Key Insights

The South African spinal surgery devices market is projected for robust growth, estimated to reach approximately $19.49 billion by 2031, expanding at a Compound Annual Growth Rate (CAGR) of 6.2% from a base year of 2024. This expansion is driven by the increasing incidence of spinal conditions, including degenerative disc disease, scoliosis, and spinal stenosis, often associated with an aging demographic and sedentary lifestyles. Technological advancements, resulting in the development of minimally invasive and more effective spinal decompression and fusion procedures, are also key contributors. Furthermore, South Africa's expanding healthcare infrastructure, marked by investments in specialized medical facilities, and a growing demand for advanced orthopedic solutions are expected to significantly boost market penetration for spinal surgery devices.

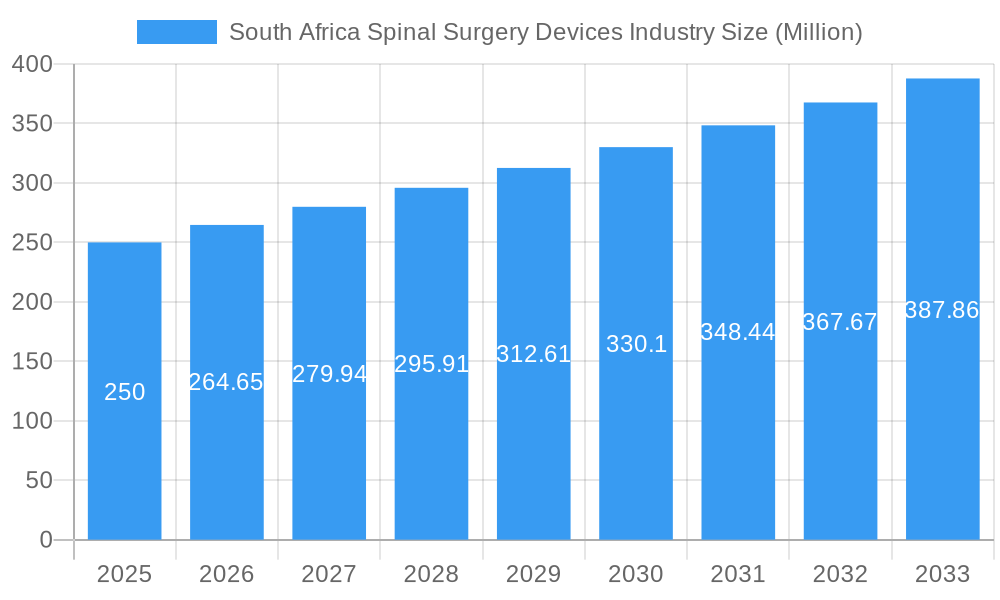

South Africa Spinal Surgery Devices Industry Market Size (In Billion)

The market is segmented into Spinal Decompression, Spinal Fusion, and Fracture Repair Devices, with Spinal Fusion devices anticipated to dominate due to their extensive use in managing chronic back pain and spinal deformities. Key end-users include hospitals, clinics, and specialized medical centers. Leading global manufacturers such as Medtronic PLC, Johnson & Johnson, and Stryker Corporation are actively involved in the South African market, fostering innovation and improving access to sophisticated surgical solutions. While significant opportunities exist, potential challenges include the high cost of advanced spinal implants and the requirement for specialized surgical expertise. Nevertheless, ongoing initiatives to enhance healthcare affordability and comprehensive training programs are expected to address these constraints, ensuring sustained, strong growth in the South African spinal surgery devices sector.

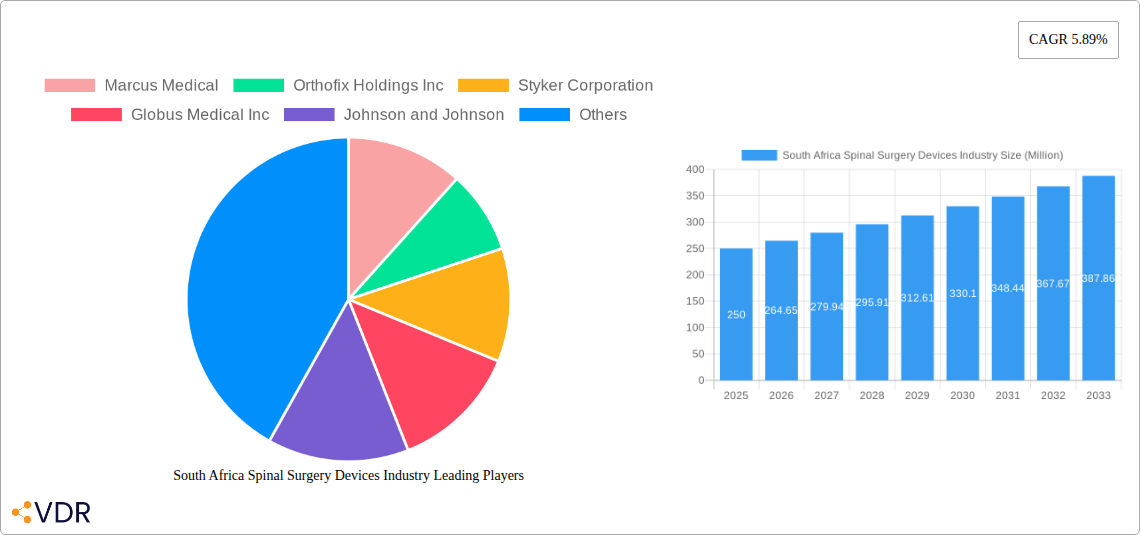

South Africa Spinal Surgery Devices Industry Company Market Share

South Africa Spinal Surgery Devices Industry: Market Analysis and Forecast (2019–2033)

This comprehensive report delves into the South Africa spinal surgery devices market, providing an in-depth analysis of its current landscape, growth trajectories, and future outlook. We examine key market dynamics, technological innovations, competitive strategies, and regulatory influences shaping the industry. The report offers granular insights into parent and child market segmentation, focusing on device types and end-users, and presents market values in Million units.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

South Africa Spinal Surgery Devices Industry Market Dynamics & Structure

The South Africa spinal surgery devices industry is characterized by a moderately concentrated market, driven by significant technological advancements and a growing demand for minimally invasive procedures. Major players like Medtronic PLC, Johnson and Johnson, and Stryker Corporation hold substantial market shares, investing heavily in research and development to introduce innovative solutions. Regulatory frameworks, overseen by bodies such as the South African Health Products Regulatory Authority (SAHPRA), are becoming increasingly stringent, emphasizing product safety and efficacy, which acts as both a driver for quality and a barrier to entry for new entrants. The competitive landscape features direct product substitutes such as conservative treatments and physical therapy, but the rising incidence of spinal deformities and degenerative conditions fuels demand for advanced surgical interventions. End-user demographics are shifting towards an aging population with a higher prevalence of spinal ailments, alongside a growing middle class with improved access to healthcare. Mergers and acquisitions (M&A) activity, though not as robust as in more developed markets, is a notable trend as larger companies seek to expand their product portfolios and market reach. For instance, the historical period saw an estimated XX M&A deal volumes, indicating strategic consolidation efforts. The innovation pipeline is primarily fueled by advancements in materials science, robotics, and biologics, aiming to improve patient outcomes and reduce recovery times.

- Market Concentration: Moderate, with a few dominant global players.

- Technological Innovation Drivers: Minimally invasive surgery techniques, advanced imaging integration, and novel biomaterials.

- Regulatory Frameworks: SAHPRA's increasing emphasis on post-market surveillance and pre-market approval processes.

- Competitive Product Substitutes: Non-surgical treatments, advanced physical therapy protocols.

- End-User Demographics: Aging population, increasing prevalence of degenerative spinal diseases, growing healthcare expenditure.

- M&A Trends: Strategic acquisitions for portfolio expansion and market penetration.

South Africa Spinal Surgery Devices Industry Growth Trends & Insights

The South Africa spinal surgery devices market is poised for substantial growth, driven by a confluence of demographic, economic, and technological factors. The market size is projected to expand significantly from an estimated XX Million units in 2025 to XX Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This growth is underpinned by an increasing adoption rate of advanced spinal fusion and decompression devices, fueled by a rising awareness among healthcare professionals and patients regarding the benefits of surgical interventions for chronic back pain and spinal deformities. Technological disruptions, such as the integration of artificial intelligence in surgical planning and the development of biodegradable implants, are further accelerating market penetration. Consumer behavior shifts are evident, with a greater preference for less invasive procedures that offer quicker recovery times and reduced hospital stays. The market penetration for advanced spinal surgery devices is estimated to grow from XX% in 2025 to XX% by 2033. The prevalence of lifestyle-related spinal issues, coupled with an aging population experiencing degenerative changes, creates a sustained demand for innovative spinal solutions. Furthermore, government initiatives aimed at improving healthcare infrastructure and accessibility are expected to boost the utilization of sophisticated spinal surgery devices. Insights from XXX, likely an industry consortium or research body, indicate a strong underlying demand for spinal fusion devices, accounting for an estimated XX% of the total market value in 2025.

Dominant Regions, Countries, or Segments in South Africa Spinal Surgery Devices Industry

Within the South Africa spinal surgery devices industry, the Hospitals segment, as an end-user, is poised to dominate market growth, driven by their comprehensive infrastructure, specialized surgical teams, and the capacity to handle complex spinal procedures. This segment is expected to account for an estimated XX% of the total market share in 2025, with a projected growth to XX% by 2033. Key drivers for hospital dominance include significant investments in advanced medical technology, government and private sector healthcare spending, and the centralization of specialized surgical expertise. Economic policies that prioritize healthcare development and the expansion of medical facilities further bolster this segment. Furthermore, the availability of skilled surgeons and support staff within hospital settings is critical for the successful adoption and utilization of sophisticated spinal surgery devices, including those for spinal fusion, spinal decompression, and fracture repair. The increasing incidence of spinal deformities and degenerative conditions, necessitating complex surgical interventions, directly translates into higher demand within hospital environments.

- Dominant End-User Segment: Hospitals

- Market Share (2025): XX%

- Projected Market Share (2033): XX%

- Key Drivers:

- Advanced medical infrastructure and technology adoption.

- Government and private sector healthcare investment.

- Concentration of specialized surgical expertise.

- Increasing prevalence of complex spinal conditions.

- Favorable economic policies promoting healthcare access.

The Spinal Fusion Devices segment, within the broader Device Type category, is another critical driver of market growth. This segment is anticipated to hold the largest market share, estimated at XX Million units in 2025, and is projected to grow at a robust CAGR of XX% through 2033. The dominance of spinal fusion devices is attributable to the rising number of patients suffering from degenerative disc disease, spinal stenosis, and spondylolisthesis, conditions often requiring fusion for stabilization and pain relief.

- Dominant Device Type Segment: Spinal Fusion Devices

- Market Size (2025): XX Million units

- Projected CAGR (2025-2033): XX%

- Key Drivers:

- High prevalence of degenerative spinal conditions.

- Advancements in fusion materials and techniques (e.g., interbody cages, biologics).

- Demand for long-term pain relief and spinal stability.

- Increasing procedural volumes in specialized orthopedic and neurosurgery departments.

South Africa Spinal Surgery Devices Industry Product Landscape

The product landscape for South Africa's spinal surgery devices is rapidly evolving, with a strong emphasis on innovation aimed at enhancing patient outcomes and surgeon efficiency. Key product categories include spinal decompression devices for relieving pressure on nerves, spinal fusion devices utilizing implants like cages and screws for stability, and fracture repair devices for managing spinal trauma. Innovations focus on bio-compatible materials, porous structures for bone integration, and modular designs for greater surgical flexibility. For instance, next-generation cervical and lumbar interbody cages are designed with advanced porosity to promote osteointegration, while pedicle screw systems are incorporating wireless connectivity for enhanced intraoperative feedback. The performance metrics being pushed include reduced implant migration, improved fusion rates, and minimized radiation exposure during procedures. Unique selling propositions often lie in the minimally invasive nature of the devices, allowing for smaller incisions, reduced blood loss, and faster recovery times, differentiating them from traditional open surgical techniques.

Key Drivers, Barriers & Challenges in South Africa Spinal Surgery Devices Industry

Key Drivers: The South Africa spinal surgery devices market is propelled by several key drivers. The increasing prevalence of age-related degenerative spinal conditions and road traffic accidents leading to spinal injuries are significant factors. Technological advancements, such as the development of minimally invasive surgical (MIS) techniques and robotic-assisted surgery, are driving adoption by offering better patient outcomes and faster recovery. Furthermore, a growing middle class with improved disposable income and greater access to private healthcare facilities is contributing to increased demand for advanced spinal treatments. Government initiatives aimed at improving healthcare infrastructure and the rising awareness among the population about spinal health also act as significant growth accelerators.

Barriers & Challenges: Despite the promising growth trajectory, the industry faces considerable barriers. High costs associated with advanced spinal surgery devices and procedures can limit accessibility for a substantial portion of the population, particularly in public healthcare settings. Stringent regulatory approval processes, while ensuring safety, can also lead to longer product launch timelines. Intense competition from both global and emerging local players can put pressure on pricing. Supply chain disruptions and the availability of skilled surgeons trained in the use of these advanced technologies are also crucial challenges that need to be addressed. The economic instability within the region can also impact healthcare spending, creating an unpredictable market environment.

Emerging Opportunities in South Africa Spinal Surgery Devices Industry

Emerging opportunities in the South Africa spinal surgery devices industry lie in the expansion of minimally invasive surgery (MIS) techniques across a broader range of spinal pathologies and patient demographics. There is significant untapped potential in the rural and semi-urban healthcare sectors, where the adoption of advanced spinal technologies has been limited due to infrastructure and cost constraints. Innovations in biodegradable implants and biologics that promote faster bone healing present an avenue for improved treatment outcomes and reduced long-term complications. Furthermore, the development of cost-effective, yet technologically advanced, spinal devices tailored to the specific economic realities of the South African market could unlock substantial growth. The increasing focus on telehealth and remote patient monitoring post-surgery also presents an opportunity for integrated digital solutions.

Growth Accelerators in the South Africa Spinal Surgery Devices Industry Industry

Several catalysts are accelerating long-term growth within the South Africa spinal surgery devices industry. Technological breakthroughs in areas like 3D printing for custom implants and the refinement of navigation and robotic surgical systems are enhancing precision and patient safety, thereby driving adoption. Strategic partnerships between device manufacturers, healthcare providers, and research institutions are fostering innovation and facilitating the translation of research into clinical practice. Market expansion strategies, including targeted marketing campaigns to raise awareness about treatment options and the development of specialized training programs for surgeons, are crucial for increasing procedural volumes. The growing emphasis on value-based healthcare is also encouraging the adoption of devices that demonstrate superior clinical and economic outcomes.

Key Players Shaping the South Africa Spinal Surgery Devices Industry Market

- Marcus Medical

- Orthofix Holdings Inc

- Stryker Corporation

- Globus Medical Inc

- Johnson and Johnson

- Medtronic PLC

- Zimmer Biomet Inc

Notable Milestones in South Africa Spinal Surgery Devices Industry Sector

- 2020/01: Launch of new generation spinal decompression systems by Medtronic PLC, improving minimally invasive surgical options.

- 2021/03: Stryker Corporation acquires a significant stake in a South African medical technology distributor, expanding its market presence.

- 2022/06: Globus Medical Inc introduces a novel anterior cervical plate system, enhancing fusion stability.

- 2023/09: Johnson and Johnson's DePuy Synthes Inc receives regulatory approval for a new expandable cage technology for spinal fusion.

- 2024/02: Orthofix Holdings Inc partners with a local research institution to advance spinal implant research in South Africa.

In-Depth South Africa Spinal Surgery Devices Industry Market Outlook

The outlook for the South Africa spinal surgery devices industry remains highly optimistic, fueled by strong underlying growth accelerators. Continued investment in research and development by key players, focusing on next-generation technologies like personalized implants and AI-driven surgical planning, will be pivotal. The expansion of training programs for orthopedic and neurosurgeons will further enhance the adoption of advanced techniques and devices. Strategic collaborations between global manufacturers and local distributors are expected to improve market penetration and accessibility. The increasing focus on treating complex spinal deformities and the growing demand for minimally invasive procedures will continue to drive innovation and market growth. As healthcare infrastructure develops and disposable incomes rise, the market is set to witness significant expansion, presenting substantial opportunities for all stakeholders involved.

South Africa Spinal Surgery Devices Industry Segmentation

-

1. Device Type

- 1.1. Spinal Decompression

- 1.2. Spinal Fusion

- 1.3. Fracture Repair Devices

-

2. End-User

- 2.1. Hospitals

- 2.2. Clinics

- 2.3. Specialized Medical Centers

South Africa Spinal Surgery Devices Industry Segmentation By Geography

- 1. South Africa

South Africa Spinal Surgery Devices Industry Regional Market Share

Geographic Coverage of South Africa Spinal Surgery Devices Industry

South Africa Spinal Surgery Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Cases of Spinal Injuries; Technological Advances in Spinal Surgery

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Process for New Product Approval

- 3.4. Market Trends

- 3.4.1. Spinal Fusion is Expected to Hold its Highest Market Share in the Device Type Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Spinal Surgery Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Spinal Decompression

- 5.1.2. Spinal Fusion

- 5.1.3. Fracture Repair Devices

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Hospitals

- 5.2.2. Clinics

- 5.2.3. Specialized Medical Centers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Marcus Medical

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Orthofix Holdings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Styker Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Globus Medical Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson and Johnson

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Medtronic PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zimmer Biomet Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Marcus Medical

List of Figures

- Figure 1: South Africa Spinal Surgery Devices Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Spinal Surgery Devices Industry Share (%) by Company 2025

List of Tables

- Table 1: South Africa Spinal Surgery Devices Industry Revenue billion Forecast, by Device Type 2020 & 2033

- Table 2: South Africa Spinal Surgery Devices Industry Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 3: South Africa Spinal Surgery Devices Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: South Africa Spinal Surgery Devices Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: South Africa Spinal Surgery Devices Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: South Africa Spinal Surgery Devices Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: South Africa Spinal Surgery Devices Industry Revenue billion Forecast, by Device Type 2020 & 2033

- Table 8: South Africa Spinal Surgery Devices Industry Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 9: South Africa Spinal Surgery Devices Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: South Africa Spinal Surgery Devices Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 11: South Africa Spinal Surgery Devices Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: South Africa Spinal Surgery Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Spinal Surgery Devices Industry?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the South Africa Spinal Surgery Devices Industry?

Key companies in the market include Marcus Medical, Orthofix Holdings Inc, Styker Corporation, Globus Medical Inc, Johnson and Johnson, Medtronic PLC, Zimmer Biomet Inc.

3. What are the main segments of the South Africa Spinal Surgery Devices Industry?

The market segments include Device Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.49 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Cases of Spinal Injuries; Technological Advances in Spinal Surgery.

6. What are the notable trends driving market growth?

Spinal Fusion is Expected to Hold its Highest Market Share in the Device Type Segment.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Process for New Product Approval.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Spinal Surgery Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Spinal Surgery Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Spinal Surgery Devices Industry?

To stay informed about further developments, trends, and reports in the South Africa Spinal Surgery Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence