Key Insights

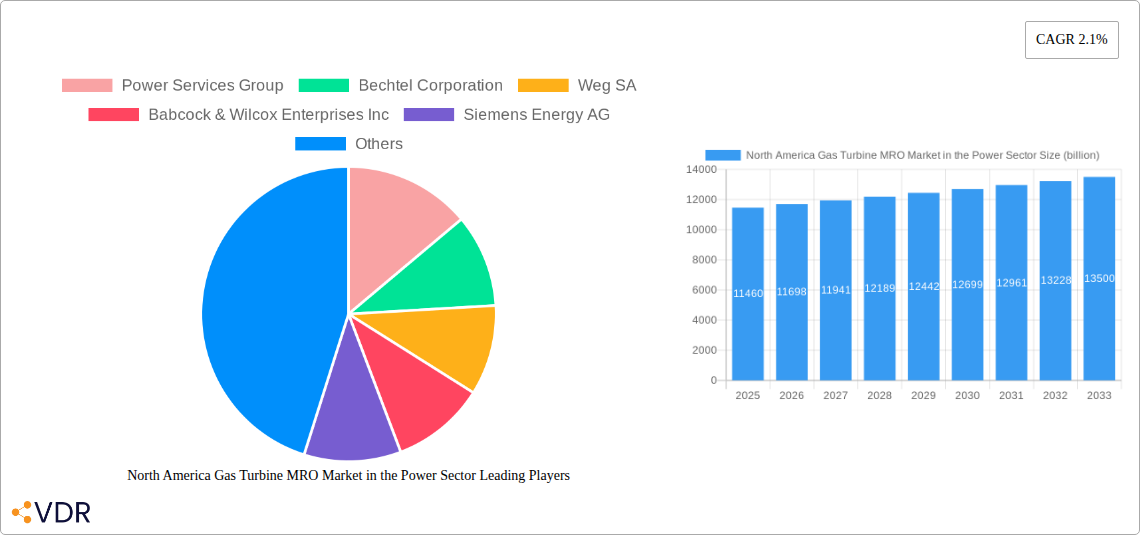

The North America Gas Turbine MRO market in the power sector is poised for steady growth, estimated at USD 11.46 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of 2.1% through 2033. This expansion is primarily fueled by the ongoing need to maintain and optimize aging gas turbine fleets powering a significant portion of North America's electricity generation. Increasing demand for reliable and efficient power, coupled with stricter environmental regulations that necessitate improved turbine performance and reduced emissions, are key drivers. Furthermore, the rising adoption of advanced diagnostic tools and predictive maintenance technologies is enhancing the efficiency and effectiveness of MRO services, contributing to market resilience. The ongoing transition towards cleaner energy sources also indirectly supports the gas turbine MRO market, as these turbines are crucial for grid stability during this transitional phase, requiring continuous operational readiness.

North America Gas Turbine MRO Market in the Power Sector Market Size (In Billion)

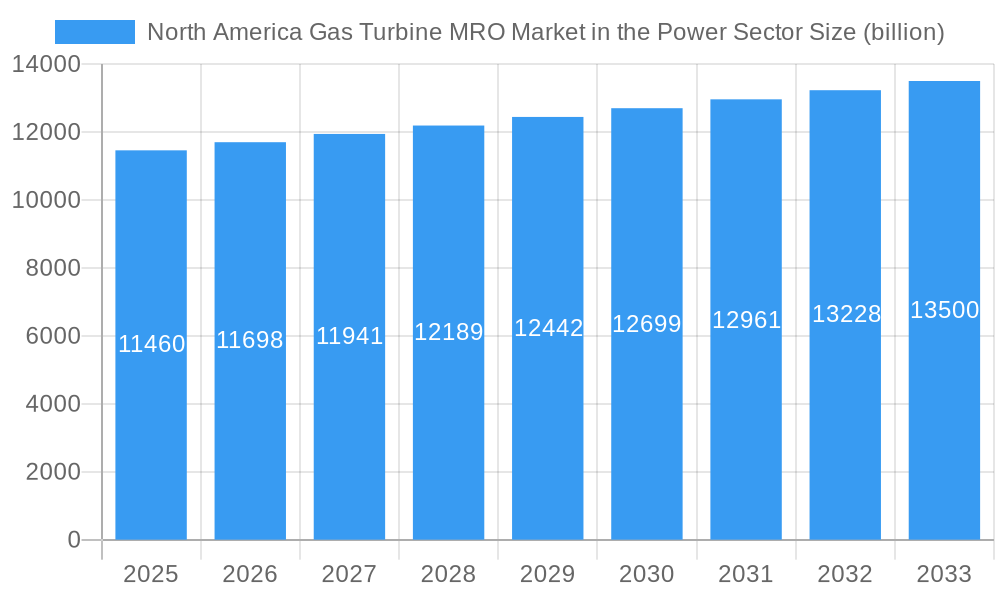

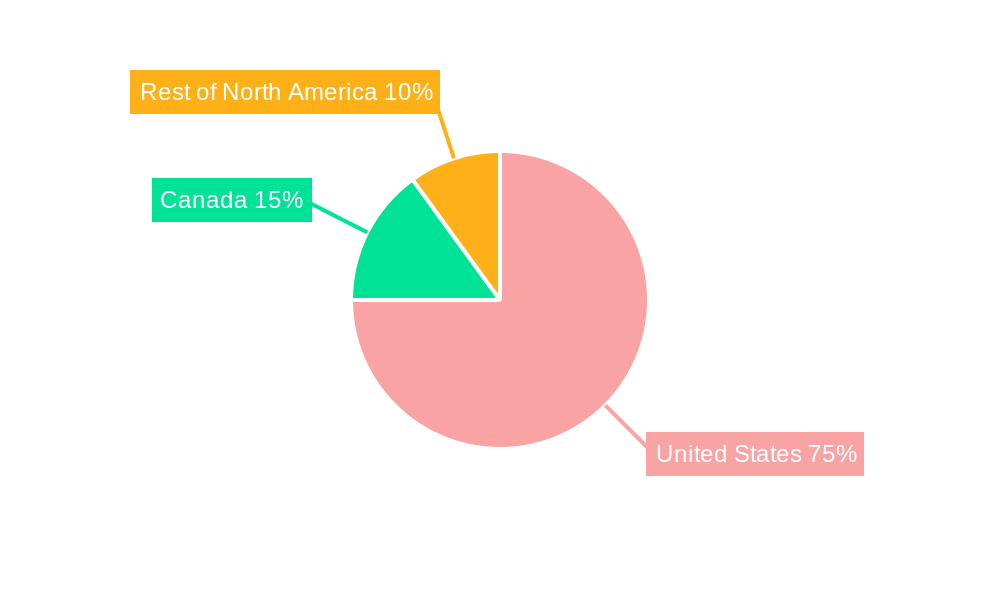

The market segmentation reveals a robust demand across all service types, including Maintenance, Repair, and Overhaul, reflecting the comprehensive lifecycle support required for gas turbines. Geographically, the United States dominates the market due to its extensive installed base of gas turbines and substantial investments in power infrastructure. Canada and the Rest of North America also present significant opportunities, driven by their own power generation needs and a growing focus on optimizing existing assets. Major industry players like Siemens Energy AG, General Electric Company, and Mitsubishi Heavy Industries Ltd are actively investing in R&D and expanding their service offerings to capture market share. The market's trajectory, while showing consistent growth, also acknowledges the long-term shifts in energy landscapes, ensuring a sustained need for efficient and dependable gas turbine operations for the foreseeable future.

North America Gas Turbine MRO Market in the Power Sector Company Market Share

Unlock unparalleled insights into the dynamic North America Gas Turbine Maintenance, Repair, and Overhaul (MRO) market within the power sector. This in-depth report, covering the period from 2019 to 2033 with a base year of 2025, delivers precise analysis of market size, growth trajectories, competitive landscapes, and emerging opportunities. Essential for industry leaders, strategists, and investors seeking to capitalize on the evolving energy infrastructure.

The North America Gas Turbine MRO market in the power sector is poised for significant expansion, driven by the critical need for reliable and efficient power generation. This report offers a granular view of the market, encompassing key segments, regional dominance, technological advancements, and strategic developments shaping the future.

Report Coverage:

Segments Analyzed:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

- Service Type: Maintenance, Repair, Overhaul

- Geography: United States, Canada, Rest of North America

North America Gas Turbine MRO Market in the Power Sector Market Dynamics & Structure

The North America Gas Turbine MRO market in the power sector exhibits a moderately concentrated structure, with a few key players dominating a substantial portion of the market share. Technological innovation is a primary driver, fueled by the continuous pursuit of enhanced efficiency, reduced emissions, and extended turbine lifecycles. Stringent environmental regulations and evolving energy policies are also shaping operational demands and MRO service requirements, pushing for cleaner and more sustainable gas turbine operations. While direct competitive product substitutes for gas turbines themselves are limited in the immediate power generation context, advancements in renewable energy integration and energy storage solutions present indirect competitive pressures by influencing the long-term demand for gas-fired power plants. End-user demographics are shifting, with an increasing reliance on gas turbines for grid stability and peak demand management, necessitating robust MRO strategies. Mergers and Acquisitions (M&A) trends are evident as larger service providers seek to expand their service portfolios, geographical reach, and economies of scale. For instance, in 2023, the estimated M&A deal volume was XX, indicating strategic consolidation. Innovation barriers include high capital investment for advanced MRO technologies and the specialized expertise required for complex turbine repairs.

- Market Concentration: Dominated by a few major service providers, but with increasing opportunities for specialized niche players.

- Technological Innovation: Focus on predictive maintenance, digital twin technology, and advanced diagnostic tools for enhanced turbine performance and longevity.

- Regulatory Frameworks: Environmental compliance, emissions standards (e.g., EPA regulations in the US), and grid modernization initiatives are key influencing factors.

- Competitive Substitutes: Indirect competition from the growing renewable energy sector and advancements in energy storage.

- End-User Demographics: Aging power plant infrastructure requiring extensive MRO, alongside new plant construction demanding specialized services.

- M&A Trends: Consolidation among key players to enhance service offerings and market penetration.

North America Gas Turbine MRO Market in the Power Sector Growth Trends & Insights

The North America Gas Turbine MRO market in the power sector is experiencing robust growth, projected to reach approximately \$XX billion in 2025 and expand to an estimated \$XX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This expansion is intricately linked to the increasing demand for electricity across North America, coupled with the ongoing retirement of older, less efficient power generation assets, necessitating the reliable operation of existing gas turbine fleets. Adoption rates of advanced MRO technologies, such as digital monitoring and predictive analytics, are steadily rising as power generation companies recognize their crucial role in minimizing downtime and optimizing operational costs. Technological disruptions, including the development of more fuel-efficient gas turbines and advancements in materials science for turbine components, are influencing the types of MRO services required. Consumer behavior, in this context referring to power generation companies, is shifting towards a greater emphasis on long-term service agreements and proactive maintenance strategies rather than reactive repairs. The market penetration of specialized MRO services is deep, with a continuous need for expert services to maintain the complex machinery that underpins grid stability. The market size evolution is directly correlated with the installed base of gas turbines and their operational hours. For example, an increase of XX% in the operational hours of heavy-duty gas turbines in the US between 2023 and 2024 necessitated a corresponding XX% rise in MRO expenditure.

Dominant Regions, Countries, or Segments in North America Gas Turbine MRO Market in the Power Sector

The United States is unequivocally the dominant region within the North America Gas Turbine MRO market in the power sector, accounting for an estimated XX% of the total market revenue in 2025. This dominance stems from several key factors, including the largest installed base of gas turbines, extensive existing power generation infrastructure, and significant ongoing investments in maintaining and upgrading its energy grid. Economic policies in the US, such as incentives for cleaner energy production and grid modernization initiatives, directly fuel the demand for comprehensive MRO services. The country’s commitment to energy security and the need for reliable baseload power, often provided by gas turbines, further solidifies its leading position.

Within the United States, the Maintenance segment, comprising scheduled inspections, routine servicing, and component replacements, currently represents the largest share of the MRO market, estimated at XX% in 2025. This is driven by the sheer volume of gas turbines in operation requiring continuous upkeep to ensure optimal performance and prevent costly failures. The Repair segment, which addresses component damage and functional issues, follows closely, driven by the need to restore turbines to their operational capacity promptly. The Overhaul segment, encompassing comprehensive disassembly, inspection, and refurbishment of entire turbine units, while representing a smaller portion in terms of frequency, is characterized by high-value contracts.

The United States benefits from a highly developed industrial ecosystem, a skilled workforce, and a robust supply chain for gas turbine parts and specialized MRO services. The presence of major gas turbine manufacturers and their authorized service providers further amplifies the market's growth and innovation. For instance, the recent investment of \$XX billion by a leading energy provider in upgrading its gas turbine fleet in Texas underscores the immense growth potential and continuous demand for MRO services in the region. The market share of the United States is projected to remain substantial throughout the forecast period, driven by ongoing infrastructure development and the critical role of gas turbines in meeting the nation's diverse energy needs.

North America Gas Turbine MRO Market in the Power Sector Product Landscape

The product landscape within the North America Gas Turbine MRO market is characterized by a sophisticated array of services and technologies designed to optimize the performance, reliability, and longevity of gas turbine assets. This includes specialized component repair, advanced diagnostic tooling, and performance enhancement solutions. Innovations focus on extending component life, improving fuel efficiency, and reducing emissions through advanced materials and repair techniques. Unique selling propositions revolve around faster turnaround times, extended warranty periods, and customized MRO plans tailored to specific turbine models and operational environments. Technological advancements such as digital twins, AI-powered predictive maintenance platforms, and specialized robotic repair systems are transforming the MRO ecosystem, offering enhanced precision and reduced human intervention in critical procedures. The application of these services spans from routine inspections to complex component remanufacturing, ensuring the continuous operational integrity of gas turbines in the power sector.

Key Drivers, Barriers & Challenges in North America Gas Turbine MRO Market in the Power Sector

Key Drivers:

- Aging Gas Turbine Fleet: A significant portion of North America's gas turbine infrastructure is aging, necessitating extensive maintenance and repair to ensure reliability and efficiency.

- Increasing Electricity Demand: Growing energy consumption across industrial, commercial, and residential sectors drives the need for consistent power generation, relying heavily on gas turbines.

- Focus on Grid Stability: Gas turbines play a crucial role in providing baseload and peaking power, essential for grid stability, thus demanding robust MRO services.

- Technological Advancements: Innovations in MRO techniques, predictive analytics, and digital solutions enhance turbine performance and reduce operational costs.

- Environmental Regulations: Stricter emissions standards encourage upgrades and efficient operation, requiring specialized MRO support.

Barriers & Challenges:

- High Capital Investment: Implementing advanced MRO technologies and acquiring specialized equipment requires substantial financial outlay.

- Skilled Workforce Shortage: A growing deficit in skilled technicians and engineers capable of performing complex MRO tasks poses a significant challenge.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability of critical spare parts and specialized components.

- Competition from Renewables: The increasing integration of renewable energy sources may, in the long term, influence the demand for new gas turbine installations, impacting the MRO market.

- Regulatory Uncertainty: Evolving environmental policies and energy transition pathways can create uncertainty in long-term investment and operational strategies.

Emerging Opportunities in North America Gas Turbine MRO Market in the Power Sector

Emerging opportunities in the North America Gas Turbine MRO market lie in the expansion of digital MRO solutions, including the implementation of AI-driven predictive maintenance and remote monitoring services. The growing demand for advanced component repair and remanufacturing, utilizing novel materials and techniques, presents a significant growth avenue. Furthermore, the increasing focus on hybrid power generation solutions, where gas turbines are integrated with renewable energy sources, creates opportunities for specialized MRO services that cater to these complex systems. The development of sustainable MRO practices, aimed at reducing waste and environmental impact, is also gaining traction.

Growth Accelerators in the North America Gas Turbine MRO Market in the Power Sector Industry

Several catalysts are accelerating growth in the North America Gas Turbine MRO market. Technological breakthroughs in areas like additive manufacturing for spare parts and advanced analytics for performance optimization are enhancing service capabilities. Strategic partnerships between Original Equipment Manufacturers (OEMs), independent service providers, and technology firms are fostering innovation and expanding service offerings. Market expansion strategies, such as geographical diversification into underserved regions and the development of lifecycle management solutions, are also propelling growth. The increasing adoption of long-term service agreements by power utilities is a significant growth accelerator, ensuring a steady revenue stream for MRO providers.

Key Players Shaping the North America Gas Turbine MRO Market in the Power Sector Market

- Power Services Group

- Bechtel Corporation

- Weg SA

- Babcock & Wilcox Enterprises Inc

- Siemens Energy AG

- Sulzer AG

- General Electric Company

- Flour Corporation

- Mitsubishi Heavy Industries Ltd

Notable Milestones in North America Gas Turbine MRO Market in the Power Sector Sector

- August 2022: Duke Energy's Lincoln Combustion Turbine Station, powered by Siemens Energy's SGT6-9000HL (60Hz) turbine, was certified as the "highest powerful simple-cycle gas power plant" with an output of 410.9 megawatts by Guinness World Records, highlighting advancements in turbine technology and performance. Siemens Energy's installation and testing of this turbine at the station near Denver, N.C., as part of an innovative partnership, underscores the collaborative efforts driving technological progress.

- May 2022: The first two Mitsubishi Power M501JAC gas turbines manufactured in North America reached commercial operation at J-POWER USA Development Co. Ltd.'s (J-POWER USA) Jackson Generation Project, a 1,200 megawatt (MW) combined-cycle power plant in Elwood, Illinois. This milestone signifies increased regional manufacturing capabilities and the growing deployment of advanced gas turbine technology in North America.

In-Depth North America Gas Turbine MRO Market in the Power Sector Market Outlook

The North America Gas Turbine MRO market in the power sector is set for sustained growth, fueled by the essential role of gas turbines in providing reliable and flexible power. Future market potential is significantly enhanced by the ongoing need to maintain and optimize existing fleets, coupled with the gradual integration of newer, more efficient turbine technologies. Strategic opportunities abound in the adoption of digital transformation initiatives, leading to predictive and prescriptive maintenance solutions that minimize downtime and operational costs. Furthermore, the increasing global emphasis on energy transition, while presenting long-term shifts, also creates short to medium-term opportunities for gas turbines to serve as bridging technologies, demanding high-quality MRO support. Investments in advanced repair techniques and component remanufacturing will be critical for service providers to remain competitive and capitalize on the evolving demands of the power generation industry.

North America Gas Turbine MRO Market in the Power Sector Segmentation

-

1. Service Type

- 1.1. Maintenance

- 1.2. Repair

- 1.3. Overhaul

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Gas Turbine MRO Market in the Power Sector Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Gas Turbine MRO Market in the Power Sector Regional Market Share

Geographic Coverage of North America Gas Turbine MRO Market in the Power Sector

North America Gas Turbine MRO Market in the Power Sector REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies and Incentives4.; Environmental Concerns

- 3.3. Market Restrains

- 3.3.1. 4.; Fossil Fuel Subsidies

- 3.4. Market Trends

- 3.4.1. Maintenance Service Type Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Gas Turbine MRO Market in the Power Sector Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Maintenance

- 5.1.2. Repair

- 5.1.3. Overhaul

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. United States North America Gas Turbine MRO Market in the Power Sector Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Maintenance

- 6.1.2. Repair

- 6.1.3. Overhaul

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Canada North America Gas Turbine MRO Market in the Power Sector Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Maintenance

- 7.1.2. Repair

- 7.1.3. Overhaul

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Rest of North America North America Gas Turbine MRO Market in the Power Sector Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Maintenance

- 8.1.2. Repair

- 8.1.3. Overhaul

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Power Services Group

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Bechtel Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Weg SA

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Babcock & Wilcox Enterprises Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Siemens Energy AG

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Sulzer AG

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 General Electric Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Flour Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Mitsubishi Heavy Industries Ltd

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Power Services Group

List of Figures

- Figure 1: North America Gas Turbine MRO Market in the Power Sector Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Gas Turbine MRO Market in the Power Sector Share (%) by Company 2025

List of Tables

- Table 1: North America Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: North America Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: North America Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Service Type 2020 & 2033

- Table 5: North America Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Country 2020 & 2033

- Table 7: North America Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Service Type 2020 & 2033

- Table 8: North America Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: North America Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Country 2020 & 2033

- Table 10: North America Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Service Type 2020 & 2033

- Table 11: North America Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Gas Turbine MRO Market in the Power Sector?

The projected CAGR is approximately 2.1%.

2. Which companies are prominent players in the North America Gas Turbine MRO Market in the Power Sector?

Key companies in the market include Power Services Group, Bechtel Corporation, Weg SA, Babcock & Wilcox Enterprises Inc, Siemens Energy AG, Sulzer AG, General Electric Company, Flour Corporation, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the North America Gas Turbine MRO Market in the Power Sector?

The market segments include Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.46 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies and Incentives4.; Environmental Concerns.

6. What are the notable trends driving market growth?

Maintenance Service Type Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Fossil Fuel Subsidies.

8. Can you provide examples of recent developments in the market?

August 2022: Duke Energy's Lincoln Combustion Turbine Station, powered by Siemens Energy's SGT6-9000HL (60Hz) turbine, has been certified as the "highest powerful simple-cycle gas power plant" with an output of 410.9 megawatts by Guinness World Records. Siemens Energy installed and is now testing its SGT6-9000HL turbine at Duke Energy's Lincoln Combustion Turbine Station near Denver, N.C., some 25 miles north of Charlotte, N.C., as part of an innovative partnership.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Gas Turbine MRO Market in the Power Sector," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Gas Turbine MRO Market in the Power Sector report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Gas Turbine MRO Market in the Power Sector?

To stay informed about further developments, trends, and reports in the North America Gas Turbine MRO Market in the Power Sector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence