Key Insights

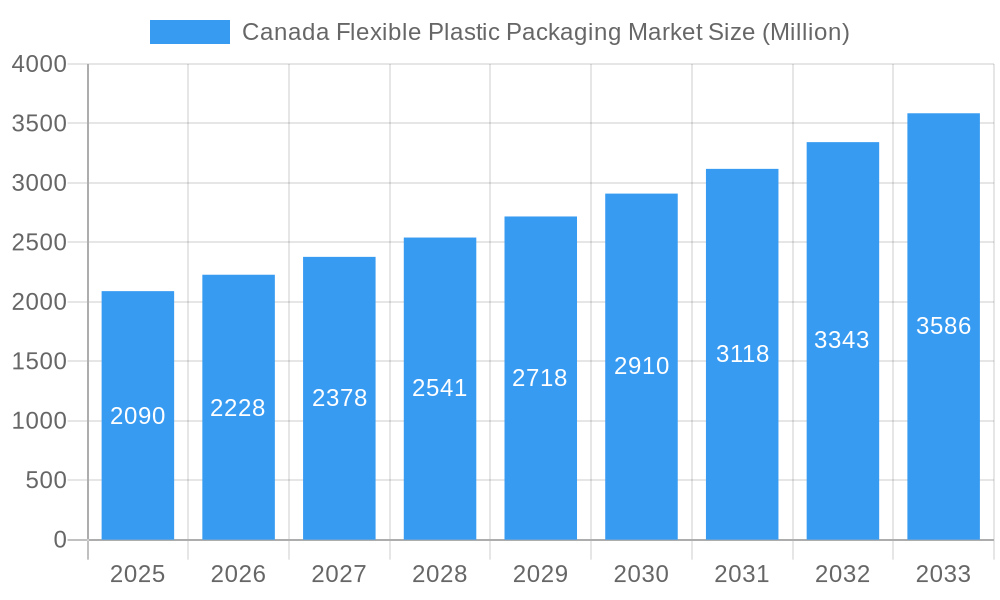

The Canada flexible plastic packaging market, valued at $2.09 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.52% from 2025 to 2033. This expansion is fueled by several key factors. The increasing demand for convenient and shelf-stable food products, particularly in the burgeoning e-commerce grocery sector, significantly contributes to market growth. Furthermore, the rising adoption of flexible packaging in the pharmaceutical and medical device industries, driven by the need for tamper-evident and sterile packaging solutions, is another significant driver. The growing popularity of single-serve and portion-controlled packaging formats further enhances market demand. While environmental concerns related to plastic waste pose a potential restraint, the industry is actively addressing this challenge through the development and adoption of sustainable alternatives like bioplastics and recyclable materials, mitigating this risk to some extent. The market segmentation reveals polyethylene (PE) and bi-orientated polypropylene (BOPP) as dominant material types, catering to a wide range of applications across food, beverage, and other end-user industries. Regional variations are expected, with potentially higher growth in urban centers and regions with strong manufacturing and processing industries. Competition is characterized by a mix of large multinational companies and regional players, with ongoing innovation focused on enhancing packaging performance and sustainability.

Canada Flexible Plastic Packaging Market Market Size (In Billion)

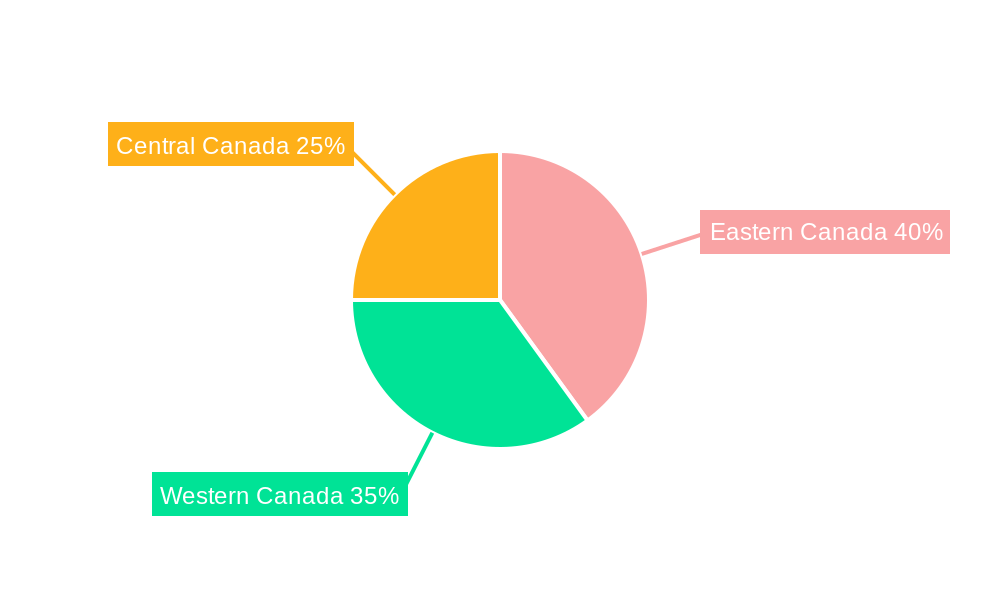

The regional breakdown within Canada – Eastern, Western, and Central Canada – will likely see varied growth rates, potentially influenced by factors such as population density, industrial activity, and consumer purchasing patterns. Western Canada, with its robust agricultural sector, may show strong growth in food packaging applications. Eastern Canada, being a major population center, is anticipated to exhibit considerable demand across various end-use industries. The forecast period (2025-2033) promises significant market expansion, driven by continuous innovation, increased consumer preference for convenient packaging, and the packaging industry’s efforts towards sustainability. The competitive landscape will likely witness strategic partnerships, mergers, and acquisitions as companies strive to expand their market share and product portfolios. Furthermore, the increasing focus on e-commerce and changing consumer lifestyles will further contribute to the growth trajectory of the Canadian flexible plastic packaging market.

Canada Flexible Plastic Packaging Market Company Market Share

This in-depth report provides a comprehensive analysis of the Canada Flexible Plastic Packaging Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on market dynamics, growth trends, key players, and future outlook. The market is segmented by material type (Polyethylene (PE), Bi-orientated Polypropylene (BOPP), Cast Polypropylene (CPP), Ethylene Vinyl Alcohol (EVOH), Other Material Types (PVC, PA, Bioplastics, and BOPET)) and end-user industry (Food, Beverage, Pharmaceutical and Medical Devices, Cosmetics and Personal Care, Household Care, Other End-user Industries). The report projects a market value of xx Million units by 2033.

Canada Flexible Plastic Packaging Market Market Dynamics & Structure

The Canadian flexible plastic packaging market is characterized by moderate concentration, with several major players and a number of smaller niche competitors. Technological innovation, particularly in sustainable packaging solutions, is a key driver, while evolving regulatory frameworks regarding plastics and recyclability significantly impact market strategies. The market faces competitive pressures from alternative packaging materials like paper and glass. Consumer demand for convenience and extended shelf life fuels market growth, however shifting consumer preferences towards eco-friendly options present both opportunities and challenges. M&A activity remains consistent, with an estimated xx deals completed in the past five years, mostly focused on enhancing product portfolios and expanding market reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Technological Innovation: Focus on sustainable materials (bioplastics, recycled content), improved barrier properties, and lightweight designs.

- Regulatory Framework: Stringent regulations on plastic waste management and recyclability are driving innovation and influencing material choices.

- Competitive Substitutes: Paper, glass, and alternative flexible packaging materials pose competitive threats.

- End-User Demographics: Growing population, changing consumption patterns, and increased demand for packaged goods are key demographic drivers.

- M&A Trends: Consolidation through mergers and acquisitions to achieve economies of scale and expand product offerings.

Canada Flexible Plastic Packaging Market Growth Trends & Insights

The Canadian flexible plastic packaging market demonstrated robust growth, achieving a CAGR of [Insert Precise CAGR for 2019-2024]% during the historical period (2019-2024). This positive trajectory is projected to continue, with a forecasted CAGR of [Insert Precise CAGR for 2025-2033]% during the period 2025-2033. This expansion is fueled by escalating demand across key sectors: food and beverage, pharmaceuticals, and personal care. The inherent cost-effectiveness, versatility, and convenience of flexible packaging solutions contribute significantly to its widespread adoption. Furthermore, technological advancements are driving a shift towards sustainable and innovative materials, emphasizing recyclability and minimizing environmental impact. Consumer preferences are increasingly aligned with eco-conscious choices, boosting the demand for bioplastics and recycled content. This trend is reflected in the anticipated market penetration of sustainable packaging, projected to rise from [Insert Precise Percentage for 2025]% in 2025 to [Insert Precise Percentage for 2033]% by 2033.

Dominant Regions, Countries, or Segments in Canada Flexible Plastic Packaging Market

Ontario and Quebec lead the Canadian flexible plastic packaging market, collectively accounting for approximately [Insert Precise Percentage]% of the total market value. This dominance stems from their higher population density, robust industrial activity, and well-established supply chains. Among material types, Polyethylene (PE) commands the largest market share, owing to its versatility, cost-effectiveness, and extensive applications across diverse end-user industries. The food and beverage sector is the primary end-user, representing approximately [Insert Precise Percentage]% of market demand due to the widespread use of flexible packaging for processed foods, beverages, and snacks. This sector's growth is further propelled by increasing consumer demand for convenient and ready-to-eat options.

- Key Growth Drivers:

- Robust economic growth and rising disposable incomes.

- Surging demand for convenient and ready-to-eat food products.

- Expansion of the e-commerce sector, driving demand for protective packaging.

- Supportive government policies promoting domestic manufacturing and sustainable practices.

- Innovation in packaging design and materials, enhancing product shelf life and appeal.

- Dominance Factors:

- Established infrastructure and advanced manufacturing capabilities in Ontario and Quebec.

- High per capita consumption of packaged goods in urban centers.

- Widespread adoption of PE packaging due to its versatility and cost-effectiveness.

Canada Flexible Plastic Packaging Market Product Landscape

The Canadian flexible plastic packaging market showcases a diverse product portfolio, with ongoing innovation focused on enhanced barrier properties, lightweight designs, and sustainable materials. New product developments prioritize extended shelf life, tamper-evident features, and user-friendly aspects such as resealable closures. Technological advancements, including the integration of smart packaging technologies and increased utilization of recycled content, are generating new avenues for product differentiation and market expansion. Many products highlight unique selling propositions (USPs) centered on increased sustainability, improved functionality, and enhanced consumer convenience, catering to evolving market demands.

Key Drivers, Barriers & Challenges in Canada Flexible Plastic Packaging Market

Key Drivers:

- Increasing demand for convenience and extended shelf life packaging.

- Growth of e-commerce and the need for robust shipping packaging.

- Technological advancements in material science and packaging design.

- Favorable regulatory environment supporting innovation and sustainability.

Key Challenges:

- Fluctuating raw material prices impacting production costs.

- Stringent environmental regulations related to plastic waste management.

- Growing consumer preference for sustainable packaging options.

- Intense competition from established and emerging players.

Emerging Opportunities in Canada Flexible Plastic Packaging Market

Significant emerging opportunities exist within the growing demand for sustainable and eco-friendly packaging solutions, encompassing bioplastics and packaging with recycled content. The market is also witnessing a rise in demand for specialized packaging tailored to niche markets, including organic foods, health and wellness products, and luxury goods. The adoption of smart packaging technologies, enabling product traceability and improved consumer engagement, presents a substantial growth opportunity, allowing for enhanced brand interaction and supply chain transparency.

Growth Accelerators in the Canada Flexible Plastic Packaging Market Industry

Sustained long-term growth will be driven by continuous technological advancements, including the development of innovative and sustainable materials, coupled with improved packaging designs that optimize efficiency and reduce environmental impact. Strategic collaborations between packaging companies and brands will play a crucial role in driving market expansion by fostering innovation and streamlining distribution. Government initiatives aimed at promoting sustainable packaging and minimizing plastic waste will further accelerate market growth by incentivizing eco-friendly practices and reducing regulatory barriers.

Key Players Shaping the Canada Flexible Plastic Packaging Market Market

- Proampac LLC

- Amcor Group Gmbh

- Flair Flexible Packaging Corporation

- Berry Global Group Inc

- Emmerson Packaging Holdings Inc

- Novolex Holdings Inc

- Mondi PLC

- Constantia Flexibles Group Gmbh

- C-p Flexible Packaging Inc

- Sigma Plastics Group Inc

Notable Milestones in Canada Flexible Plastic Packaging Market Sector

- November 2023: Berry Global Group Inc. launched its Omni Xtra+ polyethylene cling film, offering a high-performance, sustainable alternative to PVC.

- June 2023: Novolex launched its ProWAVE tote bag in a new 2.25 mm gauge film and expanded its recycled content options to 40%.

In-Depth Canada Flexible Plastic Packaging Market Market Outlook

The Canadian flexible plastic packaging market is poised for sustained growth, driven by a confluence of factors including increasing demand for convenient packaging, the rise of e-commerce, and a growing focus on sustainability. Strategic investments in R&D, strategic partnerships, and a focus on innovative, eco-friendly solutions will be crucial for companies seeking to capitalize on the market's future potential. The market is expected to see continued consolidation through mergers and acquisitions as players seek to enhance their product portfolios and expand their market reach.

Canada Flexible Plastic Packaging Market Segmentation

-

1. Material Type

- 1.1. Polyethene (PE)

- 1.2. Bi-oriented Polypropylene (BOPP)

- 1.3. Cast Polypropylene (CPP)

- 1.4. Polyvinyl Chloride (PVC)

- 1.5. Ethylene Vinyl Alcohol (EVOH)

- 1.6. Other Ma

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types (Blister Packs, Liners, etc)

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

Canada Flexible Plastic Packaging Market Segmentation By Geography

- 1. Canada

Canada Flexible Plastic Packaging Market Regional Market Share

Geographic Coverage of Canada Flexible Plastic Packaging Market

Canada Flexible Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Flexible Plastics Currently Accounts for the Largest Share in the Canadian Packaging Industry and is Expected to Retain Its Position Over the Forecast Period | Growing Demand for Convenience Foods

- 3.3. Market Restrains

- 3.3.1 Competition from Substitutes

- 3.3.2 such as Glass and Plastic Packaging

- 3.4. Market Trends

- 3.4.1. Polyethylene (PE) to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Flexible Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Polyethene (PE)

- 5.1.2. Bi-oriented Polypropylene (BOPP)

- 5.1.3. Cast Polypropylene (CPP)

- 5.1.4. Polyvinyl Chloride (PVC)

- 5.1.5. Ethylene Vinyl Alcohol (EVOH)

- 5.1.6. Other Ma

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types (Blister Packs, Liners, etc)

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Proampac LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amcor Group Gmbh

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Flair Flexible Packaging Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Berry Global Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Emmerson Packaging Holdings Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Novolex Holdings Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mondi PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Constantia Flexibles Group Gmbh

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 C-p Flexible Packaging Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sigma Plastics Group Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Proampac LLC

List of Figures

- Figure 1: Canada Flexible Plastic Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Flexible Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Flexible Plastic Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Canada Flexible Plastic Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Canada Flexible Plastic Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Canada Flexible Plastic Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Canada Flexible Plastic Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: Canada Flexible Plastic Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Canada Flexible Plastic Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: Canada Flexible Plastic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Flexible Plastic Packaging Market?

The projected CAGR is approximately 6.52%.

2. Which companies are prominent players in the Canada Flexible Plastic Packaging Market?

Key companies in the market include Proampac LLC, Amcor Group Gmbh, Flair Flexible Packaging Corporation, Berry Global Group Inc, Emmerson Packaging Holdings Inc, Novolex Holdings Inc, Mondi PLC, Constantia Flexibles Group Gmbh, C-p Flexible Packaging Inc, Sigma Plastics Group Inc.

3. What are the main segments of the Canada Flexible Plastic Packaging Market?

The market segments include Material Type, Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Flexible Plastics Currently Accounts for the Largest Share in the Canadian Packaging Industry and is Expected to Retain Its Position Over the Forecast Period | Growing Demand for Convenience Foods.

6. What are the notable trends driving market growth?

Polyethylene (PE) to Witness Major Growth.

7. Are there any restraints impacting market growth?

Competition from Substitutes. such as Glass and Plastic Packaging.

8. Can you provide examples of recent developments in the market?

November 2023: Berry Global Group Inc. launched a new version of its Omni Xtra polyethylene cling film for fresh food applications. It provides a high-performance alternative to traditional polyvinyl chloride (PVC) cling films. Omni Xtra is already established, while the new Omni Xtra+ film improved elasticity, uniform stretching behavior, and improved impact resistance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Flexible Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Flexible Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Flexible Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Canada Flexible Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence