Key Insights

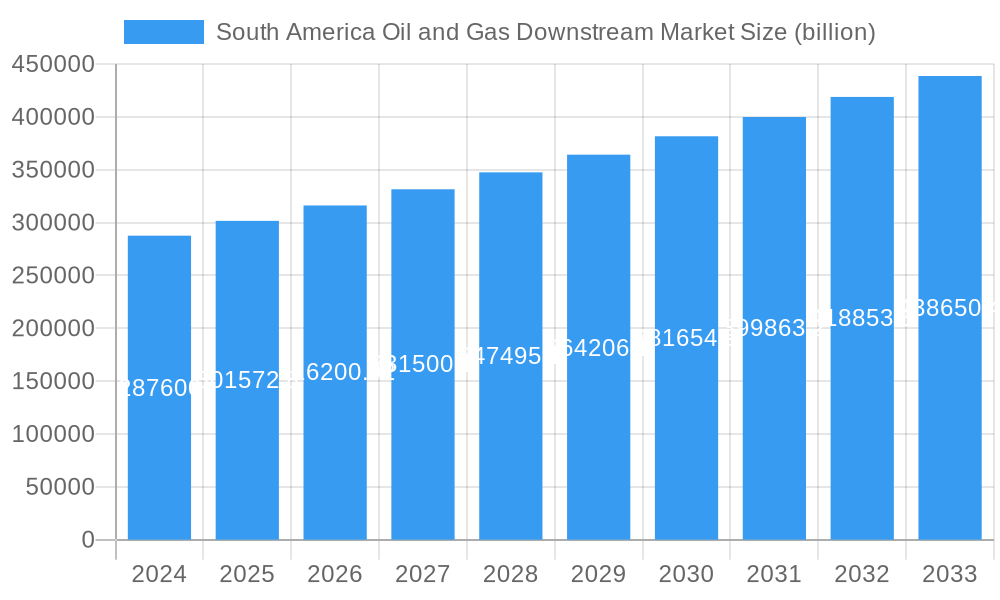

The South America Oil and Gas Downstream Market is poised for substantial growth, projected to reach USD 287.6 billion in 2024, with an estimated Compound Annual Growth Rate (CAGR) of 4.8% during the forecast period of 2025-2033. This expansion is primarily driven by robust investments in refinery upgrades and petrochemical plant expansions across key economies like Brazil, Argentina, and Colombia. The increasing demand for refined petroleum products, such as gasoline and diesel, coupled with the growing consumption of petrochemical derivatives in sectors like manufacturing and construction, forms the bedrock of this market's upward trajectory. Furthermore, initiatives aimed at enhancing energy security and optimizing existing infrastructure are contributing significantly to market dynamism. The sector's focus on modernization and capacity building underscores a commitment to meeting the evolving energy needs of the region.

South America Oil and Gas Downstream Market Market Size (In Billion)

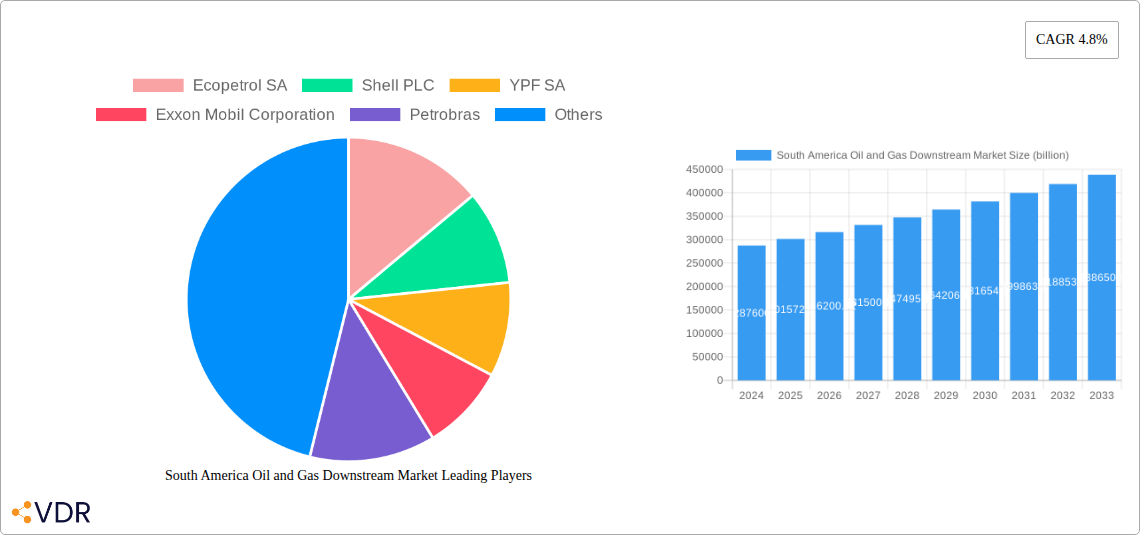

Despite the positive outlook, certain restraints could temper the market's pace. These include stringent environmental regulations and the rising global emphasis on sustainability, which may necessitate significant capital expenditure for compliance and the adoption of cleaner technologies. However, ongoing technological advancements and the development of innovative downstream processes are expected to mitigate these challenges. Key players such as Ecopetrol SA, Shell PLC, YPF SA, Exxon Mobil Corporation, Petrobras, and BP PLC are actively involved in strategic expansions and collaborations to capitalize on emerging opportunities. The market's segmentation into Refineries and Petrochemical Plants, with a geographical focus on Brazil, Argentina, Colombia, and the Rest of South America, highlights the diverse investment landscape and growth potential across the region.

South America Oil and Gas Downstream Market Company Market Share

Here's the SEO-optimized report description for the South America Oil and Gas Downstream Market, structured as requested:

This in-depth report provides a thorough analysis of the South America Oil and Gas Downstream Market, encompassing its current state, growth trajectory, and future potential. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025-2033, this study delves into critical market dynamics, key growth trends, dominant regions, and the competitive landscape. It highlights the pivotal role of parent and child markets, including Refineries (Market Overview, Key Project Information) and Petrochemical Plants, across major geographies such as Brazil, Argentina, and Colombia, along with the Rest of South America. With a focus on providing actionable insights for industry stakeholders, this report leverages high-traffic keywords to maximize search engine visibility and engagement.

South America Oil and Gas Downstream Market Market Dynamics & Structure

The South America oil and gas downstream market is characterized by a moderate to high level of concentration, with major integrated oil companies and state-owned enterprises holding significant market share. Technological innovation is primarily driven by the increasing demand for cleaner fuels, efficiency improvements in refining processes, and the development of advanced petrochemical products. Regulatory frameworks are evolving, with governments implementing stricter environmental standards and policies aimed at promoting energy security and sustainability. Competitive product substitutes are emerging, particularly in the form of biofuels and renewable energy sources, which are gradually influencing the demand for traditional petroleum products. End-user demographics are shifting, with growing middle classes in several South American nations driving increased consumption of refined fuels and petrochemical-based goods. Merger and acquisition (M&A) trends are indicative of strategic consolidation and portfolio optimization within the sector. In the historical period (2019-2024), several strategic divestitures and acquisitions were observed, with deal volumes estimated in the billions of USD, as companies sought to enhance their operational efficiency and market positioning. Barriers to innovation include high capital investment requirements, complex permitting processes, and the inherent cyclical nature of the oil and gas industry.

- Market Concentration: Dominated by a few key players, with significant state-owned entity influence.

- Technological Drivers: Focus on cleaner fuel production, enhanced refining efficiency, and advanced petrochemical applications.

- Regulatory Landscape: Increasingly stringent environmental regulations and energy policy shifts.

- Competitive Substitutes: Growing influence of biofuels and renewable energy options.

- End-User Demographics: Rising consumption driven by economic growth and expanding middle class.

- M&A Activity: Strategic consolidation and portfolio optimization are key trends, with historical deal values in the billions of USD.

- Innovation Barriers: High capital needs, regulatory complexities, and industry cyclicality.

South America Oil and Gas Downstream Market Growth Trends & Insights

The South America oil and gas downstream market is projected to experience robust growth over the forecast period, driven by a confluence of factors including increasing energy demand, strategic investments in infrastructure, and evolving consumer preferences. The market size is anticipated to expand from approximately $XXX billion in 2025 to an estimated $XXX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of X.X%. Adoption rates for advanced refining technologies are steadily increasing as companies strive to meet stringent environmental regulations and produce higher-value products. Technological disruptions, such as the integration of digital solutions for process optimization and the development of novel catalysts, are expected to play a crucial role in enhancing operational efficiency and reducing costs. Consumer behavior shifts are evident, with a growing demand for cleaner fuels like ultra-low sulfur diesel (ULSD) and gasoline, alongside an increasing preference for petrochemical-derived products in various industries, including packaging, automotive, and construction. Market penetration of cleaner fuel technologies is a significant trend, reflecting both regulatory mandates and consumer awareness. The downstream sector's ability to adapt to these changes and invest in sustainable practices will be critical for its sustained growth and profitability. Further analysis within this report will detail specific market size evolution and penetration metrics.

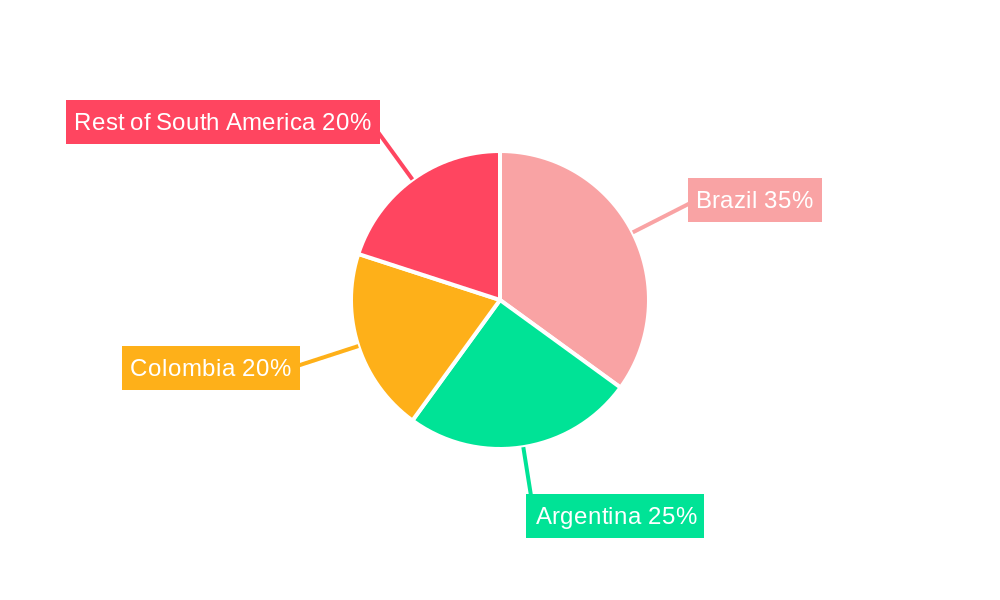

Dominant Regions, Countries, or Segments in South America Oil and Gas Downstream Market

Within the South America oil and gas downstream market, the Refineries segment, particularly with a focus on Market Overview and Key Project Information, is emerging as a dominant force, significantly driving market growth. Brazil, as the largest economy in South America, consistently leads in refining capacity and consumption, followed closely by Argentina and Colombia. These countries are experiencing substantial investments in upgrading existing refinery infrastructure and developing new processing units to meet escalating domestic fuel demand and enhance product quality. The strategic importance of refining operations is underscored by projects aimed at increasing the production of cleaner fuels. For instance, the expansion works completed by Ecopetrol at its Reficar oil refinery in Cartagena, Colombia, in September 2022, exemplify this trend. This expansion not only bolsters Colombia's energy sovereignty by guaranteeing domestic fuel supply but also positions the refinery as a key producer of diesel and gasoline with significantly reduced sulfur content (below 100 ppm for diesel and 50 ppm for gasoline), aligning with global environmental standards. The Petrochemical Plants segment also contributes significantly, with growing demand for plastics, fertilizers, and other derivatives fueling expansion plans across the region. Economic policies, robust infrastructure development, and the presence of major oil reserves in these dominant countries create a favorable environment for sustained growth in the downstream sector. Market share within the refining sector in these key countries is substantial, with potential for further expansion driven by ongoing project developments and increasing demand.

- Dominant Segment: Refineries (Market Overview, Key Project Information).

- Leading Countries: Brazil, Argentina, Colombia.

- Key Growth Drivers: Increasing domestic fuel demand, infrastructure upgrades, cleaner fuel production initiatives.

- Market Share: Significant concentration within the refining sector in leading nations.

- Growth Potential: High, driven by ongoing projects and rising consumption.

South America Oil and Gas Downstream Market Product Landscape

The product landscape within the South America oil and gas downstream market is characterized by a growing emphasis on value-added derivatives and cleaner fuel offerings. Refineries are increasingly focusing on producing higher-octane gasoline, ultra-low sulfur diesel, and jet fuel to meet stringent environmental regulations and consumer demand. Petrochemical plants are expanding their output of polymers, synthetic fibers, and specialty chemicals used in a wide array of industries, including packaging, automotive, and construction. Product innovations are driven by the pursuit of improved performance, enhanced sustainability, and cost-effectiveness. Unique selling propositions often revolve around the purity and quality of refined products, the efficiency of petrochemical manufacturing processes, and the development of bio-based alternatives where feasible. Technological advancements in catalysis, separation, and process integration are enabling the production of more sophisticated and environmentally friendly products, solidifying the downstream sector's role in supporting regional economic development.

Key Drivers, Barriers & Challenges in South America Oil and Gas Downstream Market

Key Drivers: The South America oil and gas downstream market is propelled by several key drivers. Increasing domestic energy demand, fueled by population growth and economic development, is a primary force. Investments in modernizing and expanding refining capacity, alongside the growing petrochemical industry, are critical. Furthermore, government initiatives promoting energy security and the adoption of cleaner fuel standards are significant catalysts. Technological advancements leading to improved efficiency and product quality also play a crucial role.

Barriers & Challenges: Despite positive drivers, the market faces significant barriers and challenges. High capital expenditure requirements for refinery upgrades and new plant construction present a substantial hurdle. Volatile crude oil prices and fluctuating demand can impact profitability and investment decisions. Stringent and evolving environmental regulations necessitate costly compliance measures. Supply chain disruptions, political instability in some regions, and the increasing competitive pressure from renewable energy sources pose further challenges. The need for skilled labor and the complexities of obtaining permits can also slow down project development.

Emerging Opportunities in South America Oil and Gas Downstream Market

Emerging opportunities in the South America oil and gas downstream market lie in the growing demand for petrochemical derivatives in burgeoning industries like e-commerce packaging and advanced manufacturing. There is also a significant opportunity in the production of specialty chemicals and lubricants that cater to niche industrial applications. Furthermore, the push for decarbonization presents opportunities for investments in carbon capture technologies within refineries and the potential development of blue hydrogen production. Exploring bio-based feedstocks for petrochemical production also represents a promising avenue for sustainable growth.

Growth Accelerators in the South America Oil and Gas Downstream Market Industry

Growth accelerators in the South America oil and gas downstream market industry are manifold. Strategic partnerships between national oil companies and international energy majors are fostering knowledge transfer and facilitating large-scale projects. Technological breakthroughs in refining efficiency and petrochemical process optimization are lowering operational costs and improving product yields. Government policies that incentivize investment in downstream infrastructure, coupled with growing domestic and regional demand for refined products and petrochemicals, are significant growth engines. The focus on meeting stringent environmental standards also accelerates the adoption of cleaner technologies.

Key Players Shaping the South America Oil and Gas Downstream Market Market

- Ecopetrol SA

- Shell PLC

- YPF SA

- Exxon Mobil Corporation

- Petrobras

- BP PLC

Notable Milestones in South America Oil and Gas Downstream Market Sector

- September 2022: Colombian state oil company Ecopetrol completed expansion works at its Reficar oil refinery in Cartagena, enhancing domestic fuel supply and producing cleaner diesel and gasoline with sulfur content levels below 100 ppm and 50 ppm, respectively.

- January 2021: Brazilian company Macro Desenvolvimento requested authorization from the National Agency of Petroleum, Natural Gas and Biofuels (ANP) to build and operate a USD 480 million natural gas processing unit (UPGN) in Presidente Kennedy municipality, Espírito Santo, with construction planned for December 2023 and completion by 2025.

In-Depth South America Oil and Gas Downstream Market Market Outlook

The future outlook for the South America oil and gas downstream market is marked by sustained growth, driven by evolving energy demands and technological advancements. The ongoing investments in refinery upgrades and the expansion of petrochemical facilities across key nations like Brazil, Argentina, and Colombia will continue to be significant growth accelerators. The market's ability to adapt to stricter environmental regulations by embracing cleaner fuel production and more sustainable petrochemical processes will be crucial for its long-term viability. Strategic alliances and the adoption of digital technologies for operational efficiency will further bolster the sector's competitive edge, paving the way for new opportunities in specialized chemical production and the potential integration of lower-carbon energy solutions.

South America Oil and Gas Downstream Market Segmentation

-

1. Sector

-

1.1. Refineries

- 1.1.1. Market Overview

- 1.1.2. Key Project Information

- 1.2. Petrochemical Plants

-

1.1. Refineries

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America Oil and Gas Downstream Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Oil and Gas Downstream Market Regional Market Share

Geographic Coverage of South America Oil and Gas Downstream Market

South America Oil and Gas Downstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Industrialization across the Globe; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. Refinery Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Oil and Gas Downstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Refineries

- 5.1.1.1. Market Overview

- 5.1.1.2. Key Project Information

- 5.1.2. Petrochemical Plants

- 5.1.1. Refineries

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Brazil South America Oil and Gas Downstream Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Refineries

- 6.1.1.1. Market Overview

- 6.1.1.2. Key Project Information

- 6.1.2. Petrochemical Plants

- 6.1.1. Refineries

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Argentina South America Oil and Gas Downstream Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Refineries

- 7.1.1.1. Market Overview

- 7.1.1.2. Key Project Information

- 7.1.2. Petrochemical Plants

- 7.1.1. Refineries

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Colombia South America Oil and Gas Downstream Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Refineries

- 8.1.1.1. Market Overview

- 8.1.1.2. Key Project Information

- 8.1.2. Petrochemical Plants

- 8.1.1. Refineries

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Rest of South America South America Oil and Gas Downstream Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Refineries

- 9.1.1.1. Market Overview

- 9.1.1.2. Key Project Information

- 9.1.2. Petrochemical Plants

- 9.1.1. Refineries

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Ecopetrol SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Shell PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 YPF SA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Exxon Mobil Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Petrobras

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BP PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Ecopetrol SA

List of Figures

- Figure 1: South America Oil and Gas Downstream Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Oil and Gas Downstream Market Share (%) by Company 2025

List of Tables

- Table 1: South America Oil and Gas Downstream Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 2: South America Oil and Gas Downstream Market Volume Million Forecast, by Sector 2020 & 2033

- Table 3: South America Oil and Gas Downstream Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Oil and Gas Downstream Market Volume Million Forecast, by Geography 2020 & 2033

- Table 5: South America Oil and Gas Downstream Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: South America Oil and Gas Downstream Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: South America Oil and Gas Downstream Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 8: South America Oil and Gas Downstream Market Volume Million Forecast, by Sector 2020 & 2033

- Table 9: South America Oil and Gas Downstream Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: South America Oil and Gas Downstream Market Volume Million Forecast, by Geography 2020 & 2033

- Table 11: South America Oil and Gas Downstream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: South America Oil and Gas Downstream Market Volume Million Forecast, by Country 2020 & 2033

- Table 13: South America Oil and Gas Downstream Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 14: South America Oil and Gas Downstream Market Volume Million Forecast, by Sector 2020 & 2033

- Table 15: South America Oil and Gas Downstream Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Oil and Gas Downstream Market Volume Million Forecast, by Geography 2020 & 2033

- Table 17: South America Oil and Gas Downstream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: South America Oil and Gas Downstream Market Volume Million Forecast, by Country 2020 & 2033

- Table 19: South America Oil and Gas Downstream Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 20: South America Oil and Gas Downstream Market Volume Million Forecast, by Sector 2020 & 2033

- Table 21: South America Oil and Gas Downstream Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: South America Oil and Gas Downstream Market Volume Million Forecast, by Geography 2020 & 2033

- Table 23: South America Oil and Gas Downstream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: South America Oil and Gas Downstream Market Volume Million Forecast, by Country 2020 & 2033

- Table 25: South America Oil and Gas Downstream Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 26: South America Oil and Gas Downstream Market Volume Million Forecast, by Sector 2020 & 2033

- Table 27: South America Oil and Gas Downstream Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: South America Oil and Gas Downstream Market Volume Million Forecast, by Geography 2020 & 2033

- Table 29: South America Oil and Gas Downstream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: South America Oil and Gas Downstream Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Oil and Gas Downstream Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the South America Oil and Gas Downstream Market?

Key companies in the market include Ecopetrol SA, Shell PLC, YPF SA, Exxon Mobil Corporation, Petrobras, BP PLC.

3. What are the main segments of the South America Oil and Gas Downstream Market?

The market segments include Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 287.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Industrialization across the Globe; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

Refinery Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

September 2022: The Colombian state oil company Ecopetrol completed expansion works at its Reficar oil refinery in Cartagena as it seeks to meet rising domestic fuel demand. This expansion consolidates the Cartagena refinery as a strategic asset to guarantee Colombia's energy sovereignty. Also, this refinery would now produce diesel and gasoline with sulfur content levels below 100 parts per million (ppm) and 50 ppm, respectively.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Oil and Gas Downstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Oil and Gas Downstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Oil and Gas Downstream Market?

To stay informed about further developments, trends, and reports in the South America Oil and Gas Downstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence