Key Insights

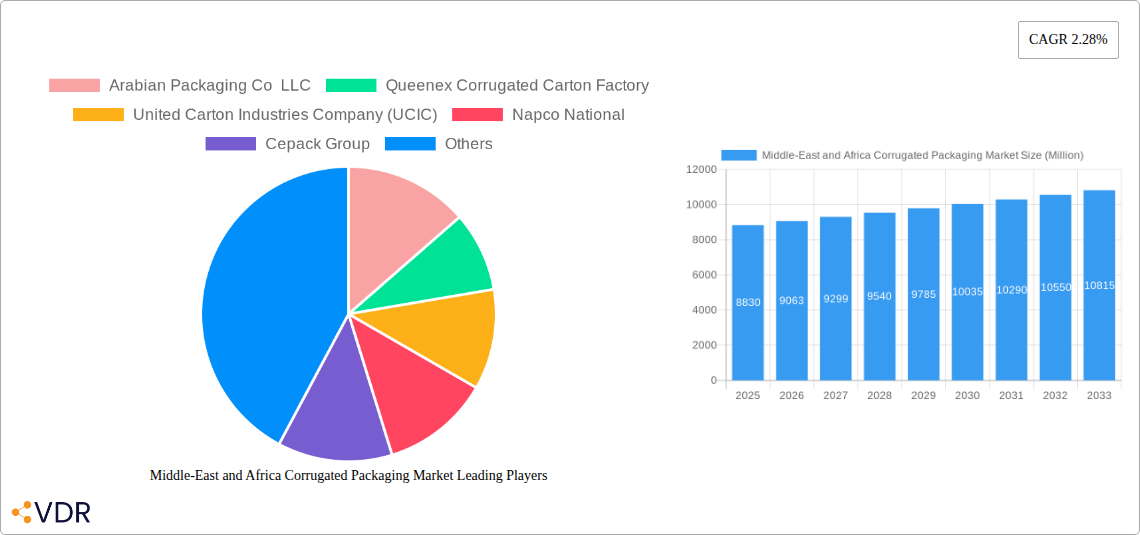

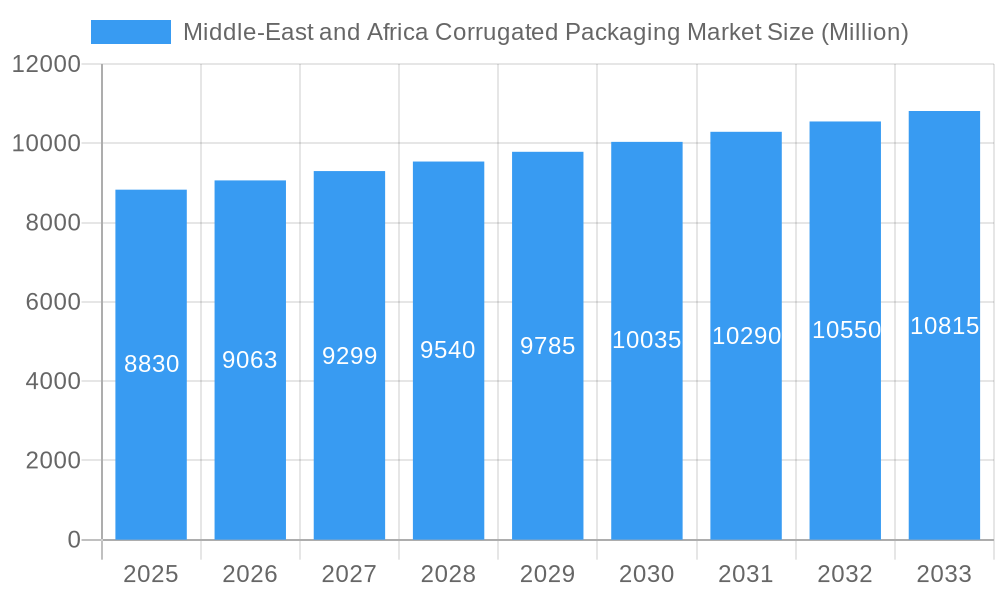

The Middle East and Africa corrugated packaging market, valued at $8.83 billion in 2025, is projected to experience steady growth, driven by a burgeoning e-commerce sector fueling demand for robust shipping solutions. The region's expanding consumer goods industry, particularly food and beverage, necessitates efficient packaging, further bolstering market expansion. Factors such as increasing urbanization and a rising middle class contribute to higher consumption rates, directly impacting packaging demand. While fluctuations in raw material prices (primarily paper and cardboard) pose a challenge, ongoing innovations in sustainable packaging materials and efficient production techniques are mitigating these concerns. The market's growth is further facilitated by a gradual shift towards customized packaging solutions tailored to specific product needs and brand identities. This trend reflects a preference for enhancing product appeal and improving the overall consumer experience.

Middle-East and Africa Corrugated Packaging Market Market Size (In Billion)

A key segment driving market growth is the food and beverage industry, which relies heavily on corrugated packaging for protection and branding. Furthermore, the growing adoption of automated packaging systems in manufacturing and distribution is enhancing efficiency and reducing operational costs. However, challenges remain. Stringent environmental regulations are pushing companies to adopt eco-friendly materials and practices, necessitating investment in research and development. Competition among numerous regional players, including Arabian Packaging Co LLC, Queenex Corrugated Carton Factory, and UCIC, is also a factor impacting market dynamics and pricing strategies. The forecast period (2025-2033) anticipates a continuation of moderate growth, fueled by the underlying factors mentioned above, albeit with careful consideration of potential economic fluctuations and global supply chain disruptions. The market is expected to see a significant shift towards digitally printed packaging as businesses seek to improve brand identity and add greater value to their products.

Middle-East and Africa Corrugated Packaging Market Company Market Share

Middle East & Africa Corrugated Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East & Africa corrugated packaging market, encompassing market dynamics, growth trends, regional insights, and key player profiles. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on the opportunities within this dynamic market. The report analyzes the parent market of packaging and the child market of corrugated packaging in the MEA region. The market size is projected in Million units.

Middle-East and Africa Corrugated Packaging Market Market Dynamics & Structure

This section delves into the dynamic forces shaping the Middle East and Africa (MEA) corrugated packaging market. We dissect the competitive landscape, pinpointing key players, their market shares, and the overall market concentration. Our analysis scrutinizes the impact of technological advancements, such as the integration of automation for enhanced efficiency and the growing adoption of sustainable materials. Furthermore, we evaluate the influence of prevailing regulatory frameworks on market growth and operational practices. The report also examines the competitive pressure exerted by substitute packaging materials and analyzes the evolving demands of diverse end-user demographics. Finally, we assess the strategic significance of mergers and acquisitions (M&A) within the sector.

- Market Concentration: The MEA corrugated packaging market is characterized by a moderately concentrated structure. While a few prominent global and regional players command a substantial market share (estimated to be between xx% and yy%), a vibrant ecosystem of smaller, agile local manufacturers also contributes significantly to the market's dynamism (collectively holding an estimated zz% to aa%). This blend fosters both scale and localized responsiveness.

- Technological Innovation: The industry is witnessing a robust embrace of technological innovation. Investments in state-of-the-art automation, including high-speed corrugators, advanced converting machinery, and cutting-edge digital printing technologies, are on the rise. These advancements are driven by an increasing demand for enhanced production efficiency, improved print quality, and greater customization capabilities. However, the significant capital outlay required for these technologies can present a barrier to entry for smaller players, prompting strategic collaborations and phased adoption plans.

- Regulatory Framework: A growing emphasis on environmental sustainability and responsible packaging waste management is increasingly influencing regulatory landscapes across the MEA region. Governments are introducing stricter guidelines regarding material sourcing, recyclability, and end-of-life management for packaging. While compliance with these evolving regulations may entail upfront costs, it also presents a significant opportunity for companies offering eco-friendly and circular economy-aligned packaging solutions.

- Competitive Product Substitutes: While corrugated packaging remains the preferred choice for a vast array of applications due to its inherent advantages in terms of sustainability, cost-effectiveness, and protective qualities, alternative packaging materials, particularly certain types of plastics, continue to pose a competitive challenge. The market's ability to innovate with enhanced barrier properties, lightweight designs, and superior printability will be crucial in solidifying its dominance against these substitutes.

- End-User Demographics: The growth trajectory of the MEA corrugated packaging market is underpinned by a highly diversified and rapidly expanding base of end-users. Key sectors fueling this demand include the burgeoning food & beverage industry, the explosive growth of e-commerce, the consistent needs of the consumer goods sector, and the robust requirements of various industrial applications. Evolving consumer preferences, including a rising demand for premium and personalized products, are directly translating into more sophisticated and tailored packaging solutions.

- M&A Trends: The MEA region has observed a consistent and strategic level of M&A activity in recent years. Approximately xx to yy deals have been recorded in the past five years. This trend indicates a clear appetite among larger, established players to consolidate their market presence, expand their geographical reach, diversify their product portfolios, and acquire specialized technologies or customer bases. Such consolidations are likely to shape the competitive landscape further.

Middle-East and Africa Corrugated Packaging Market Growth Trends & Insights

This section provides a detailed analysis of the market's growth trajectory, leveraging data and insights to project future market size and penetration rates. It examines the historical growth (2019-2024) and projects future growth (2025-2033) based on macroeconomic factors, consumer behavior shifts, and technological advancements. The analysis incorporates CAGR calculations and detailed market segmentation to provide a comprehensive understanding of the market's evolution. The impact of e-commerce growth, urbanization, and changing consumer preferences on corrugated packaging demand is analyzed in detail. Specific metrics such as CAGR for the forecast period and market penetration in key segments are provided.

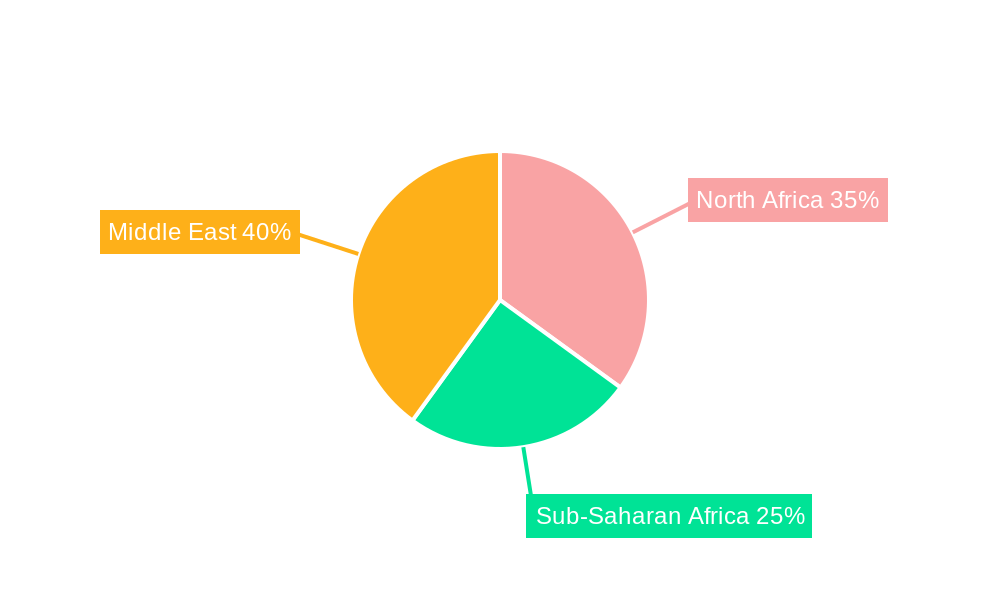

Dominant Regions, Countries, or Segments in Middle-East and Africa Corrugated Packaging Market

This section identifies the leading regions and countries within the MEA region driving market growth. It examines factors like economic development, infrastructure, and government policies that contribute to the dominance of specific areas. We analyze market share and growth potential for each region, providing detailed insights into the factors driving growth in the leading markets.

- Key Drivers: Rapid urbanization, growth of the e-commerce sector, expanding manufacturing industries, and supportive government policies are key growth drivers.

- Dominant Regions: The report identifies [Specific Region(s) e.g., North Africa, the GCC] as the dominant region(s), due to factors such as [Specific reasons: e.g., higher per capita income, robust infrastructure, strong manufacturing base]. [Specific Country(ies) e.g., Egypt, Saudi Arabia] exhibit strong growth within these regions.

- Market Share: [Detailed breakdown of market share by region and country].

- Growth Potential: The report highlights the potential for future growth, particularly in [Specific region/country], due to [Specific Factors].

Middle-East and Africa Corrugated Packaging Market Product Landscape

This section details the various types of corrugated packaging available in the market, including their applications and performance characteristics. It highlights innovative product designs, focusing on unique selling propositions (USPs) and the technological advancements driving product evolution. The focus is on material innovation (e.g., sustainable materials), improved designs for enhanced protection and efficiency, and customized packaging solutions for specific end-user needs.

Key Drivers, Barriers & Challenges in Middle East and Africa Corrugated Packaging Market

This section identifies the key factors driving market growth, including economic factors, technological advancements, and favorable government policies. Specific examples are provided to illustrate the impact of these factors. It also analyzes the key challenges and restraints affecting market expansion. These include supply chain disruptions, regulatory hurdles, and competitive pressures. Quantitative impacts where possible are provided.

- Key Drivers: Increasing e-commerce adoption, rising consumer spending, industrial expansion, and growth in the food and beverage sector.

- Challenges: Fluctuations in raw material prices, competition from alternative packaging materials, logistical constraints, and environmental regulations.

Emerging Opportunities in Middle-East and Africa Corrugated Packaging Market

The Middle East and Africa (MEA) corrugated packaging market is brimming with exciting avenues for expansion and innovation. This section illuminates these emerging opportunities, focusing on often-underserved or rapidly developing markets within the region, the potential for novel packaging applications that cater to specific product needs, and the transformative impact of shifting consumer preferences. A significant thrust of our analysis is dedicated to opportunities stemming from the global and regional drive towards greater environmental sustainability and the escalating demand for personalized and customized packaging solutions. Furthermore, we meticulously explore the immense potential within the high-growth e-commerce sector, including specialized packaging designed for the unique challenges of online retail, and identify promising prospects for niche packaging solutions tailored to distinct product categories, such as pharmaceuticals, luxury goods, and fresh produce.

Growth Accelerators in the Middle-East and Africa Corrugated Packaging Market Industry

This section focuses on factors that will significantly accelerate market growth in the long term. Emphasis is on technological innovation in materials and manufacturing processes, and strategic partnerships that expand market access or product offerings. Market expansion strategies in underserved regions are also identified as significant growth drivers.

Key Players Shaping the Middle-East and Africa Corrugated Packaging Market Market

- Arabian Packaging Co LLC

- Queenex Corrugated Carton Factory

- United Carton Industries Company (UCIC)

- Napco National

- Cepack Group

- Falcon Pack

- World Pack Industries LLC

- Universal Carton Industries Group

- Express Pack Print

- Green Packaging Boxes IND LLC

- Tarboosh Packaging Co LLC

- Unipack Containers & Carton Products LLC

- Al Rumanah Packaging

- NBM Pack

- *List Not Exhaustive

Notable Milestones in Middle-East and Africa Corrugated Packaging Market Sector

- August 2022: The International Trade Administration's report underscored the accelerating adoption of e-commerce in Kenya, propelled by enhanced 4G network coverage and widespread smartphone penetration. This development was identified as a pivotal growth catalyst for the corrugated packaging market, signalling increased demand for robust and efficient shipping solutions.

- July 2022: Americana Restaurants' strategic expansion of Pizza Hut outlets across Saudi Arabia (excluding Jeddah), operating under a franchise agreement with Yum!, highlighted a significant uptick in the demand for specialized food packaging solutions. This expansion directly translates to increased opportunities for corrugated packaging manufacturers serving the fast-food and restaurant industry.

In-Depth Middle-East and Africa Corrugated Packaging Market Market Outlook

The outlook for the Middle East and Africa corrugated packaging market is exceptionally robust and poised for sustained, substantial growth over the coming years. This positive trajectory is primarily propelled by a confluence of factors, including consistent economic expansion across numerous key nations, the relentless surge of the e-commerce sector, and ongoing, significant investments in critical infrastructure development. Consequently, the market is projected to experience considerable expansion in both volume and value. Strategic opportunities abound for companies that can effectively leverage innovative solutions in sustainable packaging, offer highly customized and value-added packaging services, and excel in optimizing supply chain efficiencies. The MEA region presents an increasingly attractive and dynamic marketplace for both established global players seeking to deepen their regional footprint and ambitious new entrants eager to capitalize on the evolving and sophisticated packaging demands of this vibrant economic zone.

Middle-East and Africa Corrugated Packaging Market Segmentation

-

1. Type

- 1.1. Slotted Containers

- 1.2. Die-cut Containers

- 1.3. Five-panel Folder Boxes

- 1.4. Other Types

-

2. End User

- 2.1. Food

- 2.2. Beverages

- 2.3. Electric Goods

- 2.4. Personal Care and Household Care

- 2.5. Other End Users

Middle-East and Africa Corrugated Packaging Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle-East and Africa Corrugated Packaging Market Regional Market Share

Geographic Coverage of Middle-East and Africa Corrugated Packaging Market

Middle-East and Africa Corrugated Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-user Segments

- 3.3. Market Restrains

- 3.3.1. Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-user Segments

- 3.4. Market Trends

- 3.4.1. Increased Demand from the E-commerce Sector to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Corrugated Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Slotted Containers

- 5.1.2. Die-cut Containers

- 5.1.3. Five-panel Folder Boxes

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Food

- 5.2.2. Beverages

- 5.2.3. Electric Goods

- 5.2.4. Personal Care and Household Care

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arabian Packaging Co LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Queenex Corrugated Carton Factory

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 United Carton Industries Company (UCIC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Napco National

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cepack Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Falcon Pack

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 World Pack Industries LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Universal Carton Industries Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Express Pack Print

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Green Packaging Boxes IND LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tarboosh Packaging Co LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Unipack Containers & Carton Products LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Al Rumanah Packaging

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 NBM Pack*List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Arabian Packaging Co LLC

List of Figures

- Figure 1: Middle-East and Africa Corrugated Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Corrugated Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Saudi Arabia Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: United Arab Emirates Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Arab Emirates Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Israel Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Israel Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Qatar Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Qatar Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Kuwait Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Kuwait Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Oman Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Oman Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Bahrain Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Bahrain Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Jordan Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Jordan Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Lebanon Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Lebanon Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Corrugated Packaging Market?

The projected CAGR is approximately 2.28%.

2. Which companies are prominent players in the Middle-East and Africa Corrugated Packaging Market?

Key companies in the market include Arabian Packaging Co LLC, Queenex Corrugated Carton Factory, United Carton Industries Company (UCIC), Napco National, Cepack Group, Falcon Pack, World Pack Industries LLC, Universal Carton Industries Group, Express Pack Print, Green Packaging Boxes IND LLC, Tarboosh Packaging Co LLC, Unipack Containers & Carton Products LLC, Al Rumanah Packaging, NBM Pack*List Not Exhaustive.

3. What are the main segments of the Middle-East and Africa Corrugated Packaging Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-user Segments.

6. What are the notable trends driving market growth?

Increased Demand from the E-commerce Sector to Drive the Market.

7. Are there any restraints impacting market growth?

Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-user Segments.

8. Can you provide examples of recent developments in the market?

August 2022 - International Trade Administration stated that the increasing e-commerce adoption in Kenya would aid the market's growth. Consumer demand for e-commerce was accelerated mainly during the COVID-19 pandemic. The government is pushing for 4G universal coverage, and smartphone ownership is accelerating, making Kenya one of the fastest-growing e-commerce markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Corrugated Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Corrugated Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Corrugated Packaging Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Corrugated Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence