Key Insights

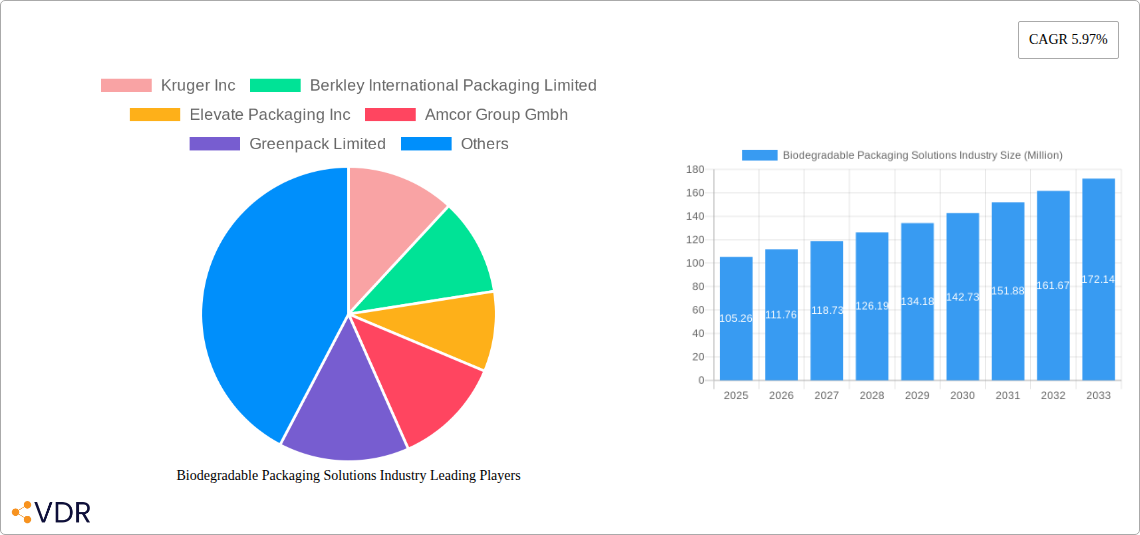

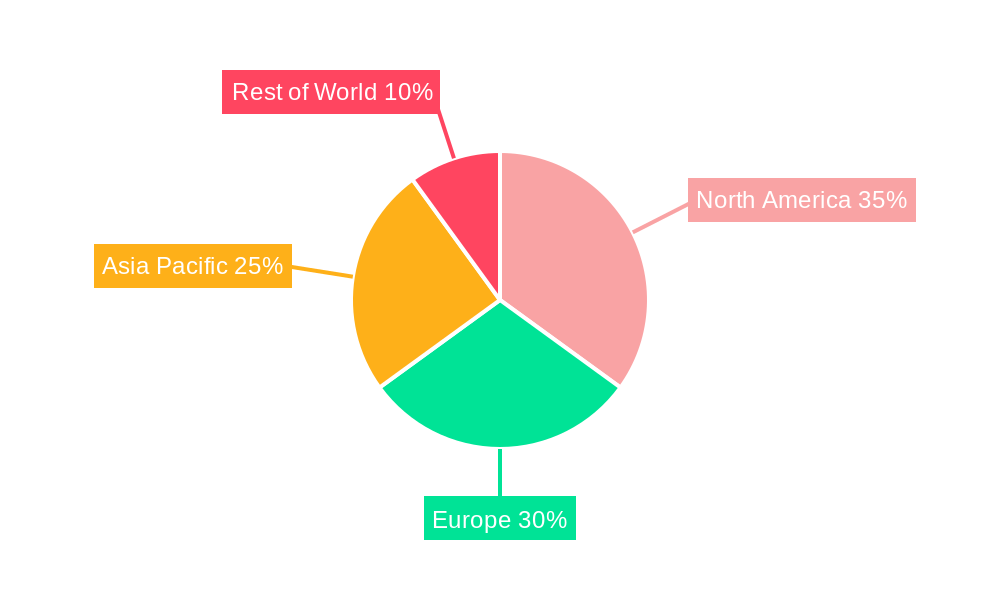

The biodegradable packaging solutions market is experiencing robust growth, projected to reach $105.26 million in 2025 and expanding at a compound annual growth rate (CAGR) of 5.97%. This surge is driven by escalating consumer demand for eco-friendly alternatives to traditional packaging materials, coupled with increasing regulatory pressure to reduce plastic waste and environmental concerns. Key drivers include the growing awareness of plastic pollution's detrimental impact on ecosystems and the rising adoption of sustainable practices across various industries. The market segmentation reveals a strong preference for plastic-based biodegradable options, followed by Polyhydroxyalkanoates (PHA) and paper-based solutions. The food and beverage sectors represent the largest application areas, followed by pharmaceuticals and personal/homecare products. North America and Europe currently hold significant market shares, but the Asia-Pacific region is anticipated to witness substantial growth driven by rising disposable incomes and increasing environmental consciousness in countries like China and India.

Biodegradable Packaging Solutions Industry Market Size (In Million)

While the market presents significant opportunities, challenges remain. High production costs compared to conventional packaging and the limitations of certain biodegradable materials in terms of durability and barrier properties pose restraints to wider adoption. However, ongoing technological advancements, such as the development of new biodegradable polymers with improved performance characteristics and cost reductions through economies of scale, are mitigating these challenges. Companies like Amcor, Smurfit Kappa, and Tetra Pak are leading the innovation efforts, investing heavily in research and development to create more sustainable and cost-effective biodegradable packaging solutions. Future growth will be fueled by collaborations across the value chain – from material producers to packaging converters and brand owners – fostering the development of circular economy models and driving further market penetration.

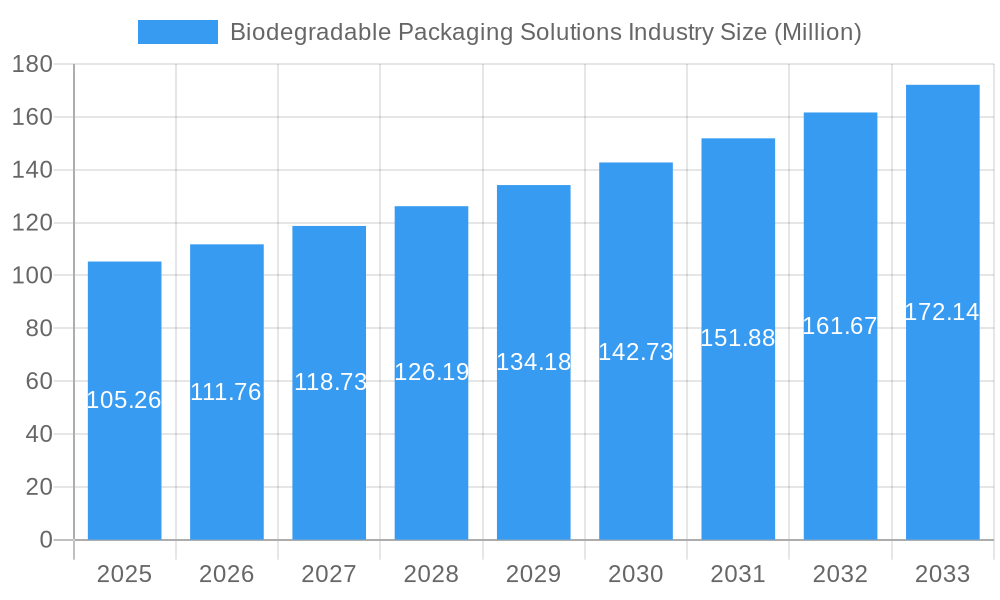

Biodegradable Packaging Solutions Industry Company Market Share

Biodegradable Packaging Solutions Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Biodegradable Packaging Solutions industry, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report is invaluable for industry professionals, investors, and stakeholders seeking to understand and capitalize on the burgeoning opportunities within this rapidly evolving sector. The market is segmented by material type (Plastic, Polyhydroxyalkanoates (PHA), Paper) and application (Food Packaging, Beverage Packaging, Pharmaceutical Packaging, Personal/Homecare Packaging). The total market size is projected to reach xx Million units by 2033.

Biodegradable Packaging Solutions Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends shaping the biodegradable packaging solutions industry. The market is characterized by a moderately concentrated structure with several key players holding significant market share. However, the entry of new players, particularly smaller, specialized businesses, is increasing competition.

- Market Concentration: The top 10 players account for approximately xx% of the global market share in 2025. This indicates a moderately consolidated market with opportunities for both established players and new entrants.

- Technological Innovation: Continuous innovation in biodegradable materials (e.g., PHA, PLA) and advanced manufacturing techniques drives market growth. However, cost-effectiveness and scalability remain key challenges.

- Regulatory Frameworks: Government regulations promoting sustainability and reducing plastic waste are significant drivers of market expansion, particularly in Europe and North America. However, varying regulations across regions create complexities for manufacturers.

- Competitive Product Substitutes: Traditional plastic packaging remains a major competitor due to its lower cost. However, increasing consumer awareness of environmental concerns favors biodegradable alternatives.

- End-User Demographics: Growing environmental consciousness among consumers, particularly millennials and Gen Z, fuels demand for eco-friendly packaging.

- M&A Trends: The past five years have witnessed xx M&A deals in the biodegradable packaging industry, indicating consolidation and strategic expansion among key players.

Biodegradable Packaging Solutions Industry Growth Trends & Insights

The global demand for sustainable alternatives is propelling the biodegradable packaging solutions market into an era of significant expansion. This surge is fueled by a dual force: heightened consumer consciousness advocating for eco-friendly products and increasingly rigorous environmental legislation worldwide. The market, valued at [Insert Market Size in 2025] Million Units in 2025, is projected to witness a robust Compound Annual Growth Rate (CAGR) of [Insert CAGR] during the forecast period of 2025-2033. This upward trajectory is expected to culminate in a market size of [Insert Market Size in 2033] Million Units by 2033. While developed economies currently lead in market penetration, developing regions are emerging as potent growth engines, driven by a growing environmental ethos and evolving consumer preferences. Groundbreaking innovations, including the development of novel bio-based polymers and advancements in compostability standards, are actively accelerating market adoption. The fundamental shift in consumer behavior towards making environmentally responsible purchasing decisions is a pivotal influence on this dynamic market's growth.

Dominant Regions, Countries, or Segments in Biodegradable Packaging Solutions Industry

North America and Europe stand as frontrunners in the biodegradable packaging market, primarily due to their comprehensive environmental regulations and a deeply ingrained consumer awareness regarding sustainability. Within these leading regions, the food packaging segment commands the largest market share, a trend closely followed by the beverage and pharmaceutical packaging sectors. Looking ahead, the Asia-Pacific region is anticipated to experience the most rapid growth, propelled by its swift economic development, escalating environmental consciousness, and supportive government policies encouraging sustainable practices.

- Key Growth Drivers in North America and Europe: The presence of stringent environmental regulations, a highly informed and proactive consumer base prioritizing sustainability, and well-established waste management and recycling infrastructure are critical drivers.

- Key Growth Drivers in Asia-Pacific: This region's growth is fueled by rapid economic expansion, increasing disposable incomes, a rising tide of environmental awareness, and proactive government initiatives aimed at promoting and adopting sustainable packaging solutions.

- Dominant Material Types: While the paper and pulp segment currently holds a significant market share due to its established infrastructure and cost-effectiveness, materials like Polyhydroxyalkanoates (PHA) and advanced bioplastics are witnessing accelerated growth rates, driven by ongoing research and development.

- Leading Application Segments: The food packaging sector continues to be the dominant application, benefiting from high demand and a growing emphasis on reducing food waste through innovative, sustainable packaging.

Biodegradable Packaging Solutions Industry Product Landscape

The biodegradable packaging solutions market features a diverse range of products, including compostable bags, films, containers, and trays made from various materials like PLA, PHA, and paper. Recent innovations focus on enhancing barrier properties, shelf life, and aesthetic appeal, making them competitive with traditional plastic packaging. Companies are also focusing on developing packaging solutions that are fully compostable and recyclable to maximize environmental benefits and consumer convenience. TIPA's recent launch of fully compostable coffee capsules, zipper bags and containers exemplifies this trend.

Key Drivers, Barriers & Challenges in Biodegradable Packaging Solutions Industry

Key Drivers:

- Increasing consumer demand for eco-friendly products.

- Stringent government regulations and bans on plastic packaging.

- Growing awareness of environmental issues and sustainability.

- Technological advancements in biodegradable materials.

Key Challenges and Restraints:

- Higher cost compared to traditional plastic packaging, limiting widespread adoption. This results in a approximately xx% higher price point compared to traditional packaging.

- Scalability challenges in production and distribution.

- Lack of standardized compostable infrastructure in some regions.

- Complexities associated with meeting diverse regulatory requirements across different regions.

Emerging Opportunities in Biodegradable Packaging Solutions Industry

- Growing demand for biodegradable packaging in emerging economies.

- Development of innovative biodegradable materials with improved properties.

- Expansion into new application areas, such as electronics and textiles.

- Increased focus on circular economy models and waste reduction strategies.

Growth Accelerators in the Biodegradable Packaging Solutions Industry

The biodegradable packaging solutions industry is experiencing rapid advancement, with technological breakthroughs in biodegradable material science acting as significant catalysts for growth. These advancements include the development of new bio-based polymers with enhanced properties, improved biodegradability rates, and superior barrier functionalities. Furthermore, strategic collaborations and partnerships between packaging manufacturers, raw material suppliers, and major retailers are instrumental in expanding market reach and facilitating wider adoption. The proactive expansion into new and previously untapped markets, particularly in rapidly developing economies with a growing environmental consciousness, presents substantial untapped growth opportunities for market players.

Key Players Shaping the Biodegradable Packaging Solutions Industry Market

- Kruger Inc.

- Berkley International Packaging Limited

- Elevate Packaging Inc.

- Amcor Group Gmbh

- Greenpack Limited

- Ranpak Holding Corporation

- Mondi Group

- International Paper Company

- Smurfit Kappa Group PLC

- Tetra Pak International SA

- Sealed Air Corporation

- Biopak PTY Ltd (Duni Group)

Notable Milestones in Biodegradable Packaging Solutions Industry Sector

- February 2024: TIPA launches a range of compostable packaging alternatives to plastic, including coffee capsules, zipper bags, and containers.

- February 2024: Print & Pack launches sustainable packaging solutions for North American small businesses, utilizing biodegradable packaging (BDP) and eco-friendly inks.

In-Depth Biodegradable Packaging Solutions Industry Market Outlook

The biodegradable packaging solutions market is strategically positioned for substantial and sustained growth over the coming decade. This optimistic outlook is underpinned by a confluence of factors including escalating global environmental awareness, the implementation of more stringent environmental protection policies, and continuous advancements in material science and manufacturing technologies. To fully capitalize on the evolving market landscape and maximize future potential, industry participants must focus on fostering strategic partnerships, driving targeted innovation in material development and product design, and diligently pursuing expansion into promising emerging markets. The market's projected expansion to [Insert Market Size in 2033] Million Units by 2033 signifies significant opportunities for forward-thinking companies committed to developing and offering innovative and sustainable packaging solutions.

Biodegradable Packaging Solutions Industry Segmentation

-

1. Material Type

-

1.1. Plastic

- 1.1.1. Starch-Based Plastics

- 1.1.2. Cellulose-Based Plastics

- 1.1.3. Polylactic Acid (PLA)

- 1.1.4. Poly-3-Hydroxybutyrate (PHB)

- 1.1.5. Polyhydroxyalkanoates (PHA)

-

1.2. Paper

- 1.2.1. Kraft Paper

- 1.2.2. Flexible Paper

- 1.2.3. Corrugated Fiberboard

- 1.2.4. Boxboard

-

1.1. Plastic

-

2. Application

- 2.1. Food Packaging

- 2.2. Beverage Packaging

- 2.3. Pharmaceutical Packaging

- 2.4. Personal/Homecare Packaging

- 3. Rest of the World

Biodegradable Packaging Solutions Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

Biodegradable Packaging Solutions Industry Regional Market Share

Geographic Coverage of Biodegradable Packaging Solutions Industry

Biodegradable Packaging Solutions Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Sustainable Products By Consumers And Brands; Stringent Government Regulations

- 3.3. Market Restrains

- 3.3.1. Lack of Supply of Bio-plastics and Related Materials

- 3.4. Market Trends

- 3.4.1. Plastic will Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biodegradable Packaging Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.1.1. Starch-Based Plastics

- 5.1.1.2. Cellulose-Based Plastics

- 5.1.1.3. Polylactic Acid (PLA)

- 5.1.1.4. Poly-3-Hydroxybutyrate (PHB)

- 5.1.1.5. Polyhydroxyalkanoates (PHA)

- 5.1.2. Paper

- 5.1.2.1. Kraft Paper

- 5.1.2.2. Flexible Paper

- 5.1.2.3. Corrugated Fiberboard

- 5.1.2.4. Boxboard

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food Packaging

- 5.2.2. Beverage Packaging

- 5.2.3. Pharmaceutical Packaging

- 5.2.4. Personal/Homecare Packaging

- 5.3. Market Analysis, Insights and Forecast - by Rest of the World

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Biodegradable Packaging Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Plastic

- 6.1.1.1. Starch-Based Plastics

- 6.1.1.2. Cellulose-Based Plastics

- 6.1.1.3. Polylactic Acid (PLA)

- 6.1.1.4. Poly-3-Hydroxybutyrate (PHB)

- 6.1.1.5. Polyhydroxyalkanoates (PHA)

- 6.1.2. Paper

- 6.1.2.1. Kraft Paper

- 6.1.2.2. Flexible Paper

- 6.1.2.3. Corrugated Fiberboard

- 6.1.2.4. Boxboard

- 6.1.1. Plastic

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food Packaging

- 6.2.2. Beverage Packaging

- 6.2.3. Pharmaceutical Packaging

- 6.2.4. Personal/Homecare Packaging

- 6.3. Market Analysis, Insights and Forecast - by Rest of the World

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Biodegradable Packaging Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Plastic

- 7.1.1.1. Starch-Based Plastics

- 7.1.1.2. Cellulose-Based Plastics

- 7.1.1.3. Polylactic Acid (PLA)

- 7.1.1.4. Poly-3-Hydroxybutyrate (PHB)

- 7.1.1.5. Polyhydroxyalkanoates (PHA)

- 7.1.2. Paper

- 7.1.2.1. Kraft Paper

- 7.1.2.2. Flexible Paper

- 7.1.2.3. Corrugated Fiberboard

- 7.1.2.4. Boxboard

- 7.1.1. Plastic

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food Packaging

- 7.2.2. Beverage Packaging

- 7.2.3. Pharmaceutical Packaging

- 7.2.4. Personal/Homecare Packaging

- 7.3. Market Analysis, Insights and Forecast - by Rest of the World

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Pacific Biodegradable Packaging Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Plastic

- 8.1.1.1. Starch-Based Plastics

- 8.1.1.2. Cellulose-Based Plastics

- 8.1.1.3. Polylactic Acid (PLA)

- 8.1.1.4. Poly-3-Hydroxybutyrate (PHB)

- 8.1.1.5. Polyhydroxyalkanoates (PHA)

- 8.1.2. Paper

- 8.1.2.1. Kraft Paper

- 8.1.2.2. Flexible Paper

- 8.1.2.3. Corrugated Fiberboard

- 8.1.2.4. Boxboard

- 8.1.1. Plastic

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food Packaging

- 8.2.2. Beverage Packaging

- 8.2.3. Pharmaceutical Packaging

- 8.2.4. Personal/Homecare Packaging

- 8.3. Market Analysis, Insights and Forecast - by Rest of the World

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Kruger Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Berkley International Packaging Limited

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Elevate Packaging Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Amcor Group Gmbh

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Greenpack Limited

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Ranpak Holding Corporation*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Mondi Group

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 International Paper Company

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Smurfit Kappa Group PLC

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Tetra Pak International SA

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Sealed Air Corporation

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Biopak PTY Ltd (Duni Group)

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.1 Kruger Inc

List of Figures

- Figure 1: Global Biodegradable Packaging Solutions Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Biodegradable Packaging Solutions Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 3: North America Biodegradable Packaging Solutions Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America Biodegradable Packaging Solutions Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Biodegradable Packaging Solutions Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Biodegradable Packaging Solutions Industry Revenue (Million), by Rest of the World 2025 & 2033

- Figure 7: North America Biodegradable Packaging Solutions Industry Revenue Share (%), by Rest of the World 2025 & 2033

- Figure 8: North America Biodegradable Packaging Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Biodegradable Packaging Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Biodegradable Packaging Solutions Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 11: Europe Biodegradable Packaging Solutions Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: Europe Biodegradable Packaging Solutions Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Biodegradable Packaging Solutions Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Biodegradable Packaging Solutions Industry Revenue (Million), by Rest of the World 2025 & 2033

- Figure 15: Europe Biodegradable Packaging Solutions Industry Revenue Share (%), by Rest of the World 2025 & 2033

- Figure 16: Europe Biodegradable Packaging Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Biodegradable Packaging Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Biodegradable Packaging Solutions Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 19: Asia Pacific Biodegradable Packaging Solutions Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 20: Asia Pacific Biodegradable Packaging Solutions Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Biodegradable Packaging Solutions Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Biodegradable Packaging Solutions Industry Revenue (Million), by Rest of the World 2025 & 2033

- Figure 23: Asia Pacific Biodegradable Packaging Solutions Industry Revenue Share (%), by Rest of the World 2025 & 2033

- Figure 24: Asia Pacific Biodegradable Packaging Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Biodegradable Packaging Solutions Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Rest of the World 2020 & 2033

- Table 4: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Rest of the World 2020 & 2033

- Table 8: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 12: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Rest of the World 2020 & 2033

- Table 14: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 20: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Rest of the World 2020 & 2033

- Table 22: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biodegradable Packaging Solutions Industry?

The projected CAGR is approximately 5.97%.

2. Which companies are prominent players in the Biodegradable Packaging Solutions Industry?

Key companies in the market include Kruger Inc, Berkley International Packaging Limited, Elevate Packaging Inc, Amcor Group Gmbh, Greenpack Limited, Ranpak Holding Corporation*List Not Exhaustive, Mondi Group, International Paper Company, Smurfit Kappa Group PLC, Tetra Pak International SA, Sealed Air Corporation, Biopak PTY Ltd (Duni Group).

3. What are the main segments of the Biodegradable Packaging Solutions Industry?

The market segments include Material Type, Application, Rest of the World.

4. Can you provide details about the market size?

The market size is estimated to be USD 105.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Sustainable Products By Consumers And Brands; Stringent Government Regulations.

6. What are the notable trends driving market growth?

Plastic will Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Supply of Bio-plastics and Related Materials.

8. Can you provide examples of recent developments in the market?

February 2024: With the same durability, shelf life, barrier, transparency, and clarity as virgin plastic packaging, TIPA launches compostable packaging, offering an alternative to plastic packaging. Certified to biodegrade in domestic or industrial compost bins, they leave no trace in the environment and provide maximum convenience to consumers. The product range comprises coffee capsules, zipper bags, mesh packaging, and resealable plastic containers. At the same time, TIPA launched a fully compostable and recyclable rice straw container line.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biodegradable Packaging Solutions Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biodegradable Packaging Solutions Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biodegradable Packaging Solutions Industry?

To stay informed about further developments, trends, and reports in the Biodegradable Packaging Solutions Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence