Key Insights

The China SLI (Starting, Lighting, and Ignition) battery market, valued at $5.62 billion in 2025, is projected to experience robust growth, driven by the burgeoning automotive sector and increasing demand for reliable power solutions. A compound annual growth rate (CAGR) of 4.46% from 2025 to 2033 indicates a significant market expansion, reaching an estimated $8.2 billion by 2033. This growth is fueled by several key factors: rising vehicle ownership, particularly in less developed regions of China, necessitating replacement batteries; the increasing adoption of advanced automotive technologies like start-stop systems, which put higher demands on battery performance; and government initiatives promoting electric vehicle (EV) adoption, indirectly boosting SLI battery demand for hybrid and conventional vehicles. Furthermore, technological advancements in battery design, leading to enhanced lifespan and performance, contribute to the market's upward trajectory. However, challenges remain, including fluctuating raw material prices, intense competition among domestic and international players, and environmental concerns related to battery disposal and recycling. Major players like GS Yuasa, Tianneng Battery Group, and Contemporary Amperex Technology (CATL) are actively engaged in innovation and strategic partnerships to maintain market dominance and navigate these challenges.

China SLI Battery Market Market Size (In Billion)

The competitive landscape is highly fragmented, with both established international players and rapidly growing domestic companies vying for market share. This competitive environment fosters innovation and drives down prices, benefiting consumers. The market segmentation (data not provided) likely includes variations based on battery chemistry (lead-acid, lithium-ion, etc.), vehicle type (passenger cars, commercial vehicles), and distribution channels. Regional variations in growth will likely reflect differing levels of automotive penetration and economic development across China's diverse regions. Understanding these dynamics is crucial for companies aiming to capitalize on this expanding market, demanding a focused approach on technological advancement, strategic partnerships, and effective distribution networks to capture and sustain a competitive edge.

China SLI Battery Market Company Market Share

China SLI Battery Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China SLI (Starting, Lighting, and Ignition) battery market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report is an indispensable resource for industry professionals, investors, and stakeholders seeking a clear understanding of this vital market segment. The total market size is predicted to reach xx Million units by 2033.

China SLI Battery Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the China SLI battery market. The market is characterized by a moderate level of concentration, with key players vying for market share. Technological innovation is driven by the demand for higher energy density, longer lifespan, and improved performance. Stringent environmental regulations are pushing manufacturers towards eco-friendly battery technologies. The report also explores the impact of mergers and acquisitions (M&A) activities on market consolidation and growth. The historical period (2019-2024) shows an average of xx M&A deals per year, with a projected increase in the forecast period.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on improved energy density, lifespan, and safety features. Barriers to innovation include high R&D costs and stringent safety standards.

- Regulatory Framework: Stringent environmental regulations drive the adoption of eco-friendly technologies. Government policies promoting electric vehicles indirectly impact SLI battery demand.

- Competitive Substitutes: Alternative energy storage solutions pose a competitive threat, but SLI batteries remain dominant in their niche applications.

- End-User Demographics: Primarily automotive, motorcycles, and other light vehicles. Growth is tied to vehicle sales and replacement cycles.

- M&A Trends: Consolidation is expected to continue, driven by economies of scale and technology acquisition.

China SLI Battery Market Growth Trends & Insights

The China SLI battery market has experienced significant growth over the historical period (2019-2024), driven by increasing vehicle sales and replacement demand. The market size reached xx Million units in 2024, and is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by expanding automotive sector, increasing disposable incomes leading to higher vehicle ownership, and government initiatives promoting the adoption of technologically advanced vehicles. The report further details consumer behavior shifts towards higher-performing and longer-lasting batteries and how technological disruptions influence market dynamics. Market penetration is expected to reach xx% by 2033.

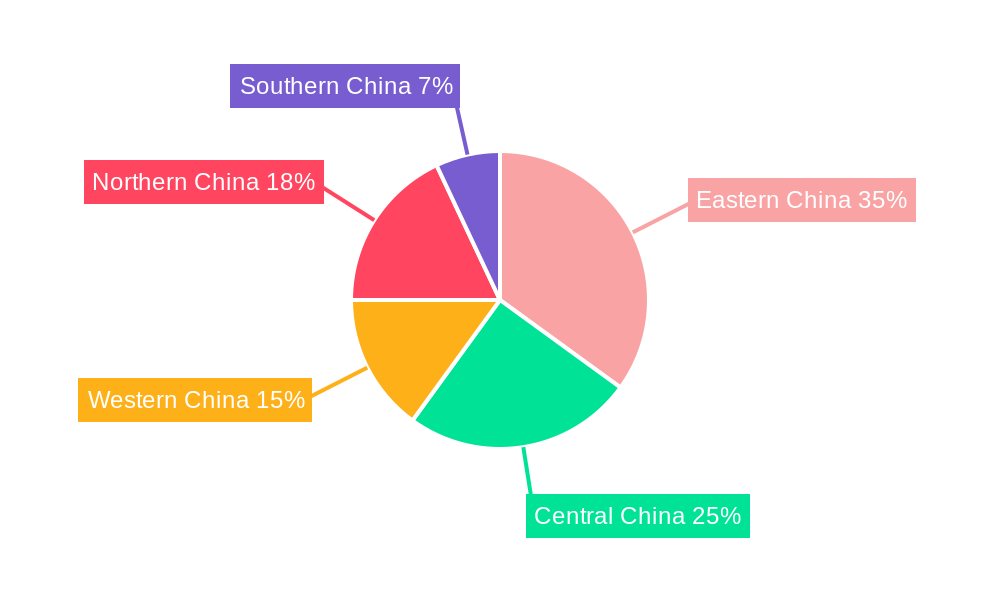

Dominant Regions, Countries, or Segments in China SLI Battery Market

The coastal regions of China, particularly Guangdong and Jiangsu provinces, dominate the SLI battery market, owing to the high concentration of automotive manufacturing and related industries. These regions benefit from robust infrastructure, supportive government policies, and a skilled workforce. The report provides a detailed analysis of regional variations in market size, growth rates, and key drivers, offering a comprehensive understanding of the geographical distribution of the market.

- Key Drivers: Strong automotive manufacturing base, well-developed infrastructure, supportive government policies, and skilled workforce.

- Dominance Factors: High vehicle production, proximity to raw material sources, and established supply chains.

- Growth Potential: Further growth is expected in less-developed regions due to increasing vehicle penetration.

China SLI Battery Market Product Landscape

The China SLI battery market offers a diverse range of products, including lead-acid batteries, which currently dominate the market. However, there is a growing trend towards advanced battery technologies, such as lithium-ion batteries, for specific applications where higher energy density and longer lifespan are required. These advancements are driven by the increasing demand for enhanced performance and longer service life in electric vehicles. Manufacturers continuously focus on improving product features like cold-cranking amperage, reserve capacity, and overall durability.

Key Drivers, Barriers & Challenges in China SLI Battery Market

Key Drivers:

- Increasing vehicle sales, particularly motorcycles and light vehicles.

- Government initiatives supporting the automotive industry.

- Expanding infrastructure and urbanization.

Challenges and Restraints:

- Intense competition among manufacturers.

- Fluctuations in raw material prices (e.g., lead).

- Stringent environmental regulations. Estimated compliance costs for manufacturers are projected at xx Million units annually by 2030.

Emerging Opportunities in China SLI Battery Market

- Growing demand for electric vehicles and hybrid vehicles is creating opportunities for advanced battery technologies.

- Expanding use of SLI batteries in energy storage systems for renewable energy applications.

- The development of cost-effective and environmentally friendly battery technologies.

Growth Accelerators in the China SLI Battery Market Industry

Technological advancements, particularly in lead-acid battery technology, and the growing adoption of electric vehicles and hybrid vehicles are key catalysts for long-term market growth. Strategic partnerships between battery manufacturers and automotive companies will further accelerate market expansion. Government support in promoting efficient battery recycling solutions and reducing reliance on imported raw materials will play a crucial role.

Key Players Shaping the China SLI Battery Market Market

- GS Yuasa International Ltd

- Tianneng Battery Group Co

- Leoch International Technology Limited Inc

- Contemporary Amperex Technology Co Limited

- Gotion Inc

- Farasis Energy (GanZhou) Co Ltd

- Clarios International Inc

- Guangzhou NPP Power Co Ltd

- Qingyuan Yiyuan Power Supply Co Ltd

- EVE Energy Co Ltd

- List Not Exhaustive

Notable Milestones in China SLI Battery Market Sector

- January 2024: BYD initiates construction of a new USD 1.4 billion battery facility in Xuzhou, with an annual capacity of 30 GWh, targeting micro vehicles and scooters.

- March 2024: Narada Power secures a USD 45 million contract from China Tower for VRLA batteries for backup power systems.

In-Depth China SLI Battery Market Market Outlook

The China SLI battery market is poised for continued growth, driven by the expansion of the automotive sector and increasing demand for reliable and efficient energy storage solutions. Strategic investments in research and development, coupled with government support for sustainable technologies, will further propel market growth. The focus on advanced battery technologies and innovative applications presents significant opportunities for manufacturers to capture market share and drive long-term profitability.

China SLI Battery Market Segmentation

-

1. Type

- 1.1. Flooded Battery

- 1.2. VRLA Battery

- 1.3. EBF Battery

-

2. End User

- 2.1. Automotive

- 2.2. Other End Users

China SLI Battery Market Segmentation By Geography

- 1. China

China SLI Battery Market Regional Market Share

Geographic Coverage of China SLI Battery Market

China SLI Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Automotive Industry4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Automotive Industry4.; Supportive Government Policies

- 3.4. Market Trends

- 3.4.1. VRLA Battery to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China SLI Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flooded Battery

- 5.1.2. VRLA Battery

- 5.1.3. EBF Battery

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GS Yuasa International Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tianneng Battery Group Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Leoch International Technology Limited Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Contemporary Amperex Technology Co Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gotion Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Farasis Energy (GanZhou) Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Clarios International Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Guangzhou NPP Power Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Qingyuan Yiyuan Power Supply Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 EVE Energy Co Ltd*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 GS Yuasa International Ltd

List of Figures

- Figure 1: China SLI Battery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China SLI Battery Market Share (%) by Company 2025

List of Tables

- Table 1: China SLI Battery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China SLI Battery Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: China SLI Battery Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: China SLI Battery Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: China SLI Battery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China SLI Battery Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: China SLI Battery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: China SLI Battery Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: China SLI Battery Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: China SLI Battery Market Volume Billion Forecast, by End User 2020 & 2033

- Table 11: China SLI Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: China SLI Battery Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China SLI Battery Market?

The projected CAGR is approximately 4.46%.

2. Which companies are prominent players in the China SLI Battery Market?

Key companies in the market include GS Yuasa International Ltd, Tianneng Battery Group Co, Leoch International Technology Limited Inc, Contemporary Amperex Technology Co Limited, Gotion Inc, Farasis Energy (GanZhou) Co Ltd, Clarios International Inc, Guangzhou NPP Power Co Ltd, Qingyuan Yiyuan Power Supply Co Ltd, EVE Energy Co Ltd*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi.

3. What are the main segments of the China SLI Battery Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.62 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Automotive Industry4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

VRLA Battery to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Growing Automotive Industry4.; Supportive Government Policies.

8. Can you provide examples of recent developments in the market?

March 2024: Narada Power secured a USD 45 million contract from China Tower for VRLA batteries. This deal focuses on providing backup power systems to the state-owned telecoms giant. Narada emphasized that this contract highlights the strategic importance of its collaborative lead battery chemistry development, which is tailored for a diverse set of industrial applications, including SLI.January 2024: Chinese automotive giant BYD initiated the construction of a new battery facility in Xuzhou, China. With an impressive investment of USD 1.4 billion, this facility is set to boast an annual capacity of 30 gigawatt-hours (GWh). The batteries manufactured here are earmarked for automotive use, specifically targeting micro vehicles and scooters. BYD's subsidiary, Findreams Battery, and tricycle manufacturer Huaihai Group inked the agreement for this venture.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China SLI Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China SLI Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China SLI Battery Market?

To stay informed about further developments, trends, and reports in the China SLI Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence