Key Insights

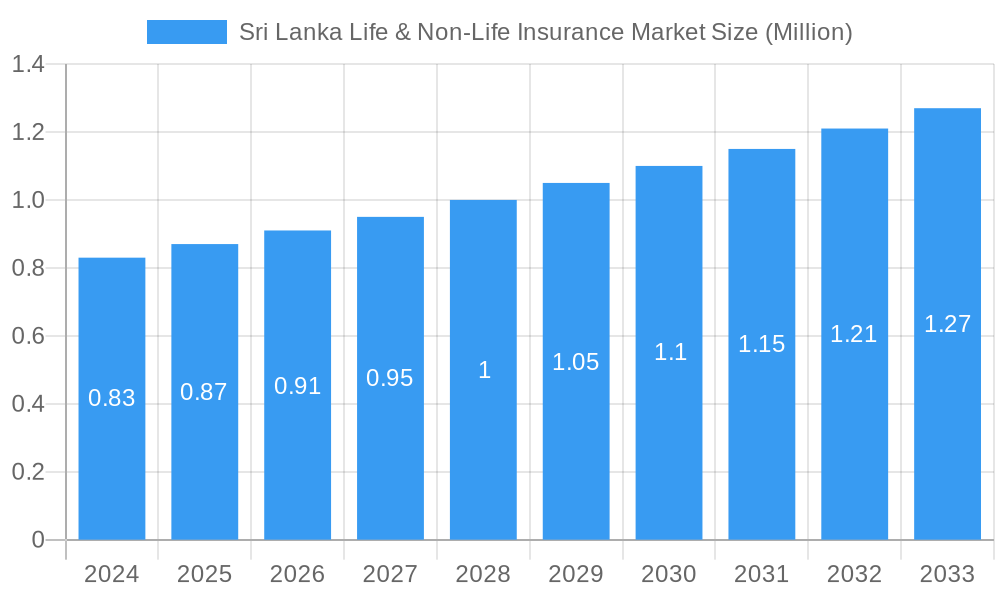

The Sri Lankan insurance market, encompassing both life and non-life segments, is poised for robust expansion, with a current market size valued at approximately USD 0.87 billion in 2025. This growth is projected to continue at a Compound Annual Growth Rate (CAGR) of 4.53% over the forecast period from 2025 to 2033, indicating a steady and significant upward trajectory. The market's expansion is fueled by several key drivers, including increasing awareness among the population about the importance of financial security and risk management, coupled with rising disposable incomes that allow for greater investment in insurance products. Furthermore, favorable government initiatives aimed at promoting financial inclusion and developing the insurance sector are also acting as significant catalysts for growth. The market is characterized by a diverse range of offerings, segmented into Life Insurances (Individual and Group) and Non-Life Insurances (including Motor, Home, and Other Non-Life Insurance categories). This segmentation caters to a broad spectrum of consumer needs, from long-term financial planning and protection to safeguarding assets against unforeseen events.

Sri Lanka Life & Non-Life Insurance Market Market Size (In Million)

The distribution landscape within Sri Lanka's insurance sector is evolving, with a multi-channel approach becoming increasingly prevalent. While traditional channels like Agencies continue to play a vital role, there's a growing reliance on Direct sales, Bancassurance partnerships, and Other innovative distribution channels to reach a wider customer base. This shift is driven by the need for convenience and accessibility, especially among younger demographics. However, the market also faces certain restraints, such as the prevailing economic conditions and evolving regulatory frameworks, which can influence consumer spending and insurer operations. Despite these challenges, the strong underlying demand for insurance, driven by a young and growing population, a burgeoning middle class, and a strategic focus on enhancing financial literacy, positions the Sri Lankan insurance market for sustained development and increased penetration in the coming years. Key players like Ceylinco Insurance, Sri Lanka Insurance, and AIA Insurance are at the forefront of this growth, continuously innovating to meet the evolving needs of policyholders.

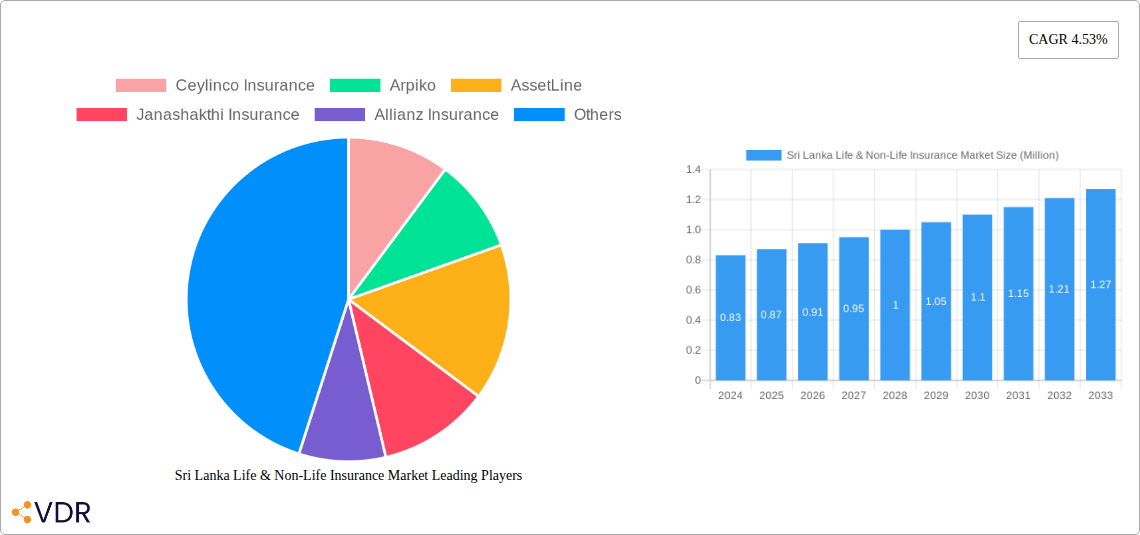

Sri Lanka Life & Non-Life Insurance Market Company Market Share

This comprehensive report provides an in-depth analysis of the Sri Lanka Life & Non-Life Insurance Market, offering critical insights for industry stakeholders. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, the report details historical trends (2019-2024) and forecasts future market evolution (2025-2033). We delve into the parent and child market dynamics, segment analysis, and the impact of evolving economic and technological landscapes.

Sri Lanka Life & Non-Life Insurance Market Market Dynamics & Structure

The Sri Lanka insurance market exhibits a moderate level of concentration, with key players like Sri Lanka Insurance, Ceylinco Insurance, Union Assurance, and AIA Insurance holding significant market shares. Technological innovation is a primary driver, with digital transformation initiatives enhancing customer experience and operational efficiency. Regulatory frameworks, overseen by the Insurance Regulatory Commission of Sri Lanka (IRCSL), are crucial in shaping market conduct and consumer protection. Competitive product substitutes, such as mutual funds and fixed deposits, present ongoing challenges, while evolving end-user demographics, characterized by a growing middle class and increasing awareness of financial security, are creating new opportunities. Mergers and acquisitions (M&A) trends are relatively subdued, indicating a preference for organic growth and strategic partnerships within the sector.

- Market Concentration: Dominated by a few large insurers, with a growing presence of niche players.

- Technological Drivers: Digitalization of policy issuance, claims processing, and customer service platforms.

- Regulatory Framework: Strict compliance requirements ensuring solvency and consumer fairness.

- Competitive Landscape: Competition from banks and investment products necessitates innovative insurance offerings.

- End-User Demographics: Increasing disposable incomes and a young, urbanizing population driving demand.

- M&A Trends: Limited but potential for consolidation in specific segments.

Sri Lanka Life & Non-Life Insurance Market Growth Trends & Insights

The Sri Lanka Life & Non-Life Insurance Market is poised for robust growth, driven by increasing disposable incomes, a growing understanding of financial planning, and a proactive government focus on economic development. The market size evolution indicates a steady upward trajectory, with adoption rates for both life and non-life insurance products showing significant potential for expansion. Technological disruptions, including the integration of Artificial Intelligence (AI) and Machine Learning (ML) in underwriting and claims, are revolutionizing operational efficiencies and customer engagement. Consumer behavior shifts are evident, with a growing preference for personalized insurance solutions and digital-first interactions. The penetration rate of insurance in Sri Lanka, while still lower than developed economies, presents a substantial opportunity for market expansion. This growth is further bolstered by initiatives aimed at increasing financial literacy and awareness regarding risk management and long-term financial security. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

Dominant Regions, Countries, or Segments in Sri Lanka Life & Non-Life Insurance Market

Within the Sri Lanka Life & Non-Life Insurance Market, Non-Life Insurances, particularly Motor Insurance, emerges as a dominant segment. This dominance is fueled by the country's increasing vehicle ownership and stringent mandatory insurance regulations. The Agency distribution channel traditionally holds a significant market share due to its widespread reach and personalized customer interaction, though Direct and Banks as distribution channels are rapidly gaining traction with digital adoption. Economically, the overall growth of the nation and rising disposable incomes directly correlate with the increased demand for both life and non-life insurance products.

- Dominant Segment (Type): Non-Life Insurances, with Motor Insurance leading.

- Key Drivers: High vehicle penetration, mandatory insurance laws, and increased road usage.

- Market Share: Estimated at xx% of the total non-life segment.

- Dominant Distribution Channel: Agency.

- Key Drivers: Established networks, customer trust, and personalized advice.

- Growth Potential: Increasing adoption of digital platforms is challenging traditional dominance.

- Regional Influence: Urban centers and economically developed provinces exhibit higher insurance penetration due to greater awareness and purchasing power.

- Economic Policies: Government initiatives supporting economic growth indirectly boost insurance demand.

- Infrastructure Development: Improvements in transportation and housing positively impact motor and home insurance demand.

- Life Insurance Segments: Individual life insurance is projected to see substantial growth driven by a rising middle class and increased awareness of long-term financial planning. Group life insurance, tied to employment, also contributes significantly to the overall life insurance market.

Sri Lanka Life & Non-Life Insurance Market Product Landscape

The Sri Lanka insurance product landscape is evolving with a focus on innovation and customer-centricity. Insurers are introducing a wider array of specialized products, including parametric insurance and microinsurance solutions tailored to specific needs. Performance metrics such as claim settlement ratios and policyholder satisfaction are becoming key differentiators. Technological advancements are enabling the development of customized insurance plans, offering greater flexibility and value to consumers. Unique selling propositions often revolve around digital ease-of-use, comprehensive coverage options, and competitive pricing.

Key Drivers, Barriers & Challenges in Sri Lanka Life & Non-Life Insurance Market

Key Drivers: The Sri Lanka Life & Non-Life Insurance Market is propelled by several factors. Economic growth and rising per capita income are increasing disposable incomes, enabling more individuals to afford insurance coverage. Growing awareness of financial security and risk management, particularly after economic uncertainties, is driving demand for both life and non-life products. Government initiatives promoting financial inclusion and digital literacy further support market expansion. Technological advancements, such as InsurTech solutions, are enhancing operational efficiency and customer experience, making insurance more accessible and attractive.

Barriers & Challenges: Despite the positive outlook, the market faces several hurdles. Low insurance penetration, especially in rural areas, remains a significant challenge, stemming from limited awareness and affordability issues. Regulatory complexities and compliance costs can impact smaller players. Intense competition from both traditional insurers and emerging FinTech companies necessitates continuous innovation and service improvement. Supply chain disruptions, particularly for certain types of non-life insurance claims, can affect service delivery. Public perception and historical mistrust of insurance can also act as a restraint, requiring sustained efforts in education and transparency.

Emerging Opportunities in Sri Lanka Life & Non-Life Insurance Market

Emerging opportunities in the Sri Lanka Life & Non-Life Insurance Market lie in tapping into the vast untapped rural market, offering microinsurance products tailored to low-income segments. The growing gig economy presents an avenue for developing flexible, on-demand insurance solutions for freelancers and contract workers. Innovative applications of AI and data analytics for personalized risk assessment and product development are crucial. Evolving consumer preferences for digital-first services and sustainable investments are creating demand for ESG-compliant insurance products. Partnerships with technology providers and e-commerce platforms can unlock new distribution channels and customer segments.

Growth Accelerators in the Sri Lanka Life & Non-Life Insurance Market Industry

Several catalysts are accelerating growth in the Sri Lanka Life & Non-Life Insurance Market. Technological breakthroughs in InsurTech, including AI-powered claims processing and personalized underwriting, are significantly improving efficiency and customer satisfaction. Strategic partnerships between insurance companies and financial institutions, telecommunication providers, and e-commerce platforms are expanding reach and creating new distribution channels. Market expansion strategies focused on underserved segments, such as SMEs and the rural population, are unlocking substantial growth potential. The increasing adoption of digital payment gateways and mobile banking also facilitates easier premium collection and claims disbursement, further smoothing the growth trajectory.

Key Players Shaping the Sri Lanka Life & Non-Life Insurance Market Market

- Ceylinco Insurance

- Arpiko

- AssetLine

- Janashakthi Insurance

- Allianz Insurance

- Sri Lanka Insurance

- Continental Insurance Lanka

- AIA Insurance

- Union Assurance

- MSBL Insurance

Notable Milestones in Sri Lanka Life & Non-Life Insurance Market Sector

- March 2023: Sri Lanka Insurance partnered with SLIM Agrisaviya to nurture the agriculture sector. The Certificate in Agri-Business and Entrepreneurship (CABE) program is a first-of-its-kind qualification available in Sri Lanka to transform farmers into “Agriprenuers.”

- January 2022: Ceylinco General Insurance launched ‘Drive Thru Claims.’ Customers who do not opt to obtain claims using the on-the-spot facility will be notified via SMS of the pending items and the documents required. Once the papers are handed over at the Dive Thru Centre, the customer will receive the cheque or cash within a few minutes.

In-Depth Sri Lanka Life & Non-Life Insurance Market Market Outlook

The future outlook for the Sri Lanka Life & Non-Life Insurance Market is highly promising, driven by sustained economic development, increasing financial literacy, and the rapid adoption of digital technologies. Growth accelerators such as InsurTech innovations, strategic alliances, and targeted market expansion will continue to fuel the sector. Opportunities to tap into underserved segments, develop bespoke insurance products for the evolving workforce, and leverage data analytics for personalized offerings present significant potential. The market is expected to witness increased penetration rates and a greater diversification of insurance products, solidifying its role as a critical pillar of Sri Lanka's financial landscape.

Sri Lanka Life & Non-Life Insurance Market Segmentation

-

1. Type

-

1.1. Life Insurances

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurances

- 1.2.1. Motor

- 1.2.2. Home

- 1.2.3. Other Non-Life Insurance

-

1.1. Life Insurances

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

Sri Lanka Life & Non-Life Insurance Market Segmentation By Geography

- 1. Sri Lanka

Sri Lanka Life & Non-Life Insurance Market Regional Market Share

Geographic Coverage of Sri Lanka Life & Non-Life Insurance Market

Sri Lanka Life & Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Long and Costly Legal Procedures

- 3.4. Market Trends

- 3.4.1. Rising Digital Personalization in Life and Non-Life Insurance at Sri Lanka

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sri Lanka Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Life Insurances

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurances

- 5.1.2.1. Motor

- 5.1.2.2. Home

- 5.1.2.3. Other Non-Life Insurance

- 5.1.1. Life Insurances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sri Lanka

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ceylinco Insurance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arpiko

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AssetLine

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Janashakthi Insurance

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Allianz Insurance

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sri Lanka Insurance

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Continental Insurance Lanka**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AIA Insurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Union Assurance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MSBL Insurance

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ceylinco Insurance

List of Figures

- Figure 1: Sri Lanka Life & Non-Life Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Sri Lanka Life & Non-Life Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sri Lanka Life & Non-Life Insurance Market?

The projected CAGR is approximately 4.53%.

2. Which companies are prominent players in the Sri Lanka Life & Non-Life Insurance Market?

Key companies in the market include Ceylinco Insurance, Arpiko, AssetLine, Janashakthi Insurance, Allianz Insurance, Sri Lanka Insurance, Continental Insurance Lanka**List Not Exhaustive, AIA Insurance, Union Assurance, MSBL Insurance.

3. What are the main segments of the Sri Lanka Life & Non-Life Insurance Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Rising Digital Personalization in Life and Non-Life Insurance at Sri Lanka.

7. Are there any restraints impacting market growth?

Long and Costly Legal Procedures.

8. Can you provide examples of recent developments in the market?

March 2023: Sri Lanka Insurance partnered with SLIM Agrisaviya to nurture the agriculture sector. The Certificate in Agri-Business and Entrepreneurship (CABE) program is a first-of-its-kind qualification available in Sri Lanka to transform farmers into “Agriprenuers.”

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sri Lanka Life & Non-Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sri Lanka Life & Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sri Lanka Life & Non-Life Insurance Market?

To stay informed about further developments, trends, and reports in the Sri Lanka Life & Non-Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence