emerging opportunities. A significant area of growth lies in the seamless integration of hydrogen into existing energy infrastructures, paving the way for its use in power generation, industrial processes, and as a grid balancing mechanism. The development of advanced and cost-effective hydrogen storage solutions, including compressed gas, liquid hydrogen, and novel material-based storage, is crucial for enabling widespread adoption. Furthermore, the expansion into new application areas such as the establishment of hydrogen fueling stations for transportation and the deployment of hydrogen-powered vehicles across various modes of transport (e.g., heavy-duty trucks, buses, trains, and even aviation) represent substantial untapped markets. Remote regions with limited grid access and energy-intensive sectors actively pursuing decarbonization strategies are also prime candidates for hydrogen adoption. The burgeoning field of fuel cell technology, critical for converting hydrogen into electricity, further amplifies these opportunities.

Growth Accelerators in the United States Hydrogen Generation Market Industry

Technological breakthroughs in electrolysis and fuel cell technology are significantly accelerating market growth. Strategic partnerships between energy companies, technology providers, and government agencies are fostering innovation and deployment. Market expansion strategies focusing on infrastructure development and public awareness campaigns are further propelling the industry forward.

Key Players Shaping the United States Hydrogen Generation Market Market

- Air Products and Chemicals Inc

- Fuel Cell Energy Inc

- Enapter S r l

- Engie S A

- Air Liquide SA

- McPhy Energy S A

- Messer Group GmbH

- Cummins Inc

- Linde Plc

- ITM Power Plc

- Taiyo Nippon Sanso Holding Corporation

Notable Milestones in United States Hydrogen Generation Market Sector

- September 2022: Linde announced ambitious plans to construct a 35-megawatt PEM electrolyzer facility in Niagara Falls, New York, a significant investment aimed at substantially boosting its green hydrogen production capabilities and contributing to regional decarbonization efforts.

- August 2022: The National Renewable Energy Laboratory (NREL) and Toyota collaborated on a groundbreaking one-megawatt PEM fuel cell power generation system. This initiative successfully demonstrated the viability and scalability of large-scale power generation directly from hydrogen fuel cells, showcasing a promising pathway for clean energy solutions.

In-Depth United States Hydrogen Generation Market Market Outlook

The outlook for the United States hydrogen generation market is exceptionally promising, characterized by robust anticipated growth. This expansion is being propelled by a trifecta of factors: accelerating technological advancements in production and storage, increasingly supportive government policies and incentives (such as tax credits and grants), and a surging demand for clean and sustainable energy solutions across all sectors of the economy. Strategic opportunities abound for companies that are agile and forward-thinking, particularly those focusing on the production of green hydrogen through electrolysis, the development of innovative and efficient hydrogen storage and transportation solutions, and the advancement of fuel cell technologies. The market's continued success and rapid growth trajectory will largely depend on its ability to effectively address key challenges, including the reduction of production costs to achieve parity with fossil fuels, the comprehensive development of hydrogen infrastructure (including pipelines, fueling stations, and storage facilities), and the establishment of a secure and reliable domestic supply chain. The long-term forecast for the US hydrogen generation market is overwhelmingly positive, with substantial potential for market expansion, technological innovation, and significant contributions to the nation's decarbonization goals.

United States Hydrogen Generation Market Segmentation

-

1. Source

- 1.1. Blue hydrogen

- 1.2. Green hydrogen

- 1.3. Grey Hydrogen

-

2. Technology

- 2.1. Steam Methane Reforming (SMR)

- 2.2. Coal Gasification

- 2.3. Others

-

3. Application

- 3.1. Oil Refining

- 3.2. Chemical Processing

- 3.3. Iron & Steel Production

- 3.4. Others

United States Hydrogen Generation Market Segmentation By Geography

- 1. United States

United States Hydrogen Generation Market Regional Market Share

Geographic Coverage of United States Hydrogen Generation Market

United States Hydrogen Generation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand From Refining And Industrial Sector4.; Favourable Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Capital Costs For Hydrogen Energy Storage

- 3.4. Market Trends

- 3.4.1. Grey to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Hydrogen Generation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Blue hydrogen

- 5.1.2. Green hydrogen

- 5.1.3. Grey Hydrogen

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Steam Methane Reforming (SMR)

- 5.2.2. Coal Gasification

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Oil Refining

- 5.3.2. Chemical Processing

- 5.3.3. Iron & Steel Production

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Air Products and Chemicals Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fuel Cell Energy Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Enapter S r l

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Engie S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Air Liquide SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 McPhy Energy S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Messer Group GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cummins Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Linde Plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ITM Power Plc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Taiyo Nippon Sanso Holding Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Air Products and Chemicals Inc

List of Figures

- Figure 1: United States Hydrogen Generation Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Hydrogen Generation Market Share (%) by Company 2025

List of Tables

- Table 1: United States Hydrogen Generation Market Revenue billion Forecast, by Source 2020 & 2033

- Table 2: United States Hydrogen Generation Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: United States Hydrogen Generation Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: United States Hydrogen Generation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Hydrogen Generation Market Revenue billion Forecast, by Source 2020 & 2033

- Table 6: United States Hydrogen Generation Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 7: United States Hydrogen Generation Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: United States Hydrogen Generation Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Hydrogen Generation Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the United States Hydrogen Generation Market?

Key companies in the market include Air Products and Chemicals Inc, Fuel Cell Energy Inc, Enapter S r l, Engie S A, Air Liquide SA, McPhy Energy S A, Messer Group GmbH, Cummins Inc, Linde Plc, ITM Power Plc, Taiyo Nippon Sanso Holding Corporation.

3. What are the main segments of the United States Hydrogen Generation Market?

The market segments include Source, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 204.86 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand From Refining And Industrial Sector4.; Favourable Government Policies.

6. What are the notable trends driving market growth?

Grey to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Capital Costs For Hydrogen Energy Storage.

8. Can you provide examples of recent developments in the market?

In September 2022, Linde announced plans to build a 35-megawatt PEM (Proton Exchange Membrane) electrolyzer to produce green hydrogen in Niagara Falls, New York. The new plant will be the largest electrolyzer installed by Linde globally and will more than double Linde's green liquid hydrogen production capacity in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Hydrogen Generation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Hydrogen Generation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Hydrogen Generation Market?

To stay informed about further developments, trends, and reports in the United States Hydrogen Generation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence