Key Insights

The Germany Electric Commercial Vehicle Battery Pack Market is poised for remarkable expansion, with a projected market size of $496.1 million in 2025, driven by a robust CAGR of 24.72%. This significant growth trajectory highlights Germany's commitment to decarbonizing its commercial transport sector. A primary catalyst for this surge is the increasing adoption of battery electric vehicles (BEVs) across various commercial segments, including buses, light commercial vehicles (LCVs), and medium & heavy-duty trucks (M&HDTs). Government incentives, stringent emission regulations, and rising fuel costs are compelling fleet operators to invest in electric alternatives. Advancements in battery technology, particularly the growing preference for LFP and NCM/NMC chemistries, are contributing to improved energy density, safety, and cost-effectiveness of battery packs. The expanding charging infrastructure and decreasing battery costs further accelerate this transition.

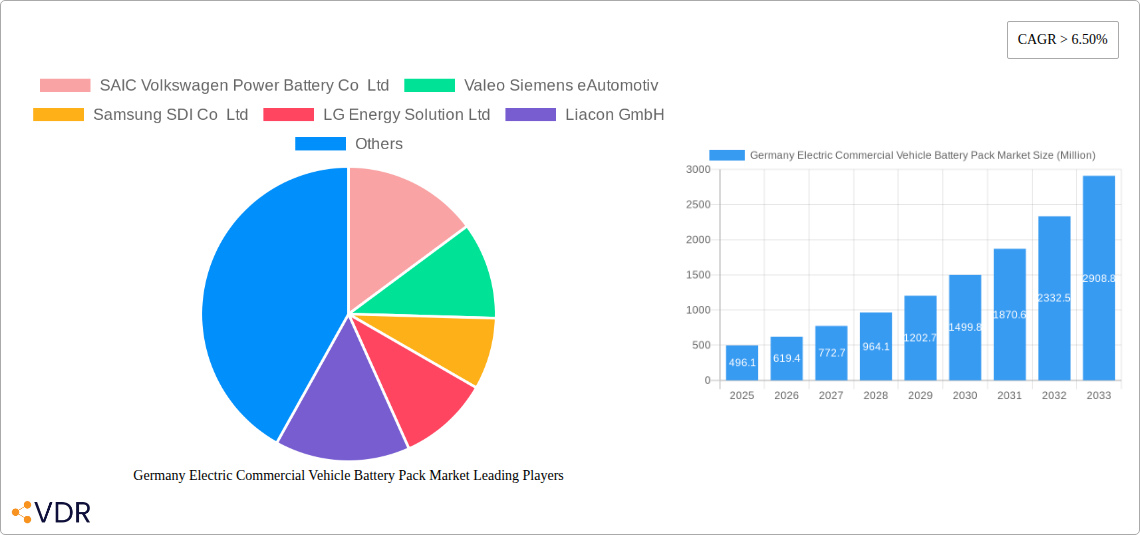

Germany Electric Commercial Vehicle Battery Pack Market Market Size (In Million)

The market segmentation reveals a dynamic landscape. Within propulsion types, BEVs dominate, reflecting the broader industry shift. Battery chemistries such as LFP and NCM/NMC are gaining traction due to their performance characteristics and cost advantages. Battery capacities ranging from 40 kWh to 80 kWh and above 80 kWh are crucial for meeting the diverse operational needs of commercial vehicles. Innovations in battery form factors, particularly pouch and prismatic cells, along with advancements in manufacturing methods like laser welding, are optimizing pack performance and integration. Key components like anodes, cathodes, and electrolytes are undergoing continuous development to enhance efficiency and lifespan. Leading global and domestic players are heavily investing in research and development, strategic collaborations, and manufacturing capacity expansion to capture a substantial share of this burgeoning market. The focus on cobalt-free materials and advanced lithium-ion technologies signals a trend towards sustainable and high-performance battery solutions for the German electric commercial vehicle sector.

Germany Electric Commercial Vehicle Battery Pack Market Company Market Share

This in-depth report provides an exhaustive analysis of the Germany Electric Commercial Vehicle Battery Pack Market, covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033). Gain critical insights into market dynamics, growth trends, dominant segments, product landscape, key drivers, emerging opportunities, and strategic outlook. We analyze the market by Body Type (Bus, LCV, M&HDT), Propulsion Type (BEV, PHEV), Battery Chemistry (LFP, NCA, NCM, NMC, Others), Capacity (15 kWh to 40 kWh, 40 kWh to 80 kWh, Above 80 kWh, Less than 15 kWh), Battery Form (Cylindrical, Pouch, Prismatic), Method (Laser, Wire), and Component (Anode, Cathode, Electrolyte, Separator), and Material Type (Cobalt, Lithium, Manganese, Natural Graphite, Nickel, Other Materials). All values are presented in million units.

Germany Electric Commercial Vehicle Battery Pack Market Dynamics & Structure

The Germany Electric Commercial Vehicle Battery Pack Market is characterized by a moderate to high degree of market concentration, driven by a significant influx of established automotive giants and specialized battery manufacturers vying for market share. Technological innovation is a primary catalyst, with continuous advancements in battery chemistry, energy density, charging speed, and lifespan directly influencing market competitiveness. Regulatory frameworks, particularly stringent EU and German emissions standards and substantial government incentives for EV adoption, are pivotal in shaping market demand and investment. Competitive product substitutes, primarily advancements in internal combustion engine efficiency and alternative fuels, present a persistent challenge, though the accelerating shift towards electrification offers a clear advantage to battery solutions. End-user demographics are evolving, with logistics companies, public transportation authorities, and corporate fleets increasingly prioritizing TCO (Total Cost of Ownership) and sustainability benefits offered by electric commercial vehicles. Mergers and acquisitions (M&A) trends are on the rise as key players seek to secure supply chains, acquire advanced technologies, and expand their market reach. For instance, notable M&A activities aimed at strengthening battery production capabilities and R&D are expected to continue, consolidating the market further. The market concentration is influenced by the capital-intensive nature of battery manufacturing and the need for robust R&D investments. Innovation barriers include the complexity of battery management systems, the demand for higher energy densities at competitive costs, and the ongoing quest for more sustainable and ethically sourced raw materials.

Germany Electric Commercial Vehicle Battery Pack Market Growth Trends & Insights

The Germany Electric Commercial Vehicle Battery Pack Market is poised for exceptional growth, driven by a confluence of supportive policies, technological advancements, and increasing environmental consciousness. The market size evolution is projected to be substantial, reflecting a dramatic increase in the adoption of electric buses, light commercial vehicles (LCVs), and medium and heavy-duty trucks. This upward trajectory is further bolstered by a significant surge in adoption rates, as fleet operators recognize the long-term economic and environmental benefits of transitioning to electric powertrains. Technological disruptions, including breakthroughs in solid-state batteries, improved thermal management systems, and enhanced battery recycling processes, are continuously pushing the boundaries of performance and cost-effectiveness, further accelerating market penetration. Consumer behavior shifts are evident, with a growing preference for zero-emission transportation solutions driven by corporate sustainability goals and public pressure. The overall market penetration of electric commercial vehicles is anticipated to witness a substantial uptick, moving from nascent stages to a more mainstream adoption within the forecast period. The CAGR is expected to be robust, reflecting the rapid industrial shift. The increasing demand for energy-efficient and sustainable logistics solutions is a key factor in this market's expansion. The government's commitment to decarbonizing the transport sector is a significant growth accelerator, encouraging significant investment in charging infrastructure and electric vehicle production. Innovations in battery management systems are enhancing safety and extending battery life, which are crucial for commercial applications.

Dominant Regions, Countries, or Segments in Germany Electric Commercial Vehicle Battery Pack Market

Within the Germany Electric Commercial Vehicle Battery Pack Market, the M&HDT (Medium & Heavy-Duty Truck) segment, powered by BEV (Battery Electric Vehicle) propulsion, is emerging as a dominant force. This dominance is largely attributed to the increasing pressure on logistics companies to reduce their carbon footprint and comply with stricter emissions regulations for large vehicles operating in urban centers and on long-haul routes. The Above 80 kWh battery capacity segment is experiencing significant growth as these heavy-duty applications require substantial energy storage to achieve adequate range and payload capacity. The NCM (Nickel Cobalt Manganese) and LFP (Lithium Iron Phosphate) battery chemistries are at the forefront, with LFP gaining traction due to its cost-effectiveness and safety advantages, especially for fleet applications where durability and lower upfront investment are prioritized.

- Body Type Dominance: M&HDT segment leads due to the critical need for decarbonizing freight transport and the growing implementation of electric long-haul trucking initiatives.

- Propulsion Type Dominance: BEV is the undisputed leader, driven by advancements in battery technology and the availability of charging infrastructure, offering a clear path to zero-emission operations.

- Capacity Dominance: Battery packs exceeding 80 kWh are crucial for meeting the operational demands of heavy-duty trucks, enabling them to cover significant distances and carry substantial loads.

- Battery Chemistry Impact: While NCM offers higher energy density, LFP is rapidly gaining market share due to its improved safety, longer cycle life, and lower cost, making it a compelling choice for fleet operators.

- Component Demand: The increasing production of these high-capacity battery packs directly fuels demand for key components such as advanced Cathodes, Anodes, and Electrolytes with higher energy density and improved stability.

- Material Type Focus: The demand for Nickel and Cobalt in NCM batteries, as well as Lithium and Manganese in both NCM and LFP, remains significant, underscoring the importance of stable and sustainable material sourcing.

The economic policies promoting EV adoption, coupled with substantial government subsidies for electric trucks and the expansion of dedicated charging infrastructure for commercial fleets, are key drivers. Germany's strong industrial base and its commitment to automotive innovation further solidify the dominance of these segments.

Germany Electric Commercial Vehicle Battery Pack Market Product Landscape

The product landscape for Germany Electric Commercial Vehicle Battery Pack Market is characterized by a relentless pursuit of higher energy density, enhanced safety, and improved cost-efficiency. Manufacturers are focusing on optimizing battery pack designs for various commercial vehicle body types, from compact LCVs to long-haul M&HDTs. Innovations include advanced thermal management systems to ensure optimal operating temperatures, leading to extended battery life and consistent performance in diverse climatic conditions. Developments in battery management systems (BMS) are crucial for maximizing efficiency, predicting remaining range, and ensuring the safety of high-voltage battery packs. Furthermore, the integration of modular battery designs is gaining traction, allowing for easier repair, replacement, and scalability of battery capacity to meet specific fleet requirements. The focus on sustainable materials and closed-loop recycling processes is also shaping product development, with an emphasis on reducing the environmental impact of battery production and end-of-life management. Unique selling propositions revolve around durability, reliability under demanding operational conditions, and rapid charging capabilities, which are critical for minimizing downtime for commercial fleets.

Key Drivers, Barriers & Challenges in Germany Electric Commercial Vehicle Battery Pack Market

Key Drivers:

- Stringent Emission Regulations: EU and German government mandates for reducing CO2 emissions are a primary driver, compelling manufacturers and fleet operators to adopt electric vehicles.

- Government Incentives & Subsidies: Financial support for purchasing electric commercial vehicles and investing in charging infrastructure significantly lowers the adoption barrier.

- Technological Advancements: Improvements in battery energy density, charging speed, and longevity are making electric commercial vehicles more practical and cost-effective.

- Growing Corporate Sustainability Goals: Many companies are committed to reducing their environmental impact, leading to increased adoption of electric fleets for logistics and services.

- Declining Battery Costs: Continued innovation and economies of scale are driving down the cost of battery packs, making EVs more competitive with traditional vehicles.

Barriers & Challenges:

- High Upfront Cost: Despite declining costs, the initial purchase price of electric commercial vehicles often remains higher than their diesel counterparts.

- Charging Infrastructure Gaps: The availability and reliability of charging infrastructure, particularly for high-power charging for heavy-duty trucks, can be a significant challenge in certain regions.

- Range Anxiety & Payload Limitations: For some long-haul or heavy-duty applications, concerns about driving range and the impact of battery weight on payload capacity persist.

- Battery Lifespan & Replacement Costs: While improving, the long-term lifespan and potential replacement costs of battery packs are still a consideration for fleet operators.

- Supply Chain Volatility & Raw Material Availability: Global supply chain disruptions and the fluctuating prices of key battery materials like lithium and cobalt can impact production and costs.

Emerging Opportunities in Germany Electric Commercial Vehicle Battery Pack Market

Emerging opportunities in the Germany Electric Commercial Vehicle Battery Pack Market lie in the development of advanced battery chemistries offering higher energy density and faster charging capabilities, such as next-generation LFP variants and solid-state batteries. The expansion of integrated charging solutions, including smart charging networks and vehicle-to-grid (V2G) technology, presents a significant avenue for growth, enabling efficient energy management and potential revenue streams for fleet operators. Furthermore, the growing demand for specialized battery packs tailored for niche commercial applications, such as refrigerated trucks or refuse collection vehicles, offers untapped market potential. The increasing focus on battery second-life applications and robust recycling infrastructure also presents an opportunity for circular economy business models. Evolving consumer preferences towards sustainable logistics solutions are creating a demand for greener delivery services, further driving the adoption of electric commercial vehicles.

Growth Accelerators in the Germany Electric Commercial Vehicle Battery Pack Market Industry

Key growth accelerators for the Germany Electric Commercial Vehicle Battery Pack Market include ongoing breakthroughs in battery technology that promise increased energy density and reduced charging times, making electric commercial vehicles a more viable option for a wider range of applications. Strategic partnerships between battery manufacturers, automotive OEMs, and energy providers are crucial for establishing robust supply chains and developing comprehensive charging solutions. The expansion of public and private investment in charging infrastructure, particularly high-speed charging stations for commercial fleets, will significantly reduce range anxiety and operational downtime. Government policies that continue to incentivize EV adoption and penalize emissions will further accelerate the shift. Moreover, innovations in battery materials science, leading to more sustainable and ethically sourced raw materials, will enhance the overall appeal and long-term viability of electric commercial vehicles.

Key Players Shaping the Germany Electric Commercial Vehicle Battery Pack Market Market

- SAIC Volkswagen Power Battery Co Ltd

- Valeo Siemens eAutomotiv

- Samsung SDI Co Ltd

- LG Energy Solution Ltd

- Liacon GmbH

- Contemporary Amperex Technology Co Ltd (CATL)

- Ebusco B V

- Akasol AG

- BYD Company Ltd

- SK Innovation Co Ltd

- Litens Automotive GmbH & Co KG

- Automotive Cells Company (ACC)

- Panasonic Holdings Corporation

- NorthVolt AB

- Super B Lithium Power B V

Notable Milestones in Germany Electric Commercial Vehicle Battery Pack Market Sector

- 2022/05: Ebusco announces major order for electric buses, signaling strong adoption in public transport.

- 2022/11: ACC (Automotive Cells Company) inaugurates its first battery cell factory, boosting European production capacity.

- 2023/01: NorthVolt AB secures significant funding to expand its gigafactory production in Europe.

- 2023/04: CATL introduces new LFP battery technology with enhanced energy density and safety features.

- 2023/07: Valeo Siemens eAutomotive announces strategic partnerships for electric powertrain components.

- 2023/10: LG Energy Solution Ltd expands its R&D efforts focusing on next-generation battery chemistries.

- 2024/02: BYD Company Ltd strengthens its presence in the European commercial vehicle market with new model launches.

- 2024/05: Akasol AG highlights advancements in high-performance battery systems for demanding commercial applications.

In-Depth Germany Electric Commercial Vehicle Battery Pack Market Market Outlook

The Germany Electric Commercial Vehicle Battery Pack Market is set for sustained and significant growth, propelled by a strong regulatory push and increasing industry commitment to sustainability. Key growth accelerators include continued advancements in battery technology, focusing on higher energy densities and faster charging solutions, which will address range anxiety and operational efficiency concerns for fleet operators. The expansion of robust and integrated charging infrastructure is paramount and will unlock the full potential of electric commercial vehicles. Strategic collaborations between battery manufacturers, vehicle OEMs, and infrastructure developers are crucial for creating a cohesive ecosystem that supports widespread adoption. Furthermore, the evolving landscape of battery materials, with an emphasis on sustainable sourcing and recycling, will contribute to the long-term viability and attractiveness of the market. The market outlook suggests a dynamic environment with continuous innovation and increasing investment, making it a pivotal sector in Germany's transition to a green economy.

Germany Electric Commercial Vehicle Battery Pack Market Segmentation

-

1. Body Type

- 1.1. Bus

- 1.2. LCV

- 1.3. M&HDT

-

2. Propulsion Type

- 2.1. BEV

- 2.2. PHEV

-

3. Battery Chemistry

- 3.1. LFP

- 3.2. NCA

- 3.3. NCM

- 3.4. NMC

- 3.5. Others

-

4. Capacity

- 4.1. 15 kWh to 40 kWh

- 4.2. 40 kWh to 80 kWh

- 4.3. Above 80 kWh

- 4.4. Less than 15 kWh

-

5. Battery Form

- 5.1. Cylindrical

- 5.2. Pouch

- 5.3. Prismatic

-

6. Method

- 6.1. Laser

- 6.2. Wire

-

7. Component

- 7.1. Anode

- 7.2. Cathode

- 7.3. Electrolyte

- 7.4. Separator

-

8. Material Type

- 8.1. Cobalt

- 8.2. Lithium

- 8.3. Manganese

- 8.4. Natural Graphite

- 8.5. Nickel

- 8.6. Other Materials

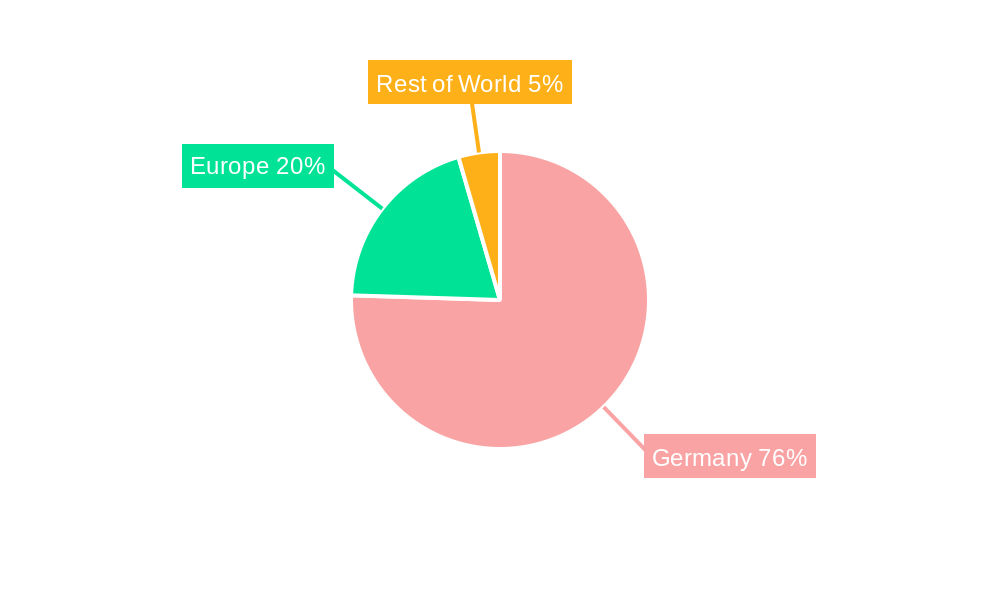

Germany Electric Commercial Vehicle Battery Pack Market Segmentation By Geography

- 1. Germany

Germany Electric Commercial Vehicle Battery Pack Market Regional Market Share

Geographic Coverage of Germany Electric Commercial Vehicle Battery Pack Market

Germany Electric Commercial Vehicle Battery Pack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand and Sales of Commercial Vehicles is Driving the Market for Hydraulic Systems

- 3.3. Market Restrains

- 3.3.1. Increasing Replacement of Conventional Hydraulic Systems with Fully-electric Hydraulic Systems Acts as a Restraint

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Electric Commercial Vehicle Battery Pack Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Bus

- 5.1.2. LCV

- 5.1.3. M&HDT

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. BEV

- 5.2.2. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Battery Chemistry

- 5.3.1. LFP

- 5.3.2. NCA

- 5.3.3. NCM

- 5.3.4. NMC

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Capacity

- 5.4.1. 15 kWh to 40 kWh

- 5.4.2. 40 kWh to 80 kWh

- 5.4.3. Above 80 kWh

- 5.4.4. Less than 15 kWh

- 5.5. Market Analysis, Insights and Forecast - by Battery Form

- 5.5.1. Cylindrical

- 5.5.2. Pouch

- 5.5.3. Prismatic

- 5.6. Market Analysis, Insights and Forecast - by Method

- 5.6.1. Laser

- 5.6.2. Wire

- 5.7. Market Analysis, Insights and Forecast - by Component

- 5.7.1. Anode

- 5.7.2. Cathode

- 5.7.3. Electrolyte

- 5.7.4. Separator

- 5.8. Market Analysis, Insights and Forecast - by Material Type

- 5.8.1. Cobalt

- 5.8.2. Lithium

- 5.8.3. Manganese

- 5.8.4. Natural Graphite

- 5.8.5. Nickel

- 5.8.6. Other Materials

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SAIC Volkswagen Power Battery Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Valeo Siemens eAutomotiv

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung SDI Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LG Energy Solution Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Liacon GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Contemporary Amperex Technology Co Ltd (CATL)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ebusco B V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Akasol AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BYD Company Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SK Innovation Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Litens Automotive GmbH & Co KG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Automotive Cells Company (ACC)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Panasonic Holdings Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 NorthVolt AB

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Super B Lithium Power B V

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 SAIC Volkswagen Power Battery Co Ltd

List of Figures

- Figure 1: Germany Electric Commercial Vehicle Battery Pack Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Germany Electric Commercial Vehicle Battery Pack Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Body Type 2020 & 2033

- Table 2: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 3: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Battery Chemistry 2020 & 2033

- Table 4: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 5: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Battery Form 2020 & 2033

- Table 6: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Method 2020 & 2033

- Table 7: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 8: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 9: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 10: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Body Type 2020 & 2033

- Table 11: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 12: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Battery Chemistry 2020 & 2033

- Table 13: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 14: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Battery Form 2020 & 2033

- Table 15: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Method 2020 & 2033

- Table 16: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 17: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 18: Germany Electric Commercial Vehicle Battery Pack Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Electric Commercial Vehicle Battery Pack Market?

The projected CAGR is approximately 24.72%.

2. Which companies are prominent players in the Germany Electric Commercial Vehicle Battery Pack Market?

Key companies in the market include SAIC Volkswagen Power Battery Co Ltd, Valeo Siemens eAutomotiv, Samsung SDI Co Ltd, LG Energy Solution Ltd, Liacon GmbH, Contemporary Amperex Technology Co Ltd (CATL), Ebusco B V, Akasol AG, BYD Company Ltd, SK Innovation Co Ltd, Litens Automotive GmbH & Co KG, Automotive Cells Company (ACC), Panasonic Holdings Corporation, NorthVolt AB, Super B Lithium Power B V.

3. What are the main segments of the Germany Electric Commercial Vehicle Battery Pack Market?

The market segments include Body Type, Propulsion Type, Battery Chemistry, Capacity, Battery Form, Method, Component, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand and Sales of Commercial Vehicles is Driving the Market for Hydraulic Systems.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Replacement of Conventional Hydraulic Systems with Fully-electric Hydraulic Systems Acts as a Restraint.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Electric Commercial Vehicle Battery Pack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Electric Commercial Vehicle Battery Pack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Electric Commercial Vehicle Battery Pack Market?

To stay informed about further developments, trends, and reports in the Germany Electric Commercial Vehicle Battery Pack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence