Key Insights

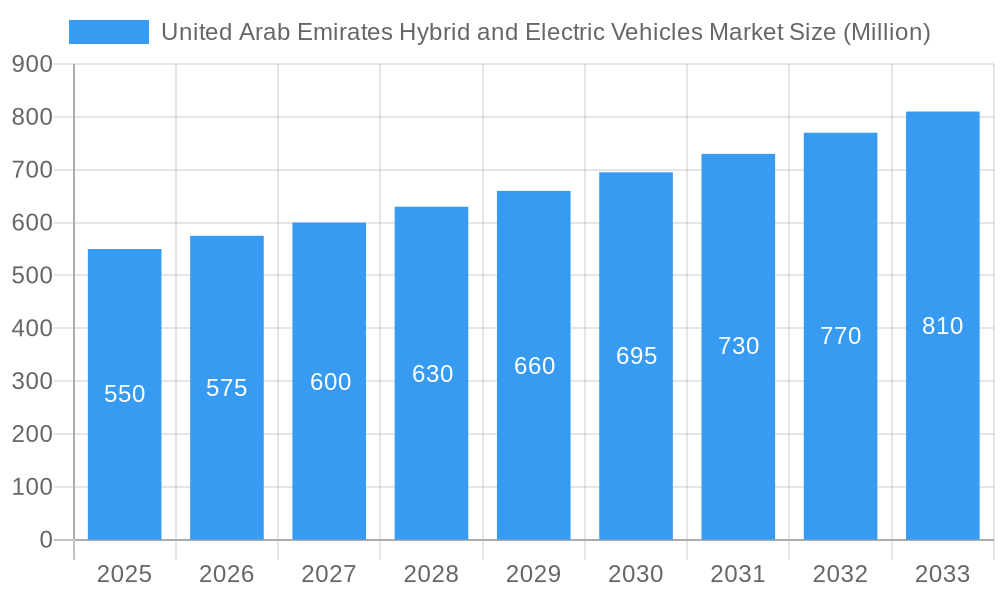

The United Arab Emirates (UAE) hybrid and electric vehicle (HEV/EV) market is experiencing robust growth, driven by government initiatives promoting sustainable transportation, rising fuel prices, and increasing environmental awareness among consumers. The UAE's strategic location and its status as a significant regional economic hub contribute to its attractiveness for HEV/EV manufacturers. While precise market size data for the UAE specifically is unavailable from the provided information, we can extrapolate based on the global CAGR of >4.00% and the strong regional growth observed in similar markets. Considering the UAE's high per capita income and focus on advanced technology adoption, we can reasonably assume a market size exceeding $500 million in 2025, with a projection of a CAGR exceeding the global average due to focused government investment. The market is segmented by vehicle type (commercial vehicles, including medium-duty trucks; passenger vehicles; and two-wheelers) and fuel category (fuel cell electric vehicles (FCEVs), hybrid electric vehicles (HEVs), and plug-in hybrid electric vehicles (PHEVs)). The growth is further fueled by investments in charging infrastructure and supportive policies aimed at reducing reliance on fossil fuels. Leading automotive manufacturers like BMW, Mercedes-Benz, Toyota, and Tesla are actively participating in this burgeoning market, vying for market share through advanced models and attractive offerings.

United Arab Emirates Hybrid and Electric Vehicles Market Market Size (In Million)

However, challenges remain. The high initial cost of HEV/EVs compared to conventional vehicles presents a barrier to wider adoption, especially in the lower-income segments. Range anxiety and the limited availability of charging stations outside major urban areas also hinder widespread acceptance. Overcoming these challenges requires further investment in charging infrastructure, government subsidies to make HEV/EVs more affordable, and sustained public awareness campaigns to address concerns about range and charging convenience. The government's commitment to sustainable transportation, coupled with technological advancements and falling battery prices, points towards a significantly larger market in the coming years. The UAE's unique position and proactive policies suggest that the country will become a leading adopter of HEV/EV technology within the region, setting a benchmark for other nations in the Middle East and Africa.

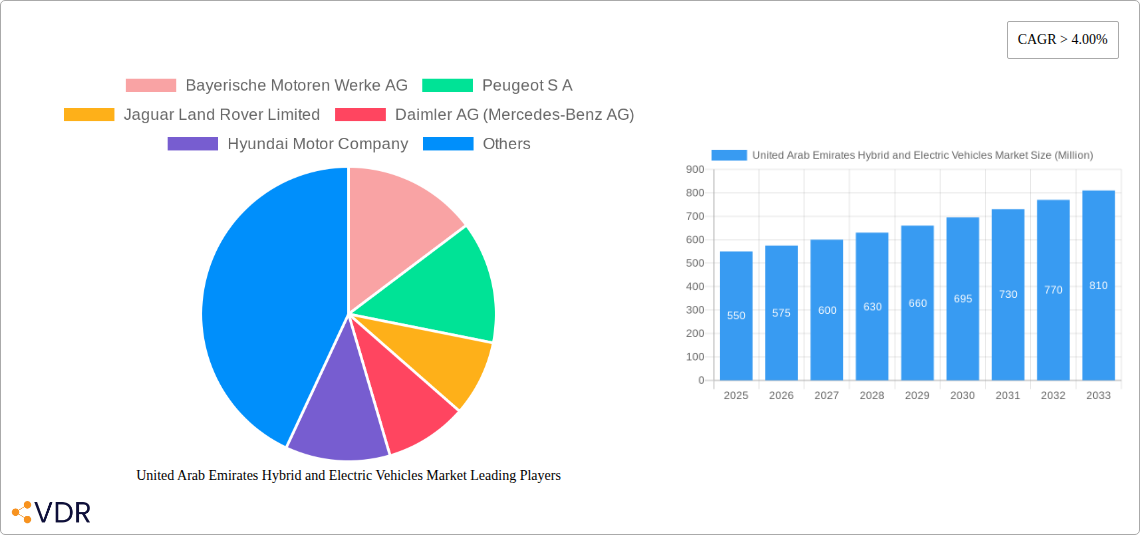

United Arab Emirates Hybrid and Electric Vehicles Market Company Market Share

United Arab Emirates Hybrid and Electric Vehicles Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning United Arab Emirates (UAE) hybrid and electric vehicle (HEV/EV) market, offering invaluable insights for industry professionals, investors, and policymakers. The study covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), delivering a detailed understanding of market dynamics, growth trends, and future potential. The report segments the market by vehicle type (Passenger Vehicles, Commercial Vehicles, Medium-duty Commercial Trucks, Two-Wheelers) and fuel category (HEV, PHEV, FCEV), providing granular analysis of each segment's performance and future trajectory. The total market size is projected to reach xx Million units by 2033.

United Arab Emirates Hybrid and Electric Vehicles Market Dynamics & Structure

The UAE's HEV/EV market is characterized by a dynamic interplay of factors influencing its growth and structure. Market concentration is currently moderate, with several key players vying for market share. Technological innovation, driven by advancements in battery technology, charging infrastructure, and vehicle design, is a key driver. Stringent government regulations promoting sustainable transportation, including emission reduction targets and incentives for EV adoption, are further accelerating market expansion. The rise of competitive product substitutes, such as fuel-efficient internal combustion engine vehicles, poses a challenge. However, growing consumer awareness of environmental concerns and the increasing availability of affordable EVs are mitigating this impact. Furthermore, the UAE's strong economic growth and substantial investments in infrastructure development create a favorable environment for EV adoption. M&A activity in the sector remains relatively low, with xx deals recorded during the historical period.

- Market Concentration: Moderate, with a few dominant players.

- Technological Innovation: Rapid advancements in battery technology, charging infrastructure, and vehicle design are key drivers.

- Regulatory Framework: Supportive government policies and incentives are accelerating market growth.

- Competitive Substitutes: Fuel-efficient ICE vehicles present competition.

- End-User Demographics: Increasingly affluent and environmentally conscious population.

- M&A Trends: Low activity, with xx deals recorded during 2019-2024.

United Arab Emirates Hybrid and Electric Vehicles Market Growth Trends & Insights

The UAE HEV/EV market exhibits robust growth, driven by a confluence of factors. Market size has steadily increased from xx Million units in 2019 to xx Million units in 2024, registering a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by increasing consumer demand for environmentally friendly vehicles, coupled with government initiatives to promote EV adoption. Technological disruptions, particularly in battery technology and charging infrastructure, have significantly improved the range, performance, and affordability of EVs, making them increasingly attractive to consumers. A shift in consumer behavior towards sustainable transportation choices, influenced by rising environmental awareness and government campaigns, is also playing a significant role. Market penetration of EVs is expected to reach xx% by 2033, indicating substantial growth potential.

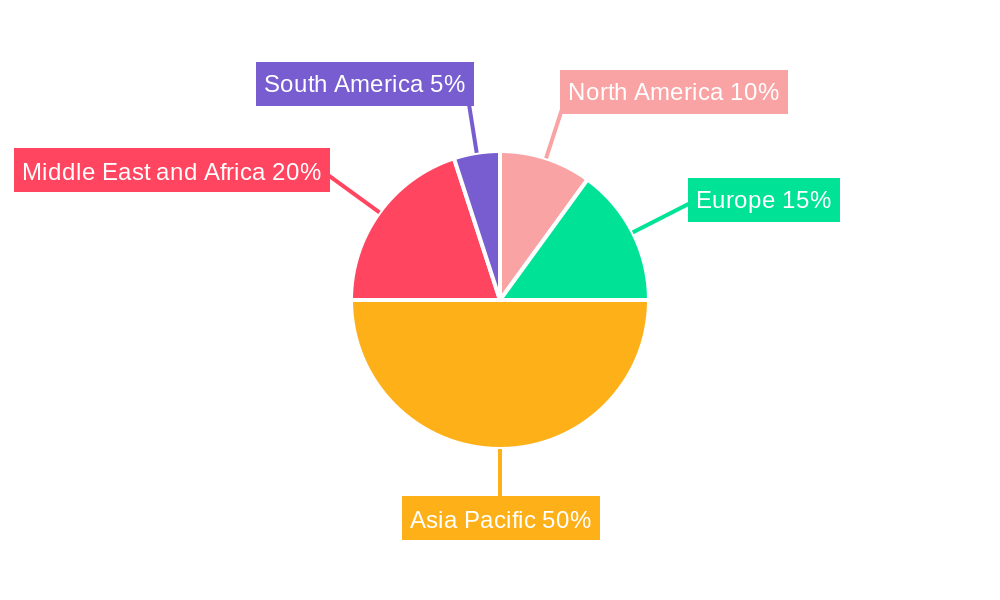

Dominant Regions, Countries, or Segments in United Arab Emirates Hybrid and Electric Vehicles Market

Within the UAE HEV/EV market, the Passenger Vehicle segment dominates, accounting for xx% of the market share in 2024. This dominance is attributed to higher consumer demand compared to commercial vehicles. The HEV segment currently holds the largest market share within the fuel category, followed by PHEVs, while FCEVs currently represent a niche segment. Dubai and Abu Dhabi are the leading regions, driven by robust infrastructure development, supportive government policies, and higher consumer spending power.

- Key Drivers:

- Supportive government policies and economic incentives.

- Development of robust charging infrastructure.

- Rising consumer awareness of environmental benefits.

- Increasing availability of affordable EVs.

- Dominance Factors:

- Higher consumer demand for passenger vehicles.

- Well-established automotive distribution networks.

- Government investments in charging infrastructure in key cities.

- Growth potential in other segments like commercial EVs and two-wheelers.

United Arab Emirates Hybrid and Electric Vehicles Market Product Landscape

The UAE HEV/EV market showcases a diverse range of products, encompassing various vehicle types, fuel categories, and technological features. Manufacturers are focusing on enhanced battery technology, improved range, faster charging capabilities, and advanced driver-assistance systems to enhance vehicle performance and appeal to a wider consumer base. Unique selling propositions (USPs) frequently highlight superior fuel efficiency, reduced emissions, innovative design features, and advanced technological integrations.

Key Drivers, Barriers & Challenges in United Arab Emirates Hybrid and Electric Vehicles Market

Key Drivers:

- Government incentives and regulations promoting EV adoption.

- Increasing consumer awareness of environmental benefits and cost savings.

- Advancements in battery technology and charging infrastructure.

Key Challenges:

- High initial purchase price of EVs compared to ICE vehicles.

- Limited availability of public charging stations in some areas.

- Range anxiety concerns among potential buyers.

- Dependence on foreign technology and supply chains.

Emerging Opportunities in United Arab Emirates Hybrid and Electric Vehicles Market

- Expansion of the commercial vehicle and two-wheeler EV segments.

- Development of specialized EV models tailored to the UAE climate.

- Integration of advanced charging technologies, like wireless charging.

- Growth of subscription-based EV services.

Growth Accelerators in the United Arab Emirates Hybrid and Electric Vehicles Market Industry

Technological breakthroughs in battery technology, leading to increased range and reduced costs, are crucial growth accelerators. Strategic partnerships between automotive manufacturers, charging infrastructure providers, and energy companies are fostering market expansion. Government initiatives promoting research and development, coupled with policies encouraging EV adoption, are further driving market growth.

Key Players Shaping the United Arab Emirates Hybrid and Electric Vehicles Market Market

Notable Milestones in United Arab Emirates Hybrid and Electric Vehicles Market Sector

- December 2023: Honda launched the e:NP1 Plus.

- December 2023: Toyota announced plans to spend $35 billion to introduce 30 battery electric vehicle models by 2030.

- December 2023: Tesla released Software Version 11.0 with a new user interface, games, updated navigation, and other features.

In-Depth United Arab Emirates Hybrid and Electric Vehicles Market Market Outlook

The UAE HEV/EV market is poised for significant growth over the forecast period, driven by continued technological advancements, supportive government policies, and growing consumer demand. Strategic opportunities exist for companies focusing on innovative technologies, sustainable solutions, and catering to the specific needs of the UAE market. The market's future potential is substantial, with significant opportunities for market expansion in various segments and regions. The continued investment in charging infrastructure and government incentives will further propel growth, making the UAE a prime market for HEV/EV manufacturers and investors.

United Arab Emirates Hybrid and Electric Vehicles Market Segmentation

-

1. Vehicle Type

-

1.1. Commercial Vehicles

- 1.1.1. Buses

- 1.1.2. Heavy-duty Commercial Trucks

- 1.1.3. Light Commercial Pick-up Trucks

- 1.1.4. Light Commercial Vans

- 1.1.5. Medium-duty Commercial Trucks

- 1.2. Passenger Vehicles

- 1.3. Two-Wheelers

-

1.1. Commercial Vehicles

-

2. Fuel Category

- 2.1. FCEV

- 2.2. HEV

- 2.3. PHEV

United Arab Emirates Hybrid and Electric Vehicles Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Hybrid and Electric Vehicles Market Regional Market Share

Geographic Coverage of United Arab Emirates Hybrid and Electric Vehicles Market

United Arab Emirates Hybrid and Electric Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Hybrid and Electric Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.1.1. Buses

- 5.1.1.2. Heavy-duty Commercial Trucks

- 5.1.1.3. Light Commercial Pick-up Trucks

- 5.1.1.4. Light Commercial Vans

- 5.1.1.5. Medium-duty Commercial Trucks

- 5.1.2. Passenger Vehicles

- 5.1.3. Two-Wheelers

- 5.1.1. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. FCEV

- 5.2.2. HEV

- 5.2.3. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bayerische Motoren Werke AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Peugeot S A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jaguar Land Rover Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Daimler AG (Mercedes-Benz AG)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hyundai Motor Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Volvo Car A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tesla Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Porsche

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Groupe Renault

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Audi AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Toyota Motor Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Honda Motor Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Bayerische Motoren Werke AG

List of Figures

- Figure 1: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Arab Emirates Hybrid and Electric Vehicles Market Share (%) by Company 2025

List of Tables

- Table 1: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Fuel Category 2020 & 2033

- Table 3: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Fuel Category 2020 & 2033

- Table 6: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Hybrid and Electric Vehicles Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the United Arab Emirates Hybrid and Electric Vehicles Market?

Key companies in the market include Bayerische Motoren Werke AG, Peugeot S A, Jaguar Land Rover Limited, Daimler AG (Mercedes-Benz AG), Hyundai Motor Company, Volvo Car A, Tesla Inc, Porsche, Groupe Renault, Audi AG, Toyota Motor Corporation, Honda Motor Co Ltd.

3. What are the main segments of the United Arab Emirates Hybrid and Electric Vehicles Market?

The market segments include Vehicle Type, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

December 2023: Honda has launched e:NP1 Plus in 2023.December 2023: Toyota have a plan to spend $35bn to introduce 30 battery electric vehicle line-up by 2030.December 2023: Tesla has introduced the Software Version 11.0 with new user interface, games, updated navigation and many features.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Hybrid and Electric Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Hybrid and Electric Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Hybrid and Electric Vehicles Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Hybrid and Electric Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence