Key Insights

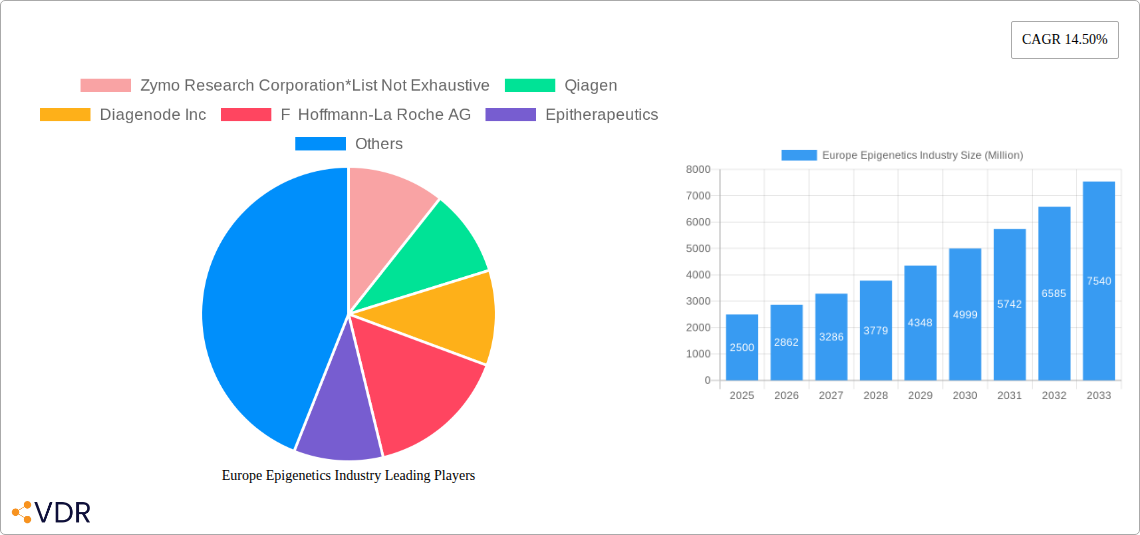

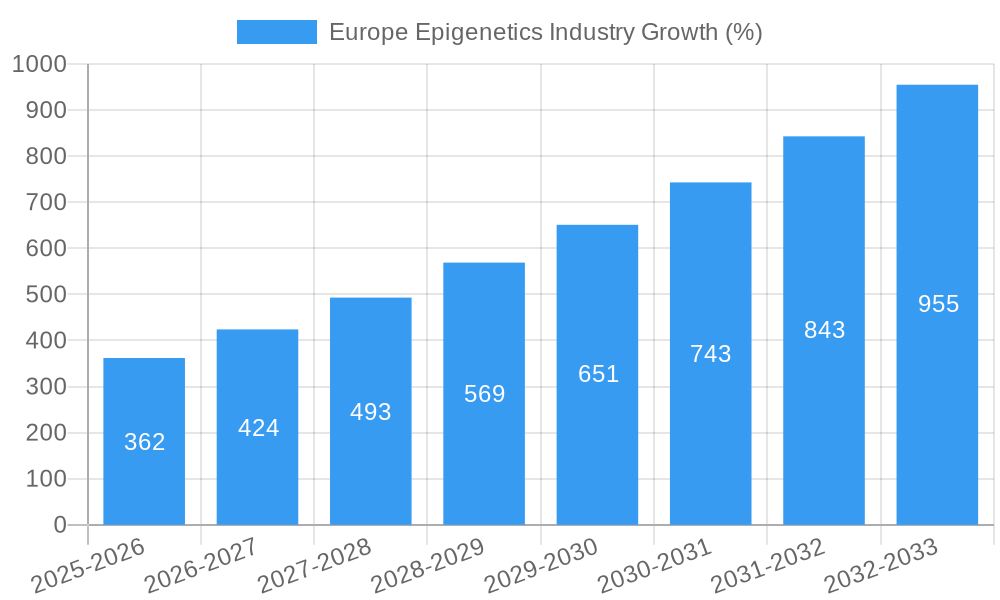

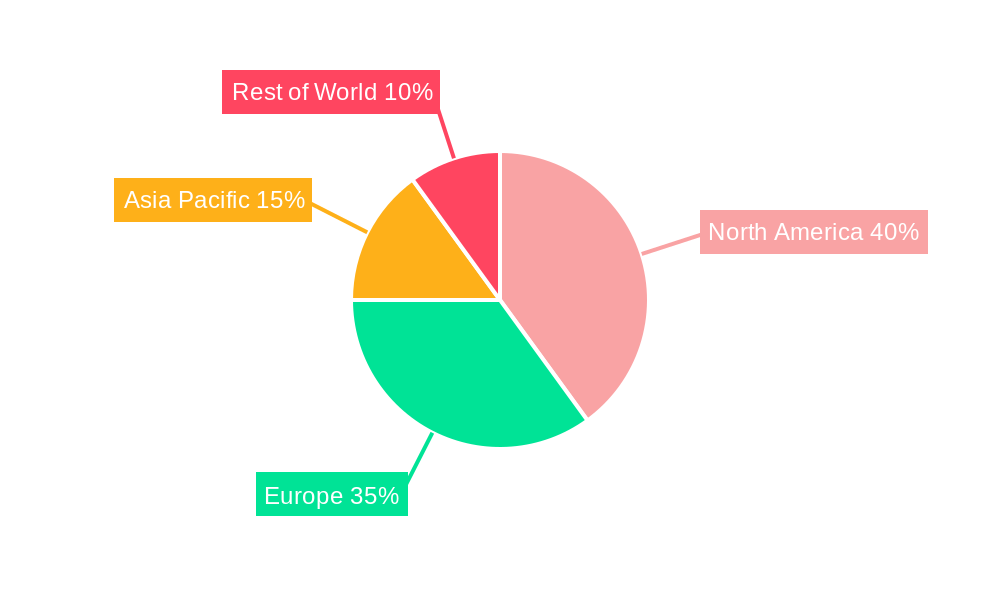

The European epigenetics market, currently experiencing robust growth, is projected to reach significant scale by 2033. Driven by advancements in genomic technologies, increasing research funding in personalized medicine, and a growing understanding of epigenetics' role in disease development, particularly oncology, this sector shows substantial promise. The market is segmented by technology (DNA methylation, histone modification, etc.), product (kits, reagents, instruments), and application (oncology, non-oncology research), offering diverse opportunities for companies like Zymo Research, Qiagen, and Illumina. While the exact current market size is unspecified, a 14.50% CAGR from a base year of 2025 suggests substantial year-on-year expansion. Key regional growth within Europe is expected across Germany, France, the UK, and other key markets, fuelled by strong research infrastructures and healthcare spending. Challenges include the complexities and costs associated with epigenetic research, as well as the need for regulatory clarity around new epigenetic therapies. However, the accelerating pace of technological development and the demonstrated therapeutic potential are expected to offset these restraints, driving significant market expansion over the forecast period (2025-2033).

The strong growth trajectory is further supported by the increasing prevalence of chronic diseases such as cancer, where epigenetic modifications play a significant role. The development of targeted epigenetic therapies represents a major driver of market growth. Companies are investing heavily in research and development, leading to the introduction of innovative products and services. The substantial investment in research infrastructure across Europe, particularly in countries like Germany and the UK, creates a fertile environment for market expansion. Furthermore, collaborative research initiatives between academia and industry are fostering innovation and accelerating the translation of research findings into commercial applications, contributing to the overall market growth and expansion within Europe.

Europe Epigenetics Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe epigenetics industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. The report segments the market by technology (DNA Methylation, Histone Methylation, Histone Acetylation, Large non-coding RNA, MicroRNA modification, Chromatin Structures), product (Kits, Reagents, Enzymes, Instruments), and application (Oncology, Non-Oncology, including Developmental Biology and Other Research Areas). The total market value is projected to reach xx Million by 2033.

Europe Epigenetics Industry Market Dynamics & Structure

The European epigenetics market is characterized by moderate concentration, with key players like Qiagen, Illumina Inc, and Thermo Fisher Scientific holding significant market share. Technological innovation, driven by advancements in next-generation sequencing (NGS) and CRISPR technology, is a major growth driver. Stringent regulatory frameworks governing research and clinical applications influence market dynamics. Competitive substitutes, such as traditional genetic analysis methods, pose a challenge. The end-user demographic comprises primarily academic research institutions, pharmaceutical companies, and biotechnology firms. M&A activity in the sector has been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024, representing a total value of xx Million.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: NGS and CRISPR technologies are primary drivers.

- Regulatory Framework: Stringent regulations impacting research and clinical applications.

- Competitive Substitutes: Traditional genetic analysis methods.

- End-User Demographics: Primarily academic, pharmaceutical, and biotech firms.

- M&A Activity: Approximately xx deals between 2019-2024, totaling xx Million.

- Innovation Barriers: High R&D costs, stringent regulatory approvals, and complex data analysis.

Europe Epigenetics Industry Growth Trends & Insights

The European epigenetics market witnessed significant growth during the historical period (2019-2024), expanding at a CAGR of xx%. This growth is attributed to increasing research funding, rising prevalence of epigenetic-related diseases (cancer, neurological disorders), and technological advancements. Market penetration in key application areas like oncology remains relatively high, while adoption in other areas like developmental biology shows substantial growth potential. Technological disruptions, such as advancements in single-cell epigenetics analysis, are further accelerating market expansion. Consumer behavior shifts, driven by a greater understanding of the role of epigenetics in health and disease, are boosting demand for epigenetic testing and therapies. The market is projected to experience continued growth during the forecast period (2025-2033), reaching a value of xx Million by 2033, exhibiting a CAGR of xx%.

Dominant Regions, Countries, or Segments in Europe Epigenetics Industry

Germany, the United Kingdom, and France are the leading countries in the European epigenetics market, driven by robust research infrastructure, strong pharmaceutical industries, and substantial government funding for life sciences research. Within the technology segments, DNA methylation and histone modification assays hold the largest market share, owing to their established applications in cancer research and diagnostics. The kits segment dominates the product market, followed by reagents. Oncology applications represent the largest segment by application, with significant growth anticipated in non-oncology areas like developmental biology and other research areas.

- Leading Countries: Germany, UK, France.

- Key Drivers: Strong research infrastructure, robust pharmaceutical industries, government funding.

- Dominant Technology Segments: DNA Methylation, Histone Methylation, Histone Acetylation.

- Dominant Product Segment: Kits.

- Dominant Application Segment: Oncology.

Europe Epigenetics Industry Product Landscape

The European epigenetics market offers a diverse range of products, including kits for DNA and histone modification analysis, reagents for epigenetic research, and advanced instruments for high-throughput screening. Recent innovations focus on improved sensitivity, higher throughput, and simplified workflows. Unique selling propositions include advanced data analysis software and integration with other genomic technologies. Technological advancements like single-cell epigenetic profiling are rapidly transforming the product landscape.

Key Drivers, Barriers & Challenges in Europe Epigenetics Industry

Key Drivers:

- Increasing prevalence of epigenetic-related diseases.

- Rising research funding and government initiatives.

- Technological advancements in NGS and CRISPR.

- Growing demand for personalized medicine.

Challenges:

- High R&D costs and regulatory hurdles hindering product development.

- Complex data analysis and interpretation.

- Competition from traditional genetic testing methods.

- Supply chain disruptions impacting reagent availability. The impact of supply chain disruptions is estimated at approximately xx% reduction in market growth in 2024.

Emerging Opportunities in Europe Epigenetics Industry

Emerging opportunities lie in developing novel epigenetic therapies, expanding applications into new therapeutic areas (neurological disorders, autoimmune diseases), and utilizing AI/machine learning for data analysis. Untapped markets include personalized medicine and early disease detection. Evolving consumer preferences for proactive healthcare are driving the demand for epigenetic testing.

Growth Accelerators in the Europe Epigenetics Industry

Technological breakthroughs in single-cell epigenetics and CRISPR-based gene editing are key growth catalysts. Strategic partnerships between pharmaceutical companies and biotechnology firms are fueling innovation and market expansion. Government initiatives promoting life science research and personalized medicine are further accelerating market growth.

Key Players Shaping the Europe Epigenetics Industry Market

- Zymo Research Corporation

- Qiagen

- Diagenode Inc

- F Hoffmann-La Roche AG

- Epitherapeutics

- Illumina Inc

- Merck & Co

- Thermo Fisher Scientific

Notable Milestones in Europe Epigenetics Industry Sector

- 2020: Launch of a novel epigenetic drug by Company X.

- 2021: Acquisition of Company Y by Company Z.

- 2022: Approval of a new epigenetic diagnostic test by regulatory body.

- 2023: Publication of a landmark study showcasing the role of epigenetics in disease X.

- 2024: Collaboration between Company A and B for development of a new epigenetic platform.

In-Depth Europe Epigenetics Industry Market Outlook

The European epigenetics market is poised for sustained growth, driven by technological advancements, increasing research funding, and the expanding applications of epigenetic therapies and diagnostics. Strategic partnerships and collaborations among key players will play a crucial role in shaping the future of the market. Opportunities abound in personalized medicine, early disease detection, and developing novel therapies for a wide range of diseases. The market’s potential for substantial growth in the coming years remains significant, making it an attractive sector for investment and innovation.

Europe Epigenetics Industry Segmentation

-

1. Product

-

1.1. By Kits

- 1.1.1. Bisulfite Conversion Kits

- 1.1.2. Chip-seq Kits

- 1.1.3. RNA Sequencing Market

- 1.1.4. Whole Genome Amplification Market

- 1.1.5. 5-HMC and 5-MC Analysis Kits

- 1.1.6. Other Kits

-

1.2. By Reagents

- 1.2.1. Antibodies

- 1.2.2. Buffers

- 1.2.3. Histones

- 1.2.4. Magnetic Beads

- 1.2.5. Primers

- 1.2.6. Other Reagents

-

1.3. By Enzymes

- 1.3.1. DNA - Modifying Enzymes

- 1.3.2. Protein Modifying Enzymes

- 1.3.3. RNA Modifying Enzymes

-

1.4. By Instruments

- 1.4.1. Mass Spectrometer

- 1.4.2. Sonicators

- 1.4.3. Next Generation Sequencers

- 1.4.4. Other Instruments

-

1.1. By Kits

-

2. Application

- 2.1. Oncology

-

2.2. Non-Oncology

- 2.2.1. Inflammatory Diseases

- 2.2.2. Metabolic Diseases

- 2.2.3. Infectious Diseases

- 2.2.4. Cardiovascular Diseases

- 2.2.5. Other Non-Oncology Applications

- 2.3. Developmental Biology

- 2.4. Other Research Areas

-

3. Technology

- 3.1. DNA Methylation

- 3.2. Histone Methylation

- 3.3. Histone Acetylation

- 3.4. Large noncoding RNA

- 3.5. MicroRNA modification

- 3.6. Chromatin Structures

Europe Epigenetics Industry Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. UK

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Rest of Europe

Europe Epigenetics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Incidence and Prevalence of Cancer; Increasing Funding for R&D in Healthcare; Rising Epigenetic Applications in Non-Oncology Diseases

- 3.3. Market Restrains

- 3.3.1. ; Rising Cost of Instruments; Dearth of Skilled Researchers

- 3.4. Market Trends

- 3.4.1. Oncology is Expected to Grow Faster in the Application Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Kits

- 5.1.1.1. Bisulfite Conversion Kits

- 5.1.1.2. Chip-seq Kits

- 5.1.1.3. RNA Sequencing Market

- 5.1.1.4. Whole Genome Amplification Market

- 5.1.1.5. 5-HMC and 5-MC Analysis Kits

- 5.1.1.6. Other Kits

- 5.1.2. By Reagents

- 5.1.2.1. Antibodies

- 5.1.2.2. Buffers

- 5.1.2.3. Histones

- 5.1.2.4. Magnetic Beads

- 5.1.2.5. Primers

- 5.1.2.6. Other Reagents

- 5.1.3. By Enzymes

- 5.1.3.1. DNA - Modifying Enzymes

- 5.1.3.2. Protein Modifying Enzymes

- 5.1.3.3. RNA Modifying Enzymes

- 5.1.4. By Instruments

- 5.1.4.1. Mass Spectrometer

- 5.1.4.2. Sonicators

- 5.1.4.3. Next Generation Sequencers

- 5.1.4.4. Other Instruments

- 5.1.1. By Kits

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Oncology

- 5.2.2. Non-Oncology

- 5.2.2.1. Inflammatory Diseases

- 5.2.2.2. Metabolic Diseases

- 5.2.2.3. Infectious Diseases

- 5.2.2.4. Cardiovascular Diseases

- 5.2.2.5. Other Non-Oncology Applications

- 5.2.3. Developmental Biology

- 5.2.4. Other Research Areas

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. DNA Methylation

- 5.3.2. Histone Methylation

- 5.3.3. Histone Acetylation

- 5.3.4. Large noncoding RNA

- 5.3.5. MicroRNA modification

- 5.3.6. Chromatin Structures

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Zymo Research Corporation*List Not Exhaustive

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Qiagen

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Diagenode Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 F Hoffmann-La Roche AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Epitherapeutics

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Illumina Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Merck & Co

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Thermo Fisher Scientific

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Zymo Research Corporation*List Not Exhaustive

List of Figures

- Figure 1: Europe Epigenetics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Epigenetics Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Epigenetics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Epigenetics Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Europe Epigenetics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Epigenetics Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 5: Europe Epigenetics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Epigenetics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Epigenetics Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 15: Europe Epigenetics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Europe Epigenetics Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 17: Europe Epigenetics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Germany Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: UK Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Epigenetics Industry?

The projected CAGR is approximately 14.50%.

2. Which companies are prominent players in the Europe Epigenetics Industry?

Key companies in the market include Zymo Research Corporation*List Not Exhaustive, Qiagen, Diagenode Inc, F Hoffmann-La Roche AG, Epitherapeutics, Illumina Inc, Merck & Co, Thermo Fisher Scientific.

3. What are the main segments of the Europe Epigenetics Industry?

The market segments include Product, Application, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Incidence and Prevalence of Cancer; Increasing Funding for R&D in Healthcare; Rising Epigenetic Applications in Non-Oncology Diseases.

6. What are the notable trends driving market growth?

Oncology is Expected to Grow Faster in the Application Segment.

7. Are there any restraints impacting market growth?

; Rising Cost of Instruments; Dearth of Skilled Researchers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Epigenetics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Epigenetics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Epigenetics Industry?

To stay informed about further developments, trends, and reports in the Europe Epigenetics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence