Key Insights

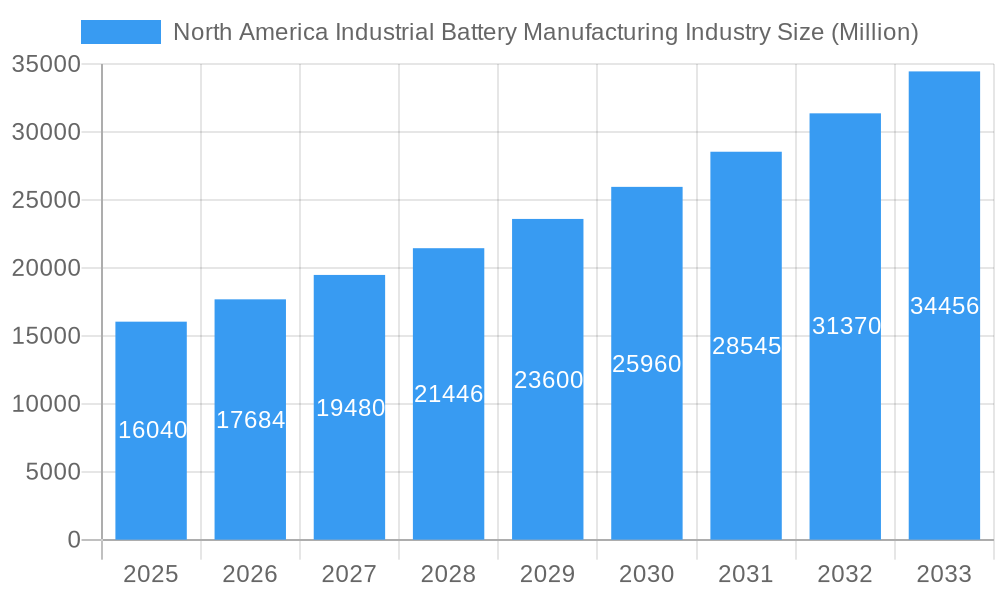

The North American Industrial Battery Manufacturing Industry is poised for significant expansion, with a projected market size of $16.04 billion in 2025, driven by a robust CAGR of 10.3% throughout the forecast period of 2025-2033. This impressive growth is primarily fueled by the escalating demand for reliable and efficient power solutions across various industrial sectors. The increasing adoption of electric forklifts in warehousing and logistics operations, coupled with the burgeoning need for uninterrupted power supply in telecommunication networks and critical infrastructure like Uninterruptible Power Supplies (UPS), are key market accelerators. Furthermore, the ongoing technological advancements in battery chemistries, particularly the dominance of Lithium-ion batteries due to their superior energy density, longer lifespan, and faster charging capabilities, are reshaping the competitive landscape and encouraging substantial investment in manufacturing capabilities. The industry is witnessing a clear shift towards more sustainable and high-performance battery solutions.

North America Industrial Battery Manufacturing Industry Market Size (In Billion)

The market dynamics are further shaped by evolving industry trends such as the integration of smart battery management systems, the growing emphasis on battery recycling and second-life applications, and the increasing regulatory push towards electrification. While the transition to advanced battery technologies presents opportunities, certain restraints exist, including the fluctuating raw material prices, particularly for lithium and cobalt, and the capital-intensive nature of setting up advanced manufacturing facilities. However, the strong underlying demand from sectors like material handling, data centers, and renewable energy integration is expected to outweigh these challenges. Geographically, the United States leads the market, with Canada and the Rest of North America also showing promising growth trajectories, indicative of a widespread industrial battery adoption across the region. Key players like EnerSys, Amara Raja Batteries Ltd., and Panasonic Corporation are at the forefront, innovating and expanding their offerings to cater to the evolving needs of this dynamic market.

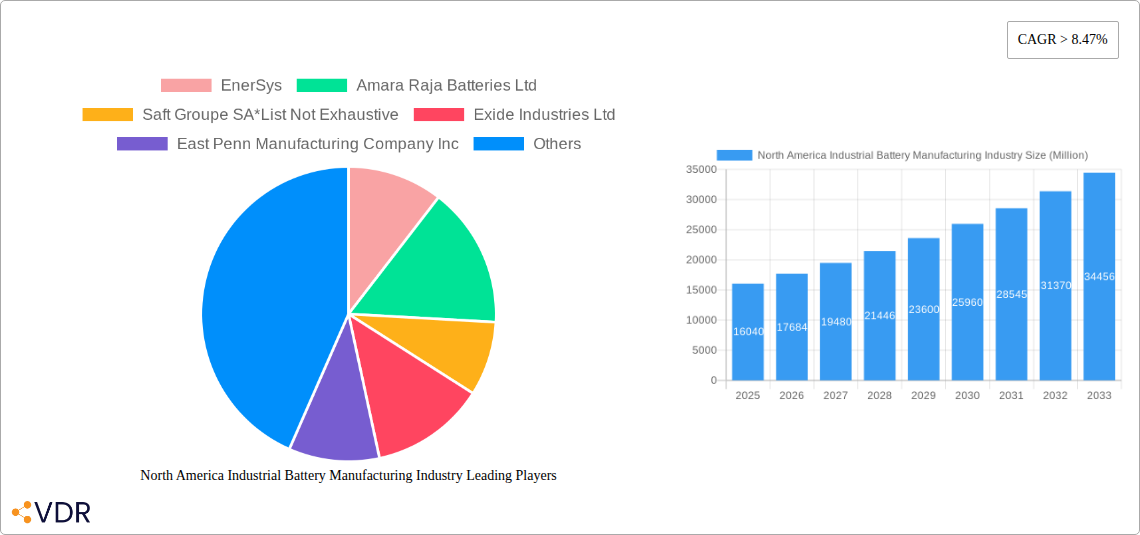

North America Industrial Battery Manufacturing Industry Company Market Share

North America Industrial Battery Manufacturing Industry: Comprehensive Market Analysis and Forecast (2019–2033)

This in-depth report provides a critical analysis of the North America Industrial Battery Manufacturing Industry, offering a detailed understanding of market dynamics, growth trends, competitive landscape, and future opportunities. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this research is essential for stakeholders seeking to navigate and capitalize on this rapidly evolving sector. We delve into both parent and child markets, providing granular insights into segments such as Lithium-ion Battery and Lead-acid Battery technologies, and applications including Forklift, Telecom, and UPS. All values are presented in billions of units.

North America Industrial Battery Manufacturing Industry Market Dynamics & Structure

The North America Industrial Battery Manufacturing Industry is characterized by a moderately concentrated market, with key players investing heavily in research and development to drive technological innovation. The escalating demand for sustainable energy storage solutions, coupled with stringent environmental regulations, is a significant driver. Competitive product substitutes, such as advancements in fuel cell technology, pose a growing challenge, necessitating continuous improvement in battery performance and cost-effectiveness. End-user demographics are increasingly skewed towards industries prioritizing reliability and efficiency, including data centers, telecommunications, and material handling. Mergers and acquisitions (M&A) activity remains robust, with companies strategically consolidating to enhance market share and expand product portfolios.

- Market Concentration: Dominated by a few large, established manufacturers, but with increasing entry of specialized players in niche segments.

- Technological Innovation: Driven by the pursuit of higher energy density, faster charging capabilities, extended lifespan, and improved safety features, particularly in Lithium-ion technologies.

- Regulatory Frameworks: Supportive policies for renewable energy integration and e-mobility are boosting demand for industrial batteries, while recycling mandates influence product design and end-of-life management.

- Competitive Product Substitutes: Emerging energy storage solutions and advancements in existing technologies present ongoing competitive pressures.

- End-User Demographics: Growing demand from critical infrastructure sectors (telecom, data centers), logistics (forklifts), and renewable energy storage.

- M&A Trends: Strategic acquisitions and partnerships are prevalent for technology acquisition, market expansion, and vertical integration.

North America Industrial Battery Manufacturing Industry Growth Trends & Insights

The North America Industrial Battery Manufacturing Industry is projected for robust expansion, fueled by the accelerating global transition towards electrification and sustainable energy practices. Market size evolution is marked by a consistent upward trajectory, with significant growth anticipated in the forecast period. Adoption rates for advanced battery technologies, especially Lithium-ion, are surging across diverse applications, driven by their superior performance characteristics compared to traditional Lead-acid batteries. Technological disruptions, including innovations in battery chemistries, manufacturing processes, and energy management systems, are continuously reshaping the competitive landscape. Consumer behavior shifts are evident, with a growing preference for batteries offering longer lifecycles, enhanced safety, and reduced environmental impact.

- Market Size Evolution: Expected to witness a substantial increase from an estimated $XX billion in 2025 to $XX billion by 2033.

- CAGR: The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025–2033).

- Adoption Rates: Higher adoption of Lithium-ion batteries for applications requiring high energy density and longer cycle life, while Lead-acid batteries continue to dominate in cost-sensitive and high-power discharge scenarios.

- Technological Disruptions: Advancements in solid-state batteries, improved thermal management systems, and smart battery management systems are key disruptors.

- Consumer Behavior Shifts: Increasing demand for "green" energy solutions, longer product warranties, and manufacturers with strong sustainability commitments.

- Market Penetration: Deeper penetration into emerging applications such as grid-scale energy storage and electric vehicle charging infrastructure.

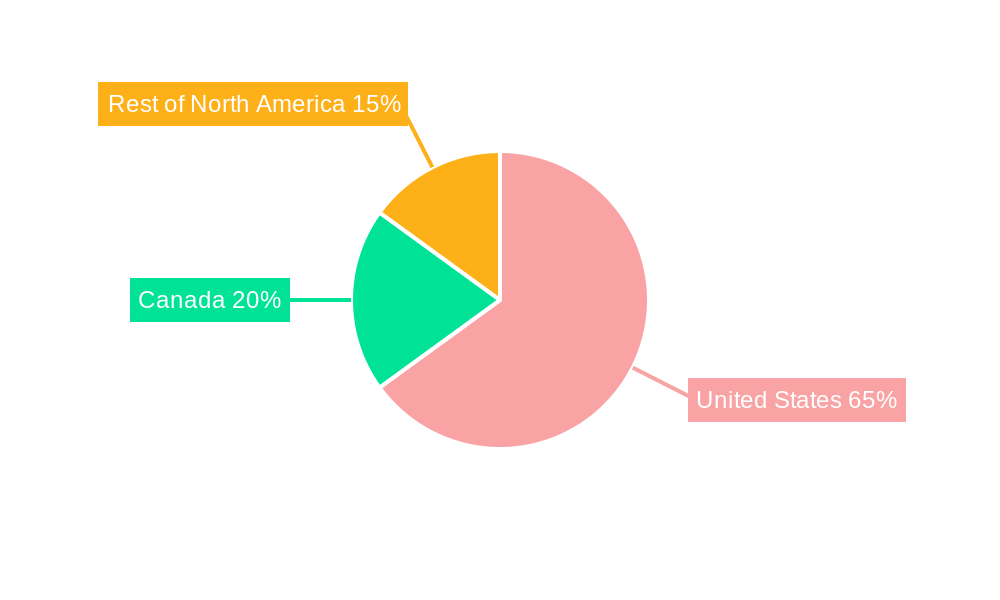

Dominant Regions, Countries, or Segments in North America Industrial Battery Manufacturing Industry

The United States stands out as the dominant region in the North America Industrial Battery Manufacturing Industry, primarily due to its robust industrial infrastructure, significant investments in renewable energy, and a thriving technology sector. This dominance is further amplified by substantial government incentives and a strong consumer and industrial demand for energy storage solutions.

Dominant Country: United States

- Key Drivers:

- Extensive adoption of Lithium-ion batteries in Telecommunications and UPS applications.

- Large manufacturing base for Forklifts and other material handling equipment.

- Significant government support for renewable energy projects and electric vehicle infrastructure, directly increasing demand for industrial batteries.

- Presence of major industrial battery manufacturers and research institutions.

- Favorable economic policies and a large domestic market.

- Market Share: The United States is estimated to hold approximately XX% of the North American industrial battery market.

- Growth Potential: Continued high growth driven by grid modernization, expansion of data centers, and electrification of industries.

- Key Drivers:

Dominant Segment (Technology): Lithium-ion Battery

- Key Drivers:

- Superior energy density, longer lifespan, and faster charging capabilities.

- Decreasing manufacturing costs due to economies of scale and technological advancements.

- Increasing demand from sectors requiring compact and powerful energy solutions.

- Growth Potential: Expected to witness the highest growth rate among battery technologies.

- Key Drivers:

Dominant Segment (Application): UPS (Uninterruptible Power Supply)

- Key Drivers:

- Critical need for reliable power backup in data centers, telecommunications, and healthcare facilities.

- Increasing digitalization and reliance on continuous power supply.

- Advancements in UPS systems that leverage higher capacity and more efficient battery technologies.

- Growth Potential: Steady and strong growth driven by the expanding digital infrastructure and critical services.

- Key Drivers:

Secondary Market: Canada

- Key Drivers: Growing interest in renewable energy integration, particularly in remote and off-grid applications, and a developing electric vehicle ecosystem.

- Market Share: Estimated to account for XX% of the North American market.

Secondary Market: Rest of North America

- Key Drivers: Emerging industrial hubs and increasing investments in energy infrastructure.

North America Industrial Battery Manufacturing Industry Product Landscape

The product landscape of the North America Industrial Battery Manufacturing Industry is defined by a continuous stream of innovation focused on enhancing performance, efficiency, and sustainability. Key product categories include advanced Lithium-ion Battery chemistries (e.g., NMC, LFP) offering higher energy density and improved safety, and evolving Lead-acid Battery technologies (e.g., AGM, Gel) that provide cost-effective solutions for specific applications. Performance metrics such as cycle life, charge/discharge rates, operating temperature ranges, and power output are constantly being improved. Unique selling propositions often lie in tailored solutions for specific industrial needs, integration with smart energy management systems, and adherence to stringent safety and environmental standards.

Key Drivers, Barriers & Challenges in North America Industrial Battery Manufacturing Industry

Key Drivers:

The North America Industrial Battery Manufacturing Industry is propelled by several key forces. The accelerating shift towards electrification across transportation and industrial sectors mandates robust energy storage solutions. Government incentives and supportive policies aimed at promoting renewable energy integration and reducing carbon emissions significantly boost demand. Furthermore, the increasing reliance on data centers and telecommunications infrastructure, which require uninterrupted power supply, drives the adoption of industrial batteries for UPS applications. Technological advancements in battery chemistries and manufacturing processes are leading to more efficient, durable, and cost-effective products.

Barriers & Challenges:

Despite the strong growth, the industry faces notable challenges. Supply chain disruptions, particularly for critical raw materials like lithium and cobalt, can impact production volumes and increase costs. Regulatory hurdles and evolving environmental standards, while driving innovation, can also create compliance challenges for manufacturers. Intense competition from both established players and emerging technologies, including advancements in alternative energy sources, requires continuous investment in R&D to maintain a competitive edge. The high initial capital investment for advanced battery manufacturing facilities also presents a barrier to entry for smaller companies.

Emerging Opportunities in North America Industrial Battery Manufacturing Industry

Emerging opportunities in the North America Industrial Battery Manufacturing Industry are multifaceted. The burgeoning market for grid-scale energy storage solutions, supporting renewable energy integration and grid stability, presents substantial growth potential. The electrification of material handling equipment beyond forklifts, such as automated guided vehicles (AGVs) and autonomous mobile robots (AMRs), opens new avenues for battery manufacturers. Furthermore, the development of battery recycling infrastructure and circular economy models offers significant economic and environmental advantages, creating opportunities for companies involved in battery lifecycle management. The demand for specialized industrial batteries in niche applications like aerospace, defense, and industrial automation is also on the rise.

Growth Accelerators in the North America Industrial Battery Manufacturing Industry Industry

Several catalysts are accelerating long-term growth in the North America Industrial Battery Manufacturing Industry. Key among these are ongoing technological breakthroughs in battery chemistries, leading to higher energy density, faster charging, and improved safety, such as the progress in solid-state battery technology. Strategic partnerships and collaborations between battery manufacturers, equipment OEMs, and energy companies are crucial for developing integrated solutions and expanding market reach. Market expansion strategies, including global supply chain diversification and penetration into underserved industrial segments, are further bolstering growth. The increasing focus on sustainability and the circular economy, driven by both consumer demand and regulatory pressures, is also a significant growth accelerator.

Key Players Shaping the North America Industrial Battery Manufacturing Industry Market

- EnerSys

- Amara Raja Batteries Ltd

- Saft Groupe SA

- Exide Industries Ltd

- East Penn Manufacturing Company Inc

- GS Yuasa Corporation

- C&D Technologies Pvt Ltd

- Panasonic Corporation

Notable Milestones in North America Industrial Battery Manufacturing Industry Sector

- June 2022: Sunlight Group received around EUR 275 million in funding to increase its lead-acid and lithium-ion battery production and R&D. The company aims to cater to the increased global demand for green energy storage solutions. Thus, the company is expected to upgrade and expands its current production and assembly lines. The company is likely to invest in facilities in Greece, Italy, and the United States to increase the output of lithium-ion and lead-acid batteries and energy storage systems.

- May 2022: The largest zero-emission and environmentally friendly battery recycling park in North America will be built and run by ACE Green Recycling in Texas, USA. When fully operational, the park is anticipated to recycle both lead-acid and lithium-ion batteries. Up to 100,000 metric tons of spent lead-acid batteries and 20,000 metric tons of used lithium-ion batteries are expected to be processed and recycled annually by the park by 2025.

In-Depth North America Industrial Battery Manufacturing Industry Market Outlook

The future outlook for the North America Industrial Battery Manufacturing Industry is exceptionally promising, driven by persistent demand for energy storage and the ongoing energy transition. Growth accelerators such as advancements in battery technology, particularly in energy density and charging speeds, alongside the expansion of renewable energy infrastructure, will continue to fuel market expansion. Strategic partnerships and a focus on circular economy principles through enhanced recycling capabilities are poised to further strengthen the industry's sustainability and economic viability. The market's trajectory indicates significant opportunities for innovation and investment, particularly in segments like grid-scale storage and specialized industrial applications, ensuring a robust and dynamic future for this critical sector.

North America Industrial Battery Manufacturing Industry Segmentation

-

1. Technology

- 1.1. Lithium-ion Battery

- 1.2. Lead-acid Battery

- 1.3. Other Te

-

2. Application

- 2.1. Forklift

- 2.2. Telecom

- 2.3. UPS

- 2.4. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Industrial Battery Manufacturing Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Industrial Battery Manufacturing Industry Regional Market Share

Geographic Coverage of North America Industrial Battery Manufacturing Industry

North America Industrial Battery Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Lithium-ion Battery Prices4.; Rising Renewable Energy Integration Worldwide

- 3.3. Market Restrains

- 3.3.1. 4.; Uncertainty in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery (LIB) Technology to be the Fastest Growing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Industrial Battery Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-acid Battery

- 5.1.3. Other Te

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Forklift

- 5.2.2. Telecom

- 5.2.3. UPS

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. United States North America Industrial Battery Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Lithium-ion Battery

- 6.1.2. Lead-acid Battery

- 6.1.3. Other Te

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Forklift

- 6.2.2. Telecom

- 6.2.3. UPS

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Canada North America Industrial Battery Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Lithium-ion Battery

- 7.1.2. Lead-acid Battery

- 7.1.3. Other Te

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Forklift

- 7.2.2. Telecom

- 7.2.3. UPS

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Rest of North America North America Industrial Battery Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Lithium-ion Battery

- 8.1.2. Lead-acid Battery

- 8.1.3. Other Te

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Forklift

- 8.2.2. Telecom

- 8.2.3. UPS

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 EnerSys

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Amara Raja Batteries Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Saft Groupe SA*List Not Exhaustive

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Exide Industries Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 East Penn Manufacturing Company Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 GS Yuasa Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 C&D Technologies Pvt Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Panasonic Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 EnerSys

List of Figures

- Figure 1: North America Industrial Battery Manufacturing Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Industrial Battery Manufacturing Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Industrial Battery Manufacturing Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: North America Industrial Battery Manufacturing Industry Volume Kiloton Forecast, by Technology 2020 & 2033

- Table 3: North America Industrial Battery Manufacturing Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: North America Industrial Battery Manufacturing Industry Volume Kiloton Forecast, by Application 2020 & 2033

- Table 5: North America Industrial Battery Manufacturing Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: North America Industrial Battery Manufacturing Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 7: North America Industrial Battery Manufacturing Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: North America Industrial Battery Manufacturing Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 9: North America Industrial Battery Manufacturing Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 10: North America Industrial Battery Manufacturing Industry Volume Kiloton Forecast, by Technology 2020 & 2033

- Table 11: North America Industrial Battery Manufacturing Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: North America Industrial Battery Manufacturing Industry Volume Kiloton Forecast, by Application 2020 & 2033

- Table 13: North America Industrial Battery Manufacturing Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: North America Industrial Battery Manufacturing Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 15: North America Industrial Battery Manufacturing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: North America Industrial Battery Manufacturing Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 17: North America Industrial Battery Manufacturing Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 18: North America Industrial Battery Manufacturing Industry Volume Kiloton Forecast, by Technology 2020 & 2033

- Table 19: North America Industrial Battery Manufacturing Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: North America Industrial Battery Manufacturing Industry Volume Kiloton Forecast, by Application 2020 & 2033

- Table 21: North America Industrial Battery Manufacturing Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: North America Industrial Battery Manufacturing Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 23: North America Industrial Battery Manufacturing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: North America Industrial Battery Manufacturing Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: North America Industrial Battery Manufacturing Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 26: North America Industrial Battery Manufacturing Industry Volume Kiloton Forecast, by Technology 2020 & 2033

- Table 27: North America Industrial Battery Manufacturing Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: North America Industrial Battery Manufacturing Industry Volume Kiloton Forecast, by Application 2020 & 2033

- Table 29: North America Industrial Battery Manufacturing Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: North America Industrial Battery Manufacturing Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 31: North America Industrial Battery Manufacturing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: North America Industrial Battery Manufacturing Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Industrial Battery Manufacturing Industry?

The projected CAGR is approximately 10.3%.

2. Which companies are prominent players in the North America Industrial Battery Manufacturing Industry?

Key companies in the market include EnerSys, Amara Raja Batteries Ltd, Saft Groupe SA*List Not Exhaustive, Exide Industries Ltd, East Penn Manufacturing Company Inc, GS Yuasa Corporation, C&D Technologies Pvt Ltd, Panasonic Corporation.

3. What are the main segments of the North America Industrial Battery Manufacturing Industry?

The market segments include Technology, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Lithium-ion Battery Prices4.; Rising Renewable Energy Integration Worldwide.

6. What are the notable trends driving market growth?

Lithium-ion Battery (LIB) Technology to be the Fastest Growing Market.

7. Are there any restraints impacting market growth?

4.; Uncertainty in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

June 2022: Sunlight Group received around EUR 275 million in funding to increase its lead-acid and lithium-ion battery production and R&D. The company aims to cater to the increased global demand for green energy storage solutions. Thus, the company is expected to upgrade and expands its current production and assembly lines. The company is likely to invest in facilities in Greece, Italy, and the United States to increase the output of lithium-ion and lead-acid batteries and energy storage systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Industrial Battery Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Industrial Battery Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Industrial Battery Manufacturing Industry?

To stay informed about further developments, trends, and reports in the North America Industrial Battery Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence