Key Insights

The South African automotive parts aluminum die casting market is poised for significant expansion, propelled by the escalating demand for lightweight vehicles and the robust growth of the regional automotive industry. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 8.2%, expanding from an estimated $85.92 billion in the base year of 2025. Key growth drivers include the increasing integration of aluminum die casting in automotive components, offering superior strength-to-weight ratios, enhanced fuel efficiency, and cost advantages over traditional materials. The market is segmented by production process (pressure die casting, vacuum die casting) and application (body assemblies, engine parts, transmission parts). While pressure die casting currently leads, vacuum die casting is anticipated to gain prominence for producing intricate components. Stricter emission regulations are further accelerating the adoption of lightweight vehicles, thereby fueling market growth. Despite challenges like raw material price volatility and potential supply chain disruptions, the market's outlook remains favorable, supported by the expanding South African automotive manufacturing base and increasing foreign direct investment. Prominent players, including Sandhar Technologies Ltd and Empire Casting Co, are strategically positioned to leverage these opportunities.

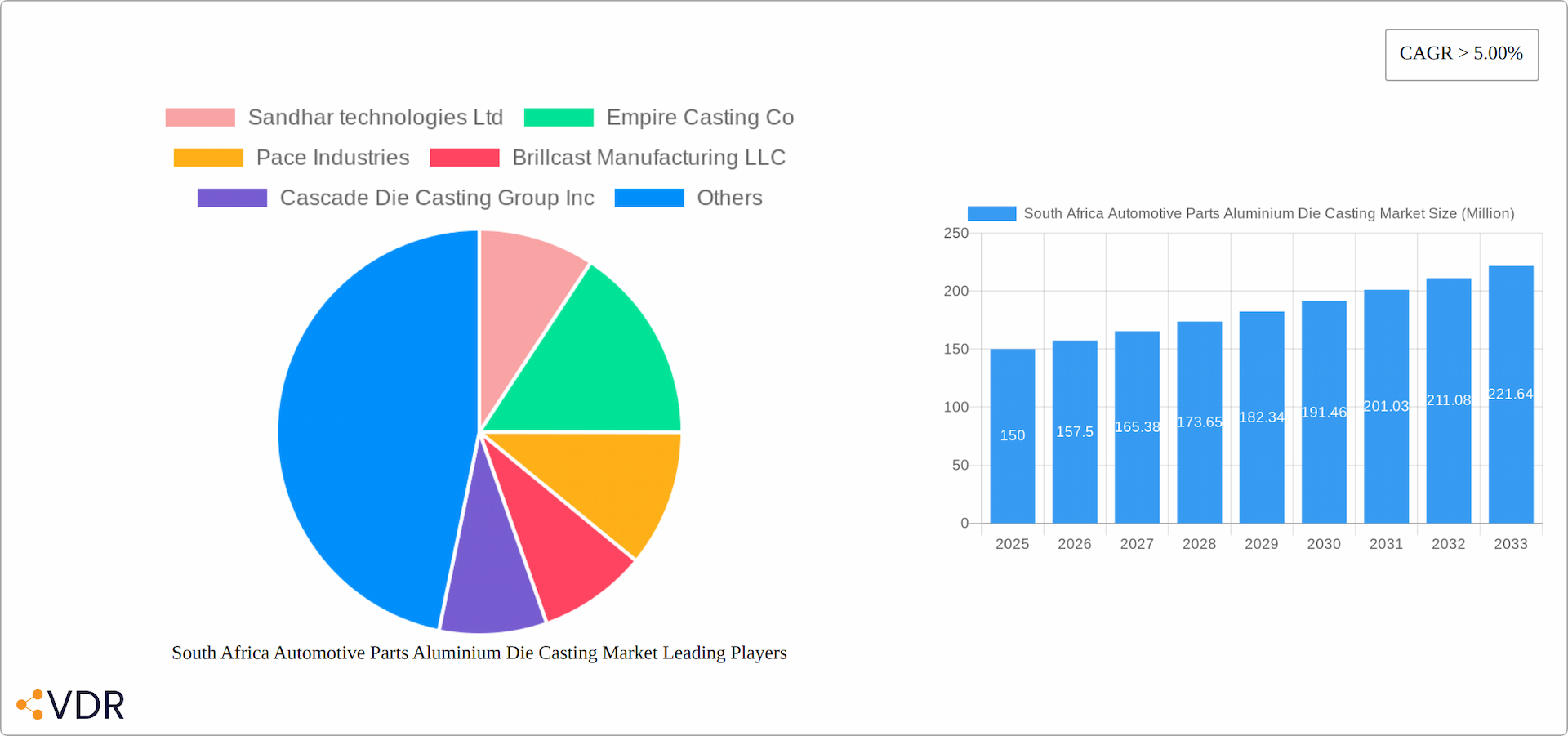

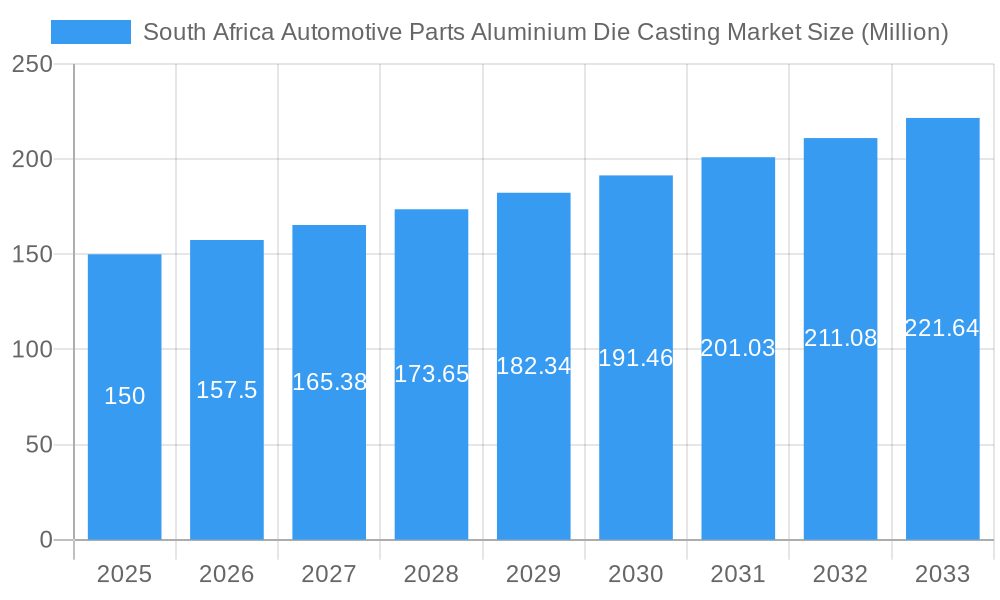

South Africa Automotive Parts Aluminium Die Casting Market Market Size (In Billion)

The South African automotive parts aluminum die casting landscape features several key players, comprising both local enterprises and international entities with established regional operations. Future market expansion will be shaped by government initiatives supporting local manufacturing, advancements in die casting technologies, and the overall performance of the South African and wider African automotive sectors. Regional disparities within South Africa, particularly concerning infrastructure and resource accessibility, will influence market development. The persistent emphasis on improving fuel efficiency and vehicle safety standards will continue to drive innovation and investment. Based on current projections, the market is expected to experience substantial growth through strategic alliances, technological innovations, and the expansion of South Africa's automotive manufacturing capabilities.

South Africa Automotive Parts Aluminium Die Casting Market Company Market Share

South Africa Automotive Parts Aluminium Die Casting Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the South Africa automotive parts aluminium die casting market, encompassing market dynamics, growth trends, regional insights, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with 2025 serving as the base year and estimated year. The parent market is the South African automotive industry, and the child market is the aluminium die casting segment within it. This report is invaluable for industry professionals, investors, and strategic decision-makers seeking a deep understanding of this dynamic market. The market size is projected to reach xx Million units by 2033.

South Africa Automotive Parts Aluminium Die Casting Market Market Dynamics & Structure

The South African automotive parts aluminium die casting market presents a moderately concentrated landscape, featuring several prominent players alongside a number of smaller, specialized firms. A key driver of market evolution is technological advancement, particularly within die casting processes and alloy development. The sector is significantly influenced by stringent regulatory frameworks concerning emissions and safety standards, shaping material selection and manufacturing procedures. Competitive pressure arises from substitute materials such as plastic components and steel castings, especially within price-sensitive market segments. The primary end-users consist of automotive original equipment manufacturers (OEMs) and Tier 1 suppliers. Mergers and acquisitions (M&A) activity has been relatively subdued in recent years (xx deals between 2019-2024), largely attributable to consolidation amongst smaller participants. However, the potential for future consolidation remains.

- Market Concentration: Moderately concentrated, with a Herfindahl-Hirschman Index (HHI) of xx. Further analysis of market share distribution amongst key players would provide a more granular understanding of market concentration.

- Technological Innovation: Significant focus on high-pressure die casting, lightweight alloys (e.g., aluminum-silicon alloys, magnesium alloys), and automation, including robotic integration and advanced process control systems. This drives efficiency and quality improvements.

- Regulatory Landscape: Stringent emission and safety standards, including those related to fuel efficiency and vehicle weight, are creating strong demand for lightweight, high-strength aluminium components. Compliance with these regulations represents a significant cost factor for manufacturers.

- Competitive Substitutes: Plastic components and steel castings present a considerable challenge, particularly in applications where cost is a primary consideration. The ongoing development of advanced materials and manufacturing techniques is crucial to maintain competitiveness.

- M&A Activity: Limited activity (xx deals between 2019-2024) suggests potential for future consolidation, driven by factors such as economies of scale and access to new technologies. Analysis of past M&A activity should highlight key drivers and potential future trends.

- Innovation Barriers: High capital expenditure for advanced technologies, such as automated production lines and specialized die tooling, and a shortage of skilled labor, particularly engineers and technicians, pose significant challenges to innovation and growth.

South Africa Automotive Parts Aluminium Die Casting Market Growth Trends & Insights

The South African automotive parts aluminium die casting market has witnessed steady growth during the historical period (2019-2024). This growth can be primarily attributed to increased vehicle production, the rising demand for lightweight vehicles, and the growing adoption of aluminum die casting in various automotive parts. The market experienced a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024, reaching an estimated market size of xx Million units in 2025. Technological advancements, such as the introduction of high-pressure die casting and improved alloy formulations, have further fueled market expansion. Shifting consumer preferences towards fuel-efficient and safer vehicles are driving demand for lightweight components, making aluminum die casting an attractive choice. The forecast period (2025-2033) projects continued growth, driven by factors like increased investment in automotive manufacturing and government initiatives to promote local content. The market is expected to reach xx Million units by 2033, with a projected CAGR of xx%. Market penetration is expected to increase from xx% in 2025 to xx% in 2033.

Dominant Regions, Countries, or Segments in South Africa Automotive Parts Aluminium Die Casting Market

The Gauteng province holds a dominant position within the South African automotive parts aluminium die casting market, accounting for approximately xx% of the total market share in 2025. This prominence is attributed to its established automotive manufacturing cluster, the presence of major OEMs and Tier 1 suppliers, and its robust supporting infrastructure. Analyzing the geographic distribution of market share across other provinces would provide a more comprehensive view of the market's regional dynamics. Regarding application types, Engine Parts currently commands the largest market share (xx%), followed by Body Assemblies (xx%). The prevalence of the pressure die casting production process (xx%) is due to its cost-effectiveness and suitability for high-volume component production. However, a detailed breakdown of market share by specific component types (e.g., cylinder heads, engine blocks, transmission cases) would provide more in-depth insights.

- Gauteng Province: Remains the leading region due to its concentrated automotive manufacturing base and well-developed infrastructure. However, the influence of other provinces should be further analyzed.

- Engine Parts: The largest application segment, driven by stringent fuel efficiency regulations and the need for lightweight, high-performance engine components.

- Pressure Die Casting: The dominant production process, valued for its cost-efficiency and ability to produce high-volume components. However, the increasing adoption of other techniques, such as low-pressure die casting, warrants further investigation.

- Key Drivers: Continued investments in automotive manufacturing, government incentives targeted at the automotive sector, and increasing global demand for lightweight vehicles are key growth drivers.

South Africa Automotive Parts Aluminium Die Casting Market Product Landscape

The South African automotive parts aluminium die casting market offers a diverse range of products tailored to various automotive applications. Current innovations emphasize enhancements in mechanical properties, weight reduction, and surface finish quality. Key product characteristics include high precision, a favorable strength-to-weight ratio, and exceptional durability. Technological advancements encompass the utilization of advanced alloys (e.g., high-strength, heat-resistant alloys), optimized die designs (incorporating features like cooling channels and venting systems), and extensive automation throughout the manufacturing process. Competitive advantages frequently include customization options, rapid prototyping capabilities, and competitive pricing strategies.

Key Drivers, Barriers & Challenges in South Africa Automotive Parts Aluminium Die Casting Market

Key Drivers: The rising demand for lightweight vehicles to improve fuel efficiency and reduce emissions is a primary driver. Government incentives promoting local content and investment in the automotive sector are also contributing significantly. Technological advancements in die casting processes and alloy development are enhancing the competitiveness of aluminum die casting.

Key Challenges: Fluctuations in raw material prices (aluminum) and energy costs present a challenge to profitability. The availability of skilled labor and the need for continuous technological upgrades pose operational constraints. Competition from international suppliers and substitute materials (plastics and steel) remains a concern.

Emerging Opportunities in South Africa Automotive Parts Aluminium Die Casting Market

Emerging opportunities include the growing demand for electric vehicles (EVs) and hybrid vehicles, which require lightweight components. The development of advanced alloys with enhanced properties and the increasing adoption of additive manufacturing techniques in die casting present significant potential. The expansion into new applications, such as battery casings and other EV components, offers further growth opportunities.

Growth Accelerators in the South Africa Automotive Parts Aluminium Die Casting Market Industry

Strategic partnerships between die casting companies and automotive OEMs are vital growth catalysts, facilitating innovation and securing a reliable supply chain. Investments in research and development (R&D) are critical for refining manufacturing processes and developing novel alloys with improved properties. Continued government support for the automotive industry via incentives and infrastructure development initiatives is essential for market expansion. Furthermore, the growing adoption of electric vehicles (EVs) and hybrid vehicles presents significant opportunities for the aluminium die casting industry, as these vehicles require lightweight components to optimize battery range and performance.

Key Players Shaping the South Africa Automotive Parts Aluminium Die Casting Market Market

- Sandhar Technologies Ltd

- Empire Casting Co

- Pace Industries

- Brillcast Manufacturing LLC

- Cascade Die Casting Group Inc

- Ningbo Die Casting Company

- Ashok Minda Group

- Dynacast

- Kemlows Diecasting Products Ltd

Notable Milestones in South Africa Automotive Parts Aluminium Die Casting Market Sector

- 2021: Introduction of a new high-pressure die casting facility by a major player.

- 2022: Successful implementation of a new lightweight aluminum alloy by a leading OEM.

- 2023: Announcement of a joint venture between two key players to expand production capacity.

In-Depth South Africa Automotive Parts Aluminium Die Casting Market Market Outlook

The South African automotive parts aluminium die casting market is poised for sustained growth, driven by strong domestic demand, technological innovation, and supportive government policies. Strategic investments in advanced manufacturing technologies, expansion into new applications, and the development of strategic partnerships will be crucial for capturing market share and achieving long-term success. The market's future potential is significant, and this report offers valuable insights for navigating this dynamic landscape.

South Africa Automotive Parts Aluminium Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Other Productino Process Types

-

2. Application Type

- 2.1. Body Assemblies

- 2.2. Engine Parts

- 2.3. Transmission Parts

- 2.4. Other Aplication Types

South Africa Automotive Parts Aluminium Die Casting Market Segmentation By Geography

- 1. South Africa

South Africa Automotive Parts Aluminium Die Casting Market Regional Market Share

Geographic Coverage of South Africa Automotive Parts Aluminium Die Casting Market

South Africa Automotive Parts Aluminium Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Automotive Industry to Drive Demand in the Die Casting Market

- 3.3. Market Restrains

- 3.3.1. High Processing Cost May Hamper Market Expansion

- 3.4. Market Trends

- 3.4.1. Vacuum Die Casting Segment is Expected to Witness the Fastest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Automotive Parts Aluminium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Other Productino Process Types

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Body Assemblies

- 5.2.2. Engine Parts

- 5.2.3. Transmission Parts

- 5.2.4. Other Aplication Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sandhar technologies Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Empire Casting Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pace Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Brillcast Manufacturing LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cascade Die Casting Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ningbo Die Casting Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ashook Minda Grou

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dynacast

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kemlows Diecasting Products Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Sandhar technologies Ltd

List of Figures

- Figure 1: South Africa Automotive Parts Aluminium Die Casting Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Automotive Parts Aluminium Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 2: South Africa Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: South Africa Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South Africa Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 5: South Africa Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: South Africa Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Automotive Parts Aluminium Die Casting Market?

The projected CAGR is approximately 8.2%.

2. Which companies are prominent players in the South Africa Automotive Parts Aluminium Die Casting Market?

Key companies in the market include Sandhar technologies Ltd, Empire Casting Co, Pace Industries, Brillcast Manufacturing LLC, Cascade Die Casting Group Inc, Ningbo Die Casting Company, Ashook Minda Grou, Dynacast, Kemlows Diecasting Products Ltd.

3. What are the main segments of the South Africa Automotive Parts Aluminium Die Casting Market?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 85.92 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Automotive Industry to Drive Demand in the Die Casting Market.

6. What are the notable trends driving market growth?

Vacuum Die Casting Segment is Expected to Witness the Fastest Growth Rate.

7. Are there any restraints impacting market growth?

High Processing Cost May Hamper Market Expansion.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Automotive Parts Aluminium Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Automotive Parts Aluminium Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Automotive Parts Aluminium Die Casting Market?

To stay informed about further developments, trends, and reports in the South Africa Automotive Parts Aluminium Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence