Key Insights

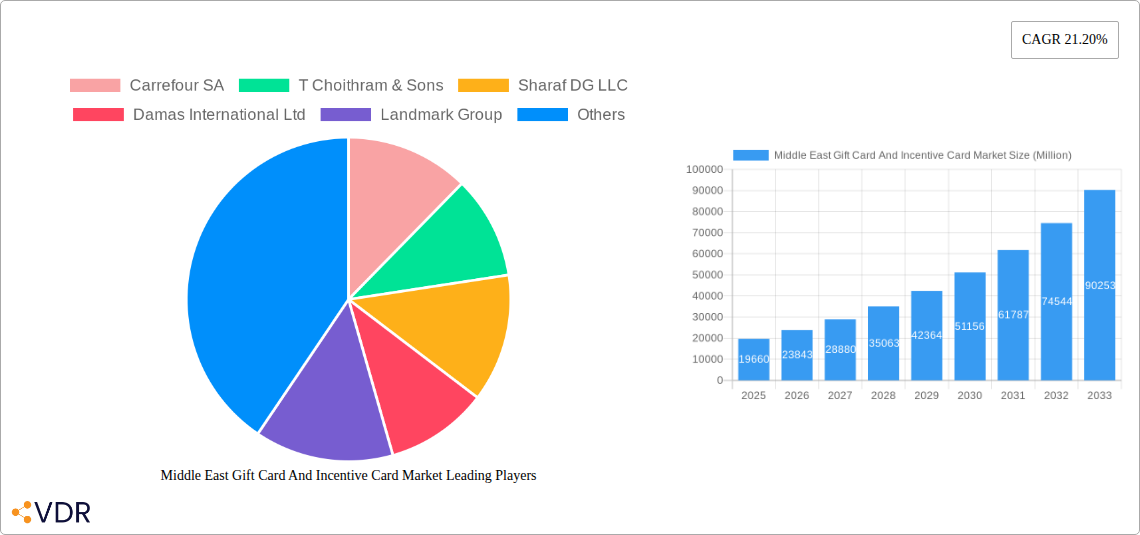

The Middle East gift card and incentive card market is experiencing robust growth, projected to reach a market size of $19.66 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 21.20% from 2025 to 2033. This surge is fueled by several key factors. The increasing adoption of e-commerce and digital payment methods across the region facilitates convenient gift card purchasing and redemption. Furthermore, the rising disposable incomes, particularly among the younger population, coupled with a growing preference for experiential gifts and flexible spending options, are driving demand. A significant trend is the diversification of gift card offerings, expanding beyond traditional retail to encompass experiences like spa treatments, restaurant meals, and entertainment events. This caters to a wider range of consumer preferences and occasions, boosting overall market growth. While challenges exist, such as concerns around security and fraud related to digital gift cards, the industry is actively addressing these issues with improved security protocols and fraud detection systems. Major players like Carrefour SA, Choithram & Sons, and Sharaf DG LLC are strategically positioning themselves within this dynamic market, focusing on innovative product offerings, strategic partnerships, and targeted marketing campaigns to capture market share.

Middle East Gift Card And Incentive Card Market Market Size (In Billion)

The market's segmentation, though not explicitly detailed, likely reflects variations in card types (e.g., physical vs. digital), distribution channels (online vs. offline), and target demographics. The considerable CAGR implies significant expansion throughout the forecast period (2025-2033). While regional data is absent, a geographical breakdown across the Middle East would likely reflect varying growth rates based on factors such as economic development levels, consumer spending habits, and e-commerce penetration. Future market success will depend on companies effectively navigating regulatory landscapes, managing security risks, and leveraging data analytics to personalize gift card offerings and enhance customer experience. Continued innovation in card designs, redemption options, and integration with loyalty programs will be essential for continued market dominance.

Middle East Gift Card And Incentive Card Market Company Market Share

Middle East Gift Card and Incentive Card Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East gift card and incentive card market, encompassing market dynamics, growth trends, dominant segments, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals seeking to understand and capitalize on opportunities within this dynamic market. The report covers both the parent market (Gift Cards) and the child market (Incentive Cards), offering a granular view of this lucrative sector. The total market size in 2025 is estimated at xx Million Units.

Middle East Gift Card and Incentive Card Market Dynamics & Structure

The Middle East gift card and incentive card market is characterized by a moderately concentrated landscape, with several key players holding significant market share. Technological innovation, particularly in digital gift card delivery and management systems, is a major driver of growth. Regulatory frameworks governing gift card issuance and redemption vary across the region, influencing market dynamics. Competitive substitutes, such as cash or other forms of payment, continue to exist. The demographic profile of end-users is diverse, ranging from young adults to older generations, with varying levels of adoption. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a total of xx M&A deals recorded between 2019-2024.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of market share in 2024.

- Technological Innovation: Digital platforms, mobile wallets, and loyalty programs are driving adoption.

- Regulatory Framework: Varying regulations across countries impact market access and operations.

- Competitive Substitutes: Cash and alternative payment methods pose competition.

- End-User Demographics: Diverse user base with varying adoption rates across age groups and income levels.

- M&A Activity: xx M&A deals recorded between 2019 and 2024, indicating moderate consolidation.

Middle East Gift Card and Incentive Card Market Growth Trends & Insights

The Middle East gift card and incentive card market has experienced robust growth over the historical period (2019-2024), exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is attributed to factors including rising disposable incomes, increased consumer spending, the expanding e-commerce sector, and the growing popularity of loyalty programs. Technological disruptions, such as the shift towards digital gift cards and mobile payment solutions, have significantly influenced market dynamics. Consumer behavior shifts, such as a preference for convenience and personalized experiences, are also shaping market trends. Market penetration currently stands at xx% in 2025, with significant growth potential remaining. We project a CAGR of xx% from 2025 to 2033.

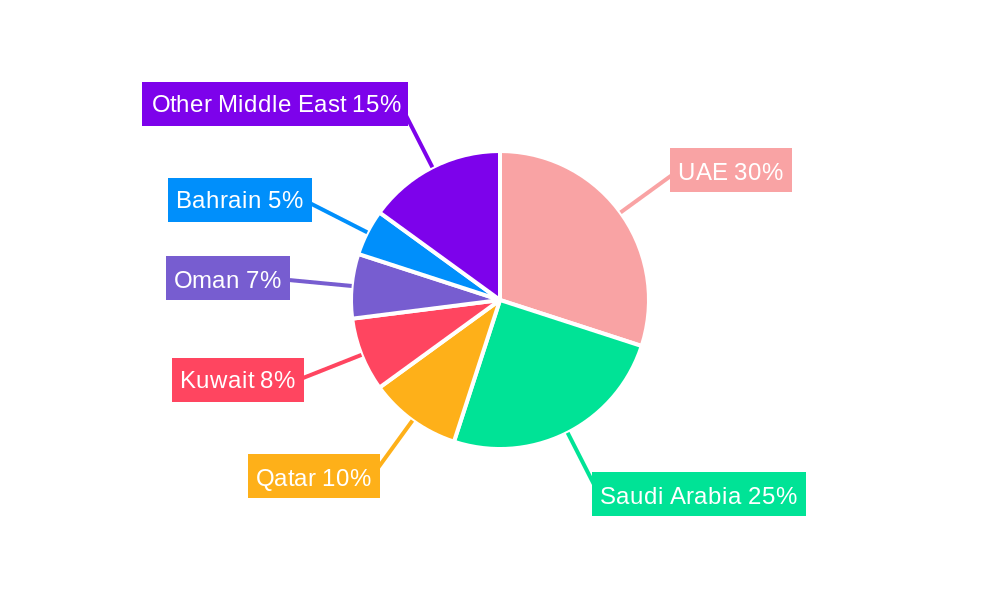

Dominant Regions, Countries, or Segments in Middle East Gift Card and Incentive Card Market

The UAE and Saudi Arabia are the dominant markets within the Middle East gift card and incentive card sector, driven by high consumer spending, robust e-commerce growth, and a favorable regulatory environment. These countries account for approximately xx% of the total market value in 2025. Key drivers include strong economic growth, substantial tourism, and a well-developed retail infrastructure. Other countries such as Qatar, Kuwait, and Oman exhibit significant growth potential. The retail segment is the leading segment driving growth within the market.

- UAE and Saudi Arabia: Dominant markets with high consumer spending and robust e-commerce.

- Economic Growth: Strong GDP growth in key markets fuels consumer spending.

- Tourism: Tourist spending contributes significantly to the gift card and incentive card market.

- Retail Infrastructure: Well-developed retail infrastructure facilitates adoption.

- Growth Potential: Emerging markets in Oman, Qatar, Kuwait are poised for expansion.

Middle East Gift Card and Incentive Card Market Product Landscape

The market offers a diverse range of gift cards and incentive cards, catering to various needs and preferences. Products range from general-purpose gift cards to those tailored for specific retailers, brands, or experiences. Digital gift cards, offering convenience and instant delivery, are gaining popularity. Technological advancements include personalized gift card designs, integrated loyalty programs, and enhanced security features such as fraud prevention measures. Unique selling propositions focus on convenience, personalization, and value-added features.

Key Drivers, Barriers & Challenges in Middle East Gift Card and Incentive Card Market

Key Drivers: Rising disposable incomes, increasing e-commerce adoption, and the proliferation of loyalty programs are key drivers. The growing preference for digital gift cards and the expansion of integrated payment systems are also significant catalysts.

Challenges & Restraints: Competition from other payment methods, regulatory complexities related to gift card issuance and redemption, and concerns about fraud and security are significant challenges. Supply chain disruptions can affect the availability of physical gift cards, and fluctuations in currency exchange rates can impact pricing and profitability.

Emerging Opportunities in Middle East Gift Card and Incentive Card Market

Untapped market segments, such as niche gift cards tailored to specific interests or demographics, present significant opportunities. The integration of gift cards with augmented reality (AR) and virtual reality (VR) experiences can enhance consumer engagement. Evolving consumer preferences towards personalized experiences and sustainable products can shape future product offerings.

Growth Accelerators in the Middle East Gift Card and Incentive Card Market Industry

Technological advancements in digital gift card platforms and mobile payment solutions are key growth accelerators. Strategic partnerships between retailers, financial institutions, and technology providers will further drive market expansion. Government initiatives supporting e-commerce and digital financial services will contribute to long-term growth.

Key Players Shaping the Middle East Gift Card and Incentive Card Market

- Carrefour SA

- T Choithram & Sons

- Sharaf DG LLC

- Damas International Ltd

- Landmark Group

- Spinneys

- Emke Group

- Inter Ikea Systems BV

- Shufersal Ltd

- Super-Pharm (Israel) Ltd

- List Not Exhaustive

Notable Milestones in Middle East Gift Card and Incentive Card Market Sector

- January 2024: Choithrams expanded its presence in Dubai by opening eight 24-hour convenience stores within Rove Hotels, enhancing its reach and brand positioning.

- May 2023: Carrefour entered the Israeli market, opening 50 stores and planning for 100 more by 2024, demonstrating market expansion.

In-Depth Middle East Gift Card and Incentive Card Market Outlook

The Middle East gift card and incentive card market is poised for continued growth, driven by sustained economic expansion, technological innovation, and increasing consumer adoption of digital payment solutions. Strategic partnerships and investments in innovative product offerings will play a crucial role in shaping future market dynamics. The market presents substantial opportunities for players capable of adapting to evolving consumer preferences and leveraging technological advancements.

Middle East Gift Card And Incentive Card Market Segmentation

-

1. Product Type

- 1.1. Food and Beverages

- 1.2. Personal

- 1.3. Books and Media Products

- 1.4. Consumer Electronics

- 1.5. Restaurants and Bars

- 1.6. Other Product Types

-

2. User Type

- 2.1. Individual

- 2.2. Corporate

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

Middle East Gift Card And Incentive Card Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Gift Card And Incentive Card Market Regional Market Share

Geographic Coverage of Middle East Gift Card And Incentive Card Market

Middle East Gift Card And Incentive Card Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Cultural Significance Of Gifting During Religious And Social Occasions Drives Demand For Gift Cards

- 3.2.2 Especially Through Offline Channels.; The Expansion Of Retail Chains And Shopping Malls In The Region Boosts The Availability And Variety Of Gift Cards

- 3.2.3 Both Online And Offline.

- 3.3. Market Restrains

- 3.3.1 The Cultural Significance Of Gifting During Religious And Social Occasions Drives Demand For Gift Cards

- 3.3.2 Especially Through Offline Channels.; The Expansion Of Retail Chains And Shopping Malls In The Region Boosts The Availability And Variety Of Gift Cards

- 3.3.3 Both Online And Offline.

- 3.4. Market Trends

- 3.4.1. Gradual Shift Toward Online Channels in the Middle East Gift Card Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Gift Card And Incentive Card Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Food and Beverages

- 5.1.2. Personal

- 5.1.3. Books and Media Products

- 5.1.4. Consumer Electronics

- 5.1.5. Restaurants and Bars

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by User Type

- 5.2.1. Individual

- 5.2.2. Corporate

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Carrefour SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 T Choithram & Sons

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sharaf DG LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Damas International Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Landmark Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Spinneys

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Emke Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Inter Ikea Systems BV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shufersal Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Super-Pharm (Israel) Ltd**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Carrefour SA

List of Figures

- Figure 1: Middle East Gift Card And Incentive Card Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Gift Card And Incentive Card Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Gift Card And Incentive Card Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Middle East Gift Card And Incentive Card Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Middle East Gift Card And Incentive Card Market Revenue Million Forecast, by User Type 2020 & 2033

- Table 4: Middle East Gift Card And Incentive Card Market Volume Billion Forecast, by User Type 2020 & 2033

- Table 5: Middle East Gift Card And Incentive Card Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Middle East Gift Card And Incentive Card Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Middle East Gift Card And Incentive Card Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Middle East Gift Card And Incentive Card Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Middle East Gift Card And Incentive Card Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Middle East Gift Card And Incentive Card Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 11: Middle East Gift Card And Incentive Card Market Revenue Million Forecast, by User Type 2020 & 2033

- Table 12: Middle East Gift Card And Incentive Card Market Volume Billion Forecast, by User Type 2020 & 2033

- Table 13: Middle East Gift Card And Incentive Card Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Middle East Gift Card And Incentive Card Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Middle East Gift Card And Incentive Card Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle East Gift Card And Incentive Card Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Saudi Arabia Middle East Gift Card And Incentive Card Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Saudi Arabia Middle East Gift Card And Incentive Card Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: United Arab Emirates Middle East Gift Card And Incentive Card Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United Arab Emirates Middle East Gift Card And Incentive Card Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Israel Middle East Gift Card And Incentive Card Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Israel Middle East Gift Card And Incentive Card Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Qatar Middle East Gift Card And Incentive Card Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Qatar Middle East Gift Card And Incentive Card Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Kuwait Middle East Gift Card And Incentive Card Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Kuwait Middle East Gift Card And Incentive Card Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Oman Middle East Gift Card And Incentive Card Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Oman Middle East Gift Card And Incentive Card Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Bahrain Middle East Gift Card And Incentive Card Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Bahrain Middle East Gift Card And Incentive Card Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Jordan Middle East Gift Card And Incentive Card Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Jordan Middle East Gift Card And Incentive Card Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Lebanon Middle East Gift Card And Incentive Card Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Lebanon Middle East Gift Card And Incentive Card Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Gift Card And Incentive Card Market?

The projected CAGR is approximately 21.20%.

2. Which companies are prominent players in the Middle East Gift Card And Incentive Card Market?

Key companies in the market include Carrefour SA, T Choithram & Sons, Sharaf DG LLC, Damas International Ltd, Landmark Group, Spinneys, Emke Group, Inter Ikea Systems BV, Shufersal Ltd, Super-Pharm (Israel) Ltd**List Not Exhaustive.

3. What are the main segments of the Middle East Gift Card And Incentive Card Market?

The market segments include Product Type, User Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.66 Million as of 2022.

5. What are some drivers contributing to market growth?

The Cultural Significance Of Gifting During Religious And Social Occasions Drives Demand For Gift Cards. Especially Through Offline Channels.; The Expansion Of Retail Chains And Shopping Malls In The Region Boosts The Availability And Variety Of Gift Cards. Both Online And Offline..

6. What are the notable trends driving market growth?

Gradual Shift Toward Online Channels in the Middle East Gift Card Market.

7. Are there any restraints impacting market growth?

The Cultural Significance Of Gifting During Religious And Social Occasions Drives Demand For Gift Cards. Especially Through Offline Channels.; The Expansion Of Retail Chains And Shopping Malls In The Region Boosts The Availability And Variety Of Gift Cards. Both Online And Offline..

8. Can you provide examples of recent developments in the market?

January 2024: Choithrams expanded its presence in Dubai by opening eight 24-hour convenience stores within Rove Hotels. This strategic move caters to tourists and residents, enhancing the company's reach across the city. The expansion aligns with Choithrams' mission to become the region's preferred retail brand, offering fresh food and essential items in prime locations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Gift Card And Incentive Card Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Gift Card And Incentive Card Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Gift Card And Incentive Card Market?

To stay informed about further developments, trends, and reports in the Middle East Gift Card And Incentive Card Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence