Key Insights

The European Alcoholic Beverages Packaging Market is projected for substantial growth, expected to reach $82.46 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This expansion is driven by evolving consumer preferences for premiumization, convenience, and sustainability. The rising demand for craft beers, artisanal spirits, and Ready-to-Drink (RTD) beverages is stimulating innovation in packaging, emphasizing aesthetic appeal and portability. Increased disposable income in key European nations and a vibrant social culture further bolster alcoholic beverage consumption, directly influencing packaging demand. Advancements in material science, leading to lighter, more durable packaging, coupled with a growing focus on recyclability and reduced environmental impact in line with EU regulations, are also significant growth factors.

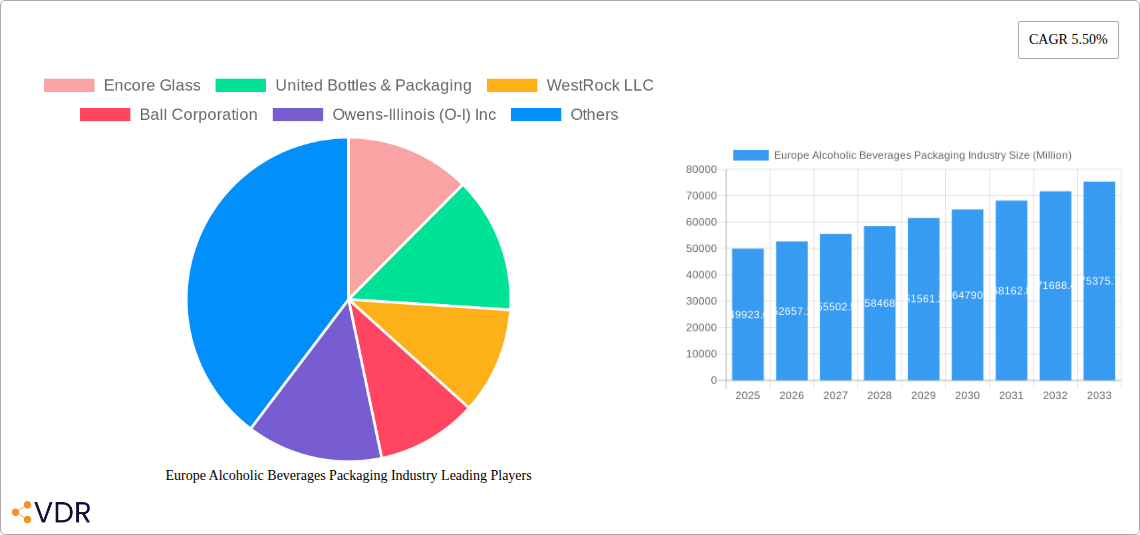

Europe Alcoholic Beverages Packaging Industry Market Size (In Billion)

The market is segmented by primary material, alcoholic product type, and packaging product type. Key packaging segments include plastic bottles, glass bottles, and metal cans, each offering distinct benefits in cost, preservation, and brand perception. Plastic provides lightweight and shatterproof qualities, while glass is favored for premium spirits and wines due to its perceived quality and inertness. Metal cans are increasingly popular for beers and RTDs, valued for recyclability and rapid cooling. The RTD segment exhibits particularly dynamic growth, driven by convenience and appeal to younger demographics. Market restraints include fluctuating raw material costs, intense competition, and the ongoing challenge of developing sustainable, cost-effective packaging solutions that meet functional and regulatory demands. Emerging trends like smart packaging and personalized designs are poised to shape the future market landscape.

Europe Alcoholic Beverages Packaging Industry Company Market Share

This report offers an in-depth analysis of the Europe Alcoholic Beverages Packaging Industry, covering market dynamics, growth trends, regional performance, product offerings, key drivers, challenges, and emerging opportunities. The study spans from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, providing critical insights for industry stakeholders. Key segments examined include Primary Material (Plastic, Paper, Metal, Glass), Alcoholic Products (Wine, Spirits, Beer, Ready-to-drink (RTD), Other Alcoholic Beverages), and Packaging Product Type (Plastic Bottles, Glass Bottles, Metal Cans, Cartons, Pouches, Other Packaging Types).

Europe Alcoholic Beverages Packaging Industry Market Dynamics & Structure

The European alcoholic beverages packaging market is characterized by a moderately concentrated structure, with a few key players holding significant market share. Technological innovation is a primary driver, focusing on sustainability, lightweighting, and enhanced shelf appeal. Stringent regulatory frameworks surrounding food-grade materials, recyclability, and labeling requirements significantly influence packaging choices. Competitive product substitutes, particularly across different material types and product formats, necessitate continuous innovation and cost-effectiveness. End-user demographics, with a growing demand for premium and convenient options, are shaping packaging designs. Mergers and acquisitions (M&A) are prevalent, indicating a consolidation trend aimed at expanding market reach and product portfolios.

- Market Concentration: Dominated by major packaging solution providers with diversified offerings.

- Technological Innovation: Emphasis on sustainable materials (e.g., recycled content, bioplastics), smart packaging, and advanced printing techniques.

- Regulatory Frameworks: Compliance with EU directives on packaging waste, food contact materials, and extended producer responsibility.

- Competitive Product Substitutes: Ongoing competition between glass, metal, plastic, and carton packaging for various alcoholic beverages.

- End-User Demographics: Shifting preferences towards smaller formats, sustainable packaging, and visually appealing designs.

- M&A Trends: Strategic acquisitions to enhance production capacity, geographical presence, and technological capabilities.

Europe Alcoholic Beverages Packaging Industry Growth Trends & Insights

The European alcoholic beverages packaging market is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This expansion is fueled by evolving consumer preferences, increasing disposable incomes, and a rising demand for premium and convenience-oriented alcoholic drinks. The market size, estimated to reach $XX Million units in 2025, is expected to climb to $XX Million units by 2033. Adoption rates for innovative and sustainable packaging solutions are steadily increasing, driven by both consumer awareness and regulatory pressures. Technological disruptions, such as advancements in material science and manufacturing processes, are enabling the development of lighter, more durable, and environmentally friendly packaging options. Consumer behavior shifts, including a growing interest in RTDs and craft beverages, are creating new packaging demands and opportunities. The increasing popularity of online sales and direct-to-consumer models also necessitates specialized packaging to ensure product integrity during transit.

Dominant Regions, Countries, or Segments in Europe Alcoholic Beverages Packaging Industry

The Glass segment within primary materials is a dominant force in the European alcoholic beverages packaging industry, driven by its perceived premium quality and excellent barrier properties, especially for wine and spirits. Geographically, Germany often leads in packaging innovation and consumption, closely followed by France and the United Kingdom, owing to their mature wine, beer, and spirits markets.

- Primary Material Dominance (Glass):

- Market Share: Historically holding over XX% of the market for premium alcoholic beverages.

- Growth Drivers: Consumer perception of quality, inertness, and recyclability, especially for wine and spirits.

- Challenges: Weight and breakability, leading to innovation in lightweight glass and protective packaging.

- Alcoholic Product Dominance (Wine & Spirits):

- Market Share: Wine and spirits packaging collectively account for a substantial portion, estimated at XX%.

- Growth Drivers: High per-capita consumption in key European countries, increasing demand for premium and aged spirits, and the growth of the wine industry.

- Insights: These categories often lead in adopting premium packaging formats and designs.

- Product Type Dominance (Glass Bottles):

- Market Share: Glass bottles represent the largest share within product types, particularly for still and sparkling wines and various spirit categories.

- Growth Drivers: Established consumer habits and brand identity tied to traditional glass bottle formats.

- Innovation: Focus on bottle shape, color, and decorative finishes to enhance brand differentiation.

- Regional Dominance (Western Europe):

- Market Share: Western European countries, including Germany, France, the UK, and Italy, command a significant majority of the market share due to established alcoholic beverage industries and higher disposable incomes.

- Economic Policies: Favorable economic conditions and supportive policies for the beverage industry.

- Infrastructure: Well-developed logistics and distribution networks that facilitate efficient packaging supply and product delivery.

Europe Alcoholic Beverages Packaging Industry Product Landscape

The European alcoholic beverages packaging landscape is dynamic, marked by continuous innovation in materials and design. Key advancements include the development of lightweight glass bottles that reduce transportation costs and environmental impact, and the increasing use of recycled PET (rPET) for RTD beverages. Metal cans are gaining traction for beer and RTDs due to their recyclability and rapid chilling properties. Paper-based cartons, particularly for wine and ciders, offer a sustainable and convenient alternative. Performance metrics are increasingly focused on barrier properties, shelf-life extension, tamper-evidence, and ease of opening. Unique selling propositions often revolve around eco-friendliness, brand aesthetics, and consumer convenience. Technological advancements in printing and finishing allow for sophisticated branding and product differentiation.

Key Drivers, Barriers & Challenges in Europe Alcoholic Beverages Packaging Industry

Key Drivers:

- Growing Demand for Premium and Craft Beverages: Driving the need for high-quality, aesthetically pleasing packaging.

- Sustainability Concerns: Increasing consumer and regulatory pressure for recyclable, reusable, and biodegradable packaging solutions.

- E-commerce Growth: Requiring robust, protective, and visually appealing packaging for direct-to-consumer sales.

- Convenience and Portability: Favoring smaller formats and easy-to-open packaging, particularly for RTDs and on-the-go consumption.

Barriers & Challenges:

- Volatile Raw Material Prices: Fluctuations in the cost of glass, metal, plastic, and paper impact overall production costs.

- Stringent Environmental Regulations: Compliance with evolving packaging waste directives and extended producer responsibility schemes.

- Supply Chain Disruptions: Global events can impact the availability and timely delivery of raw materials and finished packaging.

- Competition from Substitutes: Continuous pressure from alternative packaging materials and formats across all beverage categories.

- Capital Investment for Sustainable Technologies: High initial costs associated with adopting new, environmentally friendly manufacturing processes.

Emerging Opportunities in Europe Alcoholic Beverages Packaging Industry

Emerging opportunities lie in the expansion of sustainable packaging solutions, such as the development of advanced recycled materials and innovative biodegradable options. The growing RTD segment presents a significant opportunity for flexible packaging and innovative can designs. Furthermore, smart packaging solutions, incorporating QR codes for traceability and consumer engagement, are gaining traction. Untapped markets in Eastern Europe and the increasing demand for smaller, single-serving formats also offer substantial growth potential. The focus on circular economy principles is creating opportunities for companies that can offer closed-loop packaging systems.

Growth Accelerators in the Europe Alcoholic Beverages Packaging Industry Industry

The long-term growth of the Europe alcoholic beverages packaging industry will be significantly accelerated by technological breakthroughs in material science, leading to the development of novel, sustainable, and functional packaging. Strategic partnerships between packaging manufacturers, beverage brands, and recycling facilities will foster innovation and optimize the supply chain. Market expansion strategies, including targeting emerging consumer demographics and exploring new product categories within alcoholic beverages, will further drive growth. Investments in advanced manufacturing technologies, such as digitalization and automation, will enhance efficiency and cost-effectiveness.

Key Players Shaping the Europe Alcoholic Beverages Packaging Industry Market

- Encore Glass

- United Bottles & Packaging

- WestRock LLC

- Ball Corporation

- Owens-Illinois (O-I) Inc

- Ardagh Group SA

- Crown Holdings Incorporated

- Berry Global Inc

- IntraPac International LL

- Brick Packaging LLC

- Amcor Ltd

Notable Milestones in Europe Alcoholic Beverages Packaging Industry Sector

- August 2022: Amcor acquired a top-tier flexible packaging facility in the Czech Republic, enhancing its capacity to meet rising demand and accelerate organic growth in lucrative European categories.

- April 2022: Berlin Packaging acquired Panvetri, a family-run glass and metal packaging provider for the wine and olive oil sectors, expanding its product range and service capabilities.

In-Depth Europe Alcoholic Beverages Packaging Industry Market Outlook

The outlook for the Europe alcoholic beverages packaging industry is exceptionally positive, driven by a confluence of factors including rising consumer demand for premium and sustainably packaged products. Growth accelerators such as advancements in biodegradable materials and the expansion of the RTD market are set to redefine packaging strategies. The industry is witnessing a strategic shift towards circular economy models, creating fertile ground for innovation in recycling technologies and reusable packaging solutions. Companies that prioritize eco-friendly alternatives and cater to evolving consumer preferences for convenience and ethical sourcing will be best positioned to capitalize on future market potential.

Europe Alcoholic Beverages Packaging Industry Segmentation

-

1. Primary Material

- 1.1. Plastic

- 1.2. Paper

- 1.3. Metal

- 1.4. Glass

-

2. Alcoholic Products

- 2.1. Wine

- 2.2. Spirits

- 2.3. Beer

- 2.4. Ready-to-drink (RTD)

- 2.5. Other Types of Alcoholic Beverages

-

3. Product Type

- 3.1. Plastic Bottles

- 3.2. Glass Bottles

- 3.3. Metal Cans

- 3.4. Cartons

- 3.5. Pouches

- 3.6. Other Product Types

Europe Alcoholic Beverages Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

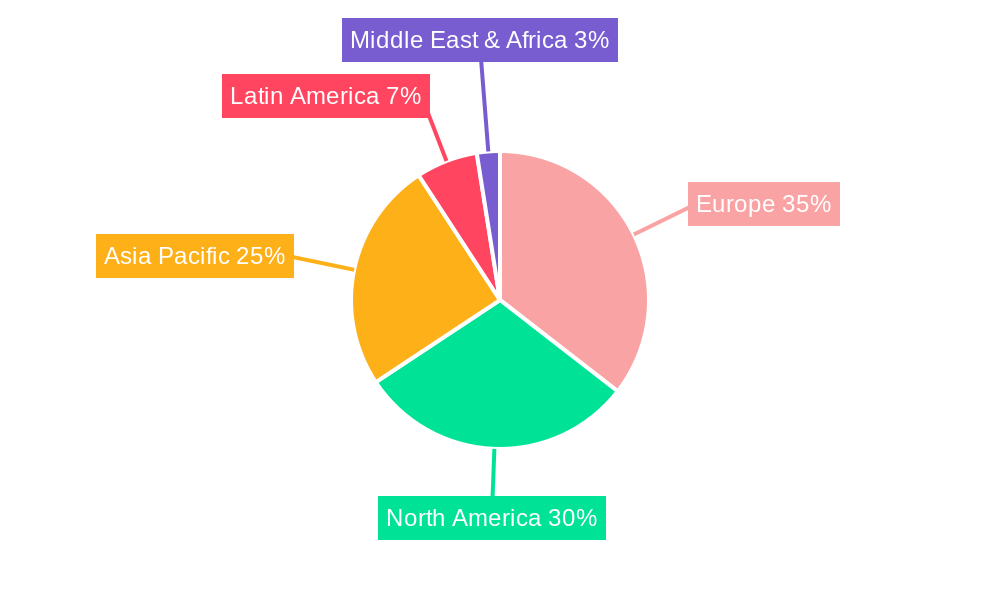

Europe Alcoholic Beverages Packaging Industry Regional Market Share

Geographic Coverage of Europe Alcoholic Beverages Packaging Industry

Europe Alcoholic Beverages Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Purchasing Power of Consumers; Increasing Consumption of Alcoholic Drinks

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Regarding Environmental Safety; Lack Of Improvement In Technology To Hinder The Growth

- 3.4. Market Trends

- 3.4.1. Glass Packaging is Expected to have a Major Share in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Alcoholic Beverages Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Plastic

- 5.1.2. Paper

- 5.1.3. Metal

- 5.1.4. Glass

- 5.2. Market Analysis, Insights and Forecast - by Alcoholic Products

- 5.2.1. Wine

- 5.2.2. Spirits

- 5.2.3. Beer

- 5.2.4. Ready-to-drink (RTD)

- 5.2.5. Other Types of Alcoholic Beverages

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Plastic Bottles

- 5.3.2. Glass Bottles

- 5.3.3. Metal Cans

- 5.3.4. Cartons

- 5.3.5. Pouches

- 5.3.6. Other Product Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Encore Glass

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Bottles & Packaging

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 WestRock LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ball Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Owens-Illinois (O-I) Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ardagh Group SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Crown Holdings Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Berry Global Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IntraPac International LL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Brick Packaging LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Amcor Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Encore Glass

List of Figures

- Figure 1: Europe Alcoholic Beverages Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Alcoholic Beverages Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Alcoholic Beverages Packaging Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 2: Europe Alcoholic Beverages Packaging Industry Revenue billion Forecast, by Alcoholic Products 2020 & 2033

- Table 3: Europe Alcoholic Beverages Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 4: Europe Alcoholic Beverages Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Alcoholic Beverages Packaging Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 6: Europe Alcoholic Beverages Packaging Industry Revenue billion Forecast, by Alcoholic Products 2020 & 2033

- Table 7: Europe Alcoholic Beverages Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Europe Alcoholic Beverages Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Alcoholic Beverages Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Alcoholic Beverages Packaging Industry?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Europe Alcoholic Beverages Packaging Industry?

Key companies in the market include Encore Glass, United Bottles & Packaging, WestRock LLC, Ball Corporation, Owens-Illinois (O-I) Inc, Ardagh Group SA, Crown Holdings Incorporated, Berry Global Inc, IntraPac International LL, Brick Packaging LLC, Amcor Ltd.

3. What are the main segments of the Europe Alcoholic Beverages Packaging Industry?

The market segments include Primary Material, Alcoholic Products, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 82.46 billion as of 2022.

5. What are some drivers contributing to market growth?

High Purchasing Power of Consumers; Increasing Consumption of Alcoholic Drinks.

6. What are the notable trends driving market growth?

Glass Packaging is Expected to have a Major Share in the market.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Regarding Environmental Safety; Lack Of Improvement In Technology To Hinder The Growth.

8. Can you provide examples of recent developments in the market?

August 2022 - Amcor, a responsible packaging solutions development and production pioneer, announced that it had acquired a top-tier flexible packaging facility in the Czech Republic. The site's advantageous location instantly improves Amcor's capacity to meet rising customer demand across its flexible packaging network in Europe. With this acquisition, the company is investing in quickening its flexible business' organic growth in Europe's lucrative categories.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Alcoholic Beverages Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Alcoholic Beverages Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Alcoholic Beverages Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Alcoholic Beverages Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence