Key Insights

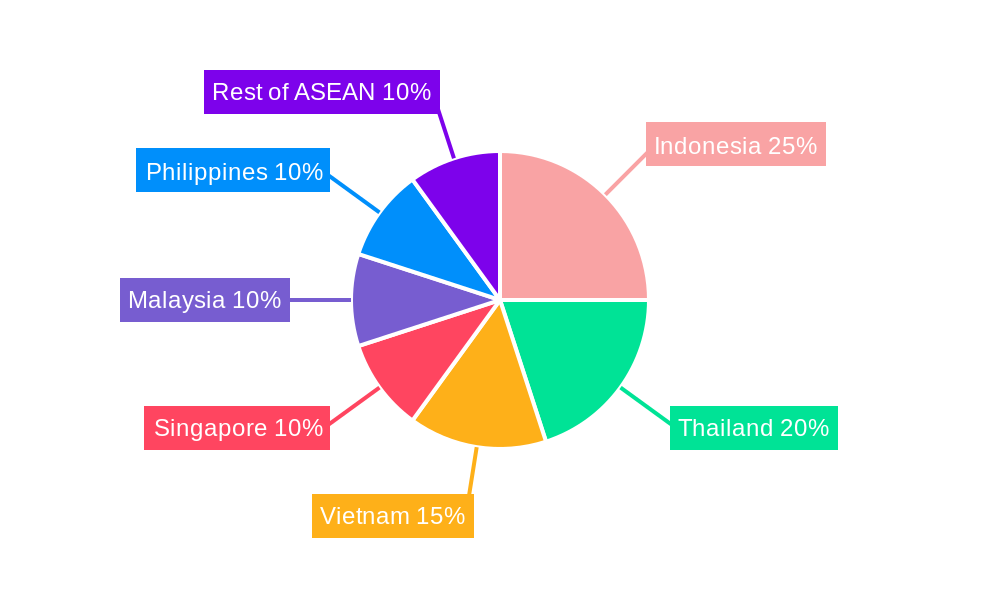

The ASEAN construction machinery market, valued at $7.63 billion in 2025, is projected to experience robust growth, driven by significant infrastructure development across the region. A Compound Annual Growth Rate (CAGR) of 6.59% from 2025 to 2033 indicates a substantial expansion, reaching an estimated market value exceeding $13 billion by 2033. Key drivers include rising urbanization, government investments in infrastructure projects (roads, bridges, buildings), and increasing industrialization. The market is segmented by machinery type (cranes, excavators, loaders, backhoes, motor graders, and others) and application (concrete and road construction, earthmoving, and material handling). Major players like Caterpillar, Komatsu, Hitachi, and Liebherr dominate the market, leveraging their technological advancements and established distribution networks. While the specific regional breakdown for Indonesia, Thailand, Vietnam, Singapore, Malaysia, Philippines, and Rest of ASEAN is unavailable, it is likely that Indonesia, Thailand, and Vietnam will represent the largest portions due to their size and ongoing infrastructure projects. Growth will be tempered by potential economic fluctuations, material price volatility, and competition among numerous global and regional players. However, the long-term outlook remains positive, fueled by the region's consistent economic growth and sustained infrastructure needs.

Construction Machinery Industry in ASEAN Market Size (In Billion)

The strong growth trajectory is fueled by several factors. The increasing demand for efficient and technologically advanced machinery is driving innovation, with manufacturers focusing on fuel-efficient, automated, and environmentally friendly equipment. Government initiatives promoting sustainable construction practices also play a role. However, challenges remain, including the potential for supply chain disruptions and the need to address skills gaps within the construction workforce. The market's competitive landscape will continue to see mergers, acquisitions, and strategic partnerships as companies seek to expand their market share and product portfolios. Furthermore, the adoption of digital technologies, such as telematics and IoT, will be crucial for optimizing efficiency and improving operational insights within the construction sector. The ASEAN construction machinery market presents significant opportunities for both established players and new entrants, particularly those focusing on sustainable solutions and technological advancements.

Construction Machinery Industry in ASEAN Company Market Share

Construction Machinery Industry in ASEAN: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Construction Machinery Industry in ASEAN, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and policymakers seeking to understand and capitalize on opportunities within this dynamic market.

Parent Market: Construction Industry in ASEAN Child Market: Construction Machinery (Cranes, Excavators, Loaders, Backhoes, Motor Graders, and other machinery)

Construction Machinery Industry in ASEAN Market Dynamics & Structure

The ASEAN construction machinery market is a dynamic and evolving sector, characterized by a robust mix of global industry leaders and agile regional contenders. The competitive landscape is nuanced, with varying degrees of market concentration observed across different machinery segments and specific applications. Technological advancements are rapidly reshaping the industry, driven by an increasing emphasis on efficiency, enhanced safety protocols, and a growing imperative for sustainable operational practices. The adoption of automation, sophisticated digitalization tools, and the integration of electric powertrains are accelerating, reflecting the market's forward-looking trajectory. Key global players such as Mitsubishi Corporation, Hitachi Construction Machinery Co, Liebherr Group, CNH Industrial, Caterpillar Inc, JCB, Komatsu Ltd, and Xuzhou Construction Machinery Group Co Ltd are significant forces. However, their market penetration and share fluctuate considerably depending on the specific product category and end-user application.

- Market Concentration: The market exhibits moderate to high concentration, with a few dominant players holding significant sway in specialized segments. Precise market share figures are subject to ongoing analysis and reporting.

- Technological Innovation: Innovation is a critical differentiator, fueled by the escalating demand for machinery that offers superior efficiency, advanced safety functionalities, and reduced environmental impact. The integration of automation, data-driven insights through digitalization, and the shift towards electric and hybrid powertrains are prominent trends.

- Regulatory Framework: Navigating the diverse regulatory environments across individual ASEAN nations presents a key aspect of market operations. While ongoing efforts are directed towards harmonizing standards and regulations to facilitate smoother cross-border trade and operations, significant variations persist.

- Competitive Product Substitutes: Direct product substitutes are relatively limited. However, continuous technological advancements are introducing innovative alternatives and upgrades within existing machinery categories, offering enhanced performance and functionality.

- End-User Demographics: The primary end-users comprise a broad spectrum of entities, including major construction firms, extensive infrastructure development agencies, and significant mining operations. The sustained and expanding investment in infrastructure projects throughout the ASEAN region acts as a principal demand driver.

- M&A Trends: The past few years have witnessed moderate merger and acquisition activity. These strategic moves are predominantly aimed at consolidating market presence, expanding product portfolios, and acquiring cutting-edge technologies. Barriers to innovation include substantial research and development investments, the inherent complexity of advanced technologies, and the crucial need for a highly skilled and adaptable workforce.

Construction Machinery Industry in ASEAN Growth Trends & Insights

The ASEAN construction machinery market experienced significant growth during the historical period (2019-2024), driven by robust infrastructure development and urbanization across the region. The market size, in Million Units, for excavators was xx in 2019 and xx in 2024. This represents a CAGR of xx%. Growth is projected to continue during the forecast period (2025-2033), although at a potentially slower pace than observed historically. This slowing is likely due to economic factors and the cyclical nature of the construction industry. Technological disruptions, such as the increasing adoption of electric and autonomous machinery, will fundamentally reshape the market dynamics. Consumer behavior is shifting towards more efficient, sustainable, and technologically advanced equipment. Market penetration of advanced features will grow, driven by increasing demand for productivity improvements and reduced operational costs. Specific adoption rates across different machinery types are unavailable at the time of report creation (xx).

Dominant Regions, Countries, or Segments in Construction Machinery Industry in ASEAN

The construction machinery market in ASEAN is not uniformly distributed. Specific data on market share by region is unavailable (xx) but several factors point to certain areas as dominant.

- Dominant Regions: Singapore, Thailand, Vietnam, and Indonesia are expected to be major markets due to robust infrastructure development plans.

- Dominant Segments (Machinery Type): Excavators and loaders are likely to be dominant segments due to their wide applicability in various construction and infrastructure projects. The specific market share is unavailable (xx).

- Dominant Segments (Application): Earthmoving and concrete/road construction are expected to be major application segments due to high demand for infrastructure development projects. Again, the exact market share is unavailable (xx).

- Key Drivers: Government investments in infrastructure, urbanization, industrialization, and economic growth in key ASEAN countries are major drivers. Economic policies that promote infrastructure projects significantly affect market growth.

Construction Machinery Industry in ASEAN Product Landscape

The construction machinery market within the ASEAN region presents a rich and diverse product portfolio, encompassing a wide array of machinery types, each at various stages of technological evolution. A notable trend is the recent introduction and increasing adoption of electric and hybrid-powered machinery, underscoring a strong commitment to environmental sustainability and the reduction of operational emissions. Key performance indicators such as fuel efficiency, overall operational cost-effectiveness, and advanced safety features are paramount in differentiating products and capturing market attention. Unique selling propositions are increasingly centered on the integration of sophisticated technological capabilities designed to amplify productivity, drive down operational expenditures, and enhance operator comfort and safety. Exemplary technological advancements include cutting-edge automation systems for complex tasks, highly efficient and responsive hydraulic systems, and intelligent, real-time monitoring and diagnostics solutions.

Key Drivers, Barriers & Challenges in Construction Machinery Industry in ASEAN

Key Drivers:

- Significant and ongoing investments in infrastructure development across the various ASEAN nations.

- The persistent trend of urbanization and increasing industrialization, leading to greater demand for construction activities.

- A rising demand for construction equipment that is not only efficient but also adheres to stringent sustainability standards.

- Proactive government support and policy initiatives aimed at fostering infrastructure development across the region.

Key Challenges and Restraints:

- Supply Chain Disruptions: Global supply chain volatility can significantly impact the availability of essential raw materials and critical components. This can consequently lead to production delays and escalated costs. The precise quantifiable impact of these disruptions is subject to ongoing assessment.

- Regulatory Hurdles: The differing regulatory landscapes across the ASEAN countries can present substantial barriers to market entry and expansion. The specific financial implications of navigating these varied regulatory frameworks require detailed analysis.

- Competitive Pressures: The intensely competitive environment, marked by the presence of both formidable global players and agile regional competitors, can lead to price erosion and affect overall profitability. The direct impact on market share dynamics is an area of continuous observation.

Emerging Opportunities in Construction Machinery Industry in ASEAN

- Untapped Markets: Significant opportunities exist in less developed regions of ASEAN with growing infrastructure needs.

- Innovative Applications: The adoption of electric, autonomous, and digitally enabled machinery presents significant opportunities.

- Evolving Consumer Preferences: Demand for more efficient, eco-friendly, and technologically advanced equipment creates opportunities for innovative products and services.

Growth Accelerators in the Construction Machinery Industry in ASEAN Industry

Transformative technological breakthroughs, particularly in the domains of automation, electrification, and digitalization, serve as powerful accelerators for growth within the ASEAN construction machinery sector. Strategic alliances and partnerships forged between machinery manufacturers and leading technology providers are instrumental in expediting the development and widespread adoption of these advanced technologies. Furthermore, expanding market reach into currently underserved or untapped segments within the broader ASEAN region, through well-executed strategic investments and collaborative ventures, is poised to significantly propel market expansion.

Key Players Shaping the Construction Machinery Industry in ASEAN Market

- Mitsubishi Corporation

- Hitachi Construction Machinery Co

- Liebherr Group

- CNH Industrial

- Caterpillar Inc

- JCB

- Komatsu Ltd

- Xuzhou Construction Machinery Group Co Ltd

Notable Milestones in Construction Machinery Industry in ASEAN Sector

- June 2023: Volvo CE introduced its first fully electric construction machinery in Singapore, marking a significant step towards sustainable construction in Southeast Asia.

- May 2022: CASE Construction Equipment launched several new products across South Asia, expanding its product portfolio and market presence.

- April 2022: Liebherr's redevelopment of its mid-sized wheel loaders enhanced product performance and competitiveness.

- January 2022: Liebherr launched three new wheel loaders, boosting its product offerings and strengthening its position in the market.

In-Depth Construction Machinery Industry in ASEAN Market Outlook

The ASEAN construction machinery market is poised for continued growth, driven by sustained infrastructure development, urbanization, and technological advancements. Strategic investments in research and development, strategic partnerships, and expansion into untapped markets will be crucial for companies to succeed in this evolving market. The long-term outlook is positive, with significant opportunities for companies that can adapt to the changing market dynamics and offer innovative, sustainable, and efficient solutions.

Construction Machinery Industry in ASEAN Segmentation

-

1. Machinery Type

- 1.1. Cranes

- 1.2. Excavators

- 1.3. Loaders

- 1.4. Backhoe

- 1.5. Motor Graders

- 1.6. Other Machinery Types

-

2. Application

- 2.1. Concrete and Road Construction

- 2.2. Earth Moving

- 2.3. Material Handling

-

3. Geography

- 3.1. Indonesia

- 3.2. Thailand

- 3.3. Vietnam

- 3.4. Singapore

- 3.5. Malaysia

- 3.6. Philippines

- 3.7. Rest of ASEAN

Construction Machinery Industry in ASEAN Segmentation By Geography

- 1. Indonesia

- 2. Thailand

- 3. Vietnam

- 4. Singapore

- 5. Malaysia

- 6. Philippines

- 7. Rest of ASEAN

Construction Machinery Industry in ASEAN Regional Market Share

Geographic Coverage of Construction Machinery Industry in ASEAN

Construction Machinery Industry in ASEAN REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction Activity May Drive the Market

- 3.3. Market Restrains

- 3.3.1. High Equipment Cost may Hamper the Market

- 3.4. Market Trends

- 3.4.1. Concrete and Road Construction To Propel The Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Cranes

- 5.1.2. Excavators

- 5.1.3. Loaders

- 5.1.4. Backhoe

- 5.1.5. Motor Graders

- 5.1.6. Other Machinery Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Concrete and Road Construction

- 5.2.2. Earth Moving

- 5.2.3. Material Handling

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Indonesia

- 5.3.2. Thailand

- 5.3.3. Vietnam

- 5.3.4. Singapore

- 5.3.5. Malaysia

- 5.3.6. Philippines

- 5.3.7. Rest of ASEAN

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.4.2. Thailand

- 5.4.3. Vietnam

- 5.4.4. Singapore

- 5.4.5. Malaysia

- 5.4.6. Philippines

- 5.4.7. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. Indonesia Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6.1.1. Cranes

- 6.1.2. Excavators

- 6.1.3. Loaders

- 6.1.4. Backhoe

- 6.1.5. Motor Graders

- 6.1.6. Other Machinery Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Concrete and Road Construction

- 6.2.2. Earth Moving

- 6.2.3. Material Handling

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Indonesia

- 6.3.2. Thailand

- 6.3.3. Vietnam

- 6.3.4. Singapore

- 6.3.5. Malaysia

- 6.3.6. Philippines

- 6.3.7. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7. Thailand Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7.1.1. Cranes

- 7.1.2. Excavators

- 7.1.3. Loaders

- 7.1.4. Backhoe

- 7.1.5. Motor Graders

- 7.1.6. Other Machinery Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Concrete and Road Construction

- 7.2.2. Earth Moving

- 7.2.3. Material Handling

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Indonesia

- 7.3.2. Thailand

- 7.3.3. Vietnam

- 7.3.4. Singapore

- 7.3.5. Malaysia

- 7.3.6. Philippines

- 7.3.7. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8. Vietnam Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8.1.1. Cranes

- 8.1.2. Excavators

- 8.1.3. Loaders

- 8.1.4. Backhoe

- 8.1.5. Motor Graders

- 8.1.6. Other Machinery Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Concrete and Road Construction

- 8.2.2. Earth Moving

- 8.2.3. Material Handling

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Indonesia

- 8.3.2. Thailand

- 8.3.3. Vietnam

- 8.3.4. Singapore

- 8.3.5. Malaysia

- 8.3.6. Philippines

- 8.3.7. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9. Singapore Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9.1.1. Cranes

- 9.1.2. Excavators

- 9.1.3. Loaders

- 9.1.4. Backhoe

- 9.1.5. Motor Graders

- 9.1.6. Other Machinery Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Concrete and Road Construction

- 9.2.2. Earth Moving

- 9.2.3. Material Handling

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Indonesia

- 9.3.2. Thailand

- 9.3.3. Vietnam

- 9.3.4. Singapore

- 9.3.5. Malaysia

- 9.3.6. Philippines

- 9.3.7. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10. Malaysia Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10.1.1. Cranes

- 10.1.2. Excavators

- 10.1.3. Loaders

- 10.1.4. Backhoe

- 10.1.5. Motor Graders

- 10.1.6. Other Machinery Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Concrete and Road Construction

- 10.2.2. Earth Moving

- 10.2.3. Material Handling

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Indonesia

- 10.3.2. Thailand

- 10.3.3. Vietnam

- 10.3.4. Singapore

- 10.3.5. Malaysia

- 10.3.6. Philippines

- 10.3.7. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 11. Philippines Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Machinery Type

- 11.1.1. Cranes

- 11.1.2. Excavators

- 11.1.3. Loaders

- 11.1.4. Backhoe

- 11.1.5. Motor Graders

- 11.1.6. Other Machinery Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Concrete and Road Construction

- 11.2.2. Earth Moving

- 11.2.3. Material Handling

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Indonesia

- 11.3.2. Thailand

- 11.3.3. Vietnam

- 11.3.4. Singapore

- 11.3.5. Malaysia

- 11.3.6. Philippines

- 11.3.7. Rest of ASEAN

- 11.1. Market Analysis, Insights and Forecast - by Machinery Type

- 12. Rest of ASEAN Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Machinery Type

- 12.1.1. Cranes

- 12.1.2. Excavators

- 12.1.3. Loaders

- 12.1.4. Backhoe

- 12.1.5. Motor Graders

- 12.1.6. Other Machinery Types

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Concrete and Road Construction

- 12.2.2. Earth Moving

- 12.2.3. Material Handling

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. Indonesia

- 12.3.2. Thailand

- 12.3.3. Vietnam

- 12.3.4. Singapore

- 12.3.5. Malaysia

- 12.3.6. Philippines

- 12.3.7. Rest of ASEAN

- 12.1. Market Analysis, Insights and Forecast - by Machinery Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Mitsubishi Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hitachi Construction Machinery Co

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Liebherr Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 CNH Industrial

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Caterpillar Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 JC Bamford Excavators Ltd (JCB)*List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Komatsu Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Xuzhou Construction Machinery Group Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Mitsubishi Corporation

List of Figures

- Figure 1: Global Construction Machinery Industry in ASEAN Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Indonesia Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 3: Indonesia Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 4: Indonesia Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 5: Indonesia Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 6: Indonesia Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 7: Indonesia Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Indonesia Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 9: Indonesia Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 10: Thailand Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 11: Thailand Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 12: Thailand Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 13: Thailand Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 14: Thailand Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 15: Thailand Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Thailand Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 17: Thailand Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 18: Vietnam Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 19: Vietnam Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 20: Vietnam Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 21: Vietnam Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 22: Vietnam Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 23: Vietnam Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Vietnam Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 25: Vietnam Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 26: Singapore Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 27: Singapore Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 28: Singapore Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 29: Singapore Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 30: Singapore Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 31: Singapore Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Singapore Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 33: Singapore Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 34: Malaysia Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 35: Malaysia Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 36: Malaysia Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 37: Malaysia Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 38: Malaysia Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 39: Malaysia Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Malaysia Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 41: Malaysia Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 42: Philippines Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 43: Philippines Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 44: Philippines Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 45: Philippines Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 46: Philippines Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 47: Philippines Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Philippines Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 49: Philippines Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 51: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 52: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 53: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 54: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 55: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 56: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 57: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 2: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 6: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 10: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 14: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 18: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 22: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 26: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 27: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 30: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 32: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Machinery Industry in ASEAN?

The projected CAGR is approximately 6.59%.

2. Which companies are prominent players in the Construction Machinery Industry in ASEAN?

Key companies in the market include Mitsubishi Corporation, Hitachi Construction Machinery Co, Liebherr Group, CNH Industrial, Caterpillar Inc, JC Bamford Excavators Ltd (JCB)*List Not Exhaustive, Komatsu Ltd, Xuzhou Construction Machinery Group Co Ltd.

3. What are the main segments of the Construction Machinery Industry in ASEAN?

The market segments include Machinery Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction Activity May Drive the Market.

6. What are the notable trends driving market growth?

Concrete and Road Construction To Propel The Demand.

7. Are there any restraints impacting market growth?

High Equipment Cost may Hamper the Market.

8. Can you provide examples of recent developments in the market?

June 2023: Volvo Construction Equipment's (Volvo CE) first fully electric construction machinery arrived in Singapore and was formally introduced to the Southeast Asia market at a grand event on the island of Sentosa in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Machinery Industry in ASEAN," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Machinery Industry in ASEAN report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Machinery Industry in ASEAN?

To stay informed about further developments, trends, and reports in the Construction Machinery Industry in ASEAN, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence