Key Insights

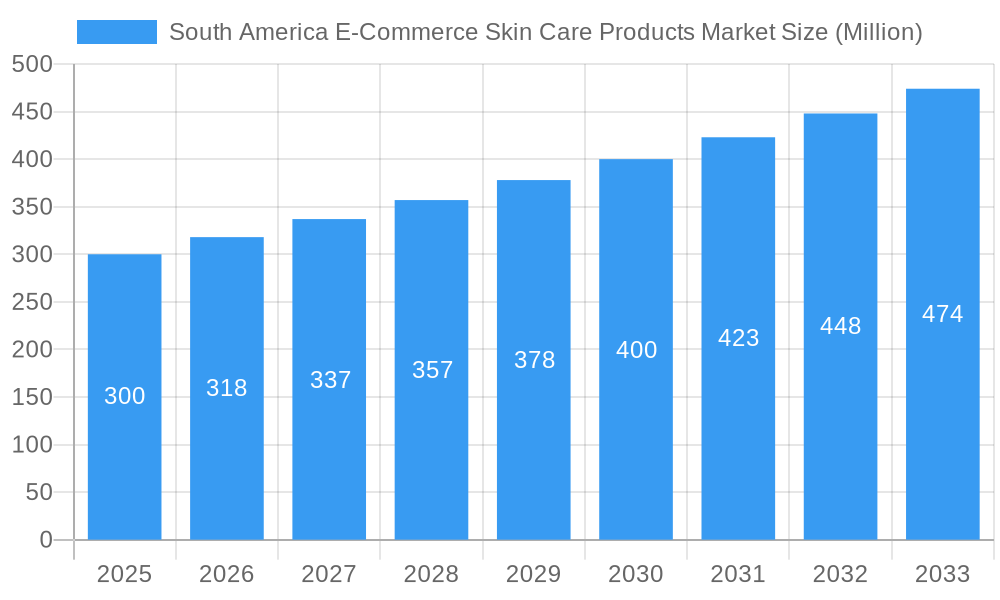

The South American e-commerce skincare market is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 6.13% between 2025 and 2033. This growth is propelled by increasing internet and smartphone adoption across Brazil, Argentina, and the wider region, expanding the online consumer base. A growing middle class with enhanced disposable income is driving demand for premium and specialized skincare. The convenience of online shopping, coupled with strategic marketing by leading brands, further fuels this market. The market is segmented by product type (body care, facial care, lip and hand care), nature (conventional, natural/organic), and sales channel (third-party retailers, company websites). The estimated market size for 2025 is 396 million. Brazil and Argentina are expected to lead, with considerable growth potential in the "Rest of South America" segment. Key challenges include variable internet access and concerns regarding product authenticity and delivery.

South America E-Commerce Skin Care Products Market Market Size (In Million)

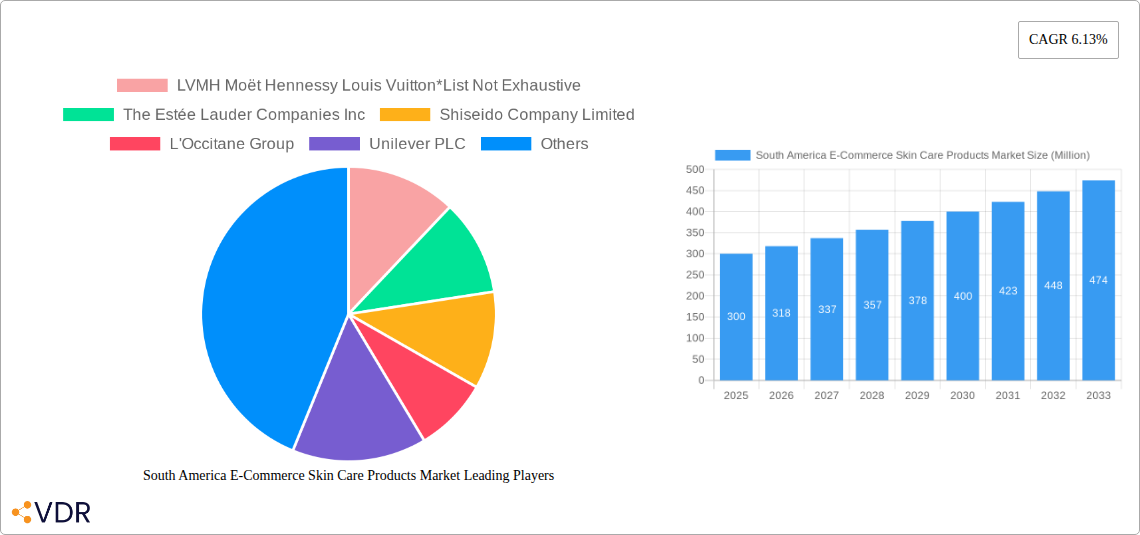

The competitive arena features global leaders and emerging regional players. Established brands utilize brand recognition and distribution, while niche players target specific segments through digital marketing. Future growth hinges on adapting to evolving consumer preferences, prioritizing sustainability, and adopting advanced e-commerce technologies. Enhancing delivery infrastructure and online security will be vital for market penetration.

South America E-Commerce Skin Care Products Market Company Market Share

South America E-Commerce Skin Care Products Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America e-commerce skin care products market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is invaluable for industry professionals, investors, and stakeholders seeking a detailed understanding of this dynamic market. The report also incorporates data from the parent market (South America E-commerce Market) and child markets (e.g., Body Care, Facial Care, Natural/Organic Skin care) for a holistic perspective.

South America E-Commerce Skin Care Products Market Dynamics & Structure

The South American e-commerce skin care market is characterized by a moderately fragmented landscape, with key players such as LVMH Moët Hennessy Louis Vuitton, The Estée Lauder Companies Inc, Shiseido Company Limited, L'Occitane Group, Unilever PLC, L'Oréal S A, The Procter & Gamble Company, Natura & Co, Grupo Boticário, and Beiersdorf AG vying for market share. Market concentration is influenced by the entry of both international and domestic brands, leading to diverse product offerings and price points.

- Market Concentration: xx% market share held by top 5 players in 2024.

- Technological Innovation: Growth is driven by advancements in formulation, packaging (e.g., sustainable options), and personalized skincare recommendations through AI.

- Regulatory Framework: Varying regulations across countries impact product labeling, ingredient approvals, and e-commerce operations.

- Competitive Substitutes: The market faces competition from traditional retail channels and other beauty categories.

- End-User Demographics: Growing middle class and increasing internet penetration in key markets like Brazil and Argentina fuels market expansion, particularly among millennials and Gen Z.

- M&A Trends: Significant M&A activity, as exemplified by L'Oréal's acquisition of Aesop in 2023, indicates consolidation and expansion strategies within the sector. XX M&A deals were recorded in the period 2019-2024.

South America E-Commerce Skin Care Products Market Growth Trends & Insights

The South America e-commerce skin care market experienced significant growth in the historical period (2019-2024), exhibiting a CAGR of xx%. This growth is primarily attributed to rising disposable incomes, increased internet and smartphone penetration, and the increasing preference for convenient online shopping. The market is expected to maintain robust growth throughout the forecast period (2025-2033), driven by factors such as the expanding middle class, changing consumer preferences towards natural and organic products, and the adoption of innovative marketing and sales strategies. Market penetration currently stands at xx%, projected to reach xx% by 2033. Technological disruptions, including the use of AR/VR for virtual try-ons and personalized recommendations, further accelerate adoption rates. Consumer behavior shifts, such as increased preference for ethically sourced and sustainable products, will shape future market trends. The market size is projected to reach xx Million units by 2033.

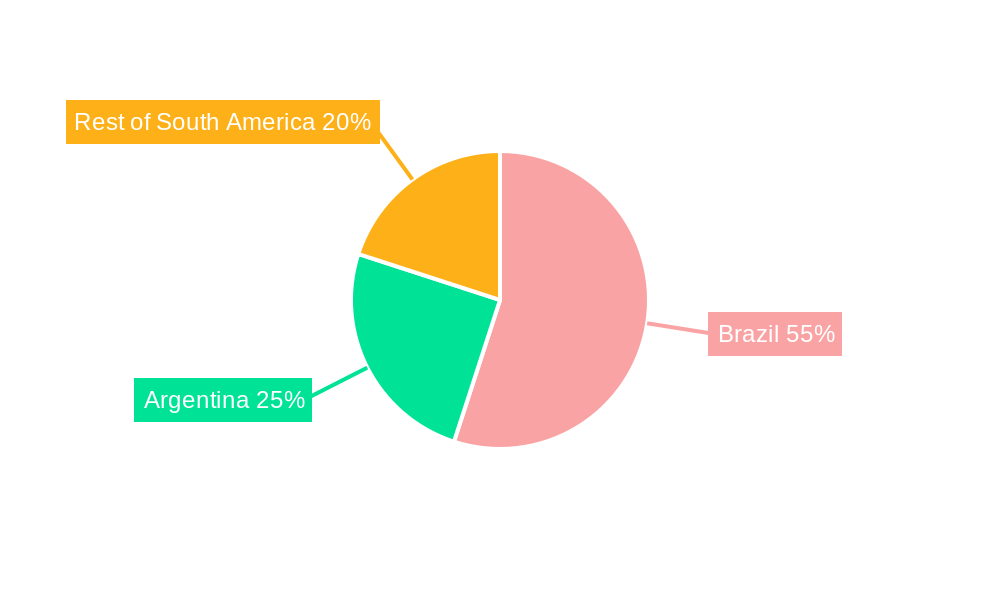

Dominant Regions, Countries, or Segments in South America E-Commerce Skin Care Products Market

Brazil remains the dominant market for e-commerce skin care products in South America, accounting for xx% of the total market share in 2024. This is fueled by high internet penetration, a large consumer base, and robust e-commerce infrastructure. Argentina also presents a significant market, while the "Rest of South America" demonstrates considerable growth potential. Within product types, Facial Care holds the largest market share, followed by Body Care and Lip and Hand Care. Conventional skin care products constitute a larger market segment compared to Natural/Organic options, though the latter is experiencing rapid growth fueled by increased health consciousness. Third-party retailers currently dominate the platform type, but company-owned websites are gaining traction as brands build direct-to-consumer channels.

- Key Drivers in Brazil: Large consumer base, high internet penetration, robust e-commerce infrastructure, and a growing middle class.

- Key Drivers in Argentina: Rising disposable incomes, increasing awareness of skincare benefits, and growing popularity of online shopping.

- Growth Potential in Rest of South America: Expansion of e-commerce infrastructure and increasing smartphone penetration.

- Facial Care Dominance: Higher demand driven by increased awareness of skin health and beauty standards.

- Natural/Organic Growth: Increasing health consciousness and preference for sustainable products.

South America E-Commerce Skin Care Products Market Product Landscape

The market showcases a diverse range of products featuring innovative formulations, such as advanced serums with targeted ingredients (e.g., retinol, hyaluronic acid), and sustainable packaging materials (e.g., recycled plastics, biodegradable components). Key performance metrics include consumer reviews, online sales data, and brand awareness scores. Unique selling propositions include personalized skincare routines, customized product formulations, and subscription models. Advancements in technology are evident in AR/VR applications for virtual try-ons and AI-powered recommendation engines.

Key Drivers, Barriers & Challenges in South America E-Commerce Skin Care Products Market

Key Drivers: Rising disposable incomes, increasing internet penetration, growing awareness of skincare benefits, and the adoption of innovative e-commerce strategies by brands.

Challenges: High import duties and taxes, complex logistics and supply chain challenges, intense competition, and counterfeit products. xx% of products sold online in 2024 were reported as counterfeit.

Emerging Opportunities in South America E-Commerce Skin Care Products Market

Untapped markets in smaller South American countries present significant opportunities. Innovative applications like personalized skincare regimens through AI-driven platforms, and the increasing focus on sustainable and ethically sourced products offer substantial growth avenues. Evolving consumer preferences towards specialized skincare addressing specific skin concerns like hyperpigmentation and acne also generate promising opportunities.

Growth Accelerators in the South America E-Commerce Skin Care Products Market Industry

Technological breakthroughs in AI-driven personalization and AR/VR experiences enhance customer engagement and drive sales. Strategic partnerships between brands and influencers increase brand awareness and market reach. Expansion into untapped markets and the development of effective marketing strategies further accelerate growth. The growth of specialized skin care tailored to specific needs will also increase the market size.

Key Players Shaping the South America E-Commerce Skin Care Products Market Market

- LVMH Moët Hennessy Louis Vuitton

- The Estée Lauder Companies Inc

- Shiseido Company Limited

- L'Occitane Group

- Unilever PLC

- L'Oréal S A

- The Procter & Gamble Company

- Natura & Co

- Grupo Boticário

- Beiersdorf AG

Notable Milestones in South America E-Commerce Skin Care Products Market Sector

- April 2023: L'Oréal SA acquired Aesop from Natura &Co's Brazil, strengthening L'Oréal's position in the premium skincare segment.

- November 2022: Natura &Co's Avon Cosmetics established new R&D operations in Brazil and Poland, signaling increased investment in product innovation and adaptation for local markets.

- October 2022: Grupo Boticário acquired Dr. Jones, expanding its reach into the men's skincare segment.

In-Depth South America E-Commerce Skin Care Products Market Market Outlook

The South America e-commerce skin care market presents significant long-term growth potential. Continued advancements in technology, increasing consumer spending, and the emergence of new market segments will fuel expansion. Strategic investments in digital marketing, supply chain optimization, and product innovation are crucial for success. The focus on personalized, sustainable, and ethically sourced products will shape the future of the market. The market size is expected to reach xx Million units by 2033, representing a substantial increase from the 2024 levels.

South America E-Commerce Skin Care Products Market Segmentation

-

1. Product Type

- 1.1. Body Care

- 1.2. Facial Care

- 1.3. Lip and Hand Care

-

2. Type

- 2.1. Conventional

- 2.2. Natural/Organic

-

3. Platform Type

- 3.1. Third Party Retailer

- 3.2. Company's Own Website

South America E-Commerce Skin Care Products Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America E-Commerce Skin Care Products Market Regional Market Share

Geographic Coverage of South America E-Commerce Skin Care Products Market

South America E-Commerce Skin Care Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Natural/Organic Formulation Skincare Products Via E-Commerce; Augmented Expenditure on Marketing and Promotional Activities

- 3.3. Market Restrains

- 3.3.1. Touch and Feel Factor Restraining the Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Natural/Organic Formulation Skin Care Products Via E-Commerce

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America E-Commerce Skin Care Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Body Care

- 5.1.2. Facial Care

- 5.1.3. Lip and Hand Care

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Conventional

- 5.2.2. Natural/Organic

- 5.3. Market Analysis, Insights and Forecast - by Platform Type

- 5.3.1. Third Party Retailer

- 5.3.2. Company's Own Website

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LVMH Moët Hennessy Louis Vuitton*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Estée Lauder Companies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shiseido Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 L'Occitane Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Unilever PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 L'Oréal S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Procter & Gamble Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Natura & Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Grupo Boticário

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Beiersdorf AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LVMH Moët Hennessy Louis Vuitton*List Not Exhaustive

List of Figures

- Figure 1: South America E-Commerce Skin Care Products Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South America E-Commerce Skin Care Products Market Share (%) by Company 2025

List of Tables

- Table 1: South America E-Commerce Skin Care Products Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: South America E-Commerce Skin Care Products Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: South America E-Commerce Skin Care Products Market Revenue million Forecast, by Type 2020 & 2033

- Table 4: South America E-Commerce Skin Care Products Market Volume K Units Forecast, by Type 2020 & 2033

- Table 5: South America E-Commerce Skin Care Products Market Revenue million Forecast, by Platform Type 2020 & 2033

- Table 6: South America E-Commerce Skin Care Products Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 7: South America E-Commerce Skin Care Products Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: South America E-Commerce Skin Care Products Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: South America E-Commerce Skin Care Products Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: South America E-Commerce Skin Care Products Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 11: South America E-Commerce Skin Care Products Market Revenue million Forecast, by Type 2020 & 2033

- Table 12: South America E-Commerce Skin Care Products Market Volume K Units Forecast, by Type 2020 & 2033

- Table 13: South America E-Commerce Skin Care Products Market Revenue million Forecast, by Platform Type 2020 & 2033

- Table 14: South America E-Commerce Skin Care Products Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 15: South America E-Commerce Skin Care Products Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: South America E-Commerce Skin Care Products Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Brazil South America E-Commerce Skin Care Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Brazil South America E-Commerce Skin Care Products Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Argentina South America E-Commerce Skin Care Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Argentina South America E-Commerce Skin Care Products Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Chile South America E-Commerce Skin Care Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Chile South America E-Commerce Skin Care Products Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 23: Colombia South America E-Commerce Skin Care Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Colombia South America E-Commerce Skin Care Products Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 25: Peru South America E-Commerce Skin Care Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Peru South America E-Commerce Skin Care Products Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: Venezuela South America E-Commerce Skin Care Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Venezuela South America E-Commerce Skin Care Products Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: Ecuador South America E-Commerce Skin Care Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Ecuador South America E-Commerce Skin Care Products Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Bolivia South America E-Commerce Skin Care Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Bolivia South America E-Commerce Skin Care Products Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: Paraguay South America E-Commerce Skin Care Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Paraguay South America E-Commerce Skin Care Products Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: Uruguay South America E-Commerce Skin Care Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Uruguay South America E-Commerce Skin Care Products Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America E-Commerce Skin Care Products Market?

The projected CAGR is approximately 6.13%.

2. Which companies are prominent players in the South America E-Commerce Skin Care Products Market?

Key companies in the market include LVMH Moët Hennessy Louis Vuitton*List Not Exhaustive, The Estée Lauder Companies Inc, Shiseido Company Limited, L'Occitane Group, Unilever PLC, L'Oréal S A, The Procter & Gamble Company, Natura & Co, Grupo Boticário, Beiersdorf AG.

3. What are the main segments of the South America E-Commerce Skin Care Products Market?

The market segments include Product Type, Type, Platform Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 396 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Natural/Organic Formulation Skincare Products Via E-Commerce; Augmented Expenditure on Marketing and Promotional Activities.

6. What are the notable trends driving market growth?

Rising Demand for Natural/Organic Formulation Skin Care Products Via E-Commerce.

7. Are there any restraints impacting market growth?

Touch and Feel Factor Restraining the Market Growth.

8. Can you provide examples of recent developments in the market?

April 2023: L'Oréal SA acquired the Aesop brand of Natura &Co's Brazil, which offers hair, body, skin, home, and fragrance products. According to the company, the acquisition of Aesop will lead to a new development cycle for Natura &Co to strengthen its financial structure and will be able to sharpen its focus on its strategic priorities, including its investment plan in Latin America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America E-Commerce Skin Care Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America E-Commerce Skin Care Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America E-Commerce Skin Care Products Market?

To stay informed about further developments, trends, and reports in the South America E-Commerce Skin Care Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence