Key Insights

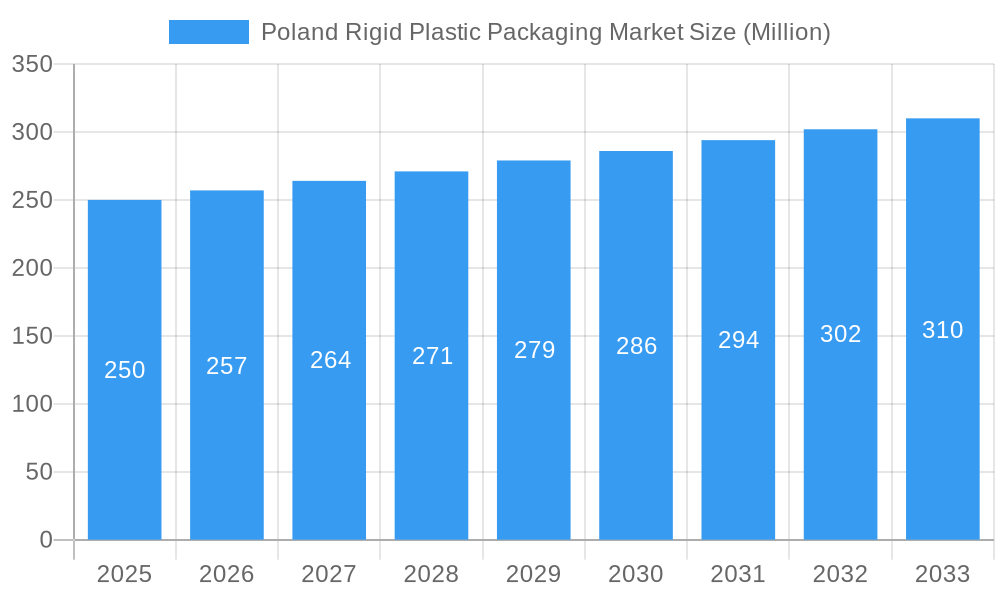

The Poland rigid plastic packaging market, valued at approximately 220.2 billion in 2025, is forecast to reach €320 million by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 3.6%. This expansion is driven by the robust growth of e-commerce, demanding efficient and protective packaging solutions. The increasing consumer preference for lightweight, durable, and recyclable plastics, alongside the significant contributions of Poland's food and beverage sector, further fuels demand. Key challenges include raw material price volatility and regulations targeting plastic waste reduction. The competitive environment features major international corporations and agile domestic firms, fostering dynamic pricing and innovation. Strategic imperatives for market leaders include prioritizing sustainable materials, advanced packaging designs, and optimized supply chain management.

Poland Rigid Plastic Packaging Market Market Size (In Billion)

Market segmentation is anticipated to be dominated by food and beverage applications, followed by consumer goods and industrial packaging. Urban centers are expected to lead regional growth due to higher consumption and advanced retail access. The competitive landscape is characterized by strategic consolidation and localized innovation, resulting in a broad spectrum of packaging solutions catering to Polish businesses and consumers. Differentiating factors for market participants will likely include value-added services like bespoke packaging and streamlined logistics.

Poland Rigid Plastic Packaging Market Company Market Share

Poland Rigid Plastic Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Poland rigid plastic packaging market, covering market dynamics, growth trends, key players, and future outlook. With a focus on the parent market of packaging and the child market of rigid plastic packaging, this report is an essential resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. Market size is presented in Million units.

Poland Rigid Plastic Packaging Market Dynamics & Structure

The Poland rigid plastic packaging market exhibits a moderately concentrated structure, with several major players and numerous smaller regional operators. Technological innovation, particularly in sustainable and lightweight packaging solutions, is a significant driver. Stringent regulatory frameworks concerning plastic waste management and recyclability are shaping market dynamics, alongside growing consumer demand for eco-friendly options. Competitive substitutes, including alternative materials like glass and paper-based packaging, pose a challenge. The market is segmented by product type (bottles, containers, etc.), end-use industry (food & beverage, pharmaceuticals, etc.), and material type. M&A activity has been moderate in recent years, with a projected xx deals completed between 2019 and 2024.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on lightweighting, recyclability, and barrier properties.

- Regulatory Framework: Stringent regulations on plastic waste and recyclability are driving innovation and investment in sustainable packaging.

- Competitive Substitutes: Growing competition from alternative materials like glass and paper-based packaging.

- End-User Demographics: Shifting consumer preferences towards sustainable and convenient packaging options.

- M&A Trends: Moderate M&A activity, with xx deals projected between 2019-2024.

Poland Rigid Plastic Packaging Market Growth Trends & Insights

The Poland rigid plastic packaging market experienced substantial growth during the historical period (2019-2024), driven by factors such as rising consumer spending, increasing demand from various end-use industries, and technological advancements. The market size witnessed a Compound Annual Growth Rate (CAGR) of xx% during this period, reaching xx million units in 2024. The forecast period (2025-2033) anticipates continued growth, with a projected CAGR of xx%, driven by increasing demand for packaged goods, the rise of e-commerce, and the adoption of innovative packaging technologies. Market penetration of sustainable rigid plastic packaging is expected to increase from xx% in 2024 to xx% by 2033. Consumer behavior shifts towards convenience and sustainability will further fuel market expansion.

Dominant Regions, Countries, or Segments in Poland Rigid Plastic Packaging Market

The food and beverage sector dominates the Poland rigid plastic packaging market, accounting for approximately xx% of total demand in 2024. This dominance is fueled by the country's robust food processing and beverage industries, along with strong consumer demand for packaged food and beverages. Major urban centers in Poland exhibit higher market penetration due to higher population density and greater consumption of packaged goods. Government initiatives promoting domestic manufacturing and sustainable packaging also influence regional growth disparities.

Key Drivers:

- Strong food and beverage industry.

- High consumer spending on packaged goods.

- Urbanization and increased consumption in major cities.

- Government support for domestic manufacturing and sustainable packaging.

Dominance Factors: High market share of food & beverage segment; increased demand from urban areas; government policies.

Poland Rigid Plastic Packaging Market Product Landscape

The Polish market offers a diverse range of rigid plastic packaging products, including bottles, jars, tubs, and containers, catering to various end-use applications. Innovation focuses on enhancing barrier properties, improving recyclability, and reducing the environmental impact. Lightweight designs, improved material formulations, and innovative closure systems are key product differentiators. The market is seeing a rise in products made from recycled materials and those featuring innovative features, such as tamper-evident seals and enhanced product visibility.

Key Drivers, Barriers & Challenges in Poland Rigid Plastic Packaging Market

Key Drivers: Growing consumer demand, increasing consumption of packaged goods, expansion of the food and beverage industry, and government support for domestic manufacturing. Technological advancements driving innovation in sustainable packaging materials also present a key driver.

Challenges: Fluctuations in raw material prices, increasing environmental regulations, growing concerns over plastic waste, and competition from alternative packaging materials pose significant challenges. Supply chain disruptions also present a considerable barrier.

Emerging Opportunities in Poland Rigid Plastic Packaging Market

Emerging opportunities lie in the growing demand for sustainable and eco-friendly packaging options. The market for recyclable and biodegradable rigid plastic packaging is expected to expand significantly. Opportunities also exist in specialized packaging solutions for niche products and e-commerce, along with increasing demand for customized and personalized packaging solutions.

Growth Accelerators in the Poland Rigid Plastic Packaging Market Industry

Technological advancements in materials science, particularly in bioplastics and recycled content, are key growth catalysts. Strategic partnerships between packaging manufacturers and brand owners are promoting innovation and sustainable practices. Government initiatives aimed at reducing plastic waste and supporting the circular economy are also contributing to long-term market growth. Expansion into new markets, such as personal care and cosmetics, presents further growth opportunities.

Key Players Shaping the Poland Rigid Plastic Packaging Market Market

- Alpla Group

- Berry Global Inc

- Sonoco Products Company

- PLASTAN KACPRZYK SP Z OO SP K

- PetRing Packaging

- BECH PACKAGING SP Z OO

- Masterchem Logoplaste Sp Z OO

- POLIMER SP Z OO

Notable Milestones in Poland Rigid Plastic Packaging Market Sector

- September 2024: RYNA Juice celebrates one year of its cold-pressed juice launch in Poland, increasing demand for premium rigid plastic packaging.

- August 2023: Coca-Cola Poland and Baltics implement new tethered bottle caps, aligning with EU single-use plastic regulations and boosting recycling rates.

In-Depth Poland Rigid Plastic Packaging Market Market Outlook

The future of the Poland rigid plastic packaging market looks promising, driven by sustained growth in consumer demand, technological advancements, and increased focus on sustainability. Strategic investments in research and development, coupled with the adoption of innovative packaging solutions, will drive long-term growth. Opportunities exist for companies that can effectively address sustainability concerns, offer innovative packaging solutions, and develop strong relationships with key stakeholders in the supply chain.

Poland Rigid Plastic Packaging Market Segmentation

-

1. Product Type

- 1.1. Bottles and Jars

- 1.2. Trays and Containers

- 1.3. Caps and Closures

- 1.4. Intermediate Bulk Containers (IBCs)

- 1.5. Drums

- 1.6. Pallets

- 1.7. Other Product Types

-

2. Material

-

2.1. Polyethylene (PE)

- 2.1.1. LDPE & LLDPE

- 2.1.2. HDPE

- 2.2. Polyethylene Terephthalate (PET)

- 2.3. Polypropylene (PP)

- 2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 2.5. Polyvinyl chloride (PVC)

- 2.6. Other Rigid Plastic Packaging Materials

-

2.1. Polyethylene (PE)

-

3. End-Use Industries

-

3.1. Food**

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Food Products

-

3.2. Foodservice**

- 3.2.1. Quick Service Restaurants (QSRs)

- 3.2.2. Full-Service Restaurants (FSRs)

- 3.2.3. Coffee and Snack Outlets

- 3.2.4. Retail Establishments

- 3.2.5. Institutional

- 3.2.6. Hospitality

- 3.2.7. Other Foodservice End Uses

- 3.3. Beverage

- 3.4. Healthcare

- 3.5. Cosmetics and Personal Care

- 3.6. Industrial

- 3.7. Building and Construction

- 3.8. Automotive

- 3.9. Other En

-

3.1. Food**

Poland Rigid Plastic Packaging Market Segmentation By Geography

- 1. Poland

Poland Rigid Plastic Packaging Market Regional Market Share

Geographic Coverage of Poland Rigid Plastic Packaging Market

Poland Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. End-user Industries such as Food Industry to Dominate the Market; Demand for Convenient and Affordable Packaging

- 3.3. Market Restrains

- 3.3.1. End-user Industries such as Food Industry to Dominate the Market; Demand for Convenient and Affordable Packaging

- 3.4. Market Trends

- 3.4.1. Plastic Resin Processing in the Country Fuels Market Expansion

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bottles and Jars

- 5.1.2. Trays and Containers

- 5.1.3. Caps and Closures

- 5.1.4. Intermediate Bulk Containers (IBCs)

- 5.1.5. Drums

- 5.1.6. Pallets

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyethylene (PE)

- 5.2.1.1. LDPE & LLDPE

- 5.2.1.2. HDPE

- 5.2.2. Polyethylene Terephthalate (PET)

- 5.2.3. Polypropylene (PP)

- 5.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 5.2.5. Polyvinyl chloride (PVC)

- 5.2.6. Other Rigid Plastic Packaging Materials

- 5.2.1. Polyethylene (PE)

- 5.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 5.3.1. Food**

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Food Products

- 5.3.2. Foodservice**

- 5.3.2.1. Quick Service Restaurants (QSRs)

- 5.3.2.2. Full-Service Restaurants (FSRs)

- 5.3.2.3. Coffee and Snack Outlets

- 5.3.2.4. Retail Establishments

- 5.3.2.5. Institutional

- 5.3.2.6. Hospitality

- 5.3.2.7. Other Foodservice End Uses

- 5.3.3. Beverage

- 5.3.4. Healthcare

- 5.3.5. Cosmetics and Personal Care

- 5.3.6. Industrial

- 5.3.7. Building and Construction

- 5.3.8. Automotive

- 5.3.9. Other En

- 5.3.1. Food**

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Alpla Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Global Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sonoco Products Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PLASTAN KACPRZYK SP Z OO SP K

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PetRing Packaging

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BECH PACKAGING SP Z OO

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Masterchem Logoplaste Sp Z OO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 POLIMER SP Z OO8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Alpla Group

List of Figures

- Figure 1: Poland Rigid Plastic Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Poland Rigid Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Poland Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Poland Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: Poland Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 4: Poland Rigid Plastic Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Poland Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Poland Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: Poland Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 8: Poland Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Rigid Plastic Packaging Market?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the Poland Rigid Plastic Packaging Market?

Key companies in the market include Alpla Group, Berry Global Inc, Sonoco Products Company, PLASTAN KACPRZYK SP Z OO SP K, PetRing Packaging, BECH PACKAGING SP Z OO, Masterchem Logoplaste Sp Z OO, POLIMER SP Z OO8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Poland Rigid Plastic Packaging Market?

The market segments include Product Type, Material, End-Use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 220.2 billion as of 2022.

5. What are some drivers contributing to market growth?

End-user Industries such as Food Industry to Dominate the Market; Demand for Convenient and Affordable Packaging.

6. What are the notable trends driving market growth?

Plastic Resin Processing in the Country Fuels Market Expansion.

7. Are there any restraints impacting market growth?

End-user Industries such as Food Industry to Dominate the Market; Demand for Convenient and Affordable Packaging.

8. Can you provide examples of recent developments in the market?

September 2024 - RYNA Juice, a renowned vendor in the beverage industry, completed one year of the launch of its range of natural fruit juices in Poland and beyond. This initiative, started in September 2023, aims to redefine refreshment by capturing the true essence of nature's offerings. RYNA Juice is dedicated to preserving the genuine flavor of 100% organic fruits, removing any additives that could diminish their natural richness. While mass production is the norm, RYNA stands out by employing a cold-pressed method, ensuring the fruits' inherent nutrients and colors are preserved, resulting in a taste that echoes its origins. Such beverage launches would create opportunities for rigid plastic packaging products in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Poland Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence