Key Insights

The China construction machinery market, a significant global player, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 5.10% from 2025 to 2033. This expansion is driven by several key factors. Firstly, substantial government investment in infrastructure development, particularly within the context of China's Belt and Road Initiative, fuels demand for construction equipment. Secondly, the ongoing urbanization and modernization across the country necessitates an increasing volume of construction projects, ranging from residential buildings to large-scale industrial infrastructure. The transition towards more sustainable construction practices also plays a role, stimulating demand for hybrid and electric machinery. While the market faces some constraints, such as fluctuating raw material prices and potential economic slowdowns, the overall positive outlook is reinforced by the continued expansion of sectors like energy and transportation. The dominance of domestic manufacturers like XCMG, Sany Group, and Zoomlion, alongside international players like Caterpillar and Liebherr, creates a competitive landscape that drives innovation and efficiency. Segmentation within the market reveals strong growth in the demand for excavators, loaders, and telescopic handlers, primarily within the infrastructure and building application segments. The OEM sales channel currently holds a significant share, although the aftermarket segment shows promising growth potential.

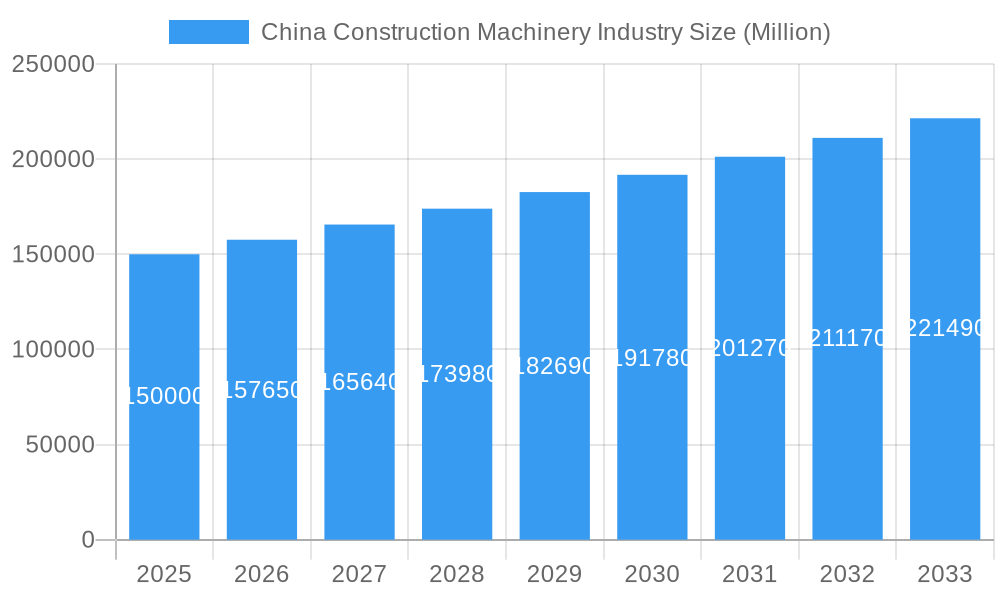

China Construction Machinery Industry Market Size (In Billion)

The market's future trajectory hinges on several crucial trends. The integration of advanced technologies such as automation, AI, and IoT is expected to enhance productivity and efficiency across construction projects. Growing environmental awareness is pushing the adoption of more eco-friendly equipment, favoring hybrid and electric models. Furthermore, the expansion of leasing and rental services is likely to reshape the market dynamics, potentially increasing access to advanced machinery for smaller construction companies. Government policies promoting sustainable development and technological advancements will continue to shape the market's direction. Given these factors, and assuming a 2025 market size of approximately $150 billion (based on typical market sizes for comparable economies and the provided CAGR), the Chinese construction machinery market is poised for continued expansion over the forecast period.

China Construction Machinery Industry Company Market Share

China Construction Machinery Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China construction machinery industry, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for industry professionals, investors, and strategic decision-makers. The report utilizes data and insights to provide a granular understanding of the parent market (Construction Machinery) and its child markets (e.g., Excavators, Cranes). Expected market values are presented in million units.

China Construction Machinery Industry Market Dynamics & Structure

The China construction machinery market is characterized by intense competition, rapid technological advancements, and evolving regulatory landscapes. Market concentration is relatively high, with a few major players dominating significant market share. Technological innovation, driven by the need for increased efficiency, reduced emissions, and enhanced safety, is a key driver. Stringent government regulations regarding environmental protection and safety standards further shape the industry. The market faces competitive pressures from both domestic and international players, with several companies engaging in mergers and acquisitions (M&A) to expand their market share and product portfolios. The number of M&A deals in the period 2019-2024 is estimated at xx.

- Market Concentration: Top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Focus on electrification, automation, and digitalization is prominent. Barriers to innovation include high R&D costs and a shortage of skilled labor.

- Regulatory Framework: Stringent emission standards and safety regulations influence product design and manufacturing.

- Competitive Product Substitutes: Limited direct substitutes exist; however, alternative construction methods impact demand.

- End-User Demographics: Primarily large construction companies and government-led infrastructure projects.

- M&A Trends: Strategic acquisitions and mergers aim to enhance technological capabilities and market reach.

China Construction Machinery Industry Growth Trends & Insights

The China construction machinery market experienced significant growth during the historical period (2019-2024), driven by robust infrastructure development and urbanization. The market size in 2024 reached approximately xx million units. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 was estimated at xx%. Technological disruptions, such as the adoption of electric and hybrid machinery, are transforming the industry. Shifting consumer preferences toward sustainable and technologically advanced equipment are impacting market demand. Market penetration of electric excavators, for instance, is expected to increase from xx% in 2025 to xx% by 2033. The forecast period (2025-2033) projects continued growth, albeit at a potentially moderated pace, influenced by factors such as economic fluctuations and government policies. Market size is predicted to reach xx million units by 2033.

Dominant Regions, Countries, or Segments in China Construction Machinery Industry

The Eastern region of China, including major economic hubs like Shanghai and Beijing, is currently the leading region for construction machinery sales, driven by robust infrastructure development and real estate activities. Within the various segments, excavators constitute the largest segment, accounting for xx% of market share in 2025. The Infrastructure application type represents the highest demand, followed by the Building segment. In the sales channel, OEM (Original Equipment Manufacturer) sales hold a significant majority. Conventional drive type excavators are currently dominating the market, but hybrid and electric drive types are projected to demonstrate significant growth driven by environmental concerns and government incentives.

- Key Drivers for Eastern Region Dominance: Extensive infrastructure projects, high concentration of construction activities, and government support.

- Key Drivers for Excavator Segment Dominance: Versatility, wide range of applications, and relatively high demand in infrastructure and building projects.

- Infrastructure Application Type: The significant government investment in infrastructure projects is the key driver of growth.

China Construction Machinery Industry Product Landscape

The industry showcases a diverse product range, encompassing cranes, telescopic handlers, excavators, loaders and backhoes, and motor graders. Continuous innovation focuses on enhancing efficiency, improving fuel economy (or battery life for electric models), integrating advanced technologies like telematics and automation, and incorporating eco-friendly features. Manufacturers are emphasizing features such as enhanced operator comfort, improved safety mechanisms, and remote diagnostics capabilities to differentiate their offerings and improve the total cost of ownership for their customers.

Key Drivers, Barriers & Challenges in China Construction Machinery Industry

Key Drivers:

- Government investments in infrastructure projects.

- Urbanization and rising construction activities.

- Technological advancements leading to increased efficiency and productivity.

Key Challenges and Restraints:

- Intense competition from both domestic and international players.

- Supply chain disruptions due to global geopolitical events.

- Fluctuations in raw material prices and economic downturns impacting investment. The impact of fluctuating steel prices, for example, is estimated to be xx% on production costs.

- Stringent environmental regulations demanding technological advancements.

Emerging Opportunities in China Construction Machinery Industry

- Growing demand for electric and hybrid construction machinery driven by environmental concerns and government initiatives.

- Expansion into rural areas and less-developed regions presents significant opportunities for market penetration.

- Adoption of advanced technologies such as AI, IoT, and automation for enhanced machine efficiency and safety features.

Growth Accelerators in the China Construction Machinery Industry

Technological breakthroughs in electric and autonomous machinery combined with strategic partnerships between manufacturers and technology providers are key drivers for long-term growth. Government support for infrastructure projects and policies promoting sustainable construction practices further accelerates market expansion. Expanding into new application areas, such as renewable energy infrastructure, will also contribute to future growth.

Key Players Shaping the China Construction Machinery Industry Market

- Kobelco Construction Machinery

- Xuzhou Construction Machinery Group Co Ltd (XCMG)

- Volvo CE

- Sany Group

- Liebherr Group

- China Communications Construction Company

- Caterpillar Inc

- Zoomlion Heavy Industry Science and Technology Co Ltd

- Tadano Ltd

- *List Not Exhaustive

Notable Milestones in China Construction Machinery Industry Sector

- August 2022: XCMG announced the building of its second XE7000 hydraulic excavator, targeting mining customers.

- October 2022: Shantui delivered its first DL300G bulldozer to a customer in Hong Kong for prestigious projects.

- November 2022: XCMG signed USD 60 million purchasing contracts with Kawasaki, Linde Hydraulics, Danfoss, and Daimler, building a high-end supply chain.

- November 2022: XCMG chose Allison transmissions as their exclusive supplier for all-terrain cranes.

In-Depth China Construction Machinery Industry Market Outlook

The China construction machinery market is poised for continued growth, driven by sustained infrastructure development, urbanization, and technological advancements. Strategic opportunities lie in expanding into emerging segments such as electric and autonomous machines, and in leveraging technological innovation to improve efficiency and sustainability. The market is expected to witness a shift toward more environmentally friendly and technologically advanced solutions, presenting exciting prospects for manufacturers who can adapt to these changes.

China Construction Machinery Industry Segmentation

-

1. Machinery Type

- 1.1. Crane

- 1.2. Telescopic Handlers

- 1.3. Excavators

- 1.4. Loaders and Backhoe

- 1.5. Motor Graders

-

2. Drive Type

- 2.1. Conventional

- 2.2. Hybrid and Electric

-

3. Sales Channel

- 3.1. OEM

- 3.2. Aftermarket

-

4. Application Type

- 4.1. Building

- 4.2. Infrastructure

- 4.3. Energy

China Construction Machinery Industry Segmentation By Geography

- 1. China

China Construction Machinery Industry Regional Market Share

Geographic Coverage of China Construction Machinery Industry

China Construction Machinery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Electrification of Construction Equipment May Propel the Market Growth

- 3.3. Market Restrains

- 3.3.1. Construction Rental Business May Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Demand for Excavators to Drive the Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Construction Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Crane

- 5.1.2. Telescopic Handlers

- 5.1.3. Excavators

- 5.1.4. Loaders and Backhoe

- 5.1.5. Motor Graders

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Conventional

- 5.2.2. Hybrid and Electric

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Application Type

- 5.4.1. Building

- 5.4.2. Infrastructure

- 5.4.3. Energy

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kobelco Construction Machinery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xuzhou Construction Machinery Group Co Ltd (XCMG)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Volvo CE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sany Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Liebherr Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China Communications Construction Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Caterpillar Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zoomlion Heavy Industry Science and Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tadano Ltd*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Kobelco Construction Machinery

List of Figures

- Figure 1: China Construction Machinery Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Construction Machinery Industry Share (%) by Company 2025

List of Tables

- Table 1: China Construction Machinery Industry Revenue undefined Forecast, by Machinery Type 2020 & 2033

- Table 2: China Construction Machinery Industry Revenue undefined Forecast, by Drive Type 2020 & 2033

- Table 3: China Construction Machinery Industry Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 4: China Construction Machinery Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 5: China Construction Machinery Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: China Construction Machinery Industry Revenue undefined Forecast, by Machinery Type 2020 & 2033

- Table 7: China Construction Machinery Industry Revenue undefined Forecast, by Drive Type 2020 & 2033

- Table 8: China Construction Machinery Industry Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 9: China Construction Machinery Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 10: China Construction Machinery Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Construction Machinery Industry?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the China Construction Machinery Industry?

Key companies in the market include Kobelco Construction Machinery, Xuzhou Construction Machinery Group Co Ltd (XCMG), Volvo CE, Sany Group, Liebherr Group, China Communications Construction Company, Caterpillar Inc, Zoomlion Heavy Industry Science and Technology Co Ltd, Tadano Ltd*List Not Exhaustive.

3. What are the main segments of the China Construction Machinery Industry?

The market segments include Machinery Type, Drive Type, Sales Channel, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Electrification of Construction Equipment May Propel the Market Growth.

6. What are the notable trends driving market growth?

Growing Demand for Excavators to Drive the Market..

7. Are there any restraints impacting market growth?

Construction Rental Business May Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: XCMG confirmed signed purchasing contracts worth USD 60 million with four major global suppliers, Kawasaki Heavy Industries, Linde Hydraulics AG, Danfoss A/S, and Daimler SE, to build a high-end global supply chain network and maintain resilience in the global construction equipment manufacturing industry. The contracts were signed at the ongoing China International Import Expo (CIIE) in Shanghai.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Construction Machinery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Construction Machinery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Construction Machinery Industry?

To stay informed about further developments, trends, and reports in the China Construction Machinery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence