Key Insights

The North American insulated shipping containers market, valued at $1.74 billion in 2025, is projected to experience robust growth, driven by the escalating demand for temperature-sensitive goods across diverse sectors. The market's Compound Annual Growth Rate (CAGR) of 6.46% from 2025 to 2033 reflects the increasing need for efficient and reliable cold chain logistics solutions. Key drivers include the expanding e-commerce sector, particularly in food delivery and pharmaceuticals, necessitating secure temperature-controlled transportation. The growing preference for ready-to-eat meals, frozen foods, and pharmaceuticals contributes significantly to this growth. Furthermore, stringent regulatory compliance related to food safety and pharmaceutical product integrity fuels demand for high-quality insulated shipping containers. The market is segmented by material type (EPS, PU, EPP, and others), end-user application (pre-cooked/frozen food, life sciences, fresh produce, etc.), and geography (United States, Canada, and Mexico). The United States currently dominates the market due to its large and diverse economy, coupled with robust e-commerce infrastructure and advanced logistics capabilities.

North America Insulated Shipping Containers Market Market Size (In Billion)

The market's growth trajectory is influenced by several trends, including the increasing adoption of sustainable and eco-friendly materials in container manufacturing, alongside technological advancements in insulation technology leading to improved energy efficiency and reduced environmental impact. However, the market faces restraints such as fluctuations in raw material prices and the relatively high initial investment associated with purchasing specialized insulated shipping containers. Competitive dynamics are characterized by the presence of both large multinational corporations and smaller specialized manufacturers, resulting in a balanced market with diverse product offerings. Future growth prospects are promising, particularly with ongoing innovations in packaging technology and increasing investments in cold chain infrastructure across North America. Further market penetration in emerging segments such as cosmetics and beverages offers significant potential for future expansion.

North America Insulated Shipping Containers Market Company Market Share

North America Insulated Shipping Containers Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America insulated shipping containers market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for industry professionals, investors, and businesses seeking a clear understanding of this dynamic sector. The market is segmented by material type (Expanded Polystyrene (EPS), Polyurethane Foam (PU), Expanded Polypropylene (EPP), Other Material Types), end-user application (Pre-cooked Food and Frozen Food, Lifesciences and Pharmaceutical, Fresh Meat, Fresh Produce, Bakery, Plants, and Flowers, Other End-user Applications), and country (United States, Canada). The total market size is projected to reach xx million units by 2033.

North America Insulated Shipping Containers Market Dynamics & Structure

The North America insulated shipping containers market is characterized by moderate concentration, with several key players competing alongside smaller regional businesses. Technological innovation, driven by the need for improved temperature control and sustainability, is a key driver. Stringent regulatory frameworks concerning food safety and pharmaceutical transport influence material choices and design. Competitive substitutes include passive and active cooling technologies, with varying efficacy and cost implications. End-user demographics are diverse, ranging from large-scale food processors to specialized pharmaceutical shippers. The market has witnessed a moderate level of mergers and acquisitions (M&A) activity, with larger companies strategically acquiring smaller players to expand their product portfolios and geographic reach.

- Market Concentration: Moderately concentrated, with a few dominant players and numerous smaller companies.

- Technological Innovation: Focus on improved insulation materials (e.g., vacuum insulated panels), reusable containers, and smart temperature monitoring systems.

- Regulatory Frameworks: Stringent regulations concerning food safety and pharmaceutical transportation influence material selection and design.

- Competitive Substitutes: Passive cooling methods (gel packs, etc.) and active cooling systems (refrigerated trucks) pose competition.

- M&A Activity: Moderate M&A activity, with larger players acquiring smaller companies to expand market share. Estimated xx M&A deals from 2019-2024.

- Innovation Barriers: High R&D costs, stringent regulatory approvals for new materials, and challenges in balancing performance with cost-effectiveness.

North America Insulated Shipping Containers Market Growth Trends & Insights

The North America insulated shipping containers market experienced significant growth from 2019 to 2024, driven primarily by the expanding e-commerce sector, increasing demand for temperature-sensitive goods (pharmaceuticals, perishables), and rising consumer awareness of cold chain integrity. The market exhibits a robust Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by technological advancements in insulation materials, the adoption of sustainable packaging solutions, and the increasing focus on reducing food waste. Consumer preference for convenient and reliable delivery of temperature-sensitive products further accelerates market expansion. Market penetration within specific end-user segments like pharmaceuticals is high, while other segments (e.g., e-commerce deliveries of food items) show immense growth potential. Technological disruptions, particularly in material science and sensor technologies, will continue to reshape the market landscape.

Dominant Regions, Countries, or Segments in North America Insulated Shipping Containers Market

The United States dominates the North America insulated shipping containers market, accounting for xx% of the total market share in 2025. This dominance is attributable to the large size of its e-commerce sector, significant pharmaceutical production, and robust food processing industries. Canada exhibits consistent growth but maintains a smaller market share compared to the United States (xx%).

Among segments, the Lifesciences and Pharmaceutical sector demonstrates high demand for insulated shipping containers due to stringent temperature control requirements for drug transportation. Expanded Polystyrene (EPS) remains the most widely used material due to its cost-effectiveness, though sustainable alternatives like Expanded Polypropylene (EPP) are gaining traction.

- Key Drivers (US): Large e-commerce sector, substantial pharmaceutical industry, extensive food processing infrastructure.

- Key Drivers (Canada): Growing e-commerce and pharmaceutical sectors, supportive government regulations for sustainable packaging.

- Dominant Segment: Lifesciences and Pharmaceutical sector due to the stringent temperature sensitivity of drug products.

- Dominant Material: Expanded Polystyrene (EPS) owing to its cost-effectiveness.

- Growth Potential: Other End-user Applications (cosmetics, wine, and beverages) shows significant untapped potential.

North America Insulated Shipping Containers Market Product Landscape

The market offers a diverse range of insulated shipping containers, varying in size, material composition, and thermal performance. Recent innovations focus on enhancing thermal efficiency, improving durability, and incorporating smart monitoring technologies. Unique selling propositions include reusable containers to promote sustainability, customizable solutions to meet specific temperature requirements, and integrated GPS tracking systems for enhanced supply chain visibility. Technological advancements center on lightweight, high-performance insulation materials and improved sealing mechanisms to minimize heat transfer.

Key Drivers, Barriers & Challenges in North America Insulated Shipping Containers Market

Key Drivers: The burgeoning e-commerce market, increasing demand for temperature-sensitive products, stringent regulations favoring better cold chain management, and advancements in insulation technology are key drivers.

Challenges and Restraints: Fluctuations in raw material prices, supply chain disruptions, and the cost associated with adopting eco-friendly materials pose significant challenges. Regulatory compliance can also be complex and expensive, and intense competition keeps profit margins under pressure.

Emerging Opportunities in North America Insulated Shipping Containers Market

Emerging opportunities lie in the increasing adoption of sustainable and eco-friendly materials, the growing demand for reusable shipping containers to reduce waste, and the integration of smart technologies for real-time temperature monitoring and supply chain optimization. Untapped markets include specialized applications (e.g., organ transportation, specialized medical supplies) and the expansion into regional markets with growing e-commerce penetration.

Growth Accelerators in the North America Insulated Shipping Containers Market Industry

Technological advancements in insulation materials, such as vacuum insulated panels and phase-change materials, are key growth accelerators. Strategic partnerships between manufacturers and logistics providers enhance supply chain efficiency. Government initiatives promoting sustainable packaging and stricter cold chain regulations further bolster growth. Expanding into underserved regions and developing customized solutions for specialized applications also provide significant growth opportunities.

Key Players Shaping the North America Insulated Shipping Containers Market Market

- Sonoco Thermosafe (sonoco Products Company)

- Therapak (AVANTOr Group)

- Airlite Plastics Co (KODIAKOOLER)

- Chill-Pak

- Insulated Products Corporation

- Polar Tech Industries

- Softbox Systems Ltd (CSAFE Global)

- Custom Pack Inc

- Sofrigam

- Intelsius (A DGP Company)

- Thermal Shipping Solution

- Cascades Inc

- Temperpack

Notable Milestones in North America Insulated Shipping Containers Market Sector

- June 2022: Cascades Inc. launched its innovative isothermal packaging technology, north box XTEND, expanding its production capacity across North America.

- March 2022: TemperPack secured USD 140 million in equity financing to expand its capacity and geographical reach.

In-Depth North America Insulated Shipping Containers Market Market Outlook

The North America insulated shipping containers market is poised for continued growth, driven by increasing demand, technological innovation, and supportive regulatory frameworks. Strategic investments in research and development, along with collaborations across the value chain, will be crucial for players to maintain a competitive edge and capitalize on emerging opportunities. The market's future potential lies in the development of sustainable, cost-effective, and technologically advanced solutions tailored to the evolving needs of various end-user segments.

North America Insulated Shipping Containers Market Segmentation

-

1. Material Type

- 1.1. Expanded Polystyrene (EPS)

- 1.2. Polyurethane Foam (PU)

- 1.3. Expanded Polypropylene (EPP)

- 1.4. Other Material Types

-

2. End-user Application

- 2.1. Pre-cooked Food and Frozen Food

- 2.2. Life Sciences and Pharmaceutical

- 2.3. Fresh Meat

- 2.4. Fresh Produce

- 2.5. Bakery, Plants, and Flowers

- 2.6. Other En

North America Insulated Shipping Containers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

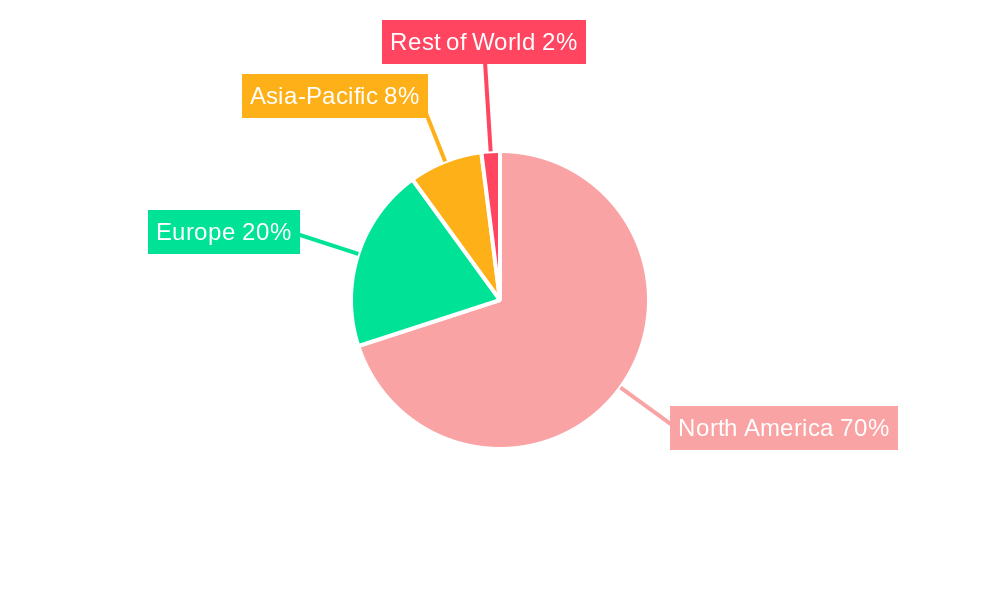

North America Insulated Shipping Containers Market Regional Market Share

Geographic Coverage of North America Insulated Shipping Containers Market

North America Insulated Shipping Containers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Pharmaceutical and Healthcare Sector to Boost the Market; Increasing Consumer Demand for Perishable Food

- 3.3. Market Restrains

- 3.3.1. Rising Operational Costs; Growing Usage of Substitute Products (Plastic)

- 3.4. Market Trends

- 3.4.1. Lifesciences and Pharmaceutical Segment Holds Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Insulated Shipping Containers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Expanded Polystyrene (EPS)

- 5.1.2. Polyurethane Foam (PU)

- 5.1.3. Expanded Polypropylene (EPP)

- 5.1.4. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Application

- 5.2.1. Pre-cooked Food and Frozen Food

- 5.2.2. Life Sciences and Pharmaceutical

- 5.2.3. Fresh Meat

- 5.2.4. Fresh Produce

- 5.2.5. Bakery, Plants, and Flowers

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sonoco Thermosafe (sonoco Products Company)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Therapak (AVANTOr Group)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Airlite Plastics Co (KODIAKOOLER)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chill-Pak

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Insulated Products Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Polar Tech Industries

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Softbox Systems Ltd (CSAFE Global)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Custom Pack Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sofrigam

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Intelsius (A DGP Company)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Thermal Shipping Solution*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Cascades Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Temperpack

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Sonoco Thermosafe (sonoco Products Company)

List of Figures

- Figure 1: North America Insulated Shipping Containers Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Insulated Shipping Containers Market Share (%) by Company 2025

List of Tables

- Table 1: North America Insulated Shipping Containers Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: North America Insulated Shipping Containers Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 3: North America Insulated Shipping Containers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Insulated Shipping Containers Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: North America Insulated Shipping Containers Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 6: North America Insulated Shipping Containers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Insulated Shipping Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Insulated Shipping Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Insulated Shipping Containers Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Insulated Shipping Containers Market?

The projected CAGR is approximately 6.46%.

2. Which companies are prominent players in the North America Insulated Shipping Containers Market?

Key companies in the market include Sonoco Thermosafe (sonoco Products Company), Therapak (AVANTOr Group), Airlite Plastics Co (KODIAKOOLER), Chill-Pak, Insulated Products Corporation, Polar Tech Industries, Softbox Systems Ltd (CSAFE Global), Custom Pack Inc, Sofrigam, Intelsius (A DGP Company), Thermal Shipping Solution*List Not Exhaustive, Cascades Inc, Temperpack.

3. What are the main segments of the North America Insulated Shipping Containers Market?

The market segments include Material Type, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Pharmaceutical and Healthcare Sector to Boost the Market; Increasing Consumer Demand for Perishable Food.

6. What are the notable trends driving market growth?

Lifesciences and Pharmaceutical Segment Holds Significant Share.

7. Are there any restraints impacting market growth?

Rising Operational Costs; Growing Usage of Substitute Products (Plastic).

8. Can you provide examples of recent developments in the market?

June 2022 - Cascades launched an innovative isothermal packaging technology, north box XTEND, by improving its line of the north box while the composition of the box creates a moisture barrier that keeps the insulation rigid and expands a new production site across North America which includes the installation of the highly automated packaging line for the production of its isothermal boxes, including the new north box XTEND.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Insulated Shipping Containers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Insulated Shipping Containers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Insulated Shipping Containers Market?

To stay informed about further developments, trends, and reports in the North America Insulated Shipping Containers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence