Key Insights

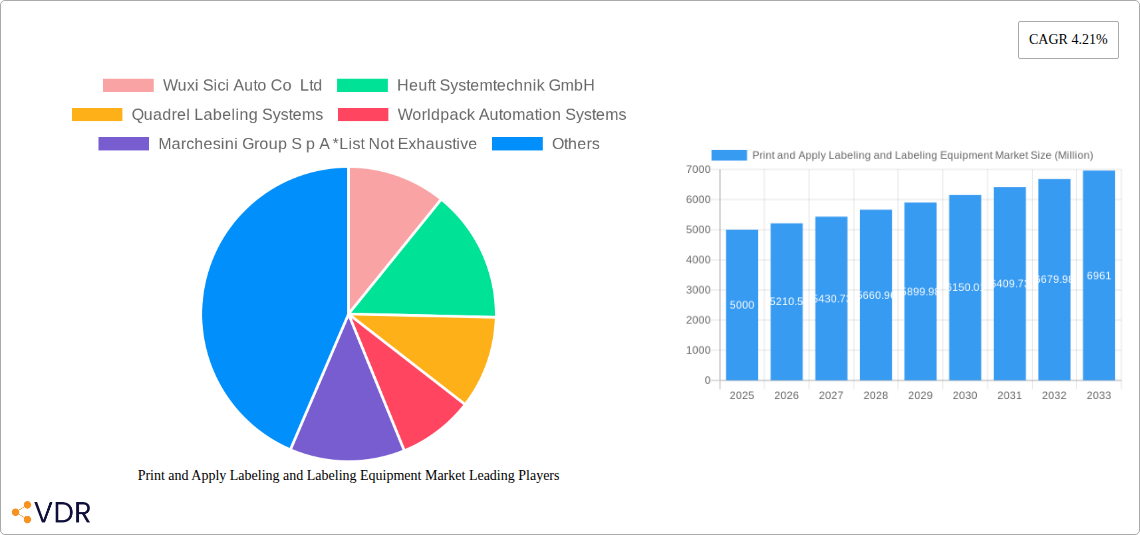

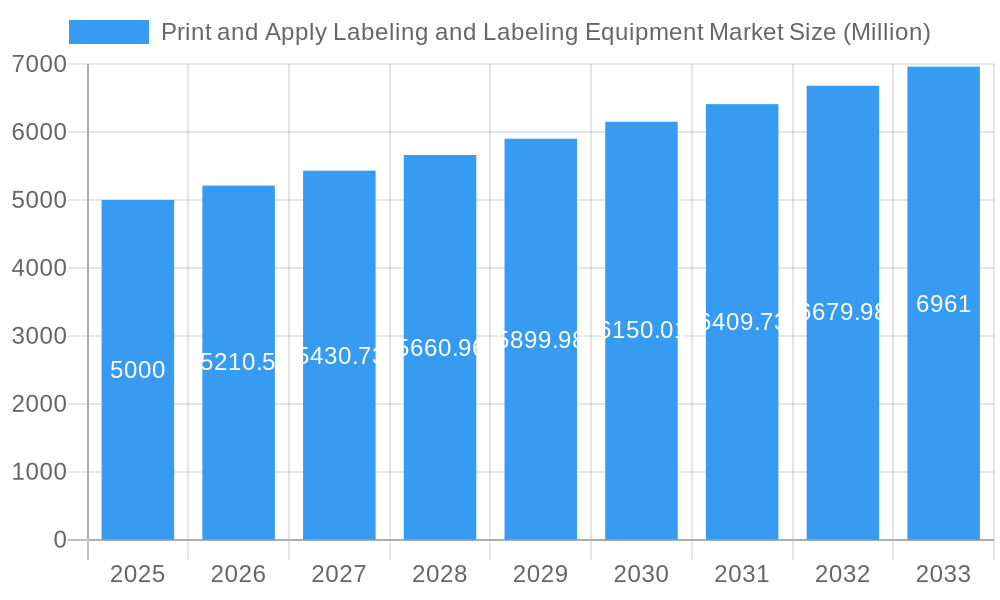

The global Print and Apply Labeling and Labeling Equipment market, valued at $5.00 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.21% from 2025 to 2033. This expansion is driven by several key factors. The rising demand for automated and efficient packaging solutions across diverse industries, particularly food and beverages, pharmaceuticals, and personal care, is a primary catalyst. Consumer preference for attractive and informative product labels, coupled with stringent regulatory requirements for accurate labeling, fuels this market's growth. Technological advancements in labeling equipment, such as the integration of advanced sensors, improved print quality, and enhanced automation capabilities, are further enhancing efficiency and productivity, thereby boosting market adoption. Growth is also propelled by the increasing adoption of pressure-sensitive and shrink sleeve labels offering superior aesthetics and product protection compared to traditional glue-based labels. However, high initial investment costs associated with advanced labeling equipment and the potential for technological obsolescence could act as restraining forces. The market segmentation reveals a dynamic landscape, with automatic labeling systems commanding the highest market share due to their enhanced efficiency and productivity. Geographically, North America and Europe are expected to hold significant market share due to established manufacturing bases and high consumer demand. However, rapidly developing economies in Asia-Pacific are poised for substantial growth, driven by increasing industrialization and rising consumer spending. The competitive landscape is characterized by a mix of established global players and regional manufacturers, resulting in a dynamic and innovative environment.

Print and Apply Labeling and Labeling Equipment Market Market Size (In Billion)

The future trajectory of the Print and Apply Labeling and Labeling Equipment market hinges on several factors. Continued technological innovations, particularly in areas such as digital printing and smart labeling solutions, will significantly impact market growth. The increasing focus on sustainability and environmentally friendly labeling materials will further shape market trends. Growing e-commerce activity and the consequent rise in demand for efficient packaging and labeling solutions will further bolster market growth. Moreover, shifts in consumer preferences, regulatory changes, and the economic landscape of different regions will continue to influence the market's trajectory. Companies focusing on R&D, strategic partnerships, and targeted market expansion strategies are best positioned for success in this competitive and dynamic market.

Print and Apply Labeling and Labeling Equipment Market Company Market Share

Print and Apply Labeling and Labeling Equipment Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Print and Apply Labeling and Labeling Equipment market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report segments the market by technology (Automatic, Semi-automatic, Manual), label type (Pressure Sensitive/Self-Adhesive, Shrink Sleeve, Glue Based, In-Mold, and Others), and end-user vertical (Pharmaceutical, Food and Beverages, Personal Care and Household Care, and Others). The market size is valued in Million units.

Print and Apply Labeling and Labeling Equipment Market Dynamics & Structure

The Print and Apply Labeling and Labeling Equipment market is characterized by a moderately consolidated structure with several major players competing alongside numerous smaller niche players. Technological innovation, particularly in automation and smart labeling solutions, is a key driver. Stringent regulatory frameworks concerning product labeling and traceability across various industries significantly impact market growth. Competitive pressure from substitute technologies (e.g., digital printing techniques) and changing end-user demographics (e.g., increasing demand for sustainable packaging) also shape market dynamics. The market has witnessed several mergers and acquisitions (M&A) in recent years, aiming to expand product portfolios and geographical reach.

- Market Concentration: Moderately consolidated, with a few dominant players holding xx% market share in 2025.

- Technological Innovation: High, driven by automation, smart labeling, and improved application techniques.

- Regulatory Frameworks: Significant impact, requiring compliance with industry-specific labeling regulations.

- M&A Activity: Moderate, with xx deals recorded between 2019 and 2024, primarily focused on expansion and technology acquisition.

- Innovation Barriers: High initial investment costs for advanced technologies and the need for skilled workforce.

Print and Apply Labeling and Labeling Equipment Market Growth Trends & Insights

The Print and Apply Labeling and Labeling Equipment market has experienced robust growth over the historical period (2019-2024), driven by rising demand across various end-user verticals. The market size is estimated at xx Million units in 2025. The adoption rate of automatic labeling systems is increasing steadily, propelled by the need for enhanced efficiency and reduced labor costs. Technological disruptions, such as the integration of digital printing and smart sensors, are reshaping the market landscape. Consumer preference for enhanced product information and brand experiences is further driving innovation. The market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated xx Million units by 2033. Market penetration of advanced labeling technologies is expected to increase significantly, particularly in developing economies.

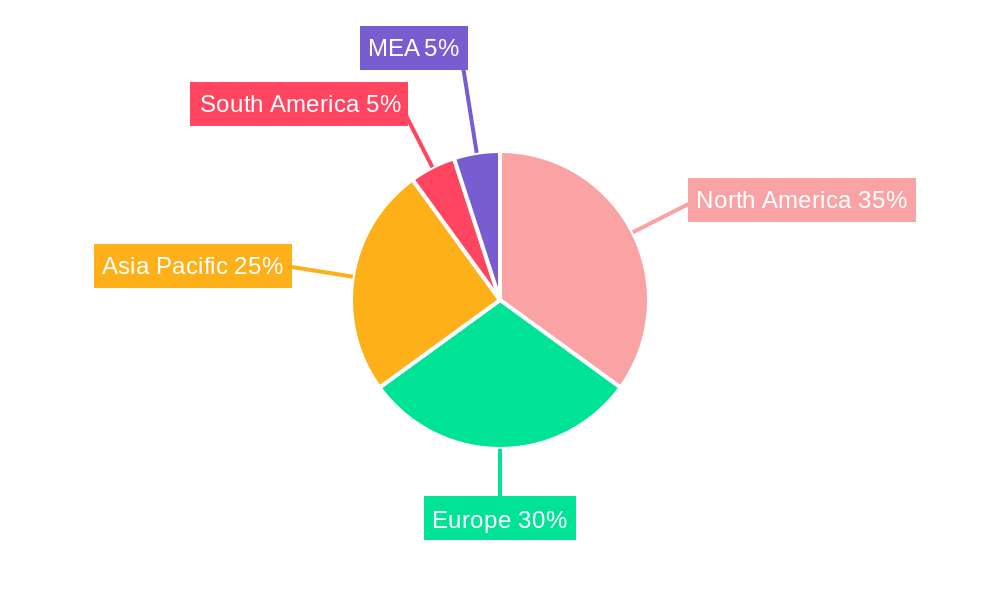

Dominant Regions, Countries, or Segments in Print and Apply Labeling and Labeling Equipment Market

The North American and European regions currently dominate the Print and Apply Labeling and Labeling Equipment market, driven by established manufacturing sectors and robust regulatory frameworks. However, the Asia-Pacific region is projected to witness the fastest growth in the forecast period due to expanding industrialization and increasing consumer spending.

By Technology: The Automatic segment holds the largest market share, driven by efficiency gains and reduced labor costs.

By Type: Pressure Sensitive/Self-Adhesive labels represent the dominant segment due to their versatility and cost-effectiveness.

By End-user Vertical: The Food and Beverages industry is the leading end-user segment owing to its high volume production requirements and stringent labeling regulations.

- Key Drivers (Asia-Pacific): Rapid industrialization, rising disposable incomes, and supportive government policies promoting manufacturing.

- Dominance Factors (North America & Europe): Established manufacturing base, high adoption of automation, and stringent regulatory standards.

- Growth Potential (Asia-Pacific): Significant, driven by increasing demand from emerging economies and the adoption of advanced labeling technologies.

Print and Apply Labeling and Labeling Equipment Market Product Landscape

The Print and Apply Labeling and Labeling Equipment market offers a wide range of solutions, from basic manual applicators to highly automated systems integrated with digital printing capabilities. Recent product innovations include improved accuracy, increased speed, enhanced operator safety features, and more sustainable materials. Unique selling propositions (USPs) include superior print quality, reduced downtime, and improved traceability. The integration of advanced sensors and data analytics is enhancing the overall efficiency and productivity of labeling processes.

Key Drivers, Barriers & Challenges in Print and Apply Labeling and Labeling Equipment Market

Key Drivers:

- Increasing demand for efficient and cost-effective packaging solutions across various industries.

- Growing need for enhanced product traceability and brand security.

- Stringent government regulations concerning labeling accuracy and compliance.

- Technological advancements in labeling technologies, including automation and digital printing.

Challenges & Restraints:

- High initial investment costs associated with advanced labeling equipment.

- Complexity in integrating new technologies into existing production lines.

- Fluctuations in raw material prices and supply chain disruptions.

- Intense competition among established players and the emergence of new entrants. This competition could potentially lead to price wars impacting profit margins by up to xx%.

Emerging Opportunities in Print and Apply Labeling and Labeling Equipment Market

- Growing demand for sustainable and eco-friendly labeling materials.

- Increasing adoption of smart packaging and connected labeling solutions.

- Expansion into niche markets, such as personalized labeling and high-value products.

- Development of innovative labeling solutions for emerging applications, such as pharmaceutical serialization and e-commerce fulfillment.

Growth Accelerators in the Print and Apply Labeling and Labeling Equipment Market Industry

Long-term growth in the Print and Apply Labeling and Labeling Equipment market will be driven by continuous technological innovation, strategic collaborations between equipment manufacturers and packaging material suppliers, and the expansion into new and emerging markets. The development of cost-effective and efficient automation solutions will further accelerate market growth. The increasing focus on sustainable and eco-friendly labeling solutions will also present significant growth opportunities.

Key Players Shaping the Print and Apply Labeling and Labeling Equipment Market Market

- Wuxi Sici Auto Co Ltd

- Heuft Systemtechnik GmbH

- Quadrel Labeling Systems

- Worldpack Automation Systems

- Marchesini Group S p A

- Kunshan Bojin Trading Co Ltd

- CECLE Machine

- Axon LLC

- HERMA GmbH

- SIDEL (Tetra Laval Group)

- PDC International Corporation

- Novexx Solutions GmbH

- Weber Marking Systems GmbH

- Sacmi Imola S C

- KHS GmbH

- Etiquette Labels Ltd

Notable Milestones in Print and Apply Labeling and Labeling Equipment Market Sector

- August 2023: Axon LLC showcased the Aurora® 5.0 shrink sleeve and tamper band applicator at Pack Expo Las Vegas, highlighting advancements in speed and operator safety (up to 500 containers per minute).

- February 2023: Sidel acquired Makro Labelling, expanding its labeling equipment portfolio and capabilities (up to five products per bottle).

In-Depth Print and Apply Labeling and Labeling Equipment Market Market Outlook

The Print and Apply Labeling and Labeling Equipment market is poised for continued growth, driven by the factors outlined above. Strategic partnerships, technological advancements, and expansion into new markets will unlock significant future potential. Companies focusing on innovation, sustainability, and customized solutions will be best positioned to capitalize on emerging opportunities. The market's long-term outlook is positive, with significant potential for expansion in various segments and regions.

Print and Apply Labeling and Labeling Equipment Market Segmentation

-

1. Technology

- 1.1. Automatic

- 1.2. Semi-automatic

- 1.3. Manual

-

2. Type

- 2.1. Pressure Sensitive/Self-Adhesive Label

- 2.2. Shrink Sleeve Label

- 2.3. Glue Based Label

- 2.4. In-mold Label and Other Types

-

3. End-user Vertical

- 3.1. Pharmaceutical

- 3.2. Food and Beverages

- 3.3. Personal Care and Household Care

- 3.4. Other End-user Verticals

Print and Apply Labeling and Labeling Equipment Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Print and Apply Labeling and Labeling Equipment Market Regional Market Share

Geographic Coverage of Print and Apply Labeling and Labeling Equipment Market

Print and Apply Labeling and Labeling Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of Digital Printing technology and Automatic Labeling Machine; Increasing Demand for Automation in Food and Beverage Packaging

- 3.3. Market Restrains

- 3.3.1. High Competition from Substitute Packaging Solutions; Improved Technology Offering Better Solutions

- 3.4. Market Trends

- 3.4.1. Food and Beverages Sector to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Print and Apply Labeling and Labeling Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Automatic

- 5.1.2. Semi-automatic

- 5.1.3. Manual

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Pressure Sensitive/Self-Adhesive Label

- 5.2.2. Shrink Sleeve Label

- 5.2.3. Glue Based Label

- 5.2.4. In-mold Label and Other Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Pharmaceutical

- 5.3.2. Food and Beverages

- 5.3.3. Personal Care and Household Care

- 5.3.4. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Print and Apply Labeling and Labeling Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Automatic

- 6.1.2. Semi-automatic

- 6.1.3. Manual

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Pressure Sensitive/Self-Adhesive Label

- 6.2.2. Shrink Sleeve Label

- 6.2.3. Glue Based Label

- 6.2.4. In-mold Label and Other Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Pharmaceutical

- 6.3.2. Food and Beverages

- 6.3.3. Personal Care and Household Care

- 6.3.4. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Print and Apply Labeling and Labeling Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Automatic

- 7.1.2. Semi-automatic

- 7.1.3. Manual

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Pressure Sensitive/Self-Adhesive Label

- 7.2.2. Shrink Sleeve Label

- 7.2.3. Glue Based Label

- 7.2.4. In-mold Label and Other Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Pharmaceutical

- 7.3.2. Food and Beverages

- 7.3.3. Personal Care and Household Care

- 7.3.4. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Print and Apply Labeling and Labeling Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Automatic

- 8.1.2. Semi-automatic

- 8.1.3. Manual

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Pressure Sensitive/Self-Adhesive Label

- 8.2.2. Shrink Sleeve Label

- 8.2.3. Glue Based Label

- 8.2.4. In-mold Label and Other Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Pharmaceutical

- 8.3.2. Food and Beverages

- 8.3.3. Personal Care and Household Care

- 8.3.4. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Print and Apply Labeling and Labeling Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Automatic

- 9.1.2. Semi-automatic

- 9.1.3. Manual

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Pressure Sensitive/Self-Adhesive Label

- 9.2.2. Shrink Sleeve Label

- 9.2.3. Glue Based Label

- 9.2.4. In-mold Label and Other Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Pharmaceutical

- 9.3.2. Food and Beverages

- 9.3.3. Personal Care and Household Care

- 9.3.4. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Print and Apply Labeling and Labeling Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Automatic

- 10.1.2. Semi-automatic

- 10.1.3. Manual

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Pressure Sensitive/Self-Adhesive Label

- 10.2.2. Shrink Sleeve Label

- 10.2.3. Glue Based Label

- 10.2.4. In-mold Label and Other Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Pharmaceutical

- 10.3.2. Food and Beverages

- 10.3.3. Personal Care and Household Care

- 10.3.4. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Wuxi Sici Auto Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Heuft Systemtechnik GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Quadrel Labeling Systems

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Worldpack Automation Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Marchesini Group S p A *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kunshan Bojin Trading Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CECLE Machine

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Axon LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HERMA GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SIDEL (Tetra Laval Group)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PDC International Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Novexx Solutions GmbH

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Weber Marking Systems GmbH

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sacmi Imola S C

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 KHS GmbH

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Etiquette Labels Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Wuxi Sici Auto Co Ltd

List of Figures

- Figure 1: Global Print and Apply Labeling and Labeling Equipment Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 7: North America Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by Technology 2025 & 2033

- Figure 11: Europe Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 15: Europe Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Europe Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by Technology 2025 & 2033

- Figure 19: Asia Pacific Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Asia Pacific Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Pacific Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Asia Pacific Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Asia Pacific Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by Technology 2025 & 2033

- Figure 27: Latin America Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Latin America Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 29: Latin America Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Latin America Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 31: Latin America Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Latin America Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by Technology 2025 & 2033

- Figure 35: Middle East and Africa Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by Technology 2025 & 2033

- Figure 36: Middle East and Africa Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 37: Middle East and Africa Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 39: Middle East and Africa Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Middle East and Africa Print and Apply Labeling and Labeling Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Print and Apply Labeling and Labeling Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 16: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 18: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 20: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 22: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 24: Global Print and Apply Labeling and Labeling Equipment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Print and Apply Labeling and Labeling Equipment Market?

The projected CAGR is approximately 4.21%.

2. Which companies are prominent players in the Print and Apply Labeling and Labeling Equipment Market?

Key companies in the market include Wuxi Sici Auto Co Ltd, Heuft Systemtechnik GmbH, Quadrel Labeling Systems, Worldpack Automation Systems, Marchesini Group S p A *List Not Exhaustive, Kunshan Bojin Trading Co Ltd, CECLE Machine, Axon LLC, HERMA GmbH, SIDEL (Tetra Laval Group), PDC International Corporation, Novexx Solutions GmbH, Weber Marking Systems GmbH, Sacmi Imola S C, KHS GmbH, Etiquette Labels Ltd.

3. What are the main segments of the Print and Apply Labeling and Labeling Equipment Market?

The market segments include Technology, Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.00 Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of Digital Printing technology and Automatic Labeling Machine; Increasing Demand for Automation in Food and Beverage Packaging.

6. What are the notable trends driving market growth?

Food and Beverages Sector to Hold Major Market Share.

7. Are there any restraints impacting market growth?

High Competition from Substitute Packaging Solutions; Improved Technology Offering Better Solutions.

8. Can you provide examples of recent developments in the market?

August 2023 - Axon, a provider of innovative shrink sleeve and tamper band applicator solutions, is excited to return to Pack Expo Las Vegas, Where Axon will showcase the Aurora® 5.0, a game-changing applicator for sleeves and tamper-evident bands. The new Aurora 5.0 can perform four different shrink applications, plus it is ergonomically designed for operator safety with enhanced standard guarding and lightweight tooling. Aurora 5.0 applicators provide reliable, steady-state production at speeds up to 500 containers per minute.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Print and Apply Labeling and Labeling Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Print and Apply Labeling and Labeling Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Print and Apply Labeling and Labeling Equipment Market?

To stay informed about further developments, trends, and reports in the Print and Apply Labeling and Labeling Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence