Key Insights

The North American flexographic printing market is poised for significant expansion, driven by escalating demand for versatile flexible packaging solutions across key sectors like food & beverage, pharmaceuticals, and consumer goods. This growth is underpinned by the increasing adoption of sustainable packaging materials, a rising preference for premium print quality, and the integration of automation and digital printing technologies to optimize production efficiency and cost-effectiveness. The market is segmented by equipment type (narrow web, wide web, sheetfed, etc.) and application (flexible packaging, labels, folding cartons, corrugated packaging, etc.). With a projected Compound Annual Growth Rate (CAGR) of 0.5%, the market size is expected to reach approximately 86.6 billion by 2025, up from an estimated base in 2024.

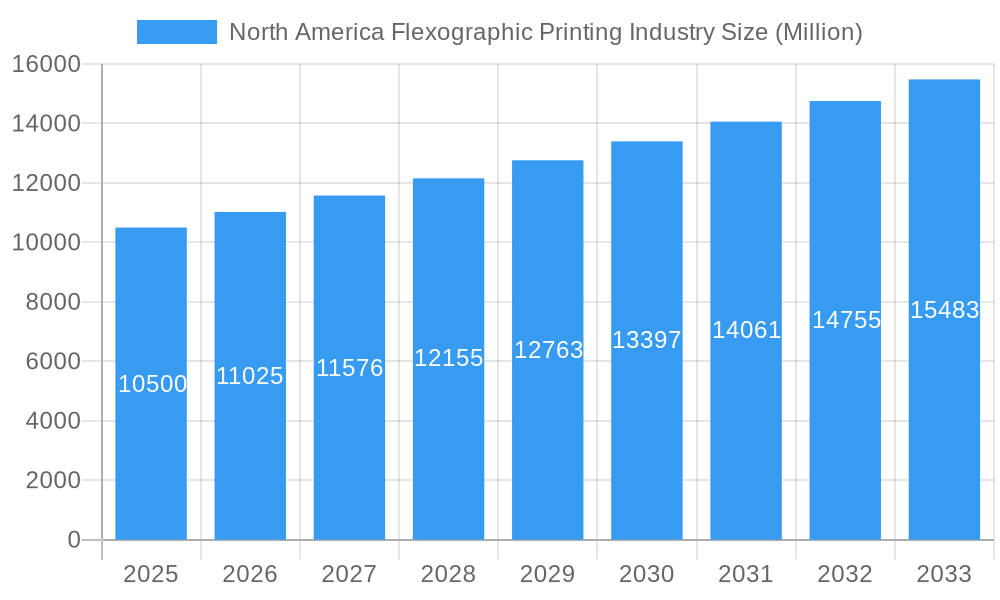

North America Flexographic Printing Industry Market Size (In Billion)

Despite this positive outlook, the industry confronts challenges, including escalating raw material and energy costs, which impact profitability. Intense market competition and the rapid evolution of printing technologies necessitate continuous innovation and strategic adaptation. Leading companies such as Koenig & Bauer, Barry-Wehmiller, and BOBST underscore a competitive environment characterized by substantial investment in technological advancements and market expansion. Nevertheless, the long-term prospects for the North American flexographic printing industry remain robust, fueled by sustained demand for sustainable packaging and the adoption of cutting-edge printing technologies that enhance efficiency and foster growth. Continued emphasis on innovation and sustainable practices will be paramount for market participants to secure a competitive advantage and leverage emerging opportunities within this dynamic sector.

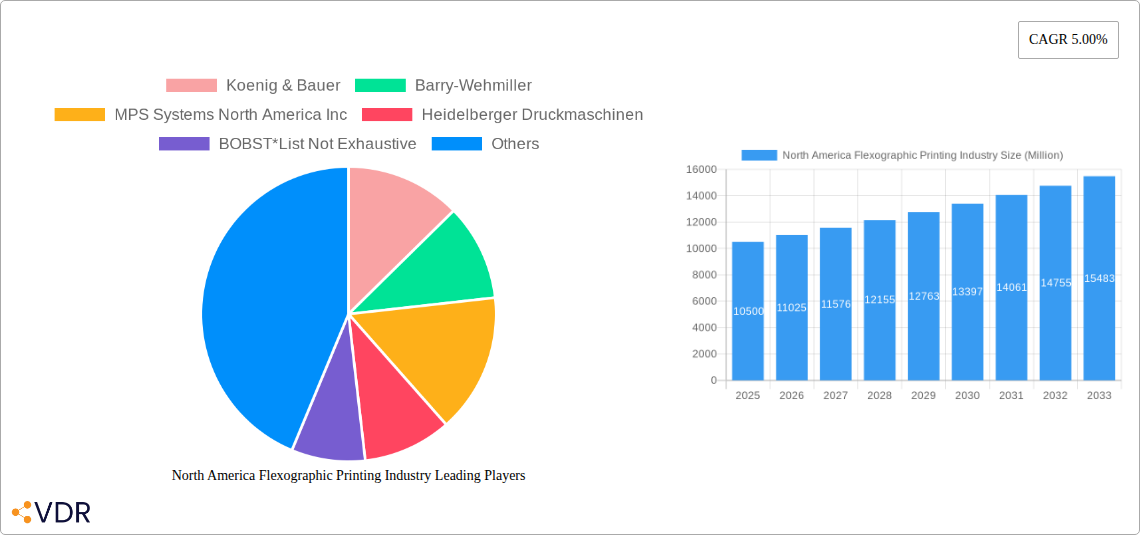

North America Flexographic Printing Industry Company Market Share

North America Flexographic Printing Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America flexographic printing industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. We delve into market dynamics, growth trends, key players, and future opportunities, covering the period from 2019 to 2033. The report segments the market by equipment type (narrow web, wide web, sheetfed, other) and application (flexible packaging, bags & sacks, labels, folding cartons, corrugated packaging, other), providing a granular understanding of market size and growth potential within each segment. The Base Year is 2025, and the Estimated Year is 2025, with a Forecast Period spanning 2025-2033 and Historical Period from 2019-2024. All values are presented in million units.

North America Flexographic Printing Industry Market Dynamics & Structure

The North American flexographic printing industry is a dynamic and evolving sector, shaped by a confluence of competitive pressures, technological breakthroughs, stringent regulatory mandates, and shifting market trends. The industry landscape is characterized by a moderately concentrated structure, where established players are actively vying for market dominance. Key contributors like Koenig & Bauer, Barry-Wehmiller, MPS Systems North America Inc, Heidelberger Druckmaschinen, BOBST, Uteco North America, Mark Andy, and Flint Group collectively command a significant market share, estimated to be around XX% in 2025. This concentration highlights the strategic importance of these entities in defining the industry's trajectory.

- Market Concentration: The North American flexographic printing market exhibits a moderate level of concentration, with an estimated Herfindahl-Hirschman Index (HHI) of XX in 2025. This suggests a competitive environment where a handful of larger players hold substantial influence, but opportunities still exist for mid-sized and specialized firms.

- Technological Innovation: The relentless pace of technological advancement is a defining characteristic of this industry. The integration of digital printing technologies and sophisticated automation solutions is fundamentally reshaping operational efficiencies and enabling unprecedented levels of customization in printed products. However, the substantial initial capital investment required for these cutting-edge technologies can present a considerable barrier to entry for smaller enterprises, thereby influencing market accessibility.

- Regulatory Framework: The industry is increasingly influenced by a robust regulatory framework, particularly concerning environmental stewardship. Stringent regulations governing ink and solvent emissions are compelling manufacturers to adopt more sustainable practices and accelerate the adoption of eco-friendly inks, substrates, and printing processes.

- Competitive Substitutes: While flexography remains a dominant force, it faces persistent competitive threats from alternative printing technologies. Digital printing, with its inherent flexibility and speed for short runs, and gravure printing, known for its high-volume quality, continue to exert pressure on flexographic printing's market share in certain applications.

- End-User Demographics: The industry's growth is intrinsically linked to the expansion of its key end-user sectors. The burgeoning demand from the food & beverage, consumer goods, and pharmaceutical industries, driven by evolving consumer preferences and market growth, is a primary engine propelling the flexographic printing market forward.

- M&A Trends: The past five years have witnessed a moderate yet consistent level of merger and acquisition (M&A) activity within the North American flexographic printing industry. This trend, with an estimated average of XX deals completed annually, indicates strategic consolidation and efforts by companies to expand their capabilities, market reach, or technological portfolios.

North America Flexographic Printing Industry Growth Trends & Insights

The North American flexographic printing market experienced a period of moderate growth during the historical period (2019-2024). Driven by increasing demand for flexible packaging and labels, the market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). The market size reached approximately xx million units in 2024 and is estimated to reach xx million units in 2025. Technological advancements, such as the adoption of high-definition flexography (HD Flexo) and improved automation, are key growth drivers. Shifting consumer preferences towards sustainable packaging solutions also contribute significantly to the industry's growth. Market penetration of HD Flexo is expected to increase from xx% in 2025 to xx% by 2033.

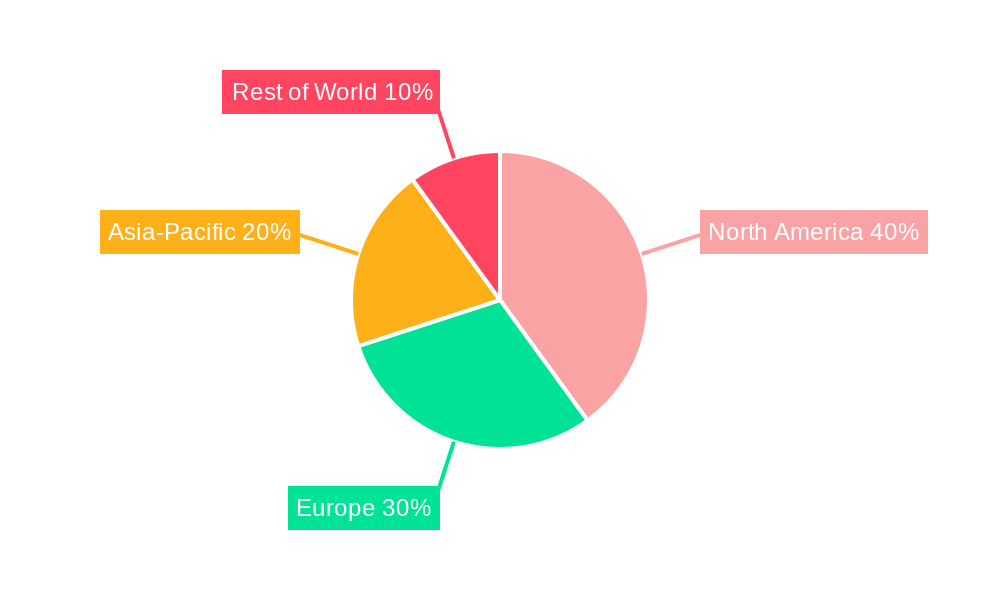

Dominant Regions, Countries, or Segments in North America Flexographic Printing Industry

The North American flexographic printing market is notably segmented by application, with flexible packaging emerging as the undisputed leader, commanding an estimated XX% market share in 2025. This segment is closely followed by the labels market, accounting for approximately XX%, and the bags and sacks segment, representing around XX%. Within the equipment domain, wide-web presses continue to dominate due to their unparalleled production capacity, catering to the high-volume demands of the packaging industry. Geographically, the Midwestern and Eastern regions of the United States stand out as key growth engines. This regional prominence is attributed to the robust manufacturing base and the substantial, sustained demand for innovative and efficient packaging solutions originating from these areas.

- Key Drivers:

- Robust economic growth across pivotal end-use sectors, fostering increased demand for printed materials.

- The exponential growth of e-commerce, which necessitates sophisticated and resilient packaging solutions.

- Supportive government initiatives and incentives promoting the adoption of sustainable and environmentally responsible packaging materials.

- Dominance Factors:

- A high concentration of established packaging manufacturers, creating a strong domestic demand for flexographic printing services.

- The presence of well-developed and efficient supply chains, ensuring timely access to raw materials and distribution of finished products.

- The availability of a skilled and experienced workforce adept in flexographic printing operations and technologies.

North America Flexographic Printing Industry Product Landscape

Recent advancements in flexographic printing technologies include the adoption of high-definition flexography (HD Flexo), which enhances print quality and reduces waste. Automation and digitalization are improving efficiency and enabling personalized packaging solutions. This drives the demand for advanced features and innovative printing solutions. New inks and substrates with improved sustainability profiles are also contributing to the evolution of the product landscape.

Key Drivers, Barriers & Challenges in North America Flexographic Printing Industry

Key Drivers:

- Increasing demand for flexible packaging from the food and beverage industry.

- Growth in e-commerce and the need for efficient packaging.

- Technological advancements in HD Flexo and automation.

Key Challenges:

- Rising raw material costs and supply chain disruptions.

- Increasing environmental regulations and the need for sustainable solutions.

- Competition from alternative printing technologies. (Estimated impact on market growth: xx% reduction in CAGR during 2027-2030 due to supply chain issues)

Emerging Opportunities in North America Flexographic Printing Industry

- The increasing consumer demand for unique and personalized packaging solutions is creating significant opportunities for flexographic printers to offer customized printing services and innovative designs.

- The global imperative for sustainability is driving a surge in the demand for eco-friendly packaging materials, presenting a fertile ground for flexographic printers to develop and implement greener printing processes and materials.

- The ongoing advancements in digital flexographic printing technologies are lowering barriers to entry for shorter runs and offering enhanced capabilities, opening new avenues for market penetration and service expansion.

Growth Accelerators in the North America Flexographic Printing Industry Industry

Several key factors are acting as powerful growth accelerators for the North American flexographic printing industry. Foremost among these are continuous technological innovations, which are enhancing printing quality, speed, and efficiency. Strategic partnerships and collaborations between leading equipment manufacturers and agile packaging converters are fostering synergistic growth and the development of integrated solutions. Furthermore, the strategic expansion into new and currently untapped markets, both geographically and in terms of emerging applications, presents substantial growth potential. The pervasive and intensifying trend towards sustainable packaging is a particularly significant catalyst, driving demand for eco-conscious solutions and creating new business opportunities for companies that can adapt and innovate in this space.

Key Players Shaping the North America Flexographic Printing Industry Market

Notable Milestones in North America Flexographic Printing Industry Sector

- 2021: Introduction of a new generation of HD Flexo presses by Mark Andy.

- 2022: Acquisition of a leading flexographic printing company by Barry-Wehmiller.

- 2023: Launch of a new sustainable ink solution by Flint Group. (Further specific details are required for more complete analysis)

In-Depth North America Flexographic Printing Industry Market Outlook

The outlook for the North American flexographic printing market is exceptionally positive, characterized by a trajectory of robust and sustained growth. This expansion is primarily fueled by the relentless pursuit of innovation in printing technologies, which are continually enhancing capabilities and reducing costs. Concurrently, the escalating demand for sustainable and environmentally responsible packaging solutions is a major market driver, pushing the industry towards greener practices. Moreover, the broadening application areas for flexographic printing across diverse industries are further contributing to its market ascendancy. The market presents a landscape rich with lucrative opportunities for forward-thinking companies. Strategic investments in state-of-the-art equipment, a dedicated focus on developing and offering eco-friendly printing solutions, and the adept identification and penetration of niche market segments are crucial for achieving enduring, long-term success. Ultimately, the future prosperity of this industry hinges on its ability to nimbly adapt to the ever-evolving technological frontier and the dynamic, changing demands of consumers and businesses alike.

North America Flexographic Printing Industry Segmentation

-

1. Equipment

- 1.1. Narrow Web

- 1.2. Wide Web

- 1.3. Sheetfed

- 1.4. Other Equipment

-

2. Application

- 2.1. Flexible Packaging

- 2.2. Bags and Sacks

- 2.3. Labels

- 2.4. Folding Cartons

- 2.5. Corrugated packaging

- 2.6. Other Applications

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

-

3.1. North America

North America Flexographic Printing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

North America Flexographic Printing Industry Regional Market Share

Geographic Coverage of North America Flexographic Printing Industry

North America Flexographic Printing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Development of Advanced Equipment that Offer Shorter Turnaround Time with Greater Accuracy; Rapid Growth of Consumer Goods

- 3.3. Market Restrains

- 3.3.1. ; Offset Printing can Hinder the Growth of Flexographic Printing

- 3.4. Market Trends

- 3.4.1. Flexible Packaging is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Flexographic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Narrow Web

- 5.1.2. Wide Web

- 5.1.3. Sheetfed

- 5.1.4. Other Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Flexible Packaging

- 5.2.2. Bags and Sacks

- 5.2.3. Labels

- 5.2.4. Folding Cartons

- 5.2.5. Corrugated packaging

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Koenig & Bauer

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Barry-Wehmiller

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MPS Systems North America Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Heidelberger Druckmaschinen

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BOBST*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Uteco North America

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mark Andy

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Flint Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Koenig & Bauer

List of Figures

- Figure 1: North America Flexographic Printing Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Flexographic Printing Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Flexographic Printing Industry Revenue billion Forecast, by Equipment 2020 & 2033

- Table 2: North America Flexographic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Flexographic Printing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Flexographic Printing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Flexographic Printing Industry Revenue billion Forecast, by Equipment 2020 & 2033

- Table 6: North America Flexographic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: North America Flexographic Printing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Flexographic Printing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Flexographic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Flexographic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Flexographic Printing Industry?

The projected CAGR is approximately 0.5%.

2. Which companies are prominent players in the North America Flexographic Printing Industry?

Key companies in the market include Koenig & Bauer, Barry-Wehmiller, MPS Systems North America Inc, Heidelberger Druckmaschinen, BOBST*List Not Exhaustive, Uteco North America, Mark Andy, Flint Group.

3. What are the main segments of the North America Flexographic Printing Industry?

The market segments include Equipment, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 86.6 billion as of 2022.

5. What are some drivers contributing to market growth?

; Development of Advanced Equipment that Offer Shorter Turnaround Time with Greater Accuracy; Rapid Growth of Consumer Goods.

6. What are the notable trends driving market growth?

Flexible Packaging is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; Offset Printing can Hinder the Growth of Flexographic Printing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Flexographic Printing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Flexographic Printing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Flexographic Printing Industry?

To stay informed about further developments, trends, and reports in the North America Flexographic Printing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence