Key Insights

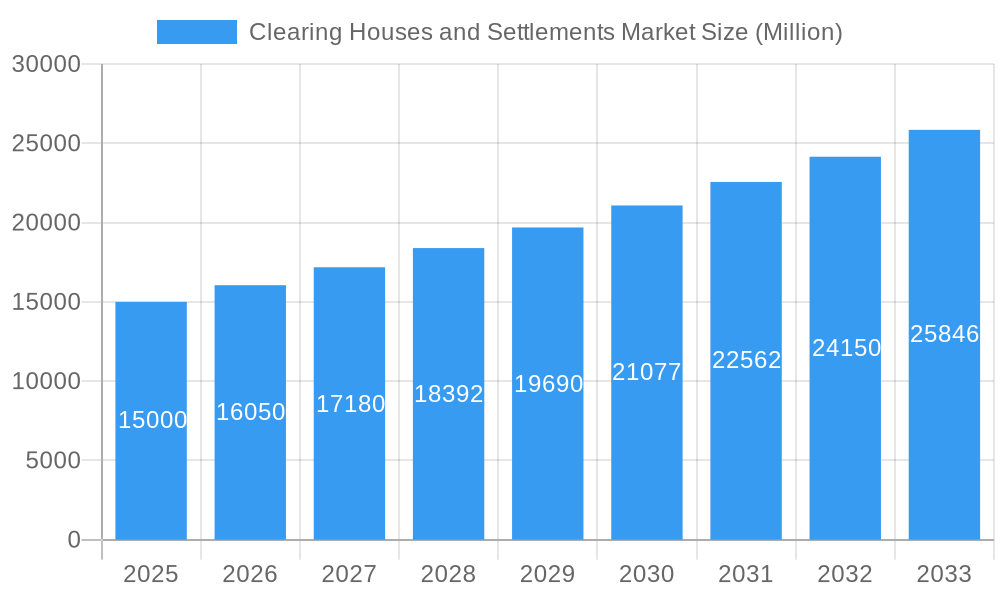

The Clearing Houses and Settlements Market is poised for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of 8% from 2025 to 2033. This growth is primarily fueled by the escalating volume of global financial transactions, amplified by the proliferation of electronic trading and the burgeoning digital economy. Stringent regulatory mandates, particularly in the wake of the 2008 financial crisis, are compelling financial institutions to adopt advanced clearing and settlement solutions for enhanced risk mitigation and transparency. The market is segmented by type, including Outward and Inward Clearing Houses, and by service, such as TARGET, SEPA, EBICS, and Other Services.

Clearing Houses and Settlements Market Market Size (In Billion)

North America and Europe are expected to maintain their market dominance, while the Asia-Pacific region presents substantial growth opportunities, driven by expanding financial markets and rapid technological adoption in economies like China and India. The competitive environment is dynamic, featuring established entities such as National Financial Services, Apex Clearing, and JP Morgan Clearing Corp, alongside innovative fintech companies. The integration of automation and blockchain technology presents both opportunities and challenges, necessitating continuous adaptation and strategic investment in technological infrastructure.

Clearing Houses and Settlements Market Company Market Share

Key service segments, including TARGET, SEPA, and EBICS, constitute major market components, each addressing specific transaction types and regulatory frameworks. The "Other Services" category encompasses emerging technologies and specialized solutions, contributing to market vitality. Regional growth trajectories are shaped by economic development, regulatory environments, and technological adoption rates. While North America and Europe represent mature markets, the Asia-Pacific region, especially China and India, is anticipated to experience accelerated growth due to its expanding financial sector. The competitive landscape is characterized by a confluence of established financial powerhouses and agile, technology-driven firms, fostering innovation and driving improvements in the efficiency and security of clearing and settlement processes. The long-term outlook for the Clearing Houses and Settlements Market remains robust, supported by sustained growth in global financial transactions and ongoing technological advancements.

Clearing Houses and Settlements Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Clearing Houses and Settlements Market, encompassing market dynamics, growth trends, regional insights, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The market is segmented by type (Outward Clearing House, Inward Clearing House) and service (TARGET, SEPA, EBICS, Other Services). The report reveals significant growth potential across various segments and regions, driven by technological advancements and regulatory changes. The market size is projected to reach xx Million by 2033.

Clearing Houses and Settlements Market Market Dynamics & Structure

The Clearing Houses and Settlements market is characterized by a moderate level of concentration, with a few major players holding significant market share. The market is estimated at xx Million in 2025, with a projected CAGR of xx% during the forecast period (2025-2033). Technological innovation, particularly in areas like blockchain and AI, is a key driver. However, stringent regulatory frameworks and cybersecurity concerns pose challenges. The market also faces competitive pressure from emerging fintech solutions offering alternative payment processing methods. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with xx deals recorded in the past 5 years.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Adoption of blockchain technology and AI for improved efficiency and security is a major driver.

- Regulatory Frameworks: Compliance with regulations like KYC/AML and GDPR significantly impacts operational costs.

- Competitive Substitutes: Fintech companies offering alternative payment solutions pose a competitive threat.

- End-User Demographics: The market comprises a diverse range of financial institutions, corporations, and individuals.

- M&A Trends: Consolidation is expected to increase in the coming years, driven by the need for scale and enhanced technology.

Clearing Houses and Settlements Market Growth Trends & Insights

The Clearing Houses and Settlements market experienced significant growth during the historical period (2019-2024), driven by increasing digital transactions and the expanding adoption of electronic payment systems. The market size grew from xx Million in 2019 to xx Million in 2024. The CAGR during this period was xx%. Technological disruptions, including the rise of real-time payment systems and improved cybersecurity measures, have accelerated adoption rates. Shifting consumer behavior towards cashless transactions further fuels market expansion. The forecast period (2025-2033) anticipates continued growth, with market penetration expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Clearing Houses and Settlements Market

North America currently dominates the Clearing Houses and Settlements market, holding a market share of approximately xx% in 2025, followed by Europe with xx%. This dominance is attributed to factors such as robust financial infrastructure, well-established regulatory frameworks, and high adoption rates of electronic payment systems. Within the segments, the Outward Clearing House segment is expected to witness faster growth compared to the Inward Clearing House segment due to the increasing volume of cross-border transactions. Similarly, the TARGET service segment shows significant growth potential due to its wide usage across Europe.

- Key Drivers (North America): Advanced technological infrastructure, strong regulatory environment, high transaction volumes.

- Key Drivers (Europe): Wide adoption of SEPA and TARGET systems, growing cross-border transactions.

- Dominance Factors: Developed financial infrastructure, supportive regulatory environment, high transaction volumes.

- Growth Potential: Expanding digital payments, increasing cross-border transactions, and technological advancements offer significant growth opportunities.

Clearing Houses and Settlements Market Product Landscape

The Clearing Houses and Settlements market offers a range of products and services, including various clearing and settlement platforms, specialized software solutions, and value-added services such as risk management and reconciliation tools. Recent product innovations focus on improving speed, security, and efficiency through the integration of AI and blockchain technologies. Unique selling propositions include real-time settlement capabilities, enhanced security features, and streamlined user interfaces.

Key Drivers, Barriers & Challenges in Clearing Houses and Settlements Market

Key Drivers: The increasing volume of digital transactions, the growing demand for real-time payments, and the rising adoption of mobile and online banking are key drivers. Government initiatives promoting digital financial inclusion also fuel market growth.

Key Challenges: Stringent regulatory compliance, cybersecurity threats, and the need for significant upfront investment in infrastructure pose major challenges. The complexity of integrating legacy systems with new technologies also hampers market growth. A potential regulatory change impacting interoperability could reduce market growth by an estimated xx% in the next 5 years.

Emerging Opportunities in Clearing Houses and Settlements Market

Untapped markets in emerging economies, particularly in Asia and Africa, present significant growth opportunities. The increasing demand for specialized clearing and settlement solutions for specific industries, such as cryptocurrencies and decentralized finance (DeFi), also offers promising avenues. The development of innovative payment solutions, tailored to the evolving needs of consumers and businesses, is another key area for growth.

Growth Accelerators in the Clearing Houses and Settlements Market Industry

Technological advancements such as artificial intelligence (AI), machine learning (ML), and distributed ledger technology (DLT) are major catalysts for growth. Strategic partnerships and collaborations between financial institutions and technology providers are also crucial. Government initiatives promoting the adoption of digital payments and financial inclusion further enhance market expansion.

Key Players Shaping the Clearing Houses and Settlements Market Market

- National Financial Services LLC

- Apex Clearing

- Bank of America Merrill Lynch

- RBC Correspondent Services

- Pershing LLC

- J P Morgan Clearing Corp

- FOLIOfn Inc

- Goldman Sachs Execution and Clearing LP

- StoneX

- Southwest Securities Inc *List Not Exhaustive

Notable Milestones in Clearing Houses and Settlements Market Sector

- January 2023: The Clearing House (TCH) announced the retirement of its President and CEO, Jim Aramanda, and the appointment of David Watson as his successor. This transition may lead to strategic shifts in the company's direction.

- December 2022: Airwallex partnered with Plaid to streamline ACH payments, potentially increasing efficiency and market penetration for ACH services.

- November 2022: Finxact and KPMG collaborated to promote embedded finance, potentially impacting the modernization of banking infrastructure and clearing processes.

In-Depth Clearing Houses and Settlements Market Market Outlook

The Clearing Houses and Settlements market is poised for robust growth in the coming years, driven by the sustained increase in digital transactions, technological advancements, and the expansion of financial inclusion initiatives. Strategic partnerships, the adoption of innovative technologies like AI and blockchain, and market expansion into underserved regions will present significant opportunities for growth and profitability. The market's future potential is strong, promising high returns for investors and stakeholders.

Clearing Houses and Settlements Market Segmentation

-

1. Type

- 1.1. Outward Clearing House

- 1.2. Inward Clearing House

-

2. Service

- 2.1. TARGET2

- 2.2. SEPA

- 2.3. EBICS

-

2.4. Other Services

- 2.4.1. EURO1

- 2.4.2. CCBM

Clearing Houses and Settlements Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Clearing Houses and Settlements Market Regional Market Share

Geographic Coverage of Clearing Houses and Settlements Market

Clearing Houses and Settlements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Cost Acts as a Restraint to the Market

- 3.4. Market Trends

- 3.4.1. Target2 is Driving Europe's Clearing and Settlements Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Outward Clearing House

- 5.1.2. Inward Clearing House

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. TARGET2

- 5.2.2. SEPA

- 5.2.3. EBICS

- 5.2.4. Other Services

- 5.2.4.1. EURO1

- 5.2.4.2. CCBM

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Outward Clearing House

- 6.1.2. Inward Clearing House

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. TARGET2

- 6.2.2. SEPA

- 6.2.3. EBICS

- 6.2.4. Other Services

- 6.2.4.1. EURO1

- 6.2.4.2. CCBM

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Outward Clearing House

- 7.1.2. Inward Clearing House

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. TARGET2

- 7.2.2. SEPA

- 7.2.3. EBICS

- 7.2.4. Other Services

- 7.2.4.1. EURO1

- 7.2.4.2. CCBM

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Outward Clearing House

- 8.1.2. Inward Clearing House

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. TARGET2

- 8.2.2. SEPA

- 8.2.3. EBICS

- 8.2.4. Other Services

- 8.2.4.1. EURO1

- 8.2.4.2. CCBM

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Outward Clearing House

- 9.1.2. Inward Clearing House

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. TARGET2

- 9.2.2. SEPA

- 9.2.3. EBICS

- 9.2.4. Other Services

- 9.2.4.1. EURO1

- 9.2.4.2. CCBM

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Outward Clearing House

- 10.1.2. Inward Clearing House

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. TARGET2

- 10.2.2. SEPA

- 10.2.3. EBICS

- 10.2.4. Other Services

- 10.2.4.1. EURO1

- 10.2.4.2. CCBM

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 National Financial Services LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Apex Clearing

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bank of America Merrill Lynch

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 RBC Correspondent Services

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pershing LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 J P Morgan Clearing Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FOLIOfn Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Goldman Sachs Execution and Clearing LP

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 StoneX

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Southwest Securities Inc*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 National Financial Services LLC

List of Figures

- Figure 1: Global Clearing Houses and Settlements Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Clearing Houses and Settlements Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Clearing Houses and Settlements Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Clearing Houses and Settlements Market Revenue (billion), by Service 2025 & 2033

- Figure 5: North America Clearing Houses and Settlements Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America Clearing Houses and Settlements Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Clearing Houses and Settlements Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Clearing Houses and Settlements Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Clearing Houses and Settlements Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Clearing Houses and Settlements Market Revenue (billion), by Service 2025 & 2033

- Figure 11: Europe Clearing Houses and Settlements Market Revenue Share (%), by Service 2025 & 2033

- Figure 12: Europe Clearing Houses and Settlements Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Clearing Houses and Settlements Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Clearing Houses and Settlements Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Clearing Houses and Settlements Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Clearing Houses and Settlements Market Revenue (billion), by Service 2025 & 2033

- Figure 17: Asia Pacific Clearing Houses and Settlements Market Revenue Share (%), by Service 2025 & 2033

- Figure 18: Asia Pacific Clearing Houses and Settlements Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Clearing Houses and Settlements Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Clearing Houses and Settlements Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Clearing Houses and Settlements Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Clearing Houses and Settlements Market Revenue (billion), by Service 2025 & 2033

- Figure 23: Latin America Clearing Houses and Settlements Market Revenue Share (%), by Service 2025 & 2033

- Figure 24: Latin America Clearing Houses and Settlements Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Clearing Houses and Settlements Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Clearing Houses and Settlements Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Clearing Houses and Settlements Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Clearing Houses and Settlements Market Revenue (billion), by Service 2025 & 2033

- Figure 29: Middle East and Africa Clearing Houses and Settlements Market Revenue Share (%), by Service 2025 & 2033

- Figure 30: Middle East and Africa Clearing Houses and Settlements Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Clearing Houses and Settlements Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 3: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 9: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 12: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 15: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Clearing Houses and Settlements Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Clearing Houses and Settlements Market?

Key companies in the market include National Financial Services LLC, Apex Clearing, Bank of America Merrill Lynch, RBC Correspondent Services, Pershing LLC, J P Morgan Clearing Corp, FOLIOfn Inc, Goldman Sachs Execution and Clearing LP, StoneX, Southwest Securities Inc*List Not Exhaustive.

3. What are the main segments of the Clearing Houses and Settlements Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 150 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market.

6. What are the notable trends driving market growth?

Target2 is Driving Europe's Clearing and Settlements Market.

7. Are there any restraints impacting market growth?

Increasing Cost Acts as a Restraint to the Market.

8. Can you provide examples of recent developments in the market?

January 2023: The Clearing House (TCH) announced that President and CEO Jim Aramanda will be retiring in early 2023, after 15 years leading the company. Aramanda will be succeeded by David Watson, who most recently served as Chief Product Officer of Swift.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Clearing Houses and Settlements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Clearing Houses and Settlements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Clearing Houses and Settlements Market?

To stay informed about further developments, trends, and reports in the Clearing Houses and Settlements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence