Key Insights

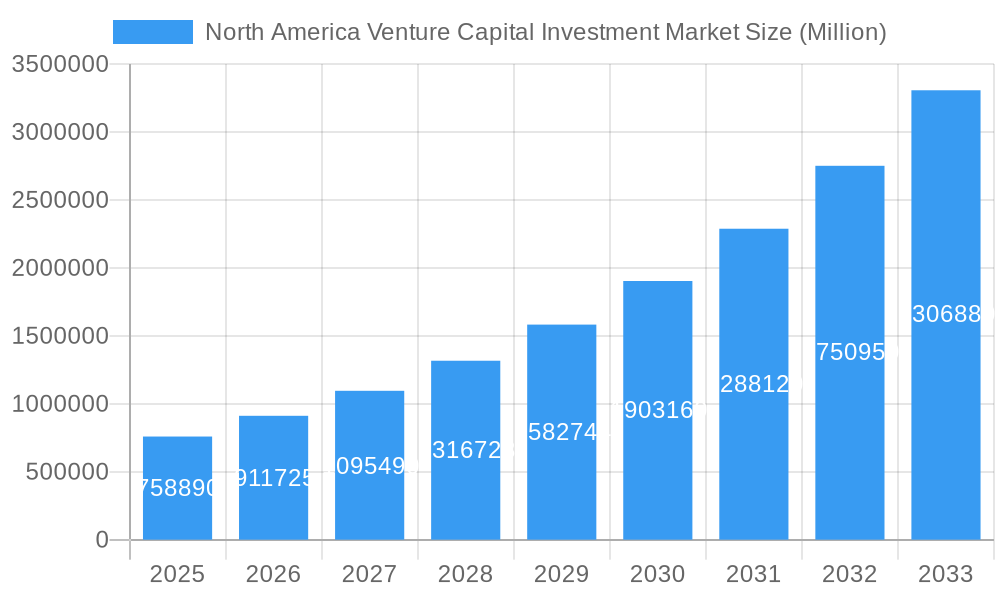

The North America Venture Capital Investment Market is poised for significant expansion, projecting a market size of 758.89 billion USD in 2025, with a robust CAGR of 20.3% anticipated throughout the forecast period of 2025-2033. This dynamic growth is primarily fueled by a surge in innovation across key sectors like Fintech, Pharma and Biotech, and IT Hardware and Services, all of which are attracting substantial capital. The increasing availability of early-stage funding, coupled with a growing appetite for later-stage investments in promising startups, indicates a healthy venture capital ecosystem. Major players such as Greylock Partners, Sequoia Capital, and Bain Capital Ventures are actively deploying capital, driving forward promising ventures. The United States, Canada, and Mexico are the primary beneficiaries and drivers of this regional investment activity, reflecting a mature and receptive market for groundbreaking technologies and business models. The market's resilience is further underscored by the continuous flow of investment into emerging technologies and disruptive business models.

North America Venture Capital Investment Market Market Size (In Billion)

The venture capital landscape in North America is characterized by a strong emphasis on technological advancements and strategic investments in high-growth industries. Fintech continues to lead the charge, transforming financial services, while the Pharma and Biotech sectors are experiencing a renaissance driven by groundbreaking research and development. The IT Hardware and Services sector also remains a cornerstone, with ongoing demand for innovative solutions. While the market benefits from substantial investor confidence and a vibrant startup culture, certain restraints may emerge. These could include increased regulatory scrutiny in rapidly evolving sectors, potential economic downturns that impact investor risk appetite, and the challenge of identifying truly disruptive ventures amidst a crowded market. Nevertheless, the overarching trend points towards sustained and aggressive investment, driven by the pursuit of high returns and the transformative potential of innovation across the North American continent.

North America Venture Capital Investment Market Company Market Share

North America Venture Capital Investment Market: Comprehensive Report 2024-2033

Explore the dynamic North America Venture Capital Investment Market, a pivotal sector driving innovation and economic growth across the continent. This report provides an in-depth analysis of market trends, investment strategies, and key players shaping the future of startups and established enterprises. Delve into the critical segments of Angel/Seed Investing, Early-stage Investing, and Later-stage Investing, alongside prominent industries such as Fintech, Pharma and Biotech, Consumer Goods, Industrial/Energy, and IT Hardware and Services. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025–2033, this report offers invaluable insights for investors, entrepreneurs, and industry stakeholders.

North America Venture Capital Investment Market Dynamics & Structure

The North America Venture Capital Investment Market is characterized by a robust and evolving landscape, marked by significant dynamism and a complex interplay of various forces. Market concentration is relatively dispersed, with a strong presence of both established venture capital firms and emerging fund managers, fostering a competitive yet collaborative ecosystem. Technological innovation remains the primary driver, with advancements in AI, blockchain, biotechnology, and sustainable technologies consistently opening new avenues for investment. Regulatory frameworks, while generally supportive of innovation, can introduce complexities, particularly concerning data privacy and emerging technologies, necessitating adaptive strategies from investment firms. Competitive product substitutes are less of a direct concern for VC firms themselves, but rather for the startups they fund; the ability of portfolio companies to differentiate their offerings is paramount. End-user demographics are increasingly influencing investment trends, with a growing demand for personalized, sustainable, and tech-enabled solutions. Merger and Acquisition (M&A) trends are consistently active, reflecting consolidation opportunities, strategic partnerships, and exit strategies for successful ventures.

- Market Concentration: A blend of large, established VC firms and a growing number of specialized funds.

- Technological Innovation Drivers: AI, machine learning, biotechnology, renewable energy, and digital transformation.

- Regulatory Frameworks: Evolving policies on data security, antitrust, and sector-specific regulations (e.g., healthcare, finance).

- Competitive Product Substitutes: The success of funded startups hinges on their ability to offer superior or novel solutions.

- End-User Demographics: Shifting preferences towards digital services, sustainability, and personalized experiences.

- M&A Trends: Consistent activity driven by strategic acquisitions, corporate venture capital exits, and IPO pipelines.

North America Venture Capital Investment Market Growth Trends & Insights

The North America Venture Capital Investment Market is poised for sustained growth, underpinned by a confluence of robust economic conditions, technological advancements, and evolving consumer behaviors. The market size has witnessed a steady expansion, fueled by significant capital inflows from institutional investors, sovereign wealth funds, and high-net-worth individuals seeking higher returns in innovation-driven sectors. Adoption rates for disruptive technologies across various industries are accelerating, leading to increased funding for startups that can capitalize on these shifts. Technological disruptions, ranging from artificial intelligence revolutionizing business processes to breakthroughs in gene editing impacting healthcare, are creating fertile ground for venture capital. Consumer behavior is increasingly shaped by digital convenience, sustainability concerns, and the demand for personalized experiences, driving investment in consumer tech, e-commerce, and health and wellness sectors. The market penetration of venture-backed solutions is expected to deepen as businesses and consumers alike embrace the benefits of cutting-edge products and services.

Market Size Evolution: The North American venture capital investment market has demonstrated consistent growth, with total investment valued at approximately \$220 billion in 2024. This figure is projected to rise to an estimated \$480 billion by 2033, reflecting a compound annual growth rate (CAGR) of approximately 9.5% over the forecast period. The historical period (2019-2024) saw a robust CAGR of 11.2%, indicating a strong recovery and expansion phase post-pandemic.

Adoption Rates: Adoption rates for digital transformation technologies, particularly within Fintech and IT services, have surged, with venture-backed companies playing a crucial role in offering innovative solutions. In the Pharma and Biotech sector, adoption of AI for drug discovery and personalized medicine has seen a significant uplift, with a corresponding increase in venture funding for companies in this space.

Technological Disruptions: Key technological disruptions, including advancements in Generative AI, quantum computing, and synthetic biology, are creating new investment theses. Venture capital firms are actively seeking out startups at the forefront of these fields, recognizing their potential to redefine industries. For example, AI-powered drug discovery platforms have garnered substantial interest, driving investment in the Pharma and Biotech sector.

Consumer Behavior Shifts: The ongoing shift towards e-commerce and subscription-based models continues to influence investment in the Consumer Goods sector. Furthermore, increasing consumer awareness of environmental issues is bolstering investments in sustainable technologies and products within the Industrial/Energy and Consumer Goods segments. The demand for personalized digital experiences is also a significant factor driving growth in IT Hardware and Services, as well as Fintech applications.

Market Penetration: The market penetration of venture-backed solutions is expanding across all major industries. In Fintech, digital payment solutions and blockchain applications are rapidly gaining traction, while in IT Hardware and Services, cloud computing and cybersecurity solutions continue to see widespread adoption. The Pharma and Biotech sector is witnessing increased penetration of AI-driven diagnostics and therapeutics.

Dominant Regions, Countries, or Segments in North America Venture Capital Investment Market

The North America Venture Capital Investment Market is a multifaceted landscape where specific regions, countries, and investment segments exert significant influence on overall growth and development. In terms of geographical dominance, the United States remains the undisputed leader, consistently attracting the lion's share of venture capital funding. Its mature innovation ecosystem, robust entrepreneurial culture, and presence of leading technology hubs like Silicon Valley and Boston create an unparalleled environment for startup creation and venture capital deployment. Canada also plays a significant role, with emerging tech clusters in Toronto, Vancouver, and Montreal contributing to the continent's venture capital activity.

Analyzing by Stage of Investment, Early-stage Investing, encompassing Angel/Seed and Early-stage rounds, is crucial for nurturing nascent ideas and nascent companies. The volume of deals in these stages often indicates the health and future potential of the venture ecosystem. Later-stage Investing, on the other hand, signifies confidence in the growth trajectory of more mature startups, often leading to significant capital infusion for scaling operations, market expansion, and eventual exit strategies.

Within the Industry segmentation, Fintech continues to be a powerhouse, driven by the digital transformation of financial services, including payments, lending, and digital banking. Pharma and Biotech consistently attract substantial investment due to the high stakes, long development cycles, and the potential for transformative healthcare solutions. Consumer Goods, while seemingly traditional, sees significant venture activity in areas like e-commerce, direct-to-consumer (DTC) brands, and innovative food and beverage concepts. Industrial/Energy is experiencing a resurgence with a focus on cleantech, renewable energy solutions, and advanced manufacturing technologies. IT Hardware and Services remains a foundational sector, encompassing cloud computing, cybersecurity, AI-driven software, and specialized hardware solutions.

- Dominant Region/Country: United States, followed by Canada, due to established innovation hubs and strong venture capital infrastructure.

- Key Drivers in the US:

- Vast pool of talent and experienced entrepreneurs.

- Access to significant institutional and private capital.

- Supportive regulatory environment for innovation.

- Strong presence of leading technology companies acting as potential acquirers.

- Dominant Segments by Stage of Investment:

- Early-stage Investing (Angel/Seed and Early-stage): Crucial for nurturing disruptive ideas and early-stage growth, often representing a significant portion of deal volume.

- Later-stage Investing: Indicates maturity and scalability, with substantial capital deployment for market leadership and expansion.

- Dominant Segments by Industry:

- Fintech: Driven by digital transformation in financial services, payments, and lending.

- Pharma and Biotech: High investment due to potential for groundbreaking healthcare advancements and significant R&D requirements.

- IT Hardware and Services: Continuous demand for cloud, cybersecurity, and AI-powered solutions.

- Industrial/Energy: Growing focus on cleantech and sustainable energy solutions.

North America Venture Capital Investment Market Product Landscape

The North America Venture Capital Investment Market is characterized by a diverse and rapidly evolving product landscape, driven by constant innovation across various technology verticals. Venture-backed companies are at the forefront of developing novel solutions that address unmet market needs and create new market opportunities. Product innovations span from sophisticated AI algorithms and advanced biotechnology platforms to sustainable energy solutions and user-centric digital services. Performance metrics for these products often emphasize scalability, user adoption rates, data security, efficiency gains, and demonstrable impact on end-user outcomes. Unique selling propositions frequently revolve around proprietary technology, disruptive business models, and superior user experience. Technological advancements, such as the miniaturization of hardware, the enhancement of AI predictive capabilities, and the development of novel drug delivery systems, are continuously reshaping the competitive arena, creating a dynamic environment where early adoption and rapid iteration are key to success.

Key Drivers, Barriers & Challenges in North America Venture Capital Investment Market

Key Drivers: The North America Venture Capital Investment Market is propelled by a confluence of powerful drivers. Technological advancements across AI, biotechnology, clean energy, and digital infrastructure are creating new frontiers for innovation and investment. The robust entrepreneurial ecosystem in North America, with its high density of skilled talent and established startup incubators, fosters a continuous pipeline of promising ventures. Economic stability and favorable monetary policies (though subject to change) often encourage investment by reducing perceived risk and increasing capital availability. Government initiatives and tax incentives aimed at fostering innovation and supporting small businesses also play a significant role.

Barriers & Challenges: Despite its strengths, the market faces several barriers and challenges. Intense competition for deal flow and talent can drive up valuations, making it challenging for investors to secure attractive entry points. Regulatory hurdles, particularly in highly regulated sectors like healthcare and finance, can slow down product development and market entry for startups. Economic downturns and geopolitical uncertainties can lead to a contraction in available capital and a more risk-averse investment climate. Scalability challenges for nascent technologies and supply chain disruptions for hardware-dependent ventures can impede growth. The sheer volume of available capital can sometimes lead to valuation bubbles, posing a risk for both investors and founders.

Emerging Opportunities in North America Venture Capital Investment Market

Emerging opportunities in the North America Venture Capital Investment Market are diverse and ripe for exploration. The deepening integration of AI across all industries presents immense potential for startups developing AI-powered solutions for automation, personalization, and predictive analytics. The growing demand for sustainable technologies fuels opportunities in cleantech, renewable energy storage, and circular economy solutions. The advancements in personalized medicine and biotechnology are creating significant potential for investment in novel drug discovery, gene therapies, and diagnostic tools. Furthermore, the metaverse and Web3 technologies, despite their nascent stages, offer untapped markets for decentralized applications, immersive experiences, and novel digital ownership models. The increasing focus on digital health and wellness platforms continues to present opportunities for innovation in preventative care, remote patient monitoring, and mental health solutions.

Growth Accelerators in the North America Venture Capital Investment Market Industry

Several catalysts are accelerating the growth of the North America Venture Capital Investment Market. Technological breakthroughs in areas like quantum computing, advanced materials, and synthetic biology are opening entirely new investment paradigms. Strategic partnerships between established corporations and venture capital firms, often through corporate venture capital arms, are providing capital, industry expertise, and market access to startups. The increasing globalization of innovation, with North American firms investing in and collaborating with international entities, is expanding market reach and fostering cross-border growth. The continuous evolution of the digital economy, including the expansion of cloud infrastructure and the proliferation of data, creates ongoing demand for innovative IT solutions. Furthermore, a growing appetite for ESG- (Environmental, Social, and Governance) focused investments is directing significant capital towards sustainable and socially responsible ventures, acting as a powerful growth accelerator.

Key Players Shaping the North America Venture Capital Investment Market Market

- Greylock Partners

- Sequoia Capital

- Bain Capital Ventures

- New Enterprise Associates

- Accel

- Khosla Ventures

- Real Ventures

- Tiger Global Management

- Matrix Partners

- Index Ventures

Notable Milestones in North America Venture Capital Investment Market Sector

- June 2022: Fund Corporation for the Overseas Development of Japan's ICT and Postal Services Inc. announced an investment in Sony Innovation Fund 3, a new fund targeting venture companies in high-growth sectors like ICT services, health tech, and fintech. This limited partner investment aimed to support business growth and startup investment in the United States, Canada, and other countries.

- May 2023: AXA Venture Partners, a global venture capital firm, launched a new strategy targeting late-stage tech companies with a EUR 1.5 Billion fund, signaling a significant commitment to North American late-stage tech ventures and plans to expand its team in the region.

In-Depth North America Venture Capital Investment Market Market Outlook

The North America Venture Capital Investment Market outlook remains exceptionally strong, driven by persistent innovation and strategic capital allocation. Growth accelerators such as rapid advancements in AI, the expanding cleantech sector driven by global sustainability initiatives, and the burgeoning fields of biotechnology and personalized medicine will continue to fuel significant investment. Strategic partnerships between venture firms and corporations, alongside the increasing focus on ESG-aligned investments, will further bolster capital inflows. The digital economy's continued expansion ensures sustained demand for IT hardware and services innovation. The market's inherent dynamism, coupled with a robust entrepreneurial spirit, positions it for sustained growth, presenting abundant opportunities for investors and founders alike to capitalize on transformative technologies and evolving market needs.

North America Venture Capital Investment Market Segmentation

-

1. Stage of Investment

- 1.1. Angel/Seed Investing

- 1.2. Early-stage Investing

- 1.3. Later-stage Investing

-

2. Industry

- 2.1. Fintech

- 2.2. Pharma and Biotech

- 2.3. Consumer Goods

- 2.4. Industrial/Energy

- 2.5. IT Hardware and Services

- 2.6. Other Industries

North America Venture Capital Investment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Venture Capital Investment Market Regional Market Share

Geographic Coverage of North America Venture Capital Investment Market

North America Venture Capital Investment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Investment in Fintech and Life Science Industry; Rising Number of Unicorns In North America

- 3.3. Market Restrains

- 3.3.1. Rising Risk in Market with Global Economic Uncertainity; Majority of Growth limited in ICT and Life Science segment

- 3.4. Market Trends

- 3.4.1. Canada Increasing Venture Capital Scenario is Fueling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Venture Capital Investment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Stage of Investment

- 5.1.1. Angel/Seed Investing

- 5.1.2. Early-stage Investing

- 5.1.3. Later-stage Investing

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Fintech

- 5.2.2. Pharma and Biotech

- 5.2.3. Consumer Goods

- 5.2.4. Industrial/Energy

- 5.2.5. IT Hardware and Services

- 5.2.6. Other Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Stage of Investment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Greylock Partners

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sequoia Capital

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bain Capital Ventures

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 New Enterprise Associates

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Accel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Khosla Ventures

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Real Ventures

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tiger Global Management

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Matrix Partners

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Index Ventures

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Greylock Partners

List of Figures

- Figure 1: North America Venture Capital Investment Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Venture Capital Investment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Venture Capital Investment Market Revenue undefined Forecast, by Stage of Investment 2020 & 2033

- Table 2: North America Venture Capital Investment Market Revenue undefined Forecast, by Industry 2020 & 2033

- Table 3: North America Venture Capital Investment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Venture Capital Investment Market Revenue undefined Forecast, by Stage of Investment 2020 & 2033

- Table 5: North America Venture Capital Investment Market Revenue undefined Forecast, by Industry 2020 & 2033

- Table 6: North America Venture Capital Investment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Venture Capital Investment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Venture Capital Investment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Venture Capital Investment Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Venture Capital Investment Market?

The projected CAGR is approximately 20.3%.

2. Which companies are prominent players in the North America Venture Capital Investment Market?

Key companies in the market include Greylock Partners, Sequoia Capital, Bain Capital Ventures, New Enterprise Associates, Accel, Khosla Ventures, Real Ventures, Tiger Global Management, Matrix Partners, Index Ventures.

3. What are the main segments of the North America Venture Capital Investment Market?

The market segments include Stage of Investment, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Investment in Fintech and Life Science Industry; Rising Number of Unicorns In North America.

6. What are the notable trends driving market growth?

Canada Increasing Venture Capital Scenario is Fueling the Market.

7. Are there any restraints impacting market growth?

Rising Risk in Market with Global Economic Uncertainity; Majority of Growth limited in ICT and Life Science segment.

8. Can you provide examples of recent developments in the market?

June 2022: Fund Corporation for the Overseas Development of Japan's ICT and Postal Services Inc. announced an investment in Sony Innovation Fund 3, which was a new investment fund targeting venture companies in industry sectors with high growth potential, including ICT services such as health tech and fintech, as a limited partner. This fund was expected to support business growth and Investment in Startups in the United States, Canada, and other countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Venture Capital Investment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Venture Capital Investment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Venture Capital Investment Market?

To stay informed about further developments, trends, and reports in the North America Venture Capital Investment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence