Key Insights

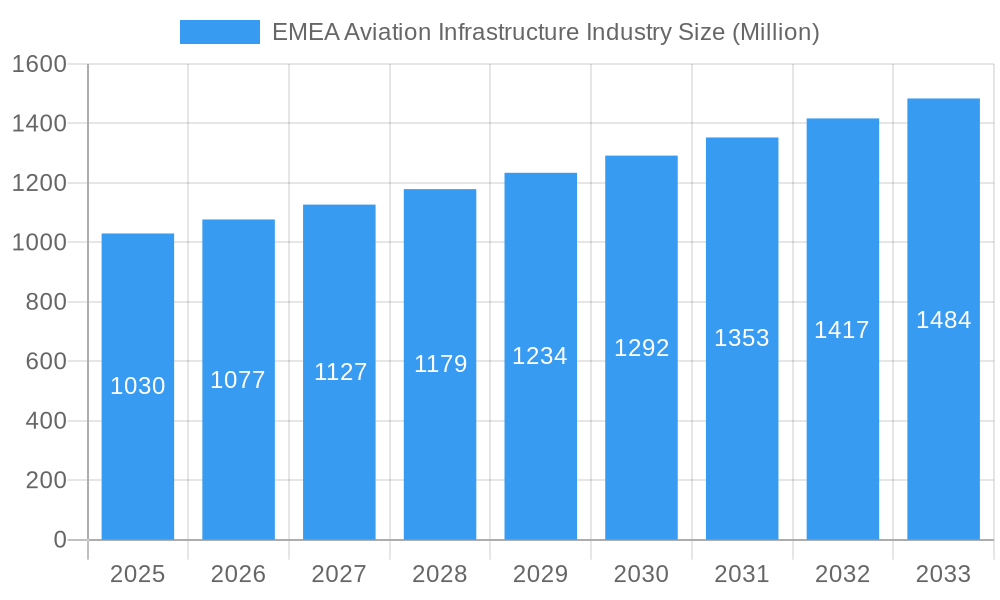

The EMEA (Europe, Middle East, and Africa) aviation infrastructure market, valued at approximately $1.03 billion in 2025, is projected to experience robust growth, driven by increasing air passenger traffic, the expansion of existing airports, and the development of new aviation hubs across the region. A compound annual growth rate (CAGR) of 4.42% from 2025 to 2033 indicates a significant market expansion. Key drivers include government initiatives promoting tourism and trade, rising disposable incomes fueling leisure travel, and the ongoing modernization of airport facilities to improve efficiency and passenger experience. The market is segmented by airport type (commercial, military, general aviation) and infrastructure type (terminals, control towers, runways, aprons, hangars, etc.). Significant investments in airport infrastructure are expected across major economies in Europe, such as the United Kingdom, Germany, and France, alongside emerging markets within the Middle East and Africa, particularly in Saudi Arabia, the UAE, and Turkey, which are witnessing rapid growth in their aviation sectors. Challenges include economic fluctuations, potential regulatory hurdles, and the need for sustainable infrastructure solutions. The competitive landscape involves major international construction companies and airport operators actively vying for contracts in this dynamic sector.

EMEA Aviation Infrastructure Industry Market Size (In Billion)

The projected growth trajectory is likely to be influenced by several factors. Increased focus on enhancing security measures at airports will also contribute to market expansion. Furthermore, the rising adoption of advanced technologies such as smart airport systems and improved air traffic management will contribute to growth in the years ahead. The competitive landscape, consisting of both global giants and regional players, is shaping the market with strategic partnerships and technological advancements becoming crucial elements for success. Market segmentation by airport and infrastructure type allows for more granular analysis of investment needs and growth potential within specific niches. Continued government support and private investment are expected to underpin future market expansion throughout the forecast period.

EMEA Aviation Infrastructure Industry Company Market Share

EMEA Aviation Infrastructure Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides a detailed analysis of the EMEA Aviation Infrastructure industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025, this study meticulously examines market dynamics, growth trends, key players, and emerging opportunities across various segments. The report leverages extensive primary and secondary research to deliver a data-driven perspective on this dynamic sector.

EMEA Aviation Infrastructure Industry Market Dynamics & Structure

The EMEA aviation infrastructure market is characterized by moderate concentration, with a few large players dominating alongside numerous regional contractors. Market share is fluid, influenced by large-scale project wins and M&A activity. Technological innovation, driven by automation, digitalization, and sustainable materials, is a key driver, though high upfront investment and regulatory hurdles pose challenges. Stringent safety regulations and environmental concerns shape the industry landscape, influencing material selection and operational procedures. The increasing demand for air travel, coupled with aging infrastructure in certain regions, fuels market expansion. However, economic downturns and geopolitical instability can significantly impact project timelines and budgets. M&A activity remains prevalent, with larger firms acquiring smaller specialized companies to expand their service offerings and geographic reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on automation (e.g., automated baggage handling), sustainable materials (e.g., recycled plastics), and digital twin technologies.

- Regulatory Framework: Stringent safety and environmental regulations impacting project development and material selection.

- M&A Activity: Significant activity observed in the historical period (2019-2024) with xx deals valued at approximately xx million.

EMEA Aviation Infrastructure Industry Growth Trends & Insights

The EMEA aviation infrastructure market experienced robust growth during the historical period (2019-2024), driven by increasing passenger traffic and government investments in airport modernization and expansion. The market size reached xx million in 2024 and is projected to witness a CAGR of xx% during the forecast period (2025-2033), reaching xx million by 2033. This growth is fueled by a combination of factors, including rising disposable incomes, increasing tourism, and government initiatives to improve air connectivity. Technological advancements in airport design and operations further contribute to the market expansion. However, economic fluctuations and potential disruptions to the global supply chain pose challenges to sustained growth. Shifting consumer preferences toward sustainable and technologically advanced airport experiences also influence market trends.

Dominant Regions, Countries, or Segments in EMEA Aviation Infrastructure Industry

The EMEA aviation infrastructure market is significantly shaped by Western Europe's robust network of established airports, high passenger traffic, and substantial government investment. Key players within Western Europe include the UK, France, and Germany, driven by their extensive airport infrastructure and ongoing modernization initiatives. The Commercial Airport segment commands the largest market share, followed closely by Terminal and Taxiway/Runway infrastructure. However, Eastern Europe demonstrates accelerating growth, fueled by significant investment in new airport construction, exemplified by Poland's substantial Solidarity Hub (CPK) project. Africa also presents a noteworthy area of emerging potential.

- Key Drivers: High passenger traffic growth in Western and increasingly Eastern Europe, significant government investments in both modernization and new-build airport projects, and the expanding need for sustainable aviation infrastructure.

- Dominant Segments (projected 2025 market share estimates): Commercial Airports (xx%), Terminals (xx%), Taxiway/Runways (xx%). Further segmentation analysis is required to incorporate other key elements such as air traffic control, baggage handling systems, and ground support equipment.

- Growth Potential: High growth potential exists across diverse areas of EMEA. Eastern Europe's ongoing expansion is complemented by significant opportunities in Africa, driven by planned infrastructure developments to support emerging economies and tourism.

EMEA Aviation Infrastructure Industry Product Landscape

The EMEA aviation infrastructure market offers a diverse range of products and services, encompassing design, construction, and maintenance of various airport facilities. Innovations include sustainable building materials, advanced air traffic control systems, smart airport technologies, and integrated security solutions. These advancements aim to improve operational efficiency, enhance passenger experience, and minimize environmental impact. Key performance indicators include project completion timelines, cost efficiency, and adherence to safety and environmental standards. Unique selling propositions include specialized expertise in complex projects, sustainable design, and digital project management tools.

Key Drivers, Barriers & Challenges in EMEA Aviation Infrastructure Industry

Key Drivers: The EMEA aviation sector is experiencing sustained growth, propelled by increased air passenger traffic, substantial government investments in airport infrastructure upgrades, and advancements in airport technologies focused on efficiency and sustainability. The rising global emphasis on sustainable aviation fuels (SAFs) and environmentally friendly infrastructure is also a major contributing factor.

Key Challenges: The industry faces significant headwinds, including persistent supply chain disruptions stemming from global events, resulting in material cost increases (e.g., a xx% increase in 2022). Regulatory hurdles and complex permitting processes contribute to project delays. Furthermore, intense competition among contractors impacts profitability, and securing adequate funding for projects, particularly in less-developed regions, remains a critical obstacle.

Emerging Opportunities in EMEA Aviation Infrastructure Industry

Significant untapped potential exists in expanding airport infrastructure across less-developed regions of EMEA, with Africa presenting particularly promising opportunities. This expansion is further accelerated by the growing demand for sustainable airport infrastructure, creating significant growth opportunities for companies specializing in eco-friendly design, construction, and operational solutions. Smart airport technologies and digitalization offer substantial opportunities to enhance operational efficiency, optimize resource allocation, improve passenger experience, and boost overall sustainability.

Growth Accelerators in the EMEA Aviation Infrastructure Industry

Technological advancements are pivotal to long-term growth, with automation, digitalization, and the adoption of sustainable materials playing key roles. Strategic partnerships between construction firms, technology providers, and airport operators are crucial for driving innovation and accelerating market expansion. Moreover, supportive government initiatives promoting sustainable aviation and airport infrastructure development will be instrumental in driving future growth and ensuring alignment with broader environmental goals.

Key Players Shaping the EMEA Aviation Infrastructure Industry Market

- Balfour Beatty Plc

- Royal BAM Group nv

- Bechtel Corporation

- STRABAG SE

- Skanska AB

- VINCI Airports

- Limak Group of Companies

- ALEC Engineering & Contracting LL

- BIC Contracting LLC

- Bouygues Construction S A

- TAV Construction

- Eiffage S A

- Impresa Pizzarotti & C S p A

Notable Milestones in EMEA Aviation Infrastructure Industry Sector

- May 2023: Poland's announcement of plans for the Solidarity Hub (CPK) airport in Warsaw, a USD 870 million project, represents a major milestone in Eastern European airport development.

- February 2023: The Airport Council of Europe's allocation of USD 440 million to expand Zvartnots International Airport in Armenia highlights the ongoing investment in upgrading existing infrastructure across the region.

- [Add other recent milestones here with dates and brief descriptions]

In-Depth EMEA Aviation Infrastructure Industry Market Outlook

The EMEA aviation infrastructure market is poised for significant growth over the next decade, driven by a confluence of factors including increasing air travel demand, government investments in airport modernization, and technological advancements. Strategic opportunities exist for companies that can offer sustainable, efficient, and technologically advanced solutions. Focusing on emerging markets in Africa and Eastern Europe, and embracing innovation in areas like smart airport technologies, will be crucial for capturing market share and achieving long-term success.

EMEA Aviation Infrastructure Industry Segmentation

-

1. Airport Type

- 1.1. Commercial Airport

- 1.2. Military Airport

- 1.3. General Aviation Airport

-

2. Infrastructure Type

- 2.1. Terminal

- 2.2. Control Tower

- 2.3. Taxiway and Runway

- 2.4. Apron

- 2.5. Hangar

- 2.6. Other Infrastructure Types

EMEA Aviation Infrastructure Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdon

- 1.2. Germany

- 1.3. France

- 1.4. Russia

- 1.5. Italy

- 1.6. Denmark

- 1.7. Rest of Europe

-

2. Middle East and Africa

- 2.1. Saudi Arabia

- 2.2. United Arab Emirates

- 2.3. Egypt

- 2.4. Qatar

- 2.5. Turkey

- 2.6. South Africa

- 2.7. Rest of Middle East and Africa

EMEA Aviation Infrastructure Industry Regional Market Share

Geographic Coverage of EMEA Aviation Infrastructure Industry

EMEA Aviation Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Airport to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global EMEA Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 5.1.1. Commercial Airport

- 5.1.2. Military Airport

- 5.1.3. General Aviation Airport

- 5.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.2.1. Terminal

- 5.2.2. Control Tower

- 5.2.3. Taxiway and Runway

- 5.2.4. Apron

- 5.2.5. Hangar

- 5.2.6. Other Infrastructure Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.3.2. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 6. Europe EMEA Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 6.1.1. Commercial Airport

- 6.1.2. Military Airport

- 6.1.3. General Aviation Airport

- 6.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6.2.1. Terminal

- 6.2.2. Control Tower

- 6.2.3. Taxiway and Runway

- 6.2.4. Apron

- 6.2.5. Hangar

- 6.2.6. Other Infrastructure Types

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 7. Middle East and Africa EMEA Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 7.1.1. Commercial Airport

- 7.1.2. Military Airport

- 7.1.3. General Aviation Airport

- 7.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7.2.1. Terminal

- 7.2.2. Control Tower

- 7.2.3. Taxiway and Runway

- 7.2.4. Apron

- 7.2.5. Hangar

- 7.2.6. Other Infrastructure Types

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 8. Competitive Analysis

- 8.1. Global Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Balfour Beatty Plc

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Royal BAM Group nv

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Bechtel Corporation

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 STRABAG SE

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Skanska AB

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 VINCI Airports

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Limak Group of Companies

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 ALEC Engineering & Contracting LL

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 BIC Contracting LLC

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Bouygues Construction S A

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 TAV Construction

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 Eiffage S A

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.13 Impresa Pizzarotti & C S p A

- 8.2.13.1. Overview

- 8.2.13.2. Products

- 8.2.13.3. SWOT Analysis

- 8.2.13.4. Recent Developments

- 8.2.13.5. Financials (Based on Availability)

- 8.2.1 Balfour Beatty Plc

List of Figures

- Figure 1: Global EMEA Aviation Infrastructure Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Europe EMEA Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 3: Europe EMEA Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 4: Europe EMEA Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 5: Europe EMEA Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 6: Europe EMEA Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Europe EMEA Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 9: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 10: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 11: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 12: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 2: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 3: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 5: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 6: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdon EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Russia EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Italy EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Denmark EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 15: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 16: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Saudi Arabia EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Arab Emirates EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Egypt EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Qatar EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Turkey EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Africa EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the EMEA Aviation Infrastructure Industry?

The projected CAGR is approximately 4.42%.

2. Which companies are prominent players in the EMEA Aviation Infrastructure Industry?

Key companies in the market include Balfour Beatty Plc, Royal BAM Group nv, Bechtel Corporation, STRABAG SE, Skanska AB, VINCI Airports, Limak Group of Companies, ALEC Engineering & Contracting LL, BIC Contracting LLC, Bouygues Construction S A, TAV Construction, Eiffage S A, Impresa Pizzarotti & C S p A.

3. What are the main segments of the EMEA Aviation Infrastructure Industry?

The market segments include Airport Type, Infrastructure Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.03 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Airport to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2023: Poland announced its plans to build a state-of-the-art airport in Warsaw. The Solidarity Hub, or CPK, which will serve as the Central and Eastern European main air transit hub, is scheduled to become operational in the summer of 2028. The CPK, with a price tag of around USD 870 million, is one of the costliest infrastructure projects currently being built in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "EMEA Aviation Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the EMEA Aviation Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the EMEA Aviation Infrastructure Industry?

To stay informed about further developments, trends, and reports in the EMEA Aviation Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence