Key Insights

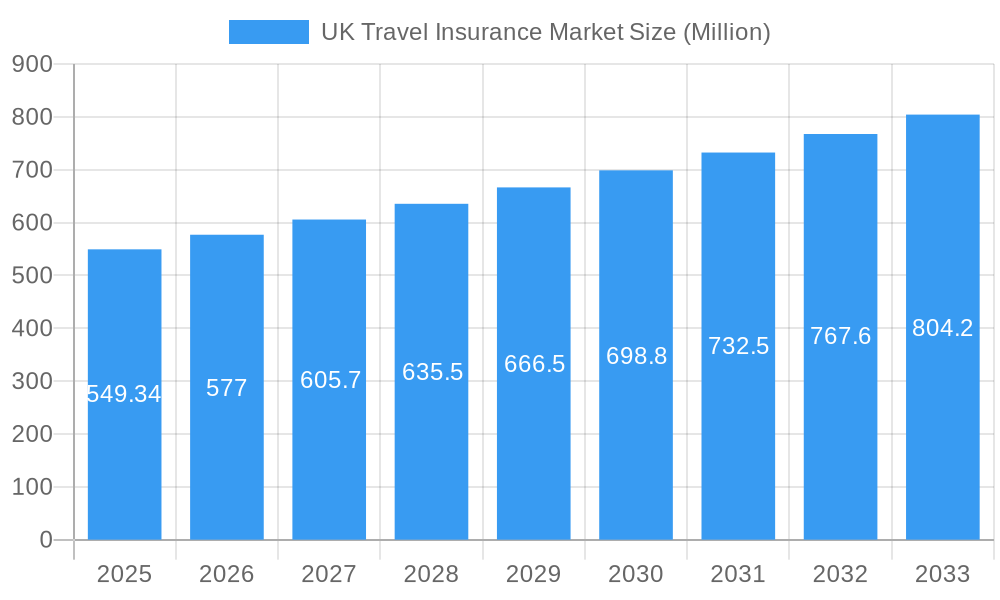

The UK travel insurance market is poised for robust growth, projected to reach a substantial market size of £549.34 million by 2025, with a Compound Annual Growth Rate (CAGR) of 5.03% expected to persist through 2033. This expansion is primarily fueled by a resurgence in international travel post-pandemic, coupled with an increasing awareness among consumers regarding the financial and logistical benefits of comprehensive travel protection. The market is segmented into Single-Trip and Annual Multi-Trip policies, with Annual Multi-Trip insurance likely to gain traction due to its convenience and cost-effectiveness for frequent travelers. Distribution channels are diverse, with traditional insurance companies and intermediaries playing a significant role, complemented by growing influence from banks and insurance brokers offering bundled packages. The senior citizen segment represents a crucial demographic, driven by a higher propensity for medical-related travel concerns and extended vacation durations.

UK Travel Insurance Market Market Size (In Million)

Several key drivers are propelling the UK travel insurance market forward. The evolving nature of travel, including adventure tourism and longer stays for educational purposes, necessitates tailored insurance solutions. Furthermore, an increasing number of policyholders are seeking coverage for non-traditional risks such as trip cancellations due to natural disasters or political instability, reflecting a more cautious approach to international journeys. The market is also witnessing a surge in digital adoption, with online platforms and comparison sites simplifying the purchasing process and increasing accessibility. However, the market faces certain restraints, including price sensitivity among some consumer segments and the potential for regulatory changes impacting policy terms and conditions. Nonetheless, the overarching trend indicates a healthy and expanding market driven by a combination of increased travel demand and a heightened appreciation for robust travel insurance coverage.

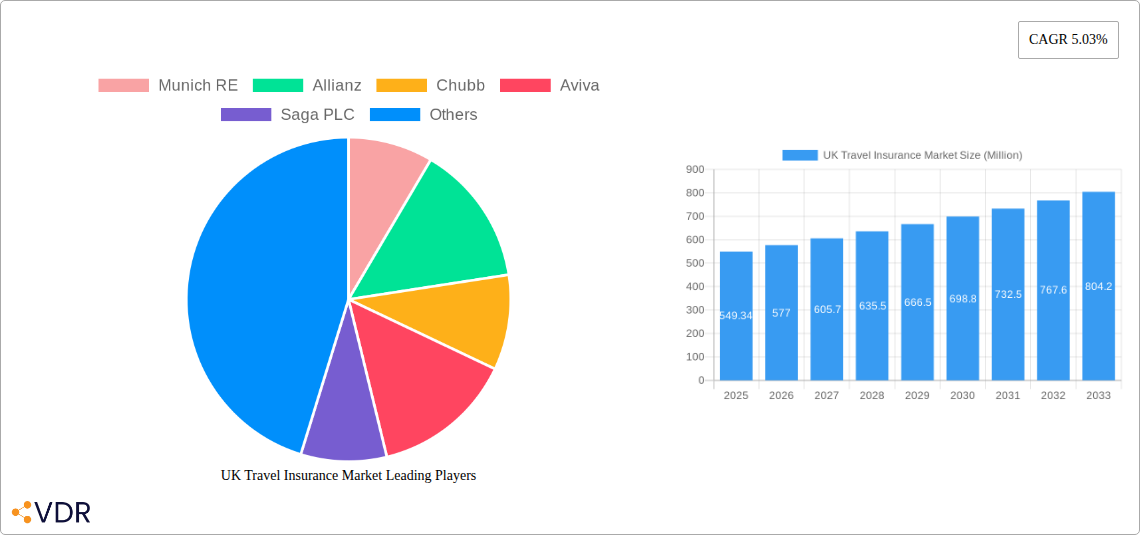

UK Travel Insurance Market Company Market Share

This in-depth report offers a definitive analysis of the UK Travel Insurance Market, providing critical insights into market dynamics, growth trajectories, and the competitive environment. Essential for insurers, reinsurers, intermediaries, and financial institutions, this study forecasts market evolution and identifies key growth drivers and challenges. All monetary values are presented in Million units.

UK Travel Insurance Market Market Dynamics & Structure

The UK Travel Insurance Market exhibits a moderately concentrated structure, with a few dominant players holding significant market share, interspersed with a growing number of specialized providers catering to niche segments. Technological innovation is a key driver, with advancements in AI for risk assessment and personalized policy creation enhancing customer experience and operational efficiency. Regulatory frameworks, primarily overseen by the Financial Conduct Authority (FCA), ensure consumer protection and market stability, influencing product design and sales practices. Competitive product substitutes, such as bundled holiday insurance or unadvised travel cover, pose a persistent challenge, necessitating continuous innovation and clear value proposition communication. End-user demographics are shifting, with an increasing demand for flexible policies that cater to diverse travel patterns and health needs, particularly among senior citizens and multi-generational family travelers. Merger and acquisition (M&A) trends are evident as larger entities seek to consolidate market presence and acquire innovative capabilities, particularly in digital distribution and underwriting.

- Market Concentration: Dominated by key players, but with increasing fragmentation in specialized segments.

- Technological Innovation Drivers: AI-powered underwriting, personalized policy engines, and digital distribution platforms.

- Regulatory Frameworks: FCA oversight ensuring consumer protection and market integrity.

- Competitive Product Substitutes: Unadvised cover, bundled insurance, and a lack of perceived value by some consumers.

- End-User Demographics: Growing demand from senior travelers, adventure tourists, and those with pre-existing medical conditions.

- M&A Trends: Consolidation for market share and technology acquisition, with an estimated XX M&A deals in the historical period.

UK Travel Insurance Market Growth Trends & Insights

The UK Travel Insurance Market has demonstrated robust growth driven by evolving consumer behaviors and an increasing recognition of the necessity for travel protection. The market size has expanded significantly, moving from approximately £xxxx Million in 2019 to an estimated £xxxx Million in 2024, showcasing a consistent upward trend. This expansion is fueled by a rising propensity for international travel, post-pandemic recovery, and a greater awareness of potential risks, from medical emergencies to travel disruptions. Technological disruptions have played a pivotal role, with the proliferation of online comparison sites and direct-to-consumer digital platforms simplifying policy acquisition and fostering greater transparency. Consumer behavior shifts have seen a move towards more comprehensive coverage, including enhanced medical provisions and cancellation protection. The adoption rate of travel insurance is projected to increase, with market penetration expected to reach xx% by 2033. The CAGR for the forecast period 2025–2033 is estimated at a healthy xx%, underscoring the market's sustained expansion.

- Market Size Evolution: From approximately £xxxx Million in 2019 to an estimated £xxxx Million in 2024, with projections for significant future growth.

- Adoption Rates: Increasing consumer awareness and the desire for comprehensive protection are driving higher adoption rates.

- Technological Disruptions: Digital platforms and comparison sites have enhanced accessibility and transparency.

- Consumer Behavior Shifts: Growing demand for flexible policies, comprehensive medical coverage, and robust cancellation protection.

- Market Penetration: Projected to reach xx% by 2033.

- CAGR: Estimated at xx% for the forecast period 2025–2033.

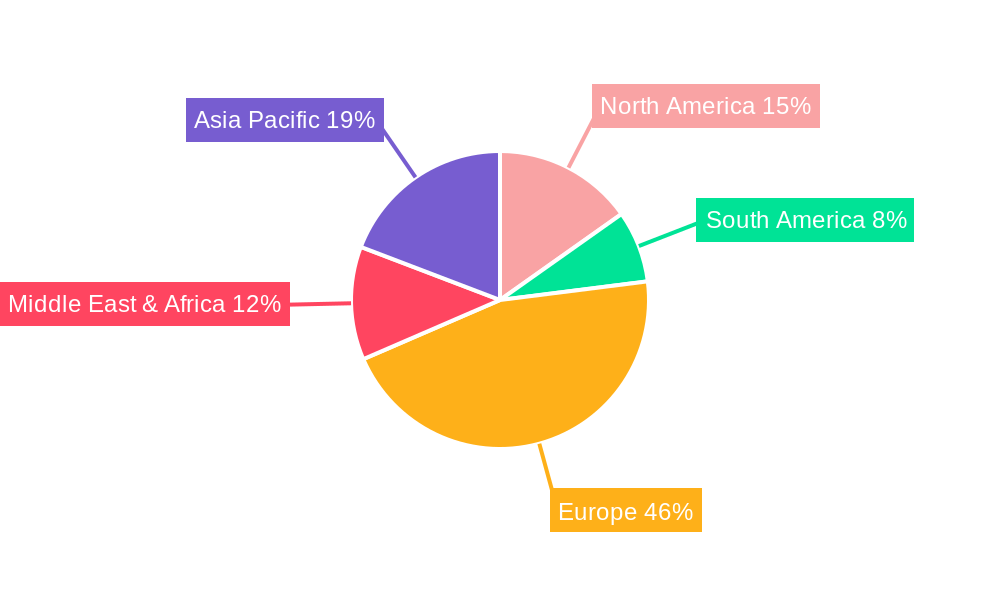

Dominant Regions, Countries, or Segments in UK Travel Insurance Market

Within the UK Travel Insurance Market, the Annual Multi-Trip Travel Insurance segment consistently drives substantial market growth, reflecting the increasing frequency of travel among a significant portion of the UK population. This segment's dominance is underpinned by the convenience and cost-effectiveness it offers to frequent travelers, who often find it more economical than purchasing single-trip policies for multiple journeys.

The Insurance Companies distribution channel also holds a dominant position, leveraging established customer bases and brand trust to offer travel insurance as part of broader financial product portfolios. However, the influence of Insurance Intermediaries and online aggregators is steadily growing, providing consumers with greater choice and competitive pricing.

Among end-users, Family Travelers represent a crucial segment. The need to protect multiple individuals against unforeseen events during holidays makes comprehensive family travel insurance a high-priority purchase. This segment is characterized by a demand for policies that cover a wide range of potential risks, from lost luggage to medical emergencies affecting children.

- Dominant Segment (Type): Annual Multi-Trip Travel Insurance

- Key Drivers: Convenience for frequent travelers, cost-effectiveness over multiple trips, and increased global travel.

- Market Share: Estimated to hold xx% of the market in 2025.

- Dominant Distribution Channel: Insurance Companies

- Key Drivers: Established customer relationships, brand loyalty, and bundled product offerings.

- Growth Potential: Strong, but with increasing competition from digital channels.

- Dominant End User: Family Travelers

- Key Drivers: Need for comprehensive coverage for multiple individuals, peace of mind, and protection against a wide array of risks.

- Market Share: Estimated to constitute xx% of the end-user market.

- Regional Dominance: While this report focuses on the UK market, within it, the South East of England, with its high population density and propensity for international travel, often demonstrates higher policy uptake.

UK Travel Insurance Market Product Landscape

The UK Travel Insurance Market's product landscape is characterized by an increasing emphasis on customization and comprehensive coverage. Innovations are centered around enhancing policy flexibility to cater to diverse travel needs, including coverage for adventure sports, pre-existing medical conditions, and longer-duration trips. Digital platforms are enabling real-time policy adjustments and the offering of add-on features, such as enhanced gadget cover or specific event protection. Performance metrics are increasingly focused on claim settlement speed, customer satisfaction, and the breadth of coverage offered. Unique selling propositions often revolve around transparent policy wording, specialized underwriting for complex risks, and seamless digital customer journeys.

Key Drivers, Barriers & Challenges in UK Travel Insurance Market

Key Drivers: The UK Travel Insurance Market is propelled by several key drivers. The rebound in international travel post-pandemic is a significant catalyst, with consumers prioritizing peace of mind. Technological advancements, such as AI in underwriting and digital sales platforms, are enhancing accessibility and personalization. An aging population with increased disposable income and a desire for global exploration also contributes to market growth, particularly for senior-specific travel insurance. Regulatory support for consumer protection further instills confidence.

- Resumption of global travel and increased travel intent.

- Technological advancements in underwriting and distribution.

- Demographic shifts: aging population and younger generations' travel habits.

- Increased consumer awareness of the importance of travel protection.

Barriers & Challenges: Despite robust growth, the market faces several challenges. Price sensitivity remains a significant barrier, with some consumers opting for minimal or no cover to save costs. The complexity of policy terms and conditions can lead to consumer confusion and distrust. Evolving risks, such as climate-related disruptions and geopolitical instability, require insurers to adapt their underwriting models and product offerings rapidly. Intense competition from online aggregators and direct insurers can lead to margin pressures.

- Price sensitivity and the perception of travel insurance as a discretionary purchase.

- Complexity of policy wording and potential for consumer misunderstanding.

- Rapidly evolving global risks (climate, political, health).

- Intense competition and pressure on premium rates.

Emerging Opportunities in UK Travel Insurance Market

Emerging opportunities lie in tailoring policies for niche travel segments, such as remote workers, digital nomads, and sustainable tourism enthusiasts. The growing demand for travel insurance that covers pandemics and epidemics, as highlighted by recent industry developments, presents a significant growth area. Insurers can leverage technology to offer dynamic pricing and personalized coverage based on real-time risk assessments. The integration of travel insurance with other travel services, such as booking platforms and destination management companies, offers cross-selling potential.

- Specialized policies for remote workers and digital nomads.

- Enhanced pandemic and epidemic coverage.

- Dynamic pricing and personalized underwriting through technology.

- Integration with travel booking platforms and service providers.

Growth Accelerators in the UK Travel Insurance Market Industry

Long-term growth in the UK Travel Insurance Market is being accelerated by strategic partnerships that expand reach and enhance product offerings. Technological breakthroughs, particularly in data analytics and AI, are enabling more accurate risk assessment and personalized customer experiences, leading to increased customer loyalty and reduced claims costs. Market expansion strategies, including targeting underserved segments and developing innovative bundled product solutions, are also critical growth accelerators. The increasing sophistication of digital distribution channels is making travel insurance more accessible and appealing to a broader consumer base.

- Strategic alliances with travel providers and technology firms.

- Advancements in AI for predictive analytics and personalized offerings.

- Expansion into emerging travel niches and demographic segments.

- Sophistication and reach of digital sales and comparison platforms.

Key Players Shaping the UK Travel Insurance Market Market

- Munich RE

- Allianz

- Chubb

- Aviva

- Saga PLC

- Prudential Guarantee

- KBC Group

- Europ Assistance

- AllClear

- ABTA

Notable Milestones in UK Travel Insurance Market Sector

- October 2023: Munich Re partnered with International SOS to develop integrated policy solutions for epidemic and pandemic management, offering health advisory services for affected policyholders.

- December 2023: Chubb formed a strategic partnership with NetSPI, a leading provider of advanced attack surface management (APM) and penetration testing services, to help clients identify vulnerabilities and mitigate risks before claims arise.

In-Depth UK Travel Insurance Market Market Outlook

The UK Travel Insurance Market is poised for continued expansion, driven by a confluence of factors including sustained demand for travel, technological innovation, and evolving consumer preferences. Future market potential lies in the deeper integration of AI for personalized underwriting, the development of more comprehensive and flexible policies that cater to emerging travel trends like extended stays and remote working, and the strategic leveraging of data analytics to enhance risk management and customer retention. The industry's ability to adapt to new risks and regulatory landscapes, alongside a focus on transparent communication and value proposition, will be crucial in capitalizing on these opportunities. Strategic partnerships and a commitment to innovation will solidify market leadership and ensure sustained growth in the coming years.

UK Travel Insurance Market Segmentation

-

1. Type

- 1.1. Single-Trip Travel Insurance

- 1.2. Annual Multi-Trip Travel Insurance

-

2. Distribution Channel

- 2.1. Insurance Companies

- 2.2. Insurance Intermediaries

- 2.3. Banks

- 2.4. Insurance Brokers

- 2.5. Others

-

3. End User

- 3.1. Senior Citizens

- 3.2. Education Travelers

- 3.3. Family Travelers

- 3.4. Others

UK Travel Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Travel Insurance Market Regional Market Share

Geographic Coverage of UK Travel Insurance Market

UK Travel Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Population Growth and the Emergence of Tourism are Driving the Market; The Positive Impact of Online Media

- 3.3. Market Restrains

- 3.3.1. Population Growth and the Emergence of Tourism are Driving the Market; The Positive Impact of Online Media

- 3.4. Market Trends

- 3.4.1. Expansion of Tourism Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single-Trip Travel Insurance

- 5.1.2. Annual Multi-Trip Travel Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Insurance Companies

- 5.2.2. Insurance Intermediaries

- 5.2.3. Banks

- 5.2.4. Insurance Brokers

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Senior Citizens

- 5.3.2. Education Travelers

- 5.3.3. Family Travelers

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Single-Trip Travel Insurance

- 6.1.2. Annual Multi-Trip Travel Insurance

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Insurance Companies

- 6.2.2. Insurance Intermediaries

- 6.2.3. Banks

- 6.2.4. Insurance Brokers

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Senior Citizens

- 6.3.2. Education Travelers

- 6.3.3. Family Travelers

- 6.3.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Single-Trip Travel Insurance

- 7.1.2. Annual Multi-Trip Travel Insurance

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Insurance Companies

- 7.2.2. Insurance Intermediaries

- 7.2.3. Banks

- 7.2.4. Insurance Brokers

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Senior Citizens

- 7.3.2. Education Travelers

- 7.3.3. Family Travelers

- 7.3.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Single-Trip Travel Insurance

- 8.1.2. Annual Multi-Trip Travel Insurance

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Insurance Companies

- 8.2.2. Insurance Intermediaries

- 8.2.3. Banks

- 8.2.4. Insurance Brokers

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Senior Citizens

- 8.3.2. Education Travelers

- 8.3.3. Family Travelers

- 8.3.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Single-Trip Travel Insurance

- 9.1.2. Annual Multi-Trip Travel Insurance

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Insurance Companies

- 9.2.2. Insurance Intermediaries

- 9.2.3. Banks

- 9.2.4. Insurance Brokers

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Senior Citizens

- 9.3.2. Education Travelers

- 9.3.3. Family Travelers

- 9.3.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Single-Trip Travel Insurance

- 10.1.2. Annual Multi-Trip Travel Insurance

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Insurance Companies

- 10.2.2. Insurance Intermediaries

- 10.2.3. Banks

- 10.2.4. Insurance Brokers

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Senior Citizens

- 10.3.2. Education Travelers

- 10.3.3. Family Travelers

- 10.3.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Munich RE

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Allianz

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chubb

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aviva

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Saga PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Prudential Guarantee

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 KBC Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Europ Assistance

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AllClear

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ABTA**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Munich RE

List of Figures

- Figure 1: Global UK Travel Insurance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global UK Travel Insurance Market Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: North America UK Travel Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America UK Travel Insurance Market Volume (Million), by Type 2025 & 2033

- Figure 5: North America UK Travel Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America UK Travel Insurance Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America UK Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: North America UK Travel Insurance Market Volume (Million), by Distribution Channel 2025 & 2033

- Figure 9: North America UK Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America UK Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America UK Travel Insurance Market Revenue (Million), by End User 2025 & 2033

- Figure 12: North America UK Travel Insurance Market Volume (Million), by End User 2025 & 2033

- Figure 13: North America UK Travel Insurance Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America UK Travel Insurance Market Volume Share (%), by End User 2025 & 2033

- Figure 15: North America UK Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America UK Travel Insurance Market Volume (Million), by Country 2025 & 2033

- Figure 17: North America UK Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America UK Travel Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 19: South America UK Travel Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 20: South America UK Travel Insurance Market Volume (Million), by Type 2025 & 2033

- Figure 21: South America UK Travel Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America UK Travel Insurance Market Volume Share (%), by Type 2025 & 2033

- Figure 23: South America UK Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 24: South America UK Travel Insurance Market Volume (Million), by Distribution Channel 2025 & 2033

- Figure 25: South America UK Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 26: South America UK Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 27: South America UK Travel Insurance Market Revenue (Million), by End User 2025 & 2033

- Figure 28: South America UK Travel Insurance Market Volume (Million), by End User 2025 & 2033

- Figure 29: South America UK Travel Insurance Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America UK Travel Insurance Market Volume Share (%), by End User 2025 & 2033

- Figure 31: South America UK Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America UK Travel Insurance Market Volume (Million), by Country 2025 & 2033

- Figure 33: South America UK Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America UK Travel Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe UK Travel Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 36: Europe UK Travel Insurance Market Volume (Million), by Type 2025 & 2033

- Figure 37: Europe UK Travel Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Europe UK Travel Insurance Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Europe UK Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 40: Europe UK Travel Insurance Market Volume (Million), by Distribution Channel 2025 & 2033

- Figure 41: Europe UK Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 42: Europe UK Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 43: Europe UK Travel Insurance Market Revenue (Million), by End User 2025 & 2033

- Figure 44: Europe UK Travel Insurance Market Volume (Million), by End User 2025 & 2033

- Figure 45: Europe UK Travel Insurance Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Europe UK Travel Insurance Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Europe UK Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe UK Travel Insurance Market Volume (Million), by Country 2025 & 2033

- Figure 49: Europe UK Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe UK Travel Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa UK Travel Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East & Africa UK Travel Insurance Market Volume (Million), by Type 2025 & 2033

- Figure 53: Middle East & Africa UK Travel Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East & Africa UK Travel Insurance Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East & Africa UK Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Middle East & Africa UK Travel Insurance Market Volume (Million), by Distribution Channel 2025 & 2033

- Figure 57: Middle East & Africa UK Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Middle East & Africa UK Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Middle East & Africa UK Travel Insurance Market Revenue (Million), by End User 2025 & 2033

- Figure 60: Middle East & Africa UK Travel Insurance Market Volume (Million), by End User 2025 & 2033

- Figure 61: Middle East & Africa UK Travel Insurance Market Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East & Africa UK Travel Insurance Market Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East & Africa UK Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East & Africa UK Travel Insurance Market Volume (Million), by Country 2025 & 2033

- Figure 65: Middle East & Africa UK Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa UK Travel Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific UK Travel Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 68: Asia Pacific UK Travel Insurance Market Volume (Million), by Type 2025 & 2033

- Figure 69: Asia Pacific UK Travel Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: Asia Pacific UK Travel Insurance Market Volume Share (%), by Type 2025 & 2033

- Figure 71: Asia Pacific UK Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 72: Asia Pacific UK Travel Insurance Market Volume (Million), by Distribution Channel 2025 & 2033

- Figure 73: Asia Pacific UK Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 74: Asia Pacific UK Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 75: Asia Pacific UK Travel Insurance Market Revenue (Million), by End User 2025 & 2033

- Figure 76: Asia Pacific UK Travel Insurance Market Volume (Million), by End User 2025 & 2033

- Figure 77: Asia Pacific UK Travel Insurance Market Revenue Share (%), by End User 2025 & 2033

- Figure 78: Asia Pacific UK Travel Insurance Market Volume Share (%), by End User 2025 & 2033

- Figure 79: Asia Pacific UK Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Asia Pacific UK Travel Insurance Market Volume (Million), by Country 2025 & 2033

- Figure 81: Asia Pacific UK Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific UK Travel Insurance Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 3: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 7: Global UK Travel Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global UK Travel Insurance Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 11: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 15: Global UK Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global UK Travel Insurance Market Volume Million Forecast, by Country 2020 & 2033

- Table 17: United States UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: Canada UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: Mexico UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 25: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 29: Global UK Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global UK Travel Insurance Market Volume Million Forecast, by Country 2020 & 2033

- Table 31: Brazil UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Brazil UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 37: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 39: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 40: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 41: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 43: Global UK Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global UK Travel Insurance Market Volume Million Forecast, by Country 2020 & 2033

- Table 45: United Kingdom UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 47: Germany UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Germany UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 49: France UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 51: Italy UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Italy UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 53: Spain UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Spain UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 55: Russia UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Russia UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 57: Benelux UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Benelux UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 59: Nordics UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Nordics UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 63: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 64: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 65: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 66: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 67: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 68: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 69: Global UK Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global UK Travel Insurance Market Volume Million Forecast, by Country 2020 & 2033

- Table 71: Turkey UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Turkey UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 73: Israel UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Israel UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 75: GCC UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: GCC UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 77: North Africa UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: North Africa UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 79: South Africa UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South Africa UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 83: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 84: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 85: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 86: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 87: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 88: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 89: Global UK Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 90: Global UK Travel Insurance Market Volume Million Forecast, by Country 2020 & 2033

- Table 91: China UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: China UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 93: India UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: India UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 95: Japan UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Japan UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 97: South Korea UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Korea UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 99: ASEAN UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: ASEAN UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 101: Oceania UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Oceania UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Travel Insurance Market?

The projected CAGR is approximately 5.03%.

2. Which companies are prominent players in the UK Travel Insurance Market?

Key companies in the market include Munich RE, Allianz, Chubb, Aviva, Saga PLC, Prudential Guarantee, KBC Group, Europ Assistance, AllClear, ABTA**List Not Exhaustive.

3. What are the main segments of the UK Travel Insurance Market?

The market segments include Type, Distribution Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 549.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Population Growth and the Emergence of Tourism are Driving the Market; The Positive Impact of Online Media.

6. What are the notable trends driving market growth?

Expansion of Tourism Industry.

7. Are there any restraints impacting market growth?

Population Growth and the Emergence of Tourism are Driving the Market; The Positive Impact of Online Media.

8. Can you provide examples of recent developments in the market?

October 2023: Munich Re, a world-renowned reinsurance company, has joined forces with the world-renowned International SOS, an international leader in health and security, to create an integrated policy solution for the management of epidemics and pandemics. As a result of this new collaboration between the two companies, International SOS is now offering health advisory services for Munich Re's policyholders affected by the pandemic.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Travel Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Travel Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Travel Insurance Market?

To stay informed about further developments, trends, and reports in the UK Travel Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence