Key Insights

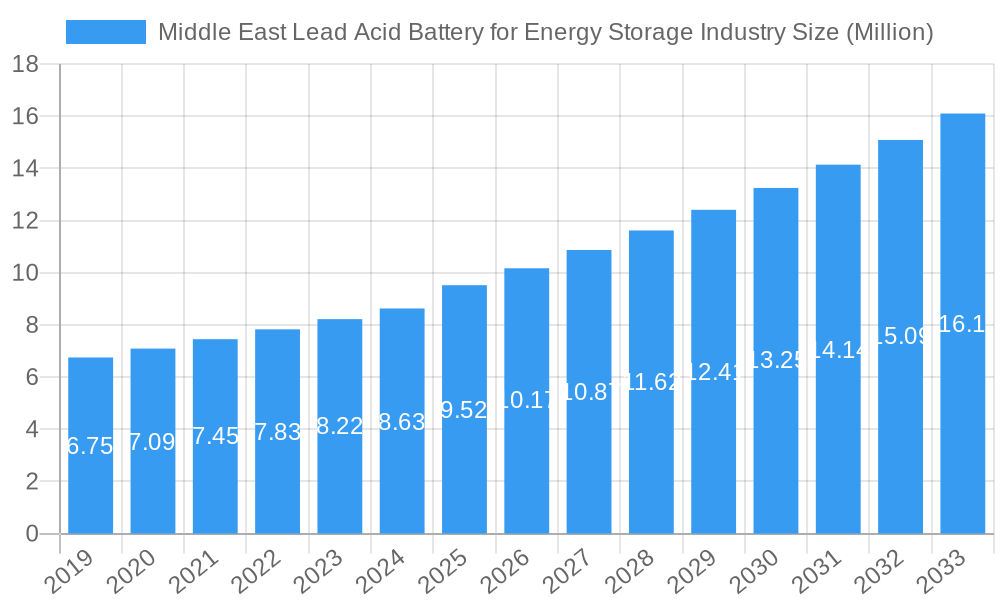

The Middle East Lead Acid Battery for Energy Storage market is poised for significant expansion, projected to reach an estimated USD 9.52 billion in 2025. This growth is propelled by a Compound Annual Growth Rate (CAGR) of 6.6% during the forecast period of 2019-2033. A primary driver for this upward trajectory is the increasing demand for reliable and cost-effective energy storage solutions across various sectors. The burgeoning renewable energy landscape, particularly solar power deployment in regions like the UAE and Saudi Arabia, necessitates robust battery storage to ensure grid stability and continuous power supply. Furthermore, the growing industrialization and urbanization across the Middle East and Africa (MEA) region are fueling the need for backup power solutions and energy management systems, where lead-acid batteries continue to hold a strong market presence due to their established infrastructure and proven performance. The region’s ongoing investments in infrastructure development, coupled with a strategic focus on energy security, are creating a fertile ground for the lead-acid battery market to flourish.

Middle East Lead Acid Battery for Energy Storage Industry Market Size (In Million)

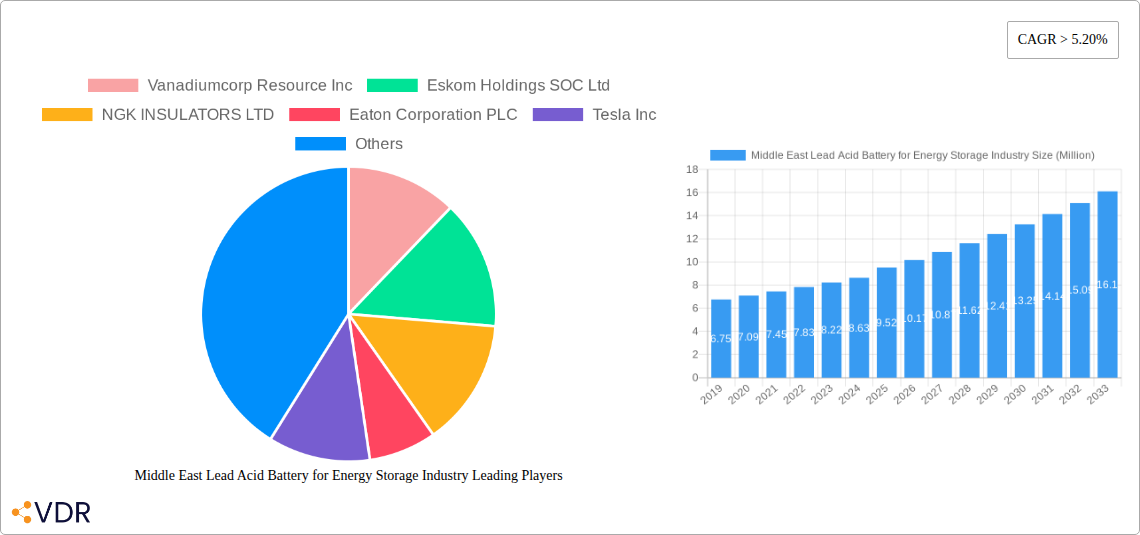

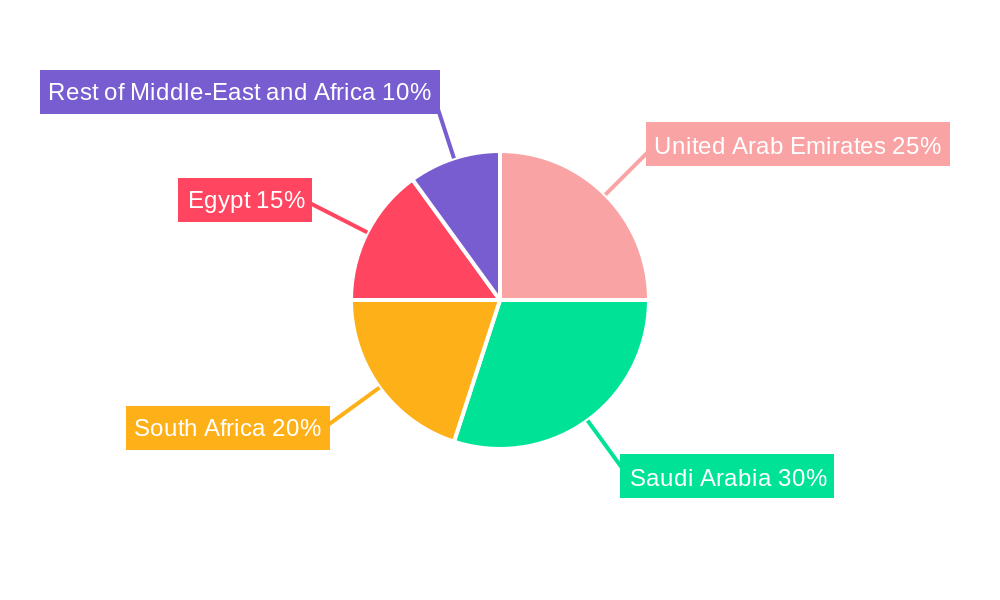

The market is characterized by a diverse range of applications, with the Residential, Commercial and Industrial, and Utility segments all contributing to overall growth. While newer battery technologies are emerging, lead-acid batteries maintain a significant share due to their maturity, recyclability, and affordability, especially for large-scale industrial and utility applications. Key restraints, such as the evolving landscape of advanced battery technologies and growing environmental concerns related to lead disposal, are being actively addressed through improved manufacturing processes and enhanced recycling initiatives. Companies like Eskom Holdings SOC Ltd and Eaton Corporation PLC are actively involved in providing and integrating energy storage solutions, while Vanadiumcorp Resource Inc and Tesla Inc, although exploring other technologies, still contribute to the broader energy storage ecosystem that influences the market. The geographical segmentation highlights the prominence of the United Arab Emirates, Saudi Arabia, South Africa, Egypt, and the Rest of the Middle-East and Africa as key markets, driven by their specific energy demands and governmental policies supporting energy storage.

Middle East Lead Acid Battery for Energy Storage Industry Company Market Share

Unlocking Energy Storage Potential: Middle East Lead Acid Battery Market Insights 2024-2033

This comprehensive report offers an in-depth analysis of the Middle East Lead Acid Battery for Energy Storage Industry, meticulously examining market dynamics, growth trends, and future opportunities. Delve into the intricate landscape of battery technologies, applications, and regional market penetration. Understand the pivotal role of lead-acid batteries in the burgeoning energy storage sector across the UAE, Saudi Arabia, South Africa, Egypt, and the broader Middle East and Africa. With a focus on the parent market (Energy Storage Systems) and the child market (Lead Acid Battery for Energy Storage), this report provides critical intelligence for stakeholders navigating this dynamic sector. The study period spans from 2019 to 2033, with the base and estimated year set at 2025, and a detailed forecast from 2025 to 2033. Historical data from 2019 to 2024 is also included.

Middle East Lead Acid Battery for Energy Storage Industry Market Dynamics & Structure

The Middle East Lead Acid Battery for Energy Storage Industry is characterized by a moderate market concentration, with established players and emerging innovators contributing to its evolving structure. Technological innovation is a significant driver, particularly advancements in lead-acid battery chemistry that enhance cycle life and energy density, though facing competition from Li-Ion Battery and Others. Regulatory frameworks are increasingly favoring energy storage solutions, driven by national visions for renewable energy integration and grid stability. Competitive product substitutes, primarily Li-Ion batteries, present a challenge, yet lead-acid batteries maintain a strong foothold due to their cost-effectiveness and proven reliability, especially in large-scale utility applications. End-user demographics are shifting, with growing demand from Residential, Commercial and Industrial, and Utility sectors. Mergers & Acquisitions (M&A) trends are present but less pronounced than in more mature battery markets, indicating a focus on organic growth and strategic partnerships. The market's competitive landscape is shaped by factors like price, performance, and the ability to meet specific energy storage requirements.

- Market Concentration: Moderate, with a mix of global manufacturers and regional distributors.

- Technological Innovation: Focus on improving cycle life, safety, and cost-efficiency of lead-acid batteries to compete with Li-Ion.

- Regulatory Frameworks: Supportive government policies for renewable energy integration and grid modernization are crucial.

- Competitive Product Substitutes: Li-Ion batteries are the primary alternative, offering higher energy density but at a higher initial cost.

- End-User Demographics: Diverse, spanning residential backup power, industrial energy management, and large-scale utility grid stabilization.

- M&A Trends: Present, but primarily focused on capacity expansion and technological integration rather than outright consolidation.

Middle East Lead Acid Battery for Energy Storage Industry Growth Trends & Insights

The Middle East Lead Acid Battery for Energy Storage Industry is poised for substantial growth, driven by increasing investments in renewable energy infrastructure and a growing need for reliable grid stabilization solutions. The market size evolution is expected to witness a significant upward trajectory, fueled by government initiatives aimed at diversifying energy portfolios and reducing carbon footprints. Adoption rates for energy storage systems, including lead-acid batteries, are projected to accelerate as the economic viability and environmental benefits become more apparent. Technological disruptions, while favoring newer chemistries like Li-Ion for certain applications, are also leading to incremental improvements in lead-acid battery technology, enhancing their competitiveness. Consumer behavior shifts are characterized by a growing demand for energy independence and resilience, particularly in the residential and commercial sectors, where lead-acid batteries offer a cost-effective backup power solution. The market penetration of lead-acid batteries is expected to remain robust in segments prioritizing affordability and proven reliability. The Compound Annual Growth Rate (CAGR) for the lead-acid battery energy storage segment is anticipated to be significant, driven by large-scale utility projects and increasing industrial adoption. The focus on grid modernization and the integration of intermittent renewable sources like solar and wind power will continue to be primary catalysts for market expansion. Furthermore, the inherent safety and recyclability of lead-acid batteries contribute to their sustained appeal, especially in regions with stringent environmental regulations and established recycling infrastructure. The demand for ancillary services such as frequency regulation and peak shaving will also bolster the market, as lead-acid batteries prove effective in these critical grid functions.

Dominant Regions, Countries, or Segments in Middle East Lead Acid Battery for Energy Storage Industry

The Middle East Lead Acid Battery for Energy Storage Industry's dominance is multifaceted, with specific regions, countries, and segments exhibiting exceptional growth potential. Saudi Arabia and the United Arab Emirates are emerging as frontrunners, driven by ambitious national visions that prioritize renewable energy integration and the development of smart cities. Their significant investments in Gigaprojects and a strong focus on grid modernization create substantial demand for energy storage solutions. South Africa, despite its unique economic landscape, also presents a robust market, largely due to the critical need for grid stability and backup power solutions to address challenges within its national utility, Eskom. Egypt, with its increasing solar and wind power capacity, is another key market demonstrating strong growth.

Within the Technology segment, while Li-Ion batteries are gaining traction for their high energy density, Lead Acid Battery continues to hold a significant share, especially in large-scale utility applications and for cost-sensitive residential and commercial setups. The Application segment sees Utility applications leading the charge, with massive grid-scale storage projects requiring cost-effective and reliable solutions. Commercial and Industrial applications are also witnessing robust growth as businesses seek to optimize energy consumption, manage peak demand charges, and ensure operational continuity. Residential applications, while smaller in individual unit size, collectively contribute to market expansion, particularly for backup power during grid outages.

- Dominant Countries: Saudi Arabia and United Arab Emirates, due to significant renewable energy investments and smart city initiatives.

- Key Driver (Saudi Arabia/UAE): Ambitious national visions for renewable energy integration and smart city development.

- Dominant Country (Africa): South Africa, driven by the necessity for grid stability and backup power solutions.

- Key Driver (South Africa): Need to address grid reliability issues and support renewable energy integration.

- Dominant Application: Utility-scale energy storage, essential for grid stabilization and renewable energy integration.

- Emerging Application: Commercial and Industrial (C&I) energy storage, driven by cost optimization and energy security.

- Key Driver (Technology): Lead Acid Battery's cost-effectiveness and proven reliability in utility-scale applications.

- Market Share (Estimated): Utility segment is expected to hold the largest market share, followed by Commercial & Industrial.

Middle East Lead Acid Battery for Energy Storage Industry Product Landscape

The product landscape for Middle East Lead Acid Batteries for Energy Storage is characterized by a focus on enhanced performance, durability, and cost-effectiveness. Innovations are centered around improving cycle life, charge/discharge efficiency, and temperature resistance to suit the demanding environmental conditions of the region. Manufacturers are developing specialized battery designs for grid-scale storage systems, offering high power output and long duration capabilities. Advancements in electrolyte formulations and plate designs contribute to reduced degradation and extended operational lifespans. Applications range from grid stabilization and frequency regulation to renewable energy integration and reliable backup power for residential and commercial facilities. Unique selling propositions often revolve around the proven maturity and recyclability of lead-acid technology, making it an attractive option for sustainable energy storage strategies.

Key Drivers, Barriers & Challenges in Middle East Lead Acid Battery for Energy Storage Industry

The Middle East Lead Acid Battery for Energy Storage Industry is propelled by several key drivers, including the region's aggressive push towards renewable energy adoption, particularly solar power, which necessitates effective energy storage solutions. Government incentives and favorable policies supporting energy independence and grid modernization further fuel demand. The cost-effectiveness of lead-acid batteries compared to other technologies makes them an attractive option for a wide range of applications, from utility-scale projects to residential backup power.

However, the industry faces significant barriers and challenges. The primary challenge is the ongoing competition from Li-Ion Battery technology, which offers higher energy density and longer cycle life, albeit at a higher initial cost. Technological limitations of lead-acid batteries, such as lower energy density and a shorter lifespan compared to some emerging technologies, can be a restraint for specific high-performance applications. Supply chain disruptions, particularly for critical raw materials, can impact production costs and lead times. Regulatory hurdles and the need for standardized safety protocols for battery installations can also slow down market penetration.

- Key Drivers:

- Rapid growth of renewable energy (solar, wind).

- Government initiatives for energy security and grid modernization.

- Cost-effectiveness and proven reliability of lead-acid technology.

- Increasing demand for backup power solutions.

- Barriers & Challenges:

- Competition from Li-Ion Battery technology.

- Lower energy density and shorter lifespan compared to some alternatives.

- Potential supply chain disruptions for lead and other materials.

- Need for standardized safety regulations and installation practices.

Emerging Opportunities in Middle East Lead Acid Battery for Energy Storage Industry

Emerging opportunities in the Middle East Lead Acid Battery for Energy Storage Industry lie in the development of enhanced hybrid energy storage systems, combining the cost-effectiveness of lead-acid with the high-density capabilities of other chemistries. The growing demand for off-grid and microgrid solutions in remote areas presents a significant untapped market. Furthermore, innovation in battery management systems (BMS) tailored for lead-acid batteries can unlock new levels of performance and longevity. The increasing focus on circular economy principles presents an opportunity for lead-acid battery manufacturers to emphasize their high recyclability rates and develop robust end-of-life management programs.

Growth Accelerators in the Middle East Lead Acid Battery for Energy Storage Industry Industry

Several factors are acting as growth accelerators for the Middle East Lead Acid Battery for Energy Storage Industry. The continued decline in the cost of renewable energy generation, particularly solar, directly boosts the need for complementary energy storage solutions. Strategic partnerships between battery manufacturers, project developers, and utilities are crucial for deploying large-scale projects and addressing complex grid integration challenges. The development of smart grid technologies and demand-side management programs further enhances the value proposition of energy storage systems. Moreover, growing awareness of energy security and the desire to reduce reliance on fossil fuels are compelling governments and private entities to invest heavily in energy storage, with lead-acid batteries playing a vital role due to their economic advantages.

Key Players Shaping the Middle East Lead Acid Battery for Energy Storage Industry Market

- Vanadiumcorp Resource Inc

- Eskom Holdings SOC Ltd

- NGK INSULATORS LTD

- Eaton Corporation PLC

- Tesla Inc

- Sumitomo Corporation

- Philadelphia Solar LTD

Notable Milestones in Middle East Lead Acid Battery for Energy Storage Industry Sector

- December 2022: China-based clean power provider Sungrow signed a Memorandum of Understanding with Saudi Arabia-based power generation company ACWA Power to deliver an energy storage system for NEOM city. Sungrow will deliver a 536 megawatt/600 megawatt-hour plant for the Giga project under the provisions of the MoU.

- December 2022: Eskom, South Africa's principal utility and grid operator, has begun work on its first battery energy storage system (BESS) with Hyosung Heavy Industries. It will generate 8MW of power and store 32MWh of energy, and it will be erected in 7-12 months with a connection to Eskom's Elandskop substation. The project will cost a total of USD 630 million.

- November 2022: ALEC Energy completed the installation of a TES.POD system, Azelio's thermal long-duration energy storage technology. The device was installed in an off-grid microgrid configuration at a visitor center in Dubai's Mohammed bin Rashid Al Maktoum Solar Complex (MBR), which incorporates a Concentrated Solar Power (CSP) system dubbed Noor Energy 1.

In-Depth Middle East Lead Acid Battery for Energy Storage Industry Market Outlook

The Middle East Lead Acid Battery for Energy Storage Industry is set for robust expansion, with future market potential driven by the region's commitment to energy transition and grid resilience. Strategic opportunities abound in leveraging the cost-effectiveness of lead-acid batteries for large-scale utility projects, especially in nations with substantial solar and wind energy deployments. The increasing demand for reliable backup power in the face of grid instability and the growing adoption of decentralized energy systems will further cement lead-acid's position. Innovation in hybrid systems and advanced battery management technologies will unlock new applications and enhance performance, ensuring a sustained and significant role for lead-acid batteries in the region's evolving energy landscape.

Middle East Lead Acid Battery for Energy Storage Industry Segmentation

-

1. Technology

- 1.1. Li-Ion Battery

- 1.2. Lead Acid Battery

- 1.3. Others

-

2. Application

- 2.1. Residential

- 2.2. Commercial and Industrial

- 2.3. Utility

-

3. Geography

- 3.1. United Arab Emirates

- 3.2. Saudi Arabia

- 3.3. South Africa

- 3.4. Egypt

- 3.5. Rest of Middle-East and Africa

Middle East Lead Acid Battery for Energy Storage Industry Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. South Africa

- 4. Egypt

- 5. Rest of Middle East and Africa

Middle East Lead Acid Battery for Energy Storage Industry Regional Market Share

Geographic Coverage of Middle East Lead Acid Battery for Energy Storage Industry

Middle East Lead Acid Battery for Energy Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Amount of Waste Generation

- 3.2.2 Growing Concern for Waste Management to Meet the Needs for Sustainable Urban Living4.; Increasing Focus on Non-fossil Fuel Sources of Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Expensive Nature of Incinerators

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Lead Acid Battery for Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Li-Ion Battery

- 5.1.2. Lead Acid Battery

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial and Industrial

- 5.2.3. Utility

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. South Africa

- 5.3.4. Egypt

- 5.3.5. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.4.2. Saudi Arabia

- 5.4.3. South Africa

- 5.4.4. Egypt

- 5.4.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. United Arab Emirates Middle East Lead Acid Battery for Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Li-Ion Battery

- 6.1.2. Lead Acid Battery

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial and Industrial

- 6.2.3. Utility

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United Arab Emirates

- 6.3.2. Saudi Arabia

- 6.3.3. South Africa

- 6.3.4. Egypt

- 6.3.5. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Saudi Arabia Middle East Lead Acid Battery for Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Li-Ion Battery

- 7.1.2. Lead Acid Battery

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial and Industrial

- 7.2.3. Utility

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United Arab Emirates

- 7.3.2. Saudi Arabia

- 7.3.3. South Africa

- 7.3.4. Egypt

- 7.3.5. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. South Africa Middle East Lead Acid Battery for Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Li-Ion Battery

- 8.1.2. Lead Acid Battery

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial and Industrial

- 8.2.3. Utility

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United Arab Emirates

- 8.3.2. Saudi Arabia

- 8.3.3. South Africa

- 8.3.4. Egypt

- 8.3.5. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Egypt Middle East Lead Acid Battery for Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Li-Ion Battery

- 9.1.2. Lead Acid Battery

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial and Industrial

- 9.2.3. Utility

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United Arab Emirates

- 9.3.2. Saudi Arabia

- 9.3.3. South Africa

- 9.3.4. Egypt

- 9.3.5. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Rest of Middle East and Africa Middle East Lead Acid Battery for Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Li-Ion Battery

- 10.1.2. Lead Acid Battery

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential

- 10.2.2. Commercial and Industrial

- 10.2.3. Utility

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. United Arab Emirates

- 10.3.2. Saudi Arabia

- 10.3.3. South Africa

- 10.3.4. Egypt

- 10.3.5. Rest of Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Vanadiumcorp Resource Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eskom Holdings SOC Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NGK INSULATORS LTD

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Eaton Corporation PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tesla Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sumitomo Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Philadelphia Solar LTD

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Vanadiumcorp Resource Inc

List of Figures

- Figure 1: Middle East Lead Acid Battery for Energy Storage Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East Lead Acid Battery for Energy Storage Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 3: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 10: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 11: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 18: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 19: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 26: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 27: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 34: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 35: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 36: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 37: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 42: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 43: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 44: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 45: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 46: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 47: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Lead Acid Battery for Energy Storage Industry?

The projected CAGR is approximately 2.68%.

2. Which companies are prominent players in the Middle East Lead Acid Battery for Energy Storage Industry?

Key companies in the market include Vanadiumcorp Resource Inc, Eskom Holdings SOC Ltd, NGK INSULATORS LTD, Eaton Corporation PLC, Tesla Inc, Sumitomo Corporation, Philadelphia Solar LTD.

3. What are the main segments of the Middle East Lead Acid Battery for Energy Storage Industry?

The market segments include Technology, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Amount of Waste Generation. Growing Concern for Waste Management to Meet the Needs for Sustainable Urban Living4.; Increasing Focus on Non-fossil Fuel Sources of Energy.

6. What are the notable trends driving market growth?

Lithium-ion Battery Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Expensive Nature of Incinerators.

8. Can you provide examples of recent developments in the market?

December 2022: China-based clean power provider Sungrow signed a Memorandum of Understanding with Saudi Arabia-based power generation company ACWA Power to deliver an energy storage system for NEOM city. Sungrow will deliver a 536 megawatt/600 megawatt-hour plant for the Giga project under the provisions of the MoU.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Lead Acid Battery for Energy Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Lead Acid Battery for Energy Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Lead Acid Battery for Energy Storage Industry?

To stay informed about further developments, trends, and reports in the Middle East Lead Acid Battery for Energy Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence