Key Insights

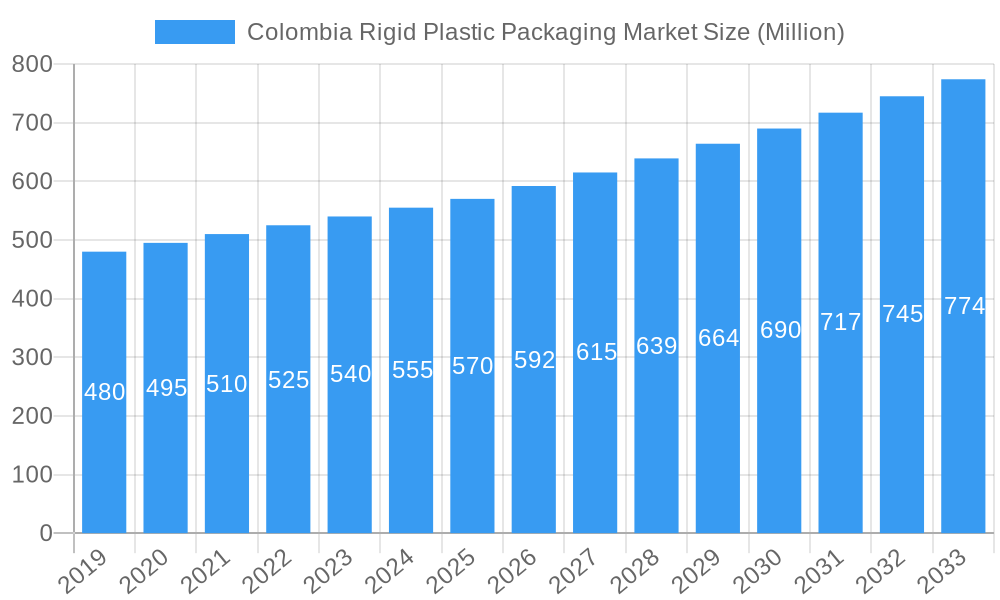

The Colombian rigid plastic packaging market is projected for significant growth, driven by robust demand from the food and beverage sectors. With an estimated market size of 0.84 million in 2025 and a Compound Annual Growth Rate (CAGR) of 3.87% through 2033, the market demonstrates a strong expansion trajectory. This growth is fueled by increasing packaged goods consumption, the expanding foodservice industry, and the rising demand for convenient, safe packaging. Key product types including bottles, jars, trays, containers, caps, and closures are expected to see considerable adoption, aligning with global consumer preferences for single-use and resealable packaging. The prevalence of Polyethylene (PE) and Polypropylene (PP) as primary materials highlights their versatility, durability, and cost-effectiveness across diverse end-user industries.

Colombia Rigid Plastic Packaging Market Market Size (In Million)

Evolving consumer lifestyles, coupled with an increasing focus on product safety and shelf-life extension, particularly within the food and healthcare sectors, further bolster market expansion. The growing adoption of rigid plastic packaging by the cosmetics and personal care industry also contributes to market momentum. While strong growth drivers are present, potential restraints such as environmental concerns and evolving regulations surrounding plastic waste management may necessitate increased investment in sustainable packaging alternatives and recycling initiatives.

Colombia Rigid Plastic Packaging Market Company Market Share

This comprehensive report provides an in-depth analysis of the Colombian rigid plastic packaging market, offering crucial insights into its dynamics, growth trends, product landscape, and competitive environment. Covering the period from 2019 to 2033, with a base year of 2025, this report is an indispensable resource for stakeholders seeking to understand the evolving rigid plastic packaging solutions in Colombia and identify strategic opportunities.

We dissect the market by product type (Bottles and Jars, Trays and Containers, Caps and Closures, Intermediate Bulk Containers (IBCs), Drums, Pallets, Other Product Types), material (Polyethylene (PE) - LDPE & LLDPE, HDPE; Polyethylene Terephthalate (PET); Polypropylene (PP); Polystyrene (PS) and Expanded Polystyrene (EPS); Polyvinyl Chloride (PVC); Other Rigid Plastic Packaging Materials), and end-user industries (Food - Candy & Confectionery, Frozen Foods, Fresh Produce, Dairy Products, Dry Foods, Meat, Poultry, and Seafood, Pet Food, Other Food Products; Foodservice - Quick Service Restaurants (QSRs), Full-Service Restaurants (FSRs), Coffee and Snack Outlets, Retail Establishments, Institutional, Hospitality, Other Foodservice End Uses; Beverage; Healthcare; Cosmetics and Personal Care; Industrial; Building and Construction; Automotive; Other). The report presents all values in Million Units, ensuring clarity and precision.

Key companies shaping this market include ALPLA Werke Alwin Lehner GmbH & Co KG, Berry Global Inc, Amcor Group GmbH, Greif Inc, Amfora Packaging SAS, Weener Plastics Group BV, Sonoco Products Company, RPM Colombia SAS, Aptar Group Inc, and Proplas SA. Through detailed Heat Map Analysis and Competitor Analysis focusing on Emerging vs Established Players, we deliver actionable intelligence.

Colombia Rigid Plastic Packaging Market Dynamics & Structure

The Colombia rigid plastic packaging market is characterized by a moderately consolidated structure, with a few major players holding significant market share. Technological innovation is a key driver, with companies continuously investing in advanced manufacturing processes and sustainable material development to meet evolving regulatory demands and consumer preferences. Stringent regulatory frameworks, particularly concerning waste management and the use of recycled content, are shaping product development and market entry strategies. Competitive product substitutes, such as flexible packaging and alternative materials, present ongoing challenges, necessitating continuous innovation in performance and cost-effectiveness. End-user demographics, particularly the growing middle class and increasing demand for convenience in food and beverage sectors, are major contributors to market growth. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios, gain market access, and achieve economies of scale. For instance, recent M&A activities indicate a trend towards consolidating production capabilities and enhancing supply chain efficiencies. The market's concentration is influenced by the significant capital investment required for advanced manufacturing, leading to strategic alliances and partnerships becoming increasingly prevalent.

Colombia Rigid Plastic Packaging Market Growth Trends & Insights

The rigid plastic packaging market in Colombia is poised for robust growth, driven by escalating demand across diverse end-user industries and evolving consumer behaviors. The market size is projected to witness a substantial increase, fueled by a healthy CAGR during the forecast period. Adoption rates for advanced packaging solutions, particularly those incorporating sustainability features, are on an upward trajectory. Technological disruptions, including advancements in material science and manufacturing techniques, are enabling the development of lighter, more durable, and recyclable rigid plastic packaging. Consumer behavior shifts, such as a greater emphasis on product safety, shelf-life extension, and convenience, are directly impacting the demand for high-quality rigid packaging. The food and beverage sector continues to be a primary growth engine, owing to population growth and increasing per capita consumption. Similarly, the healthcare and cosmetics industries are demanding specialized rigid packaging solutions that offer protection, aesthetics, and compliance with stringent safety standards. The penetration of e-commerce is also indirectly boosting the market by increasing the need for protective secondary packaging. This confluence of factors is expected to drive sustained market expansion, with innovation in material composition and design playing a pivotal role in capturing market share and meeting future demands.

Dominant Regions, Countries, or Segments in Colombia Rigid Plastic Packaging Market

The Colombia rigid plastic packaging market demonstrates significant dominance within specific segments, driven by a confluence of economic, demographic, and industrial factors.

- Product Type Dominance: The Bottles and Jars segment holds a commanding position, primarily due to its pervasive application across the Beverage, Food, and Cosmetics and Personal Care industries. The inherent versatility, reusability, and barrier properties of PET and HDPE bottles make them the preferred choice for a vast array of liquid and semi-liquid products. For instance, the demand for bottled water, soft drinks, juices, and edible oils directly fuels the growth of this segment. Similarly, cosmetic and pharmaceutical products heavily rely on bottles for packaging.

- Material Dominance: Polyethylene Terephthalate (PET) stands out as the dominant material. Its excellent clarity, strength-to-weight ratio, and recyclability make it ideal for beverage bottles and food containers. The increasing focus on sustainability and the circular economy further bolsters PET's appeal. Polyethylene (PE), particularly HDPE, also commands a substantial market share, especially for opaque containers, detergents, and industrial chemicals, owing to its chemical resistance and durability.

- End-User Industry Dominance: The Food industry is the largest consumer of rigid plastic packaging, followed closely by the Beverage sector.

- Food Industry Drivers: Within the food sector, Dairy Products, Dry Foods, and Frozen Foods are particularly significant. The need for extended shelf life, protection from contamination, and visual appeal drives the demand for trays, containers, and bottles. The expanding processed food market and the growing consumer preference for pre-packaged meals contribute to this dominance. For example, the market for yogurt cups, cheese trays, and ready-to-eat meal containers is substantial.

- Beverage Industry Drivers: The constant demand for bottled water, carbonated soft drinks, and juices ensures the sustained growth of rigid plastic packaging in the beverage industry. The industry's ability to innovate with lighter and more sustainable bottle designs further solidifies its leading position.

Economic policies promoting industrial growth, coupled with investments in infrastructure that improve supply chain logistics, are key enablers for these dominant segments. The increasing disposable income of consumers and their evolving lifestyles further propel the demand for packaged goods, thus reinforcing the dominance of these segments. The market's growth potential within these dominant areas remains high, driven by ongoing innovation and the expanding consumer base.

Colombia Rigid Plastic Packaging Market Product Landscape

The product landscape of the Colombia rigid plastic packaging market is dynamic, with continuous innovation focused on enhanced functionality and sustainability. Bottles and jars, particularly those made from PET, remain a cornerstone, offering excellent transparency and barrier properties for beverages and personal care items. Trays and containers are increasingly sophisticated, incorporating multi-layer structures for extended shelf life in food applications and features like easy-open lids. Caps and closures are seeing advancements in tamper-evident designs and lightweighting. Intermediate Bulk Containers (IBCs) and drums are crucial for industrial applications, with a growing emphasis on durability and recyclability. Unique selling propositions include the development of PCR-infused packaging, offering brands a sustainable choice without compromising performance. Technological advancements are enabling thinner wall designs and improved impact resistance, reducing material usage and overall carbon footprint.

Key Drivers, Barriers & Challenges in Colombia Rigid Plastic Packaging Market

Key Drivers:

- Growing Demand for Packaged Goods: An expanding middle class and urbanization are increasing the consumption of packaged food, beverages, and personal care products.

- Sustainability Initiatives: The push for recycled content (PCR) and recyclability is a significant driver for innovation and adoption of eco-friendly rigid plastics.

- Technological Advancements: Improvements in manufacturing processes and material science enable lighter, stronger, and more cost-effective packaging solutions.

- Convenience and Shelf-Life Extension: Consumers' demand for convenience and longer shelf-life products necessitates robust and protective packaging.

Barriers & Challenges:

- Plastic Waste Management and Environmental Concerns: Negative public perception and regulatory pressures regarding plastic pollution pose a significant challenge.

- Volatility in Raw Material Prices: Fluctuations in the prices of crude oil and its derivatives can impact the cost of plastic resins.

- Competition from Alternative Materials: Growing use of glass, metal, and paper-based packaging presents a competitive threat.

- Infrastructure for Recycling: Limited and underdeveloped recycling infrastructure in some regions can hinder the circular economy model for rigid plastics.

- Regulatory Compliance: Navigating evolving environmental regulations and product safety standards requires ongoing investment and adaptation.

Emerging Opportunities in Colombia Rigid Plastic Packaging Market

Emerging opportunities in the Colombia rigid plastic packaging market lie in the increasing demand for sustainable packaging solutions, particularly those incorporating post-consumer recycled (PCR) content. The growth of e-commerce presents a significant opportunity for specialized protective rigid packaging. Furthermore, the expanding healthcare sector's need for sterile, tamper-evident, and precisely designed rigid containers offers substantial growth potential. Untapped markets in less developed regions of Colombia, coupled with evolving consumer preferences for premium and convenient packaging in niche food and beverage segments, represent further avenues for expansion. Innovations in smart packaging, including those with integrated tracking or quality indicators, are also poised to gain traction.

Growth Accelerators in the Colombia Rigid Plastic Packaging Market Industry

Several catalysts are accelerating the growth of the Colombia rigid plastic packaging industry. Technological breakthroughs in blow molding and injection molding techniques are enabling the production of more complex and lightweight designs, optimizing material usage and reducing costs. Strategic partnerships between packaging manufacturers and resin suppliers are fostering innovation in sustainable materials. Market expansion strategies, including the development of localized production facilities and distribution networks, are crucial for catering to the diverse needs of the Colombian market. Furthermore, a growing awareness and adoption of circular economy principles are driving investments in recycling technologies and the use of rPET and other recycled rigid plastics, creating a virtuous cycle of growth and sustainability.

Key Players Shaping the Colombia Rigid Plastic Packaging Market Market

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Berry Global Inc

- Amcor Group GmbH

- Greif Inc

- Amfora Packaging SAS

- Weener Plastics Group BV

- Sonoco Products Company

- RPM Colombia SAS

- Aptar Group Inc

- Proplas SA

Notable Milestones in Colombia Rigid Plastic Packaging Market Sector

- August 2024: Aptar Group Inc. introduced a new lightweight disc top closure for beauty, personal care, and home care products. This closure, made from PP with PCR content, offers various finishes and customization options, enhancing product differentiation.

- May 2024: ALPLA Werke Alwin Lehner GmbH & Co. KG unveiled a recyclable wine bottle made from PET, reducing carbon consumption by 38% compared to glass. The company aims for an annual production of one million units from rPET starting in 2025.

In-Depth Colombia Rigid Plastic Packaging Market Market Outlook

The Colombia rigid plastic packaging market is on a strong growth trajectory, underpinned by a combination of increasing consumer demand, technological advancements, and a growing commitment to sustainability. The outlook is positive, with continued innovation in lightweighting, increased use of recycled materials, and the development of specialized packaging solutions for diverse end-user industries. Strategic investments in expanding production capacity and enhancing recycling infrastructure will be key to unlocking the full market potential. The market is well-positioned to capitalize on opportunities arising from evolving consumer preferences for convenience, safety, and environmentally responsible products, ensuring sustained growth and profitability in the coming years.

Colombia Rigid Plastic Packaging Market Segmentation

-

1. Product Type

- 1.1. Bottles and Jars

- 1.2. Trays and Containers

- 1.3. Caps and Closures

- 1.4. Intermediate Bulk Containers (IBCs)

- 1.5. Drums

- 1.6. Pallets

- 1.7. Other Product Types

-

2. Material

-

2.1. Polyethylene (PE)

- 2.1.1. LDPE & LLDPE

- 2.1.2. HDPE

- 2.2. Polyethylene Terephthalate (PET)

- 2.3. Polypropylene (PP)

- 2.4. Polystyrene (PS) and Expanded Polystyrene (EPS)

- 2.5. Polyvinyl Chloride (PVC)

- 2.6. Other Rigid Plastic Packaging Materials

-

2.1. Polyethylene (PE)

-

3. End-user Industries

-

3.1. Food**

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, and Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Food Products

-

3.2. Foodservice**

- 3.2.1. Quick Service Restaurants (QSRs)

- 3.2.2. Full-Service Restaurants (FSRs)

- 3.2.3. Coffee and Snack Outlets

- 3.2.4. Retail Establishments

- 3.2.5. Institutional

- 3.2.6. Hospitality

- 3.2.7. Other Foodservice End Uses

- 3.3. Beverage

- 3.4. Healthcare

- 3.5. Cosmetics and Personal Care

- 3.6. Industrial

- 3.7. Building and Construction

- 3.8. Automotive

- 3.9. Other En

-

3.1. Food**

Colombia Rigid Plastic Packaging Market Segmentation By Geography

- 1. Colombia

Colombia Rigid Plastic Packaging Market Regional Market Share

Geographic Coverage of Colombia Rigid Plastic Packaging Market

Colombia Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand in the Food and Beverage Industry; Increasing Popularity of E-commerce Channels to Boost Cosmetic and Personal Care Industry

- 3.3. Market Restrains

- 3.3.1. Rising Demand in the Food and Beverage Industry; Increasing Popularity of E-commerce Channels to Boost Cosmetic and Personal Care Industry

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) Segment is Estimated to Have the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bottles and Jars

- 5.1.2. Trays and Containers

- 5.1.3. Caps and Closures

- 5.1.4. Intermediate Bulk Containers (IBCs)

- 5.1.5. Drums

- 5.1.6. Pallets

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyethylene (PE)

- 5.2.1.1. LDPE & LLDPE

- 5.2.1.2. HDPE

- 5.2.2. Polyethylene Terephthalate (PET)

- 5.2.3. Polypropylene (PP)

- 5.2.4. Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.2.5. Polyvinyl Chloride (PVC)

- 5.2.6. Other Rigid Plastic Packaging Materials

- 5.2.1. Polyethylene (PE)

- 5.3. Market Analysis, Insights and Forecast - by End-user Industries

- 5.3.1. Food**

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, and Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Food Products

- 5.3.2. Foodservice**

- 5.3.2.1. Quick Service Restaurants (QSRs)

- 5.3.2.2. Full-Service Restaurants (FSRs)

- 5.3.2.3. Coffee and Snack Outlets

- 5.3.2.4. Retail Establishments

- 5.3.2.5. Institutional

- 5.3.2.6. Hospitality

- 5.3.2.7. Other Foodservice End Uses

- 5.3.3. Beverage

- 5.3.4. Healthcare

- 5.3.5. Cosmetics and Personal Care

- 5.3.6. Industrial

- 5.3.7. Building and Construction

- 5.3.8. Automotive

- 5.3.9. Other En

- 5.3.1. Food**

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ALPLA Werke Alwin Lehner GmbH & Co KG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Global Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amcor Group GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Greif Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amfora Packaging SAS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Weener Plastics Group BV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sonoco Products Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 RPM Colombia SAS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Aptar Group Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Proplas SA8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ALPLA Werke Alwin Lehner GmbH & Co KG

List of Figures

- Figure 1: Colombia Rigid Plastic Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Colombia Rigid Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Colombia Rigid Plastic Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Colombia Rigid Plastic Packaging Market Revenue million Forecast, by Material 2020 & 2033

- Table 3: Colombia Rigid Plastic Packaging Market Revenue million Forecast, by End-user Industries 2020 & 2033

- Table 4: Colombia Rigid Plastic Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Colombia Rigid Plastic Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Colombia Rigid Plastic Packaging Market Revenue million Forecast, by Material 2020 & 2033

- Table 7: Colombia Rigid Plastic Packaging Market Revenue million Forecast, by End-user Industries 2020 & 2033

- Table 8: Colombia Rigid Plastic Packaging Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia Rigid Plastic Packaging Market?

The projected CAGR is approximately 3.87%.

2. Which companies are prominent players in the Colombia Rigid Plastic Packaging Market?

Key companies in the market include ALPLA Werke Alwin Lehner GmbH & Co KG, Berry Global Inc, Amcor Group GmbH, Greif Inc, Amfora Packaging SAS, Weener Plastics Group BV, Sonoco Products Company, RPM Colombia SAS, Aptar Group Inc, Proplas SA8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Colombia Rigid Plastic Packaging Market?

The market segments include Product Type, Material, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.84 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand in the Food and Beverage Industry; Increasing Popularity of E-commerce Channels to Boost Cosmetic and Personal Care Industry.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) Segment is Estimated to Have the Largest Market Share.

7. Are there any restraints impacting market growth?

Rising Demand in the Food and Beverage Industry; Increasing Popularity of E-commerce Channels to Boost Cosmetic and Personal Care Industry.

8. Can you provide examples of recent developments in the market?

•August 2024: Aptar Group Inc., a US-based company with operations in Colombia, unveiled a new lightweight disc top closure tailored for beauty, personal care, and home care products. Crafted from polypropylene (PP) and infused with post-consumer recycled (PCR) content, the company provides a range of frost and gloss finishes. Furthermore, brands can personalize the closure with logos or marketing messages, enhancing product differentiation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Colombia Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence