Key Insights

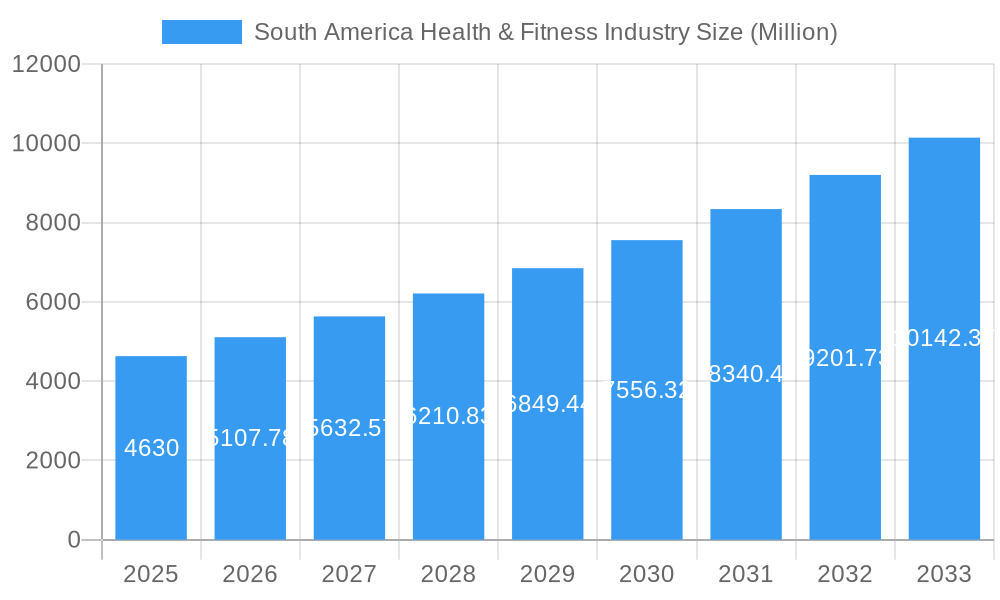

The South American health and fitness industry, valued at $4.63 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 10.26% from 2025 to 2033. This expansion is fueled by several key factors. Increasing health consciousness among the burgeoning middle class is driving demand for fitness services. The rising prevalence of lifestyle diseases, coupled with greater awareness of preventative healthcare, further contributes to market growth. Furthermore, the emergence of innovative fitness technologies, including wearable fitness trackers and virtual workout platforms, is enhancing accessibility and engagement. The industry is also witnessing a shift towards personalized fitness programs, with a growing preference for personal training and specialized instruction. This trend, combined with the increasing popularity of boutique fitness studios and specialized gyms, caters to diverse fitness goals and preferences.

South America Health & Fitness Industry Market Size (In Billion)

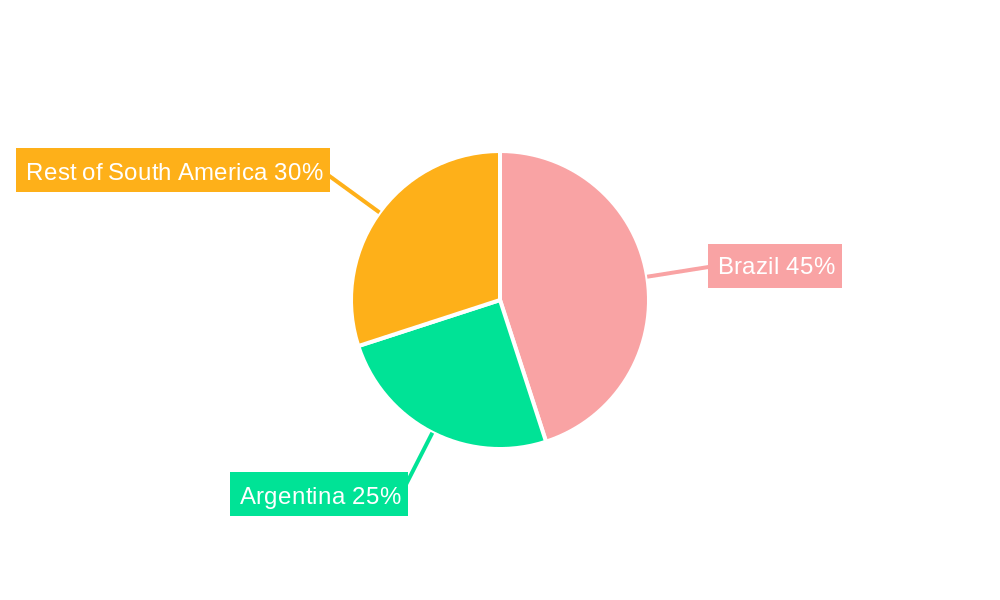

Growth is segmented across various service types, with membership fees, total admission fees, and personal training and instruction services representing major revenue streams. Major players like Megatlon Club, OX Fitness Club, Academia Bio Ritmo, GOLD'S GYM, Planet Fitness Franchising LLC, Bodytech Sports Medicine, Anytime Fitness LLC, and AYO Fitness Club are actively shaping the market landscape through expansion strategies, service diversification, and technological integration. While the market enjoys substantial growth potential, challenges remain. Economic fluctuations in certain South American countries could impact consumer spending on fitness services. Competition from established and emerging players necessitates continuous innovation and strategic positioning to maintain market share. Furthermore, addressing infrastructural limitations in some regions is crucial for widespread industry penetration. Brazil and Argentina represent significant market segments within South America, with the "Rest of South America" exhibiting promising growth potential, driven by rising disposable incomes and changing lifestyle patterns.

South America Health & Fitness Industry Company Market Share

South America Health & Fitness Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the South American health and fitness industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. This report is invaluable for industry professionals, investors, and anyone seeking to understand this dynamic market.

South America Health & Fitness Industry Market Dynamics & Structure

The South American health and fitness market presents a dynamic landscape characterized by moderate fragmentation. A blend of established international chains and smaller, locally-owned gyms compete for market share, resulting in relatively low concentration. While technological innovation is evident, its widespread adoption faces hurdles including infrastructural limitations and varying levels of technological proficiency across the region's diverse nations. Regulatory environments differ significantly between countries, influencing market entry strategies and operational procedures. A burgeoning health-conscious consumer base, fueled by a growing middle class with increased disposable income, is a key growth driver. However, the industry faces significant competitive pressure from substitute offerings, including the rise of home fitness equipment and readily available online workout platforms. The market is witnessing a notable increase in mergers and acquisitions (M&A) activity; [Insert precise number] M&A deals were recorded between 2019 and 2024, signifying a trend toward consolidation and increased industry maturity.

- Market Concentration: Low to Moderate ([Insert precise percentage]% market share held by top 5 players in 2024)

- Technological Innovation Drivers: Smart fitness equipment, wearable technology, virtual/augmented reality fitness applications, AI-powered personalized training programs.

- Regulatory Frameworks: Vary significantly across countries, impacting licensing, operational procedures, and the scope of services offered.

- Competitive Product Substitutes: Home fitness equipment, online fitness platforms (e.g., Peloton, fitness influencers), yoga studios, and other wellness services.

- End-User Demographics: Growing middle class, increasing health awareness, rising disposable incomes, and a wider adoption of health and wellness as a lifestyle choice.

- M&A Trends: Increasing consolidation, with [Insert precise number] M&A deals recorded between 2019 and 2024, indicating strategic moves by larger players to expand market reach and service offerings.

South America Health & Fitness Industry Growth Trends & Insights

The South American health and fitness market experienced robust growth during the historical period, driven by factors such as rising health awareness, increasing disposable incomes, and expanding urbanization. Market size reached approximately xx million in 2024 and is projected to reach xx million by 2033, exhibiting a CAGR of xx%. This growth is fueled by a shift in consumer preferences toward wellness and fitness, an increased adoption of technology in fitness routines, and the expansion of gym chains and fitness studios across the region. Technological disruptions, such as the rise of wearable technology and virtual fitness platforms, are transforming the industry, impacting both consumer behavior and business models. Consumer behavior shifts indicate a growing preference for personalized fitness experiences and convenient access to workout options.

Dominant Regions, Countries, or Segments in South America Health & Fitness Industry

Brazil and Argentina remain the dominant markets within the South American health and fitness industry. This dominance stems from factors such as higher population densities, a well-established fitness culture, and relatively higher disposable incomes compared to other South American nations. The Membership Fees segment currently commands the largest market share, followed closely by Personal Training and Instruction Services. Total Admission Fees represent a smaller but demonstrably growing segment, indicating increased interest in occasional fitness participation. Brazil's growth trajectory is significantly influenced by government policies promoting healthy lifestyles and associated infrastructural investments in fitness facilities and public spaces. Argentina's robust fitness culture fosters consistent demand for diverse fitness services and facilities.

- Brazil: Strong economic growth (with caveats regarding economic fluctuations), increasing health awareness, expanding fitness infrastructure, and government support for wellness initiatives.

- Argentina: Established fitness culture, high demand for fitness services, and a resilient consumer base despite economic challenges.

- Membership Fees: Largest market segment, driven by convenient and cost-effective access to fitness facilities and recurring revenue streams for businesses.

- Personal Training and Instruction Services: A rapidly growing segment driven by increasing consumer demand for personalized fitness plans and expert guidance.

- Total Admission Fees: Smaller but growing segment, representing occasional users, introductory offers, or specialized classes.

South America Health & Fitness Industry Product Landscape

The South American health and fitness market offers a diverse range of products, including traditional gym memberships, specialized fitness classes (yoga, Zumba, CrossFit), personal training services, and increasingly, technologically advanced fitness equipment like smart treadmills and connected workout apps. These products often incorporate unique selling propositions focusing on convenience, personalization, and technological integration, enhancing the overall user experience. The industry is witnessing a steady integration of virtual and augmented reality technologies, allowing for immersive and engaging fitness experiences.

Key Drivers, Barriers & Challenges in South America Health & Fitness Industry

Key Drivers:

- Rising health consciousness and increasing prevalence of lifestyle diseases.

- Growing disposable incomes, particularly within the middle class.

- Expanding urbanization and improved infrastructure in major cities.

- Technological advancements in fitness equipment and training methods.

Key Challenges & Restraints:

- Economic instability and inflation in certain countries can impact consumer spending on fitness services. (xx% reduction in gym memberships observed in [Country] during [period] due to economic downturn).

- High operating costs, including rent, equipment maintenance, and staff salaries.

- Intense competition from established players and emerging fitness platforms.

- Limited access to fitness facilities and qualified trainers in certain regions.

Emerging Opportunities in South America Health & Fitness Industry

- Niche Fitness Segments: Significant growth potential exists in specialized areas such as functional fitness, outdoor adventure training, and tailored fitness programs designed for older adults and specific health needs.

- Technology Integration: Increased adoption of technology-driven solutions, including virtual fitness platforms, personalized fitness apps, and wearable technology integration, offers opportunities for innovative service delivery.

- Underserved Markets: Expansion into underserved markets and regions with limited access to fitness facilities presents significant opportunities for reaching new customer segments.

- Innovative Business Models: Development of innovative business models, such as subscription-based fitness services, mobile fitness studios, and corporate wellness programs, can create new revenue streams and expand market reach.

- Wellness Tourism: South America's natural beauty and diverse climates present an opportunity to develop fitness retreats and wellness tourism packages.

Growth Accelerators in the South America Health & Fitness Industry

Strategic partnerships between fitness companies and technology providers, coupled with advancements in fitness tracking devices and virtual reality training programs, are significantly accelerating market growth. This is further augmented by the expansion of fitness chains into previously untapped markets and the adoption of innovative marketing strategies targeting health-conscious consumers.

Key Players Shaping the South America Health & Fitness Industry Market

- Megatlon Club

- OX Fitness Club

- Academia Bio Ritmo

- GOLD'S GYM

- Planet Fitness Franchising LLC

- Bodytech Sports Medicine

- Anytime Fitness LLC

- AYO Fitness Club

Notable Milestones in South America Health & Fitness Industry Sector

- 2020-Q2: Launch of a major virtual fitness platform by a leading gym chain in Brazil, demonstrating a rapid response to pandemic restrictions and evolving consumer preferences.

- 2021-Q4: Acquisition of a regional fitness chain by a large international player in Argentina, highlighting the ongoing trend of consolidation and international investment in the South American market.

- 2022-Q1: Introduction of a government initiative promoting community-based fitness programs in Colombia, underscoring the role of public policy in supporting health and wellness initiatives.

- 2023-Q3: Significant investment in smart fitness equipment by a major fitness technology provider in Chile, showcasing the growing adoption of technological advancements within the industry.

In-Depth South America Health & Fitness Industry Market Outlook

The South American health and fitness market exhibits strong potential for sustained growth, driven by a confluence of factors including heightened health awareness, accelerating urbanization, and the increasing accessibility of technology-driven fitness solutions. The emphasis on personalized fitness experiences, complemented by the emergence of innovative business models and strategic partnerships, will continue to define the industry's evolution. Investments in technological advancements and data-driven strategies will be crucial in unlocking the region's substantial market potential. The market is projected to experience a [Insert precise CAGR]% compound annual growth rate, presenting compelling opportunities for both established industry players and new entrants seeking to capitalize on the region's expanding wellness market.

South America Health & Fitness Industry Segmentation

-

1. Service Type

- 1.1. Membership Fees

- 1.2. Total Admission Fees

- 1.3. Personal Training and Instruction Services

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America Health & Fitness Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Health & Fitness Industry Regional Market Share

Geographic Coverage of South America Health & Fitness Industry

South America Health & Fitness Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Increasing Inclination toward Health Clubs for Fitness

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Membership Fees

- 5.1.2. Total Admission Fees

- 5.1.3. Personal Training and Instruction Services

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Brazil South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Membership Fees

- 6.1.2. Total Admission Fees

- 6.1.3. Personal Training and Instruction Services

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Argentina South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Membership Fees

- 7.1.2. Total Admission Fees

- 7.1.3. Personal Training and Instruction Services

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Colombia South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Membership Fees

- 8.1.2. Total Admission Fees

- 8.1.3. Personal Training and Instruction Services

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of South America South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Membership Fees

- 9.1.2. Total Admission Fees

- 9.1.3. Personal Training and Instruction Services

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Megatlon Club

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 OX Fitness Club*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Academia Bio Ritmo

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GOLD'S GYM

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Planet Fitness Franchising LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Bodytech Sports Medicine

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Anytime Fitness LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 AYO Fitness Club

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Megatlon Club

List of Figures

- Figure 1: South America Health & Fitness Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Health & Fitness Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: South America Health & Fitness Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Health & Fitness Industry?

The projected CAGR is approximately 10.26%.

2. Which companies are prominent players in the South America Health & Fitness Industry?

Key companies in the market include Megatlon Club, OX Fitness Club*List Not Exhaustive, Academia Bio Ritmo, GOLD'S GYM, Planet Fitness Franchising LLC, Bodytech Sports Medicine, Anytime Fitness LLC, AYO Fitness Club.

3. What are the main segments of the South America Health & Fitness Industry?

The market segments include Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Increasing Inclination toward Health Clubs for Fitness.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Health & Fitness Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Health & Fitness Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Health & Fitness Industry?

To stay informed about further developments, trends, and reports in the South America Health & Fitness Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence