Key Insights

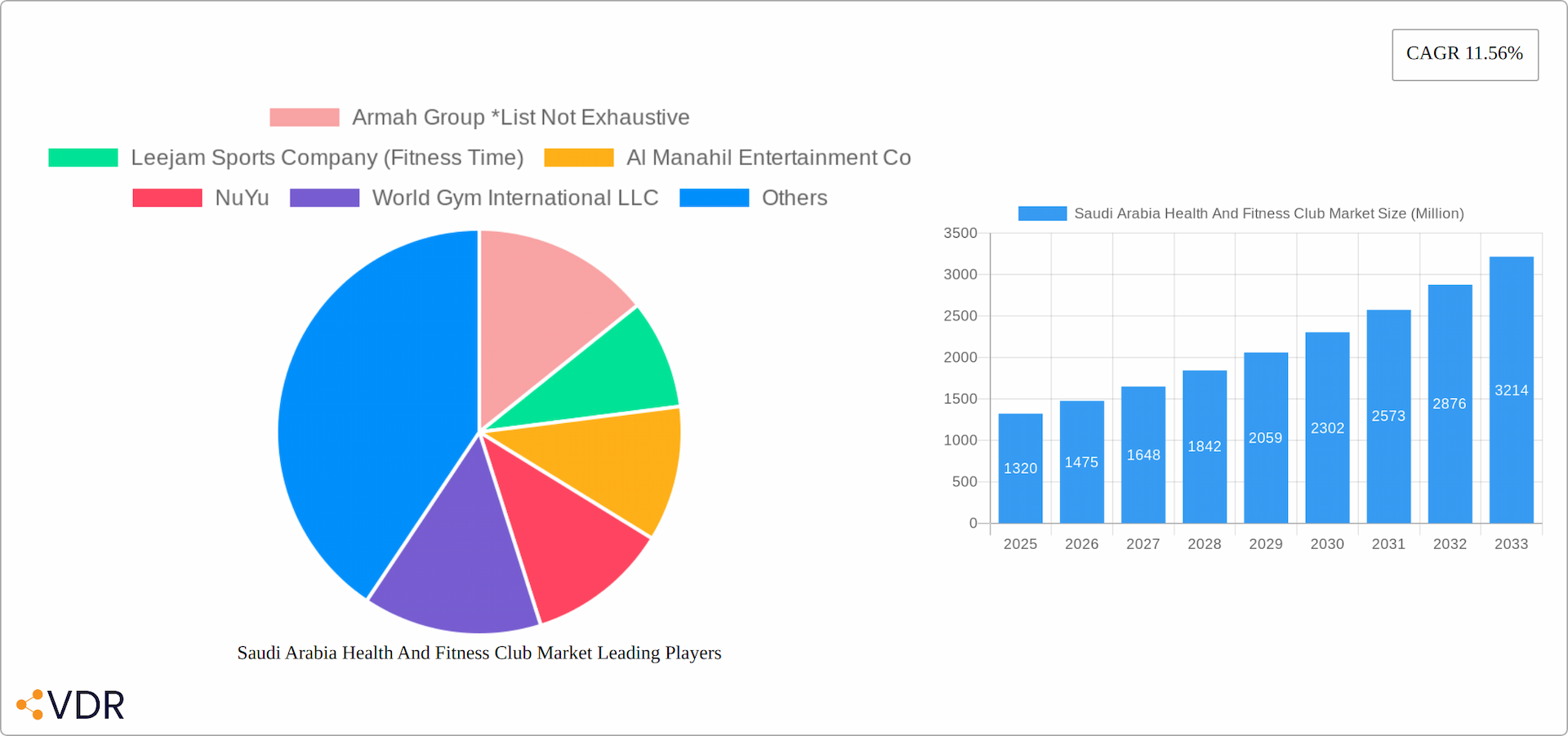

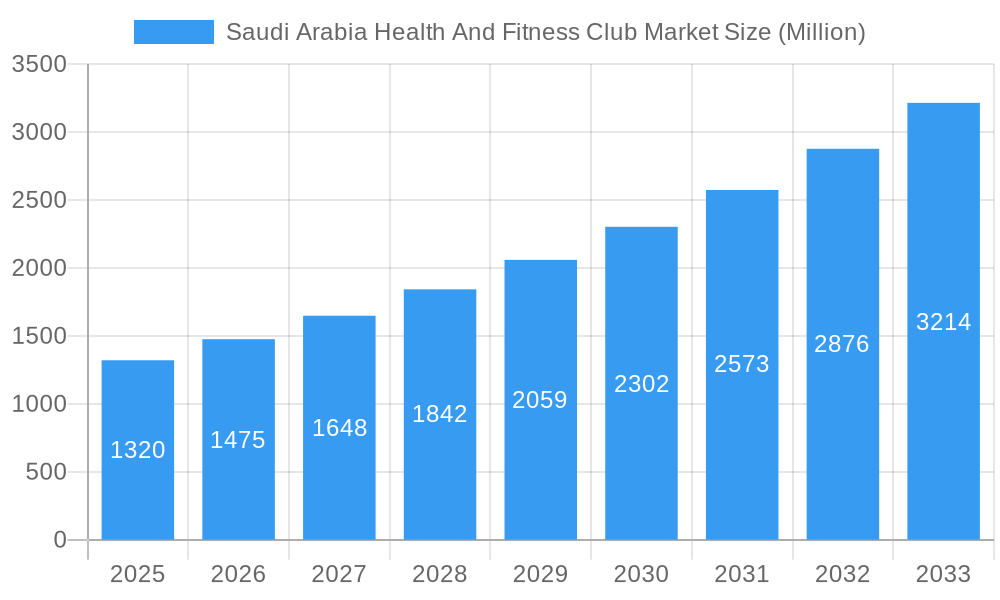

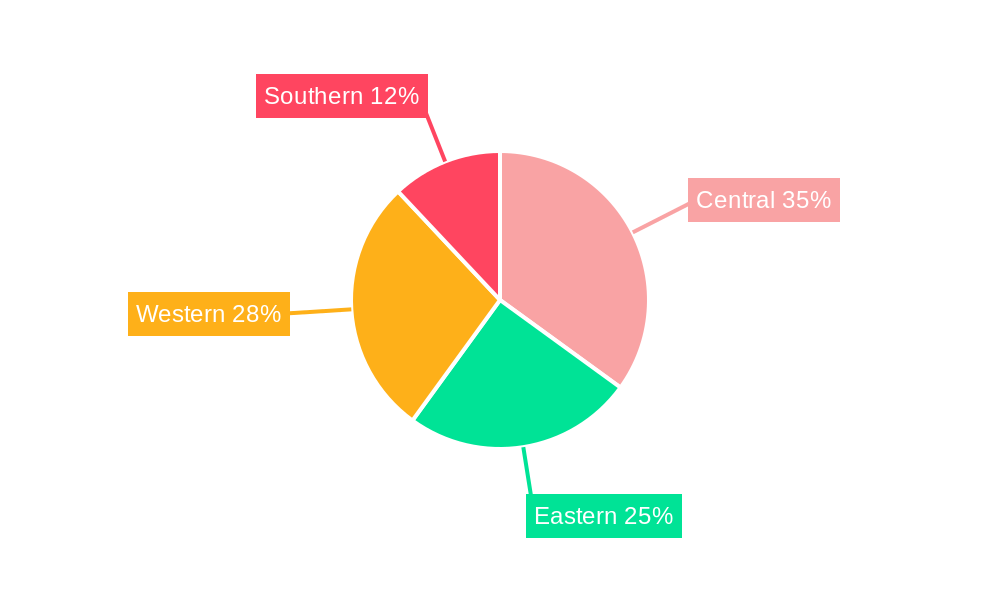

The Saudi Arabia health and fitness club market is experiencing robust growth, projected to reach a market size of $1.32 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 11.56% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing health consciousness among Saudis, coupled with government initiatives promoting a healthier lifestyle and substantial investments in sports infrastructure, are significantly boosting market demand. The rising disposable incomes within the population further contribute to the affordability of premium fitness services and memberships. The market is segmented by revenue stream (membership fees, personal training, and other services) and end-user demographics (men and women). While membership fees form a substantial portion of revenue, the demand for personalized training and specialized fitness programs is also on the rise, creating opportunities for diversification within the industry. Competition is intensifying with established players like Leejam Sports Company (Fitness Time), Al Manahil Entertainment Co., and international brands such as World Gym International LLC vying for market share. The regional distribution across Saudi Arabia’s central, eastern, western, and southern regions indicates varying levels of market penetration and future growth potential, with urban centers likely showcasing higher demand.

Saudi Arabia Health And Fitness Club Market Market Size (In Billion)

Looking ahead, several trends are poised to shape the future of the Saudi Arabian health and fitness club market. The growing adoption of technology in fitness, including the integration of wearable technology and fitness apps, will enhance the user experience and create opportunities for data-driven personalized fitness programs. Furthermore, an increasing focus on specialized fitness programs, such as boutique studios offering yoga, Pilates, and CrossFit, will cater to diverse fitness preferences. While the market faces some restraints, such as the potential for economic fluctuations impacting consumer spending and the need for ongoing investment in infrastructure and skilled trainers, the long-term growth outlook remains highly positive, driven by the nation's commitment to improving public health and the escalating demand for premium fitness experiences. Expansion into underserved areas and strategic partnerships could further unlock significant market potential for existing and new entrants.

Saudi Arabia Health And Fitness Club Market Company Market Share

Saudi Arabia Health and Fitness Club Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Saudi Arabia health and fitness club market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report segments the market by revenue stream (Membership Fees, Personal Training and Instruction Services, Other Revenue Streams) and end-user (Men, Women), offering granular analysis for informed business strategies. The market size is presented in Million units.

Saudi Arabia Health And Fitness Club Market Market Dynamics & Structure

The Saudi Arabian health and fitness club market is undergoing a dynamic transformation, propelled by a heightened emphasis on public health and wellness, increasing disposable incomes, and strategic government endeavors to foster healthier lifestyles. While the market exhibits moderate concentration with a blend of established, large-scale operators and a significant number of agile, independent facilities, it is actively shaped by evolving consumer demands and technological integration. The penetration of digital fitness solutions, including sophisticated tracking applications and immersive virtual training platforms, is increasingly disrupting traditional club models. This evolution necessitates continuous adaptation and innovation from market participants. The regulatory landscape, while generally conducive to industry expansion, mandates strict adherence to comprehensive health and safety protocols. The market also contends with competition from a growing array of alternative fitness avenues, such as advanced home workout solutions and accessible outdoor recreational opportunities. Further fueling this dynamic, Mergers & Acquisitions (M&A) activity is on an upward trend, signaling strategic consolidation and ambitious expansion plans across the sector.

- Market Concentration: The market is characterized by moderate concentration, featuring a few prominent entities alongside a substantial number of smaller, specialized operators. The top 5 players are estimated to hold approximately 45-55% of the market share in 2024.

- Technological Innovation: There is a robust and growing adoption of fitness technologies. However, widespread implementation faces certain barriers, including the initial investment costs associated with advanced equipment and varying levels of digital literacy among the user base.

- Regulatory Framework: The regulatory environment is largely supportive of the industry's growth, with a primary focus on ensuring adherence to stringent safety and operational standards. Specific compliance requirements can differ across various regions within Saudi Arabia.

- Competitive Substitutes: The market faces significant competitive pressure from accessible home workout routines, engaging outdoor fitness activities, and the rapidly expanding ecosystem of online fitness platforms offering flexible and often more affordable alternatives.

- End-User Demographics: Participation is increasingly broadening across both genders, with a discernible and growing engagement from younger demographics who are demonstrating a pronounced shift towards proactive health management and fitness consciousness.

- M&A Trends: Mergers and acquisitions are becoming a prevalent strategy for market players, particularly among larger chains aiming to achieve greater economies of scale, expand their geographical footprint, and diversify their service portfolios. Approximately 8-12 significant M&A deals have been recorded within the last five years.

Saudi Arabia Health And Fitness Club Market Growth Trends & Insights

The Saudi Arabia health and fitness club market is demonstrating a strong and sustained growth trajectory, underpinned by a confluence of potent drivers. The market size has witnessed remarkable expansion, escalating from an estimated $250 Million in 2019 to $480 Million in 2024. This significant growth is a direct reflection of escalating health consciousness among the populace, a notable rise in disposable incomes, and the steadfast support of government policies championing a healthier nation. The rate at which individuals are adopting fitness club memberships continues to climb steadily, primarily due to the unparalleled convenience, comprehensive service offerings, and the holistic wellness environments provided by these establishments. Disruptive technological advancements, including the proliferation of virtual training modules, the widespread adoption of wearable fitness trackers, and the emergence of highly personalized fitness applications, are actively reshaping the industry landscape. These innovations are instrumental in elevating the user experience, enabling tailored workout regimens, and fostering greater member engagement. Consumer behavior is increasingly oriented towards bespoke fitness solutions, signaling a clear demand for personalized experiences and integrated wellness strategies. The Compound Annual Growth Rate (CAGR) for the period between 2025 and 2033 is projected to be robust at approximately 12-15%, fueled by continued government investment in sports and fitness infrastructure and a rising awareness of the importance of combating lifestyle-related diseases. Despite this rapid growth, market penetration rates remain relatively modest, indicating substantial untapped potential for future expansion.

Dominant Regions, Countries, or Segments in Saudi Arabia Health And Fitness Club Market

The major cities of Riyadh, Jeddah, and Dammam are the dominant regions, demonstrating significant growth in both the number of fitness clubs and memberships. The high population density, economic activity, and readily available infrastructure contribute to the dominance of these urban centers. Within the revenue streams, Membership Fees contribute the most significant portion of revenue, with Personal Training and Instruction Services showing strong growth potential. Similarly, the male segment currently holds a larger market share compared to the female segment, but the female segment is expected to experience notable growth.

- Key Drivers: Rapid urbanization, increasing disposable income, supportive government policies promoting health and fitness, and expansion of fitness club chains.

- Riyadh's Dominance: Highest concentration of fitness clubs, highest market share (xx% in 2024), superior infrastructure supporting fitness center development.

Saudi Arabia Health And Fitness Club Market Product Landscape

The Saudi Arabia health and fitness club market offers an expansive and diversified spectrum of products and services, meticulously designed to accommodate a wide array of fitness levels, individual goals, and lifestyle preferences. This encompasses traditional gym memberships providing access to state-of-the-art cardio and weight training equipment, alongside a rich array of specialized fitness programs such as dynamic yoga sessions, energetic Zumba classes, and high-intensity CrossFit training. Forward-thinking fitness clubs are increasingly integrating cutting-edge technologies to elevate the member experience. This includes immersive virtual reality fitness programs that offer engaging and gamified workouts, as well as sophisticated personalized training plans that leverage data insights from wearable fitness trackers to optimize performance and prevent injuries. Many premium facilities distinguish themselves through exceptional amenities, including luxurious swimming pools, rejuvenating spa services, and comprehensive wellness centers, thereby delivering a truly holistic approach to fitness and well-being. The overarching trend is a deliberate focus on delivering a premium, highly personalized, and results-oriented fitness journey for every member.

Key Drivers, Barriers & Challenges in Saudi Arabia Health And Fitness Club Market

Key Drivers: The market's upward momentum is significantly propelled by a burgeoning public awareness regarding health and fitness, a sustained increase in disposable incomes, the unwavering support of government policies and initiatives, and the rapid advancement and adoption of technology. Notably, the Saudi Vision 2030 initiative places a considerable emphasis on enhancing public health and promoting active lifestyles, which directly translates into a supportive environment for the growth of the fitness industry.

Challenges and Restraints: The industry grapples with several significant challenges that impact profitability and operational efficiency. These include high operating costs associated with maintaining modern facilities and equipment, intense competition stemming from both new market entrants and well-established players, the complexities of navigating and ensuring consistent compliance with evolving regulatory frameworks, and the persistent difficulty in attracting and retaining highly qualified and certified fitness professionals. The cumulative impact of these factors is estimated to potentially temper the overall CAGR by approximately 3-5% during the forecast period.

Emerging Opportunities in Saudi Arabia Health And Fitness Club Market

Emerging opportunities include the expansion of specialized fitness programs such as boutique fitness studios, incorporating digital platforms to enhance the customer experience, and targeting underserved segments of the population with tailored fitness solutions. The incorporation of virtual reality technology and AI-powered personalized training plans represent significant growth opportunities, while focusing on corporate wellness programs and partnerships holds significant potential.

Growth Accelerators in the Saudi Arabia Health And Fitness Club Market Industry

Technological advancements in fitness tracking, virtual reality fitness, and AI-powered personal training tools are key growth drivers. Strategic partnerships between fitness centers and healthcare providers could facilitate greater integration within the overall wellness sector. Government initiatives supporting healthy lifestyles and expansion into new geographic locations within the country will enhance market reach.

Key Players Shaping the Saudi Arabia Health And Fitness Club Market Market

- Armah Group

- Leejam Sports Company (Fitness Time)

- Al Manahil Entertainment Co

- NuYu

- World Gym International LLC

- Arena

- RSG Group GmbH

- Lava Fitness

- Kinetico

- Landmark Fitness Limited

Notable Milestones in Saudi Arabia Health And Fitness Club Market Sector

- June 2023: Leejam Sports, a leading player in the market, significantly strengthened its presence and service offerings through the acquisition of Al-Tatheer Sports for SAR 12 million, marking a strategic move towards market consolidation.

- October 2023: In a move to diversify its service portfolio and cater to a growing demand for specialized care, Leejam Sports forged a strategic partnership with Burjeel Holdings to launch four "PhysioTherabia" centers in Riyadh, expanding into the crucial rehabilitation and wellness sector.

- November 2023: Demonstrating a commitment to geographical expansion and catering to diverse market segments, Leejam Sports inaugurated a new men's Xpress fitness center in Al-Kharj, further broadening its reach across new locations within Saudi Arabia.

In-Depth Saudi Arabia Health And Fitness Club Market Market Outlook

The Saudi Arabia health and fitness club market presents significant long-term growth potential, driven by continued economic growth, rising health awareness, and technological innovation. Strategic partnerships, expansion into new geographical areas, and the development of innovative fitness offerings will be crucial for future success. The market is poised for considerable expansion, particularly in the segments of personalized training and digital fitness solutions, indicating a promising outlook for investors and industry participants.

Saudi Arabia Health And Fitness Club Market Segmentation

-

1. Revenue Stream

- 1.1. Membership Fees

- 1.2. Personal Training and Instruction Services

- 1.3. Other Revenue Streams

-

2. End User

- 2.1. Men

- 2.2. Women

Saudi Arabia Health And Fitness Club Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Saudi Arabia Health And Fitness Club Market Regional Market Share

Geographic Coverage of Saudi Arabia Health And Fitness Club Market

Saudi Arabia Health And Fitness Club Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strategic Investments by Fitness Clubs; Growth Of Gym Culture and Penetration of International Brands

- 3.3. Market Restrains

- 3.3.1. Demand For Home Gym and Recreation Activities; Dependency on Self-operated E-health Platforms

- 3.4. Market Trends

- 3.4.1. Membership-Based Fitness And Health Clubs Are The Most Popular

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Health And Fitness Club Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Revenue Stream

- 5.1.1. Membership Fees

- 5.1.2. Personal Training and Instruction Services

- 5.1.3. Other Revenue Streams

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Revenue Stream

- 6. North America Saudi Arabia Health And Fitness Club Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Revenue Stream

- 6.1.1. Membership Fees

- 6.1.2. Personal Training and Instruction Services

- 6.1.3. Other Revenue Streams

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.1. Market Analysis, Insights and Forecast - by Revenue Stream

- 7. Europe Saudi Arabia Health And Fitness Club Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Revenue Stream

- 7.1.1. Membership Fees

- 7.1.2. Personal Training and Instruction Services

- 7.1.3. Other Revenue Streams

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.1. Market Analysis, Insights and Forecast - by Revenue Stream

- 8. Asia Pacific Saudi Arabia Health And Fitness Club Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Revenue Stream

- 8.1.1. Membership Fees

- 8.1.2. Personal Training and Instruction Services

- 8.1.3. Other Revenue Streams

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.1. Market Analysis, Insights and Forecast - by Revenue Stream

- 9. South America Saudi Arabia Health And Fitness Club Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Revenue Stream

- 9.1.1. Membership Fees

- 9.1.2. Personal Training and Instruction Services

- 9.1.3. Other Revenue Streams

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.1. Market Analysis, Insights and Forecast - by Revenue Stream

- 10. Middle East and Africa Saudi Arabia Health And Fitness Club Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Revenue Stream

- 10.1.1. Membership Fees

- 10.1.2. Personal Training and Instruction Services

- 10.1.3. Other Revenue Streams

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Men

- 10.2.2. Women

- 10.1. Market Analysis, Insights and Forecast - by Revenue Stream

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Armah Group *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Leejam Sports Company (Fitness Time)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Al Manahil Entertainment Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NuYu

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 World Gym International LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arena

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RSG Group GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lava Fitness

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kinetico

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Landmark Fitness Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Armah Group *List Not Exhaustive

List of Figures

- Figure 1: Saudi Arabia Health And Fitness Club Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Health And Fitness Club Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by Revenue Stream 2020 & 2033

- Table 2: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by Revenue Stream 2020 & 2033

- Table 3: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by End User 2020 & 2033

- Table 5: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by Revenue Stream 2020 & 2033

- Table 8: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by Revenue Stream 2020 & 2033

- Table 9: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by End User 2020 & 2033

- Table 11: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Rest of North America Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of North America Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by Revenue Stream 2020 & 2033

- Table 22: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by Revenue Stream 2020 & 2033

- Table 23: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by End User 2020 & 2033

- Table 24: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by End User 2020 & 2033

- Table 25: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by Country 2020 & 2033

- Table 27: Germany Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: UK Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: UK Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: France Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: France Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: Russia Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Russia Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: Spain Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Spain Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Rest of Europe Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Europe Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by Revenue Stream 2020 & 2033

- Table 40: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by Revenue Stream 2020 & 2033

- Table 41: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by End User 2020 & 2033

- Table 43: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by Country 2020 & 2033

- Table 45: India Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: India Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 47: China Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: China Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: Japan Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Japan Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: Rest of Asia Pacific Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by Revenue Stream 2020 & 2033

- Table 54: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by Revenue Stream 2020 & 2033

- Table 55: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by End User 2020 & 2033

- Table 56: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by End User 2020 & 2033

- Table 57: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by Country 2020 & 2033

- Table 59: Brazil Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Brazil Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 61: Argentina Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Argentina Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Rest of South America Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of South America Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by Revenue Stream 2020 & 2033

- Table 66: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by Revenue Stream 2020 & 2033

- Table 67: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by End User 2020 & 2033

- Table 68: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by End User 2020 & 2033

- Table 69: Saudi Arabia Health And Fitness Club Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Saudi Arabia Health And Fitness Club Market Volume K Units Forecast, by Country 2020 & 2033

- Table 71: South Africa Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: South Africa Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 73: Saudi Arabia Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Saudi Arabia Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Saudi Arabia Health And Fitness Club Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Saudi Arabia Health And Fitness Club Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Health And Fitness Club Market?

The projected CAGR is approximately 11.56%.

2. Which companies are prominent players in the Saudi Arabia Health And Fitness Club Market?

Key companies in the market include Armah Group *List Not Exhaustive, Leejam Sports Company (Fitness Time), Al Manahil Entertainment Co, NuYu, World Gym International LLC, Arena, RSG Group GmbH, Lava Fitness, Kinetico, Landmark Fitness Limited.

3. What are the main segments of the Saudi Arabia Health And Fitness Club Market?

The market segments include Revenue Stream, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Strategic Investments by Fitness Clubs; Growth Of Gym Culture and Penetration of International Brands.

6. What are the notable trends driving market growth?

Membership-Based Fitness And Health Clubs Are The Most Popular.

7. Are there any restraints impacting market growth?

Demand For Home Gym and Recreation Activities; Dependency on Self-operated E-health Platforms.

8. Can you provide examples of recent developments in the market?

November 2023: Leejam Sports opened a new men’s Xpress fitness center in Al-Kharj. The new center is on King Fahd Road in As Sulaymaniyah, Al-Kharj, and spans 875 square meters. Although it does not have swimming pools, the center has a low-cost, 24-hour operating approach.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Health And Fitness Club Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Health And Fitness Club Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Health And Fitness Club Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Health And Fitness Club Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence