Key Insights

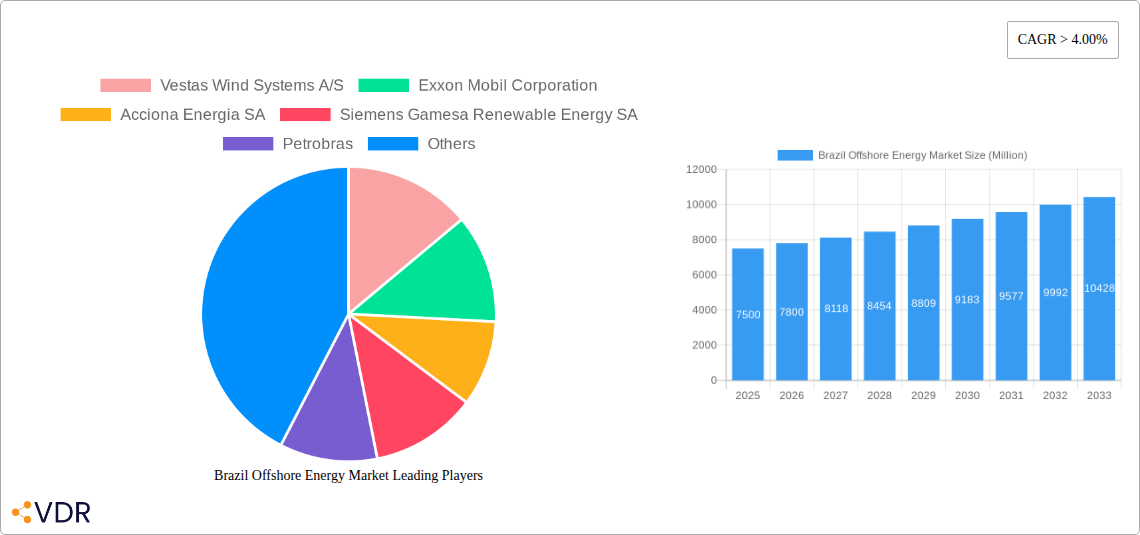

The Brazil offshore energy market, integrating wind, oil & gas, and wave power, is poised for substantial growth. Projected to expand at a Compound Annual Growth Rate (CAGR) of 9.45%, the market is forecast to reach $1.6 billion by 2025. This valuation reflects Brazil's extensive oil and gas reserves, its expanding renewable energy targets, particularly in offshore wind, and advancements in wave energy technology. Key growth drivers include escalating energy demand, governmental support for renewables, and abundant offshore resources. Leading trends encompass the deployment of floating offshore wind technology for deeper waters, innovations in wave energy capture, and a strong emphasis on environmental sustainability. Challenges such as high upfront investment, regulatory hurdles, and environmental considerations must be managed to ensure sustained market expansion. The market is segmented across wind, oil & gas, and wave energy, with prominent players like Vestas, ExxonMobil, and Acciona actively shaping this evolving sector.

Brazil Offshore Energy Market Market Size (In Billion)

Brazil's extensive coastline, rich wind resources, and strategic initiatives to diversify its energy portfolio and curb carbon emissions significantly bolster its offshore energy sector. The forecast period of 2025-2033 anticipates robust expansion, fueled by infrastructure investment, technological advancements, and supportive government policies. Despite existing challenges, the long-term growth outlook for the Brazil offshore energy market is compelling, offering significant investment potential and contributing to Brazil's energy security and sustainable development objectives. This analysis highlights considerable opportunities for investors and businesses in this dynamic market.

Brazil Offshore Energy Market Company Market Share

Brazil Offshore Energy Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Brazil offshore energy market, encompassing wind, oil & gas, and wave energy segments. It offers invaluable insights for investors, industry professionals, and strategic decision-makers seeking to capitalize on this dynamic market's growth potential. The report covers the period from 2019 to 2033, with a focus on 2025 as the base and estimated year, and a detailed forecast spanning 2025-2033. Market values are presented in millions.

Brazil Offshore Energy Market Dynamics & Structure

The Brazilian offshore energy market is characterized by a complex interplay of factors shaping its growth trajectory. Market concentration is currently moderate, with major players like Petrobras and international giants such as Exxon Mobil Corporation and Chevron Corporation holding significant shares. However, increased participation from renewable energy players such as Vestas Wind Systems A/S, Acciona Energia SA, and Siemens Gamesa Renewable Energy SA signifies a shift towards diversification. Technological innovation is a crucial driver, particularly in offshore wind, where advancements in turbine technology and floating platforms are essential. The regulatory landscape, though evolving, presents both opportunities and challenges, impacting investment decisions. The presence of established oil & gas infrastructure provides a foundation for offshore wind development. Finally, M&A activity is expected to increase as companies seek to consolidate their positions and expand their portfolios.

- Market Concentration: Moderate, with significant players from oil & gas and renewables.

- Technological Innovation: Key driver, particularly in offshore wind turbine technology and installation methods.

- Regulatory Framework: Evolving, presenting both opportunities and challenges.

- Competitive Product Substitutes: Limited, mainly within renewable energy sources.

- End-User Demographics: Primarily large-scale power producers and industrial consumers.

- M&A Trends: Increasing activity anticipated due to market consolidation and expansion efforts. The number of deals in the past five years is estimated at xx.

Brazil Offshore Energy Market Growth Trends & Insights

The Brazilian offshore energy market is poised for substantial growth, driven by increasing energy demand, government support for renewable energy, and substantial offshore resources. The market size is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx million by 2033. This growth is fueled by increasing adoption rates of offshore wind energy, alongside continued investment in the established oil and gas sector. Technological advancements, particularly in cost reductions for offshore wind turbines and improved efficiency in oil and gas extraction, are accelerating market expansion. Changing consumer behavior, with a growing awareness of sustainability, further supports the transition to cleaner energy sources. Market penetration of offshore wind is expected to increase significantly by 2033, reaching xx%. The wave energy segment remains relatively nascent but shows promise for future development.

Dominant Regions, Countries, or Segments in Brazil Offshore Energy Market

The Southeast region of Brazil is currently the most dominant area for offshore energy development, primarily due to its established oil and gas infrastructure and proximity to significant energy demand centers. The offshore wind sector is showing significant growth potential across this region, particularly with major projects planned near Aracatu.

- Offshore Wind: Rapid growth expected due to government incentives and abundant wind resources.

- Oil & Gas: Continues to be a significant contributor, but facing pressure from renewable energy's rise.

- Wave Energy: Limited market presence at present, but with potential for future growth.

- Key Drivers: Government policies supporting renewable energy, abundant offshore wind resources, and existing oil & gas infrastructure.

The Oil & Gas segment currently holds the largest market share, estimated at xx%, followed by Offshore Wind at xx%. However, the offshore wind segment is projected to experience the fastest growth, potentially overtaking oil and gas in market share by xx.

Brazil Offshore Energy Market Product Landscape

The Brazilian offshore energy market showcases a diverse product landscape. Offshore wind turbines are experiencing significant advancements in terms of capacity and efficiency, allowing for larger-scale projects and reduced levelized cost of energy (LCOE). In the oil & gas sector, technological advancements are focused on enhancing extraction techniques and optimizing production processes. Wave energy technologies are still under development, with several companies focusing on improving energy capture and conversion efficiency. The focus is on developing innovative solutions and enhancing the cost-competitiveness of offshore energy technologies.

Key Drivers, Barriers & Challenges in Brazil Offshore Energy Market

Key Drivers:

- Abundant offshore wind and wave energy resources.

- Government support for renewable energy development.

- Growing demand for clean energy.

- Investment in infrastructure development.

Key Barriers & Challenges:

- High initial investment costs for offshore renewable energy projects.

- Regulatory complexities and permitting processes.

- Limited skilled workforce for offshore wind farm installations and maintenance.

- Supply chain issues, particularly for specialized equipment. This resulted in a xx million delay in project xx in 2024.

Emerging Opportunities in Brazil Offshore Energy Market

- Development of large-scale offshore wind farms in under-explored areas.

- Integration of offshore energy into smart grids.

- Innovation in wave energy capture and conversion technologies.

- Expansion of the offshore energy sector into northern regions of Brazil.

Growth Accelerators in the Brazil Offshore Energy Market Industry

Strategic partnerships between international and Brazilian companies are playing a significant role in accelerating growth, combining expertise and facilitating technology transfer. Technological breakthroughs in turbine design and floating platform technology are also vital. The government's continued commitment to renewable energy targets further stimulates investments and market expansion.

Key Players Shaping the Brazil Offshore Energy Market Market

- Vestas Wind Systems A/S

- Exxon Mobil Corporation

- Acciona Energia SA

- Siemens Gamesa Renewable Energy SA

- Petrobras

- Chevron Corporation

- Eco Wave Power Global

- Enel Green Power SpA

- Repsol SA

- General Electric Company

Notable Milestones in Brazil Offshore Energy Market Sector

- June 2022: Corio Generation plans five offshore wind projects (5+ GW capacity) in partnership with Servtec.

- May 2022: Petrobras and Equinor assess feasibility of a 4 GW offshore wind farm near Aracatu.

In-Depth Brazil Offshore Energy Market Outlook

The Brazilian offshore energy market presents significant long-term growth potential, driven by strong government support, abundant resources, and increasing global demand for clean energy. Strategic investments in infrastructure and technological innovation are crucial to maximizing this potential. The sector is poised for substantial expansion across the different energy types, generating significant economic benefits and contributing to Brazil's energy transition.

Brazil Offshore Energy Market Segmentation

-

1. Type

- 1.1. Wind

- 1.2. Oil and Gas

- 1.3. Wave

Brazil Offshore Energy Market Segmentation By Geography

- 1. Brazil

Brazil Offshore Energy Market Regional Market Share

Geographic Coverage of Brazil Offshore Energy Market

Brazil Offshore Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Demand of Refined Petroleum Products4.; Need for Sustainable Refined Petroleum Products

- 3.3. Market Restrains

- 3.3.1. Increase in Adoption of Alternative Fuel Vehicles

- 3.4. Market Trends

- 3.4.1. The Oil and Gas Segment is Expected to Dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Offshore Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wind

- 5.1.2. Oil and Gas

- 5.1.3. Wave

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vestas Wind Systems A/S

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Exxon Mobil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Acciona Energia SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens Gamesa Renewable Energy SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Petrobras

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chevron Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Eco Wave Power Global

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Enel Green Power SpA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Repsol SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 General Electric Company*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Vestas Wind Systems A/S

List of Figures

- Figure 1: Brazil Offshore Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Offshore Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Offshore Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Brazil Offshore Energy Market Volume gigawatts Forecast, by Type 2020 & 2033

- Table 3: Brazil Offshore Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Brazil Offshore Energy Market Volume gigawatts Forecast, by Region 2020 & 2033

- Table 5: Brazil Offshore Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Brazil Offshore Energy Market Volume gigawatts Forecast, by Type 2020 & 2033

- Table 7: Brazil Offshore Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Brazil Offshore Energy Market Volume gigawatts Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Offshore Energy Market?

The projected CAGR is approximately 9.45%.

2. Which companies are prominent players in the Brazil Offshore Energy Market?

Key companies in the market include Vestas Wind Systems A/S, Exxon Mobil Corporation, Acciona Energia SA, Siemens Gamesa Renewable Energy SA, Petrobras, Chevron Corporation, Eco Wave Power Global, Enel Green Power SpA, Repsol SA, General Electric Company*List Not Exhaustive.

3. What are the main segments of the Brazil Offshore Energy Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Surge in Demand of Refined Petroleum Products4.; Need for Sustainable Refined Petroleum Products.

6. What are the notable trends driving market growth?

The Oil and Gas Segment is Expected to Dominate the market.

7. Are there any restraints impacting market growth?

Increase in Adoption of Alternative Fuel Vehicles.

8. Can you provide examples of recent developments in the market?

June 2022: Corio Generation intended to develop five offshore wind projects in Brazil with a combined capacity of more than 5 GW. Servtec, a Brazilian power generation company, will develop the five projects with Corio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatts.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Offshore Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Offshore Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Offshore Energy Market?

To stay informed about further developments, trends, and reports in the Brazil Offshore Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence