Key Insights

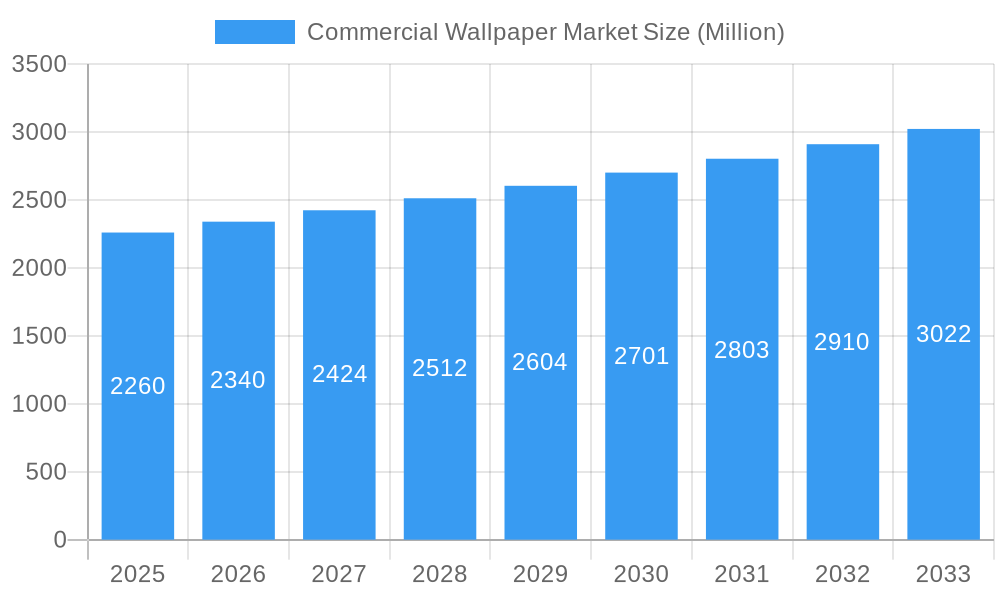

The commercial wallpaper market, valued at approximately $2.26 billion in 2025, is projected to experience steady growth, driven by increasing commercial construction activity globally and a rising preference for aesthetically pleasing and durable interior designs in offices, hotels, restaurants, and retail spaces. The market's Compound Annual Growth Rate (CAGR) of 3.59% from 2019-2033 indicates a consistent expansion, although the rate might fluctuate year-to-year based on economic conditions and construction cycles. Vinyl wallpapers, known for their durability and easy maintenance, dominate the market, followed by non-woven options favored for their breathability and high-quality finish. The commercial segment is a major revenue driver, outpacing non-commercial applications due to higher volumes of installations in large-scale projects and the need for frequent renovations or updates in commercial settings. Factors like increasing disposable incomes in developing economies, and innovative wallpaper designs incorporating sustainable and eco-friendly materials, further contribute to market growth. However, potential restraints include fluctuations in raw material prices, competition from alternative wall coverings such as paint and tiles, and the increasing adoption of sustainable and eco-friendly construction practices which may favor alternative wall coverings in certain niche segments.

Commercial Wallpaper Market Market Size (In Billion)

Growth will likely be geographically diverse. North America and Europe are expected to retain significant market shares due to established infrastructure and high demand. However, Asia's rapidly developing economies, particularly China and India, present significant growth opportunities, given the increasing construction activity and rising disposable incomes. The competitive landscape includes both established international players such as AS Creation Tapeten AG, Rasch GmbH & Co KG, and Schumacher & Co, and regional players catering to specific market needs. Strategic partnerships, acquisitions, and product diversification will be crucial for companies to maintain a competitive edge and capitalize on the projected growth. The market will also see a greater emphasis on customization, digital printing capabilities, and the integration of smart technologies within wallpaper, creating new avenues for innovation and premium pricing opportunities.

Commercial Wallpaper Market Company Market Share

This in-depth report provides a comprehensive analysis of the Commercial Wallpaper Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers both the parent market (Wallcovering Market) and the child market (Commercial Wallpaper Market), offering granular insights for informed decision-making. The study period spans 2019-2033, with 2025 as the base and estimated year.

Commercial Wallpaper Market Market Dynamics & Structure

The commercial wallpaper market is characterized by moderate concentration, with several key players holding significant market share. Market dynamics are shaped by several key factors:

- Technological Innovation: The ongoing development of sustainable and innovative wallpaper materials (e.g., eco-friendly vinyl, advanced non-woven fabrics) is driving market growth. However, high R&D costs present an innovation barrier for smaller players.

- Regulatory Landscape: Building codes and environmental regulations influence material choices and manufacturing processes. Compliance requirements can pose challenges for some market participants.

- Competitive Substitutes: Paints, murals, and other wall coverings present competition. The market is driven by the unique aesthetic appeal and design flexibility of wallpaper.

- End-User Demographics: The commercial sector, including offices, hotels, restaurants, and retail spaces, presents the primary end-user segment. Design trends and preferences in these sectors greatly influence market demand.

- Mergers & Acquisitions (M&A): The market has witnessed a moderate level of M&A activity in recent years (xx deals in the past 5 years, representing xx% of the market). Consolidation among key players could intensify in the future.

Market concentration is estimated at xx%, with the top 5 players holding approximately xx% of the market share in 2024. The market exhibits a relatively fragmented structure at the lower end, with numerous smaller regional players catering to niche segments.

Commercial Wallpaper Market Growth Trends & Insights

The Commercial Wallpaper Market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx Million units by 2033. This growth is fueled by several factors: increasing urbanization and construction activity, rising disposable incomes in developing economies, and growing preference for aesthetically pleasing and functional interior designs in commercial spaces. Market penetration in developing economies remains relatively low, presenting significant growth opportunities. Technological disruptions, such as the introduction of digitally printed wallpapers and peel-and-stick options, are further accelerating market expansion. Consumer behavior shifts towards eco-friendly and sustainable products are also influencing market trends. Adoption rates of new technologies are projected to increase from xx% in 2025 to xx% by 2033, further boosting market expansion.

Dominant Regions, Countries, or Segments in Commercial Wallpaper Market

North America and Europe currently dominate the commercial wallpaper market, accounting for approximately xx% and xx% of the global market share in 2024 respectively. However, Asia-Pacific is expected to exhibit the fastest growth rate during the forecast period, driven by robust infrastructure development and rising urbanization.

By Wallpaper Type:

- Vinyl Wallpaper: Maintains a significant market share due to its durability and affordability.

- Non-woven Wallpaper: Growing in popularity due to its ease of application and superior quality.

- Paper-based Wallpaper: Remains a significant segment, especially in the budget-conscious market.

- Fabric Wallpaper: Caters to high-end commercial projects, offering luxury and design flexibility.

By Application:

- Commercial: The leading segment, driven by the demand for aesthetically pleasing and durable wall coverings in offices, hotels, and retail spaces.

- Non-commercial: Residential applications constitute a substantial market. The growth of this segment is influenced by similar factors as Commercial Wallpaper Market including design trends and disposable income.

Key drivers for regional dominance include strong economic growth, favorable government policies supporting construction, and well-established distribution networks.

Commercial Wallpaper Market Product Landscape

The commercial wallpaper market offers a diverse range of products, including vinyl, non-woven, paper-based, and fabric wallpapers. Recent innovations focus on enhanced durability, ease of application, and sustainable materials. Peel-and-stick options and digitally printed designs are gaining traction, offering greater design flexibility and reduced installation costs. Unique selling propositions emphasize design aesthetics, durability, and ease of maintenance.

Key Drivers, Barriers & Challenges in Commercial Wallpaper Market

Key Drivers:

- Increasing construction activity globally.

- Growing demand for aesthetically appealing commercial spaces.

- Technological advancements in wallpaper materials and printing techniques.

Challenges & Restraints:

- Fluctuations in raw material prices.

- Intense competition from alternative wall covering options.

- Environmental regulations impacting manufacturing processes.

The impact of these challenges on market growth is estimated at xx% reduction in projected CAGR.

Emerging Opportunities in Commercial Wallpaper Market

- Growing demand for sustainable and eco-friendly wallpaper options.

- Expansion into untapped markets in developing economies.

- Customization and personalization of wallpaper designs.

Growth Accelerators in the Commercial Wallpaper Market Industry

Strategic partnerships between wallpaper manufacturers and interior designers, coupled with technological breakthroughs in digital printing and sustainable materials, are key growth accelerators. Expansion into new geographic markets and the development of innovative product lines further enhance market expansion potential.

Key Players Shaping the Commercial Wallpaper Market Market

- AS Creation Tapeten AG

- LEN-TEX Corporation

- Tapetenfabrik Gebr Rasch GmbH & Co KG

- F Schumacher & Co

- York Wall Coverings Inc

- Grandeco Wallfashion Group

- Gratex Industries Ltd

- Laura Ashley Holdings PLC

- Erismann & Cie GmbH

- Sangetsu Corporation

- Asian Paints Ltd

- Sanderson Design Group PLC

- Brewster Home Fashion LLC

Notable Milestones in Commercial Wallpaper Market Sector

- September 2022: Schumacher opened its first showroom in Nashville, TN, expanding its retail presence and access to designers.

- March 2023: The launch of the Erin and Ben Napier Co. Collection by York Wallcoverings introduced a new, popular peel-and-stick design line, potentially expanding the market to DIY consumers.

In-Depth Commercial Wallpaper Market Market Outlook

The Commercial Wallpaper Market is poised for sustained growth, driven by continued urbanization, technological innovation, and a rising preference for personalized and sustainable interior design solutions. Strategic partnerships, expansion into emerging markets, and the development of innovative products will further contribute to the market's long-term potential. The market anticipates xx Million units by 2033, representing a significant expansion and growth opportunity.

Commercial Wallpaper Market Segmentation

-

1. Wallpaper Type

- 1.1. Vinyl

- 1.2. Non-woven

- 1.3. Paper-based

- 1.4. Fabric Wallpaper

- 1.5. Other Wallpaper Types

-

2. Application

- 2.1. Commercial

- 2.2. Non-commercial

Commercial Wallpaper Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Commercial Wallpaper Market Regional Market Share

Geographic Coverage of Commercial Wallpaper Market

Commercial Wallpaper Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trends of Aesthetics; High Demand for Non-woven Wallpapers

- 3.3. Market Restrains

- 3.3.1. Growth of Digital Marketing and the Practice of Online Reading

- 3.4. Market Trends

- 3.4.1. Non-Woven Wallpaper Type Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Wallpaper Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 5.1.1. Vinyl

- 5.1.2. Non-woven

- 5.1.3. Paper-based

- 5.1.4. Fabric Wallpaper

- 5.1.5. Other Wallpaper Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial

- 5.2.2. Non-commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 6. North America Commercial Wallpaper Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 6.1.1. Vinyl

- 6.1.2. Non-woven

- 6.1.3. Paper-based

- 6.1.4. Fabric Wallpaper

- 6.1.5. Other Wallpaper Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial

- 6.2.2. Non-commercial

- 6.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 7. Europe Commercial Wallpaper Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 7.1.1. Vinyl

- 7.1.2. Non-woven

- 7.1.3. Paper-based

- 7.1.4. Fabric Wallpaper

- 7.1.5. Other Wallpaper Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial

- 7.2.2. Non-commercial

- 7.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 8. Asia Pacific Commercial Wallpaper Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 8.1.1. Vinyl

- 8.1.2. Non-woven

- 8.1.3. Paper-based

- 8.1.4. Fabric Wallpaper

- 8.1.5. Other Wallpaper Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial

- 8.2.2. Non-commercial

- 8.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 9. Latin America Commercial Wallpaper Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 9.1.1. Vinyl

- 9.1.2. Non-woven

- 9.1.3. Paper-based

- 9.1.4. Fabric Wallpaper

- 9.1.5. Other Wallpaper Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Commercial

- 9.2.2. Non-commercial

- 9.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 10. Middle East and Africa Commercial Wallpaper Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 10.1.1. Vinyl

- 10.1.2. Non-woven

- 10.1.3. Paper-based

- 10.1.4. Fabric Wallpaper

- 10.1.5. Other Wallpaper Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Commercial

- 10.2.2. Non-commercial

- 10.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AS Creation Tapeten AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LEN-TEX Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tapetenfabrik Gebr Rasch GmbH & Co KG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 F Schumacher & Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 York Wall Coverings Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Grandeco Wallfashion Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gratex Industries Ltd*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Laura Ashley Holdings PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Erismann & Cie GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sangetsu Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Asian Paints Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sanderson Design Group PLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Brewster Home Fashion LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 AS Creation Tapeten AG

List of Figures

- Figure 1: Global Commercial Wallpaper Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Commercial Wallpaper Market Revenue (Million), by Wallpaper Type 2025 & 2033

- Figure 3: North America Commercial Wallpaper Market Revenue Share (%), by Wallpaper Type 2025 & 2033

- Figure 4: North America Commercial Wallpaper Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Commercial Wallpaper Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Commercial Wallpaper Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Commercial Wallpaper Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Commercial Wallpaper Market Revenue (Million), by Wallpaper Type 2025 & 2033

- Figure 9: Europe Commercial Wallpaper Market Revenue Share (%), by Wallpaper Type 2025 & 2033

- Figure 10: Europe Commercial Wallpaper Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Commercial Wallpaper Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Commercial Wallpaper Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Commercial Wallpaper Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Commercial Wallpaper Market Revenue (Million), by Wallpaper Type 2025 & 2033

- Figure 15: Asia Pacific Commercial Wallpaper Market Revenue Share (%), by Wallpaper Type 2025 & 2033

- Figure 16: Asia Pacific Commercial Wallpaper Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Commercial Wallpaper Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Commercial Wallpaper Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Commercial Wallpaper Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Commercial Wallpaper Market Revenue (Million), by Wallpaper Type 2025 & 2033

- Figure 21: Latin America Commercial Wallpaper Market Revenue Share (%), by Wallpaper Type 2025 & 2033

- Figure 22: Latin America Commercial Wallpaper Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Latin America Commercial Wallpaper Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Commercial Wallpaper Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Commercial Wallpaper Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Commercial Wallpaper Market Revenue (Million), by Wallpaper Type 2025 & 2033

- Figure 27: Middle East and Africa Commercial Wallpaper Market Revenue Share (%), by Wallpaper Type 2025 & 2033

- Figure 28: Middle East and Africa Commercial Wallpaper Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Commercial Wallpaper Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Commercial Wallpaper Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Commercial Wallpaper Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Wallpaper Market Revenue Million Forecast, by Wallpaper Type 2020 & 2033

- Table 2: Global Commercial Wallpaper Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Commercial Wallpaper Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Commercial Wallpaper Market Revenue Million Forecast, by Wallpaper Type 2020 & 2033

- Table 5: Global Commercial Wallpaper Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Commercial Wallpaper Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Commercial Wallpaper Market Revenue Million Forecast, by Wallpaper Type 2020 & 2033

- Table 8: Global Commercial Wallpaper Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Commercial Wallpaper Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Commercial Wallpaper Market Revenue Million Forecast, by Wallpaper Type 2020 & 2033

- Table 11: Global Commercial Wallpaper Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Commercial Wallpaper Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Commercial Wallpaper Market Revenue Million Forecast, by Wallpaper Type 2020 & 2033

- Table 14: Global Commercial Wallpaper Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Commercial Wallpaper Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Commercial Wallpaper Market Revenue Million Forecast, by Wallpaper Type 2020 & 2033

- Table 17: Global Commercial Wallpaper Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Commercial Wallpaper Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Wallpaper Market?

The projected CAGR is approximately 3.59%.

2. Which companies are prominent players in the Commercial Wallpaper Market?

Key companies in the market include AS Creation Tapeten AG, LEN-TEX Corporation, Tapetenfabrik Gebr Rasch GmbH & Co KG, F Schumacher & Co, York Wall Coverings Inc, Grandeco Wallfashion Group, Gratex Industries Ltd*List Not Exhaustive, Laura Ashley Holdings PLC, Erismann & Cie GmbH, Sangetsu Corporation, Asian Paints Ltd, Sanderson Design Group PLC, Brewster Home Fashion LLC.

3. What are the main segments of the Commercial Wallpaper Market?

The market segments include Wallpaper Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trends of Aesthetics; High Demand for Non-woven Wallpapers.

6. What are the notable trends driving market growth?

Non-Woven Wallpaper Type Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Growth of Digital Marketing and the Practice of Online Reading.

8. Can you provide examples of recent developments in the market?

March 2023: Erin Napier, known for her role in the TV show Hometown, has recently collaborated with the oldest wallpaper manufacturer in the United States, York Wallcoverings, to introduce a new collection. The collection, named the Erin and Ben Napier Co. Collection, offers a variety of peel-and-stick wallpapers featuring whimsical flowers and folk art-inspired designs. This delightful collection is expected to captivate color-loving Southerners, who will undoubtedly be enamored by its charming aesthetics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Wallpaper Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Wallpaper Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Wallpaper Market?

To stay informed about further developments, trends, and reports in the Commercial Wallpaper Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence