Key Insights

The France General Surgical Devices Market is projected for significant expansion, with an estimated market size of $25.15 billion in 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.6% through 2033. This growth is driven by the increasing prevalence of chronic diseases, advancements in minimally invasive surgical techniques, and a rising demand for sophisticated medical devices. An aging population in France further contributes to this demand, as older individuals often require more surgical interventions. Continuous innovation in surgical instrumentation, including enhanced laparoscopic tools and advanced wound closure systems, is improving surgical outcomes and patient recovery, thereby stimulating market adoption. Increased healthcare infrastructure investment and a supportive regulatory environment also bolster market growth.

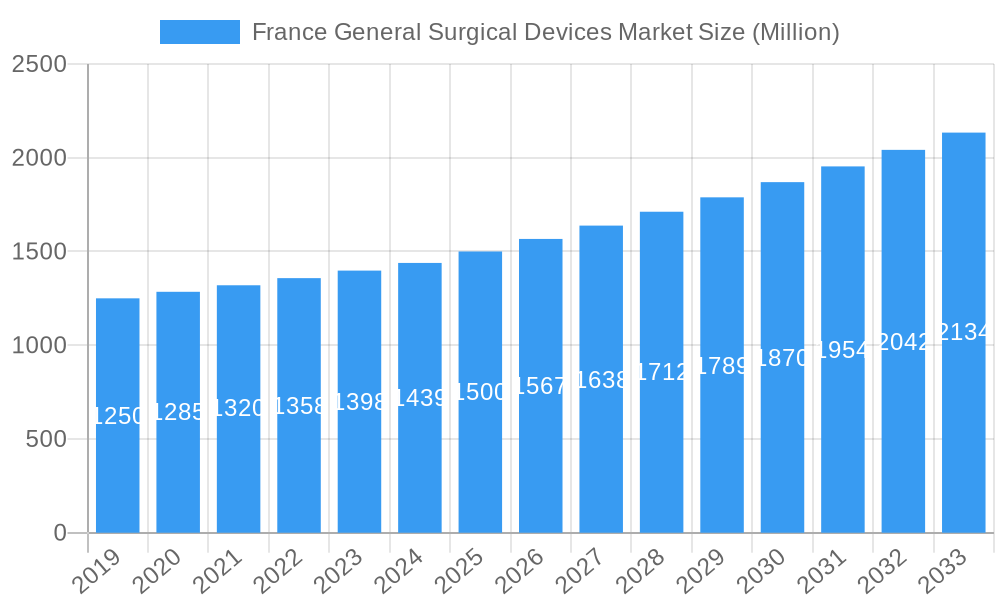

France General Surgical Devices Market Market Size (In Billion)

Key market segments highlight significant opportunities. Laparoscopic Devices and Electrosurgical Devices are anticipated to lead in product categories due to their essential role in modern, less invasive procedures. In terms of applications, Gynecology and Urology, Cardiology, and Orthopaedics are expected to be the dominant segments, reflecting the high volume of surgeries performed. While stringent regulatory approvals and the high cost of advanced equipment may pose some challenges, the overarching trends of technological innovation and rising healthcare expenditure are expected to drive the market forward. Leading companies such as Medtronic PLC, Stryker Corporation, and Johnson & Johnson are actively influencing the market through product development and strategic partnerships, fostering a dynamic competitive environment.

France General Surgical Devices Market Company Market Share

This comprehensive report offers critical insights into the France General Surgical Devices Market for industry stakeholders, investors, and strategic planners. Covering a study period from 2019 to 2033, with a base year of 2025, this analysis delves into market dynamics, growth trends, the competitive landscape, and future outlook for the French surgical instruments sector. Optimized with high-traffic keywords like "surgical robotics France," "minimally invasive surgery devices," "medical devices market France," and "healthcare technology innovation," this report aims to enhance search engine visibility and engage industry professionals. We provide a holistic understanding of opportunities and challenges within the French healthcare ecosystem by exploring both parent and child market segments. All quantitative values are presented in billion units.

France General Surgical Devices Market Market Dynamics & Structure

The France General Surgical Devices Market is characterized by a moderate to high level of market concentration, with a few key global players holding significant market share. Technological innovation is a primary driver, fueled by increasing demand for minimally invasive procedures and advancements in robotic surgery. Regulatory frameworks, overseen by bodies like the French National Agency for Medicines and Health Products Safety (ANSM), play a crucial role in shaping market access and product approvals, ensuring patient safety and device efficacy. Competitive product substitutes exist, particularly between traditional instruments and their advanced counterparts, leading to constant innovation pressure. End-user demographics, including an aging population and a growing prevalence of chronic diseases, contribute to the sustained demand for a wide array of surgical interventions. Mergers and Acquisitions (M&A) trends are notable, with larger companies acquiring innovative startups to expand their product portfolios and market reach.

- Market Concentration: Dominated by a few large multinational corporations, alongside a growing number of specialized niche players.

- Technological Innovation Drivers: Advancements in robotics, AI-assisted surgery, advanced imaging, and miniaturization of devices are key catalysts.

- Regulatory Frameworks: Stringent approval processes and post-market surveillance by ANSM are paramount.

- Competitive Product Substitutes: Ongoing development of single-use versus reusable devices, and manual versus automated surgical tools.

- End-User Demographics: An aging population with increasing co-morbidities drives demand for complex surgical interventions.

- M&A Trends: Strategic acquisitions focused on robotic surgery, AI integration, and specialized therapeutic areas. For instance, the acquisition of innovative surgical technology firms by established medical device giants is a recurring theme.

France General Surgical Devices Market Growth Trends & Insights

The France General Surgical Devices Market is projected to experience robust growth over the forecast period, driven by several pivotal factors. The increasing adoption of minimally invasive surgical techniques is a significant market shaper, leading to higher demand for specialized laparoscopic and robotic-assisted surgical instruments. Technological disruptions, such as the integration of artificial intelligence and advanced robotics in surgical platforms, are redefining procedural efficiency and patient outcomes, thereby accelerating market penetration. Consumer behavior shifts, influenced by greater patient awareness of treatment options and a preference for less invasive and faster recovery procedures, are also contributing to market expansion. The French healthcare system's commitment to adopting cutting-edge medical technology, coupled with supportive government initiatives aimed at modernizing healthcare infrastructure, further bolsters the market's growth trajectory.

The market size evolution is directly correlated with the increasing number of surgical procedures performed annually across various specialties. As the base year 2025 marks an estimated market value of XX Million units, projections indicate a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This growth is underpinned by a continuous increase in the adoption rates of advanced surgical devices, particularly those facilitating complex procedures with enhanced precision. Technological disruptions are not merely incremental; they represent a paradigm shift, with innovations in surgical robotics France and AI in surgery poised to transform traditional surgical practices. The shift towards personalized medicine also influences the demand for tailored surgical solutions and instruments. Furthermore, patient-centric care models are encouraging the uptake of technologies that minimize patient trauma and accelerate recovery times, directly impacting the demand for minimally invasive surgery devices. The aging demographic in France, coupled with a higher incidence of lifestyle-related diseases, continues to fuel the demand for a diverse range of surgical interventions, from orthopaedic to cardiovascular procedures. The evolving landscape of medical devices market France is thus characterized by a dynamic interplay of technological advancement, evolving patient preferences, and strategic investments in healthcare infrastructure.

Dominant Regions, Countries, or Segments in France General Surgical Devices Market

Within the France General Surgical Devices Market, the Laproscopic Devices segment is identified as a dominant force driving market growth. This dominance is attributable to the widespread adoption of laparoscopic surgery across numerous surgical specialties, owing to its inherent advantages such as reduced invasiveness, shorter hospital stays, and faster patient recovery. The increasing prevalence of procedures in Gynecology and Urology, General Surgery, and Orthopaedics has significantly boosted the demand for sophisticated laparoscopic instruments. France’s robust healthcare infrastructure, coupled with a high level of physician training in minimally invasive techniques, further solidifies the leadership of this segment.

The Product: Laproscopic Devices segment exhibits a substantial market share estimated at XX% of the total France General Surgical Devices Market in 2025. This segment's growth is propelled by continuous innovation in areas like single-port laparoscopy, advanced visualization systems, and specialized energy devices. The application of these devices is particularly prominent in Gynecology and Urology and General Surgery, where these techniques have become the standard of care for many conditions.

- Key Drivers for Laparoscopic Devices Dominance:

- Minimally Invasive Surgery Trend: Growing preference for procedures with reduced patient trauma.

- Technological Advancements: Development of advanced imaging, articulation, and energy delivery systems.

- Physician Proficiency: High training standards and adoption rates among French surgeons.

- Economic Benefits: Reduced hospital stay and recovery time contribute to lower healthcare costs.

- Market Share & Growth Potential: The laparoscopic segment is expected to grow at a CAGR of XX% from 2025-2033, outpacing other product categories.

- Interplay with Applications: The surge in gynecological and urological surgeries, driven by factors like increasing cancer diagnoses and benign conditions requiring intervention, directly fuels the demand for laparoscopic solutions. Similarly, advancements in orthopedic minimally invasive procedures are expanding the market for specialized laparoscopic instruments in this field.

- Regulatory Support: Favorable regulatory pathways for innovative laparoscopic devices encourage market entry and adoption.

- Infrastructure: Well-equipped hospitals and surgical centers across France are readily adopting and utilizing advanced laparoscopic technologies.

The Application: Gynecology and Urology segment also plays a pivotal role in the market's expansion. The increasing incidence of urological and gynecological cancers, coupled with a rising demand for fertility treatments and corrective procedures, drives the need for specialized surgical devices in these areas. The integration of robotic-assisted surgery further enhances the precision and efficacy of procedures in these sensitive applications, contributing significantly to the overall market growth.

France General Surgical Devices Market Product Landscape

The France General Surgical Devices Market is characterized by a diverse and evolving product landscape, driven by relentless innovation and a focus on enhancing surgical outcomes. Handheld Devices, the foundational category, continue to see refinement in ergonomics and material science. Laparoscopic Devices are at the forefront of technological integration, featuring advanced optics, articulated instruments, and integrated energy sources for minimally invasive procedures. Electro Surgical Devices are witnessing advancements in waveform generation and tissue management, enabling more precise cutting and coagulation with reduced thermal spread. Wound Closure Devices are expanding beyond traditional sutures to include bio-absorbable sealants, advanced staples, and smart closure systems that promote faster and scar-free healing. Trocars and Access Devices are being designed for smaller incisions and improved patient comfort. The "Other Products" category encompasses specialized instruments for niche applications, reflecting the market's breadth. Unique selling propositions often lie in the device's ability to improve surgeon control, reduce procedure time, minimize tissue damage, and accelerate patient recovery, pushing the boundaries of what is surgically possible.

Key Drivers, Barriers & Challenges in France General Surgical Devices Market

The France General Surgical Devices Market is propelled by several key drivers including the ongoing adoption of minimally invasive surgical techniques, continuous technological advancements in surgical robotics and AI, and an aging population demanding more complex procedures. Supportive government initiatives promoting healthcare modernization also act as significant catalysts.

However, the market faces notable barriers and challenges. High research and development costs associated with innovative medical devices can impede smaller players. Stringent regulatory approval processes, while ensuring safety, can lead to extended market entry timelines. Reimbursement policies for advanced surgical technologies can also be a hurdle, impacting adoption rates. Supply chain disruptions, as evidenced by recent global events, pose a risk to the availability of critical components and finished goods. Competitive pressures from both global giants and agile local manufacturers further necessitate strategic differentiation.

Emerging Opportunities in France General Surgical Devices Market

Emerging opportunities in the France General Surgical Devices Market lie in the burgeoning field of AI-powered surgical decision support systems, which promise to enhance diagnostic accuracy and procedural planning. The expansion of remote surgical training and telesurgery platforms presents a significant opportunity to overcome geographical barriers and improve access to specialized surgical expertise. Furthermore, the increasing demand for personalized surgical solutions tailored to individual patient anatomies and pathologies creates a niche for customized device manufacturing and innovative biomaterials. The growing focus on sustainability within healthcare also opens avenues for the development of reusable, easily sterilizable, or biodegradable surgical instruments.

Growth Accelerators in the France General Surgical Devices Market Industry

Key catalysts driving long-term growth in the France General Surgical Devices Market include the increasing integration of robotic-assisted surgery across more complex procedures, such as neurosurgery and cardiac surgery. Strategic partnerships between medical device manufacturers and healthcare providers are crucial for co-development and faster adoption of innovative technologies. Furthermore, market expansion strategies, including direct sales forces and distributor networks focused on underserved regions or emerging surgical applications, are vital. Investments in research and development for next-generation surgical instruments, incorporating advanced imaging and data analytics, will continue to accelerate market penetration and drive sustained revenue growth.

Key Players Shaping the France General Surgical Devices Market Market

- Cadence Inc (Kohlberg & Company)

- Maquet Holding BV & Co KG

- Medtronic PLC

- Stryker Corporation

- Conmed Corporation

- Johnson & Johnson

- B Braun Melsungen AG

- Boston Scientific Corporation

- Olympus Corporation

- Integer Holdings Corporation

Notable Milestones in France General Surgical Devices Market Sector

- September 2022: eCential Robotics, a surgical robotics business, launched a spine surgery platform offering intra-operative 2D and 3D imaging, navigation, and robotic guiding for surgical procedures.

- April 2022: eCential Robotics and Amplitude Surgical announced a long-term partnership to enhance knee surgery robotics.

In-Depth France General Surgical Devices Market Market Outlook

The future outlook for the France General Surgical Devices Market is exceptionally promising, driven by ongoing technological innovation and a sustained demand for advanced healthcare solutions. Growth accelerators such as the increasing adoption of AI in surgical planning and execution, coupled with the expansion of robotic-assisted procedures in specialized fields, will significantly boost market potential. Strategic collaborations between technology providers and healthcare institutions are anticipated to foster rapid commercialization of novel devices. The market is poised for significant expansion as healthcare providers continue to invest in technologies that improve patient outcomes, reduce recovery times, and enhance surgical precision, making France a key hub for innovation and adoption in the global surgical devices arena.

France General Surgical Devices Market Segmentation

-

1. Product

- 1.1. Handheld Devices

- 1.2. Laproscopic Devices

- 1.3. Electro Surgical Devices

- 1.4. Wound Closure Devices

- 1.5. Trocars and Access Devices

- 1.6. Other Products

-

2. Application

- 2.1. Gynecology and Urology

- 2.2. Cardiology

- 2.3. Orthopaedic

- 2.4. Neurology

- 2.5. Other Applications

France General Surgical Devices Market Segmentation By Geography

- 1. France

France General Surgical Devices Market Regional Market Share

Geographic Coverage of France General Surgical Devices Market

France General Surgical Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Minimally Invasive Devices and Increasing Healthcare Expenditure; Growing Cases of Injuries and Accidents

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Improper Reimbursement for Surgical Devices

- 3.4. Market Trends

- 3.4.1. Handheld Devices is Expected to Hold a Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France General Surgical Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Handheld Devices

- 5.1.2. Laproscopic Devices

- 5.1.3. Electro Surgical Devices

- 5.1.4. Wound Closure Devices

- 5.1.5. Trocars and Access Devices

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gynecology and Urology

- 5.2.2. Cardiology

- 5.2.3. Orthopaedic

- 5.2.4. Neurology

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cadence Inc (Kohlberg & Company)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maquet Holding BV & Co KG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Medtronic PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stryker Corporation*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Conmed Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson & Johnson

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 B Braun Melsungen AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Boston Scientific Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Olympus Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Integer Holdings Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cadence Inc (Kohlberg & Company)

List of Figures

- Figure 1: France General Surgical Devices Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France General Surgical Devices Market Share (%) by Company 2025

List of Tables

- Table 1: France General Surgical Devices Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: France General Surgical Devices Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: France General Surgical Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: France General Surgical Devices Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: France General Surgical Devices Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: France General Surgical Devices Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France General Surgical Devices Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the France General Surgical Devices Market?

Key companies in the market include Cadence Inc (Kohlberg & Company), Maquet Holding BV & Co KG, Medtronic PLC, Stryker Corporation*List Not Exhaustive, Conmed Corporation, Johnson & Johnson, B Braun Melsungen AG, Boston Scientific Corporation, Olympus Corporation, Integer Holdings Corporation.

3. What are the main segments of the France General Surgical Devices Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.15 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Minimally Invasive Devices and Increasing Healthcare Expenditure; Growing Cases of Injuries and Accidents.

6. What are the notable trends driving market growth?

Handheld Devices is Expected to Hold a Significant Share of the Market.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Improper Reimbursement for Surgical Devices.

8. Can you provide examples of recent developments in the market?

In September 2022, eCential Robotics, a surgical robotics business, created a spine surgery platform that provides intra-operative 2D and 3D imaging, navigation, and robotic guiding for surgical procedures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France General Surgical Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France General Surgical Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France General Surgical Devices Market?

To stay informed about further developments, trends, and reports in the France General Surgical Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence