Key Insights

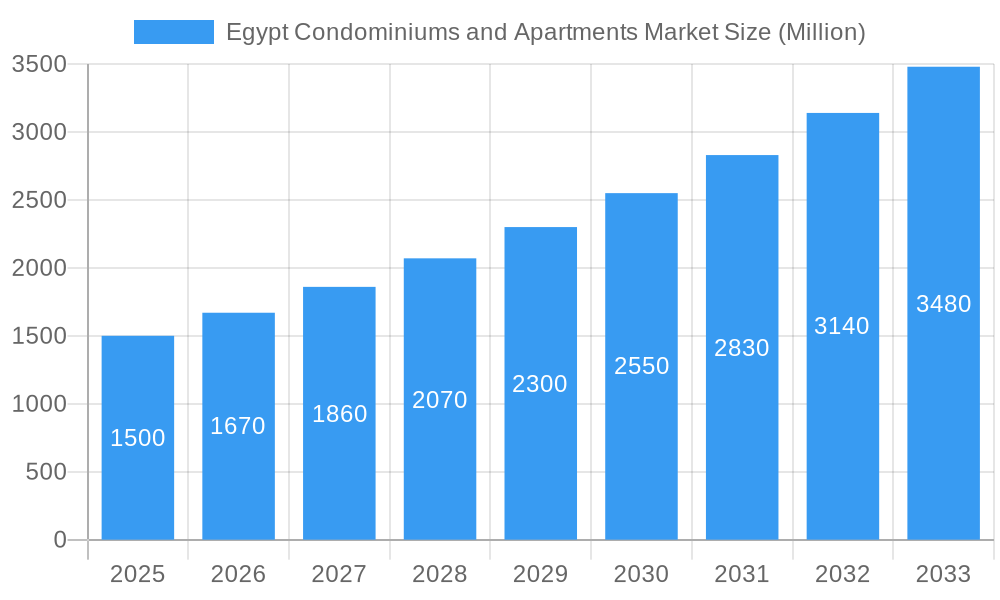

Egypt's condominiums and apartments market is poised for substantial expansion, propelled by rapid population growth, accelerating urbanization, and a growing middle class aspiring to enhanced living conditions. The market, valued at $20.02 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 10.96% during the forecast period (2025-2033). Key urban centers such as Cairo, Alexandria, Luxor, Aswan, and Hurghada are at the forefront of this growth, attracting considerable investment in residential projects. Demand is further stimulated by government-led real estate development initiatives, infrastructure enhancements, and robust domestic and foreign investment inflows. Persistent challenges include economic uncertainties, variable construction costs, and the critical need for sustainable and affordable housing solutions across all socioeconomic segments.

Egypt Condominiums and Apartments Market Market Size (In Billion)

Prominent developers including Iwan Developments, Orascom Development, SODIC, and Hassan Allam Properties are instrumental in shaping the market. They offer a wide array of projects designed to meet the diverse needs of the population. Market segmentation by major cities highlights the distinct demand patterns and investment prospects across Egypt. Future growth will likely be underpinned by supportive government economic policies, continued infrastructure development, and evolving consumer preferences. Emphasis on sustainable and technologically advanced properties is anticipated to increase, attracting further investment and a broader buyer base. Despite existing hurdles, the Egyptian condominiums and apartments market demonstrates a positive outlook, presenting significant opportunities for developers and investors.

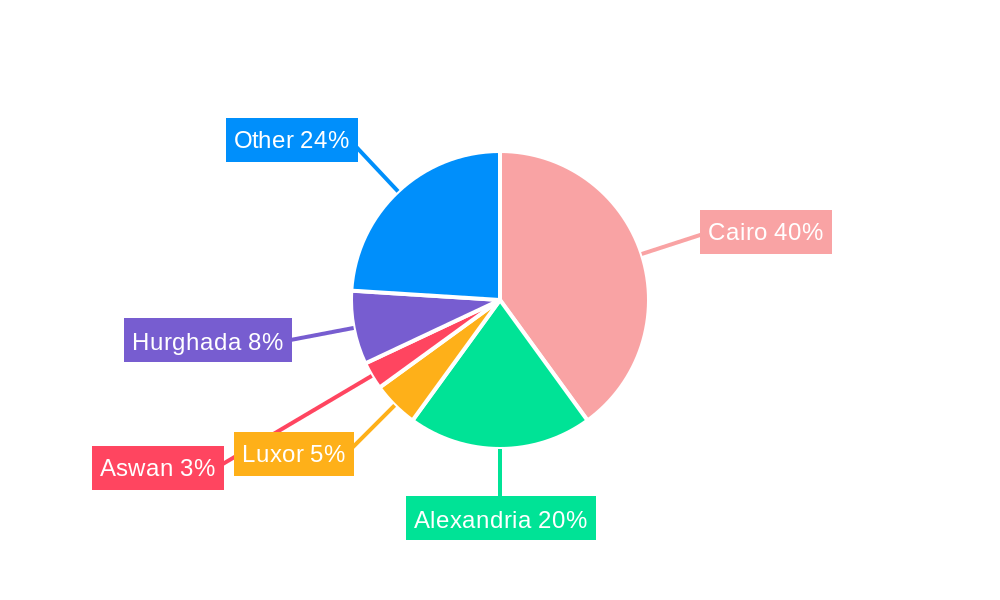

Egypt Condominiums and Apartments Market Company Market Share

Egypt Condominiums and Apartments Market: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Egypt condominiums and apartments market, covering historical performance (2019-2024), current status (2025), and future projections (2025-2033). It caters to real estate investors, developers, and industry professionals seeking insights into this dynamic market. The report segments the market by key cities (Cairo, Luxor, Aswan, Alexandria, Hurghada) and analyzes the activities of major players like Iwan Developments, ERA Real Estate Egypt, Orascom Development, Coldwell Banker Egypt, ORA Developments, ERG Developments, Wadi Degla Developments, SODIC, NEWGIZA, El Shams, LA Vista Developments, and Hassan Allam Properties (list not exhaustive).

Keywords: Egypt real estate, Egypt apartments, Egypt condominiums, Cairo real estate, Alexandria real estate, Hurghada real estate, real estate market analysis, Egyptian property market, residential market Egypt, real estate investment Egypt, apartment market Egypt, condominium market Egypt, Orascom Development, SODIC, Iwan Developments, ERA Real Estate Egypt.

Egypt Condominiums and Apartments Market Market Dynamics & Structure

This section analyzes the market's competitive landscape, regulatory environment, and technological influences. We delve into market concentration, examining the market share held by major players and assessing the level of competition. Technological advancements impacting construction methods, smart home integration, and property management systems are explored. The report also examines the regulatory framework governing the real estate sector in Egypt, including building codes, zoning regulations, and property ownership laws. Finally, it considers M&A activity within the sector, providing quantitative data on deal volumes and qualitative insights into the driving forces behind these transactions.

- Market Concentration: xx% market share held by top 5 players (2024). Increased consolidation expected by 2033.

- Technological Innovation: Adoption of Building Information Modeling (BIM) and prefabricated construction methods is increasing efficiency. Smart home technology integration is gaining traction, impacting premium segment pricing.

- Regulatory Framework: Recent amendments to property laws are impacting foreign investment and development timelines.

- Competitive Substitutes: Limited direct substitutes; competition mainly within the segment based on location and pricing.

- End-User Demographics: Growing middle class and increasing urbanization are driving demand, particularly in Cairo and New Cairo.

- M&A Trends: xx M&A deals recorded between 2019-2024. Increased activity predicted due to market consolidation.

Egypt Condominiums and Apartments Market Growth Trends & Insights

This section details the evolution of the Egyptian condominium and apartment market, analyzing growth trajectories, market size fluctuations, and technological impacts. We present quantitative data such as Compound Annual Growth Rate (CAGR) and market penetration rates. The analysis considers shifting consumer preferences, impacting demand for different property types and locations. The impact of macroeconomic factors, such as inflation and interest rates, on the market's performance is also addressed. We also factor in the effects of government policies and regulations on the construction and sales of residential units.

- Market Size: xx Million units (2019); xx Million units (2024); xx Million units (2025, estimated); xx Million units (2033, forecast).

- CAGR: xx% (2019-2024); xx% (2025-2033, projected).

- Market Penetration: xx% (2024); xx% (2033, projected).

- Technological Disruptions: Increased use of PropTech solutions, impacting marketing, sales, and property management.

- Consumer Behavior Shifts: Growing demand for sustainable and energy-efficient buildings, impacting construction practices.

Dominant Regions, Countries, or Segments in Egypt Condominiums and Apartments Market

Cairo remains the dominant region, driven by high population density, economic activity, and infrastructure development. However, growth in other cities like New Cairo and the New Administrative Capital (NAC) is significant, fueled by government-led initiatives to improve infrastructure and housing availability. The report examines the factors contributing to Cairo’s dominance, including its robust economy, well-established infrastructure, and high concentration of employment opportunities. This section also identifies emerging regional markets with high growth potential.

- Cairo: Dominant due to population density, economic activity, and existing infrastructure. High demand for both luxury and affordable housing.

- New Cairo & NAC: Rapid growth due to government investment in infrastructure and new development projects.

- Alexandria & Hurghada: Coastal locations offer attractive lifestyle options and growing tourism sectors, driving demand.

- Luxor & Aswan: Tourism-dependent markets with niche demand for luxury and heritage properties.

Egypt Condominiums and Apartments Market Product Landscape

The Egyptian condominium and apartment market offers a diverse range of products catering to various income levels and preferences. From luxury high-rise developments in prime locations to more affordable options in suburban areas, the market caters to a broad spectrum of buyers. Innovative features, such as smart home technologies and sustainable building materials, are increasingly integrated into new projects, enhancing their appeal. The report analyzes product differentiation strategies employed by developers to compete in a dynamic market.

Key Drivers, Barriers & Challenges in Egypt Condominiums and Apartments Market

Key Drivers:

- Government initiatives promoting real estate development.

- Growing population and urbanization.

- Rising disposable incomes and improved access to financing.

- Increased foreign investment in the real estate sector.

Key Challenges & Restraints:

- Inflation and fluctuating interest rates impact affordability and investment decisions.

- Bureaucratic hurdles and lengthy approval processes hinder development timelines.

- Land scarcity in desirable urban locations increases development costs.

- Competition among developers impacts pricing and profitability.

Emerging Opportunities in Egypt Condominiums and Apartments Market

- Growing demand for sustainable and environmentally friendly housing.

- Potential for development in underserved areas and new cities.

- Opportunities for integrating technology to enhance property management and services.

- Niche markets for specialized housing, such as senior living communities.

Growth Accelerators in the Egypt Condominiums and Apartments Market Industry

The long-term growth trajectory of the Egyptian condominium and apartment market is largely dependent on continued economic growth and government support for the real estate sector. Furthermore, advancements in construction technology and sustainable building practices will accelerate market expansion and enhance sector appeal. Strategic partnerships among developers and international investors also contribute significantly to growth.

Key Players Shaping the Egypt Condominiums and Apartments Market Market

- Iwan Developments

- ERA Real Estate Egypt

- Orascom Development

- Coldwell Banker Egypt

- ORA Developments

- ERG Developments

- Wadi Degla Developments

- SODIC

- NEWGIZA

- El Shams

- LA Vista Developments

- Hassan Allam Properties

Notable Milestones in Egypt Condominiums and Apartments Market Sector

- October 2022: ERG Developments launched the Ri8 project in the New Administrative Capital (NAC), a USD 178 million investment comprising 1,063 apartments across 34 buildings.

- October 2022: Ora Developers partnered with JLL for project management and cost management services on a 360-feddan mixed-use development including 407 residential units.

In-Depth Egypt Condominiums and Apartments Market Market Outlook

The Egyptian condominium and apartment market is poised for sustained growth, driven by robust population increase and governmental support. Opportunities lie in adopting innovative technologies and sustainable practices to cater to a rising middle class with evolving lifestyle preferences. Strategic partnerships and efficient project management will further enhance the sector's potential, making it an attractive market for both local and international investors.

Egypt Condominiums and Apartments Market Segmentation

-

1. Key Cities

- 1.1. Cairo

- 1.2. Luxor

- 1.3. Aswan

- 1.4. Alexandria

- 1.5. Hurghada

Egypt Condominiums and Apartments Market Segmentation By Geography

- 1. Egypt

Egypt Condominiums and Apartments Market Regional Market Share

Geographic Coverage of Egypt Condominiums and Apartments Market

Egypt Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Private Investment in Real Estate Sector; Growth in the Luxury Housing Market

- 3.3. Market Restrains

- 3.3.1. Increase in primary and secondary rents in the market

- 3.4. Market Trends

- 3.4.1. Apartments Construction Gaining Traction in Egypt

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 5.1.1. Cairo

- 5.1.2. Luxor

- 5.1.3. Aswan

- 5.1.4. Alexandria

- 5.1.5. Hurghada

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Iwan Developments

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ERA Real Estate Egypt

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Orascom Development

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Coldwell Banker Egypt

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ORA Developments

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ERG Developments

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wadi Degla Developments

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SODIC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 NEWGIZA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 El Shams**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 LA Vista Developments

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hassan Allam Properties

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Iwan Developments

List of Figures

- Figure 1: Egypt Condominiums and Apartments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Egypt Condominiums and Apartments Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Condominiums and Apartments Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 2: Egypt Condominiums and Apartments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Egypt Condominiums and Apartments Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 4: Egypt Condominiums and Apartments Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Condominiums and Apartments Market?

The projected CAGR is approximately 10.96%.

2. Which companies are prominent players in the Egypt Condominiums and Apartments Market?

Key companies in the market include Iwan Developments, ERA Real Estate Egypt, Orascom Development, Coldwell Banker Egypt, ORA Developments, ERG Developments, Wadi Degla Developments, SODIC, NEWGIZA, El Shams**List Not Exhaustive, LA Vista Developments, Hassan Allam Properties.

3. What are the main segments of the Egypt Condominiums and Apartments Market?

The market segments include Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.02 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Private Investment in Real Estate Sector; Growth in the Luxury Housing Market.

6. What are the notable trends driving market growth?

Apartments Construction Gaining Traction in Egypt.

7. Are there any restraints impacting market growth?

Increase in primary and secondary rents in the market.

8. Can you provide examples of recent developments in the market?

October 2022- ERG Developments (the developer of the residential projects) launched residential project Ri8 in the New Administrative Capital (NAC) with an investment of more than USD 178 million. The project is spread over 25-acre land and consists of 34 residential buildings incorporating 1,063 apartments. This project will be completed in three phases.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the Egypt Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence