Key Insights

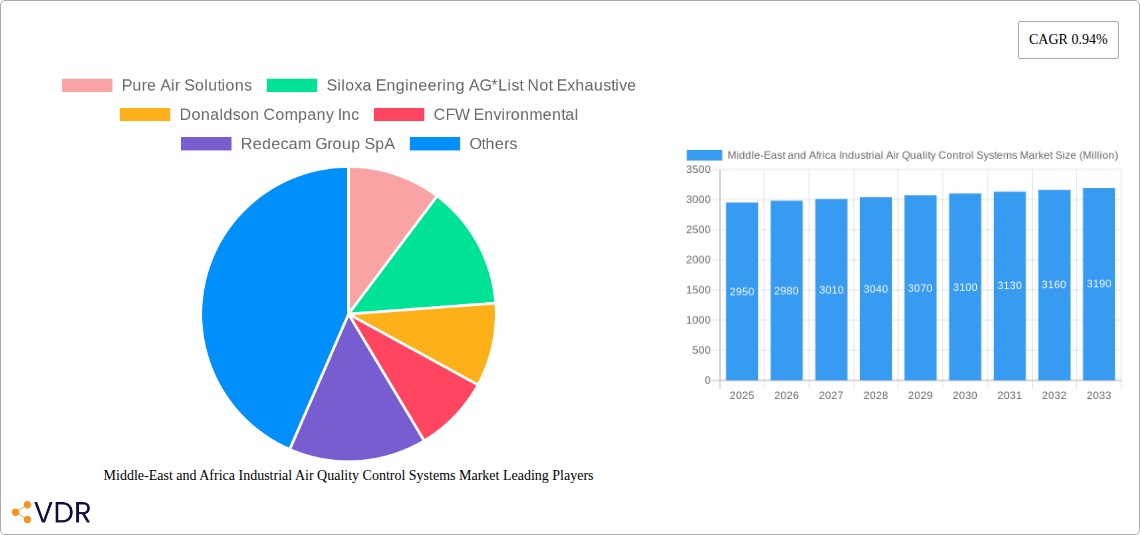

The Middle East and Africa Industrial Air Quality Control Systems market, valued at $2.95 billion in 2025, is projected to experience steady growth, driven by increasing industrialization and stringent environmental regulations across the region. The Compound Annual Growth Rate (CAGR) of 0.94% reflects a moderate expansion, influenced by factors such as the varying economic landscapes of different nations within the region and the cyclical nature of certain industrial sectors like oil and gas. Key growth drivers include rising concerns about air pollution's impact on public health and the environment, coupled with governmental initiatives promoting cleaner production methods. The power generation, cement, and oil & gas industries are major contributors to market demand, necessitating the adoption of technologies like Electrostatic Precipitators (ESPs), Flue Gas Desulfurization (FGD) systems, and Selective Catalytic Reduction (SCR) units to control emissions of nitrogen oxides (NOx), sulfur oxides (SO2), and particulate matter (PM). The market segmentation showcases a diverse technological landscape, with ESPs, FGDs, and SCRs likely holding significant market share due to their established presence and effectiveness in large-scale industrial applications. Challenges include the high initial investment costs associated with these systems, particularly for smaller businesses, and the need for skilled personnel to operate and maintain them. Future growth hinges on technological advancements leading to more efficient and cost-effective solutions, as well as supportive policies and financing options to accelerate adoption in developing economies within the region.

Middle-East and Africa Industrial Air Quality Control Systems Market Market Size (In Billion)

The African sub-region, while exhibiting a slower growth trajectory compared to some Middle Eastern counterparts, shows potential for increased investment in air quality control systems as its industrial sector matures. Key countries like South Africa, Sudan, and Egypt are expected to contribute significantly to regional growth due to their relatively developed industrial base and existing infrastructure. The market's trajectory will likely be influenced by factors including government regulations (stringency and enforcement), economic growth in key industrial sectors, and the availability of financing options for implementing these often expensive systems. Further research focused on individual country profiles within the Middle East and Africa will be necessary for a more granular understanding of market opportunities and challenges in this dynamic region.

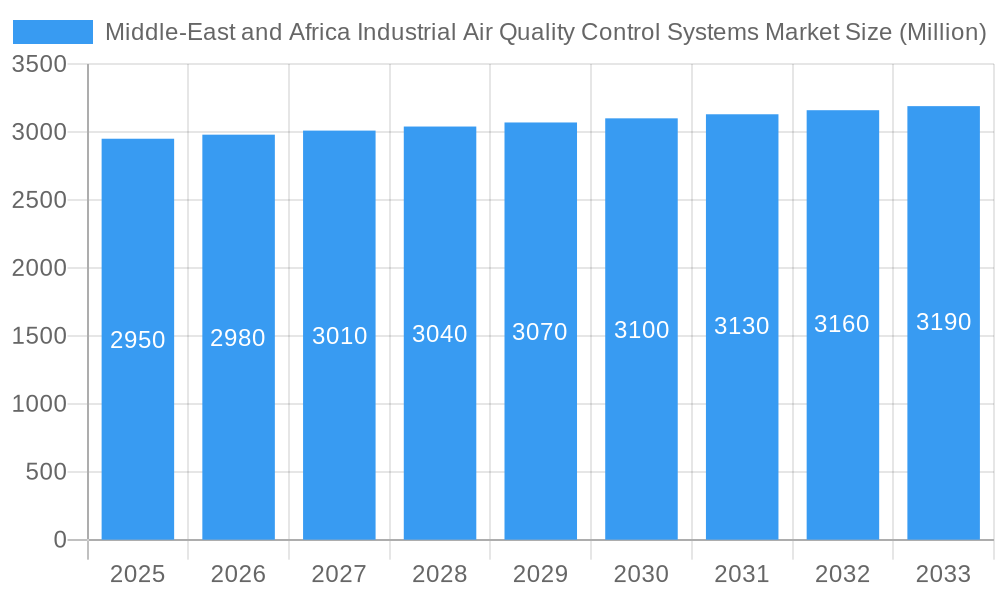

Middle-East and Africa Industrial Air Quality Control Systems Market Company Market Share

Middle-East and Africa Industrial Air Quality Control Systems Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa Industrial Air Quality Control Systems market, covering the period 2019-2033. It delves into market dynamics, growth trends, dominant segments, key players, and emerging opportunities, offering valuable insights for industry professionals, investors, and stakeholders. The report leverages extensive research and data analysis to provide a clear and actionable understanding of this rapidly evolving market. The total market size is estimated at XX million units in 2025 and is projected to reach XX million units by 2033.

Middle-East and Africa Industrial Air Quality Control Systems Market Market Dynamics & Structure

The Middle East and Africa Industrial Air Quality Control Systems market is characterized by moderate concentration, with several key players vying for market share. Technological innovation, driven by stringent environmental regulations and the need for sustainable industrial practices, is a major growth driver. The regulatory landscape, particularly concerning emissions standards, significantly influences market demand. Competitive pressures from substitute technologies and the emergence of innovative solutions are shaping market dynamics. Mergers and acquisitions (M&A) activity, while not at a high volume (estimated at xx deals in the past 5 years), is expected to increase as larger companies consolidate their market position and acquire promising technologies. End-user demographics are diversified, encompassing industries like power generation, cement, chemicals, and oil & gas.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on energy efficiency, automation, and advanced filtration technologies.

- Regulatory Frameworks: Stringent emission standards in several countries are driving adoption.

- Competitive Substitutes: Emerging technologies like carbon capture and utilization pose a competitive threat.

- M&A Trends: Consolidation is expected to increase, driven by expansion and technological acquisition.

- Innovation Barriers: High initial investment costs and technological complexity can hinder innovation.

Middle-East and Africa Industrial Air Quality Control Systems Market Growth Trends & Insights

The Middle East and Africa Industrial Air Quality Control Systems market exhibits substantial growth potential, driven by increasing industrialization, rising environmental awareness, and government initiatives promoting cleaner production. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). Market penetration is still relatively low in some regions, offering significant growth opportunities. Technological disruptions, including the adoption of IoT-enabled systems and AI-powered monitoring, are transforming the market landscape. Consumer behavior shifts towards sustainability are also driving demand for eco-friendly solutions. The market size is expected to reach XX million units by 2033.

(Note: This section would contain the detailed 600-word analysis leveraging data and insights specific to the market. This response cannot provide specific data points.)

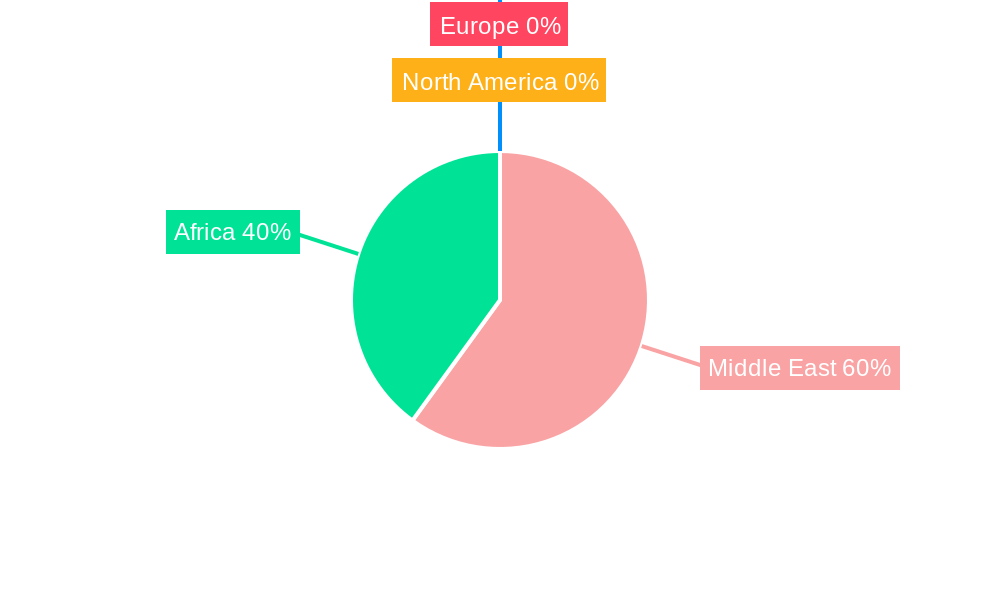

Dominant Regions, Countries, or Segments in Middle-East and Africa Industrial Air Quality Control Systems Market

The market is geographically diverse, with significant growth observed across several regions and countries. The Oil & Gas industry segment and the Power Generation industry are currently leading in terms of system adoption, followed by the Cement sector. Within the Type segment, Electrostatic Precipitators (ESP) and Fabric Filters currently dominate due to their established technology and cost-effectiveness. However, the demand for Selective Catalytic Reduction (SCR) systems is expected to increase significantly due to increasingly stringent NOx emission regulations. In terms of emissions control, Particulate Matter (PM) control systems currently hold the largest share, followed by Sulphur Oxide (SO2) and Nitrogen Oxides (NOx). The UAE and Saudi Arabia are currently leading in market adoption and growth due to robust industrial activity and significant investments in infrastructure development.

- Key Growth Drivers: Government regulations, industrial expansion, rising environmental concerns, and infrastructure investments.

- Dominant Regions: UAE, Saudi Arabia, South Africa, and Egypt exhibit the highest growth potential.

- Leading Segments: Oil & Gas, Power Generation, and Cement industries; ESP, Fabric Filters, and SCR within the type segment; and PM control within the emissions segment.

Middle-East and Africa Industrial Air Quality Control Systems Market Product Landscape

The market offers a diverse range of air quality control systems, each tailored to specific industrial applications and emission types. Technological advancements have led to the development of more efficient and energy-saving systems, featuring enhanced automation, remote monitoring capabilities, and improved particulate matter removal efficiency. Key product innovations focus on integrating advanced sensor technologies, data analytics, and AI for predictive maintenance and optimized performance. Many manufacturers now offer customized solutions to meet specific client requirements. Unique selling propositions often revolve around efficiency, reliability, lifecycle cost, and environmental impact.

Key Drivers, Barriers & Challenges in Middle-East and Africa Industrial Air Quality Control Systems Market

Key Drivers: Increasing industrialization, stringent environmental regulations (e.g., stricter emission standards in various countries), rising energy costs driving demand for energy-efficient systems, and government incentives for clean technology adoption.

Key Challenges: High initial capital investment for advanced systems, lack of awareness about the long-term benefits of air quality control, skilled labor shortages for operation and maintenance, and the need for robust infrastructure to support new technologies. Supply chain disruptions also represent a significant challenge, impacting the availability and cost of components. This can reduce the rate of market growth by an estimated xx% annually.

Emerging Opportunities in Middle-East and Africa Industrial Air Quality Control Systems Market

Untapped markets in less developed regions present significant growth opportunities. The adoption of IoT and AI-powered solutions offer lucrative avenues for innovation. The rising demand for energy-efficient systems and customized solutions opens up further market potential. Growing awareness of air pollution's health impacts is pushing for more stringent regulations, creating additional market demand.

Growth Accelerators in the Middle-East and Africa Industrial Air Quality Control Systems Market Industry

Technological breakthroughs, particularly in areas like carbon capture and advanced filtration, are key growth accelerators. Strategic partnerships between technology providers and industrial companies will drive market expansion. Government support through incentives and funding for clean technology initiatives is essential for accelerating growth. Focus on sustainable industrial practices will further increase the uptake of these systems.

Key Players Shaping the Middle-East and Africa Industrial Air Quality Control Systems Market Market

- Pure Air Solutions

- Siloxa Engineering AG

- Donaldson Company Inc

- CFW Environmental

- Redecam Group SpA

- Aircure

- Dürr AG

- The ERG Group

- FLSmidth & Co A/S

- Alfa Laval AB

Notable Milestones in Middle-East and Africa Industrial Air Quality Control Systems Market Sector

- December 2022: Khalifa University's collaboration with Levidian Nanosystems for carbon reduction technology application in various industries. This signifies growing interest in sustainable solutions within the region.

- March 2022: Gaussian Robotics' product showcase at The Big 5 Saudi trade expo, indicating increased focus on automated cleaning and maintenance solutions within the industrial sector.

In-Depth Middle-East and Africa Industrial Air Quality Control Systems Market Market Outlook

The Middle East and Africa Industrial Air Quality Control Systems market is poised for substantial growth, driven by a confluence of factors including rising environmental consciousness, increasing industrial activity, and supportive government policies. Strategic partnerships and technological innovations will play a crucial role in unlocking the market's full potential. The focus on sustainable industrial practices, coupled with advancements in air pollution control technologies, positions this market for significant expansion in the coming years.

Middle-East and Africa Industrial Air Quality Control Systems Market Segmentation

-

1. Type

- 1.1. Electrostatic Precipitators (ESP)

- 1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 1.3. Selective Catalytic Reduction (SCR)

- 1.4. Fabric Filters

- 1.5. Others

-

2. Application

- 2.1. Power Generation Industry

- 2.2. Cement Industry

- 2.3. Chemicals and Fertilizers

- 2.4. Iron and Steel Industry

- 2.5. Automotive Industry

- 2.6. Oil & Gas Industry

- 2.7. Other Applications

-

3. Emissions

- 3.1. Nitrogen Oxides (NOX)

- 3.2. Sulphur Oxide (SO2)

- 3.3. Particulate Matter (PM)

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. South Africa

- 4.3. Algeria

- 4.4. Rest of Middle East and Africa

Middle-East and Africa Industrial Air Quality Control Systems Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. Algeria

- 4. Rest of Middle East and Africa

Middle-East and Africa Industrial Air Quality Control Systems Market Regional Market Share

Geographic Coverage of Middle-East and Africa Industrial Air Quality Control Systems Market

Middle-East and Africa Industrial Air Quality Control Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand from the Downstream Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Adoption of Renewable and Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Iron and Steel is Expected to Have Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Electrostatic Precipitators (ESP)

- 5.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 5.1.3. Selective Catalytic Reduction (SCR)

- 5.1.4. Fabric Filters

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Power Generation Industry

- 5.2.2. Cement Industry

- 5.2.3. Chemicals and Fertilizers

- 5.2.4. Iron and Steel Industry

- 5.2.5. Automotive Industry

- 5.2.6. Oil & Gas Industry

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Emissions

- 5.3.1. Nitrogen Oxides (NOX)

- 5.3.2. Sulphur Oxide (SO2)

- 5.3.3. Particulate Matter (PM)

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. South Africa

- 5.4.3. Algeria

- 5.4.4. Rest of Middle East and Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. South Africa

- 5.5.3. Algeria

- 5.5.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle-East and Africa Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Electrostatic Precipitators (ESP)

- 6.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 6.1.3. Selective Catalytic Reduction (SCR)

- 6.1.4. Fabric Filters

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Power Generation Industry

- 6.2.2. Cement Industry

- 6.2.3. Chemicals and Fertilizers

- 6.2.4. Iron and Steel Industry

- 6.2.5. Automotive Industry

- 6.2.6. Oil & Gas Industry

- 6.2.7. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Emissions

- 6.3.1. Nitrogen Oxides (NOX)

- 6.3.2. Sulphur Oxide (SO2)

- 6.3.3. Particulate Matter (PM)

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. South Africa

- 6.4.3. Algeria

- 6.4.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South Africa Middle-East and Africa Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Electrostatic Precipitators (ESP)

- 7.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 7.1.3. Selective Catalytic Reduction (SCR)

- 7.1.4. Fabric Filters

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Power Generation Industry

- 7.2.2. Cement Industry

- 7.2.3. Chemicals and Fertilizers

- 7.2.4. Iron and Steel Industry

- 7.2.5. Automotive Industry

- 7.2.6. Oil & Gas Industry

- 7.2.7. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Emissions

- 7.3.1. Nitrogen Oxides (NOX)

- 7.3.2. Sulphur Oxide (SO2)

- 7.3.3. Particulate Matter (PM)

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. South Africa

- 7.4.3. Algeria

- 7.4.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Algeria Middle-East and Africa Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Electrostatic Precipitators (ESP)

- 8.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 8.1.3. Selective Catalytic Reduction (SCR)

- 8.1.4. Fabric Filters

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Power Generation Industry

- 8.2.2. Cement Industry

- 8.2.3. Chemicals and Fertilizers

- 8.2.4. Iron and Steel Industry

- 8.2.5. Automotive Industry

- 8.2.6. Oil & Gas Industry

- 8.2.7. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Emissions

- 8.3.1. Nitrogen Oxides (NOX)

- 8.3.2. Sulphur Oxide (SO2)

- 8.3.3. Particulate Matter (PM)

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. South Africa

- 8.4.3. Algeria

- 8.4.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Middle East and Africa Middle-East and Africa Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Electrostatic Precipitators (ESP)

- 9.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 9.1.3. Selective Catalytic Reduction (SCR)

- 9.1.4. Fabric Filters

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Power Generation Industry

- 9.2.2. Cement Industry

- 9.2.3. Chemicals and Fertilizers

- 9.2.4. Iron and Steel Industry

- 9.2.5. Automotive Industry

- 9.2.6. Oil & Gas Industry

- 9.2.7. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Emissions

- 9.3.1. Nitrogen Oxides (NOX)

- 9.3.2. Sulphur Oxide (SO2)

- 9.3.3. Particulate Matter (PM)

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. South Africa

- 9.4.3. Algeria

- 9.4.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Pure Air Solutions

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Siloxa Engineering AG*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Donaldson Company Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 CFW Environmental

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Redecam Group SpA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Aircure

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Durr AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 The ERG Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 FLSmidth & Co A/S

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Alfa Laval AB

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Pure Air Solutions

List of Figures

- Figure 1: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Industrial Air Quality Control Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Emissions 2020 & 2033

- Table 4: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Emissions 2020 & 2033

- Table 9: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Emissions 2020 & 2033

- Table 14: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Emissions 2020 & 2033

- Table 19: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Emissions 2020 & 2033

- Table 24: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Middle-East and Africa Industrial Air Quality Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Industrial Air Quality Control Systems Market?

The projected CAGR is approximately 0.94%.

2. Which companies are prominent players in the Middle-East and Africa Industrial Air Quality Control Systems Market?

Key companies in the market include Pure Air Solutions, Siloxa Engineering AG*List Not Exhaustive, Donaldson Company Inc, CFW Environmental, Redecam Group SpA, Aircure, Durr AG, The ERG Group, FLSmidth & Co A/S, Alfa Laval AB.

3. What are the main segments of the Middle-East and Africa Industrial Air Quality Control Systems Market?

The market segments include Type, Application, Emissions, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.95 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand from the Downstream Industry.

6. What are the notable trends driving market growth?

Iron and Steel is Expected to Have Significant Share in the Market.

7. Are there any restraints impacting market growth?

4.; Adoption of Renewable and Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

In December 2022, Khalifa University of Science and Technology joined forces to find local applications for Levidian Nanosystems' carbon reduction LOOP technology. The RIC-2D at Khalifa University and Zero Carbon Ventures has built a technology facility at the Arzanah Complex on the university's Sas Al Nakhl (SAN) Campus in Abu Dhabi. The system's input and outputs will be studied to create applications for various waste gas blends, such as those used in the oil and gas industry, agriculture, landfills, and wastewater treatment plants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Industrial Air Quality Control Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Industrial Air Quality Control Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Industrial Air Quality Control Systems Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Industrial Air Quality Control Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence