Key Insights

The North American Sodium-Glucose Cotransporter 2 (SGLT2) inhibitor market, encompassing drugs like Jardiance (Empagliflozin), Farxiga/Forxiga (Dapagliflozin), and Invokana (Canagliflozin), is experiencing robust growth. Driven by increasing prevalence of type 2 diabetes and related cardiovascular diseases, coupled with the efficacy and safety profile of SGLT2 inhibitors demonstrated in clinical trials, the market is projected to maintain a significant Compound Annual Growth Rate (CAGR). Key players such as Eli Lilly, Janssen Pharmaceuticals, and Boehringer Ingelheim are intensely competing, driving innovation in formulation and expanding indications for these drugs beyond diabetes management to encompass heart failure and chronic kidney disease. The market's expansion is further fueled by an aging population and rising healthcare expenditure in North America. However, potential restraints include the high cost of these medications, which may limit accessibility for some patients, and the emergence of competing therapies. The market is segmented geographically, with the United States holding the largest share within the North American region due to higher prevalence of target diseases and robust healthcare infrastructure. Canada and Mexico contribute significantly, but at a smaller scale, reflecting differences in demographics and healthcare systems. Future market growth will likely depend on sustained R&D, successful clinical trials demonstrating expanded efficacy, and the strategic pricing and market access strategies employed by pharmaceutical companies.

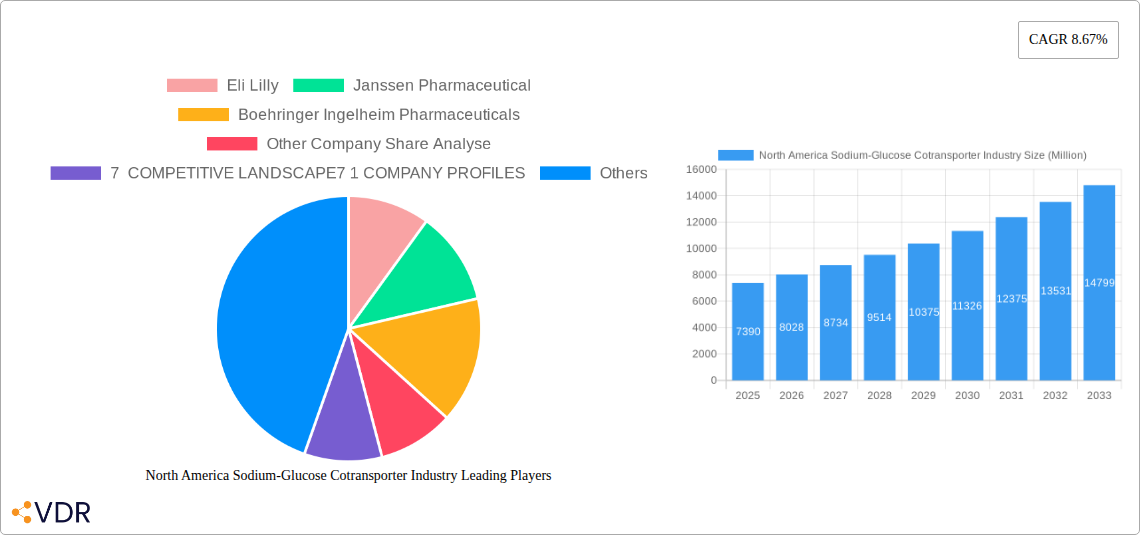

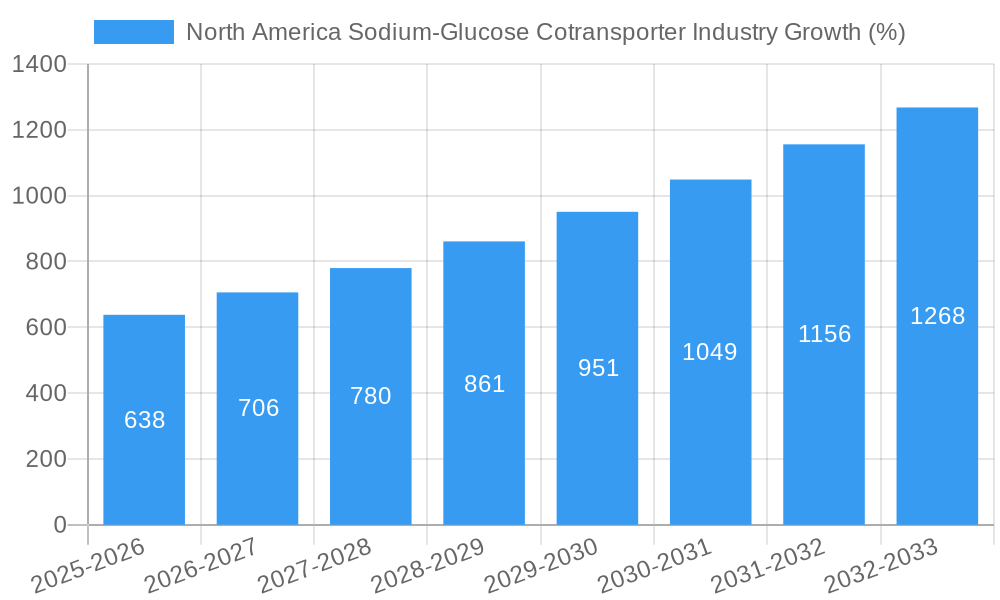

The historical period (2019-2024) showed strong growth, laying the foundation for the projected expansion. The base year of 2025 serves as a critical point, reflecting the cumulative effect of past trends and serving as the starting point for the forecast period (2025-2033). The market size in 2025, estimated based on the provided 7.39 million value unit and considering the historical growth trajectory, serves as a foundation for projecting future values. Utilizing the provided CAGR of 8.67%, a robust forecast can be developed, reflecting the market's expected dynamic growth throughout the forecast period. The competitive landscape, involving significant players with substantial market share, contributes to market intensity and fuels innovation. Future developments including the potential for new indications and the launch of biosimilar products will continue to shape this dynamic market.

North America Sodium-Glucose Cotransporter (SGLT2i) Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Sodium-Glucose Cotransporter (SGLT2i) industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. With a focus on key players like Eli Lilly, Janssen Pharmaceutical, Boehringer Ingelheim Pharmaceuticals, AstraZeneca Pharmaceuticals, and Astellas, this report offers crucial insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

North America Sodium-Glucose Cotransporter Industry Market Dynamics & Structure

The North American SGLT2i market is characterized by a moderately concentrated landscape, with key players holding significant market share. Technological innovation, primarily focused on improving efficacy and reducing side effects, is a major driver. Stringent regulatory frameworks, including FDA approvals, significantly influence market access and growth. Competitive pressures arise from the emergence of alternative treatments for diabetes and cardiovascular diseases. The market exhibits substantial growth potential due to the increasing prevalence of diabetes and heart failure, particularly within the aging population. M&A activity remains moderate, with strategic partnerships and collaborations playing a larger role.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% of market share in 2024.

- Technological Innovation: Focus on improved efficacy, reduced side effects, and novel delivery methods.

- Regulatory Framework: Stringent FDA approvals and post-market surveillance.

- Competitive Substitutes: Other anti-diabetic and cardiovascular medications.

- End-User Demographics: Primarily patients with type 2 diabetes, heart failure, and chronic kidney disease.

- M&A Trends: Moderate M&A activity, with emphasis on strategic partnerships and licensing agreements. xx M&A deals were recorded between 2019 and 2024.

North America Sodium-Glucose Cotransporter Industry Growth Trends & Insights

The North American SGLT2i market experienced significant growth between 2019 and 2024, driven by increasing prevalence of diabetes and heart failure, along with favorable clinical trial outcomes demonstrating the efficacy of SGLT2 inhibitors in reducing cardiovascular events. The market is projected to maintain a robust CAGR of xx% during the forecast period (2025-2033), reaching a market size of $xx billion by 2033. This growth is further fueled by expanding indications for SGLT2 inhibitors, such as chronic kidney disease and heart failure with preserved ejection fraction (HFpEF), and the ongoing development of novel formulations and delivery systems. Increased patient awareness and physician adoption also contribute to the market's expansion. Market penetration continues to grow as more patients are diagnosed and treated with SGLT2i medications. Technological advancements, particularly in drug delivery and personalized medicine, will further drive market growth.

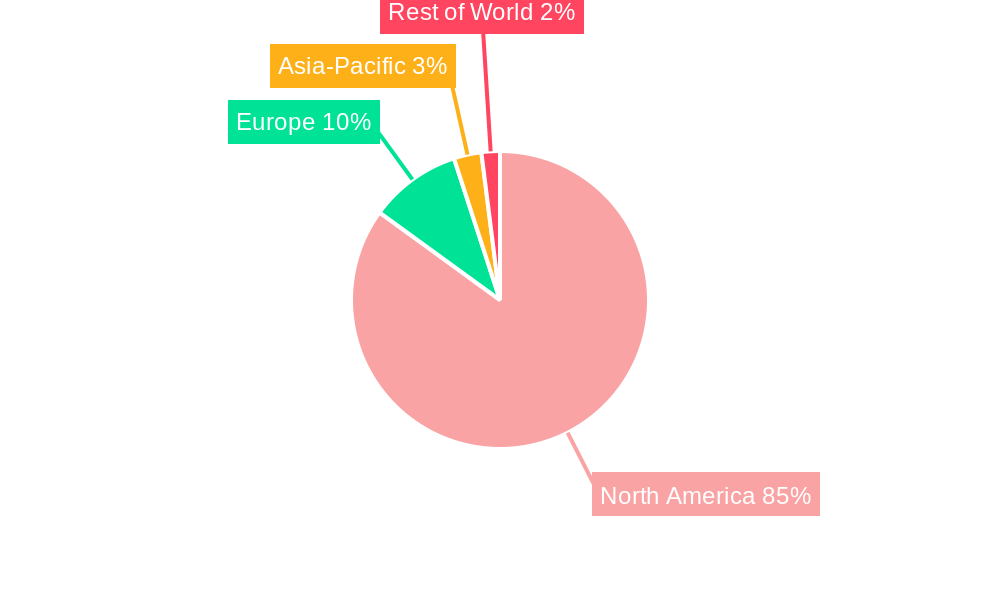

Dominant Regions, Countries, or Segments in North America Sodium-Glucose Cotransporter Industry

The United States dominates the North American SGLT2i market, owing to its large patient population and robust healthcare infrastructure. Within the drug segment, Jardiance (empagliflozin), Farxiga/Forxiga (dapagliflozin), and Invokana (canagliflozin) are leading products, contributing significantly to market growth. The high prevalence of diabetes and cardiovascular diseases within the US population fuels demand for these drugs. Growth is further stimulated by favorable reimbursement policies and increased physician awareness of the clinical benefits of SGLT2i therapy. Canada, while smaller in size, also exhibits significant market growth potential due to its expanding diabetic population and well-developed healthcare system.

- Key Growth Drivers (US): High prevalence of diabetes and cardiovascular diseases; Favorable reimbursement policies; Increased physician awareness.

- Key Growth Drivers (Canada): Expanding diabetic population; Well-developed healthcare system; Government initiatives to improve diabetes management.

- Market Share: US holds xx% market share, Canada holds xx% market share in 2024.

- Growth Potential: Strong growth potential in both the US and Canada, driven by increasing prevalence of target conditions.

North America Sodium-Glucose Cotransporter Industry Product Landscape

The SGLT2i product landscape is characterized by a range of oral medications, each with unique formulations and dosages. Innovations focus on improving bioavailability, reducing side effects, and extending the duration of action. Many SGLT2 inhibitors are now approved for multiple indications, broadening their market applications. The market has seen significant advancements in the development of combination therapies, further enhancing treatment efficacy. Key selling points include improved glycemic control, cardiovascular risk reduction, and kidney protection.

Key Drivers, Barriers & Challenges in North America Sodium-Glucose Cotransporter Industry

Key Drivers:

- Increasing prevalence of diabetes and heart failure.

- Favorable clinical trial results demonstrating cardiovascular benefits.

- Expanding indications and broader therapeutic applications.

- Technological advancements leading to improved efficacy and safety.

Key Challenges:

- High drug costs impacting patient affordability and access.

- Potential side effects, such as urinary tract infections and ketoacidosis.

- Competition from other anti-diabetic and cardiovascular therapies.

- Regulatory hurdles and market access challenges in certain regions. xx% of new drug applications face delays in 2024.

Emerging Opportunities in North America Sodium-Glucose Cotransporter Industry

- Expanding indications for SGLT2 inhibitors into new therapeutic areas (e.g., non-alcoholic fatty liver disease).

- Development of novel formulations with improved efficacy and reduced side effects.

- Personalized medicine approaches based on patient-specific genetic profiles.

- Growing demand for combination therapies to address multiple co-morbidities.

Growth Accelerators in the North America Sodium-Glucose Cotransporter Industry Industry

Technological breakthroughs in drug delivery systems, such as extended-release formulations, and ongoing research to better understand the mechanisms of action of SGLT2 inhibitors will significantly accelerate market growth. Strategic partnerships between pharmaceutical companies and healthcare providers to improve patient access and adherence will also play a critical role. Expansion into untapped markets through clinical trials and regulatory approvals in new indications will further fuel market expansion.

Key Players Shaping the North America Sodium-Glucose Cotransporter Industry Market

- Eli Lilly

- Janssen Pharmaceutical

- Boehringer Ingelheim Pharmaceuticals

- AstraZeneca Pharmaceuticals

- Astellas

Notable Milestones in North America Sodium-Glucose Cotransporter Industry Sector

- February 2022: The US FDA approved empagliflozin (Jardiance) for patients with heart failure with preserved ejection fraction (HFpEF).

- March 2022: Eli Lilly and Boehringer Ingelheim received EU approval for Jardiance (empagliflozin) for heart failure treatment.

In-Depth North America Sodium-Glucose Cotransporter Industry Market Outlook

The North American SGLT2i market is poised for continued robust growth, driven by technological advancements, expanding indications, and increasing patient awareness. Strategic partnerships and acquisitions will further shape the competitive landscape. The market's future potential is substantial, offering significant opportunities for pharmaceutical companies and healthcare providers alike. Innovative product development and expanding market access will be key factors driving future growth.

North America Sodium-Glucose Cotransporter Industry Segmentation

-

1. Drug

- 1.1. Jardiance (Empagliflozin)

- 1.2. Farxiga/Forxiga (Dapagliflozin)

- 1.3. Invokana (Canagliflozin)

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Sodium-Glucose Cotransporter Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Sodium-Glucose Cotransporter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Medical Device Market; Advancement in Technology

- 3.3. Market Restrains

- 3.3.1. Medical Device Market Consolidation

- 3.4. Market Trends

- 3.4.1. Jardiance Drug Holds the Highest Share in The North America Sodium-Dependent Glucose Co-Transporter 2 (Sglt2) Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Sodium-Glucose Cotransporter Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 5.1.1. Jardiance (Empagliflozin)

- 5.1.2. Farxiga/Forxiga (Dapagliflozin)

- 5.1.3. Invokana (Canagliflozin)

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 6. United States North America Sodium-Glucose Cotransporter Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Drug

- 6.1.1. Jardiance (Empagliflozin)

- 6.1.2. Farxiga/Forxiga (Dapagliflozin)

- 6.1.3. Invokana (Canagliflozin)

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Drug

- 7. Canada North America Sodium-Glucose Cotransporter Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Drug

- 7.1.1. Jardiance (Empagliflozin)

- 7.1.2. Farxiga/Forxiga (Dapagliflozin)

- 7.1.3. Invokana (Canagliflozin)

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Drug

- 8. Rest of North America North America Sodium-Glucose Cotransporter Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Drug

- 8.1.1. Jardiance (Empagliflozin)

- 8.1.2. Farxiga/Forxiga (Dapagliflozin)

- 8.1.3. Invokana (Canagliflozin)

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Drug

- 9. United States North America Sodium-Glucose Cotransporter Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Sodium-Glucose Cotransporter Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Sodium-Glucose Cotransporter Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Sodium-Glucose Cotransporter Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Eli Lilly

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Janssen Pharmaceutical

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Boehringer Ingelheim Pharmaceuticals

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Other Company Share Analyse

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 7 COMPETITIVE LANDSCAPE7 1 COMPANY PROFILES

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Astellas*List Not Exhaustive 7 2 COMPANY SHARE ANALYSIS

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 AstraZeneca Pharmaceuticals

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.1 Eli Lilly

List of Figures

- Figure 1: North America Sodium-Glucose Cotransporter Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Sodium-Glucose Cotransporter Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Sodium-Glucose Cotransporter Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Sodium-Glucose Cotransporter Industry Revenue Million Forecast, by Drug 2019 & 2032

- Table 3: North America Sodium-Glucose Cotransporter Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America Sodium-Glucose Cotransporter Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Sodium-Glucose Cotransporter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Sodium-Glucose Cotransporter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Sodium-Glucose Cotransporter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Sodium-Glucose Cotransporter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Sodium-Glucose Cotransporter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Sodium-Glucose Cotransporter Industry Revenue Million Forecast, by Drug 2019 & 2032

- Table 11: North America Sodium-Glucose Cotransporter Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America Sodium-Glucose Cotransporter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: North America Sodium-Glucose Cotransporter Industry Revenue Million Forecast, by Drug 2019 & 2032

- Table 14: North America Sodium-Glucose Cotransporter Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: North America Sodium-Glucose Cotransporter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Sodium-Glucose Cotransporter Industry Revenue Million Forecast, by Drug 2019 & 2032

- Table 17: North America Sodium-Glucose Cotransporter Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Sodium-Glucose Cotransporter Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Sodium-Glucose Cotransporter Industry?

The projected CAGR is approximately 8.67%.

2. Which companies are prominent players in the North America Sodium-Glucose Cotransporter Industry?

Key companies in the market include Eli Lilly, Janssen Pharmaceutical, Boehringer Ingelheim Pharmaceuticals, Other Company Share Analyse, 7 COMPETITIVE LANDSCAPE7 1 COMPANY PROFILES, Astellas*List Not Exhaustive 7 2 COMPANY SHARE ANALYSIS, AstraZeneca Pharmaceuticals.

3. What are the main segments of the North America Sodium-Glucose Cotransporter Industry?

The market segments include Drug, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Medical Device Market; Advancement in Technology.

6. What are the notable trends driving market growth?

Jardiance Drug Holds the Highest Share in The North America Sodium-Dependent Glucose Co-Transporter 2 (Sglt2) Market.

7. Are there any restraints impacting market growth?

Medical Device Market Consolidation.

8. Can you provide examples of recent developments in the market?

March 2022: Eli Lilly and Boehringer Ingelheim gained approval, for heart failure treatment from the EU for sodium-glucose co-transporter-2-inhibitor (SGLT2-I), Jardiance (empagliflozin). Previously Jardiance gained a label expansion for treating HF in the US.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Sodium-Glucose Cotransporter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Sodium-Glucose Cotransporter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Sodium-Glucose Cotransporter Industry?

To stay informed about further developments, trends, and reports in the North America Sodium-Glucose Cotransporter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence