Key Insights

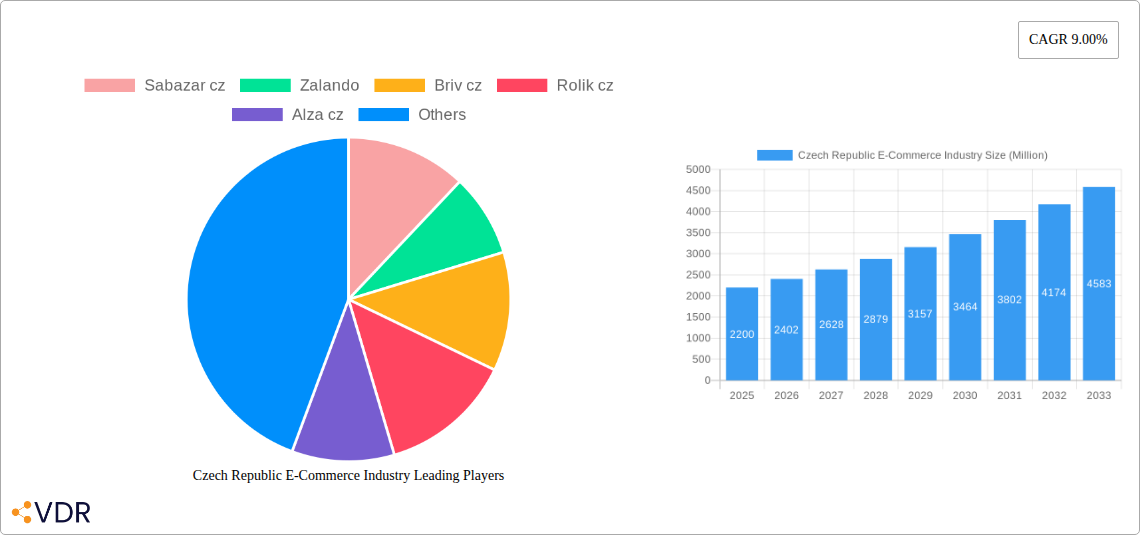

The Czech Republic e-commerce market exhibits robust growth, projected to reach a significant size by 2033. A Compound Annual Growth Rate (CAGR) of 9.00% from 2019 to 2033 signifies consistent expansion, driven by increasing internet and smartphone penetration, a rising young and digitally savvy population, and a growing preference for online shopping convenience. Key players like Alza.cz, Mall.cz, and Zalando have established strong market positions, fostering competition and innovation. The market's segmentation, primarily by application (e.g., fashion, electronics, groceries), offers opportunities for specialized e-commerce businesses to target niche markets. While precise market size figures for past years are not provided, a conservative estimate suggests a current market size (2025) exceeding €2 billion, given the growth rate and the presence of large established players. This estimate accounts for factors including the country's GDP and existing retail landscape. Further growth will likely be influenced by evolving consumer preferences, including the increasing popularity of mobile commerce and the adoption of advanced technologies like AI-powered recommendation systems and personalized shopping experiences.

Czech Republic E-Commerce Industry Market Size (In Billion)

Continued expansion hinges on addressing existing restraints. These include potential challenges in logistics and delivery infrastructure, particularly in rural areas, as well as cybersecurity concerns related to online transactions and data protection. Government initiatives aimed at improving digital infrastructure and consumer protection will play a crucial role in shaping future market growth. The ongoing development of payment methods and enhanced customer service will also be critical for the continuous growth and success of the Czech e-commerce industry. The competitiveness of the Czech market, with both domestic and international players, will ensure a dynamic and innovative marketplace for the foreseeable future.

Czech Republic E-Commerce Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Czech Republic's e-commerce market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for businesses, investors, and industry professionals seeking to understand and capitalize on opportunities within this rapidly evolving sector. The report analyzes the parent market of online retail and its child markets such as apparel, cosmetics, and electronics.

Czech Republic E-Commerce Industry Market Dynamics & Structure

The Czech Republic's e-commerce landscape is characterized by a dynamic interplay of market concentration, technological advancements, regulatory frameworks, and competitive forces. The market is moderately concentrated, with a few major players holding significant market share, alongside numerous smaller businesses. However, technological innovation, driven by factors like increased mobile penetration and improved logistics infrastructure, is fostering competition and driving growth.

Market Structure & Concentration:

- Alza.cz and Mall.cz dominate the overall market with an estimated combined market share of xx%.

- Strong presence of international players like Zalando further shapes market dynamics.

- The increasing number of smaller niche e-commerce businesses contributes to a fragmented yet competitive landscape.

Technological Innovation:

- Rapid adoption of mobile commerce (m-commerce) is a significant driver of market growth.

- Investments in advanced logistics and delivery solutions are improving efficiency and customer satisfaction.

- Innovation in payment gateways and cybersecurity enhance consumer trust and security.

Regulatory Framework & Competition:

- The Czech Republic's regulatory environment generally supports e-commerce growth.

- The rise of marketplaces (AukroSRO, Bazar.cz) intensifies competition and expands consumer choice.

- The presence of numerous product substitutes across different categories influences consumer purchasing decisions.

End-User Demographics & M&A Trends:

- Growing internet penetration and increasing digital literacy fuel e-commerce adoption across various demographics.

- The age group 25-44 represents a significant portion of online shoppers.

- M&A activity in the sector is moderate, with strategic acquisitions aiming to expand market reach and enhance product offerings. The estimated value of M&A deals in the period 2019-2024 was approximately xx Million.

Czech Republic E-Commerce Industry Growth Trends & Insights

The Czech Republic's e-commerce market has experienced robust growth over the historical period (2019-2024), driven by factors such as rising internet and smartphone penetration, increasing consumer confidence in online transactions, and the expansion of logistics networks. The market size has grown from xx Million in 2019 to an estimated xx Million in 2024. This translates to a Compound Annual Growth Rate (CAGR) of xx%. This growth trajectory is expected to continue in the forecast period (2025-2033), albeit at a slightly moderated pace, driven by factors such as increasing market maturity and potential economic fluctuations. The market penetration is expected to rise from xx% in 2024 to xx% by 2033. Technological disruptions, particularly in areas such as AI-powered personalization, augmented reality (AR) shopping experiences, and improved delivery solutions, continue to shape consumer behavior and drive further market expansion. Consumer preferences are shifting towards seamless omnichannel experiences, creating opportunities for businesses to integrate online and offline channels effectively. The adoption of mobile payments and digital wallets is also rising rapidly. Challenges remain, including concerns about data security and customer trust. However, the overall outlook remains positive, with substantial growth potential in the coming years.

Dominant Regions, Countries, or Segments in Czech Republic E-Commerce Industry

The Czech Republic's e-commerce market demonstrates strong growth across various segments. However, the dominant segment is Apparel and Fashion, driven by a combination of factors:

High consumer demand: The Czech Republic has a significant demand for apparel and fashion products, with consumers increasingly favoring online shopping for convenience, variety, and competitive pricing.

Strong online presence of retailers: Major players such as Zalando, Modivo, and smaller domestic players cater specifically to this segment. These companies have invested heavily in online platforms with user-friendly interfaces and efficient logistics.

Technological advancements: E-commerce platforms in this sector are adopting AR/VR technologies and personalized recommendations to enhance the customer experience, which fuels growth.

Favorable demographics: The substantial young and middle-aged population in the Czech Republic drives this segment's growth, as these groups are more inclined to shop online.

Market Share: While precise figures are proprietary, it can be estimated that the apparel and fashion segment likely holds the largest market share of the overall Czech e-commerce market, exceeding xx% in 2024. This share is projected to increase further in the coming years.

Growth Potential: The significant growth potential of the Apparel and Fashion segment is supported by ongoing technological innovation, increasing consumer adoption of online shopping, and the continued investment in logistics improvements within the Czech Republic.

Czech Republic E-Commerce Industry Product Landscape

The Czech Republic's e-commerce product landscape is diverse and evolving, encompassing a wide range of goods and services. Innovation is evident in areas such as personalized product recommendations using AI, improved online payment security systems, and the integration of augmented reality (AR) technology for virtual try-on experiences. The emphasis on seamless customer experiences, including fast and reliable delivery options, efficient returns processes, and proactive customer service, contributes to overall market competitiveness.

Key Drivers, Barriers & Challenges in Czech Republic E-Commerce Industry

Key Drivers:

- Rising internet penetration and smartphone usage.

- Increased consumer trust in online transactions.

- Improved logistics and delivery infrastructure.

- Government initiatives promoting digitalization.

Key Challenges and Restraints:

- Cybersecurity concerns and the risk of fraud. An estimated xx Million CZK in losses due to online fraud in 2024.

- Competition from established and emerging players.

- Supply chain disruptions and potential logistics bottlenecks.

- The need for continued investment in digital infrastructure, especially in rural areas.

Emerging Opportunities in Czech Republic E-Commerce Industry

- Growth in niche e-commerce segments (e.g., sustainable products, personalized goods).

- Expansion of cross-border e-commerce.

- Increasing adoption of mobile payment solutions and digital wallets.

- Integration of AI and machine learning to enhance customer experience.

Growth Accelerators in the Czech Republic E-Commerce Industry Industry

Long-term growth in the Czech Republic's e-commerce sector will be accelerated by continued investments in technological infrastructure, strategic partnerships between online retailers and logistics providers, and the expansion into new markets. The adoption of innovative technologies, such as AI-driven personalization and AR/VR shopping experiences, will further enhance customer engagement and drive sales growth. Government initiatives aimed at digitalization will also play a crucial role in fostering a supportive environment for e-commerce businesses.

Key Players Shaping the Czech Republic E-Commerce Industry Market

- Sabazar cz

- Zalando

- Briv cz

- Rolik cz

- Alza cz

- AukroSRO

- NotinoSRO

- Bazar cz

- Camarm

- Mall cz

Notable Milestones in Czech Republic E-Commerce Industry Sector

- January 2023: Mall Group closes brick-and-mortar stores, focusing on online expansion.

- October 2022: Notino partners with BWX, expanding its natural cosmetics offerings.

- November 2022: Modivo partners with Mondi for sustainable packaging solutions.

In-Depth Czech Republic E-Commerce Industry Market Outlook

The Czech Republic's e-commerce market is poised for sustained growth over the forecast period (2025-2033). Continued technological advancements, coupled with rising consumer adoption of online shopping, point towards a significant expansion in market size and penetration. Strategic partnerships and investments in logistics and infrastructure will further enhance the sector's competitiveness. Opportunities exist for both established players and emerging businesses to capture market share by focusing on innovation, customer experience, and sustainable practices. The overall outlook is positive, with considerable potential for long-term growth and expansion within the Czech Republic's dynamic e-commerce environment.

Czech Republic E-Commerce Industry Segmentation

-

1. Business Model

- 1.1. B2C E-Commerce

- 1.2. B2B E-Commerce

-

2. Product Category

- 2.1. Consumer Electronics

- 2.2. Fashion and Apparel

- 2.3. Food and Beverage

- 2.4. Furniture and Home

- 2.5. Others

-

3. Region

- 3.1. Prague

- 3.2. Central

- 3.3. North Moravia and Silesia

- 3.4. West Bohemia

- 3.5. South Moravia

Czech Republic E-Commerce Industry Segmentation By Geography

- 1. Czech Republic

Czech Republic E-Commerce Industry Regional Market Share

Geographic Coverage of Czech Republic E-Commerce Industry

Czech Republic E-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Fashion Industry

- 3.3. Market Restrains

- 3.3.1. ; Lack of Comprehensiveness of Chinese Digital Design Tools

- 3.4. Market Trends

- 3.4.1. Surge in demand for ecommerce due to COVID-19

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Czech Republic E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 5.1.1. B2C E-Commerce

- 5.1.2. B2B E-Commerce

- 5.2. Market Analysis, Insights and Forecast - by Product Category

- 5.2.1. Consumer Electronics

- 5.2.2. Fashion and Apparel

- 5.2.3. Food and Beverage

- 5.2.4. Furniture and Home

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Prague

- 5.3.2. Central

- 5.3.3. North Moravia and Silesia

- 5.3.4. West Bohemia

- 5.3.5. South Moravia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Czech Republic

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sabazar cz

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zalando

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Briv cz

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rolik cz

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alza cz

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AukroSRO

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NotinoSRO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bazar cz

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Camarm

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mall cz

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sabazar cz

List of Figures

- Figure 1: Czech Republic E-Commerce Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Czech Republic E-Commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: Czech Republic E-Commerce Industry Revenue undefined Forecast, by Business Model 2020 & 2033

- Table 2: Czech Republic E-Commerce Industry Volume K Unit Forecast, by Business Model 2020 & 2033

- Table 3: Czech Republic E-Commerce Industry Revenue undefined Forecast, by Product Category 2020 & 2033

- Table 4: Czech Republic E-Commerce Industry Volume K Unit Forecast, by Product Category 2020 & 2033

- Table 5: Czech Republic E-Commerce Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Czech Republic E-Commerce Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Czech Republic E-Commerce Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Czech Republic E-Commerce Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Czech Republic E-Commerce Industry Revenue undefined Forecast, by Business Model 2020 & 2033

- Table 10: Czech Republic E-Commerce Industry Volume K Unit Forecast, by Business Model 2020 & 2033

- Table 11: Czech Republic E-Commerce Industry Revenue undefined Forecast, by Product Category 2020 & 2033

- Table 12: Czech Republic E-Commerce Industry Volume K Unit Forecast, by Product Category 2020 & 2033

- Table 13: Czech Republic E-Commerce Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 14: Czech Republic E-Commerce Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 15: Czech Republic E-Commerce Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Czech Republic E-Commerce Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Czech Republic E-Commerce Industry?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the Czech Republic E-Commerce Industry?

Key companies in the market include Sabazar cz, Zalando, Briv cz, Rolik cz, Alza cz, AukroSRO, NotinoSRO, Bazar cz, Camarm, Mall cz.

3. What are the main segments of the Czech Republic E-Commerce Industry?

The market segments include Business Model, Product Category, Region.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Fashion Industry.

6. What are the notable trends driving market growth?

Surge in demand for ecommerce due to COVID-19.

7. Are there any restraints impacting market growth?

; Lack of Comprehensiveness of Chinese Digital Design Tools.

8. Can you provide examples of recent developments in the market?

November 2022: The Mondi Group, a packaging solutions provider, teamed with MODIVO, a Czech online retailer of apparel. Mondi will provide corrugated boxes and paper MailerBAGS for Modivo to use to package orders. Until now, Modivo has used traditional rigid packaging.Because of this, packing costs will go down and materials that are better for the environment will be used.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Czech Republic E-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Czech Republic E-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Czech Republic E-Commerce Industry?

To stay informed about further developments, trends, and reports in the Czech Republic E-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence