Key Insights

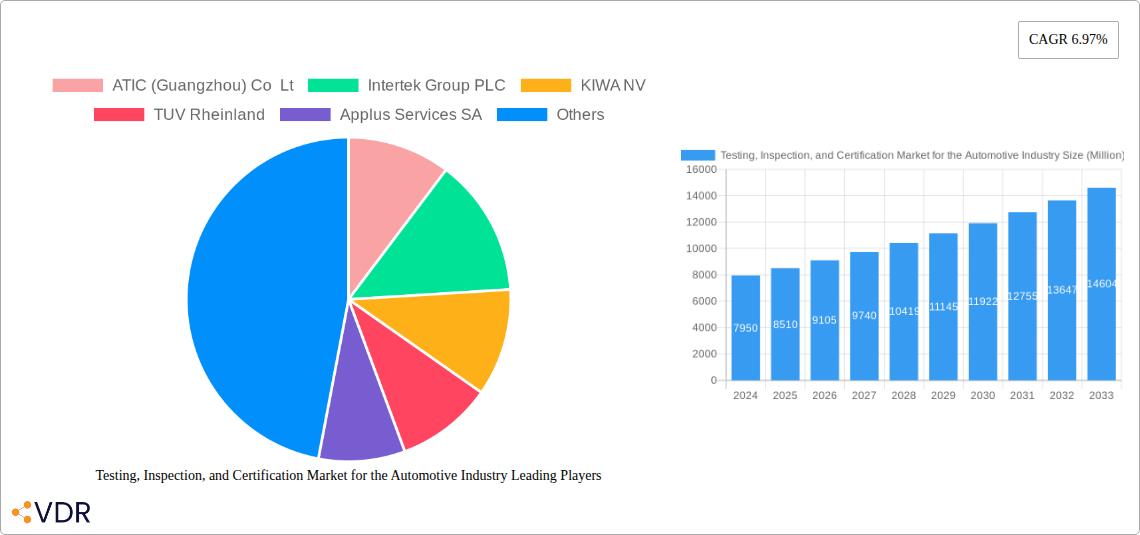

The global Testing, Inspection, and Certification (TIC) market for the automotive industry is experiencing robust expansion, currently valued at 8.51 Billion USD and projected to grow at a Compound Annual Growth Rate (CAGR) of 6.97% through 2033. This dynamic growth is fueled by a confluence of factors, most notably the escalating complexity of automotive technologies and stringent regulatory mandates. The increasing adoption of advanced driver-assistance systems (ADAS), autonomous driving capabilities, electric vehicle (EV) components, and connected car technologies necessitates rigorous testing and validation to ensure safety, reliability, and compliance. Furthermore, global regulatory bodies are continuously updating and enforcing stricter standards related to emissions, safety, cybersecurity, and material composition, compelling manufacturers to invest heavily in comprehensive TIC services. The sheer volume of new vehicle models, evolving supply chains, and the drive for enhanced consumer trust in vehicle performance and safety all contribute to the sustained demand for these critical services.

Testing, Inspection, and Certification Market for the Automotive Industry Market Size (In Billion)

Key trends shaping the automotive TIC market include the increasing demand for cybersecurity testing as vehicles become more connected, and the growing focus on lifecycle assessment and sustainability, driving demand for environmental compliance testing. The expansion of EV infrastructure and the rapid development of battery technologies also present significant opportunities for specialized TIC services. While the market benefits from strong drivers, it faces certain restraints, such as the high cost of advanced testing equipment and the potential for consolidation among TIC providers, which could impact pricing. Emerging economies, particularly in Asia, are demonstrating significant growth potential due to increasing automotive production and the adoption of international quality standards. Prominent players like SGS SA, Bureau Veritas, Intertek Group PLC, and TUV SUD are actively expanding their service portfolios and global reach to capitalize on these evolving market dynamics.

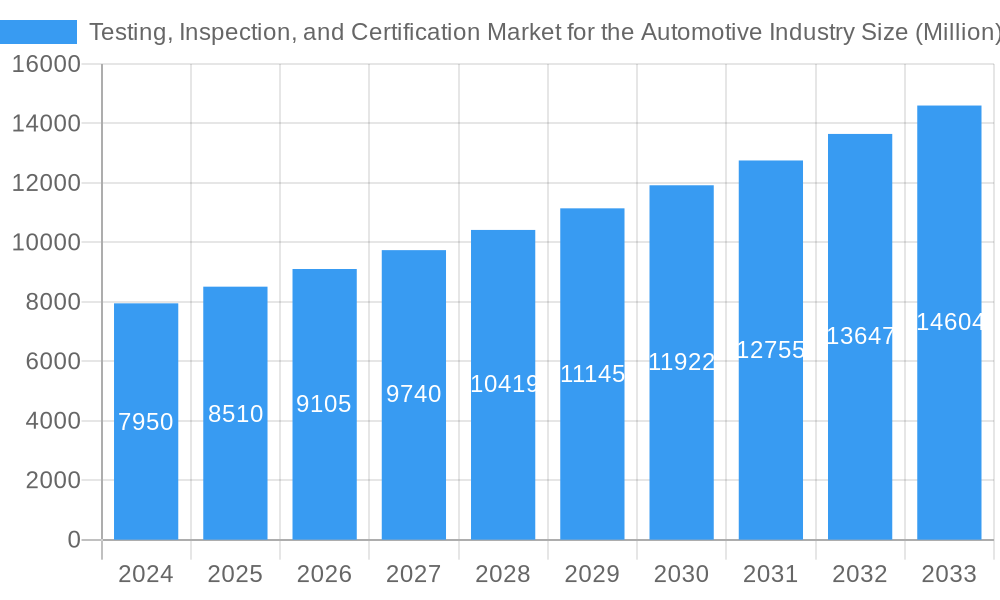

Testing, Inspection, and Certification Market for the Automotive Industry Company Market Share

Comprehensive Report: Automotive Testing, Inspection, and Certification (TIC) Market – Growth, Trends, and Future Outlook (2019-2033)

This in-depth report provides an unparalleled analysis of the global Automotive Testing, Inspection, and Certification (TIC) market, a critical component of the automotive supply chain and vehicle safety. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base and estimated year of 2025, this study offers actionable insights for automotive manufacturers, Tier 1 suppliers, TIC service providers, and regulatory bodies. We delve into the nuances of the parent automotive TIC market and its child markets by service type, including automotive testing services, automotive inspection services, and automotive certification services. With a focus on high-traffic keywords such as automotive compliance, vehicle homologation, automotive cybersecurity testing, EV battery testing, and autonomous vehicle testing, this report is optimized for maximum search engine visibility and professional engagement.

Testing, Inspection, and Certification Market for the Automotive Industry Market Dynamics & Structure

The Automotive Testing, Inspection, and Certification (TIC) market is characterized by a moderate to high level of concentration, with major global players dominating the landscape. Technological innovation is a significant driver, fueled by the rapid evolution of vehicle technologies, including electrification, connectivity, and autonomous driving. Regulatory frameworks, such as stringent vehicle safety standards and emissions regulations, are paramount in dictating market demands and shaping service offerings. Competitive product substitutes are limited, as TIC services are largely non-discretionary for market entry and ongoing compliance. End-user demographics are diverse, spanning established automotive giants to emerging electric vehicle (EV) startups. Mergers and acquisitions (M&A) trends are evident as larger TIC providers seek to expand their capabilities and geographical reach to cater to evolving industry needs.

- Market Concentration: Dominated by a few key global players, with a growing number of specialized regional providers.

- Technological Innovation Drivers: Electrification (e.g., EV battery testing, charging infrastructure), advanced driver-assistance systems (ADAS), connectivity (V2X), and the need for automotive cybersecurity testing.

- Regulatory Frameworks: Increasingly stringent global emission standards (e.g., Euro 7), safety regulations (e.g., UN ECE regulations), and data privacy laws influencing vehicle homologation requirements.

- Competitive Product Substitutes: Limited, with most automotive companies relying on external TIC providers for credibility and compliance.

- End-User Demographics: Major OEMs, new EV manufacturers, shared mobility providers, and suppliers across the automotive value chain.

- M&A Trends: Consolidation among TIC providers to enhance service portfolios and gain market share, with an estimated 15-20 significant M&A deals annually within the broader industrial TIC sector, impacting the automotive segment.

Testing, Inspection, and Certification Market for the Automotive Industry Growth Trends & Insights

The global Automotive Testing, Inspection, and Certification (TIC) market is poised for robust growth, projected to expand from an estimated $50,000 million in 2025 to $80,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.5%. This impressive trajectory is underpinned by a confluence of factors, including escalating vehicle complexity, evolving regulatory landscapes, and a heightened focus on safety and quality assurance. The increasing adoption of electric vehicles (EVs) is a significant catalyst, driving demand for specialized EV battery testing, charging system validation, and electromagnetic compatibility (EMC) testing. Furthermore, the proliferation of advanced driver-assistance systems (ADAS) and the nascent stages of autonomous driving necessitate rigorous testing and validation of sensors, software, and integrated systems.

Technological disruptions are continuously reshaping the TIC landscape. The integration of artificial intelligence (AI) and machine learning (ML) in testing processes is enhancing efficiency and accuracy, while digital twins and simulation technologies are enabling virtual testing and reducing physical prototype requirements. The shift towards software-defined vehicles is creating new avenues for automotive cybersecurity testing and over-the-air (OTA) update validation. Consumer behavior is also playing a crucial role, with an increasing demand for safer, more sustainable, and connected vehicles, pushing manufacturers to invest heavily in comprehensive TIC services to ensure compliance and build consumer trust. Market penetration of advanced safety features and autonomous technologies is projected to reach over 70% of new vehicle sales by 2030, directly correlating with TIC service uptake. The report's analysis incorporates data from sources such as the International Organization of Motor Vehicle Manufacturers (OICA) and the European Environment Agency (EEA) to provide a holistic view of market dynamics.

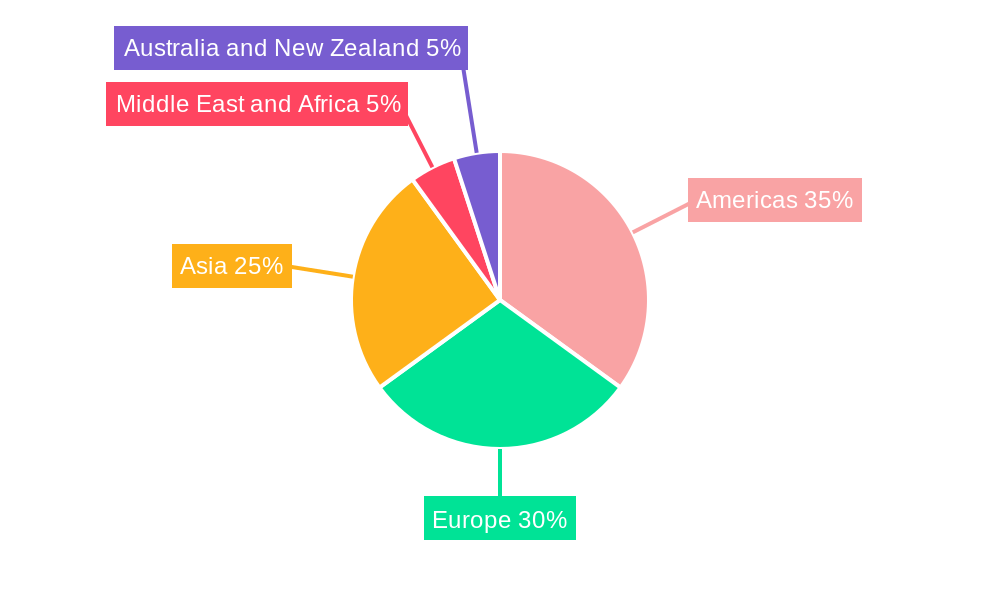

Dominant Regions, Countries, or Segments in Testing, Inspection, and Certification Market for the Automotive Industry

The Testing segment within the Automotive Testing, Inspection, and Certification (TIC) market is currently the most dominant, accounting for an estimated 55% of the total market share in 2025, valued at $27,500 million. This segment’s dominance is driven by the intrinsic need for thorough testing of all automotive components and systems throughout the product lifecycle, from research and development to post-production validation. The increasing complexity of modern vehicles, particularly in areas like powertrain, safety systems, and infotainment, necessitates extensive testing to ensure performance, durability, and compliance with ever-evolving standards.

North America emerges as the leading region, projected to hold a market share of approximately 30% in 2025, with an estimated market value of $15,000 million. This regional leadership is attributed to several key drivers:

- Economic Policies and Strong Automotive Presence: The region boasts a robust automotive manufacturing base with major OEMs and a significant number of Tier 1 suppliers. Favorable economic policies and substantial investments in automotive R&D further bolster demand for TIC services. The US, in particular, has a high adoption rate for new automotive technologies, pushing the need for advanced testing.

- Strict Regulatory Frameworks: While generally less stringent than Europe in some areas, North America maintains rigorous safety and emissions standards (e.g., NHTSA regulations, EPA standards), necessitating comprehensive testing and certification to access the market.

- Technological Innovation Hub: The concentration of technology companies and research institutions in North America, especially in areas like autonomous driving and electric mobility, fuels the demand for specialized testing and validation services. The rapid development and deployment of autonomous vehicle testing protocols are a significant growth area.

- Infrastructure and Investment: Significant investments in automotive infrastructure, including testing facilities and research centers, support the region's dominance. The push towards electrification in countries like the United States and Canada is creating substantial opportunities for EV battery testing and related services.

While North America leads, Europe remains a strong contender, driven by exceptionally stringent emission regulations (e.g., Euro 7) and comprehensive safety standards, making vehicle homologation a critical and continuous process. The Asia-Pacific region, particularly China, is exhibiting the fastest growth rate due to its massive automotive production volume and the rapid expansion of its EV market, demanding extensive testing and certification for both domestic and international markets.

Testing, Inspection, and Certification Market for the Automotive Industry Product Landscape

The product landscape within the Automotive Testing, Inspection, and Certification (TIC) market is characterized by highly specialized and technologically advanced service offerings. Innovations are primarily focused on enhancing the accuracy, speed, and comprehensiveness of testing, inspection, and certification processes. This includes the development of advanced simulation software for virtual testing of components and systems, sophisticated diagnostic tools for real-time performance monitoring, and automated inspection systems leveraging AI for defect detection. Unique selling propositions often revolve around expertise in niche areas such as EV battery safety testing, automotive cybersecurity vulnerability assessment, and functional safety testing for ADAS. Technological advancements are geared towards meeting stringent regulatory requirements for emissions, safety, and sustainability, ensuring that vehicles are compliant with global standards.

Key Drivers, Barriers & Challenges in Testing, Inspection, and Certification Market for the Automotive Industry

Key Drivers:

- Increasing Vehicle Complexity: The integration of advanced technologies like EVs, ADAS, and connected car features necessitates more sophisticated testing.

- Stringent Regulatory Mandates: Evolving global safety, emissions, and cybersecurity regulations are compelling manufacturers to invest in comprehensive TIC services.

- Focus on Vehicle Safety and Quality: Growing consumer demand for safer and more reliable vehicles drives the need for rigorous testing and certification.

- Growth of the Electric Vehicle (EV) Market: The rapid expansion of EVs requires specialized testing for batteries, charging systems, and electrical components.

Barriers & Challenges:

- High Cost of Advanced Testing Equipment: The investment required for cutting-edge testing facilities and equipment can be substantial.

- Shortage of Skilled Personnel: A lack of qualified engineers and technicians with expertise in new automotive technologies poses a challenge.

- Rapid Technological Evolution: Keeping pace with the fast-changing technological landscape requires continuous adaptation of testing methodologies and services.

- Global Supply Chain Disruptions: Intermittent disruptions in the automotive supply chain can impact the demand for TIC services and project timelines.

Emerging Opportunities in Testing, Inspection, and Certification Market for the Automotive Industry

Emerging opportunities in the Automotive TIC market are abundant, particularly in the burgeoning fields of electric and autonomous mobility. The increasing demand for EV battery lifecycle management, including performance testing, degradation analysis, and end-of-life assessment, presents a significant growth area. Furthermore, the development and deployment of autonomous driving systems create a substantial need for functional safety testing, cybersecurity validation, and real-world autonomous vehicle testing in diverse environmental conditions. The growth of shared mobility services also introduces new requirements for fleet management and vehicle validation. Untapped markets in developing economies undergoing rapid automotive industrialization offer substantial expansion potential.

Growth Accelerators in the Testing, Inspection, and Certification Market for the Automotive Industry Industry

Several key catalysts are accelerating the growth of the Automotive TIC market. Technological breakthroughs in areas like AI-driven testing automation and advanced simulation are enhancing efficiency and expanding service capabilities. Strategic partnerships between TIC providers and automotive manufacturers, as well as technology firms, are fostering innovation and ensuring access to cutting-edge expertise. Market expansion strategies, including global reach and the development of specialized service portfolios tailored to emerging trends like automotive cybersecurity compliance and sustainable mobility testing, are further driving growth. The increasing focus on data analytics for predictive maintenance and quality improvement also creates new service opportunities.

Key Players Shaping the Testing, Inspection, and Certification Market for the Automotive Industry Market

- ATIC (Guangzhou) Co Lt

- Intertek Group PLC

- KIWA NV

- TUV Rheinland

- Applus Services SA

- Eurofins Scientific

- UL Solutions Inc

- SGS SA

- National Technical Systems (NTS)

- DEKRA SE

- Bureau Veritas

- Element Materials Technology

- TUV Nord

- TUV SUD

Notable Milestones in Testing, Inspection, and Certification Market for the Automotive Industry Sector

- 2023 March: DEKRA SE acquires a leading cybersecurity testing company, enhancing its automotive cybersecurity testing capabilities.

- 2023 July: SGS SA launches a new service for EV battery recycling certification, addressing sustainability concerns.

- 2024 January: UL Solutions Inc. expands its ADAS testing facilities in North America to meet growing demand.

- 2024 April: TÜV SÜD introduces a comprehensive validation program for Level 3 autonomous driving systems.

- 2024 September: Bureau Veritas announces a strategic partnership with an AI firm to develop advanced diagnostic tools for vehicle inspection services.

- 2025 February: Element Materials Technology invests in new capabilities for hydrogen fuel cell testing, anticipating future energy trends.

- 2025 May: Intertek Group PLC receives accreditation for new electric vehicle charging infrastructure testing standards.

In-Depth Testing, Inspection, and Certification Market for the Automotive Industry Market Outlook

The future outlook for the Automotive Testing, Inspection, and Certification market is exceptionally promising, driven by sustained technological advancements and evolving regulatory demands. Growth accelerators, including the ongoing transition to electric mobility, the progressive development of autonomous driving technologies, and the increasing imperative for robust automotive cybersecurity, will continue to fuel demand for specialized TIC services. Strategic opportunities lie in expanding service offerings to encompass the entire vehicle lifecycle, from the development of next-generation battery technologies and advanced driver-assistance systems to the complex challenges of software updates and connected vehicle security. The market is poised for further consolidation and innovation, with companies that can offer comprehensive, integrated, and technologically advanced solutions best positioned for long-term success and market leadership.

Testing, Inspection, and Certification Market for the Automotive Industry Segmentation

-

1. Service Type

- 1.1. Testing

- 1.2. Inspection

- 1.3. Certification

Testing, Inspection, and Certification Market for the Automotive Industry Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Mexico

- 1.3. Brazil

-

2. Europe

- 2.1. Germany

- 2.2. Spain

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. India

- 4. Australia and New Zealand

- 5. Middle East and Africa

Testing, Inspection, and Certification Market for the Automotive Industry Regional Market Share

Geographic Coverage of Testing, Inspection, and Certification Market for the Automotive Industry

Testing, Inspection, and Certification Market for the Automotive Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Wireless Streaming of Audio Content; Increased Adoption of Smart TVs and Smart Home Devices

- 3.3. Market Restrains

- 3.3.1. Lack of International Accepted Standards

- 3.4. Market Trends

- 3.4.1. Electric Vehicles to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Testing, Inspection, and Certification Market for the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Testing

- 5.1.2. Inspection

- 5.1.3. Certification

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Americas

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Americas Testing, Inspection, and Certification Market for the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Testing

- 6.1.2. Inspection

- 6.1.3. Certification

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Testing, Inspection, and Certification Market for the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Testing

- 7.1.2. Inspection

- 7.1.3. Certification

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Testing, Inspection, and Certification Market for the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Testing

- 8.1.2. Inspection

- 8.1.3. Certification

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Australia and New Zealand Testing, Inspection, and Certification Market for the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Testing

- 9.1.2. Inspection

- 9.1.3. Certification

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Testing, Inspection, and Certification Market for the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Testing

- 10.1.2. Inspection

- 10.1.3. Certification

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ATIC (Guangzhou) Co Lt

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Intertek Group PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 KIWA NV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TUV Rheinland

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Applus Services SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eurofins Scientific

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 UL Solutions Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SGS SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 National Technical Systems (NTS)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DEKRA SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bureau Veritas

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Element Materials Technology

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TUV Nord

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TUV SUD

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 ATIC (Guangzhou) Co Lt

List of Figures

- Figure 1: Global Testing, Inspection, and Certification Market for the Automotive Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Testing, Inspection, and Certification Market for the Automotive Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: Americas Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 4: Americas Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 5: Americas Testing, Inspection, and Certification Market for the Automotive Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: Americas Testing, Inspection, and Certification Market for the Automotive Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 7: Americas Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 8: Americas Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit), by Country 2025 & 2033

- Figure 9: Americas Testing, Inspection, and Certification Market for the Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Americas Testing, Inspection, and Certification Market for the Automotive Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 12: Europe Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 13: Europe Testing, Inspection, and Certification Market for the Automotive Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 14: Europe Testing, Inspection, and Certification Market for the Automotive Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 15: Europe Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Testing, Inspection, and Certification Market for the Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Testing, Inspection, and Certification Market for the Automotive Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 20: Asia Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 21: Asia Testing, Inspection, and Certification Market for the Automotive Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Asia Testing, Inspection, and Certification Market for the Automotive Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 23: Asia Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Testing, Inspection, and Certification Market for the Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Testing, Inspection, and Certification Market for the Automotive Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Australia and New Zealand Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 28: Australia and New Zealand Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 29: Australia and New Zealand Testing, Inspection, and Certification Market for the Automotive Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 30: Australia and New Zealand Testing, Inspection, and Certification Market for the Automotive Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 31: Australia and New Zealand Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Australia and New Zealand Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Testing, Inspection, and Certification Market for the Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Australia and New Zealand Testing, Inspection, and Certification Market for the Automotive Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 36: Middle East and Africa Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 37: Middle East and Africa Testing, Inspection, and Certification Market for the Automotive Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 38: Middle East and Africa Testing, Inspection, and Certification Market for the Automotive Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 39: Middle East and Africa Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 40: Middle East and Africa Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit), by Country 2025 & 2033

- Figure 41: Middle East and Africa Testing, Inspection, and Certification Market for the Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Testing, Inspection, and Certification Market for the Automotive Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Testing, Inspection, and Certification Market for the Automotive Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Testing, Inspection, and Certification Market for the Automotive Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 3: Global Testing, Inspection, and Certification Market for the Automotive Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Testing, Inspection, and Certification Market for the Automotive Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Testing, Inspection, and Certification Market for the Automotive Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Global Testing, Inspection, and Certification Market for the Automotive Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 7: Global Testing, Inspection, and Certification Market for the Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Testing, Inspection, and Certification Market for the Automotive Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United States Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Mexico Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Mexico Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Brazil Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Brazil Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Global Testing, Inspection, and Certification Market for the Automotive Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 16: Global Testing, Inspection, and Certification Market for the Automotive Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 17: Global Testing, Inspection, and Certification Market for the Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Testing, Inspection, and Certification Market for the Automotive Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Germany Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Spain Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: France Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Global Testing, Inspection, and Certification Market for the Automotive Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 26: Global Testing, Inspection, and Certification Market for the Automotive Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 27: Global Testing, Inspection, and Certification Market for the Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Testing, Inspection, and Certification Market for the Automotive Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: China Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: China Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Japan Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Japan Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: South Korea Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: South Korea Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: India Testing, Inspection, and Certification Market for the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: India Testing, Inspection, and Certification Market for the Automotive Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Testing, Inspection, and Certification Market for the Automotive Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 38: Global Testing, Inspection, and Certification Market for the Automotive Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 39: Global Testing, Inspection, and Certification Market for the Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Testing, Inspection, and Certification Market for the Automotive Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global Testing, Inspection, and Certification Market for the Automotive Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 42: Global Testing, Inspection, and Certification Market for the Automotive Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 43: Global Testing, Inspection, and Certification Market for the Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Testing, Inspection, and Certification Market for the Automotive Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Testing, Inspection, and Certification Market for the Automotive Industry?

The projected CAGR is approximately 6.97%.

2. Which companies are prominent players in the Testing, Inspection, and Certification Market for the Automotive Industry?

Key companies in the market include ATIC (Guangzhou) Co Lt, Intertek Group PLC, KIWA NV, TUV Rheinland, Applus Services SA, Eurofins Scientific, UL Solutions Inc, SGS SA, National Technical Systems (NTS), DEKRA SE, Bureau Veritas, Element Materials Technology, TUV Nord, TUV SUD.

3. What are the main segments of the Testing, Inspection, and Certification Market for the Automotive Industry?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Wireless Streaming of Audio Content; Increased Adoption of Smart TVs and Smart Home Devices.

6. What are the notable trends driving market growth?

Electric Vehicles to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Lack of International Accepted Standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Testing, Inspection, and Certification Market for the Automotive Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Testing, Inspection, and Certification Market for the Automotive Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Testing, Inspection, and Certification Market for the Automotive Industry?

To stay informed about further developments, trends, and reports in the Testing, Inspection, and Certification Market for the Automotive Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence