Key Insights

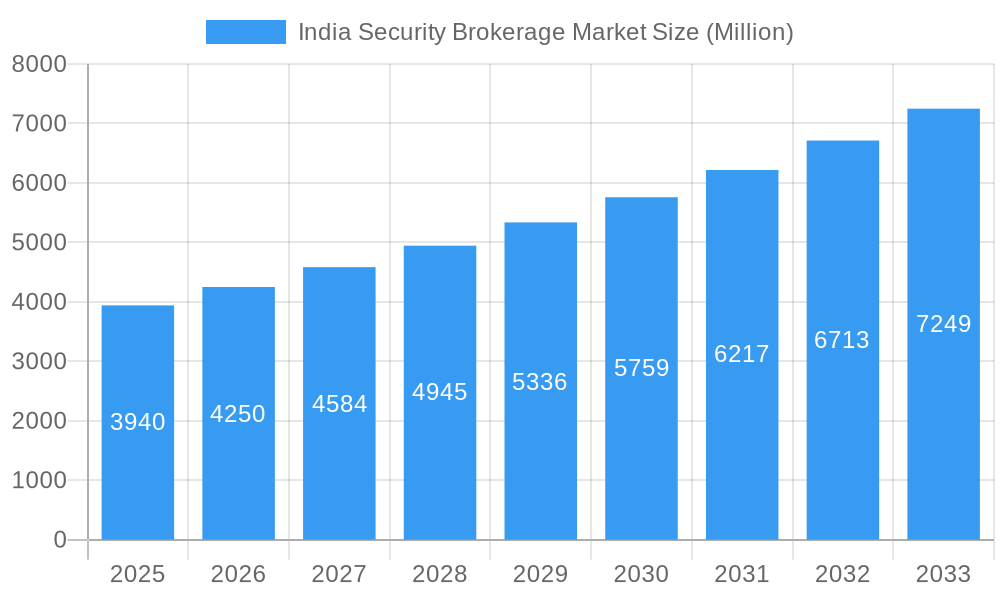

The Indian security brokerage market, valued at $3.94 billion in 2025, is projected to experience robust growth, driven by rising digital adoption, increasing financial literacy, and a burgeoning young, investor-savvy population. The 7.89% CAGR from 2019 to 2033 indicates a significant expansion in market size, exceeding $8 billion by 2033. This growth is fueled by the proliferation of discount brokers offering user-friendly platforms and low transaction fees, attracting both novice and experienced investors. Government initiatives promoting financial inclusion and increased market volatility also contribute to this upward trajectory. However, the market faces challenges, including regulatory changes, intense competition, and the risk of market downturns impacting investor sentiment and trading volumes. Key players such as Zerodha, Angel Broking, Upstox, Groww, and others are strategically adapting to these dynamics, leveraging technology and expanding their product offerings to maintain a competitive edge. The market segmentation likely includes demographics (age, income), investment types (equity, derivatives, mutual funds), and geographical regions, although detailed segment-specific data is unavailable.

India Security Brokerage Market Market Size (In Billion)

The competitive landscape is highly dynamic, with established players facing increasing pressure from agile fintech startups. These newcomers leverage technology to enhance the user experience, providing seamless trading interfaces and innovative investment tools. The market's future growth hinges on factors including financial market stability, regulatory environment, and the continued development of technologically advanced trading platforms. Successful players will be those that effectively cater to the evolving needs of a sophisticated and increasingly digital investor base while mitigating the inherent risks associated with securities trading. Continued education and awareness programs aimed at enhancing financial literacy will play a crucial role in the market's sustained expansion.

India Security Brokerage Market Company Market Share

India Security Brokerage Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the India Security Brokerage Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report is crucial for investors, industry professionals, and strategic decision-makers seeking a deep understanding of this rapidly evolving market. The parent market is the Indian financial services sector, and the child market is online brokerage services. The market is valued at xx Million USD in 2025.

India Security Brokerage Market Dynamics & Structure

The Indian security brokerage market exhibits a dynamic interplay of factors shaping its structure and growth trajectory. Market concentration is moderate, with a few large players alongside numerous smaller firms. Technological innovation, driven by advancements in mobile technology and AI-powered trading platforms, is a key driver. The regulatory framework, overseen by SEBI (Securities and Exchange Board of India), plays a crucial role in market stability and investor protection. The emergence of robo-advisors and algorithmic trading presents competitive product substitutes. The end-user demographic is expanding, encompassing millennials and Gen Z increasingly adopting online trading. M&A activity is relatively frequent, reflecting consolidation trends and strategic expansion efforts.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: AI-driven trading algorithms, mobile-first platforms, and robo-advisors are reshaping the landscape.

- Regulatory Framework: SEBI regulations ensure market integrity and investor protection, influencing market practices.

- Competitive Substitutes: Robo-advisors and algorithmic trading pose a competitive challenge to traditional brokerage services.

- End-User Demographics: Growing adoption among millennials and Gen Z fuels market expansion.

- M&A Trends: Consolidation through mergers and acquisitions is a prominent trend, with xx major deals recorded between 2019 and 2024.

India Security Brokerage Market Growth Trends & Insights

The India security brokerage market has witnessed significant growth over the historical period (2019-2024), driven by factors such as rising internet and smartphone penetration, increasing financial literacy, and a burgeoning middle class. The market size expanded from xx Million USD in 2019 to xx Million USD in 2024, exhibiting a CAGR of xx%. This growth is expected to continue, albeit at a slightly moderated pace, driven by sustained digital adoption and increased participation in the stock market. Technological disruptions, including the rise of fintech platforms and mobile trading apps, have significantly impacted consumer behavior, favoring convenience and accessibility.

The market penetration rate has increased substantially, reflecting the growing preference for online brokerage services over traditional methods. Future growth will be influenced by factors such as regulatory changes, economic conditions, and the emergence of new technologies. The forecast period (2025-2033) projects a CAGR of xx%, with the market size reaching xx Million USD by 2033.

Dominant Regions, Countries, or Segments in India Security Brokerage Market

Metropolitan areas and Tier-1 cities in India are currently dominating the security brokerage market, driven by higher internet and smartphone penetration, greater financial literacy, and a concentration of high-net-worth individuals. These regions benefit from robust infrastructure and a higher concentration of financial institutions. However, growth is also evident in Tier-2 and Tier-3 cities as internet access expands and financial awareness increases.

- Key Drivers: Higher internet penetration, increased financial literacy, growing middle class, and robust infrastructure in metropolitan areas.

- Dominance Factors: Market share concentration in urban centers, access to financial resources, and availability of skilled professionals.

- Growth Potential: Significant untapped potential exists in Tier-2 and Tier-3 cities as internet and financial literacy improve.

India Security Brokerage Market Product Landscape

The product landscape is characterized by a wide range of offerings, including online trading platforms, mobile apps, robo-advisors, and investment research tools. Key features include user-friendly interfaces, advanced charting tools, real-time market data, and personalized investment recommendations. Technological advancements are driving innovation, resulting in improved platform performance, enhanced security measures, and more sophisticated trading capabilities. Unique selling propositions often revolve around ease of use, cost-effectiveness, and access to exclusive research.

Key Drivers, Barriers & Challenges in India Security Brokerage Market

Key Drivers:

- Rising smartphone and internet penetration.

- Increased financial literacy among younger demographics.

- Government initiatives to promote financial inclusion.

- Technological advancements enabling user-friendly platforms.

Key Challenges:

- Intense competition among established and emerging players.

- Regulatory hurdles and compliance requirements.

- Cybersecurity threats and data privacy concerns.

- Infrastructure limitations in certain regions. This results in xx% of potential customers unable to access services.

Emerging Opportunities in India Security Brokerage Market

- Expansion into Tier-2 and Tier-3 cities.

- Development of specialized products for niche investor segments.

- Integration of AI and machine learning for personalized investment advice.

- Leveraging blockchain technology for enhanced security and transparency.

Growth Accelerators in the India Security Brokerage Market Industry

Strategic partnerships between brokerage firms and fintech companies, focused on leveraging technology and expanding reach, will play a critical role in accelerating market growth. Further technological breakthroughs, particularly in AI-driven trading tools and personalized financial planning, will drive increased adoption rates. Expansion into underserved markets will also contribute significantly to market expansion and create new revenue streams.

Key Players Shaping the India Security Brokerage Market Market

- Zerodha

- Angel Brokers

- Upstox

- Groww

- 5 paisa

- SAS Online

- India Infoline

- Trade Smart Online

- Flyers Securities

- ICICI direct stock broker

- List Not Exhaustive

Notable Milestones in India Security Brokerage Market Sector

- May 2023: Groww acquires Indiabulls Housing Finance's mutual fund business for INR 175.62 crores (21.23 million USD), expanding its mutual fund offerings and enhancing accessibility.

- March 2022: Axis Bank's acquisition of Citibank's consumer businesses strengthens its position in wealth management and retail banking, indirectly impacting the brokerage landscape through increased customer base.

In-Depth India Security Brokerage Market Market Outlook

The Indian security brokerage market is poised for sustained growth over the forecast period, driven by factors such as increasing digital adoption, expanding financial inclusion, and continuous technological advancements. Strategic partnerships and expansion into underserved markets will further fuel this growth. Opportunities exist for innovative firms to capitalize on emerging trends, including AI-powered investment tools and personalized financial planning services, further shaping the future of the market. The market's potential is vast, and strategic players are well-positioned to reap significant rewards from the continued expansion of the Indian economy and the rise of the middle class.

India Security Brokerage Market Segmentation

-

1. Type of Security

- 1.1. Bonds

- 1.2. Stocks

- 1.3. Treasury Notes

- 1.4. Derivatives

- 1.5. Other Types of Securities

-

2. Brokerage Service

- 2.1. Stocks

- 2.2. Insurance

- 2.3. Mortgage

- 2.4. Real Estate

- 2.5. Forex

- 2.6. Leasing

- 2.7. Other Brokerage Services

-

3. Service

- 3.1. Full-Service

- 3.2. Discount

- 3.3. Online

- 3.4. Robo Advisor

- 3.5. Brokers-Dealers

India Security Brokerage Market Segmentation By Geography

- 1. India

India Security Brokerage Market Regional Market Share

Geographic Coverage of India Security Brokerage Market

India Security Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Retail Participation; Favorable systematic liquidity in domestic and international market

- 3.3. Market Restrains

- 3.3.1. High Retail Participation; Favorable systematic liquidity in domestic and international market

- 3.4. Market Trends

- 3.4.1. Increasing Demat account and brokerage business affecting Indian Security Brokerage Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Security Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Security

- 5.1.1. Bonds

- 5.1.2. Stocks

- 5.1.3. Treasury Notes

- 5.1.4. Derivatives

- 5.1.5. Other Types of Securities

- 5.2. Market Analysis, Insights and Forecast - by Brokerage Service

- 5.2.1. Stocks

- 5.2.2. Insurance

- 5.2.3. Mortgage

- 5.2.4. Real Estate

- 5.2.5. Forex

- 5.2.6. Leasing

- 5.2.7. Other Brokerage Services

- 5.3. Market Analysis, Insights and Forecast - by Service

- 5.3.1. Full-Service

- 5.3.2. Discount

- 5.3.3. Online

- 5.3.4. Robo Advisor

- 5.3.5. Brokers-Dealers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type of Security

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zerodha

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Angel Brokers

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Upstox

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Groww

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 5 paisa

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SAS Online

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 India Infoline

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trade Smart Online

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Flyers Securities

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ICICI direct stock broker**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Zerodha

List of Figures

- Figure 1: India Security Brokerage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Security Brokerage Market Share (%) by Company 2025

List of Tables

- Table 1: India Security Brokerage Market Revenue Million Forecast, by Type of Security 2020 & 2033

- Table 2: India Security Brokerage Market Volume Billion Forecast, by Type of Security 2020 & 2033

- Table 3: India Security Brokerage Market Revenue Million Forecast, by Brokerage Service 2020 & 2033

- Table 4: India Security Brokerage Market Volume Billion Forecast, by Brokerage Service 2020 & 2033

- Table 5: India Security Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: India Security Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 7: India Security Brokerage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Security Brokerage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: India Security Brokerage Market Revenue Million Forecast, by Type of Security 2020 & 2033

- Table 10: India Security Brokerage Market Volume Billion Forecast, by Type of Security 2020 & 2033

- Table 11: India Security Brokerage Market Revenue Million Forecast, by Brokerage Service 2020 & 2033

- Table 12: India Security Brokerage Market Volume Billion Forecast, by Brokerage Service 2020 & 2033

- Table 13: India Security Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 14: India Security Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 15: India Security Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Security Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Security Brokerage Market?

The projected CAGR is approximately 7.89%.

2. Which companies are prominent players in the India Security Brokerage Market?

Key companies in the market include Zerodha, Angel Brokers, Upstox, Groww, 5 paisa, SAS Online, India Infoline, Trade Smart Online, Flyers Securities, ICICI direct stock broker**List Not Exhaustive.

3. What are the main segments of the India Security Brokerage Market?

The market segments include Type of Security, Brokerage Service, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.94 Million as of 2022.

5. What are some drivers contributing to market growth?

High Retail Participation; Favorable systematic liquidity in domestic and international market.

6. What are the notable trends driving market growth?

Increasing Demat account and brokerage business affecting Indian Security Brokerage Market.

7. Are there any restraints impacting market growth?

High Retail Participation; Favorable systematic liquidity in domestic and international market.

8. Can you provide examples of recent developments in the market?

May 2023: Fintech unicorn Groww acquired a 100 percent stake in the mutual fund business of Indiabulls Housing Finance for INR 175.62 crores (21.23 million USD). The acquisition was made to make mutual funds more accessible, simpler, and transparent, besides lowering the cost by Groww.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Security Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Security Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Security Brokerage Market?

To stay informed about further developments, trends, and reports in the India Security Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence