Key Insights

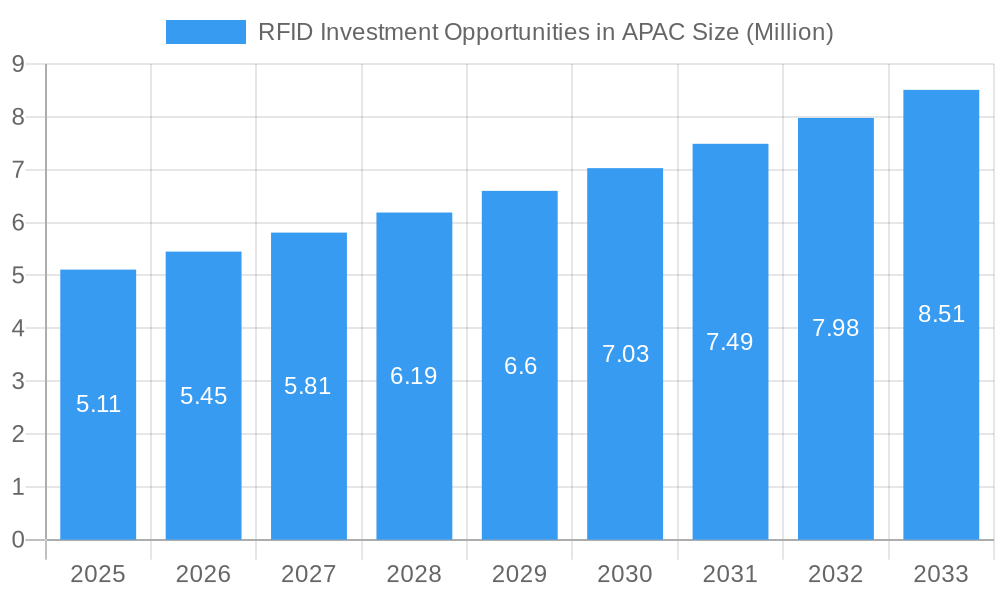

The Asia Pacific (APAC) region presents a robust and dynamic landscape for RFID investment, poised for significant expansion driven by escalating demand across diverse industries. With an estimated market size of USD 5.11 million in 2025, the region is projected to witness a Compound Annual Growth Rate (CAGR) of 6.68% through 2033, indicating a sustained and strong upward trajectory. Key growth catalysts include the burgeoning retail and consumer goods sector, where inventory management and customer experience enhancements are paramount. The automotive and manufacturing industries are also heavily investing in RFID for streamlined supply chains, enhanced production efficiency, and sophisticated asset tracking. Furthermore, the increasing adoption of RFID in healthcare for patient tracking and medical device management, alongside its application in banking and finance for secure transaction processing, underscores the technology's versatility and indispensability.

RFID Investment Opportunities in APAC Market Size (In Million)

The region's rapid digital transformation, coupled with favorable government initiatives promoting technological adoption and smart city development, further bolsters RFID market penetration. China and India, leading economic powerhouses within APAC, are at the forefront of this adoption, fueled by their extensive manufacturing bases and large consumer markets. Japan and South Korea, with their advanced technological infrastructure and early embrace of automation, also represent significant growth hubs. While the implementation of comprehensive RFID systems requires substantial initial investment, potentially acting as a restraint, the long-term benefits in terms of operational efficiency, reduced losses, and improved data accuracy are proving to be compelling drivers for businesses. Emerging trends such as the integration of AI and IoT with RFID solutions are expected to unlock new avenues for innovation and market expansion, making APAC a prime target for strategic RFID investments.

RFID Investment Opportunities in APAC Company Market Share

RFID Investment Opportunities in APAC: Comprehensive Market Analysis & Growth Projections (2019–2033)

Unlock lucrative investment prospects within the rapidly expanding RFID market across the Asia-Pacific (APAC) region. This in-depth report provides a holistic view of RFID investment opportunities in APAC, meticulously analyzing market dynamics, growth trends, dominant segments, product innovations, key drivers, and emerging opportunities. Discover critical insights for strategic decision-making, from understanding market concentration and technological advancements to identifying leading companies and pivotal milestones. With data spanning the Historical Period (2019–2024), Base Year (2025), and Forecast Period (2025–2033), this report equips investors, technology providers, and industry stakeholders with the intelligence needed to navigate and capitalize on this dynamic market. Leverage our expert analysis on RFID tags, readers, antennas, software, and middleware across key applications like Retail & Consumer Goods, Asset Tracking, Banking & Finance, Automotive, Manufacturing, and Healthcare & Medical. All quantitative values are presented in Million units for clarity and ease of comparison.

RFID Investment Opportunities in APAC Market Dynamics & Structure

The APAC RFID market exhibits dynamic shifts driven by robust technological innovation and increasing adoption across diverse industries. Market concentration varies, with key players dominating specific segments while emerging companies foster healthy competition. Technological innovation is a significant driver, spurred by advancements in miniaturization, power efficiency, and data processing capabilities of RFID tags and readers. Regulatory frameworks, while evolving, are generally supportive of technologies that enhance supply chain visibility and security. Competitive product substitutes, such as barcodes, still hold a presence, but the superior functionality of RFID is steadily displacing them in high-value applications. End-user demographics are increasingly sophisticated, demanding real-time data, enhanced security, and seamless integration. Mergers and acquisitions (M&A) trends are a key indicator of market maturity, with larger entities acquiring innovative startups to expand their product portfolios and market reach.

- Technological Innovation Drivers: Increasing demand for real-time inventory management, enhanced supply chain security, and automation.

- Regulatory Frameworks: Government initiatives promoting smart city development and digital transformation foster RFID adoption.

- Competitive Product Substitutes: While barcodes persist, RFID offers advanced capabilities in read range, data capacity, and reusability.

- End-User Demographics: Growing preference for efficient, data-driven operations and improved customer experiences.

- M&A Trends: Strategic acquisitions aimed at consolidating market share and acquiring cutting-edge RFID technologies.

RFID Investment Opportunities in APAC Growth Trends & Insights

The APAC RFID market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This significant expansion is underpinned by increasing adoption rates across a multitude of sectors, driven by the inherent benefits of RFID technology in enhancing efficiency, security, and visibility. The market size is estimated to reach approximately $XX,XXX million units by the end of the forecast period, a remarkable increase from the XX,XXX million units recorded in the base year of 2025. Technological disruptions, such as the development of more advanced RFID tags with enhanced durability and read capabilities, alongside sophisticated readers and integrated software solutions, are pivotal in this growth trajectory. Consumer behavior shifts are also playing a crucial role; for instance, the retail sector is increasingly leveraging RFID for accurate inventory management, personalized customer experiences, and combating counterfeit goods, thereby boosting adoption. Similarly, the manufacturing industry is capitalizing on RFID for precise asset tracking, streamlined production processes, and quality control. In the healthcare sector, RFID is instrumental in managing medical equipment, tracking patient records securely, and ensuring the integrity of pharmaceutical supply chains. The automotive industry is also a significant contributor, utilizing RFID for vehicle identification, component tracking, and after-sales service management. The banking and finance sector is adopting RFID for secure identification and transaction processing. Emerging applications in logistics and smart cities further contribute to the overall market penetration, indicating a robust and sustained upward trend in RFID adoption throughout the APAC region. This sustained growth underscores the strategic importance of investing in RFID solutions within APAC.

Dominant Regions, Countries, or Segments in RFID Investment Opportunities in APAC

The Retail & Consumer Goods segment is a dominant force propelling the RFID market in APAC. This sector's immense scale, coupled with the pressing need for enhanced inventory accuracy, loss prevention, and personalized customer experiences, makes it a prime area for RFID implementation. The sheer volume of transactions and the complexity of supply chains within retail necessitate the real-time visibility that RFID provides. For instance, major retailers are increasingly adopting RFID tags on individual items to achieve near-perfect inventory counts, significantly reducing stockouts and overstock situations. This translates to billions of RFID tags being deployed annually within this segment alone.

Key drivers contributing to this dominance include:

- Economic Policies: Supportive trade policies and a growing middle class in countries like China, India, and Southeast Asian nations fuel consumer spending, thereby increasing the demand for efficiently managed retail operations.

- Infrastructure Development: Robust logistics and warehousing infrastructure across major APAC economies enables seamless integration of RFID solutions from manufacturing to the point of sale.

- Technological Adoption: A high propensity among APAC consumers and businesses to adopt new technologies for convenience and efficiency.

China stands out as the leading country, significantly contributing to the market's growth due to its vast manufacturing base, extensive retail market, and strong government support for technological advancements. Its substantial population and rapidly growing e-commerce sector further amplify the demand for RFID solutions in supply chain management and inventory control. The manufacturing sector in China, being the "world's factory," is a massive consumer of RFID for tracking components, finished goods, and ensuring quality control throughout the production process.

- Market Share: The Retail & Consumer Goods segment is estimated to hold approximately XX% of the total RFID market in APAC.

- Growth Potential: Expected to exhibit a CAGR of XX% within the forecast period, driven by ongoing digital transformation initiatives.

- Key Country Dominance: China is anticipated to account for over XX% of the APAC RFID market revenue in 2025.

- Sectoral Drivers: The increasing adoption of RFID for anti-counterfeiting measures in high-value consumer goods is a significant growth catalyst.

While Retail & Consumer Goods leads, other segments like Asset Tracking in manufacturing and logistics, and Healthcare & Medical for equipment and pharmaceutical tracking, are also experiencing substantial growth. The manufacturing sector's push towards Industry 4.0 and smart factories heavily relies on RFID for operational efficiency.

RFID Investment Opportunities in APAC Product Landscape

The APAC RFID market is characterized by a diverse and evolving product landscape, with significant innovations in RFID tags, readers, antennas, and software. Advanced RFID tags are being developed with enhanced read ranges, improved data storage capacities, and greater durability to withstand harsh environmental conditions across manufacturing and logistics. Innovations in passive and active RFID tags cater to a wide array of applications, from simple item identification to complex real-time location tracking. RFID readers are becoming more intelligent, offering faster read speeds, higher antenna port density, and improved connectivity options, enabling seamless data collection. Software and middleware solutions are crucial for integrating RFID data into existing enterprise systems, providing actionable insights and automating workflows. The performance metrics of these products, such as read accuracy, data transmission rates, and battery life (for active tags), are continuously improving, driving wider adoption and enabling more sophisticated applications.

Key Drivers, Barriers & Challenges in RFID Investment Opportunities in APAC

The RFID market in APAC is propelled by several key drivers. The escalating demand for enhanced supply chain visibility and efficiency, particularly in the e-commerce and retail sectors, is a primary catalyst. Technological advancements leading to more affordable and versatile RFID solutions are broadening their applicability. Government initiatives promoting digitalization and smart manufacturing further stimulate adoption. The need for improved asset tracking and management in industries like healthcare and logistics is also a significant growth factor.

However, several barriers and challenges impede market growth. High initial investment costs for comprehensive RFID systems can be a deterrent for small and medium-sized enterprises. Interoperability issues between different RFID systems and existing IT infrastructure can create integration complexities. Security and privacy concerns related to data collection also present challenges, requiring robust data protection measures. Furthermore, a lack of skilled professionals for implementation and maintenance can hinder widespread adoption.

- Key Drivers:

- Demand for supply chain optimization.

- Cost reduction in inventory management.

- Government support for digital transformation.

- Growing e-commerce penetration.

- Key Challenges:

- High implementation costs for SMEs.

- Interoperability and integration hurdles.

- Data security and privacy concerns.

- Shortage of skilled RFID professionals.

Emerging Opportunities in RFID Investment Opportunities in APAC

Emerging opportunities in the APAC RFID market lie in the expansion of its application into new verticals and the development of specialized RFID solutions. The "smart city" initiative across several APAC nations presents a significant avenue for RFID deployment in areas such as public transportation, waste management, and smart grids. The increasing focus on food safety and traceability in the agricultural sector also offers a growing niche for RFID-enabled tracking from farm to fork. Furthermore, the development of ultra-high frequency (UHF) RFID with longer read ranges and enhanced anti-collision capabilities is opening doors for large-scale asset tracking in vast industrial complexes and logistics hubs. The integration of RFID with other emerging technologies like Artificial Intelligence (AI) and the Internet of Things (IoT) promises to unlock more intelligent and automated solutions, creating unique investment prospects in data analytics and predictive maintenance powered by RFID data.

Growth Accelerators in the RFID Investment Opportunities in APAC Industry

Several growth accelerators are poised to significantly boost the RFID industry in APAC. Technological breakthroughs, such as the development of highly sensitive and energy-efficient RFID sensors, will enable new applications in environmental monitoring and healthcare diagnostics. Strategic partnerships between RFID solution providers and major industry players will foster wider adoption by leveraging established distribution channels and market access. The increasing globalization of supply chains necessitates more robust tracking and authentication solutions, which RFID provides, thereby driving its expansion into new geographical markets within APAC and beyond. Furthermore, the growing consumer demand for product authenticity and ethical sourcing will continue to push industries towards implementing RFID for enhanced transparency and traceability.

Key Players Shaping the RFID Investment Opportunities in APAC Market

Jadaktech Rasilant Technologies Tsinghua Tongfang Co Ltd Ceyon Technology Yodobashi Camera Co Ltd Ripro Corporation CHILITAG Technology Perfect RFID EMW Co Ltd

Notable Milestones in RFID Investment Opportunities in APAC Sector

- 2019: Significant increase in RFID adoption for inventory management in major retail chains across Southeast Asia.

- 2020: Launch of advanced UHF RFID tags optimized for harsh industrial environments in China.

- 2021: Government initiatives in South Korea and Singapore to promote smart manufacturing using RFID technologies.

- 2022: Expansion of RFID applications in healthcare for tracking high-value medical equipment and pharmaceuticals in Japan.

- 2023: Increased M&A activity with larger technology firms acquiring specialized RFID startups in the region.

- 2024 (Estimated): Growing adoption of RAIN RFID for broader supply chain visibility solutions across the APAC region.

In-Depth RFID Investment Opportunities in APAC Market Outlook

The APAC RFID market outlook is exceptionally promising, driven by continuous innovation and increasing integration across diverse sectors. Growth accelerators such as advancements in sensor technology, strategic industry collaborations, and the global push for supply chain resilience will fuel sustained expansion. The future holds significant potential for RFID solutions that offer enhanced data analytics capabilities, particularly when combined with AI and IoT, paving the way for truly intelligent operations. Investors looking to capitalize on the burgeoning digital transformation across APAC will find substantial strategic opportunities within the RFID ecosystem, from hardware manufacturers to software providers and system integrators. The market's trajectory indicates a strong and consistent upward trend, making it a compelling area for long-term investment.

RFID Investment Opportunities in APAC Segmentation

-

1. Product

- 1.1. RFID Tags

- 1.2. Readers

- 1.3. Antennas

- 1.4. RFID Software and Middleware Services

-

2. Application

- 2.1. Retail & Consumer Goods

- 2.2. Asset Tracking

- 2.3. Banking and Finance

- 2.4. Automotive

- 2.5. Manufacturing

- 2.6. Healthcare & Medical

- 2.7. Other Applications

RFID Investment Opportunities in APAC Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

RFID Investment Opportunities in APAC Regional Market Share

Geographic Coverage of RFID Investment Opportunities in APAC

RFID Investment Opportunities in APAC REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rapid Adoption Of The Technology In Various Sectors; High Return On Investment

- 3.3. Market Restrains

- 3.3.1. ; Inadequate Infrastructure

- 3.4. Market Trends

- 3.4.1. Application in Automotive to Account for a Significant Share in APAC

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global RFID Investment Opportunities in APAC Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. RFID Tags

- 5.1.2. Readers

- 5.1.3. Antennas

- 5.1.4. RFID Software and Middleware Services

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Retail & Consumer Goods

- 5.2.2. Asset Tracking

- 5.2.3. Banking and Finance

- 5.2.4. Automotive

- 5.2.5. Manufacturing

- 5.2.6. Healthcare & Medical

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America RFID Investment Opportunities in APAC Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. RFID Tags

- 6.1.2. Readers

- 6.1.3. Antennas

- 6.1.4. RFID Software and Middleware Services

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Retail & Consumer Goods

- 6.2.2. Asset Tracking

- 6.2.3. Banking and Finance

- 6.2.4. Automotive

- 6.2.5. Manufacturing

- 6.2.6. Healthcare & Medical

- 6.2.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America RFID Investment Opportunities in APAC Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. RFID Tags

- 7.1.2. Readers

- 7.1.3. Antennas

- 7.1.4. RFID Software and Middleware Services

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Retail & Consumer Goods

- 7.2.2. Asset Tracking

- 7.2.3. Banking and Finance

- 7.2.4. Automotive

- 7.2.5. Manufacturing

- 7.2.6. Healthcare & Medical

- 7.2.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe RFID Investment Opportunities in APAC Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. RFID Tags

- 8.1.2. Readers

- 8.1.3. Antennas

- 8.1.4. RFID Software and Middleware Services

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Retail & Consumer Goods

- 8.2.2. Asset Tracking

- 8.2.3. Banking and Finance

- 8.2.4. Automotive

- 8.2.5. Manufacturing

- 8.2.6. Healthcare & Medical

- 8.2.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa RFID Investment Opportunities in APAC Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. RFID Tags

- 9.1.2. Readers

- 9.1.3. Antennas

- 9.1.4. RFID Software and Middleware Services

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Retail & Consumer Goods

- 9.2.2. Asset Tracking

- 9.2.3. Banking and Finance

- 9.2.4. Automotive

- 9.2.5. Manufacturing

- 9.2.6. Healthcare & Medical

- 9.2.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific RFID Investment Opportunities in APAC Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. RFID Tags

- 10.1.2. Readers

- 10.1.3. Antennas

- 10.1.4. RFID Software and Middleware Services

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Retail & Consumer Goods

- 10.2.2. Asset Tracking

- 10.2.3. Banking and Finance

- 10.2.4. Automotive

- 10.2.5. Manufacturing

- 10.2.6. Healthcare & Medical

- 10.2.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Jadaktech

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rasilant Technologies*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tsinghua Tongfang Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ceyon Technology

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yodobashi Camera Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ripro Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CHILITAG Technology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Perfect RFID

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EMW Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Jadaktech

List of Figures

- Figure 1: Global RFID Investment Opportunities in APAC Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America RFID Investment Opportunities in APAC Revenue (Million), by Product 2025 & 2033

- Figure 3: North America RFID Investment Opportunities in APAC Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America RFID Investment Opportunities in APAC Revenue (Million), by Application 2025 & 2033

- Figure 5: North America RFID Investment Opportunities in APAC Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America RFID Investment Opportunities in APAC Revenue (Million), by Country 2025 & 2033

- Figure 7: North America RFID Investment Opportunities in APAC Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America RFID Investment Opportunities in APAC Revenue (Million), by Product 2025 & 2033

- Figure 9: South America RFID Investment Opportunities in APAC Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America RFID Investment Opportunities in APAC Revenue (Million), by Application 2025 & 2033

- Figure 11: South America RFID Investment Opportunities in APAC Revenue Share (%), by Application 2025 & 2033

- Figure 12: South America RFID Investment Opportunities in APAC Revenue (Million), by Country 2025 & 2033

- Figure 13: South America RFID Investment Opportunities in APAC Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe RFID Investment Opportunities in APAC Revenue (Million), by Product 2025 & 2033

- Figure 15: Europe RFID Investment Opportunities in APAC Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe RFID Investment Opportunities in APAC Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe RFID Investment Opportunities in APAC Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe RFID Investment Opportunities in APAC Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe RFID Investment Opportunities in APAC Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa RFID Investment Opportunities in APAC Revenue (Million), by Product 2025 & 2033

- Figure 21: Middle East & Africa RFID Investment Opportunities in APAC Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa RFID Investment Opportunities in APAC Revenue (Million), by Application 2025 & 2033

- Figure 23: Middle East & Africa RFID Investment Opportunities in APAC Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East & Africa RFID Investment Opportunities in APAC Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa RFID Investment Opportunities in APAC Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific RFID Investment Opportunities in APAC Revenue (Million), by Product 2025 & 2033

- Figure 27: Asia Pacific RFID Investment Opportunities in APAC Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific RFID Investment Opportunities in APAC Revenue (Million), by Application 2025 & 2033

- Figure 29: Asia Pacific RFID Investment Opportunities in APAC Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific RFID Investment Opportunities in APAC Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific RFID Investment Opportunities in APAC Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Product 2020 & 2033

- Table 17: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Product 2020 & 2033

- Table 29: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Product 2020 & 2033

- Table 38: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Application 2020 & 2033

- Table 39: Global RFID Investment Opportunities in APAC Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific RFID Investment Opportunities in APAC Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the RFID Investment Opportunities in APAC?

The projected CAGR is approximately 6.68%.

2. Which companies are prominent players in the RFID Investment Opportunities in APAC?

Key companies in the market include Jadaktech, Rasilant Technologies*List Not Exhaustive, Tsinghua Tongfang Co Ltd, Ceyon Technology, Yodobashi Camera Co Ltd, Ripro Corporation, CHILITAG Technology, Perfect RFID, EMW Co Ltd.

3. What are the main segments of the RFID Investment Opportunities in APAC?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.11 Million as of 2022.

5. What are some drivers contributing to market growth?

; Rapid Adoption Of The Technology In Various Sectors; High Return On Investment.

6. What are the notable trends driving market growth?

Application in Automotive to Account for a Significant Share in APAC.

7. Are there any restraints impacting market growth?

; Inadequate Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "RFID Investment Opportunities in APAC," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the RFID Investment Opportunities in APAC report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the RFID Investment Opportunities in APAC?

To stay informed about further developments, trends, and reports in the RFID Investment Opportunities in APAC, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence