Key Insights

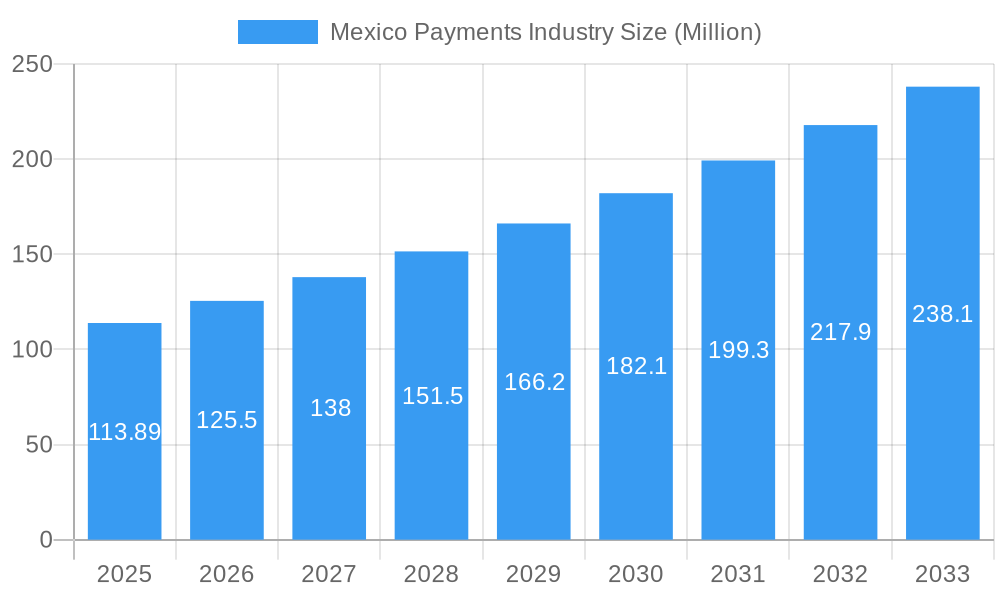

The Mexico Payments Industry is poised for substantial growth, projected to reach a market size of USD 113.89 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 10.18% expected to persist through 2033. This robust expansion is primarily driven by the increasing adoption of digital payment methods and a burgeoning e-commerce landscape. Key drivers include government initiatives promoting financial inclusion, a growing young and tech-savvy population, and the increasing preference for convenient and secure transaction methods. The shift away from traditional cash transactions is accelerating, fueled by the widespread availability of point-of-sale terminals and the rapid proliferation of digital wallets, including mobile payment solutions. These trends are significantly reshaping the payment ecosystem, making it more efficient and accessible for both consumers and businesses across various sectors.

Mexico Payments Industry Market Size (In Million)

The market segmentation highlights a dynamic shift across different payment modes and end-user industries. While Point of Sale (POS) transactions, encompassing card payments and digital wallets, will continue to be significant, online sales are experiencing exponential growth. This surge in online transactions is particularly evident in sectors like retail and entertainment, which are rapidly embracing digital commerce. The healthcare and hospitality industries are also increasingly adopting sophisticated payment solutions to enhance customer experience and operational efficiency. Despite the strong growth trajectory, certain restraints such as cybersecurity concerns and the need for enhanced digital literacy among a portion of the population need to be addressed. However, with major financial institutions and payment network providers like HSBC, Citibank, American Express, Mastercard, and Visa actively investing and innovating within the Mexican market, the industry is well-positioned to overcome these challenges and capitalize on the immense growth opportunities.

Mexico Payments Industry Company Market Share

Here's the SEO-optimized report description for the Mexico Payments Industry, designed for maximum visibility and engagement:

This comprehensive report offers an in-depth analysis of the dynamic Mexico Payments Industry, providing critical insights for stakeholders navigating this rapidly evolving landscape. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, the report delves into market dynamics, growth trends, regional dominance, product innovation, and key players. It meticulously examines the impact of technological advancements, evolving consumer behavior, and regulatory shifts on the adoption of digital payment solutions across various end-user industries.

Our analysis dissects the market into parent and child segments, including Point of Sale (Card Pay, Digital Wallet, Cash, Other Points of Sale) and Online Sale (Other), alongside end-user industries such as Retail, Entertainment, Healthcare, and Hospitality. With a focus on quantitative data and actionable intelligence, this report is an indispensable resource for financial institutions, payment processors, fintech innovators, and investors seeking to capitalize on the immense opportunities within the Mexican payments ecosystem. All monetary values are presented in Million units.

Mexico Payments Industry Market Dynamics & Structure

The Mexico Payments Industry is characterized by a moderately concentrated market, with key players like HSBC, Citibank, Banorte, and Visa wielding significant influence. Technological innovation is a primary driver, fueled by the widespread adoption of smartphones and increasing internet penetration, which facilitates the growth of digital wallets and mobile payment solutions. The regulatory framework, while evolving, aims to foster a more secure and inclusive payments environment, with initiatives supporting real-time payments and consumer protection. Competitive product substitutes are abundant, ranging from traditional card payments to burgeoning Buy Now, Pay Later (BNPL) services and P2P payment apps, constantly pushing for better user experiences and lower transaction costs. End-user demographics are increasingly digitally-savvy, demanding seamless and convenient payment methods across all touchpoints. Mergers and Acquisitions (M&A) trends are notable, as established financial institutions and fintechs seek to expand their service offerings and market reach.

- Market Concentration: Dominated by a few large financial institutions and payment networks, with a growing presence of agile fintech companies.

- Technological Innovation: Driven by mobile penetration, internet access, and the demand for real-time, secure, and convenient payment solutions.

- Regulatory Framework: Evolving to support innovation, enhance security, and promote financial inclusion, with a particular focus on interoperability and data protection.

- Competitive Substitutes: Diverse options including card payments, digital wallets, bank transfers, BNPL services, and cash, leading to intense competition.

- End-User Demographics: Younger, digitally native populations are driving the adoption of new payment technologies and demanding seamless online and offline experiences.

- M&A Trends: Strategic acquisitions and partnerships are common as companies aim to gain market share, acquire new technologies, and expand their service portfolios.

Mexico Payments Industry Growth Trends & Insights

The Mexico Payments Industry is poised for remarkable growth, driven by a confluence of factors that are reshaping transaction behaviors and market infrastructure. The market size is projected to expand significantly over the forecast period, fueled by an accelerated adoption rate of digital payment methods. Technological disruptions, including the proliferation of contactless payments, the rise of instant payment systems, and the integration of AI in fraud detection, are fundamentally altering the payments landscape. Consumer behavior shifts are a pivotal influence, with a growing preference for convenience, speed, and security in every transaction. This is evident in the increasing use of mobile wallets for both online and in-store purchases, as well as a demand for integrated financial services. The historical period of 2019-2024 has laid the groundwork for this expansion, witnessing a steady incline in digital transaction volumes and a gradual decline in cash dependency.

- Market Size Evolution: Significant expansion projected from USD 350,000 Million in 2023 to an estimated USD 650,000 Million by 2033, reflecting robust growth in transaction volumes and value.

- Adoption Rates: Digital payment adoption is surging, with an estimated 75% of the adult population expected to engage in at least one digital payment method by 2028, up from 60% in 2023.

- Technological Disruptions: The implementation of real-time payment networks, advancements in biometric authentication, and the increasing integration of IoT devices for payments are key disruptors.

- Consumer Behavior Shifts: A marked increase in preference for contactless payments, mobile-first banking, and personalized financial management tools. The younger demographic, in particular, is driving innovation adoption.

- CAGR: The market is expected to grow at a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period (2025-2033).

- Market Penetration: Digital payment penetration is expected to reach 80% of all consumer transactions by 2030, significantly impacting traditional payment methods.

Dominant Regions, Countries, or Segments in Mexico Payments Industry

Within the Mexico Payments Industry, Retail emerges as the dominant end-user industry, showcasing unparalleled growth and adoption of diverse payment modalities. This dominance is propelled by the sheer volume of transactions and the continuous push for omnichannel retail experiences. Point of Sale transactions, particularly Card Pay and Digital Wallets, are experiencing exponential growth in this segment, reflecting consumer preference for speed and convenience. The Online Sale segment, encompassing e-commerce and digital services, also plays a crucial role, often facilitated by the same digital payment infrastructure.

Mexico's urban centers, particularly Mexico City, Guadalajara, and Monterrey, represent the most dynamic regions for payment innovation and adoption. These areas boast higher disposable incomes, greater internet and smartphone penetration, and a more tech-savvy population, making them early adopters of new payment technologies. Economic policies encouraging digital transformation and a supportive regulatory environment further bolster growth in these regions.

Dominant End-User Industry: Retail

- Market Share: Retail transactions account for an estimated 45% of all payment volumes in Mexico.

- Key Drivers: Growing e-commerce penetration, increased consumer spending power, and the demand for seamless in-store and online checkout experiences.

- Growth Potential: High, with continued investment in digital infrastructure and loyalty programs designed to encourage cashless transactions.

Dominant Mode of Payment: Card Pay & Digital Wallets (Point of Sale)

- Market Share: Card payments collectively hold approximately 40% of POS transactions, with digital wallets rapidly gaining ground at an estimated 25% and growing.

- Key Drivers: Ubiquity of POS terminals, government initiatives promoting digital payments, and widespread consumer trust in established card networks.

- Growth Potential: Significant, driven by the ongoing shift away from cash and the introduction of innovative contactless solutions.

Dominant Regions: Mexico City, Guadalajara, Monterrey

- Market Share: These metropolitan areas contribute over 60% of the total digital payment transaction value in the country.

- Key Drivers: High population density, robust economic activity, advanced digital infrastructure, and a concentration of businesses adopting modern payment solutions.

- Growth Potential: Sustained growth expected due to ongoing urbanization and increasing disposable incomes.

Mexico Payments Industry Product Landscape

The Mexico Payments Industry is witnessing a wave of innovative products and services designed to enhance user experience, security, and efficiency. Digital wallets are evolving beyond simple payment tools to become comprehensive financial hubs, offering features like budgeting, rewards programs, and peer-to-peer transfers. Contactless payment solutions, including NFC-enabled cards and mobile payments, are becoming standard, driving faster checkout times at the Point of Sale. Real-time payment platforms are gaining traction, enabling instant fund transfers between individuals and businesses, fostering greater liquidity and efficiency. Furthermore, advancements in biometric authentication, such as fingerprint and facial recognition, are enhancing security for online and mobile transactions, building consumer confidence in digital payment ecosystems.

Key Drivers, Barriers & Challenges in Mexico Payments Industry

Key Drivers:

- Government Initiatives: Programs promoting financial inclusion and digital payments, such as the modernization of payment infrastructure and reduced transaction fees.

- Technological Advancements: Increasing smartphone penetration, widespread internet access, and the adoption of innovative payment technologies like QR codes and NFC.

- Consumer Demand: A growing preference for convenient, fast, and secure payment methods, especially among younger demographics.

- E-commerce Growth: The rapid expansion of online retail and digital services necessitates efficient and secure online payment solutions.

Barriers & Challenges:

- Digital Divide: Unequal access to internet and smartphones in rural areas can limit the reach of digital payment solutions.

- Security Concerns & Fraud: Perceived and actual risks of data breaches and online fraud can hinder adoption among some consumer segments.

- Regulatory Compliance: Navigating evolving regulations and ensuring compliance with data privacy and anti-money laundering laws can be complex for new entrants.

- Cash Dependency: A significant portion of the population in certain regions still relies heavily on cash for daily transactions, creating a barrier to complete digital transition.

- Infrastructure Gaps: While improving, some areas may still lack adequate connectivity or reliable power for consistent digital payment processing.

Emerging Opportunities in Mexico Payments Industry

Emerging opportunities in the Mexico Payments Industry lie in expanding financial inclusion to underserved populations, particularly in rural areas, through mobile-first solutions and agent banking networks. The burgeoning Buy Now, Pay Later (BNPL) segment presents a significant growth avenue, catering to consumer demand for flexible payment options at the point of sale and online. Furthermore, the integration of payments within the Internet of Things (IoT) ecosystem, enabling seamless, automated transactions for smart devices and services, offers a nascent but promising frontier. The development of specialized payment solutions for micro, small, and medium-sized enterprises (MSMEs) to streamline their operations and access working capital is another key area for innovation.

Growth Accelerators in the Mexico Payments Industry Industry

Key growth accelerators in the Mexico Payments Industry include the continued expansion of digital payment infrastructure, spurred by public-private partnerships and investments from global payment networks. The increasing adoption of real-time payment systems, like those facilitated by the collaboration between ACI Worldwide and Mexipay, is crucial for enhancing transaction speeds and efficiency. Strategic partnerships between fintech companies and traditional financial institutions are vital for leveraging combined strengths, expanding customer reach, and offering integrated financial services. The growing demand for cross-border payment solutions and remittances, driven by Mexico's significant diaspora, also acts as a powerful growth catalyst.

Key Players Shaping the Mexico Payments Industry Market

- HSBC

- Citibank

- Banco Inbursa

- Scotiabank

- American Express

- Mastercard

- Banco Azteca

- Banorte

- BanCoppel

- Visa

Notable Milestones in Mexico Payments Industry Sector

- November 2023: ACI Worldwide and Mexipay joined forces to encourage the adoption of real-time payments in Mexico. Through this partnership, Mexipay will utilize ACI's payment platform to offer ISO 20022 real-time payments and other payment services in Mexico, enabling Mexipay to access smaller banks and merchants.

- September 2023: Mexico's payment fintech, Clara, plans to expand its operations to Brazil following its successful acquisition of a central bank license. This strategic move is anticipated to greatly boost the company's growth, with Brazil expected to become its primary market in the near future. Clara currently processes monthly transactions in Brazil amounting to approximately BRL 100 million, equivalent to nearly USD 20 million.

In-Depth Mexico Payments Industry Market Outlook

The Mexico Payments Industry is set for a period of sustained and accelerated growth, driven by an expanding digital economy and a proactive regulatory environment. The ongoing advancements in payment technologies, coupled with evolving consumer preferences for seamless digital transactions, will continue to fuel the adoption of mobile wallets, contactless payments, and real-time payment systems. Strategic alliances and the expansion of fintech services, as exemplified by Clara's international growth, will further democratize access to sophisticated payment solutions. The industry's future hinges on bridging the digital divide, enhancing cybersecurity measures, and fostering an ecosystem that benefits both consumers and businesses, unlocking significant potential for innovation and market expansion.

Mexico Payments Industry Segmentation

-

1. Mode of Payment

-

1.1. Point of Sale

- 1.1.1. Card Pay

- 1.1.2. Digital Wallet (includes Mobile Wallets)

- 1.1.3. Cash

- 1.1.4. Other Points of Sale

-

1.2. Online Sale

- 1.2.1. Other

-

1.1. Point of Sale

-

2. End-user Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-user Industries

Mexico Payments Industry Segmentation By Geography

- 1. Mexico

Mexico Payments Industry Regional Market Share

Geographic Coverage of Mexico Payments Industry

Mexico Payments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Growth of Digital Payments; Increase in Internet Penetration

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Personnel and Training Facilities

- 3.4. Market Trends

- 3.4.1. Increase in Internet Penetration is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Payments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale

- 5.1.1.1. Card Pay

- 5.1.1.2. Digital Wallet (includes Mobile Wallets)

- 5.1.1.3. Cash

- 5.1.1.4. Other Points of Sale

- 5.1.2. Online Sale

- 5.1.2.1. Other

- 5.1.1. Point of Sale

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 HSBC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Citibank

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Banco Inbursa

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Scotiabank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 American Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mastercard

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Banco Azteca

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Banorte

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BanCoppel

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Visa

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 HSBC

List of Figures

- Figure 1: Mexico Payments Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Payments Industry Share (%) by Company 2025

List of Tables

- Table 1: Mexico Payments Industry Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 2: Mexico Payments Industry Volume K Unit Forecast, by Mode of Payment 2020 & 2033

- Table 3: Mexico Payments Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Mexico Payments Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: Mexico Payments Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Mexico Payments Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Mexico Payments Industry Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 8: Mexico Payments Industry Volume K Unit Forecast, by Mode of Payment 2020 & 2033

- Table 9: Mexico Payments Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Mexico Payments Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Mexico Payments Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Mexico Payments Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Payments Industry?

The projected CAGR is approximately 10.18%.

2. Which companies are prominent players in the Mexico Payments Industry?

Key companies in the market include HSBC, Citibank, Banco Inbursa, Scotiabank, American Express, Mastercard, Banco Azteca, Banorte, BanCoppel, Visa.

3. What are the main segments of the Mexico Payments Industry?

The market segments include Mode of Payment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 113.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Growth of Digital Payments; Increase in Internet Penetration.

6. What are the notable trends driving market growth?

Increase in Internet Penetration is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Lack of Skilled Personnel and Training Facilities.

8. Can you provide examples of recent developments in the market?

November 2023: ACI Worldwide and Mexipay have joined forces to encourage the adoption of real-time payments in Mexico. Through this partnership, Mexipay will utilize ACI's payment platform to offer ISO 20022 real-time payments and other payment services in Mexico. This collaboration will enable Mexipay to access smaller banks and merchants, delivering managed services to the market by implementing and operating our platform built around ACI's solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Payments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Payments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Payments Industry?

To stay informed about further developments, trends, and reports in the Mexico Payments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence