Key Insights

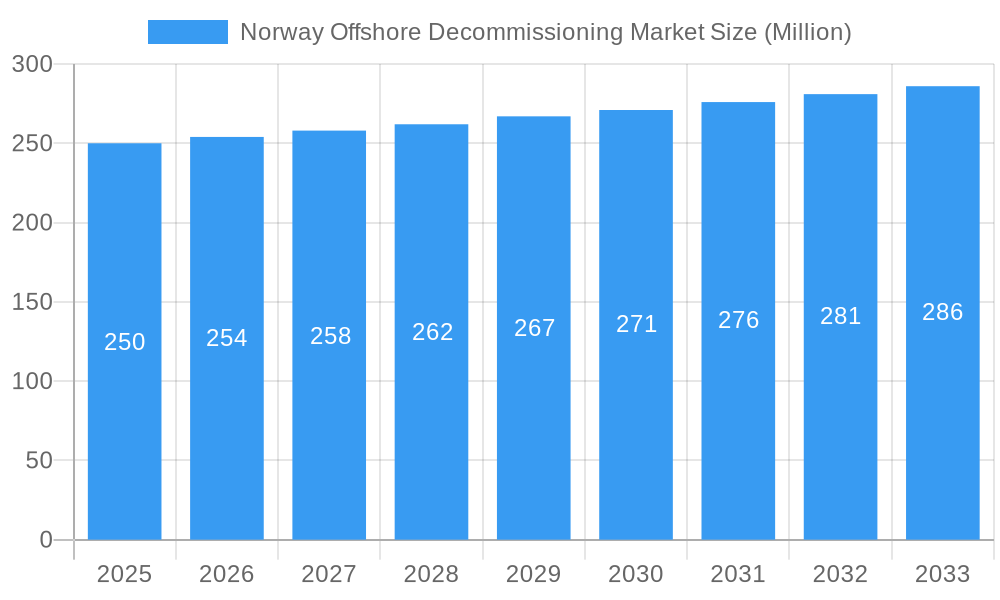

The Norway offshore decommissioning market, valued at approximately $250 million in 2025, is projected to experience robust growth, driven by a combination of factors. The aging infrastructure of the Norwegian Continental Shelf necessitates substantial decommissioning activities, creating a significant demand for well plugging and abandonment services, platform removal, and other related operations. Government regulations and environmental concerns further stimulate this market, pushing operators towards responsible and timely decommissioning. The market's segmentation highlights the prevalence of deepwater and ultra-deepwater projects, given Norway's extensive offshore oil and gas activities in these challenging environments. This requires specialized expertise and technology, increasing the overall project costs but also opening opportunities for technologically advanced companies. The involvement of key players like Equinor, Aker Solutions, and DNV GL underscores the market's maturity and the presence of established operators with strong decommissioning capabilities. The projected CAGR of over 1.5% suggests consistent growth through 2033, fueled by the continuous maturation of the existing offshore infrastructure and ongoing regulatory pressures. Further growth will be influenced by technological advancements in decommissioning techniques, including improved efficiency and reduced environmental impact.

Norway Offshore Decommissioning Market Market Size (In Million)

The market is segmented by service type (well plugging and abandonment holding the largest share), depth (deepwater and ultra-deepwater projects leading), and structure (topsides and substructure demanding different specialized skills and resources). While Norway is the primary focus, future growth could be influenced by regional collaboration and expertise sharing, possibly attracting international companies specializing in various aspects of decommissioning. The forecast period (2025-2033) will be significantly shaped by the successful implementation of innovative decommissioning strategies and the ability of service providers to meet the increasing demand for efficient and sustainable solutions. The long-term outlook remains positive, reflecting the long-term implications of the existing offshore infrastructure and the ongoing commitment to responsible decommissioning practices.

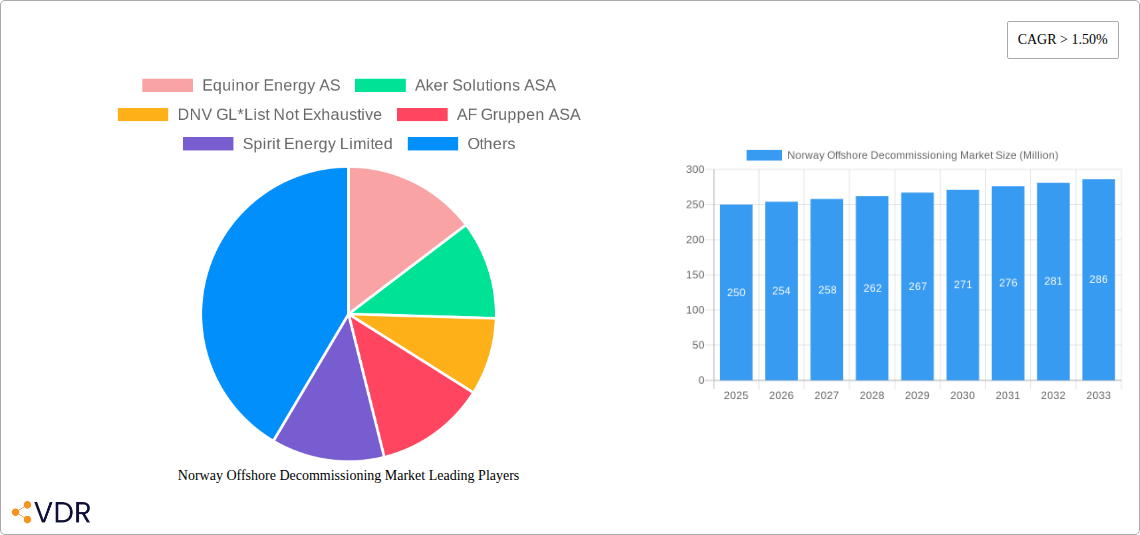

Norway Offshore Decommissioning Market Company Market Share

This comprehensive report provides a detailed analysis of the Norway offshore decommissioning market, covering the period 2019-2033. It offers in-depth insights into market dynamics, growth trends, dominant segments, key players, and emerging opportunities, equipping stakeholders with actionable intelligence for strategic decision-making. The report segments the market by service type (Well Plugging & Abandonment, Platform Removal, Others), water depth (Shallow, Deepwater, Ultra-Deepwater), and structure (Topsides, Substructure). The total market size is projected to reach xx Million by 2033.

Norway Offshore Decommissioning Market Market Dynamics & Structure

The Norway offshore decommissioning market is characterized by a moderately concentrated landscape, with key players like Equinor Energy AS, Aker Solutions ASA, and DNV GL holding significant market share. Technological innovation, particularly in robotics and remotely operated vehicles (ROVs), is a key driver, improving efficiency and safety. However, high decommissioning costs and stringent regulatory frameworks present challenges. The market is also influenced by M&A activity, with several companies consolidating their position.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025 (Estimated).

- Technological Innovation: Focus on automation, ROVs, and advanced dismantling techniques driving efficiency gains.

- Regulatory Framework: Stringent environmental regulations and safety standards impacting project costs and timelines.

- Competitive Substitutes: Limited direct substitutes, but alternative approaches to waste management and material recycling are emerging.

- End-User Demographics: Primarily comprised of oil and gas operators, with increasing involvement of specialized decommissioning contractors.

- M&A Trends: Moderate M&A activity observed during the historical period (2019-2024), with xx major deals recorded. The forecast period (2025-2033) anticipates xx-xx more deals driven by cost optimization and expertise consolidation.

Norway Offshore Decommissioning Market Growth Trends & Insights

The Norway offshore decommissioning market witnessed significant growth during the historical period (2019-2024), driven by aging offshore infrastructure and increasing regulatory pressure. The market size expanded from xx Million in 2019 to xx Million in 2024, exhibiting a CAGR of xx%. This growth trajectory is expected to continue during the forecast period (2025-2033), reaching xx Million by 2033, driven by an increasing number of aging platforms requiring decommissioning and technological advancements leading to increased efficiency and reduced costs. The market penetration rate of advanced decommissioning technologies is expected to increase from xx% in 2025 to xx% by 2033. Adoption is primarily driven by cost savings and environmental compliance. The market growth also hinges on governmental policies promoting sustainable decommissioning practices and attracting foreign investment.

Dominant Regions, Countries, or Segments in Norway Offshore Decommissioning Market

The Norwegian North Sea region dominates the market, primarily due to its high concentration of aging offshore oil and gas infrastructure. The Deepwater segment exhibits the highest growth potential due to the complexity and cost associated with decommissioning deepwater installations, necessitating specialized expertise and advanced technologies. Within services, Platform Removal commands a larger market share due to the scale and complexity involved.

- Dominant Region: Norwegian North Sea.

- Key Drivers: High concentration of aging offshore platforms, stringent environmental regulations, and government support for sustainable decommissioning.

- Growth Potential: Deepwater and Ultra-Deepwater segments hold the highest growth potential due to the high complexity and cost.

- Market Share: Platform Removal holds the largest market share among services, followed by Well Plugging & Abandonment.

Norway Offshore Decommissioning Market Product Landscape

The market is characterized by a range of specialized services and technologies, including advanced robotics, remotely operated vehicles (ROVs), and innovative dismantling techniques. These advancements focus on improving efficiency, minimizing environmental impact, and enhancing worker safety. Key selling propositions include reduced decommissioning timeframes, cost optimization, and environmentally responsible disposal methods.

Key Drivers, Barriers & Challenges in Norway Offshore Decommissioning Market

Key Drivers: Aging infrastructure requiring decommissioning, stringent environmental regulations, and government incentives promoting sustainable practices.

Key Challenges: High decommissioning costs, technological limitations in handling complex structures, and potential supply chain disruptions. Regulatory hurdles and skilled labor shortages also present significant challenges, potentially delaying projects and increasing costs by an estimated xx%.

Emerging Opportunities in Norway Offshore Decommissioning Market

Untapped opportunities exist in developing and deploying more efficient decommissioning technologies. The integration of AI and machine learning could significantly enhance decision-making and optimization. Further, innovative recycling and reuse approaches for decommissioned materials present significant environmental and economic opportunities.

Growth Accelerators in the Norway Offshore Decommissioning Market Industry

Technological advancements, particularly in robotics and AI, are key growth accelerators. Strategic partnerships between oil and gas operators, decommissioning contractors, and technology providers are also crucial in streamlining operations and reducing costs. Furthermore, government policies promoting sustainable decommissioning and attracting foreign investment significantly contribute to the industry's growth.

Key Players Shaping the Norway Offshore Decommissioning Market Market

- Equinor Energy AS

- Aker Solutions ASA

- DNV GL

- AF Gruppen ASA

- Spirit Energy Limited

Notable Milestones in Norway Offshore Decommissioning Market Sector

- 2021: Introduction of new regulations on waste management during decommissioning.

- 2022: Successful completion of a major platform removal project using advanced robotic technology.

- 2023: Significant investment in R&D for innovative decommissioning solutions.

In-Depth Norway Offshore Decommissioning Market Market Outlook

The Norway offshore decommissioning market is poised for robust growth in the coming years, driven by the continued need to decommission aging infrastructure and the increasing adoption of advanced technologies. Strategic partnerships, technological innovation, and supportive government policies will shape the market's future. The market presents significant opportunities for companies specializing in decommissioning services and technologies.

Norway Offshore Decommissioning Market Segmentation

-

1. Service

- 1.1. Well Plugging & Abandonment

- 1.2. Platform Removal

- 1.3. Others

-

2. Depth

- 2.1. Shallow

- 2.2. Deepwater and Ultra-Deepwater

-

3. Structure

- 3.1. Topsides

- 3.2. Substructure

Norway Offshore Decommissioning Market Segmentation By Geography

- 1. Norway

Norway Offshore Decommissioning Market Regional Market Share

Geographic Coverage of Norway Offshore Decommissioning Market

Norway Offshore Decommissioning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment

- 3.3. Market Restrains

- 3.3.1. 4.; Uncertainty in the Rules Governing Energy Storage Operations and Ownership

- 3.4. Market Trends

- 3.4.1. Topsides Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Offshore Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Well Plugging & Abandonment

- 5.1.2. Platform Removal

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Depth

- 5.2.1. Shallow

- 5.2.2. Deepwater and Ultra-Deepwater

- 5.3. Market Analysis, Insights and Forecast - by Structure

- 5.3.1. Topsides

- 5.3.2. Substructure

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Equinor Energy AS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aker Solutions ASA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DNV GL*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AF Gruppen ASA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Spirit Energy Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Equinor Energy AS

List of Figures

- Figure 1: Norway Offshore Decommissioning Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Norway Offshore Decommissioning Market Share (%) by Company 2025

List of Tables

- Table 1: Norway Offshore Decommissioning Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 2: Norway Offshore Decommissioning Market Revenue undefined Forecast, by Depth 2020 & 2033

- Table 3: Norway Offshore Decommissioning Market Revenue undefined Forecast, by Structure 2020 & 2033

- Table 4: Norway Offshore Decommissioning Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Norway Offshore Decommissioning Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 6: Norway Offshore Decommissioning Market Revenue undefined Forecast, by Depth 2020 & 2033

- Table 7: Norway Offshore Decommissioning Market Revenue undefined Forecast, by Structure 2020 & 2033

- Table 8: Norway Offshore Decommissioning Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Offshore Decommissioning Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Norway Offshore Decommissioning Market?

Key companies in the market include Equinor Energy AS, Aker Solutions ASA, DNV GL*List Not Exhaustive, AF Gruppen ASA, Spirit Energy Limited.

3. What are the main segments of the Norway Offshore Decommissioning Market?

The market segments include Service, Depth, Structure.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment.

6. What are the notable trends driving market growth?

Topsides Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Uncertainty in the Rules Governing Energy Storage Operations and Ownership.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Offshore Decommissioning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Offshore Decommissioning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Offshore Decommissioning Market?

To stay informed about further developments, trends, and reports in the Norway Offshore Decommissioning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence