Key Insights

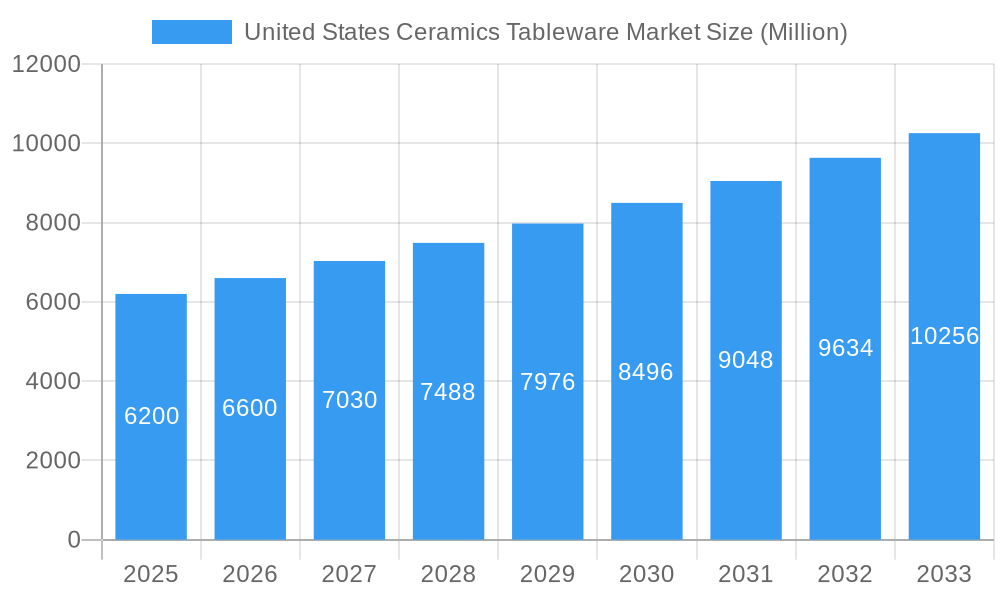

The United States ceramics tableware market, valued at $6.20 billion in 2025, is projected to experience robust growth, driven by several key factors. A rising preference for aesthetically pleasing and durable tableware among consumers fuels demand across household and commercial segments. The increasing popularity of casual dining and entertaining at home, coupled with a renewed interest in home décor, significantly boosts sales. Furthermore, the expansion of online retail channels provides convenient access to a wider variety of ceramics tableware, stimulating market growth. While the market faces challenges like fluctuations in raw material prices and competition from alternative materials like melamine and plastic, the overall trend points toward sustained growth. Porcelain and bone china remain dominant segments, favored for their elegance and durability, while stoneware ceramics cater to a broader market seeking affordable yet stylish options. Key players like JARS Ceramistes, Oneida Group, and Mikasa are leveraging brand recognition and product innovation to maintain market share. Growth is anticipated across all distribution channels, with online sales continuing to gain momentum. The market's projected Compound Annual Growth Rate (CAGR) of 6.69% from 2025 to 2033 indicates a substantial expansion over the forecast period.

United States Ceramics Tableware Market Market Size (In Billion)

The segmentation within the US ceramics tableware market reveals important insights into consumer preferences and market dynamics. The household segment is the largest consumer, driven by increasing disposable incomes and a focus on enhancing the dining experience. However, growth in the commercial sector (restaurants, hotels) is also significant, as establishments seek upscale tableware to enhance their brand image and customer experience. Supermarkets and hypermarkets remain the primary distribution channels, but specialty stores and online platforms are experiencing rapid growth, catering to niche demands and offering convenience. The competitive landscape is characterized by a mix of established brands and emerging players, who are increasingly focusing on sustainable and ethically sourced materials to appeal to environmentally conscious consumers. This competitive pressure will further drive innovation and efficiency in the market, sustaining growth in the coming years.

United States Ceramics Tableware Market Company Market Share

United States Ceramics Tableware Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States ceramics tableware market, encompassing market size, growth trends, competitive landscape, and future outlook. The report covers the historical period (2019-2024), the base year (2025), and forecasts the market's trajectory through 2033. With detailed segmentation by type (Porcelain and Bone China, Stoneware (Ceramic), Other Types), end-user (Household, Commercial), and distribution channel (Supermarkets and Hypermarkets, Specialty Stores, Wholesalers, Online, Other Distribution Channels), this report is an essential resource for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic market. The total market value in 2025 is estimated at XX Million units.

United States Ceramics Tableware Market Dynamics & Structure

The United States ceramics tableware market is characterized by a moderately concentrated landscape, with key players such as JARS CERAMISTES, The Oneida Group, Raynaud Limoges, Lifetime Brands, Newell Brands, Homer Laughlin China, International Tableware, Meyer Corporation, CuisinArt, and Mikasa vying for market share. Technological innovation, particularly in materials science and design, plays a significant role in driving market growth. Regulatory frameworks concerning food safety and material composition influence product development and manufacturing processes. Competitive pressures from substitute materials, such as melamine and plastic tableware, also shape market dynamics. End-user demographics, particularly shifts in consumer preferences towards sustainability and aesthetic trends, significantly impact demand. The market has witnessed several mergers and acquisitions (M&A) activities in recent years, reflecting consolidation trends and strategic expansion strategies.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% of the market share in 2025.

- Technological Innovation: Focus on sustainable materials, innovative designs, and improved durability.

- Regulatory Landscape: Compliance with FDA regulations regarding food safety and material composition.

- Competitive Substitutes: Growing competition from melamine and plastic tableware, impacting market share.

- M&A Activity: XX M&A deals recorded between 2019 and 2024, indicating consolidation and strategic growth.

- End-User Demographics: Shifting consumer preferences towards sustainable and aesthetically pleasing tableware.

United States Ceramics Tableware Market Growth Trends & Insights

The United States ceramics tableware market experienced a CAGR of xx% during the historical period (2019-2024). This growth is attributed to several factors, including rising disposable incomes, increasing urbanization, and changing consumer lifestyles. The adoption rate of premium and specialized ceramics tableware is also rising, driven by a growing awareness of quality and design. Technological disruptions, such as the introduction of new materials and manufacturing processes, continue to improve product quality and efficiency. Consumer behavior shifts towards online purchasing and a preference for personalized tableware further influence market trends. The market is expected to maintain a steady growth trajectory in the forecast period (2025-2033), with a projected CAGR of xx%. Market penetration for premium segments is expected to increase significantly, driven by rising disposable incomes and evolving consumer tastes.

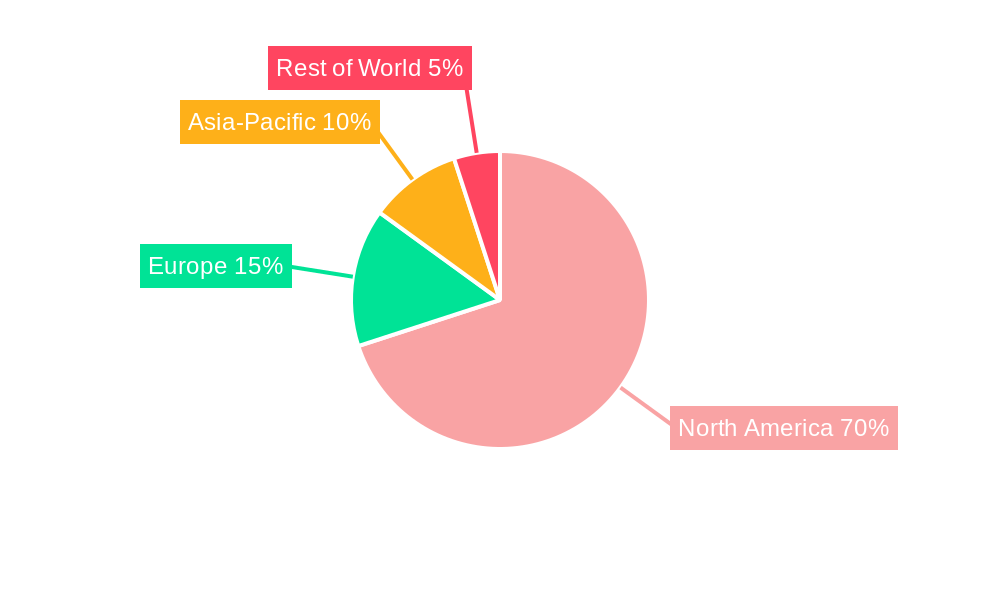

Dominant Regions, Countries, or Segments in United States Ceramics Tableware Market

The household segment dominates the end-user category, accounting for approximately xx% of the total market value in 2025. Within the product type segment, Porcelain and Bone China hold the largest market share due to their perceived quality and aesthetic appeal. The supermarkets and hypermarkets distribution channel accounts for the largest sales volume, showcasing the significance of mass-market retail. Growth is driven by factors like increasing consumer spending on home improvement, the popularity of home-cooked meals, and a growing preference for durable and aesthetically pleasing tableware. The Northeast and West Coast regions exhibit higher growth rates due to factors such as higher disposable income and a strong emphasis on lifestyle.

- Household Segment: Dominant end-user segment, driving growth due to rising disposable incomes and preference for home-cooked meals.

- Porcelain and Bone China: Largest product type segment, driven by perceived quality, elegance, and aesthetic appeal.

- Supermarkets/Hypermarkets: Dominant distribution channel, leveraging widespread accessibility and convenience.

- Northeast & West Coast Regions: Exhibit higher growth rates driven by higher disposable incomes and lifestyle trends.

United States Ceramics Tableware Market Product Landscape

The United States ceramics tableware market is a dynamic and diverse sector, offering a comprehensive spectrum of products from everyday functional dinnerware to artisanal, bespoke creations. Contemporary product development is heavily influenced by a strong emphasis on sustainability, with manufacturers increasingly adopting eco-friendly materials, lead-free glazes, and advanced production methods that boost both longevity and user experience. Key differentiators in this market include the intricate detail of designs, the ability to offer bespoke customization, and a genuine commitment to environmentally conscious manufacturing processes. Technological advancements are primarily channeled into fortifying product resilience, improving thermal performance, and simplifying maintenance. The market caters to a broad range of aesthetic sensibilities, exhibiting a parallel inclination towards both understated minimalist designs and elaborately ornate styles to satisfy a wide array of consumer tastes.

Key Drivers, Barriers & Challenges in United States Ceramics Tableware Market

Key Drivers: Rising disposable incomes, increasing urbanization, changing consumer lifestyles, and growing preference for premium tableware are driving market growth. Technological innovations in materials and design are contributing to product differentiation and enhanced consumer appeal.

Key Challenges: Fluctuating raw material prices, increasing manufacturing costs, and intense competition from cheaper alternatives like melamine and plastic tableware present significant challenges. Supply chain disruptions and regulatory compliance issues add further complexity. The impact of these challenges is estimated to reduce market growth by approximately xx% by 2033.

Emerging Opportunities in United States Ceramics Tableware Market

Significant growth avenues are emerging from the escalating consumer demand for tableware that is both sustainable and ethically produced. The burgeoning e-commerce landscape, coupled with the growing appeal of personalized and custom-designed tableware, presents substantial prospects for market expansion. Untapped markets in underserved rural regions and specialized consumer niches also offer considerable potential for new ventures and growth. Furthermore, the proliferation of direct-to-consumer (DTC) business models is actively reshaping the competitive dynamics and consumer interaction within the market.

Growth Accelerators in the United States Ceramics Tableware Market Industry

Technological advancements in material science and manufacturing processes continue to fuel innovation and drive efficiency gains. Strategic partnerships and collaborations between tableware manufacturers and designers are fostering product diversification and enhanced brand recognition. Expansion into untapped market segments and geographic regions presents promising growth avenues.

Key Players Shaping the United States Ceramics Tableware Market Market

- JARS CERAMISTES

- The Oneida Group

- Raynaud Limoges

- Lifetime Brands

- Newell Brands

- Homer Laughlin China

- International Tableware

- Meyer Corporation

- CuisinArt

- Mikasa

Notable Milestones in United States Ceramics Tableware Market Sector

- October 2022: Jars Ceramics launches a new showroom showcasing stoneware collections.

- March 2022: Lifetime Brands acquires Can't Live Without It (S'well Bottle), expanding its portfolio.

In-Depth United States Ceramics Tableware Market Market Outlook

The United States ceramics tableware market is projected to experience robust and consistent growth, propelled by evolving consumer preferences, continuous technological innovation, and rising disposable incomes. Strategic avenues for expansion include the development of pioneering sustainable products, the penetration of specialized market segments, and the adept utilization of digital platforms to foster deeper customer engagement. The market's future trajectory is exceptionally promising, offering attractive opportunities for both established industry leaders and agile new entrants.

United States Ceramics Tableware Market Segmentation

-

1. Type

- 1.1. Porcelain and Bone China

- 1.2. Stoneware (Ceramic)

- 1.3. Other Types

-

2. End User

- 2.1. Household

-

2.2. Commercial

- 2.2.1. Accomodation and Hospitality Segment

- 2.2.2. Food Service Segment

- 2.2.3. Other End Users

-

3. Distribution Channel

- 3.1. Supermarkets and Hypermarkets

- 3.2. Specialty Stores

- 3.3. Wholesalers

- 3.4. Online

- 3.5. Other Distribution Channels

United States Ceramics Tableware Market Segmentation By Geography

- 1. United States

United States Ceramics Tableware Market Regional Market Share

Geographic Coverage of United States Ceramics Tableware Market

United States Ceramics Tableware Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Restaurants and Food Chains globally; Rise in the share of people opting for vegan and vegetarian foods

- 3.3. Market Restrains

- 3.3.1. Rise in price of electric appliances globally; Rising inflation decreasing the purchasing power

- 3.4. Market Trends

- 3.4.1. Increase in Product Development Activities Create Lucrative Prospects in Ceramic Tableware Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Ceramics Tableware Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Porcelain and Bone China

- 5.1.2. Stoneware (Ceramic)

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Household

- 5.2.2. Commercial

- 5.2.2.1. Accomodation and Hospitality Segment

- 5.2.2.2. Food Service Segment

- 5.2.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets and Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Wholesalers

- 5.3.4. Online

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JARS CERAMISTES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Oneida Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Raynaud Limoges

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lifetime Brands

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Newell Brands

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Homer Laughlin China

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 International Tableware

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Meyer Coroporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CuisinArt

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mikasa

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JARS CERAMISTES

List of Figures

- Figure 1: United States Ceramics Tableware Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Ceramics Tableware Market Share (%) by Company 2025

List of Tables

- Table 1: United States Ceramics Tableware Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Ceramics Tableware Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: United States Ceramics Tableware Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: United States Ceramics Tableware Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: United States Ceramics Tableware Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United States Ceramics Tableware Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: United States Ceramics Tableware Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United States Ceramics Tableware Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: United States Ceramics Tableware Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: United States Ceramics Tableware Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: United States Ceramics Tableware Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: United States Ceramics Tableware Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: United States Ceramics Tableware Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: United States Ceramics Tableware Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: United States Ceramics Tableware Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States Ceramics Tableware Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Ceramics Tableware Market?

The projected CAGR is approximately 6.69%.

2. Which companies are prominent players in the United States Ceramics Tableware Market?

Key companies in the market include JARS CERAMISTES, The Oneida Group, Raynaud Limoges, Lifetime Brands, Newell Brands, Homer Laughlin China, International Tableware, Meyer Coroporation, CuisinArt, Mikasa.

3. What are the main segments of the United States Ceramics Tableware Market?

The market segments include Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Restaurants and Food Chains globally; Rise in the share of people opting for vegan and vegetarian foods.

6. What are the notable trends driving market growth?

Increase in Product Development Activities Create Lucrative Prospects in Ceramic Tableware Market.

7. Are there any restraints impacting market growth?

Rise in price of electric appliances globally; Rising inflation decreasing the purchasing power.

8. Can you provide examples of recent developments in the market?

In October 2022, Jars Ceramics launches a new showroom at 41 Madison during the New York Tabletop Show. The company will showcase new stoneware pieces with rich glazes and colors including deep and moody blues, greens, and blacks in the Wabi and Dashi collections and vintage, charming pastels in the Canine collection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Ceramics Tableware Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Ceramics Tableware Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Ceramics Tableware Market?

To stay informed about further developments, trends, and reports in the United States Ceramics Tableware Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence