Key Insights

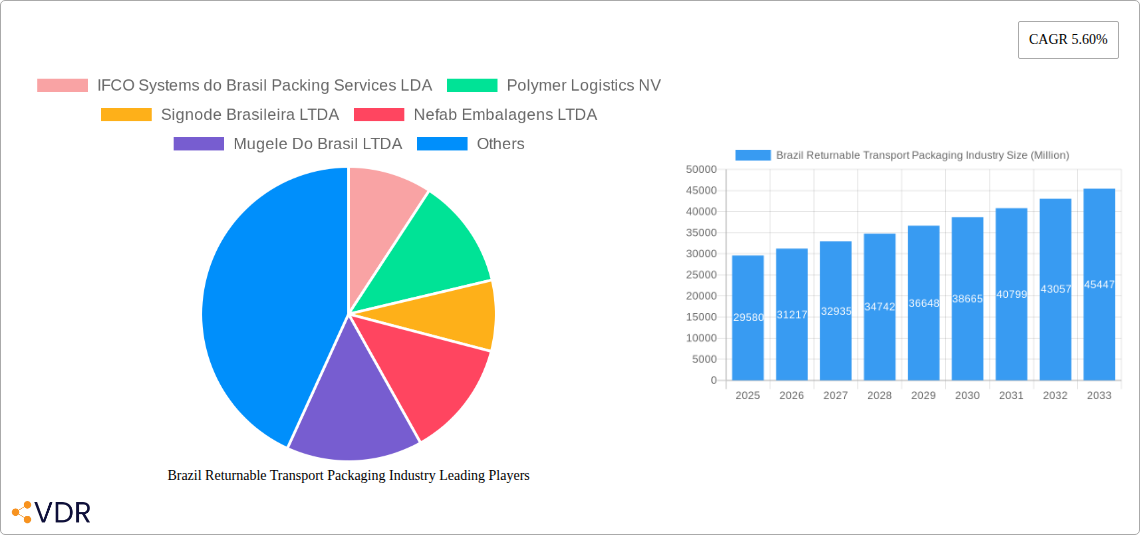

The Brazilian Returnable Transport Packaging (RTP) market is poised for substantial growth, projected to reach an estimated USD 29.58 billion in 2025. This expansion is fueled by a robust Compound Annual Growth Rate (CAGR) of 5.5% expected over the forecast period of 2025-2033. The increasing adoption of sustainable and cost-effective logistics solutions by major industries such as Automotive, Food and Beverages, and Consumer Goods is a primary driver. Businesses are recognizing the long-term economic and environmental benefits of RTP, including reduced waste, lower transportation costs through optimized cubic utilization, and enhanced product protection. The demand for durable and reusable containers, pallets, and drums is escalating as companies prioritize efficiency and circular economy principles within their supply chains. Furthermore, government initiatives promoting eco-friendly practices and the growing awareness of the environmental impact of single-use packaging are contributing to this positive market trajectory.

Brazil Returnable Transport Packaging Industry Market Size (In Billion)

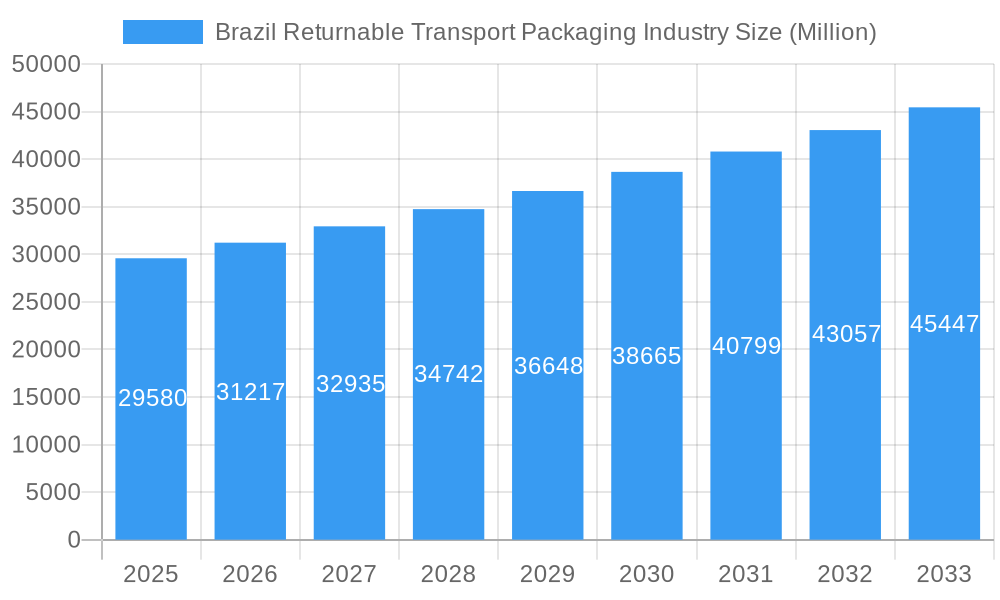

The market segmentation reveals a strong reliance on plastic as the dominant material for RTP, owing to its durability, light weight, and versatility. Containers and pallets represent the largest product segments, reflecting their widespread use across various industries for efficient material handling and storage. While the RTP market in Brazil demonstrates a promising outlook, potential restraints such as initial capital investment for RTP systems and the availability of efficient reverse logistics infrastructure could pose challenges. However, the overwhelming trend towards sustainability, coupled with continuous innovation in RTP design and technology, is expected to mitigate these concerns. Key players like IFCO Systems do Brasil, Polymer Logistics NV, and Chep Brazil are actively investing in expanding their RTP offerings and infrastructure within the region, further solidifying market growth and innovation.

Brazil Returnable Transport Packaging Industry Company Market Share

Brazil Returnable Transport Packaging Industry Report: Comprehensive Analysis and Future Outlook

This in-depth report provides a strategic overview of the Brazil Returnable Transport Packaging (RTP) industry, a critical component of the nation's logistics and supply chain ecosystem. Spanning the historical period from 2019 to 2024 and projecting to 2033, this analysis leverages extensive data and industry expertise to deliver actionable insights for stakeholders. We meticulously examine market dynamics, growth trends, regional dominance, product innovation, key drivers, emerging opportunities, and the competitive landscape, including a detailed look at leading companies and notable milestones. The report is structured to offer maximum clarity and immediate value, presenting quantitative and qualitative data that illuminates the present and future trajectory of this vital sector.

Brazil Returnable Transport Packaging Industry Market Dynamics & Structure

The Brazil Returnable Transport Packaging industry exhibits a moderately concentrated market structure, with a blend of large multinational players and regional specialists vying for market share. Technological innovation is a primary driver, with advancements in material science and smart packaging solutions enhancing durability, traceability, and environmental sustainability. Regulatory frameworks, particularly those promoting circular economy principles and waste reduction, are increasingly influencing market development and mandating the adoption of reusable packaging solutions across various sectors. Competitive product substitutes, primarily single-use packaging, remain a persistent challenge, but the rising cost of waste disposal and growing environmental awareness are steadily eroding their market dominance. End-user demographics are shifting towards sustainability-conscious businesses, actively seeking RTP solutions that align with their corporate social responsibility goals. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger entities acquiring smaller innovators to expand their service offerings and geographic reach. For instance, the sector has witnessed a consistent deal volume of 3-5 significant M&A transactions annually within the last three years, reflecting strategic moves to gain market access and technological prowess. Innovation barriers include the high initial capital investment required for RTP infrastructure and the need for robust reverse logistics networks.

- Market Concentration: Moderately concentrated, with key players holding significant shares.

- Technological Innovation: Driven by smart packaging, material science, and automation.

- Regulatory Frameworks: Increasingly supportive of circular economy models and waste reduction.

- Competitive Product Substitutes: Single-use packaging remains a challenge, though its appeal is diminishing.

- End-User Demographics: Growing demand from sustainability-focused businesses.

- M&A Trends: Steady consolidation through strategic acquisitions.

- Innovation Barriers: High capital investment and complex reverse logistics.

Brazil Returnable Transport Packaging Industry Growth Trends & Insights

The Brazil Returnable Transport Packaging industry is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.8% from 2025 to 2033. This growth is underpinned by a multifaceted evolution in market size, adoption rates, technological disruptions, and consumer behavior shifts. The estimated market size for returnable transport packaging in Brazil in 2025 is xx billion units, with projections reaching xx billion units by 2033. Adoption rates for RTP solutions are steadily increasing across key sectors, driven by a compelling economic case that includes reduced packaging costs over the lifecycle, minimized waste disposal fees, and improved supply chain efficiency. Technological disruptions, such as the integration of IoT sensors for real-time tracking and condition monitoring of RTP assets, are enhancing their value proposition and facilitating more sophisticated fleet management. Consumer behavior has undergone a significant transformation, with businesses increasingly prioritizing suppliers who demonstrate a commitment to environmental sustainability and operate within a circular economy framework. This shift is compelling companies to re-evaluate their packaging strategies and invest in reusable solutions. The market penetration of RTP in traditional sectors like automotive and food and beverages is already substantial, but significant untapped potential exists in emerging industries and smaller enterprises seeking cost-effective and sustainable logistics. The ongoing digitalization of supply chains further complements the adoption of RTP, enabling better coordination and optimization of return logistics, thereby enhancing the overall return on investment for RTP users. The increasing awareness of the environmental impact of single-use plastics is also a major catalyst, pushing industries to explore viable alternatives like durable plastic crates, metal stillages, and robust wooden pallets that can be reused multiple times. This transition not only benefits the environment but also contributes to long-term cost savings for businesses.

Dominant Regions, Countries, or Segments in Brazil Returnable Transport Packaging Industry

Within the Brazil Returnable Transport Packaging industry, the Plastic segment is demonstrably dominant, driven by its versatility, durability, and cost-effectiveness over multiple usage cycles. This dominance is observed across the Containers product category, which represents the largest sub-segment within the RTP market. The Food and Beverages application sector stands out as the primary growth engine, fueled by stringent hygiene regulations and the inherent need for robust, easily cleanable packaging solutions. The economic policies of Brazil, coupled with significant investments in infrastructure development, particularly in logistics and transportation networks, have created a fertile ground for the expansion of RTP solutions. The sheer volume of goods transported within the Food and Beverages sector, ranging from fresh produce to processed goods, necessitates efficient and reliable packaging, making returnable containers indispensable. Market share within the Plastic segment for containers is estimated at xx% in 2025, with a projected CAGR of xx% for the forecast period. Key drivers for this segment's dominance include the Brazilian government's focus on reducing plastic waste and promoting a circular economy, which directly benefits the reusable nature of plastic RTP. Furthermore, the ease of cleaning and sanitizing plastic RTP makes it ideal for food safety compliance, a non-negotiable aspect for this industry. Infrastructure improvements, such as enhanced road networks and port facilities, facilitate the efficient movement of both filled and empty returnable containers, thereby optimizing reverse logistics. The consumer goods sector also contributes significantly to the demand for plastic containers, owing to their stackability and protective qualities. While Metal and Wood segments play crucial roles, particularly in heavy-duty applications and specific niche markets, Plastic RTP's broad applicability, adaptability, and continuous innovation in material composition and design position it as the leading force in the Brazilian market. The growth potential in this segment is further amplified by the increasing demand for customized RTP solutions tailored to specific product needs within the food and beverage supply chain, from small crates for dairy products to larger bins for agricultural produce.

- Dominant Material: Plastic (estimated xx% market share in 2025).

- Dominant Product: Containers (estimated xx% market share within the plastic segment).

- Dominant Application: Food and Beverages (driving demand and adoption).

- Key Drivers:

- Government policies promoting circular economy and waste reduction.

- Stringent food safety and hygiene regulations.

- Cost-effectiveness and durability of plastic RTP over its lifecycle.

- Investments in logistics and transportation infrastructure.

- Growing consumer demand for sustainable supply chains.

Brazil Returnable Transport Packaging Industry Product Landscape

The product landscape of the Brazil Returnable Transport Packaging industry is characterized by continuous innovation aimed at enhancing efficiency, sustainability, and traceability. Plastic containers, particularly foldable and stackable designs, lead in product development, offering improved space utilization during transit and storage. Innovations include the integration of RFID tags and QR codes for enhanced inventory management and real-time tracking throughout the supply chain. Pallets are seeing advancements in composite materials and ergonomic designs, reducing weight while maintaining load capacity. Drums and barrels are being re-engineered for greater chemical resistance and ease of cleaning, catering to the chemical and industrial sectors. The performance metrics of these products are continuously improving, with an emphasis on increased lifespan, reduced failure rates, and better resistance to environmental factors. Unique selling propositions often revolve around customization options, such as specialized inserts for delicate products, temperature-controlled features for perishable goods, and tamper-evident seals for enhanced security. Technological advancements are also focused on creating lighter yet stronger materials, contributing to reduced fuel consumption during transportation.

Key Drivers, Barriers & Challenges in Brazil Returnable Transport Packaging Industry

The Brazil Returnable Transport Packaging industry is propelled by several key drivers. Technological advancements in material science and smart tracking solutions are making RTP more attractive and efficient. Economic incentives such as reduced waste disposal costs and longer-term cost savings on packaging materials significantly boost adoption. Government initiatives promoting sustainability and the circular economy provide a strong regulatory push. Growing environmental consciousness among businesses and consumers alike is creating a demand for eco-friendly logistics.

However, the industry faces significant barriers and challenges. High initial capital investment for acquiring RTP assets can deter smaller businesses. Establishing and maintaining efficient reverse logistics networks remains complex and costly. Resistance to change from established single-use packaging practices presents an adoption hurdle. Fragmented supply chains and a lack of standardized RTP systems can hinder interoperability. Competition from low-cost single-use packaging continues to exert pressure. Supply chain disruptions, as seen in recent global events, can impact the availability and cost of raw materials for RTP manufacturing. The challenge of ensuring proper sanitation and maintenance of RTP assets across a diverse user base also requires continuous attention.

Emerging Opportunities in Brazil Returnable Transport Packaging Industry

Emerging opportunities in the Brazil Returnable Transport Packaging industry are manifold. The burgeoning e-commerce sector presents a substantial avenue for specialized RTP solutions designed for last-mile delivery, offering enhanced protection and reusability. There's a growing demand for "packaging-as-a-service" models, where companies lease RTP assets rather than owning them, reducing upfront costs and simplifying logistics management. The expansion of bioplastics and recycled materials in RTP manufacturing offers a more sustainable alternative to virgin plastics. Untapped markets in the pharmaceutical and healthcare sectors are also emerging, requiring highly controlled and sterile RTP solutions. Evolving consumer preferences towards sustainable brands are compelling more small and medium-sized enterprises (SMEs) to explore RTP options, creating a market for more accessible and affordable solutions. The development of smart RTP with integrated tracking and condition monitoring capabilities is opening doors for data-driven supply chain optimization.

Growth Accelerators in the Brazil Returnable Transport Packaging Industry Industry

Several catalysts are accelerating the growth of the Brazil Returnable Transport Packaging industry. Technological breakthroughs in durable and lightweight materials, coupled with advancements in IoT and data analytics for asset management, are enhancing the value proposition of RTP. Strategic partnerships between RTP providers, logistics companies, and end-users are streamlining adoption and creating integrated supply chain solutions. Government policies and incentives that favor reusable packaging and penalize waste are significant growth accelerators. The increasing emphasis on ESG (Environmental, Social, and Governance) compliance by corporations is driving demand for sustainable packaging solutions. Furthermore, the continuous improvement in the cost-effectiveness of RTP over its lifecycle compared to single-use alternatives, driven by economies of scale and operational efficiencies, is a major growth accelerator. The expanding network of specialized RTP pooling and servicing companies is also crucial in facilitating wider adoption.

Key Players Shaping the Brazil Returnable Transport Packaging Industry Market

- IFCO Systems do Brasil Packing Services LDA

- Polymer Logistics NV

- Signode Brasileira LTDA

- Nefab Embalagens LTDA

- Mugele Do Brasil LTDA

- Chep Brazil

- Kuehne-Nagel Serviços Logísticos

- SSI Schaefer LTDA

- Orbis Corporation

Notable Milestones in Brazil Returnable Transport Packaging Industry Sector

- 2020: Increased adoption of reusable plastic crates for grocery delivery services in response to heightened demand during the pandemic.

- 2021: Significant investment by major players in expanding RTP pooling infrastructure across key Brazilian logistics hubs.

- 2022: Introduction of smart RTP containers with integrated GPS and temperature sensors by leading providers.

- 2023: Government announcements reinforcing circular economy mandates, leading to increased corporate inquiries and pilot programs for RTP solutions.

- 2024: Growing partnerships between RTP suppliers and e-commerce platforms to develop optimized last-mile delivery packaging.

In-Depth Brazil Returnable Transport Packaging Industry Market Outlook

The Brazil Returnable Transport Packaging industry is set for sustained and accelerated growth, driven by a confluence of favorable market conditions and strategic developments. The strong emphasis on sustainability, coupled with evolving regulatory landscapes, will continue to propel the adoption of RTP across diverse sectors. Growth accelerators such as technological innovation in smart packaging and the expansion of service-based models will further enhance the attractiveness and accessibility of RTP solutions. Key players are expected to focus on expanding their service offerings, optimizing reverse logistics, and developing customized solutions to meet the specific needs of industries like food and beverages, consumer goods, and automotive. The market outlook is exceptionally positive, with significant potential for further penetration and innovation, making Brazil a dynamic and expanding market for returnable transport packaging.

Brazil Returnable Transport Packaging Industry Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Metal

- 1.3. Wood

-

2. Product

- 2.1. Containers

- 2.2. Pallets

- 2.3. Drums and Barrels

- 2.4. Other Products

-

3. Application

- 3.1. Automotive

- 3.2. Food and Beverages

- 3.3. Consumer Goods

- 3.4. Other Applications

Brazil Returnable Transport Packaging Industry Segmentation By Geography

- 1. Brazil

Brazil Returnable Transport Packaging Industry Regional Market Share

Geographic Coverage of Brazil Returnable Transport Packaging Industry

Brazil Returnable Transport Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Food and Beverage Sector in Brazil to Propel Demand For RTP; Long-term Cost Benefits Associated With RTP

- 3.3. Market Restrains

- 3.3.1. ; Relatively Higher Initial Costs Remain a Concern in Some Parts of the Country

- 3.4. Market Trends

- 3.4.1. Barrels and Drums is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Returnable Transport Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Metal

- 5.1.3. Wood

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Containers

- 5.2.2. Pallets

- 5.2.3. Drums and Barrels

- 5.2.4. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Automotive

- 5.3.2. Food and Beverages

- 5.3.3. Consumer Goods

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IFCO Systems do Brasil Packing Services LDA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Polymer Logistics NV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Signode Brasileira LTDA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nefab Embalagens LTDA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mugele Do Brasil LTDA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chep Brazil

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne-Nagel Serviços Logísticos

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SSI Schaefer LTDA*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Orbis Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 IFCO Systems do Brasil Packing Services LDA

List of Figures

- Figure 1: Brazil Returnable Transport Packaging Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Brazil Returnable Transport Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Brazil Returnable Transport Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: Brazil Returnable Transport Packaging Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 3: Brazil Returnable Transport Packaging Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Brazil Returnable Transport Packaging Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Brazil Returnable Transport Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 6: Brazil Returnable Transport Packaging Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 7: Brazil Returnable Transport Packaging Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Brazil Returnable Transport Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Returnable Transport Packaging Industry?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Brazil Returnable Transport Packaging Industry?

Key companies in the market include IFCO Systems do Brasil Packing Services LDA, Polymer Logistics NV, Signode Brasileira LTDA, Nefab Embalagens LTDA, Mugele Do Brasil LTDA, Chep Brazil, Kuehne-Nagel Serviços Logísticos, SSI Schaefer LTDA*List Not Exhaustive, Orbis Corporation.

3. What are the main segments of the Brazil Returnable Transport Packaging Industry?

The market segments include Material, Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Food and Beverage Sector in Brazil to Propel Demand For RTP; Long-term Cost Benefits Associated With RTP.

6. What are the notable trends driving market growth?

Barrels and Drums is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

; Relatively Higher Initial Costs Remain a Concern in Some Parts of the Country.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Returnable Transport Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Returnable Transport Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Returnable Transport Packaging Industry?

To stay informed about further developments, trends, and reports in the Brazil Returnable Transport Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence