Key Insights

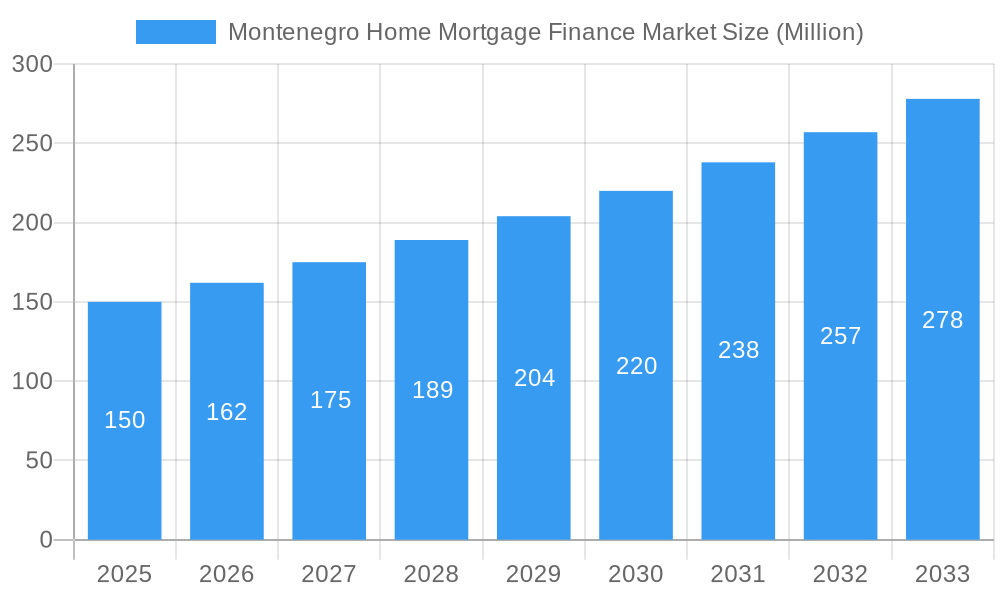

The Montenegro home mortgage finance market exhibits robust growth potential, driven by a burgeoning population, rising urbanization, and increasing disposable incomes. A compound annual growth rate (CAGR) exceeding 8% from 2019 to 2033 indicates a significant expansion of the market. This growth is fueled by favorable government policies aimed at stimulating the housing sector, including potential tax incentives and streamlined mortgage approval processes. Key players such as Erste Bank Montenegro, Lovćen Bank, First Bank, Crnogorska Komercijalna Banka, and Ziraat Bank Montenegro are actively competing in this expanding market, offering a range of mortgage products tailored to diverse borrower needs. However, market growth may be tempered by factors such as economic fluctuations, interest rate volatility, and potential regulatory changes. The market segmentation likely includes variations in loan types (fixed-rate, variable-rate, etc.), loan amounts, and target demographics (first-time homebuyers, existing homeowners, etc.). Further research into specific loan products and market shares held by individual banks would offer a more granular understanding of market dynamics. While precise market size figures for specific years are not provided, extrapolation based on the given CAGR and a reasonable starting point suggests considerable market expansion throughout the forecast period.

Montenegro Home Mortgage Finance Market Market Size (In Million)

The forecast period (2025-2033) is expected to witness continued growth, driven by ongoing infrastructure development and tourism investments. The relatively small size of the Montenegrin market, however, implies that even a high CAGR translates into relatively smaller absolute growth figures compared to larger markets. The market is likely to be affected by external factors, including global economic trends and changes in the European Union's economic policies, especially those influencing lending rates and investor confidence in the region. Competition amongst established banks is intense and likely to lead to innovative product offerings and competitive pricing. The success of individual institutions will hinge on their ability to effectively target key demographic groups and manage risk within the evolving regulatory landscape.

Montenegro Home Mortgage Finance Market Company Market Share

Montenegro Home Mortgage Finance Market: 2019-2033 Outlook

This comprehensive report provides an in-depth analysis of the Montenegro home mortgage finance market, covering historical performance (2019-2024), the current state (2025), and future projections (2025-2033). It examines market dynamics, growth trends, key players, and emerging opportunities, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report meticulously analyzes the parent market (Montenegro Financial Services) and its child market (Home Mortgage Finance), providing granular data and forecasts in Million units.

Montenegro Home Mortgage Finance Market Dynamics & Structure

This section analyzes the competitive landscape, regulatory environment, and technological advancements shaping the Montenegro home mortgage finance market. The market is characterized by a moderate level of concentration, with key players including Erste Bank Montenegro, Lovćen Bank, First Bank, Crnogorska Komercijalna Banka, and Ziraat Bank Montenegro (list not exhaustive). Technological innovation is driven by the increasing adoption of digital platforms and fintech solutions, although regulatory hurdles and limited digital literacy pose challenges.

- Market Concentration: Moderate, with the top 5 banks holding an estimated xx% market share in 2025.

- Technological Innovation: Increasing adoption of online mortgage applications and digital lending platforms, but hampered by limited digital infrastructure and skills.

- Regulatory Framework: Relatively stable, but subject to ongoing changes influenced by EU directives and domestic policies.

- Competitive Product Substitutes: Limited, primarily alternative lending sources from non-bank financial institutions.

- End-User Demographics: Primarily driven by young professionals and families in urban areas, with growth potential in rural segments.

- M&A Trends: Recent activity includes Erste Bank Montenegro's acquisition of S-Leasing Podgorica in October 2022, indicating consolidation within the market. The total value of M&A deals in the sector from 2019-2024 is estimated at xx Million.

Montenegro Home Mortgage Finance Market Growth Trends & Insights

The Montenegro home mortgage finance market has exhibited steady growth in recent years, driven by factors such as rising disposable incomes, increasing urbanization, and government initiatives to support homeownership. The market size reached an estimated xx Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth reflects both increasing mortgage loan origination and rising average loan sizes. While the market faces challenges from macroeconomic fluctuations and regional political instability, underlying trends suggest sustained expansion. Technological disruption in the form of fintech solutions and increased digitalization are expected to further reshape the market, enhancing efficiency and accessibility for borrowers. Consumer behavior shifts towards a preference for digital channels are also driving growth in online mortgage applications. Market penetration is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Montenegro Home Mortgage Finance Market

The coastal regions of Montenegro, specifically Budva and Kotor, exhibit the highest concentration of mortgage activity, driven by tourism-related investments and a higher concentration of higher income households. Podgorica, the capital city, also remains a significant driver of market growth.

- Key Drivers:

- Strong tourism sector attracting foreign investment.

- Government initiatives supporting affordable housing.

- Growing middle class with increased disposable income.

- Development of new housing projects in coastal and urban areas.

- Dominance Factors: Higher property values, increased demand, and higher concentration of financial institutions in coastal regions. Market share for coastal regions is estimated at xx% in 2025.

Montenegro Home Mortgage Finance Market Product Landscape

The product landscape is dominated by traditional fixed-rate and variable-rate mortgages. However, increasing competition and technological advancements are driving the emergence of innovative products, such as green mortgages and mortgages tailored to specific needs like first-time homebuyers. These newer products often feature better terms, faster processing, and greater transparency, thus enhancing customer experience.

Key Drivers, Barriers & Challenges in Montenegro Home Mortgage Finance Market

Key Drivers: Increasing disposable incomes, government initiatives promoting homeownership, and growing urbanization are key drivers. Furthermore, low interest rates (in certain periods) stimulate borrowing.

Key Challenges: Macroeconomic instability, geopolitical uncertainties, and stringent lending regulations pose significant challenges to market growth. Furthermore, access to funding for SMEs involved in construction and development remains constrained, limiting new housing supply. Non-performing loans (NPLs) constitute another risk factor.

Emerging Opportunities in Montenegro Home Mortgage Finance Market

Untapped potential exists in serving rural populations and expanding the range of mortgage products, including green mortgages and those specifically targeting low-income groups. Technological advancements can greatly improve access for borrowers, streamline the application process, and boost efficiency for lenders.

Growth Accelerators in the Montenegro Home Mortgage Finance Market Industry

Strategic partnerships between banks and fintech companies to leverage technological advancements will accelerate growth. Furthermore, government initiatives aimed at stimulating construction and affordable housing will play a significant role. Expansion into underserved segments and the development of tailored mortgage products, addressing the needs of specific demographics, will also contribute to growth.

Key Players Shaping the Montenegro Home Mortgage Finance Market Market

- Erste Bank Montenegro

- Lovćen Bank

- First Bank

- Crnogorska Komercijalna Banka

- Ziraat Bank Montenegro (List Not Exhaustive)

Notable Milestones in Montenegro Home Mortgage Finance Market Sector

- October 2022: Erste Bank Podgorica acquired 100% of S-Leasing Podgorica, signaling market consolidation.

- February 2022: The EBRD provided a EUR 4 million credit line to Lovćen Banka, boosting SME lending and economic recovery.

In-Depth Montenegro Home Mortgage Finance Market Market Outlook

The Montenegro home mortgage finance market is poised for sustained growth over the forecast period. Strategic investments in technology, targeted expansion into underserved markets, and supportive government policies will drive long-term expansion. The potential for growth is significant, provided that macroeconomic stability is maintained and challenges related to regulatory frameworks and access to financing are effectively addressed.

Montenegro Home Mortgage Finance Market Segmentation

-

1. Application

- 1.1. Home Purchase

- 1.2. Refinance

- 1.3. Home Improvement

- 1.4. Others

-

2. Providers

- 2.1. Banks

- 2.2. Housing Finance Companies

- 2.3. Real Estate Agents

-

3. Interest Rate

- 3.1. Fixed Rate Mortgage Loan

- 3.2. Adjustable Rate Mortgage Loan

Montenegro Home Mortgage Finance Market Segmentation By Geography

- 1. Montenegro

Montenegro Home Mortgage Finance Market Regional Market Share

Geographic Coverage of Montenegro Home Mortgage Finance Market

Montenegro Home Mortgage Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growth in Tourism in Montenegro is Anticipated to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Montenegro Home Mortgage Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Home Purchase

- 5.1.2. Refinance

- 5.1.3. Home Improvement

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Providers

- 5.2.1. Banks

- 5.2.2. Housing Finance Companies

- 5.2.3. Real Estate Agents

- 5.3. Market Analysis, Insights and Forecast - by Interest Rate

- 5.3.1. Fixed Rate Mortgage Loan

- 5.3.2. Adjustable Rate Mortgage Loan

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Montenegro

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Erste Bank Montenegro

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lovćen Bank

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 First Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Crnogorska Komercijalna Banka

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ziraat Bank Montenegro**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Erste Bank Montenegro

List of Figures

- Figure 1: Montenegro Home Mortgage Finance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Montenegro Home Mortgage Finance Market Share (%) by Company 2025

List of Tables

- Table 1: Montenegro Home Mortgage Finance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Montenegro Home Mortgage Finance Market Revenue Million Forecast, by Providers 2020 & 2033

- Table 3: Montenegro Home Mortgage Finance Market Revenue Million Forecast, by Interest Rate 2020 & 2033

- Table 4: Montenegro Home Mortgage Finance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Montenegro Home Mortgage Finance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Montenegro Home Mortgage Finance Market Revenue Million Forecast, by Providers 2020 & 2033

- Table 7: Montenegro Home Mortgage Finance Market Revenue Million Forecast, by Interest Rate 2020 & 2033

- Table 8: Montenegro Home Mortgage Finance Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Montenegro Home Mortgage Finance Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Montenegro Home Mortgage Finance Market?

Key companies in the market include Erste Bank Montenegro, Lovćen Bank, First Bank, Crnogorska Komercijalna Banka, Ziraat Bank Montenegro**List Not Exhaustive.

3. What are the main segments of the Montenegro Home Mortgage Finance Market?

The market segments include Application, Providers, Interest Rate.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growth in Tourism in Montenegro is Anticipated to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: Montenegro's Erste Bank Podgorica acquired 100% of the capital of S-Leasing Podgorica from the founders of the leasing company, Vienna-based Erste Group Immorent International Holding and Graz-based Steiermaerkische Bank und Sparkassen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Montenegro Home Mortgage Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Montenegro Home Mortgage Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Montenegro Home Mortgage Finance Market?

To stay informed about further developments, trends, and reports in the Montenegro Home Mortgage Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence