Key Insights

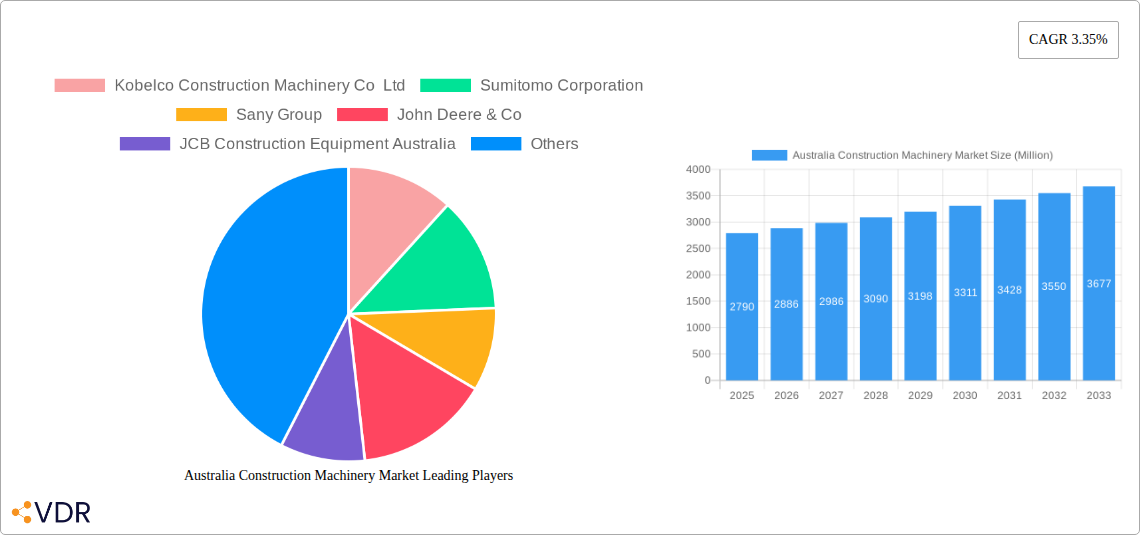

The Australian construction machinery market, valued at $2.79 billion in 2025, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 3.35% from 2025 to 2033. This growth is driven by several factors. Firstly, significant infrastructure development projects, including road expansions, building constructions, and mining operations, are fueling demand for heavy machinery. Secondly, increasing urbanization and population growth are creating a consistent need for new construction, boosting the market further. Technological advancements, such as the integration of automation and data analytics in construction machinery, also contribute positively. However, the market faces certain restraints. Fluctuations in commodity prices, particularly in the mining sector, can impact investment decisions and demand. Furthermore, environmental regulations and concerns regarding carbon emissions are pushing for the adoption of more sustainable machinery, potentially slowing down the growth of some traditional segments until sufficient adoption of greener technologies becomes economical. Segmentation reveals strong performance in both material handling and earthmoving applications, with hydraulic excavators and wheel loaders commanding significant market share among machinery types. Key players like Caterpillar, Komatsu, and Hitachi, along with strong local players like JCB, are fiercely competitive, shaping market dynamics through technological innovation and strategic partnerships.

Australia Construction Machinery Market Market Size (In Billion)

The market's growth trajectory for the forecast period (2025-2033) indicates a promising outlook for investors. However, success hinges on adaptability. Companies need to invest in research and development to cater to the evolving demands of sustainable practices and technological advancements. Companies which demonstrate a capacity for innovation and cater to evolving customer needs related to efficiency and environmental responsibility will be well positioned for success in the Australian construction machinery market. The market’s segmentation provides various entry points for businesses, particularly those focusing on specialized equipment or innovative solutions that address emerging industry needs.

Australia Construction Machinery Market Company Market Share

Australia Construction Machinery Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australia construction machinery market, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, key players, and future outlook, offering valuable insights for industry professionals, investors, and strategists. The report segments the market by application type (Material Handling, Earth Moving, Transportation) and machinery type (Hydraulic Excavators, Wheel Loaders, Crawler Trucks, Dump Trucks, Motor Graders), providing granular data for informed decision-making. The total market size is projected to reach xx Million units by 2033.

Australia Construction Machinery Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market consolidation within the Australian construction machinery sector. The market is characterized by a moderate level of concentration, with several multinational corporations holding significant market share. However, the presence of several smaller, specialized players ensures a dynamic competitive environment.

- Market Concentration: The top five players account for approximately xx% of the total market share in 2025 (estimated).

- Technological Innovation: The adoption of electric and hybrid machinery, advanced automation features, and telematics is driving innovation. Barriers to innovation include high initial investment costs and the need for skilled labor.

- Regulatory Framework: Australian government regulations concerning safety, emissions, and worker protection significantly influence market dynamics.

- Competitive Product Substitutes: The market faces competition from alternative technologies, especially in specialized construction tasks.

- End-User Demographics: The construction industry in Australia is comprised of a mix of large corporations, SMEs, and government agencies, each with unique machinery needs and purchasing behaviours.

- M&A Trends: The past five years have witnessed xx M&A deals in the Australian construction machinery sector, reflecting industry consolidation trends. However, the deal volume fluctuates based on economic conditions.

Australia Construction Machinery Market Growth Trends & Insights

The Australian construction machinery market experienced significant growth during the historical period (2019-2024), driven by robust infrastructure investment and a relatively strong economy. However, the market faced some challenges in 2020-2021 due to the COVID-19 pandemic and associated supply chain disruptions. Despite these challenges, the market is expected to maintain a steady growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033). The increasing adoption of technologically advanced machinery, coupled with government initiatives focused on infrastructure development, will be key drivers of market expansion. Market penetration of electric and hybrid machinery is still relatively low but is expected to increase significantly by 2033, driven by rising environmental concerns and technological advancements.

Dominant Regions, Countries, or Segments in Australia Construction Machinery Market

The Earth Moving segment constitutes the largest share of the market (xx%), followed by Material Handling (xx%) and Transportation (xx%). Within machinery types, Hydraulic Excavators hold the largest market share, driven by their versatility in various construction applications. New South Wales and Victoria, driven by significant infrastructure projects and economic activity, constitute the largest regional markets. Key growth drivers include:

- Infrastructure Development: Government investments in infrastructure projects, particularly roads, railways, and utilities, are significant drivers of market growth in major regions.

- Mining and Resource Extraction: The strong mining sector in Australia continues to generate significant demand for heavy construction machinery, particularly in Western Australia and Queensland.

- Construction of Residential and Commercial Buildings: The construction of residential and commercial buildings in major cities sustains a steady demand for a wide range of construction equipment.

Australia Construction Machinery Market Product Landscape

The Australian construction machinery market showcases a diverse range of products, featuring technologically advanced hydraulic excavators, wheel loaders, and other heavy machinery. Key innovations include the integration of advanced telematics systems for remote monitoring and improved efficiency. Electric and hybrid models are gradually gaining traction, although their high initial costs pose a challenge to wider adoption. Manufacturers focus on enhancing fuel efficiency, durability, and operator comfort, providing unique selling propositions to attract customers.

Key Drivers, Barriers & Challenges in Australia Construction Machinery Market

Key Drivers: Government investments in infrastructure, mining boom cycles, and increasing urbanization in major cities are driving market growth. Technological advancements leading to enhanced machine efficiency and automation also contribute significantly.

Key Challenges: Supply chain disruptions, increasing material costs, and skilled labor shortages pose significant challenges to the market. Stringent emission regulations and the high initial cost of adopting electric machinery also act as restraints. Import tariffs and trade policies can influence the cost and availability of imported machinery.

Emerging Opportunities in Australia Construction Machinery Market

The market presents opportunities in the adoption of electric and autonomous machinery, coupled with the expanding demand for specialized equipment in niche construction sectors like renewable energy infrastructure. The potential for digitalization and connectivity in construction projects offers further avenues for growth. The increasing focus on sustainability is also driving demand for eco-friendly machinery.

Growth Accelerators in the Australia Construction Machinery Market Industry

Technological breakthroughs, strategic partnerships between OEMs and technology providers, and expansion into new market segments are accelerating long-term growth. The government’s focus on infrastructure development and supportive policies further stimulates market expansion. The rise of rental and leasing models is also increasing equipment accessibility for smaller construction firms.

Key Players Shaping the Australia Construction Machinery Market Market

- Kobelco Construction Machinery Co Ltd

- Sumitomo Corporation

- Sany Group

- John Deere & Co

- JCB Construction Equipment Australia

- Hitachi Construction Machinery Co Ltd

- Manitou BF SA

- Volvo Construction Equipment

- Caterpillar Inc

- Komatsu Ltd

- CNH Australia

- Wacker Neuson

- Liebherr International

- Doosan Infracore Ltd

- Shandong Lin gong Construction Machinery

- Yanmar Construction Equipment Co Ltd

- XCMG Group

Notable Milestones in Australia Construction Machinery Market Sector

- October 2023: Isuzu Australia Limited (IAL) announces the launch of its new medium-duty F-Series trucks, signifying an upgrade in the Australian trucking market.

- July 2023: Komatsu Ltd. announces the launch of its PC200LCE-11 and 210LCE-11 electric excavators, signifying a step towards more sustainable construction practices in Australia.

In-Depth Australia Construction Machinery Market Market Outlook

The Australian construction machinery market is poised for sustained growth, driven by ongoing infrastructure investments and the increasing adoption of advanced technologies. Strategic partnerships, market consolidation, and expanding into new applications within renewable energy and sustainable construction will create significant opportunities for growth. The market is expected to exhibit strong resilience and further market penetration of electric and hybrid machinery will drive expansion throughout the forecast period.

Australia Construction Machinery Market Segmentation

-

1. Application Type

- 1.1. Material Handling

- 1.2. Earth Moving

- 1.3. Transportation

-

2. Machinery Type

- 2.1. Hydraulic Excavators

- 2.2. Wheel Loaders

- 2.3. Crawler Trucks

- 2.4. Dump Trucks

- 2.5. Motor Graders

Australia Construction Machinery Market Segmentation By Geography

- 1. Australia

Australia Construction Machinery Market Regional Market Share

Geographic Coverage of Australia Construction Machinery Market

Australia Construction Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Infrastructure Development and Construction Activities to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Regulations and Internal Trade Policies May Hinder the Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Infrastructure Development and Construction Activities to Drive the Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Construction Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Material Handling

- 5.1.2. Earth Moving

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Machinery Type

- 5.2.1. Hydraulic Excavators

- 5.2.2. Wheel Loaders

- 5.2.3. Crawler Trucks

- 5.2.4. Dump Trucks

- 5.2.5. Motor Graders

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kobelco Construction Machinery Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sumitomo Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sany Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 John Deere & Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JCB Construction Equipment Australia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hitachi Construction Machinery Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Manitou BF SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Volvo Construction Equipment

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Caterpillar Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Komatsu Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CNH Australia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Wacker Neuson

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Liebherr International

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Doosan Infracore Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Shandong Lin gong Construction Machinery*List Not Exhaustive

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Yanmar Construction Equipment Co Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 XCMG Group

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Kobelco Construction Machinery Co Ltd

List of Figures

- Figure 1: Australia Construction Machinery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Construction Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Construction Machinery Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 2: Australia Construction Machinery Market Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 3: Australia Construction Machinery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Construction Machinery Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 5: Australia Construction Machinery Market Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 6: Australia Construction Machinery Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Construction Machinery Market?

The projected CAGR is approximately 3.35%.

2. Which companies are prominent players in the Australia Construction Machinery Market?

Key companies in the market include Kobelco Construction Machinery Co Ltd, Sumitomo Corporation, Sany Group, John Deere & Co, JCB Construction Equipment Australia, Hitachi Construction Machinery Co Ltd, Manitou BF SA, Volvo Construction Equipment, Caterpillar Inc, Komatsu Ltd, CNH Australia, Wacker Neuson, Liebherr International, Doosan Infracore Ltd, Shandong Lin gong Construction Machinery*List Not Exhaustive, Yanmar Construction Equipment Co Ltd, XCMG Group.

3. What are the main segments of the Australia Construction Machinery Market?

The market segments include Application Type, Machinery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Infrastructure Development and Construction Activities to Drive the Market.

6. What are the notable trends driving market growth?

Rising Infrastructure Development and Construction Activities to Drive the Market..

7. Are there any restraints impacting market growth?

Regulations and Internal Trade Policies May Hinder the Market Growth.

8. Can you provide examples of recent developments in the market?

October 2023: Isuzu Australia Limited (IAL) has recently disclosed that the initial release of its advanced truck range in Australia will consist of the new medium-duty F Series models equipped with four-cylinder engines. The unveiling of the F-Series and its forthcoming model launch was announced at the 2023 Japan Mobility Show, where IAL actively participated. This event served as a platform for both commemorating the impending introduction of innovative models in the Australian market and gaining valuable insights into the latest technological advancements and industry updates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Construction Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Construction Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Construction Machinery Market?

To stay informed about further developments, trends, and reports in the Australia Construction Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence